If you’re aiming for a rewarding career in credit analysis—with visibility, stability & upward mobility—then a well-structured banking and finance course is your foundation. In particular, modules on credit assessment, risk evaluation, and financial reporting are indispensable in today’s fast-evolving credit ecosystem.

Whether you’re wondering how to become a credit analyst, exploring credit analysis courses in India, or weighing the skills needed for real-world finance roles—this guide is for you. Let’s break it down—clearly, practically, and with direction.

Why a Credit Analysis Career Makes Sense Today

Banks, NBFCs, fintechs, and corporates are aggressively expanding… and that requires robust credit decisions. That’s why the demand for professionals who can assess borrowers—big or small—is skyrocketing. A focused credit analysis course India course can springboard your career in credit analysis across multiple industries.

- High demand – credit decisions underpin business lending, project finance, trade, and more.

- Visibility & influence – as a credit analyst, your findings often inform leadership decisions.

- Career growth – from analyst → manager → credit head or risk specialist.

What a Banking and Finance Course Needs to Cover

To launch a successful career in credit analysis, your banking and finance course must go beyond basics—it should train you in data analysis, financial modeling, borrower evaluation & risk frameworks.

Look for these key modules:

| Module | Why It Matters |

| Financial Statement Analysis | Understand balance sheets, P&L, cash flow and ratio interpretation |

| Credit Risk Assessment Frameworks | Learn to quantify risk and evaluate borrower profiles |

| Cash Flow & Collateral Modelling | Build models to evaluate repayment capacity and backup options |

| Industry & Macro Analysis | Assess external factors impacting borrower performance |

| Compliance, Documentation & KYC | Understand regulatory requirements around lending |

| Case Studies & Credit Memo Writing | Develop real credit memos for lending decisions |

A program like Imarticus credit analyst course often includes these, creating a clear transition path from training → hire-ready.

Choosing the Right Credit Analysis Course in India

There are many options—but not all are created equal. Here’s how to evaluate them smartly:

✅ Blueprint: What to Look For

- Industry-oriented curriculum

Does it cover core credit skills? Does it simulate lending decisions? - Hands-on financial modeling

Ensure it teaches tools like Excel modeling and scenario testing. - Placement assistance & mentoring

Does it offer mock interviews, resume support or hiring access? - Faculty experience

Instructors with real lending / credit background = better learning. - Credibility of provider

Programs like Imarticus credit analyst course combine certification + job readiness in a credible framework.

How to Become a Credit Analyst: Step-by-Step

Curious about how to become a credit analyst? Here’s a clear, methodical path:

- Develop foundational finance skills via a comprehensive financial statement analysis course

- Specialise in credit risk through a strong credit analysis course India

- Apply knowledge practically through case studies and credit memos

- Use placement support within your banking and finance course to land interviews

- Join the sector, start as a junior analyst—then grow into senior roles

Most top-tier courses also spotlight these steps within their structure.

Essential Skills for Banking and Finance Jobs

To succeed in credit or other finance roles, you need much more than theoretical knowledge. Let’s break down the key competencies:

Technical Skills

- Financial modeling – proficiency in Excel and projecting cash flows

- Ratio interpretation – ability to read liquidity, leverage & coverage ratios

- Risk metrics – credit scoring, default probability, credit rating

- Analytical tools – use of Power BI, data visualization, BI dashboards

Human-Centered Skills

- Credit memo writing – concise rationale behind decisions

- Stakeholder engagement – explain risks/opportunities clearly

- Problem-solving – uncover anomalies and suggest solutions

- Ethics & compliance – maintain transparency, prevent fraud

A solid program will integrate both—preparing you for real industry demands.

Role of Imarticus in Credit Analyst Preparation

Imarticus credit analyst course is a strong contender if you want a career-aligned program with placement support.

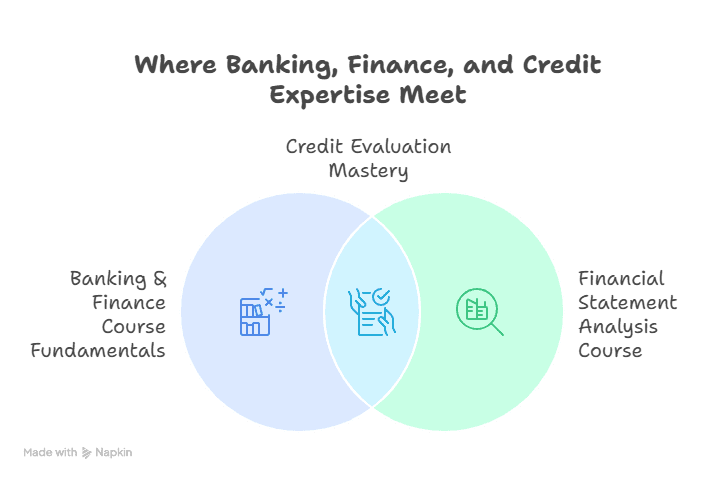

- Combines banking and finance course fundamentals with focused credit modules

- Uses financial statement analysis course frameworks to teach statement reading → linkage → borrower evaluation

