Table of Contents

When people search for investment banking jobs, they’re rarely just looking for a job title. What they’re really trying to figure out is whether investment banking is actually a realistic career option for them – and whether the effort, long hours, and competition are truly worth it.

I hear this question all the time, especially from freshers, BCom and BBA graduates, CA students, and early professionals looking to switch careers:

Is investment banking something people like me can really get into, or is it only for a select few from top-tier colleges?

The short answer: yes, it is accessible – but not in the way most people expect. This is where many aspirants get stuck. Investment banking jobs look glamorous from the outside, but the entry paths aren’t obvious. This is why searches for investment banking job openings and investment banking freshers jobs have grown so sharply – people want clarity, not just titles.

A general degree alone rarely leads straight into core investment banking roles. That’s why so many people start searching for an investment banking certification – not because a course guarantees a job, but because structured, role-focused training helps bridge the gap between academic knowledge and how banks actually operate.

Once you stop chasing titles and start focusing on practical roles, execution skills, and long-term progression, an investment banking career becomes far more achievable than it first appears.

In this guide, I’ll break down:

What investment banking jobs actually look like in India

The different roles within investment banking – not just the glamorous ones

How freshers and career switchers realistically enter the industry

What to aim for early in your career and what not to

How investment banking careers grow over time

By the end, you’ll have a clear, realistic picture of how investment banking jobs really work – and whether this career path makes sense for you.

Did you know? Investment banking rewards responsibility and consistency far more than raw ambition.

What Is Investment Banking?

If you’ve ever found yourself wondering what is investment banking, here’s a simple way to look at it. Investment banking is the part of finance where the biggest business decisions actually get done. It’s about helping companies raise money, buy or sell other businesses, go public through IPOs, or survive and restructure during difficult times.

This isn’t the everyday traditional banking. It has large deals, tight deadlines, and high stakes. A single decision can involve crores of rupees and shape the future of an entire company. That’s why the work is intense – and also why investment banking has a reputation for being challenging, prestigious, and among the highest-paying careers in finance.

What Are Investment Banking Jobs?

Investment banking jobs are the roles that support and execute these major financial and investment decisions, each with a clearly defined investment banking job description tied to deal execution, analysis, or support.

Depending on where you work and how you enter the industry, your job could involve analysing companies, building financial models, coordinating deal execution, or advising senior clients.

There are multiple investment banking roles, each with different responsibilities, pressure levels, and career paths.

When people search for jobs in investment banking, they often assume there’s only one path. In reality, how you enter matters more than where you want to end up. Some people start in front office roles, many start in operations or analyst support roles, and grow from there.

| Investment Banking Jobs | What the Role Involves | Typical Entry Level |

| Investment Banking Analyst | Financial modelling, valuation, pitch decks | Freshers / 0-2 years |

| Investment Banking Operations | Deal support, documentation, and compliance | Freshers |

| Financial Modelling Analyst | Valuation and deal models | Freshers / Early career |

| FP&A / Finance Analyst | Planning, forecasting, reporting | Freshers |

| Associate | Deal execution, managing analysts | 2-5 years |

| Vice President (VP) | Leading deals, client coordination | 5-9 years |

| Banking Consultant | Advisory and strategy support | Experienced hires |

(Source – Naukri.com, LinkedIn Jobs, Indeed India, Glassdoor India, AmbitionBox)

These roles reflect how investment banker jobs in India are structured across global banks, advisory firms, and shared service centres.

Understanding these investment banking job types early helps you:

- Set realistic expectations.

- Choose the right entry point.

- Plan long-term career growth instead of chasing titles.

In short, investment banking isn’t one job – it’s a career ecosystem. Once you’re inside it, the opportunities open up much faster.

Fact – Not all investment banking roles involve extreme work hours. Intensity varies widely based on role, team, and stage of a deal.

Why Investment Banking Jobs Are So Talked About

If you are wondering, what is the job of an investment banker? There are three main reasons investment banking jobs attract so much attention.

The Financial Upside – Investment banking remains one of the highest-paying career paths in finance, especially over the long term. While starting salaries vary, growth can be steep if you perform well. So, the investment banking job’s salary is one of the biggest reasons why this career continues to attract ambitious professionals, despite the long hours and steep learning curve, because the long-term financial upside can far outweigh the early challenges.

