Last updated on October 30th, 2025 at 06:23 pm

Do you want to create a profitable investment banking career? Before going through the introduction of the financial markets industry, one must learn the fundamentals of investment banking. It could be commerce students, a finance buff, or an investment analyst looking to contribute – this handbook will move beyond perplexed jargon, market fluctuation, and certificates. Kick-starting your investment banking career on the right note can make you leave a mark in this ruthless profession.

What is Investment Banking?

Investment banking is the department of a bank that handles the issuance of capital to governments, corporations, and institutions. It involves underwriting, mergers & acquisitions (M&A), and advisory. It is highly responsible for financial development and facilitating companies to raise capital cost-effectively.

Investment bankers include:

- Assisting companies to float with IPOs

- Assisting big clients with big-ticket financial deals

- Managing mergers, acquisitions, and restructuring

- Underwriting top new debt and equity securities

Why Choose an Investment Banking Career?

A finance career of an investment banker carries prestige, decent salaries, and rapid career advancement. Finance graduates seek this career for thousands of them

- Highest Salary Packages – Early career provides one of the highest paying salary scales in finance

- Rapid Learning Environment – Learn through actual transactions and market events

- International Exposure – Multinational clients and international transactions

- Professional Growth – Proper career growth and networking

This makes it the best option for students who are interested in having a lifelong career in the finance sector.

Investment Banking Explained Simply

Before moving to higher levels, all students need to know the fundamentals of investment banking:

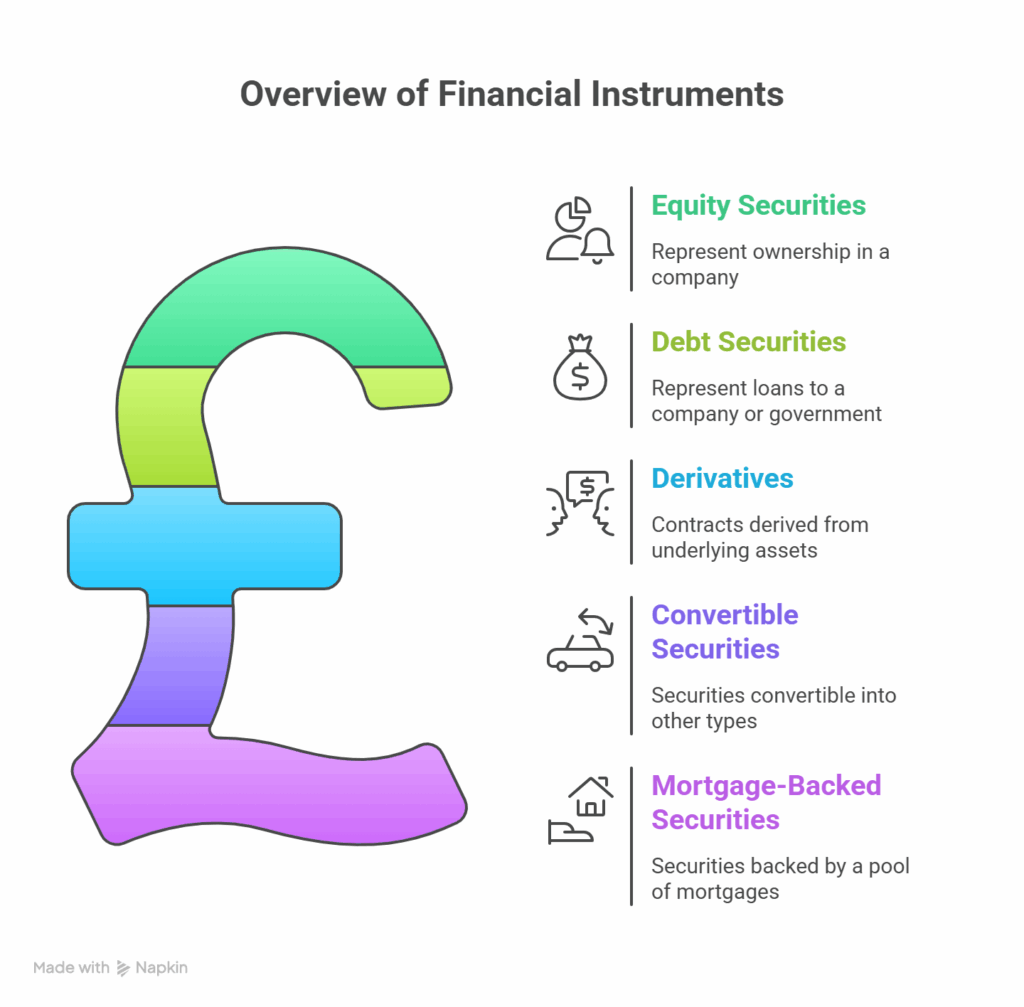

- Capital Raising – Issuance of debt/equity securities to raise capital

- M&A Advisory – Acting as advisor to companies in the event of mergers or acquisitions

- Sales & Trading – Selling and purchasing securities on their behalf

- Research – Stock, bond, and market research to recommend

- Asset Management – Investment on behalf of another

It is important that these concepts be well understood before establishing a good investment banking career.

