Introduction

The new Chief Financial Officer (CFO) is no longer a number-cruncher. The CFO of today is a strategic leader, a digital transformer, and a key decision-maker. If you’re someone with aspirations in the C-suite, the journey is complicated—but supremely rewarding. So, how to become a CFO in today’s constantly changing financial world? It starts with becoming an expert in a mix of traditional finance expertise and future-proof skills.

Let’s not make it sound too easy—becoming a CFO is no cakewalk. You won’t just need an MBA and a head for numbers. From driving cross-functional teams to adopting artificial intelligence in decision-making, the stakes are changing fast. If you’re already a finance leader or just embarking on the path, this guide takes a look at the essential skills that every future CFO needs to acquire today.

Table of Contents

- CFO Leadership Development

- Strategic Finance Skills

- CFO Digital Transformation Skills

- Executive Finance Education

- CFO Career Growth

- Frequently Asked Questions (FAQs)

- Key Takeaways

- Conclusion

CFO Leadership Development

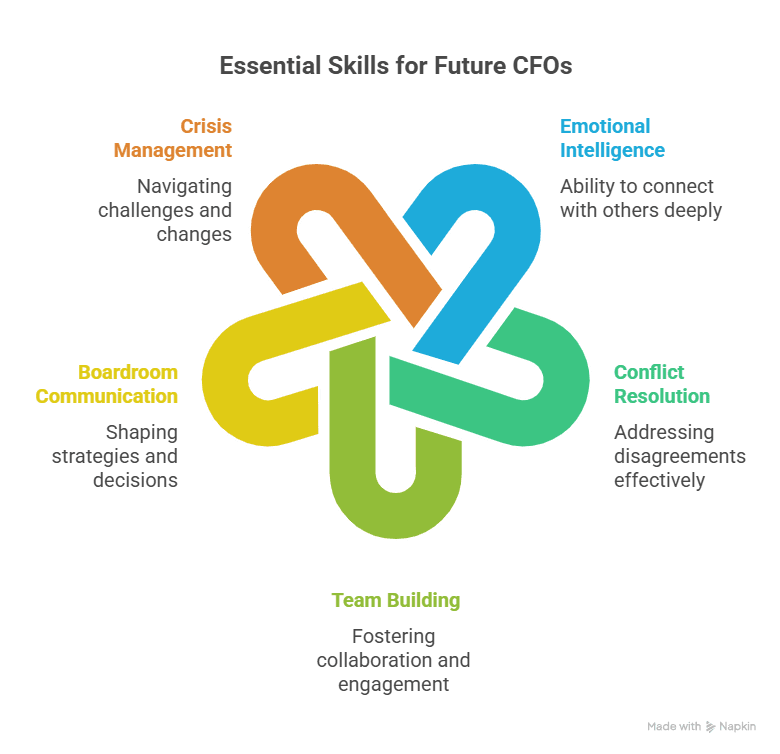

To become a CFO is not merely to know numbers—it’s to guide people, spark vision, and create strategy. CFO leadership development emphasizes building interpersonal influence and cross-functional collaboration.

CFOs of the future must also have strong communication skills. You will be sharing complex financial insights to stakeholders who are not from a financial background, influencing teams through change, and negotiating with the board. The emotional intelligence to be an active listener and skills in crisis are essential attributes that define productive CFO leadership.

Key Areas of CFO Leadership Development:

- Emotional intelligence and empathy

- Conflict resolution and negotiation

- Team building and talent retention

- Boardroom communication and influence

- Crisis and change management

In accordance with a recent Deloitte poll, 78% of CEOs anticipate their CFOs driving transformation—rather than merely managing finance. Such a high degree of expectation further highlights the importance of leadership skills for determining how to become a CFO.

Strategic Finance Skills

Strategic thinking is what separates excellent CFOs from superior ones. Strategic finance skills are something that cannot be bargained away if you’re committed to becoming a CFO in today’s intricate business environment.

It’s not sufficient just to record what’s already occurred—you need to predict what’s next and suggest moves that drive maximum shareholder value. This means scenario planning, investment analysis, risk management, and M&A analysis. Strategic finance is all about linking the dots between financial data, market trends, and business growth over time.

Comparison Table: Traditional vs Strategic CFO Thinking

| Traditional CFO | Strategic CFO |

| Focuses on reporting | Focuses on forecasting |

| Manages budgets | Aligns finance with strategy |

| Cost control expert | Growth enabler |

| Siloed finance view | Cross-functional business partner |

Strategic Finance Skills comprise:

- Business forecasting & predictive analytics

- Capital structuring and allocation

- Scenario analysis and risk modelling

- Business valuation and investor relations

- M&A strategy and due diligence

According to McKinsey, today’s CFO will need to be the co-pilot of the CEO, having the financial vision to guide uncertain futures.

CFO Digital Transformation Skills

Digital competency has become a must in financial management. To be a master of CFO digital transformation capabilities will make you stand out in the competition to becoming a CFO in tech-driven companies.

