Last updated on November 10th, 2025 at 05:42 pm

In most finance interviews today, one line on a resume changes the tone of the conversation: “CFA Level II Candidate” or “CFA Charterholder.”

It’s not magic. It’s signalling. It tells the interviewer that you’ve gone through a program known for its depth, precision, and rigour, a program that the global finance community still treats as the most reliable marker of competence. And that has earned it the reputation of a gold standard credential.

When someone speaks of the “CFA course” or “CFA courses” in the context of the “chartered financial analyst” designation, they’re referring to the entire journey of the CFA Institute’s credential: registration, exam levels, modules, practical experience, and membership. In effect, the “CFA program” is a pipeline from candidate → charter-holder.

What Is CFA? Breaking Down the CFA Course Details

Ask anyone who’s worked on a trading desk, or sat through an investment pitch at 11 p.m., and they’ll tell you, the CFA charter isn’t about passing exams. It’s about building judgment. When you look at the CFA course details, you realise they’re designed for exactly that, cultivating the analytical discipline and ethical grounding that real finance demands.

The Chartered Financial Analyst (CFA) program, run by the CFA Institute, has been around long enough to outlast trends in finance. Before fintech, before algorithmic trading, before “financial influencers,” this was the course that serious professionals quietly pursued while working full-time.

So, what is CFA, really? It’s the industry’s way of measuring whether you understand how money actually moves, not in theory, but in real markets, under pressure.

Here’s a simple way to see it:

If an MBA gives you a panoramic view of business, the CFA hands you the lens that lets you zoom into the numbers; the mechanics of risk, return, and valuation. It’s like learning to read the financial “DNA” of a company instead of just its headlines.

The CFA course has three levels, each structured to build a different layer of expertise.

- Level I is about understanding the tools: financial reporting, quantitative methods, and ethics.

- Level II teaches you how to apply them in analysis and valuation.

- Level III focuses on how to manage portfolios and make strategic investment decisions.

And that’s why it’s often called the gold standard in finance. Across investment banks, asset management firms, consulting houses, and even family offices, a CFA next to your name quietly signals something specific; not prestige, but credibility.

Every charterholder has a version of the same story: years of late-night studying, long workdays, and a few failed attempts. But when they finally earn the charter, something shifts. Colleagues start asking them for investment rationale, not opinions. Recruiters stop asking if they’re “finance material.”

Watch this video to find out why this charter remains the most respected badge in global markets.

CFA Course Details: Duration & Timing

When you dig into the CFA course details, one of the first questions that comes up is how long it really takes to complete. Understanding the CFA course duration helps you plan your preparation realistically, balancing study time, work commitments, and exam cycles.

Many aspirants start their journey wondering, “How long until I finish the CFA course?” The truth is, the timeline varies, but knowing what to expect helps you pace yourself without burnout.

Typical duration

- Many candidates budget 300 hours per level for exam preparation per the Institute’s guidelines.

- Realistic completion timelines vary depending on full-time work, study habits, and exam availability.

- In India, for working professionals, a 2 to 4 year timeline is common: e.g., one level every 9–12 months, plus time for work experience.

Exam windows & cadence

- Exams for each level are offered multiple times a year: February, May, August, and November.

- If you finish Level I in, say, August, you might attempt Level II the following February or May, hence the “calendar loaf” adds time.

- If you fail or defer, the timeline extends. On average, many aspirants complete the entire “CFA course full details” path in about 3 years.