Core Concepts in Corporate Finance

Financial knowledge of corporations is required by those who wish to become investment bankers. The following are utilised primarily in the practice of day-to-day banking:

- Valuation Techniques – DCF, Comparable Company Analysis

- Financial Modelling – Modelling company performance with Excel

- Risk Management – Identification and mitigation of financial risks

- Leverage – Analysis of transactions financed by debt

- Working Capital Management – Analysis of a firm’s short-term assets/liabilities

Understanding Financial Markets

You can’t have an investment banking career without knowing global capital markets. Markets set the shape of the deal and where there is investment. Some of the most important things to know are:

- Stock Markets – Where equity that’s publicly traded is bought and sold

- Bond Markets – Interest rate mechanisms and debt securities

- Foreign Exchange Markets – Currency risk management

- Commodities Markets – Selling and purchasing oil, metals, and crops

- Understanding how these markets operate helps bankers make intelligent and shrewd deals.

Investment Banking Terminology for Students

Students need to be accustomed to investment banking terminology. Some of the words that all newcomers need to understand are:

- IPO (Initial Public Offering) – Selling private company’s shares to the public for the first time

- M&A (Mergers and Acquisitions) – Union of companies

- Pitch Book – Investment bank’s sales pitch

- Leveraged Buyout (LBO) – Purchasing of a company using borrowed money

- Due Diligence – Auditing process of a prospective investment

All these words are the vocabulary of any banking professional.

Why Certifications Matter in Banking?

If you’re serious about an investment banking career, earning a top-notch certification is not optional—it’s essential. Certifications:

- Boost your resume credibility

- Teach industry-relevant skills

- Offer well-structured learning under guidance of experts

- Increase chances of getting placed with top companies

The best option at one’s disposal is the Certified Investment Banking Operations Professional (CIBOP) program by Imarticus Learning.

Overview of the CIBOP Program by Imarticus

Certified Investment Banking Operations Professional (CIBOP) is an experience guaranteed program for 0-3 years experience finance freshers. The program is offered in 3-months and 6-months options.

Highlights:

- 100% Job Guarantee

- 85% Placement Rate with packages up to ₹9 LPA

- 60% Average Salary Increase

- 1200+ Batches Completed

- 1000+ Hiring Partners

- Projects: Money Laundering, Trade Compliance, Ethical Banking

It’s one of the best investment banking certification programs in India, with real-world case studies and projects.

Career Outcomes After Completing CIBOP

Upon completion of CIBOP, you’ll be ready for various roles in top investment banks:

- Investment Banking Associate

- Wealth Management Associate

- Regulatory Reporting Analyst

- Client Onboarding Associate

- KYC Analyst

- Trade Surveillance Analyst

- Hedge Fund Associate

- Collateral Management Analyst

With support from Imarticus’s 1000+ hiring partners, you’re set for a finance career opportunity that truly delivers results.

FAQs

1. What is the duration of the CIBOP program?

You can choose between a 3-month full-time or 6-month part-time format, depending on your availability.

2. Can a non-finance graduate enrol in CIBOP?

The course is designed for finance graduates, but students from other backgrounds may be considered based on aptitude.

3. Is this course suitable for beginners?

Yes. Being a fresher with no experience, CIBOP starts from scratch and shapes your competencies.

4. What are the salary prospects after completing CIBOP?

Imarticus provides average salary for ₹4 LPA and even ₹9 LPA for top scorers, 60% of whom receive a salary increment.

5. Are the certifications globally recognised?

CIBOP is highly valued in India as well as by Imarticus’s 1000+ recruitment clients, including multinational companies.

6. Will I get job placement assistance after the course?

Yes, in addition to the course are 7 interview guarantees and full career support from resume building to interview preparation.

7. Do I need coding skills for investment banking?

Not necessarily. Although Excel cannot be avoided, CIBOP is all about handling critical banking operations, regulatory affairs, and market conventions.

Conclusion

Investment banking as a career calls for the correct knowledge, correct guidance, and correct credentials. Understanding the underlying principles of investment banking, acquiring the skills to adapt with the financial terminology, and becoming an associate of a legitimate investment banking certification like CIBOP is the secret to scaling the heights of your career.

CIBOP by Imarticus Learning is more than a course—it’s a transformation. If you’re ready to build a future in one of the most lucrative sectors in finance, now is the time to act.