Career Acceleration – Few careers expose you so quickly to:

- Large transactions

- Senior executives

- High-level decision-making

That exposure compounds fast.

Exit Opportunities – People don’t just stay in investment banks forever. Many move on to:

- Private equity

- Corporate strategy

- CFO tracks

- Entrepreneurship

So investment banking jobs are often seen as career accelerators, not just long-term roles.

Fact – Even professionals who leave investment banking later often benefit from higher long-term earnings due to early skill compounding and exposure.

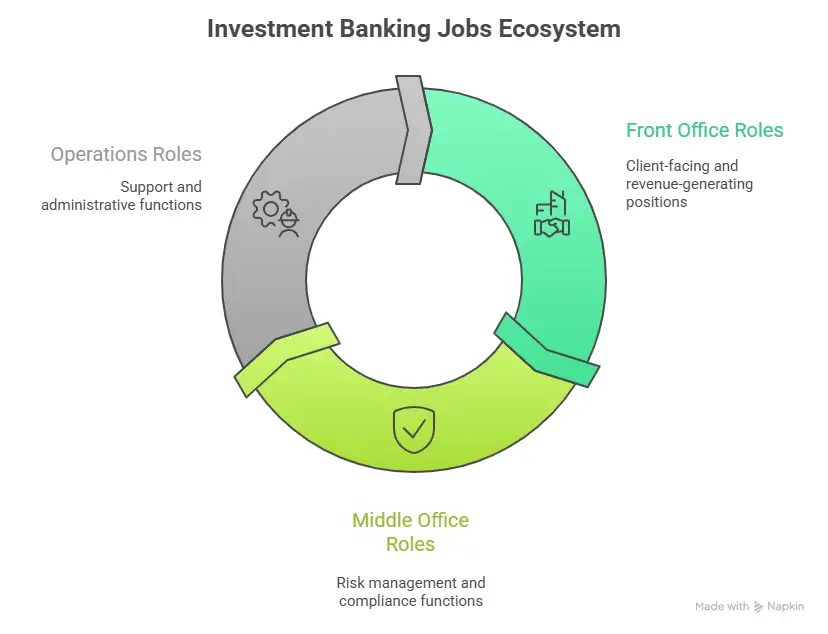

Types of Investment Banking Jobs

One of the biggest mistakes people make is assuming all investment banking jobs are the same. They’re not. There are multiple investment banking job roles, and understanding this early saves years of confusion.

Front Office Investment Banking Jobs

These are the roles most people imagine when they think of investment banking.

Typical titles include:

- Investment banking analyst jobs

- Associate roles

- Roles in M&A, ECM, DCM

What Front Office Roles Actually Involve

Early in your career, front office work is very execution-heavy:

- Financial modelling

- Valuation analysis

- Pitch decks

- Industry research

As you grow, the focus shifts to:

- Managing analysts

- Running deal processes

- Interacting with clients

- Eventually originating deals

Who These Roles Are For

Front office investment banking jobs suit people who:

- Thrive under pressure.

- Are comfortable with long hours.

- Enjoy analytical, detail-heavy work.

- Want faster salary and responsibility growth.

They also have the highest competition, especially at the entry level.

Investment Banking Operations Jobs

Investment banking operations roles are one of the most common gateways into global banks in India, and many front-office professionals begin their careers here.

This is where most people misunderstand investment banking careers. When students search for investment banking freshers’ jobs or entry-level investment banking jobs, what they often find in reality are investment banking operations jobs.

And that’s not a downgrade – it’s how many careers actually begin.

What Are Investment Banking Operations Jobs?

Operations roles support deal execution by handling:

- Documentation

- Process workflows

- Compliance checks

- Transaction settlements

These roles ensure that deals executed by front office teams actually get completed correctly.

Why Operations Roles Matter

Investment banking operations jobs:

- Offer structured entry into global banks.

- Have more predictable working hours.

- Provide exposure to real deal lifecycles.

Many professionals use these roles as stepping stones into higher-paying roles later.

This is why searches like banking operations jobs for freshers are so common – and relevant.