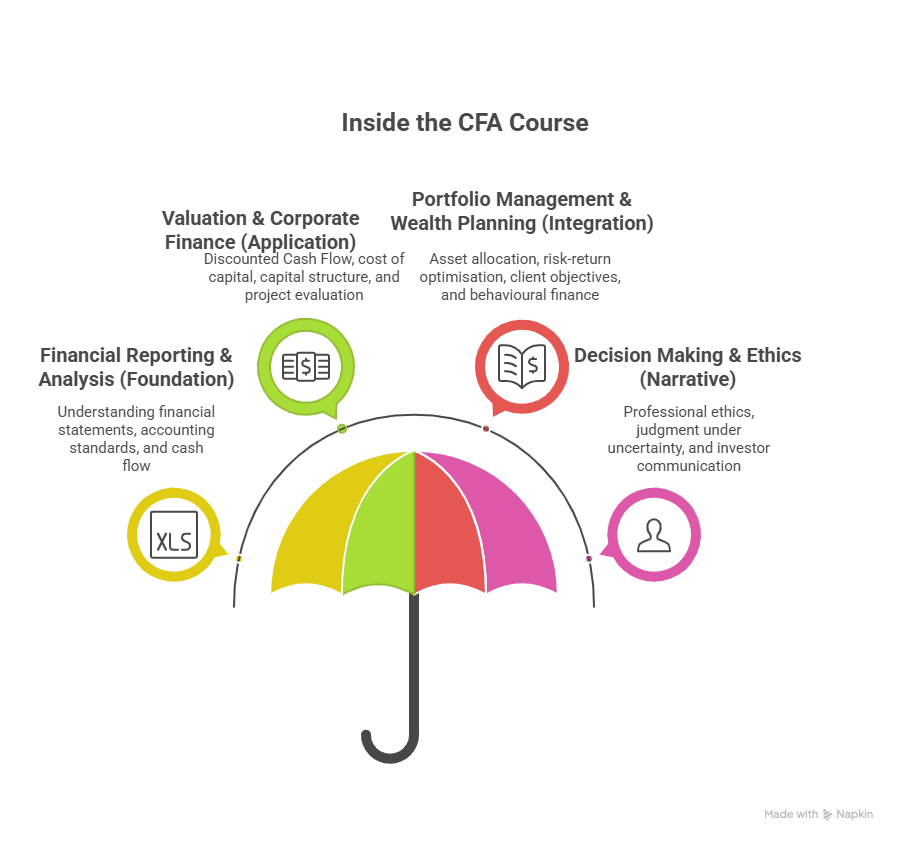

Here is a visual overview of the aspects of this charter that you can expect:

Here is an overview of the high-level components of the CFA Journey:

- Registration/enrolment – initial entry into the CFA Program.

- Exams – three sequential levels: Level I, Level II, Level III.

- Work experience requirement – minimum professional investment/finance experience to become a charter-holder.

Membership & continuing obligations – once chartered, maintaining membership, abiding by ethics, and CPD.

CFA Course Details by Level

The CFA Course Details by Level reflect how the program is intentionally structured to transform a candidate’s approach to finance step by step. Each level serves a distinct purpose – Level I grounds you in the core concepts, Level II tests how you apply them in analytical and valuation contexts, and Level III challenges you to make strategic portfolio decisions like a practitioner.

Together, they form a well-sequenced journey from technical literacy to professional mastery. Understanding this progression helps candidates plan their CFA course duration realistically and align their study efforts with the depth and complexity of each stage

Here is a summary table of each level in the CFA program and typical completion times:

| Level | Focus & Format | Approx. Study Hours | Typical Duration from registration |

| Level I | Foundations: ethics, quantitative methods, economics, accounting, etc. | ~300 hrs | 9–12 months |

| Level II | Asset valuation: equity, fixed income, derivatives, advanced financial reporting. | ~300–350 hrs | Additional 9–14 months |

| Level III | Portfolio management & wealth planning: application of concepts, ethics embedded throughout. | ~300 hrs+ | Final 6-12 months + experience requirement |

Work Experience & Other Requirements

A key part of the CFA course details is the work experience requirement, which many gloss over:

- To become a full charter-holder, you must accumulate at least 4 years of qualified professional work experience in investment decision-making roles (it may be accrued before, during, or after passing the exams).

- You must also apply to the CFA Institute once you have passed all three levels and met the experience requirement.

- Annual membership dues: after chartering, there is an annual USD 299 membership fee to the CFA Institute, plus possibly local society dues. (CFA Institute)

This means that even after passing all three levels, there is an implied lag time before you can use “CFA charter-holder” on your résumé. Thus, when you talk about CFA course duration, it’s not just exam time but the total time to charter.

