When people search for CMA Jobs in India, they are usually looking for clarity rather than motivation. They want to know what roles exist, where they exist, and how realistic those roles are in the Indian job market.

At its core, CMA-aligned roles in India revolve around decision support, financial control, and performance management. These jobs sit closer to the boardroom than traditional accounting functions. Over the past decade, Indian companies have started valuing finance professionals who understand costing, budgeting, forecasting, and internal controls at a deep level.

I want to start with something every aspirant feels but rarely says out loud. You do not just want letters after your name. You want those letters to turn into real, visible career outcomes. When I look at CMA Jobs, I break them into three clear questions in my mind:

→ Who hires?

→ For what kind of work?

→ At what level of impact and pay?

Once these three are clear, the rest becomes planning and execution. To make sense of these questions, this blog looks at CMA jobs in India the way the market sees them. It breaks down the roles, the industries and companies where these roles show up, and how responsibilities and pay tend to evolve with experience.

Along the way, it also explains how CMA skills translate into day-to-day work, how freshers typically enter the field, and what long-term career movement looks like, so the full picture stays practical and grounded in how finance teams operate in India today.

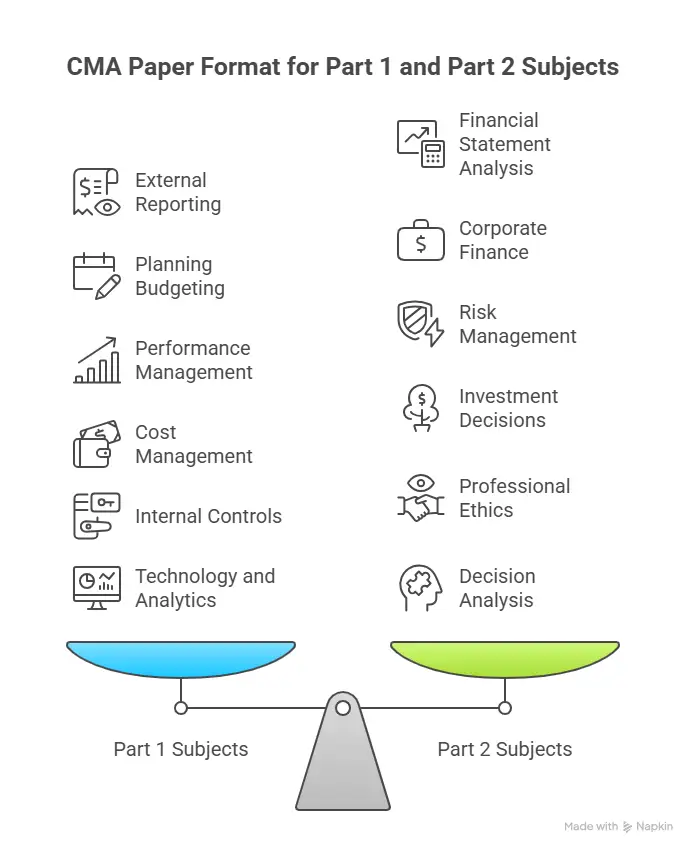

Understanding CMA and Its Relevance to Jobs in India

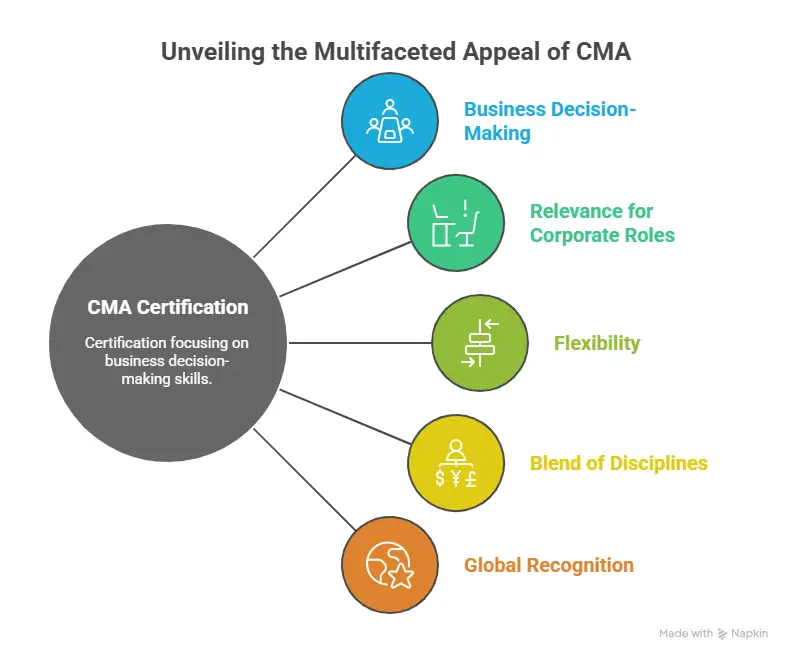

Before moving deeper into CMA jobs in India, it helps to clearly understand what the qualification stands for and why it shows up so often in corporate finance roles across the country.

