Last updated on October 31st, 2025 at 10:25 am

When you study the companies that survive market shocks, expand into new regions, or maintain consistent profitability year after year, there’s a common thread: they know how to handle their costs. Not in the simplistic sense of “spend less” but in the disciplined way of aligning every financial decision with strategy. That discipline has a name – cost management strategies.

Not dry calculations. Not endless spreadsheets. It’s the art of connecting every rupee, dollar, or euro to a decision that matters. And when you’re preparing for the US CMA course, this isn’t a side chapter you gloss over. It’s one of the central lessons that will define how you think as a finance professional.

A core topic examined in this course is cost management approaches, which is the fundamental focus of managerial accounting. Cost management is not simply a tool for budgeting; rather, it provides professionals with an opportunity to assess performance levels, allocate resources effectively, and create sustainable value for the organisation.

In this article, we will delve into the significance of cost management in the CMA journey, explore its impact on career investment, and share success stories that highlight its effects.

What are Cost Management Strategies?

You’ve heard about the US CMA course. And now, you want to know what cost management strategies are in it? I will break it down for you with easy tidbits to understand.

Cost management strategies are the game plans businesses use to control and optimise their expenses. That budget plan you heard about, or the expenses sheet your colleague was worried about, or the resource allocation meeting everyone was scrambling about at work. Everything boils down to this.

However, the point is not always about cutting costs. Experienced cost managers make smarter decisions, improve efficiency, and boost profitability. As a cost manager, your role is to ensure that every rupee spent is going to add value to the organisation.

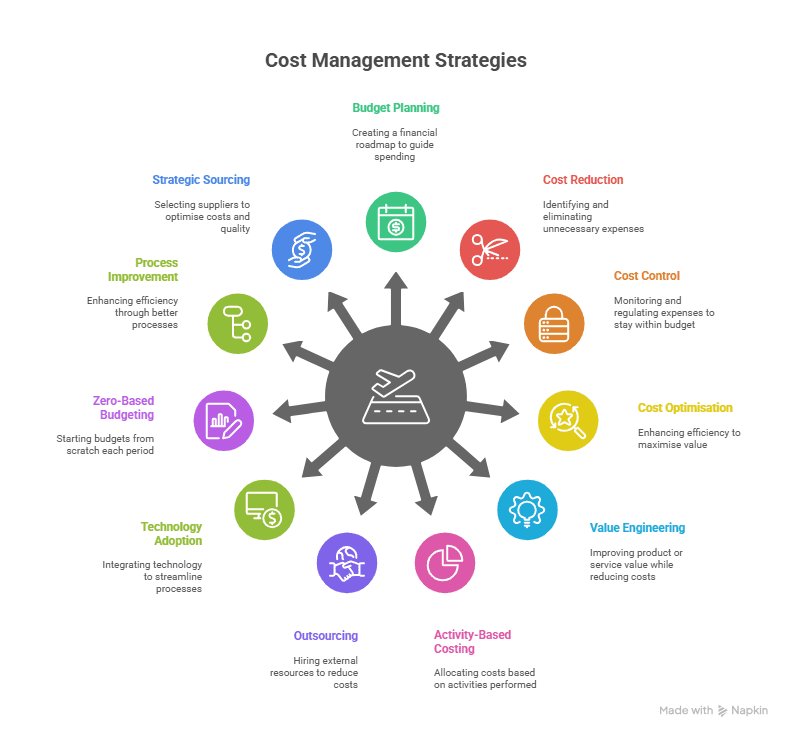

The following are some key cost management strategies:

- Budgeting: A cost manager develops detailed budgets that guide expenditures and investments to the organisation.

- Cost Reduction: They help in finding and removing unsolicited expenses to increase profitability.

- Cost Control: You will hear them monitoring expenses to ensure costs stay within budgeted amounts.

- Cost Optimisation: Cost Managers make continuous improvement of processes and resource allocation to achieve the best value for money.

- Activity-Based Costing (ABC): They have to allocate costs to particular products or services based on the actual activities that require them. This goes to accurately identify high-cost areas.

- Value Engineering: Another tenet of their role as cost managers is to analyse functions to achieve the optimal performance at the lowest cost.

- Outsourcing: You will see a cost manager delegating non-core activities to external specialists to reduce costs. This is a sustainable approach financially for many organisations.

- Technology Adoption: One of the holy grails for cost managers to follow would be incorporating advanced technologies to streamline operations and reduce costs.

