In today’s fast-moving, tech-powered world… digital marketing is no longer just about running ads or writing social media captions. It’s about thinking strategically, adapting quickly & creating impact at scale. If you’re looking for the best digital marketing course in India, don’t just search for flashy ads or short-term hacks—look for something that helps you become a digital leader.

Because the truth is… the most successful marketers today aren’t just campaign managers… they’re digital strategists, automation experts, SEO wizards & analytics storytellers.

What Sets the Best Digital Marketing Course in India Apart?

Let’s face it—there are hundreds of digital marketing courses out there. But only a few truly prepare you to lead in today’s tech-first marketing ecosystem.

The best digital marketing course in India goes beyond tools… it helps you build digital leadership skills that last through market shifts, tech disruptions & evolving consumer behaviours.

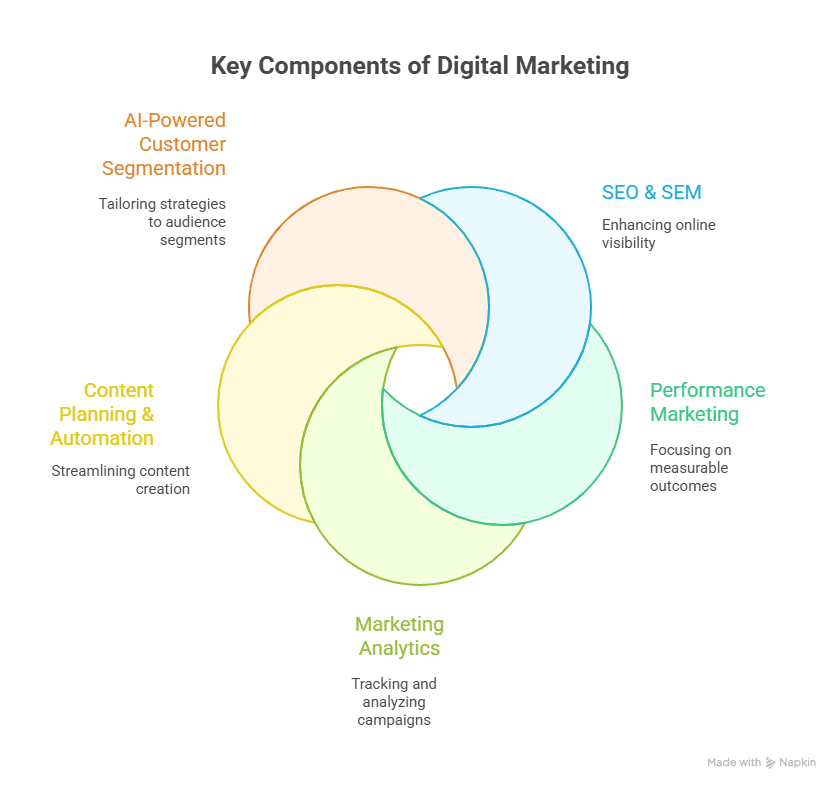

Here’s what a top-tier program should offer:

| Key Element | Why It Matters |

| Digital Leadership Training | Helps you think beyond tasks… into strategy, vision & innovation |

| Advanced SEO and SEM Training | Ensures your campaigns are discoverable & profitable |

| Marketing Automation Course | Teaches how to scale campaigns with smart tools |

| Career-Focused Learning Path | Aligns learning with real job roles & career outcomes |

| Certified Digital Marketing Program | Adds credibility to your profile… boosts job readiness |

One such course that delivers this holistic learning is the MyCaptain Digital Marketing Program by Imarticus Learning. It’s not just about ads… it’s about preparing digital professionals for leadership.

Why Leadership is the New Must-Have Skill in Marketing

Marketing today requires more than creative instincts. You need to make data-driven decisions… understand buyer psychology… integrate AI tools & lead teams across digital platforms.