Most finance professionals think they’re too busy for CFA prep. The truth? Their work experience already gives them a head start. Watch this video to master the CFA with a smart 2-hour-a-day routine designed for full-time professionals.

Why this matters for India-based professionals

- Given exam windows and typical work commitments, Indian aspirants often complete the programme in 3 to 4 years, sometimes more if balancing full-time work and travel.

- Because of currency fluctuations and the cost of study/travel, you’ll want to budget accordingly (covered in Part 2).

- The credential is globally recognised, which means even if you study in India, the duration and timeline are relevant to international employers.

Deep Dive into CFA Course Details

When you look beyond the usual list of subjects, the CFA Course Details reveal a carefully layered progression, one that mirrors how finance professionals evolve in real life. The curriculum is a map of financial maturity. It starts with the fundamentals of ethics and quantitative methods, builds analytical depth through financial reporting and corporate finance, and culminates in portfolio management and wealth planning.

This structured escalation not only ensures conceptual clarity but also trains your thinking to move from interpreting numbers to telling financial stories with purpose and precision.

Key topic areas across the programme

- Ethical and Professional Standards (embedded in all levels)

- Quantitative Methods

- Economics

- Financial Reporting & Analysis (FRA)

- Corporate Finance

- Equity Investments

- Fixed Income

- Derivatives

- Alternative Investments

- Portfolio Management & Wealth Planning

Topic-weight table example (for Level I)

| Topic | Approx. % Weight* |

| Ethical & Professional Standards | ~15–20% |

| Quantitative Methods | ~8–12% |

| Economics | ~8–10% |

| Financial Reporting & Analysis | ~13–17% |

| Corporate Finance | ~8–12% |

| Equity Investments | ~10–12% |

| Fixed Income | ~8–10% |

| Derivatives | ~5–8% |

| Alternative Investments | ~5–8% |

| Portfolio Management & Wealth Planning | ~5–8% |

What the CFA Course will cost you in India

Understanding what the CFA course will cost you in India goes beyond just the registration fee; it’s about recognising the long-term value of the investment. Every stage of the CFA program demands not only financial planning but also a commitment of time and focus, making it essential to view the expense as part of your professional growth strategy.

By examining the CFA course details from a cost perspective, the CFA Level 1 prep can be better for candidates for the journey ahead, ensuring that each rupee spent translates into tangible career momentum and global credibility in the finance domain.

Global fee summary

- The total fees for all three levels of the CFA programme range from USD 3,520 – USD 4,600, depending on registration timing.

- For the USD to INR conversion, additional local costs (coaching, materials, travel) must be added for the Indian context.

India-specific cost estimates

- All three levels combined in India: approx ₹2.65 lakhs to ₹3.4 lakhs (excluding coaching) per one estimate.

- Another estimate: ₹3 lakhs to ₹3.6 lakhs, including exam fees plus preparatory coaching.

CFA Registration Fees and other expenses (India context)

| Expense | Typical Amount | Notes |

| Registration & exam fees (all 3 levels) | ₹2.65 lakhs–₹3.4 lakhs | Early registration helps savings |

| Study materials/coaching | ₹60,000–₹2 lakhs | Varies hugely by institute |

| Rescheduling/retake fees | ₹20,000–₹25,000 per level | If you defer or fail |

| Membership dues post-charter | USD 299 (~₹25,000) + local society dues | Annual cost |

Return on Investment (ROI) and Career Value of the CFA Course

The CFA course is a bit like learning to cook a proper meal for the first time. You spend more time chopping, cleaning, and simmering than actually eating. But once you’ve done it a few times, you realise that all that effort wasn’t wasted; it taught you control, timing, and judgment. And suddenly, what looked like “work” turns into a skill that pays off every single day.

That’s how the CFA works in your career. It takes patience to get through the syllabus, the exams, and the long study hours. But what you gain is credibility, sharper analysis, better decision-making that keeps giving back in the long run.

Real ROI in finance isn’t about the first paycheck after certification. It’s about the steady returns that come when your expertise starts to speak louder than your résumé.