- Zero-Based Budgeting: You might think of it as justifying all expenses from scratch, rather than basing them on previous budgets.

- Process Improvement: Cost Managers simplify workflows to eliminate inefficiencies and decrease costs.

- Strategic Sourcing: A Cost Manager has to select suppliers based on cost, quality, and reliability to optimise procurement.

You can help your organisation by understanding and implementing these strategies to manage its costs effectively, ensuring financial health and supporting long-term growth.

What is the US CMA Course?

The US CMA certification is a worldwide recognised certification offered by the Institute of Management Accountants (IMA) that prepares experts in finance for superior knowledge in financial planning, analysis, control, decision-making, and professional ethics.

Unlike alternative certifications of finance-heavy theory, the US CMA course is founded first upon teaching practical application, and here it prepares professionals to execute applications in the workplace. The subject range is broad, including:

- Financial reporting and analysis

- Strategic management

- Risk management

- Decision analysis

- Cost management strategies

By integrating cost management into its core modules, the US CMA ensures that learners not only understand accounting numbers but also how to use them strategically to drive business growth.

Why Cost Management Strategies Matter in the US CMA Course

The phrase cost management strategies might sound straightforward, but in the context of CMA, it represents a powerful set of practices that help professionals optimise financial performance.

The reasons for its centrality are the following:

- Strategic Decision-Making– You, as a CMA professional, are trained to look at costs in much detail, ensuring the identification of inefficiencies in the processes and providing recommendations that maximise profitability and assist in developing long-term competitive advantage.

- Accurate Performance Evaluation– Through variance analysis and other tools, cost management helps businesses compare actual outcomes with planned budgets. This allows CMAs to spot deviations early and recommend timely corrective actions.

- Planning and Budgeting– Cost management allows businesses to assess actual outcomes against the planned budget using variance analysis and additional tools. Without this, CMAs are unable to detect variances quickly and recommend appropriate actions in a timely manner.

- Value Creation- CMA professionals, rather than being focused on cost-cutting, use cost management to make better allocation of resources so the business is creating value for stakeholders while still being cost-effective.

The Role of Cost Management in a Global Economy

When I look at the global economy today, it honestly feels like being on a bullet train. It’s fast, it’s unpredictable, and if you blink, you miss the next stop. What I’ve noticed is that the businesses that actually thrive aren’t the ones just chasing growth, but the ones that keep a tight handle on costs-whether that’s across different countries, through new tech, or even during a crisis. Cost management has really evolved into a strategy for survival and expansion, not just a “finance exercise.”

Manufacturing: Lean Costing as an Efficiency Engine

In manufacturing, every bit of waste is like a leak in the ship; it slowly sinks margins. That’s where lean costing comes in. It’s about cutting the fluff and doubling down on the activities that truly add value.

- Lean Manufacturing: Toyota nailed this years ago. By building lean into its DNA, they turned efficiency into a culture. To this day, competitors are still trying to copy what Toyota does naturally.

- Automation: I picture this as robots on assembly lines or machines doing precision tasks that humans just can’t match. Sure, the investment up front stings a bit, but the long-term payoff-lower labour costs, higher accuracy, and consistency-makes it a no-brainer.

Services: Process Costing for Smarter Pricing

Services are trickier because you’re not dealing with raw materials-you’re dealing with time, people, and processes. That’s why I love process costing. It gives you the clarity to see which services are actually profitable and which ones are draining you.

- Healthcare: Hospitals do this all the time-allocating expenses to departments so they can price services more fairly and figure out what’s eating into budgets.

- Financial Services: Banks use process costing to work out what it really costs to process loans or maintain accounts. That way, they’re not underpricing just to stay competitive.

It’s kind of like splitting a dinner bill with friends-you’re not covering someone else’s share if all you had was a salad. You only pay for what you actually ordered.

Technology: Cloud-Based Cost Tracking for Real-Time Control

Tech is moving at lightning speed, and the old-school budgeting approach just can’t keep up. That’s why I think cloud-based cost tracking is such a lifesaver- it gives you real-time visibility and lets you adjust spending on the fly instead of waiting for quarterly reports.

- Cloud Computing: Take AWS, for example. It doesn’t just rent servers. It shows you exactly how much you’re spending down to the last gigabyte, so there are no nasty surprises in your IT bills.

- AI Integration: And AI takes this a step further by spotting patterns, flagging inefficiencies, and even predicting where costs might spike. Gartner says early adopters of AI in cost management could slash IT expenses by up to 20% by 2026. That’s huge.