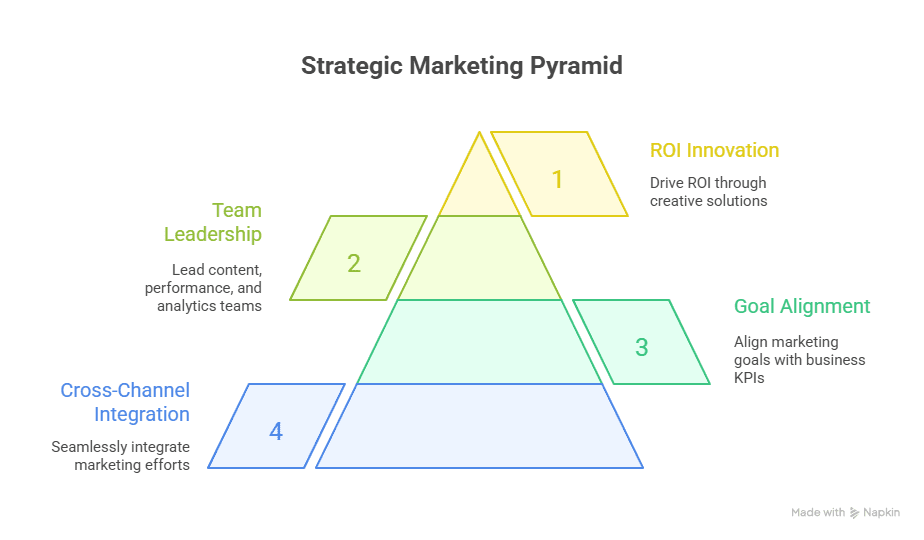

This is where digital leadership skills come in. It’s about learning to:

- Build cross-channel strategies

- Align marketing goals with business KPIs

- Lead content, performance & analytics teams

- Drive ROI through innovation

So, when choosing the best digital marketing course in India, look for programs that don’t just teach tools… but shape thinkers & doers.

Don’t Just Learn Ads… Learn Automation Too

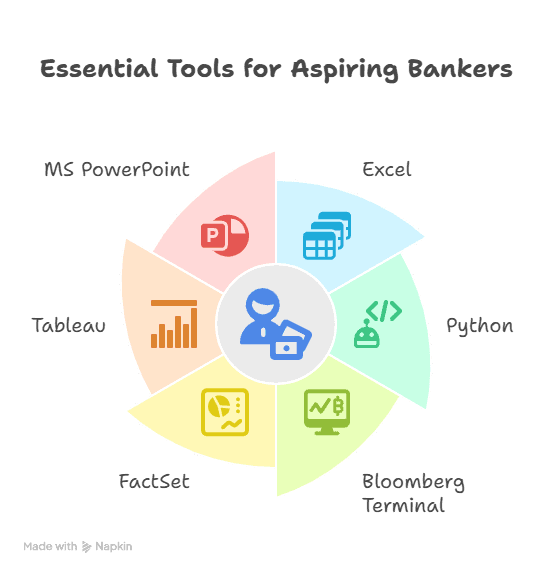

The modern marketer’s best friend? Automation. From email drip campaigns to dynamic ad retargeting… automation helps you work smarter, not harder.

That’s why a strong marketing automation course is a must in any advanced curriculum. It enables you to:

- Schedule & personalise campaigns

- Trigger communications based on user behaviour

- Save time while boosting conversion rates

A course like MyCaptain’s Digital Marketing Program includes live training on automation tools like Mailchimp, HubSpot & others—turning learners into workflow pros.

Here’s a quick view of key automation elements taught in top programs:

| Automation Focus | Impact on Campaigns |

| Email Automation | Nurture leads at scale with custom sequences |

| Lead Scoring | Focus on high-intent leads using predictive scoring |

| Behavioural Triggers | Automate follow-ups based on actions like clicks/opens |

| CRM Integration | Sync customer journeys with marketing touchpoints |

Why Advanced SEO and SEM Training is Non-Negotiable

Let’s be real—without visibility, your content is just noise. That’s why advanced SEO and SEM training is one of the most critical components in a digital marketing curriculum.