Middle Office and Related Finance Jobs

Some roles sit close to investment banking without being pure deal-making jobs.

These include:

- Financial modelling jobs

- Financial planning & analysis jobs

- Risk and compliance roles

- Banking consultant jobs

These roles form part of the broader ecosystem of investment banking-related jobs and are valid long-term careers on their own.

Did you know? Most investment banking professionals don’t start in glamorous front-office roles. A large share enters through operations, analyst support, or execution roles and moves up once they build deal exposure.

Understanding Investment Banking Job Roles

Here’s a simplified view of common roles people ask about:

| Role | What You Actually Do | Who It Suits |

| Investment Banking Analyst | Models, valuations, decks | Strong finance freshers |

| Associate | Manage analysts & execution | 2 to 5 years of experience |

| VP / Director | Lead deals & clients | Senior professionals |

| Investment Banking Operations | Execution & documentation | Entry-level & switchers |

| Financial Modelling Analyst | Build deal models | Finance-focused grads |

| FP&A Roles | Planning & forecasting | Corporate finance aspirants |

(Source – J.P. Morgan Careers, Goldman Sachs Careers, Morgan Stanley Careers, Citi Careers)

This table alone clears up many questions around the investment banking job role.

Where Investment Banking Fits in Bank Jobs After BCom

Many students search for bank jobs after BCom, hoping that investment banking is one of them. It can be – but not automatically. A BCom degree gives you fundamentals, but investment banking jobs require:

- Financial modelling

- Valuation understanding

- Strong Excel skills

- Comfort with accounting and numbers

That’s why many BCom graduates start with:

- Operations roles

- Analyst support jobs

- Finance-related jobs for freshers

And then move up.

Investment Banking Jobs for CA Freshers

CA-qualified candidates often ask about investment banking jobs for CA freshers.

CAs are valued for:

- Accounting depth

- Financial due diligence

- Valuation support

- Transaction advisory

With additional modelling and capital markets exposure, many CAs transition into core investment banking roles successfully.

“Investment banking jobs involve helping companies raise capital, execute mergers and acquisitions, manage IPOs, and make high-stakes financial decisions. Roles range from front office deal-making to operations, modelling, and execution support.”

Investment Banking Jobs for Freshers

When people search for investment banker jobs for freshers, they often expect:

- High pay

- Front office exposure

- Big brand banks

One of the biggest misconceptions is that investment banking is closed to beginners. Most investment banking freshers’ jobs are designed around execution, support, and operations functions, not immediate deal leadership. In reality, most freshers typically enter through:

- Investment banking analyst roles (competitive)

- Investment banking operations roles

- Financial modelling and support roles

For many, operations roles offer a more practical entry point, especially for those without elite academic backgrounds. Once you’re inside the system, growth becomes much easier.

Investment Banker Jobs for Freshers: Who Can Apply?

You’ll find investment banker jobs for freshers open to:

- Commerce and business graduates

- Engineers with strong analytical skills

- CA freshers in specialised roles

There are also investment banking jobs for CA freshers, particularly in valuation, transaction advisory, and operations.

Who Should Choose Investment Banking Jobs?

Before getting caught up in job titles or pay numbers, it’s worth taking a step back and asking yourself a simpler question: what kind of work environment do you actually enjoy?

choosing-investment-banking-jobs.webp

Investment banking can be highly rewarding, but it isn’t always comfortable. It comes with real pressure, fast pace, and things don’t always go as planned – so you need to be prepared for uncertainty.

This quick checklist helps you see whether the day-to-day reality matches your strengths and expectations.

| If you are someone who… | Investment Banking Fit |

| Enjoys responsibility and high-pressure environments | ✅ |

| Likes numbers, analysis, and decision-making | ✅ |

| Wants faster long-term income and career growth | ✅ |

| Needs predictable working hours early in their career | ❌ |

| Prefers routine, repetitive work | ❌ |

| Dislikes ambiguity, tight deadlines, or constant change | ❌ |

Takeaway: Investment banking isn’t about comfort – it’s about growth. If you enjoy challenges, responsibility, and long-term upside, it can be a powerful career choice.

Investment Banking Job Simulation & Practical Exposure

One growing trend is investment banking job simulation – hands-on exposure to deal workflows before entering the industry.