The Bigger Picture

When I connect the dots, the story is pretty simple: cost management has shifted from being about “cutting” to being about “growing smarter.” Whether you’re running a factory, a hospital, or a data centre, the playbook is the same- know where value is created, cut the noise, and make quicker, sharper decisions.

And this is exactly where the CMA course shines. It trains you to apply cost management strategies in real-world, global markets. That’s why CMAs are in such demand at multinational companies. They’re the people who can take all these principles-lean costing, process costing, cloud-based tracking-and actually make them work across industries and countries.

The CMA course ensures candidates are trained in applying these principles to global markets, making them invaluable assets to multinational corporations.

To provide a clearer understanding, here’s a table summarising the application of cost management strategies across different sectors:

| Sector | Strategy Applied | Key Benefits |

| Manufacturing | Lean Costing | Waste reduction, improved margins |

| Services | Process Costing | Accurate pricing, profitability analysis |

| Technology | Cloud-Based Cost Tracking | Real-time insights, dynamic budgeting |

| Global | Adaptive Cost Strategies | Mitigation of tariff impacts, reshoring benefits |

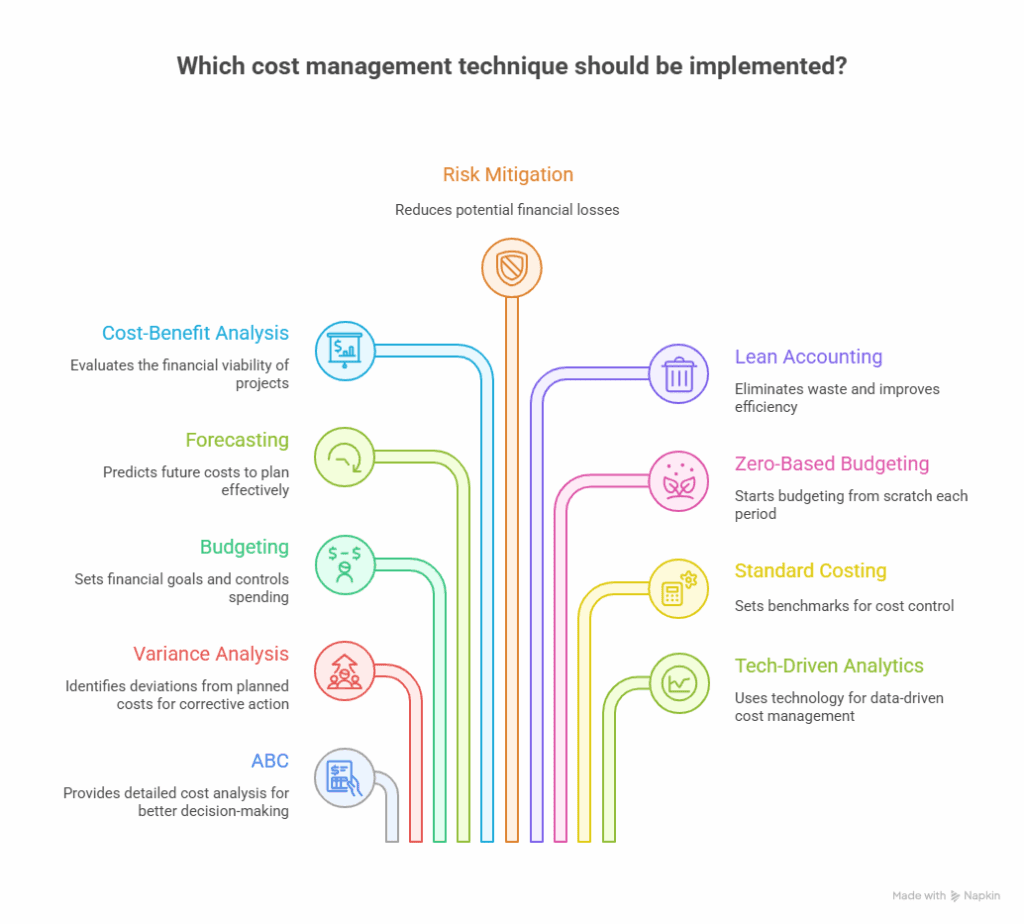

Best Practices in Cost Management Strategies

When I first came across cost management strategies, I also thought it would be all about trimming budgets and cutting corners. But it’s really not that. It’s about getting smart with money. Knowing what’s worth spending on and what’s just draining resources. Once I understood that, the whole thing made way more sense.