Salary uplift & career access

- While specific CFA Salary in India numbers vary, globally, a charter-holder often commands a significantly higher salary ceiling than non-charter peers.

- Pass rates remain low because the credential’s scarcity adds premium value.

Qualitative ROI

- The “chartered financial analyst” credential signals to employers: strong analytical skills, ethics, investment-orientation, and global mindset.

- For Indian professionals aiming at roles in portfolio management, wealth advisory, investment banking, and asset management, the CFA credential gives “ticket-to-table” access internationally.

- At Imarticus Learning, we emphasise: completing the programme shows commitment and ability to manage a challenging study + work dual path, which many recruiters value.

Tips to maximise ROI

- Choose your optional domain (once you reach Level III) aligned with your career interest (e.g., if you aim for private equity, pick alternative investments).

- Start the work-experience log early so you can complete that part in parallel.

- Time your exams smartly so you minimise idle gaps. Fewer idle months = faster CFA course duration = faster ROI.

- Use networking (CFA society local chapter) to convert credentials into opportunities.

Study Strategy for the CFA Course

Beyond the content list and cost, the strategy is what separates successful candidates. Here are actionable pointers:

- Create a study calendar: If you are working full-time, allocate 10–15 hours/week; aim to complete the curriculum 8–10 weeks before the exam to leave adequate revision time.

- Use mock exams and question banks: Practising application increases retention; analytics show first-time passers tend to have a consistent schedule and mock count.

- Prioritise Ethics & Professional Standards: Many candidates underestimate this, yet it is heavily weighted and carries a clear signal of charter status.

- Avoid large gaps between levels: As data shows, deferred candidates have lower pass rates.

- Leverage institute support: At Imarticus Learning, we provide study sessions, peer groups, and revision boot camps, all contributing to reducing the CFA course duration.

Exam Difficulty & Pass-Rate Insights

When discussing CFA course details, one question always surfaces: how hard is it to pass? The answer lies not just in numbers, but in understanding what the exams truly demand. Each level of the CFA program is designed to test a different layer of your analytical maturity. Level I checks your conceptual grasp across ten subjects, Level II pushes you into applied valuation and real-world case analysis, and Level III assesses how well you can integrate everything into portfolio-level decision-making.

The CFA exams are challenging because they simulate the rigour of real financial decision-making – where precision, patience, and ethical judgment intersect. Pass rates historically hover between 35% and 45%, a reflection of the program’s depth rather than its difficulty alone.

Snapshot of recent pass rates (global)

- Level I: ~43% for August 2025.

- Level II: ~44% for August 2025.

- Level III: ~50% for August 2025.

What this means for you

- More than half of global candidates fail each level. This signals the credential’s rigour and the value of proper preparation.

- If you procrastinate, leave long gaps, or study less than recommended, your timeline will stretch, and your ROI will drop.

- First-time test takers generally perform better than those deferred: recent data shows first-time Level I pass rate ~52% vs deferred ~28%.

CFA Charter Turns Your Resume into a Golden Ticket

The CFA Charter doesn’t just add three letters to your name; it transforms how employers see you. Recruiters recognise it as proof of discipline, global competence, and ethical judgment, traits that instantly set you apart. According to the CFA Institute’s 2024 Compensation Study, Charterholders earn 50–60% higher median salaries than non-chartered peers, a strong signal of its market value.

Think of it as a global trust stamp for your resume. Whether you apply in Mumbai, London, or New York, “CFA Charterholder” tells hiring managers you don’t just understand finance, you think in its language.