It’s not just about keywords anymore. It’s about:

- Mastering search intent

- Creating Google-friendly content

- Running high-ROI paid search campaigns

- Understanding bidding strategies & Quality Score

These are core modules in any certified digital marketing program aiming to build full-stack marketers. Without SEO & SEM mastery… you’re missing half the puzzle.

Read more on SEO’s role in shaping your career in our blog on Different Digital Marketing Business Models.

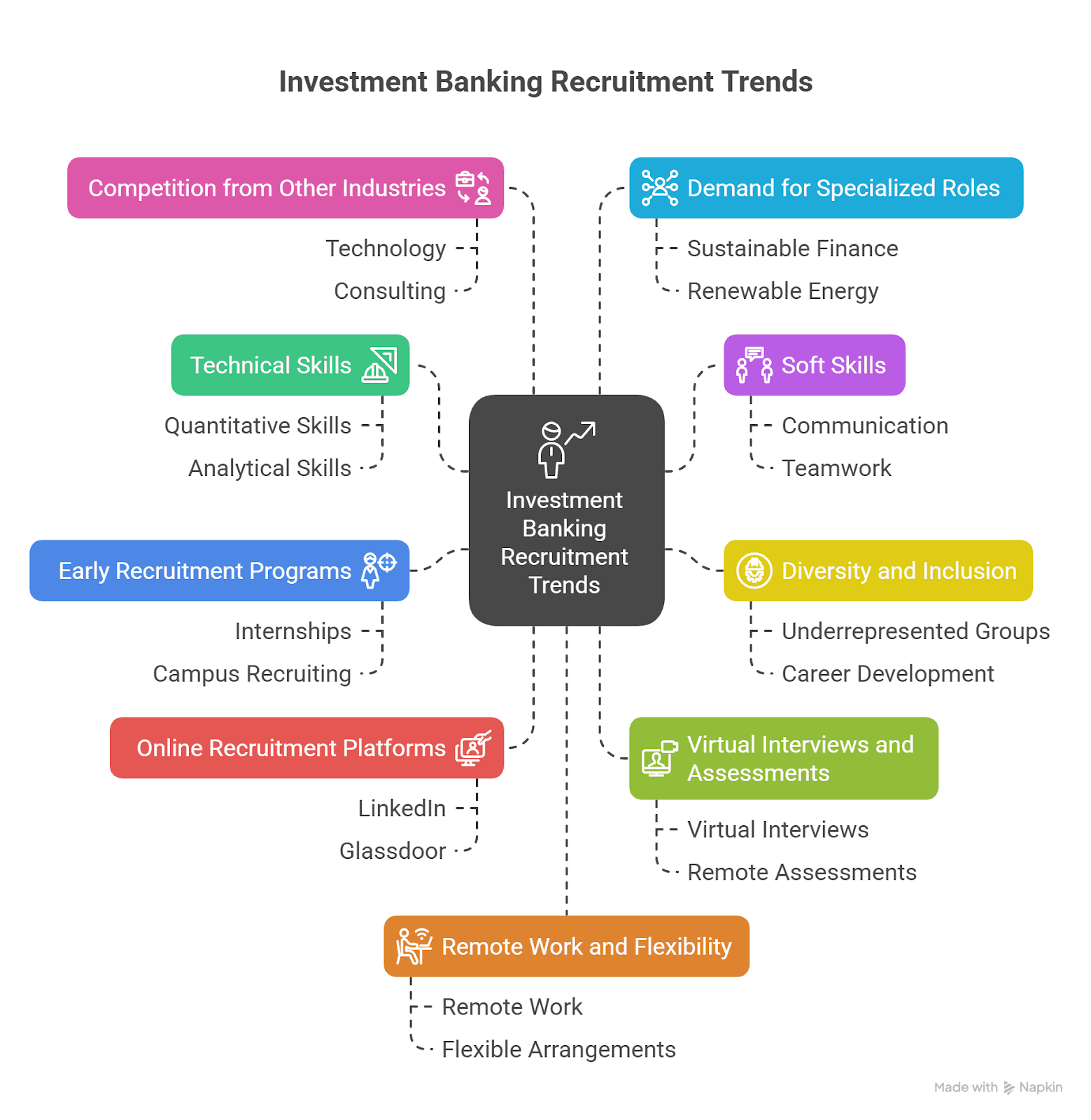

Career Growth in Digital Marketing India – The Numbers Don’t Lie

The industry is exploding. Whether you want to work with a startup, MNC or go freelance… the career growth in digital marketing India is showing no signs of slowing down.