This matters because banks don’t hire based on theory alone. They want people who understand:

How do deals move from start to finish?

How does documentation work?

How accuracy and timelines matter?

Where Job-Focused Training Fits In

One reason many people struggle to land investment banking jobs is that college doesn’t prepare you for how banks actually operate.

This is where structured, role-focused programs help bridge the gap. Investment Banking courses that focus specifically on preparing candidates for investment banking operations and execution roles, aligning training with real job requirements rather than academic theory.

For many freshers and career switchers, this becomes a practical way to enter the investment banking ecosystem.

A Day in the Life of an Investment Banking Professional

This is something most aspirants never see clearly. An investment banking analyst’s day usually revolves around:

- Working on Excel models and PowerPoint decks.

- Updating numbers based on client feedback.

- Coordinating with seniors across tight deadlines.

An investment banking operations professional, on the other hand, spends more time on:

- Deal documentation and process checks.

- Ensuring timelines and compliance are met.

- Coordinating between the front office, legal, and operations teams.

Both roles are demanding – but in different ways. Knowing this early helps you choose an entry point that actually matches your strengths and long-term goals, rather than just chasing a title that sounds impressive on paper.

Fact – In investment banking, skills often outweigh degrees after the first role. Strong Excel, modelling, and deal understanding can matter more than whether you studied BCom, BBA, CA, or Engineering.

Are Investment Banking Jobs Worth It?

This is the question behind almost every search about investment banking careers. And the most honest answer is still the same: it depends on you. But one important piece of the puzzle that can’t be ignored is investment banking salary – because for many people, that’s a big part of why the trade-off feels worthwhile.

Investment banking jobs are worth it if you:

- Enjoy high-responsibility work where your output actually matters.

- Are comfortable working under pressure and tight deadlines.

- Want faster career progression and income growth compared to most finance roles.

- Are willing to invest early in skill-building, long hours, and a steep learning curve.

In return, investment banking offers something few careers do: compounding financial growth. While the first couple of years can feel intense. Many professionals see meaningful pay jumps within 2 to 3 years – far faster than in most corporate finance or accounting roles.

On the other hand, investment banking jobs may not be worth it if you:

- Want predictable hours early in your career.

- Dislike detail-heavy, deadline-driven work.

- Expect instant rewards without a learning curve or putting in sustained effort.

In these cases, the salary alone may not compensate for the pressure. Investment banking salary is high precisely because the work is demanding. Firms pay a premium for people who can handle responsibility, complexity, and long hours – especially in front-office roles.

What ultimately makes investment banking worth it for many professionals is the long-term upside. Even if the starting pay feels similar to other finance roles, the growth curve is very different. As you move from execution to decision-making and client ownership, your compensation increasingly reflects the value you create, not just the hours you work.

Bonuses become larger, pay becomes more performance-linked, and senior roles can lead to income levels that few traditional finance careers match.

So there’s no universal yes or no. Investment banking jobs are worth it when the effort, pressure, and learning curve align with your goals – and when you’re comfortable earning more because you’re carrying more responsibility. There’s no right or wrong choice here – only informed ones.

Fact – Few finance careers expose professionals to large transactions, senior decision-makers, and high-stakes environments as early as investment banking does.

How People Actually Succeed in Investment Banking Jobs

Most successful investment banking careers follow a similar pattern:

- Choose a realistic entry role.

- Build strong fundamentals early.

- Focus on learning over titles.

- Use early roles as platforms, not destinations.

Most build their way there. If you understand how investment banking jobs really work – and plan your entry accordingly – the career can be challenging, demanding, and extremely rewarding.

Skills That Actually Matter in Investment Banking Jobs

Across all investment banking job types, the same skills keep showing up:

- Excel and financial modelling

- Valuation fundamentals

- Accounting clarity

- Attention to detail

- Ability to work under pressure

Degrees open doors – but skills decide how far you go.

Common Myths About Investment Banking Jobs

Investment banking is surrounded by a lot of assumptions – some exaggerated, some outdated. Before you decide whether this career is right for you, it helps to separate perception from reality.