And the best part? It’s not just about looking back and saying, “Well, that went over budget.” It’s about staying ahead of the curve, so you can make better calls before the money’s already gone. A few practices really stuck with me:

- Activity-Based Costing (ABC) – This one feels like detective work. You trace costs back to the activities causing them, and suddenly you see exactly where things are bloated or inefficient.

- Variance Analysis – I used to think this sounded boring, but it’s actually pretty eye-opening. You line up what you planned versus what actually happened, and it tells you where things went off track (or where you did better than expected).

- Budgeting and Forecasting – To me, this is like having a roadmap. It gives you direction, but it’s flexible enough that if something changes, you can adjust without losing sight of the bigger goal.

- Cost-Benefit Analysis – Honestly, this is just the “is it worth it?” test. Simple, but so many businesses skip it and end up spending on stuff that doesn’t really deliver.

- Risk Management in Costs – This is basically carrying an umbrella. Most days you won’t need it, but when it pours, you’ll be glad you had one.

What I like about these methods is that they don’t feel like number-crunching for the sake of it. They make you think differently about money. It’s not about penny-pinching – it’s about making every rupee or dollar actually matter.

And seeing how companies like Unilever and Nestlé are using the same strategies-not just to cut costs but to cut waste and meet sustainability goals-was a bit of a lightbulb moment for me. It’s proof that smart cost management isn’t just good for profits. It’s how you build a business that lasts.

These advantages in the US CMA for cost management strategies train you to anticipate challenges, question assumptions, and guide strategy with precision. In essence, mastering them turns cost management from a routine task into a framework for smarter, more informed leadership in any finance or accounting role.

Did you know global leaders like Unilever and Nestlé are tying cost management with sustainability?

This helps them reduce energy consumption and waste. And the best part? It not only cuts costs for them but also meets ESG targets, creating long-term business value.

Career Opportunities After The US CMA Course

The US CMA course is designed for finance professionals who want to use numbers to shape business decisions. That’s why CMAs often find themselves in roles where finance and strategy meet.

Here’s a way to picture it: a company is like a living body. Money flows through it the way blood flows through veins. Some flows keep the system alive; others quietly leak out. CMAs are trained to spot these leakages (in terms of money, obviously), understand where resources truly add value, and recommend actions that keep the whole system healthy.

This is exactly why CMAs step into roles that go far beyond traditional accounting. They bring skills in cost control, financial planning, and performance analysis that directly support decision-making at the leadership level.

As a CMA, you’re influencing business outcomes. You become the professional who can answer questions like: “Which projects will deliver maximum value for the investment?”, “Where can efficiency improvements free up resources for strategic initiatives?”, and “How do we structure financial decisions to manage risk without stifling innovation?”

By mastering cost management strategies, candidates open the door to roles that require both technical and strategic expertise.

| Career Role | Focus Area | How Cost Management Strategies Apply |

| Corporate Strategist | High-level corporate strategy and decision-making | Uses cost insights to shape organisational priorities, optimise resource allocation, and guide long-term strategy. |

| Global Finance Professional | International finance and cross-border operations | Applies standardised cost management practices to compare financial performance globally and make informed investment decisions. |

| Tech-Driven Finance Expert | Leveraging emerging technologies for finance | Integrates AI, analytics, and blockchain to forecast costs, improve efficiency, and enhance data-driven decision-making. |

| Risk Management Specialist | Identifying and mitigating financial risks | Anticipates potential cost overruns, evaluates risk exposures, and implements proactive strategies to protect organisational financial health. |

These roles ensure that CMAs remain at the cutting edge of financial leadership.

The Imarticus Learning Advantage

The US CMA course at Imarticus Learning is built for people who actually want to use skills at work, not just pass a test.

Global Curriculum with Real Industry Input

Imarticus is a Gold Learning Partner with IMA, and the CMA course here is designed in collaboration with KPMG in India. That means you’re not just learning “book theory.” You’re picking up practices and case studies that companies are already using around the world.

Learning That’s Hands-On

This is the part I like most. Instead of just memorising, you get to:

- Work on 20+ case studies and simulations (reviewed by KPMG experts).

- Compete for internships with KPMG India if you’re among the top performers.

- Join live sessions and webinars that keep you updated on what’s actually happening in finance right now.