CFOs today need to know how automation, AI, and cloud computing are transforming budgeting, as well as compliance. You don’t have to learn coding—but you need to know how to get the most from digital tools for speed, accuracy, and decision-making in real time.

Core CFO Digital Transformation Skills:

- ERP & automation system understanding

- AI-based forecasting and scenario modeling

- Cloud computing & SaaS integration

- Data governance & cybersecurity awareness

- Robotic Process Automation (RPA) for finance

65% of CFOs are currently investing in digital capabilities to future-proof their teams, according to a PwC study. Undoubtedly, digital transformation is more than a buzzword—it’s a CFO imperative.

Executive Finance Education

Academic education comes first in terms of how to become a CFO—but it is executive education that fine-tunes leadership skills and makes you competitive. Studying specialized executive finance education programs enables would-be CFOs to fine-tune their skills in the moment, gain insights from experienced veterans in the field, and remain current with world financial trends.

These courses most often combine leadership development, financial theory, and strategic thinking. More significantly, they expose you to a peer network of other emerging financial leaders, creating opportunities for collaboration and development.

Top Advantages of Executive Finance Training

- International finance practices exposure

- Advanced M&A, valuation, and governance courses

- Simulated case studies on financial transformation

- Industry practitioner leadership coaching

- Alumni networks and international exposure

Looking for an actual path to enhance your CFO journey? Look no further than the Chief Financial Officer Programme by London Business School and Imarticus Learning. This intensive program will develop high-potential finance individuals into global-class CFOs through strategic learning, leadership labs, and real-world simulations.

CFO Career Growth

Regardless of where you are in your finance career, steady growth is essential. Knowing the levels of CFO career development will assist you in determining the appropriate skills to focus on at each stage.

CFOs generally start out as accountants, controllers, or analysts—but it’s those who venture beyond operational finance who speed up their development. New competencies and greater exposure are needed at each career level to continue climbing.

Career Path to Becoming a CFO

| Career Stage | Focus Area |

| Financial Analyst | Technical financial reporting |

| Finance Manager | Operational efficiency, budgeting |

| Financial Controller | Risk management, compliance |

| VP of Finance | Strategic decision-making, forecasting |

| CFO | Leadership, digital innovation, vision |

Tips to Fast-Track CFO Career Growth:

- Work on cross-functional projects

- Volunteer for digital transformation projects

- Network with senior finance leaders

- Participate in industry conferences and bootcamps

- Mentorship and executive coaching

If you’re asking how to become a CFO, the answer is ongoing evolution. From tactical activities to strategic leadership, each advancement in your career requires deliberate skill-development.

FAQs

1. How long does it take to become a CFO?

The timeframe is different.. but generally, most CFOs take 10–20 years from entry level, based on industry, education & exposure to strategic finance roles.

2. Do I need an MBA to become a CFO?

An MBA is not necessary.. but extremely helpful! It will refine your leadership, networking & strategic thinking—essential qualities for becoming a successful CFO.

3. Can a Chartered Accountant turn into a CFO?

Yes. Some CFOs are CA alumni. But they need to bridge into leadership, digital, and strategy spaces before making the transition.

4. Which industries are ideal for CFO career progression?

Sector domains such as technology, healthcare, and finance provide strong CFO positions, particularly for individuals with skills in transformation and innovation.

5. Do digital skills matter for a CFO?

Yes. Familiarity with solutions such as RPA, ERP, AI, and analytics platforms is necessary to power contemporary finance operations with optimal speed.

6. Is executive finance education worthwhile?

Yes. These programs provide practical learning, leadership development, and peer exposure that speed up your journey to CFO.

7. How do I differentiate myself as a CFO candidate?

By showing -cross-functional leadership, digital savvy & strategic decision-making skills in addition to financial proficiency.

8. What certifications are useful in becoming a CFO?

CPA, CFA, CMA, and data analytics or corporate governance certifications bring tremendous value towards your CFO preparedness.

9. What is the average salary of a CFO in India?

As per AmbitionBox, the CFO salary in India varies between ₹50 LPA to ₹1 Cr based on the industry and company.

10. Am I ready to be a CFO?

If you already have strategy leadership, team management, digital transformation contributions & stakeholder relationships under your belt —you’re almost there.

Key Takeaways

- It takes more than being good at finance to be a CFO—it takes leadership, vision, and agility.

- CFOs need to acquire leadership, strategy, digital transformation, and cross-functional collaboration skills.

- Executive finance learning improves competitive edge through ongoing learning.

- The adoption of CFO digital transformation capabilities is essential to survive and prosper in a technology-reliant commercial environment.

- A robust CFO leadership development program guarantees your voice being heard in the boardroom.

Conclusion

The future of finance requires a new CFO, a person who combines extensive financial knowledge with the ability to think strategically, work digitally, and lead through influence. If you’re serious about assessing how to become a CFO, it is time to take action. The world is changing and whichever group is prepared for today will lead tomorrow.

To acquire the strategic advantage and leadership kit required to move into the CFO position, sign up for the Chief Financial Officer Programme by London Business School and Imarticus Learning. It’s not a course—it’s your ticket to the C-suite.