Let’s clear up a few of the most common myths people have about investment banking jobs.

| Common Myth | What Actually Happens |

| You need an Ivy League or IIM background | A top institute helps, but it’s not mandatory. Practical skills, deal exposure, and job readiness matter far more in the long run. |

| Operations roles are career dead ends. | Many front-office professionals start in operations and transition with the right upskilling and internal exposure. |

| Only engineers get hired. | Commerce graduates, MBAs, and CAs are widely hired across analyst, operations, and support roles. |

| You’ll work 16 hours forever. | Early years are intense, but senior roles focus more on decision-making, clients, and value creation than sheer hours. |

Did You Know? Banks rarely hire freshers for what they might become. They hire for what candidates can execute accurately on Day 1.

Investment Banking Jobs in India vs Abroad

Investment banking jobs exist globally, but India plays a very different – and often underestimated- role in how careers actually begin and grow.

In India, the investment banking ecosystem is more welcoming at the entry level. Banks hire aggressively for analyst, operations, and support roles, which means entry barriers are lower compared to Western markets.

Freshers and early professionals get hands-on exposure sooner, work on live transactions, and build real banking experience early in their careers. Because teams are lean and deal volumes are high, career acceleration often happens faster in the first few years.

In markets like the US or UK, the picture looks different. The same contrast applies when comparing investment banker jobs in India with opportunities in hubs like London or investment banking jobs in Singapore, where hiring typically favours experienced professionals.

To make this difference clearer, it helps to look at how investment banking careers typically compare in India versus global markets. While both paths can lead to strong long-term outcomes, the way professionals enter the industry, grow early in their careers, and move across markets is often quite different.

| Factor | India | US / UK |

| Entry Barriers | Relatively lower | Highly competitive |

| Common Entry Roles | Analyst, operations, execution support | Analyst (top-tier institutions) |

| Accessibility for Freshers | High | Limited |

| Early Career Growth | Faster in the first 3-5 years | Slower but structured |

| Pay (Absolute) | Lower | Higher |

| Skill Exposure | Broad, hands-on | Specialised |

| Lateral Movement | Easier early on | Requires prior deal exposure |

| Typical Career Path | India → Global roles | Mostly domestic progression |

That’s why many professionals choose to start their investment banking careers in India, build solid deal exposure and technical skills, and then move into global roles once they have credibility on their side.

Career Fact – The fastest career growth in investment banking usually happens after your second role, not your first.

Investment Banking Jobs: A Practical Pathway with Imarticus Learning

If you’ve ever wondered how to get a job in investment banking, one of the biggest gaps people face isn’t ambition – it’s preparation.

Most university degrees don’t teach you how banks actually operate or what hiring teams look for in candidates. That’s where Imarticus Learning’s Investment Banking Course comes in.

This program is built around real investment banking operations jobs, not just finance theory. It equips you with industry-relevant knowledge of financial products, trade life cycles, risk and compliance frameworks, and settlement workflows – the exact skills employers expect from entry-level professionals.

Imarticus Learning offers:

- Role-focused learning built around real investment banking operations jobs.

- Hands-on exposure to trade lifecycles, settlements, and compliance workflows.

- Job-ready skills aligned with what entry-level banking roles actually expect.

- Strong placement support, including interview prep and hiring partner access.

- Guaranteed interviews to help convert learning into real opportunities.

- Ideal for freshers and career switchers, including BCom, BBA, and CA graduates.

- Short, focused program with lower time and cost compared to long degrees.

Along with practical training, the course offers guaranteed interview opportunities and placement support, helping you bridge the gap between learning and landing your first role in banking operations or analyst positions.

FAQs About Investment Banking Jobs

If you’re exploring investment banking jobs, it’s natural to have questions – about roles, entry paths, salaries, and whether this career is right for you. Here are some of the most frequently asked questions to help you make informed career decisions with confidence.

What is a job in investment banking?

A job in investment banking involves helping companies make major financial decisions – such as raising capital, acquiring or selling businesses, or preparing for IPOs. Depending on the role, your work may include financial modelling, valuation, deal execution, documentation, or client coordination. It’s high-responsibility work, which is why investment banking jobs are known for strong learning and long-term pay potential.

What kinds of jobs are in investment banking?

There isn’t just one type of investment banking job. Common roles include:

- Investment banking analyst jobs include modelling, valuation, and pitch decks.