Career Support That Feels Personal

And then there’s the career side. Imarticus helps with placements in finance, consulting, and tech, but it doesn’t stop there. You also get mentorship from people who’ve been through the CMA journey themselves — people who can tell you what really works in the real world.

A Certification That Carries Weight

At the end, you don’t just walk away with a CMA qualification. You also get a joint certification from Imarticus and KPMG India. On a resume, that’s a strong signal that you’ve been trained with both academic rigour and industry insight.

Cost Management Strategies: Future Trends

The world of cost management is changing faster than ever, and the US CMA course reflects this shift by preparing professionals to think ahead, not just account for the past. Today, costs are influenced by technology, global operations, and social responsibility, meaning that the way organisations track and optimise expenses must evolve as well.

Global interconnectedness and shifting stakeholder expectations. Every decision, from supply chain choices to workforce deployment, carries a ripple effect that traditional methods fail to capture. Forward-thinking CMAs are being trained to anticipate these ripple effects, integrate multidimensional cost considerations, and align financial insights with broader business goals.

Here are some trends shaping its future relevance in CMA training:

- AI-Powered Forecasting: Machine learning tools are redefining how budgets are planned and risks are assessed.

- Sustainability Costing: Integrating environmental and social costs into financial decision-making.

- Real-Time Analytics: Cloud-based tools providing instant access to cost data.

- Global Standardisation: Harmonisation of international accounting standards for cost reporting.

By mastering these cost management strategies, CMA professionals are preparing themselves not just for today’s roles but also for the future of global finance.

FAQs on Cost Management Strategies

Got questions about how cost management strategies really work in the real world? Here are some of the most frequently asked questions answered in a simple, practical way to help you understand why they matter.

What are cost management strategies?

Cost management strategies are really about being smart with money, not stingy. They’re the methods companies use to plan, monitor, and adjust how funds are spent so that every rupee or dollar is working toward business goals. It’s like having a roadmap for expenses, knowing when to invest more and when to pull back.

Why are cost management strategies important?

Cost Management strategies matter because money disappears quickly without a plan. No company, no matter how big, has endless resources. I’ve seen how strong cost management strategies make sure money goes into things that actually push the business forward instead of just draining cash.

And it’s not just me saying this. A Deloitte survey found 88% expect to pursue cost improvement over the next 24 months, regardless of whether their revenues are increasing or decreasing. That tells me it’s become a survival skill, not just a finance function.

What is the work of cost management?

Cost management can be seen as being part watchdog and part strategist. It’s about keeping a close eye on where money flows, spotting waste before it snowballs, and redirecting resources to areas with the highest impact. It’s less about penny-pinching but more about shaping smarter business decisions. The Harvard Business Review nailed it when they said that effective cost management helps companies not just survive but actually grow stronger.

What is the salary of a cost manager in India?

The salary for cost managers in India is pretty attractive because the role directly impacts profits. If you’re starting out, you can expect something in the ₹5–7 LPA range, but with 5–10 years of experience, it jumps to ₹12–20 LPA.

At senior levels in big firms or MNCs, ₹25 LPA and beyond is not unusual. According to Glassdoor, the demand is strong, and honestly, that makes sense. Companies will always pay well for someone who protects their bottom line.

How to become a cost manager?

If I were starting from scratch, I’d begin with a degree in finance, accounting, or business. Then I’d add a professional edge with a certification like the US CMA, since it dives deep into cost management strategies for business decisions.

From there, I’d get hands-on experience in budgeting, planning, and cost analysis roles. The more you practice turning numbers into insights, the more valuable you become. Because analytical skills + problem-solving = your best friends on this journey.