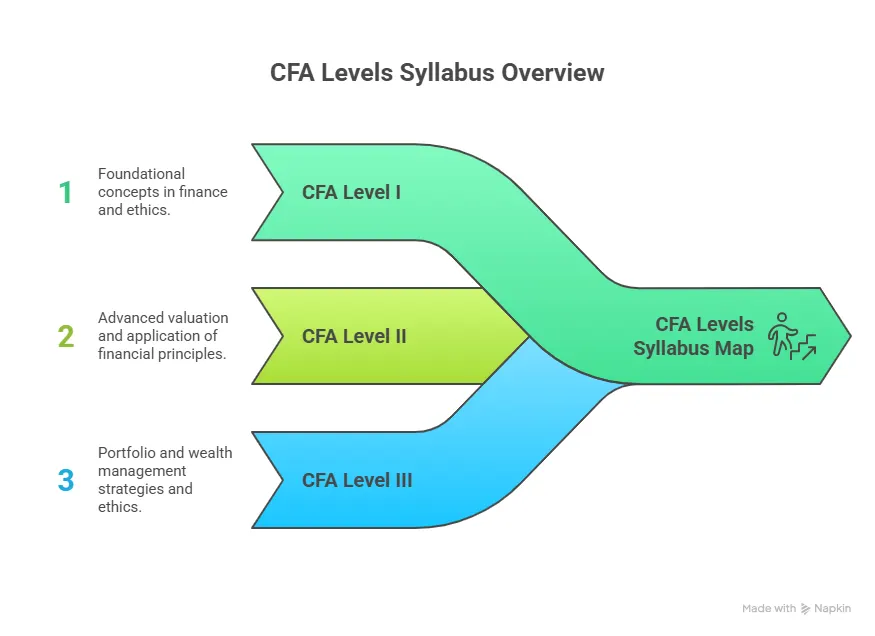

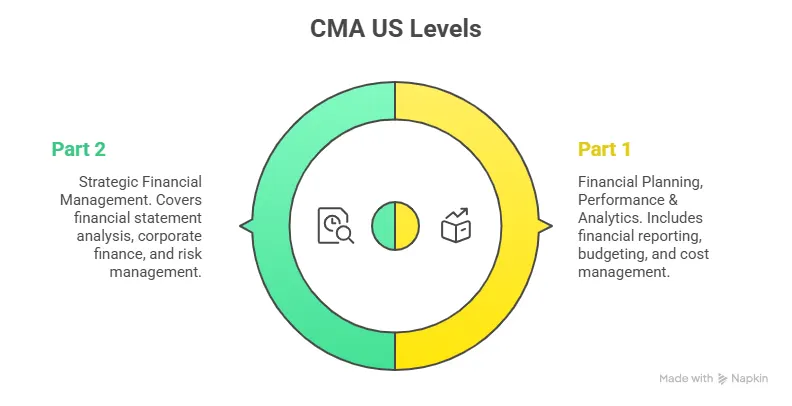

The US Certified Management Accountant credential is a global qualification awarded by the Institute of Management Accountants (IMA). Unlike traditional accounting certifications that focus heavily on compliance or reporting, the US CMA is built around internal decision-making.

When people search for what is CMA, they are often trying to figure out whether the qualification has relevance beyond exams and theory. In practice, the US CMA aligns closely with how finance teams operate inside multinational companies, global capability centres, consulting firms, and large Indian corporates.

In India, the CMA course has gained visibility because many organisations follow global reporting structures while running finance operations locally. This has made the qualification especially relevant in environments where finance professionals are expected to interpret numbers, support leadership decisions, and manage performance.