- Offers placement support—mock interviews, resume review & partner hiring access

- Delivers learning via weekend online batches—ideal for working professionals or freshers

✔️ It’s one of the few programs in India that helps you go from credential → confidence → career entry in credit.

Beyond Credit: Other Job Roles After Banking and Finance Course

Completing a credit-focused banking and finance course opens doors beyond credit itself. These include:

| Job Role | Why It Fits |

| Financial Analyst | Use financial statement insights for forecasting and valuation |

| Risk Analyst | Specialised in sector risk and digital fraud |

| Relationship Manager | Use credit understanding to support client acquisition & retention |

| Debt Capital Markets | Apply structuring skills for bond-related lending decisions |

| Corporate Banking | Combine credit & industry knowledge to serve corporate borrowers |

These roles benefit from credit skills and are usually part of the career in credit analysis trajectory.

Compare: Credit Analysis Course vs Generic Finance Programs

When choosing, contrast depth vs. breadth. Here’s a simplified view:

| Course Type | Credit-Focused | General Finance/Banking Course |

| Depth in lending | High – deep insight into credit decisions | Moderate – covers risk but not granular lending |

| Job-specific placement | Yes – targeted interviews | Broader placement, maybe not credit-specific |

| Time to job readiness | Shorter – 3–6 months to hiring skills | Longer – may need more time for credit practice |

| Role flexibility | Mostly credit & risk roles | Wider range – FP&A, treasury, compliance, credit |

If your target is credit, then a focused credit analysis pathway is most efficient.

Real-World Project Exposure = Better Hiring Outcomes

Recruiters frequently cite “hands-on experience” as a top differentiator. With relevant financial modeling, credit analysis memos, scenario testing, and case evaluations—candidates immediately stand out.

That’s why selecting a program with capstone projects is so important.

Starting Salary & Growth in Credit Roles

Let’s talk numbers—always a key motivator:

| Experience Level | Estimated Salary (INR/year) |

| Entry-level Credit Analyst | 4–6 LPA |

| 2–4 years’ senior Analyst | 6–10 LPA |

| 5+ years / Manager Levels | 10–20+ LPA |

These roles offer steady upward mobility—with leadership growth in roles like Head of Credit Risk, Structured Lending Manager, or even CFO roles later.

FAQs

1. Which is the best credit analysis course India offers for beginners?

One with real cases… expert faculty… & placement help.

2. How to become a credit analyst without prior experience?

Start with core skills… then take a certified course.

3. What are the top skills needed for banking and finance jobs today?

Statement reading… risk basics… Excel… & clear thinking.

4. Is the Imarticus credit analyst course useful for freshers?

Yes… it’s beginner-friendly… & recruiter-connected.

5. Can I skip an MBA & just do a financial statement analysis course?

Yes… it’s focused… faster… & very job-ready.

6. What are typical job roles after banking and finance course completion?

Credit analyst… risk associate… RM… & more.

7. Is a career in credit analysis stable in 2025?

Yes… demand is rising… across fintech & banking.

8. Do I need finance background for a credit analysis course India recommends?

Not always… just be sharp… & open to learning.

Final Thoughts: Launching Your Credit Career with the Right Learning

If your vision is a career in credit analysis, you’ll need a program that’s narrowly and expertly tuned to the needs of lenders. The combination of banking and finance course fundamentals + deep credit analysis course India modules makes for the ideal launchpad.

When you pair it with practical exposure—financial statement analysis courses, placement support, mentor guidance—you turn aspiration into a high-paying, high-growth timeline.

And if you want to see what that looks like in action, consider exploring the Imarticus credit analyst course, where structured training meets hiring support for roles in credit, risk, and finance.

👉 Bonus: Explore how valuation models and analysis apply in lending and M&A in this blog on valuation methods, and learn how broader financial roles evolve in this career impact feature.