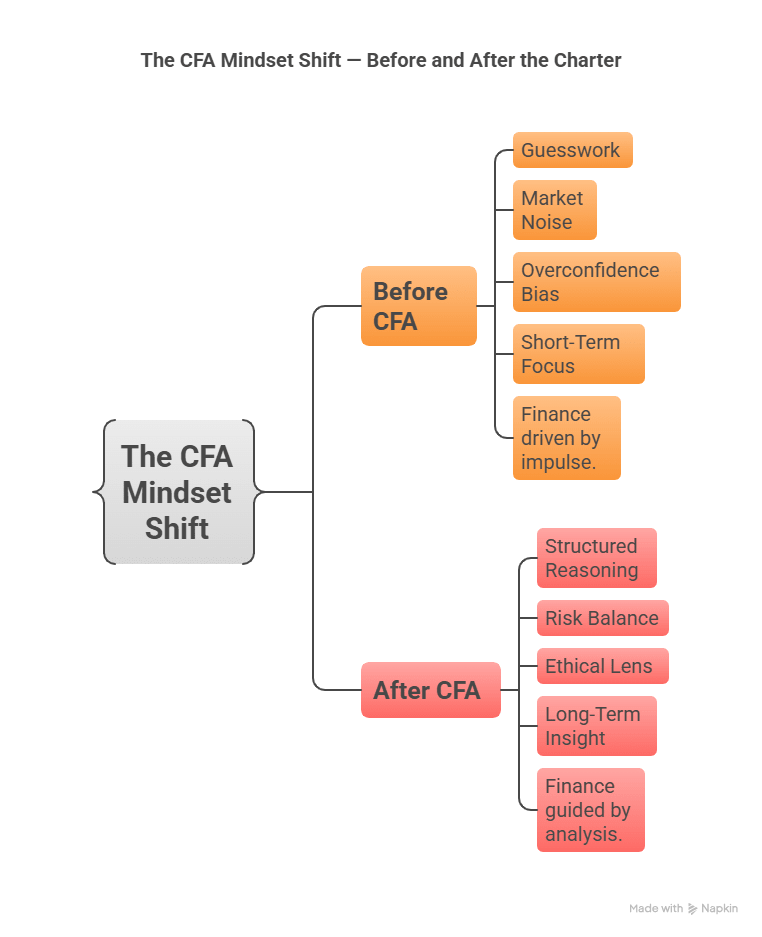

The CFA Mindset Shift: Before and After the Charter

Before earning the charter, finance feels like solving numbers; after it, you start seeing the story behind them. The CFA mindset turns guesswork into insight, reaction into reasoning, and information into interpretation.

It’s the difference between playing chess and seeing the whole board; that’s the kind of clarity and foresight the CFA journey builds in every professional. This flowchart shows the skills that get added once you hold the charter.

Strategic Advantages of the CFA Credential

What makes the CFA course worth doing from a strategic mindset?

- Global recognition: The “chartered financial analyst” title is a global stamp of investment expertise, not just local accounting credentials.

- Versatility: The syllabus covers a wide investment spectrum (equities, fixed income, derivatives, alternatives), enabling transitions into varied CFA roles.

- Ethics-anchored: Employers increasingly value ethics/state-of-the-profession orientation; the CFA embeds this deeply.

- Network access: Charter-holders join global and local CFA societies; these professional networks often drive jobs and career development.

- Career differentiator: In India, especially, having “CFA” on your résumé sets you apart in competitive hiring, provided you communicate your “CFA course details” (what you learned, how you applied it).

FAQs on CFA Course Details

Before you take your first step toward becoming a Chartered Financial Analyst, it’s natural to have questions about timelines, difficulty, salaries, or the commitment it truly demands. This section compiles the most frequently asked questions about the CFA course details, giving you clear, experience-based insights to help you plan your journey with confidence.

What is the CFA course for?

The CFA course is designed to provide a rigorous foundation and advanced skill-set in investment management, financial analysis, portfolio construction and ethics. The CFA course details cover three levels of exam content, work-experience requirements, and professional membership through the CFA Institute. Imarticus Learning ensures that you understand every step of the CFA course details, from registration to exams to charter application.

Is CFA harder than CA?

When comparing CA versus the CFA course, the CFA programme differs in focus, structure and global applicability. “Chartered accountant” tracks typically focus on accounting, audit and taxation in your local jurisdiction, while the CFA centres around investment analysis, portfolio management and global financial markets. The difficulty of the CFA course is reinforced by pass-rates (for example, ~43% at Level I) and the breadth of topics. With guidance from Imarticus Learning, your preparation will cover all the critical CFA course details to mitigate that challenge.

How many years CFA course?