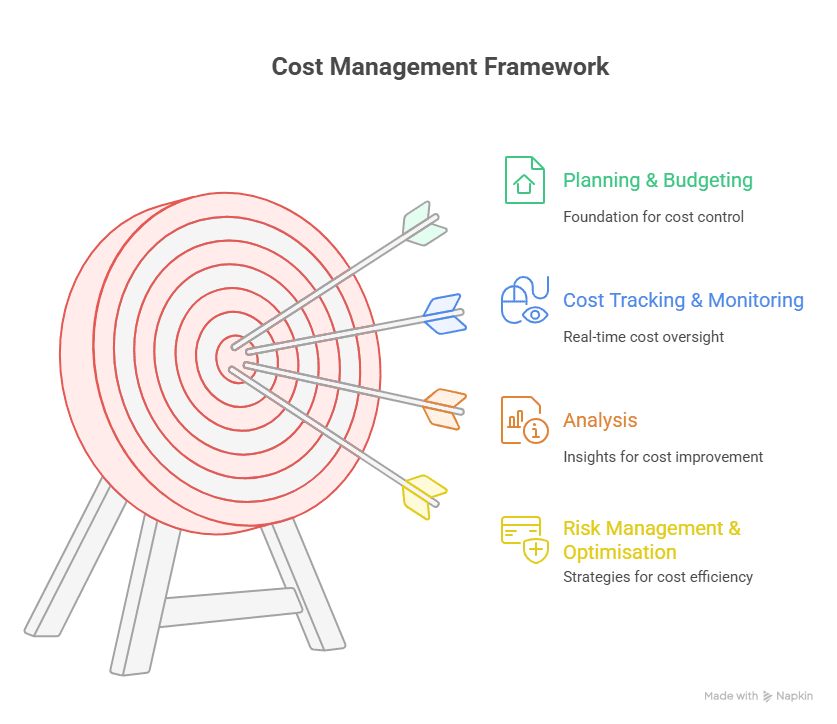

What are the 4 stages of cost management?

I think of it as a loop:

- Planning: laying down budgets and setting the rules of the game.

- Estimation: using data (and a bit of forecasting instinct) to predict costs.

- Control: keeping expenses in check and fixing things when they go off course.

- Analysis & Reporting: looking back at what happened, finding patterns, and learning for the future.

It’s not a one-time checklist- it’s a cycle that keeps repeating. That’s why PMI calls it a best practice in project cost management strategies.

How do CMAs use cost management strategies?

If I were a CMA (or when I think like one), I’d use cost management strategies to help leaders make better calls. That could mean flagging a product that’s eating more cash than it brings in, or showing how to optimise operations without hurting quality.

IMA research actually highlights how CMAs are becoming key decision-makers because they mix financial expertise with strategy. That’s a powerful combo.

Are cost management strategies useful for all industries?

Oh, 100%. I’ve seen them work everywhere. Factories use them to cut production costs, hospitals to make better use of staff and equipment, IT companies for project budgets, and banks to keep operations lean.

Basically, if there’s money moving, cost management strategies can sharpen the edge. McKinsey even points out that businesses that adopt cost strategies often become more competitive overall, not just cheaper to run.

What role does technology play in cost management today?

Technology is a game-changer in cost management. With AI and analytics, I can see spending in real time, spot hidden leaks, and even forecast problems before they hit.

Automation also saves time on the boring stuff, which frees managers to focus on strategy. And this isn’t just hype-Gartner predicts that AI-driven cost optimisation could slash operating costs by up to 30% in the next few years. That’s massive, and it shows why tech is now at the heart of modern cost management strategies.

References

- https://www.deloitte.com/dk/en/services/consulting/research/gx-global-cost-survey.html

- https://hbr.org/2023/07/cost-cutting-that-makes-you-stronger

- https://www.glassdoor.co.in/Salaries/cost-manager-salary-SRCH_KO0,12.htm

- https://www.pmi.org/learning/library/cost-management-9106

- https://www.gartner.com/en/newsroom/press-releases/2024-10-22-gartner-unveils-top-predictions-for-it-organizations-and-users-in-2025-and-beyond

Final Words

When I think about the US CMA course, what really stands out to me is how practical it is. Sure, it’s a finance certification, but at its core, it’s teaching you cost management strategies that you’ll actually use in real business situations.

And honestly, cost management isn’t just about cutting expenses-it’s about asking the right questions: Where is the money going? Which activities are really worth it? How can we stretch resources without compromising growth? That’s the kind of thinking the CMA pushes you into, and along the way, you pick up tools like activity-based costing, budgeting, forecasting, and even tech-driven ways to manage costs better.

The cool part is that these skills don’t lock you into one industry-you can take them anywhere. For me, it feels less like memorising formulas and more like developing a mindset: looking at numbers not as numbers, but as decisions, trade-offs, and opportunities.

So if I had to sum it up? Learning cost management strategies through the CMA isn’t about tweaking spreadsheets-it’s about learning how to think smarter with money. And that’s a skill every finance leader, in any industry, needs.

👉 If you’re looking to explore these strategies in more depth and understand how they’re applied in real-world scenarios, the US CMA course by Imarticus Learning offers a structured pathway to do so, with practical insights and guidance from industry experts.