Last Updated on 7 months ago by Imarticus Learning

In the finance world of today, having the capability to analyze quickly is not sufficient. If you want to get into high-impact finance roles or push your current career even further, taking a financial modelling course could be the answer. With corporations and banks placing heavy focus on data-driven strategy, sound financial modelling skills are now a prized possession for professionals who want to make that transition from analysis to impact.

Why Does a Financial Modelling Course Matters in Today’s Finance Ecosystem?

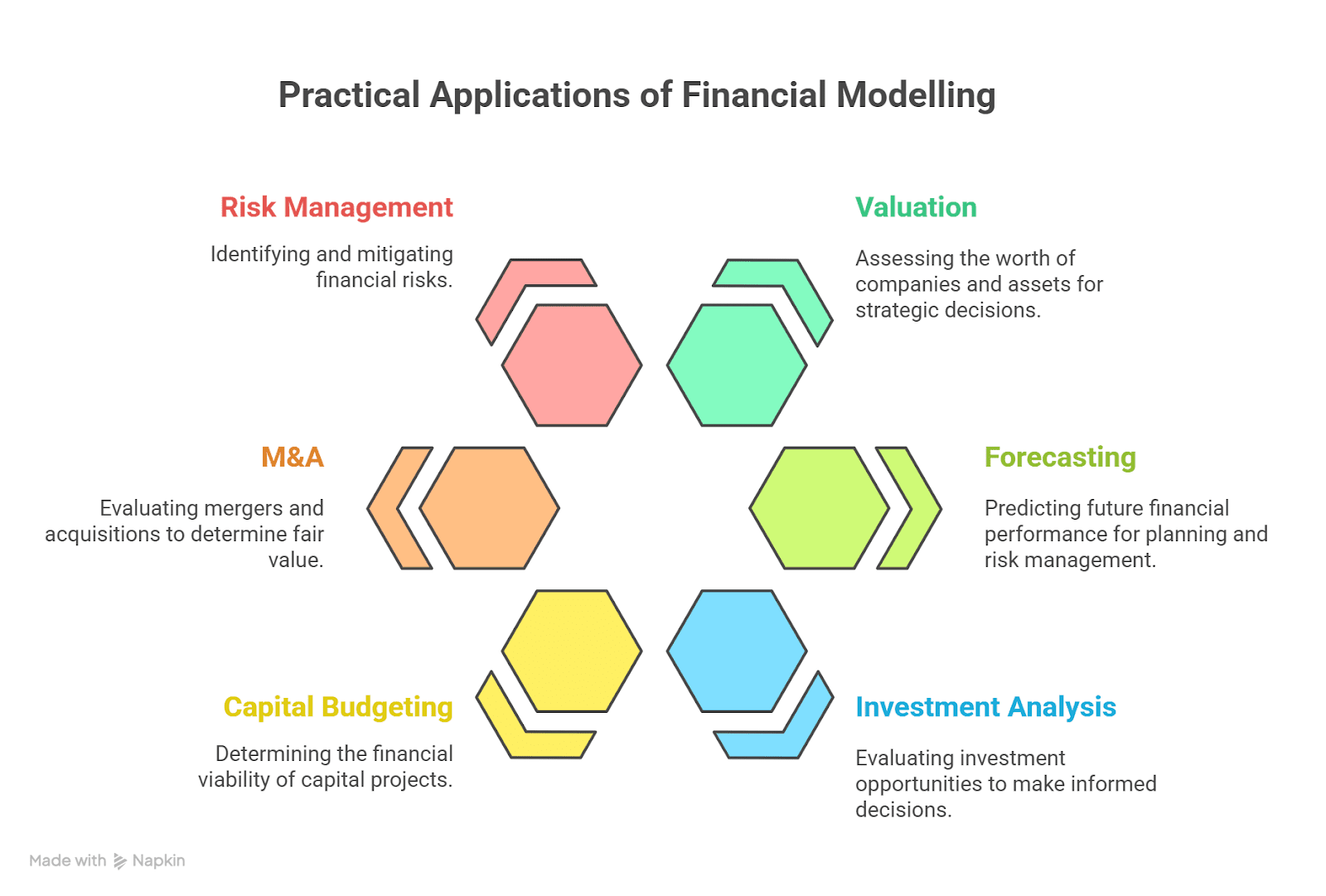

An excellent financial modelling course educates professionals on how to work with numbers most effectively to predict company performance, estimate the value of an organization, evaluate investment opportunities, and inform strategic decision-making. The changing finance landscape translates to the need for experts who don’t merely calculate numbers but tell good stories with them.

If you are a graduate entering finance or an executive looking to reskill, skills in the intricate world of modelling give you the credibility to speak on the language of financiers, bankers, and decision-makers. From forecasting revenues through to discounted cash flow analysis, these are the skills squarely in the middle of every investment presentation and boardroom discussion.

What Does a Financial Modelling Course Cover?

The appeal of a comprehensive financial modeling course is its range and depth. It typically integrates theoretical understanding with experiential, practical learning to give students first-hand experience.

Key Modules You Can Expect:

- Excel for finance professionals – Simplifying data and performing automated computations for financial accuracy

- Business valuation and forecasting – Placing figures on the worth of companies based on various valuation techniques

- Scenario and sensitivity analysis – Stress-testing models to cover risk and volatility

- Presentation and narrative – Representing figures to stakeholders in a convincing style

- Simulation-based case studies – Using tools on industry-based simulations to build credibility

Having valuation and modelling training means students can learn and master it all from simple three-statement models to more sophisticated equity research templates.