The number of years to complete the CFA course varies widely. Many candidates finish within 3 to 4 years, but a faster path (2 years) is possible for full-time study; others may take longer if balancing full-time employment. As you review the CFA course details, make sure to factor in exam windows, necessary work experience and potential retakes, all of which affect your timeline.

What is a CFA salary?

The CFA credential is often associated with higher compensation compared to non-credentialed peers. When you display the relevant CFA credential on your resume (such as passing three levels, work experience, and portfolio management exposure), employers recognise the depth of training and may offer roles with enhanced pay scales.

Is CFA better than MBA?

Whether the CFA course is “better” than an MBA depends on your career goals. The CFA programme is highly specialised in investment finance, offering globally recognised certification and a rigorous curriculum. The MBA tends to cover broader management, leadership and business functions. If you aim for portfolio management or investment roles, the CFA course may provide stronger domain credibility; if you aim for general management, an MBA might be appropriate.

Is CFA Level 3 very hard?

Yes, Level III is a challenging part of the CFA course. It emphasises synthesis of prior material (Levels I & II) and application through portfolio management, ethics and case-type questions. The pass rate (~50%) indicates that while candidates who reach Level III are committed, the exam sees rigorous testing.

Can CFA earn 1 crore?

Achieving annual compensation of ₹1 crore (INR) with a CFA credential is possible, especially in senior investment-management roles, private equity, hedge funds, or global roles. However, merely completing the CFA course details is not a guarantee: your role, geography, experience, firm size, and value proposition matter.

Is 27 too late for CFA?

No, age 27 is not too late for the CFA programme. At that age, you may have a few years of work experience already, which is advantageous. What’s more critical is your study plan, time commitment, and alignment with your career path. When you review the CFA course full details at Imarticus Learning, you’ll find that the timeline is flexible and adaptable to your individual context, and success at age 27 or older is common.

Is the CFA Level 1 pass rate?

The latest data shows that the pass rate for Level I of the CFA course is around 43% for August 2025 globally. That means fewer than half of the candidates pass on the first attempt. Reviewing and mastering the CFA course details, subject weights, exam format, and study hours significantly improves your odds. Imarticus Learning guides you through these specifics to maximise your results.

What if I fail in CFA Level 1?

If you fail Level I of the CFA course, it’s not the end of the road. You can attempt the next available exam window after ensuring you meet any deferral or retake conditions. But the failure will extend your CFA course duration and potentially increase costs (retake fees, extra study time).

What are the fees for the CFA exam in India?

In India, the fees for the CFA programme (all three levels combined) are typically in the range of ₹2.65 lakhs to ₹3.4 lakhs, excluding coaching and study materials. For individual levels, early registration discounts apply. When you evaluate these numbers, ensure you plan for the full CFA course, that is, registration, exams, study materials, retakes, and travel if required.

What’s a good CFA score?

Since the CFA Institute does not publish exact minimum passing scores (MPS) for each exam, candidates rely on estimations. For Level I, estimates suggest a minimum of ~65-70% correct answers historically. A “good” score in the context of the CFA course details means comfortably above this threshold, with strong performance in Ethics, FRA and Portfolio Management. Imarticus Learning’s mock‐exam analytics help you target that “good” score.

Looking Ahead

The CFA course is a method, not a medal. Over the chapters here, you’ve seen its structure, the real-world curriculum that moves from accounts to valuation to portfolio judgment, the time and cost realities, and the behavioural habits the program installs. These CFA course details are the mechanics of professional reliability: how you frame a question, what assumptions you allow, and how you document a decision so others can trust it.

Completing the program reshapes your work: you stop guessing at signals and start testing them; you write memos that survive scrutiny; you make portfolio calls that account for tail risks, not just upside stories.

If you want a quick litmus test, ask yourself this: Do you want to be someone who’s repeatably right under pressure, or someone who hopes to be right? The CFA is the discipline that trains you toward the former.

If you’re ready to develop that level of mastery, explore the CFA Course in Collaboration with KPMG in India, offered by Imarticus Learning. Start building the skill set and credibility that define global finance professionals, one deliberate step at a time.