Here’s what the numbers look like:

| Digital Marketing Role | Avg. Salary (INR) | Growth Rate |

| Digital Marketing Executive | ₹3.5 – ₹5 LPA | 25% YoY |

| Social Media Manager | ₹6 – ₹10 LPA | 30% YoY |

| SEO/SEM Specialist | ₹5 – ₹8 LPA | 35% YoY |

| Performance Marketing Manager | ₹10 – ₹18 LPA | 40%+ YoY |

| Digital Marketing Head | ₹20 LPA & above | Leadership driven |

A structured program like MyCaptain’s not only equips you with skills… but also offers guaranteed interviews, increasing your chances of career breakthroughs.

Need more insights? Read our guide on the Scope of Digital Marketing in India.

Certified Digital Marketing Program: Why Certification Matters

A certified digital marketing program gives you more than a certificate—it gives you validation. Employers trust recognised programs that:

- Have structured, updated curriculums

- Include live projects with real clients

- Provide job support & career mentorship

- Train you on current tools like Meta Ads, Google Ads & more

This is exactly what MyCaptain’s Program delivers—an 18-week immersive experience that builds your portfolio & confidence.

Want to understand how digital marketing is evolving across sectors in India? Check out our blog on Digital Marketing in India.

What You Should Look for in the Best Digital Marketing Course in India

Not all programs are created equal… so here’s what to keep in mind:

| Must-Have Feature | Why It’s Important |

| Live classes by industry experts | Real-world insights & updated knowledge |

| Hands-on project work | Helps build a job-ready portfolio |

| Specialised modules on automation & SEO | Gives you depth, not just surface knowledge |

| Soft skills & leadership training | Builds confidence for client-facing & team roles |

| Placement assistance & certification | Ensures job readiness & credibility |

If a course offers all of the above… chances are you’ve found the best digital marketing course in India for your needs.

FAQs

1. What makes the best digital marketing course in India stand out?

It blends digital leadership skills, automation tools & real-world training.

2. Is a marketing automation course useful for beginners?

Yes… it teaches how to scale campaigns & save time with smart workflows.

3. Why is digital leadership skills training important today?

It helps you lead teams… plan strategies & grow in your digital career.

4. What does advanced SEO and SEM training include?

It covers keyword strategy… ad bidding & Google ranking techniques.

5. Can I expect career growth in digital marketing India?

Absolutely… demand is rising fast across brands, startups & agencies.

6. Does a certified digital marketing program help with jobs?

Yes… it adds credibility & boosts chances for better job roles.

7. Is marketing automation course only for email campaigns?

No… it includes lead nurturing, behavioural triggers & CRM syncing too.

8. How do digital leadership skills impact career growth?

They build confidence… decision-making power & future-ready profiles.

9. What tools are taught in advanced SEO and SEM training?

Google Ads… Analytics… SEMrush & other real-time SEO tools.

10. Why choose a certified digital marketing program over free courses?

Because it offers structure… industry projects & expert mentorship.

Final Words: It’s Not Just a Course—It’s a Career Builder

In the digital age, anyone can learn how to run an ad. But becoming a digital leader? That takes structure, strategy… & the right training.

Whether you’re a fresh graduate, freelancer or mid-career switcher… enrolling in the best digital marketing course in India is a smart investment. One that goes beyond tools & templates… and prepares you for a future filled with growth, innovation & leadership.

From building digital leadership skills… to mastering advanced SEO and SEM training… to applying smart workflows through a marketing automation course… you’re not just learning—you’re transforming.

Explore the MyCaptain Digital Marketing Program today & take your first step toward becoming a digital leader.