Strategic Benefits of Enrolling in a Financial Modelling Course

Financial modeling is not an art of Excel wizardry or formulas. It promotes disciplined thought, financial storytelling, and stakeholder engagement. Below are some tactical benefits of a financial modeling course:

- Better Decision-Making: Better evaluate investments, mergers, and firm fitness

- Career Mobility: Enhance your candidacy for corporate finance, private equity, or investment banking roles

- Increased Salary Potential: Modeled practitioners command higher salaries

- Practical Application: EASILY apply theory to industry benchmarks

For anyone wishing to have advanced financial analysis training, financial modeling is a stepping stone which cannot be ignored. You do not just hone analytical skills but also achieve the decision-making advantage.

Who Should Consider a Financial Modelling Course?

The course is designed for a wide range of professionals. If any one of the following is applicable to your scenario, then you should consider it:

- Recent graduates in commerce, economics, or finance

- Financial analyst certification professionals

- Chartered Accountants who wish to pursue corporate advisory

- MBA students who wish to specialize in finance

- Entrepreneurs who desire greater control of their business forecasts

Besides, it provides a great platform for those professionals with an interest in investment banking skill development or career switch to strategic finance.

Real-world Application: Bridging the Gap Between Learning and Doing

Unlike most finance courses, a course in financial modeling is application-oriented. You don’t learn something and then forget; you apply it, smash it, rebuild it, and then present it.

The most common single criticism of hiring managers is that the candidates have no experience. A good course remedies this with the use of:

- Equity research reports

- IPO modelling

- LBO (Leveraged Buyout) structures

- Real-time valuation of listed companies

It makes the learners job-ready and self-assured.

The Role of Excel for Finance Professionals

The workhorse of modern financial modeling is Excel. While Python and R are gaining prominence in financial analytics, routine corporate finance work cannot be accomplished without Excel.

Excel as a financial analyst is not learned by mastering short cuts, but by generating fault-free models, constructing dashboards, and creating easy-to-use templates that pass the test of scrutiny. An elite class financial modelling course allocates a high percentage of its study material to this foundation.

Career Opportunities After a Financial Modelling Course

One of the most satisfying things about going for a financial modelling course is the level of career options it presents. From corporates to consultancies and investment banks, the demand transcends industries.

Typical Job Roles Include:

- Financial Analyst

- Corporate Finance Executive

- Business Analyst

- Investment Banking Analyst

- Equity Research Associate

- Strategy Consultant

The fusion of solid analytics, valuation techniques, and business acumen makes you an asset to any firm.

Building Global Finance Careers with Strategic Modelling Skills

The finance sector is more and more borderless. Employers require professionals with international viewpoints and practical modelling skills. This means a financial modelling course can be a stepping stone to international finance career prospects.

From London’s international banks to Singapore’s fintech firms, employers require applicants who can interpret numbers correctly and link them to business objectives in general.

Certified Investment Banking Operations Professional (CIBOP) – The Next Step in Your Finance Journey

If you aspire to transition from the profession of modelling to a good investment banking operations role, Imarticus Learning’s Certified Investment Banking Operations Professional (CIBOP™) course can be your transition tool.

This career transition program is specifically designed for finance graduates aged 0-3 years. Operations, compliance, and risk management being the key focus, it offers you the ideal transition from your financial modelling skills.

Why Choose CIBOP?

- 100% Placement Assurance

- Salaries of up to 9 LPA

- 85% Placement

- 3 & 6-Month Course Options

- More than 50,000 learners trained

- awarded as “Best Education Provider in Finance”

Course curriculum is:

- Securities Operations

- Wealth & Asset Management

- Anti-Money Laundering

- Risk & Regulatory Frameworks

With actual projects like ethical banking, KYC, and trade-based money laundering, you’ll be job-ready with end-to-end experience.

Roles After Completion Include:

- Investment Banking Associate

- Hedge Fund Associate

- Risk Management Consultant

- KYC Analyst

- Collateral Management Analyst

- Trade Surveillance Analyst

Pair your financial modelling course with CIBOP, and you’re not only ready for a job; you’re ready for a career.

FAQs

1. What is a financial modelling course?

A financial modelling course gets you ready to build models imitating financial performance and underpinning investment choices, budgeting, and strategy.

2. Who should take a financial modelling course?

Freshers, finance specialists, analysts, CAs, and MBA students who need to enhance their skills in valuation and strategic analysis.

3. Is Excel proficiency required before joining a financial modelling course?

Not necessary but an asset. Most courses include an introductory module in Excel as a foundation.

4. What tools will I learn in a financial modelling course?

Excel first and foremost, but also calculator facilities, scenario analysis software, and occasionally add-ons such as Power BI.

5. Can a financial modelling course help in investment banking?

Yes. Investment banking is highly reliant on financial modelling. It’s employed in valuations, mergers & acquisitions, and financial planning.

6. Are there any certifications that add value after this course?

Yes, certifications such as CIBOP™ give operational depth to your modelling skill, with increased employability.

7. Is a financial modelling course suitable for freshers?

Yes. Most of the courses are fresher-oriented and take freshers through the basic to advanced modelling techniques.

Conclusion

In the data economy, the power to convert numbers into business insight is invaluable. A financial modelling course is the bridge between raw data and strategic understanding. Whether you aim to pursue a career in investment banking, corporate finance, or equity research, financial modelling skills are a compulsory stepping stone.

To propel your career one notch higher, think of combining your modelling skills with a course such as Certified Investment Banking Operations Professional (CIBOP™) by Imarticus Learning. With assured interviews, strong placement assistance, and training on industry demands, you don’t only study finance — you live it.

Realize your true potential. Join a financial modelling course now and set a new path to your career in strategic finance.