- Investment banking operations jobs like deal support, documentation, and compliance.

- Associate and VP roles like deal execution and client management.

- Financial modelling and FP&A roles linked to investment banking.

Together, these form a career ecosystem rather than a single job title.

What degree do I need for an investment banking job?

There’s no single mandatory degree. Investment banking jobs are commonly held by graduates from a Commerce background, like BCom, BBA, Engineering for analytical roles, Chartered Accountancy (CA), and MBA (Finance). What matters most is job-ready skills, not just the degree name.

Is an MBA or a CA better for investment banking?

CA is strong for valuation, transaction advisory, and operations roles.

An MBA (Finance) helps with front office access and client-facing roles. Neither is universally better – they lead to different entry paths.

Who earns more, a CA or an investment banker?

Compensation depends more on role and performance than qualifications. A CA working in transaction advisory or investment banking operations may earn less initially than a front-office investment banker – but over time, both paths can lead to very high compensation if you move into deal-driven roles.

How do I start my career in investment banking?

Most people start their investment banking careers through:

- Entry-level analyst roles

- Investment banking operations jobs

- Financial modelling or support roles

For freshers, structured, role-focused training helps bridge the gap between college and real bank expectations. Programs from institutions like Imarticus Learning are designed specifically to prepare candidates for investment banking operations and execution roles, which are common entry points.

Are there investment banking jobs for freshers?

Yes, investment banking jobs for freshers do exist – but mostly in:

- Investment banking operations

- Analyst support roles

- Financial modelling jobs

Direct front office roles are competitive, but many professionals start in support or operations roles and grow into higher-paying positions over time.

What is the investment banking job’s salary?

Investment banking job salaries vary widely by role and experience:

- Freshers typically start between ₹4-10 LPA, depending on the role.

- The salaries can rise sharply with 2 to 5 years of experience.

- Senior professionals earn significantly more through bonuses and performance pay.

That steep growth curve is one reason investment banking jobs remain so popular.

Are there investment banking jobs in Mumbai for freshers?

Yes. Mumbai, being the financial capital, is the largest hub for investment banking jobs in India. Entry-level roles are commonly available in operations, analyst support, and transaction services – especially near areas like Andheri and BKC.

Are there investment banking jobs in Pune?

Pune offers fewer front-office roles compared to Mumbai, but investment banking operations and support jobs are available, particularly in global capability centres and back-office hubs.

Are there investment banking jobs in Dubai?

Most professionals move to Dubai after gaining experience in India or other global markets. Investment banking jobs in Dubai exist, particularly in capital markets, advisory, and operations roles.

Which companies offer investment banking jobs in India?

Investment banking jobs in India are usually offered by global banks like J.P. Morgan, Goldman Sachs, and Morgan Stanley. Indian investment banks and advisory firms, Boutique M&A and valuation firms. These jobs usually require prior skills or experience.

Are there investment banking jobs for CA freshers?

Yes. Investment banking jobs for CA freshers are common in:

- Valuation and transaction advisory.

- Financial due diligence.

- Investment banking operations.

With added financial modelling and capital markets exposure, many CAs transition into core investment banking roles.

Will investment banking jobs be replaced by AI?

AI is automating repetitive tasks – but it won’t replace investment banking. What it will do is:

- Reduce manual work.

- Increase the need for judgment, interpretation, and decision-making.

Investment banking jobs that involve analysis, client interaction, and deal strategy will continue to be in demand.

Investment Banking Jobs: What It Really Takes to Succeed

Investment banking jobs aren’t easy. They demand long hours, precision, accountability, and a steep learning curve. Most successful professionals don’t enter investment banking through a single perfect role. They enter through realistic entry points – analyst support, operations, modelling, or execution roles – and build upward from there.

And if you feel the gap is skills or exposure, which is common, the right investment banking course focused on real job roles can significantly shorten your learning curve and improve your chances of entering the ecosystem.

If you’re serious about starting a career in investment banking, especially as a fresher or career switcher, focus on job-ready skills, realistic entry roles, and structured preparation. Explore an investment banking course that aligns with how banks actually hire, and build your career step by step instead of waiting for a perfect break.