How companies actually use CMAs in India

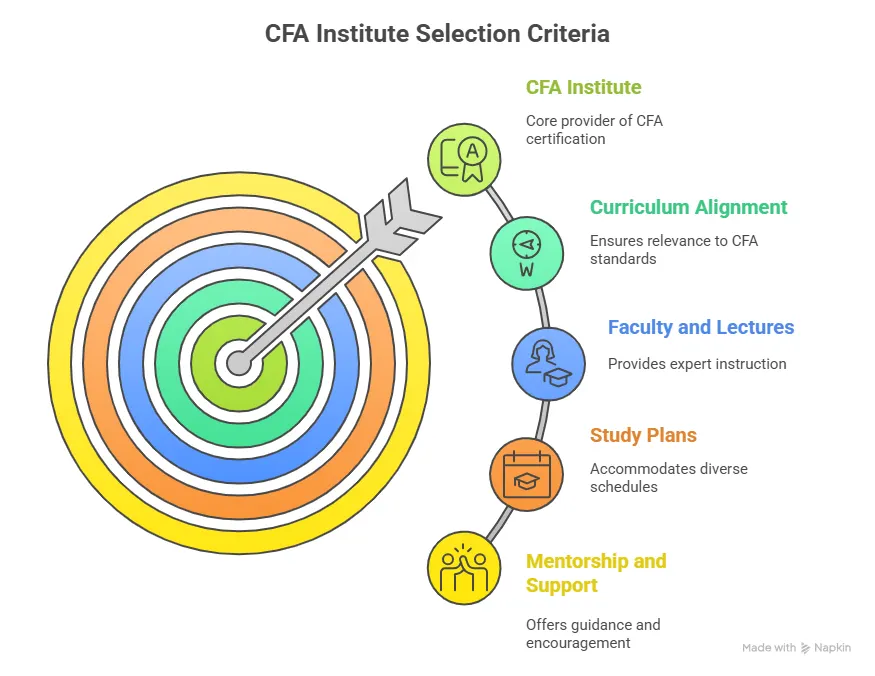

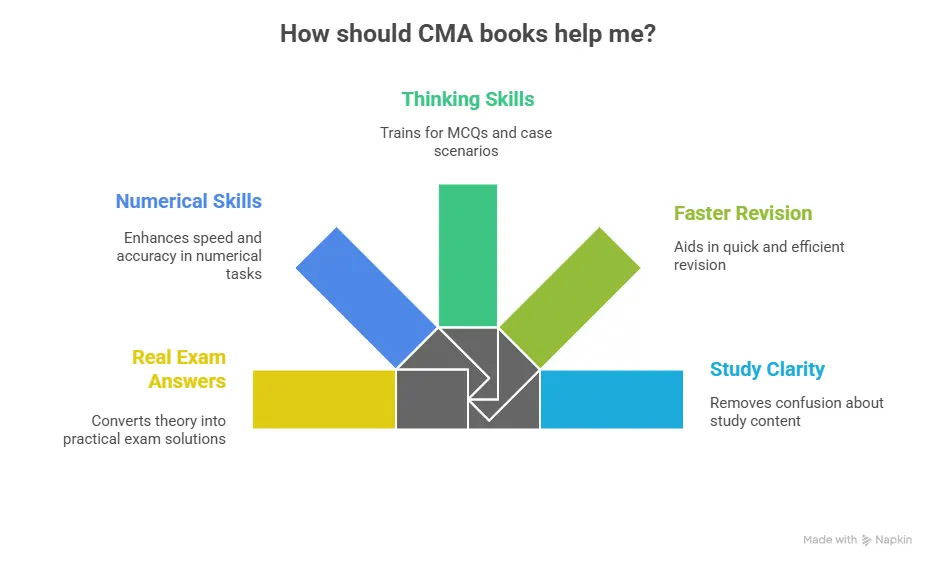

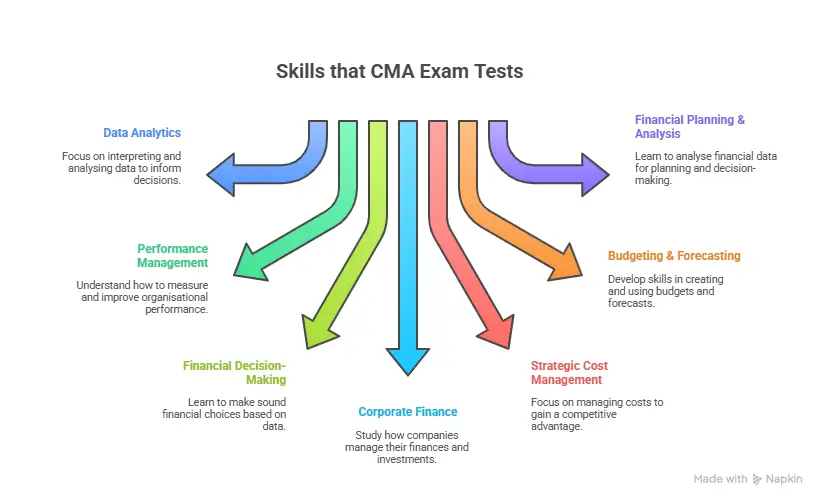

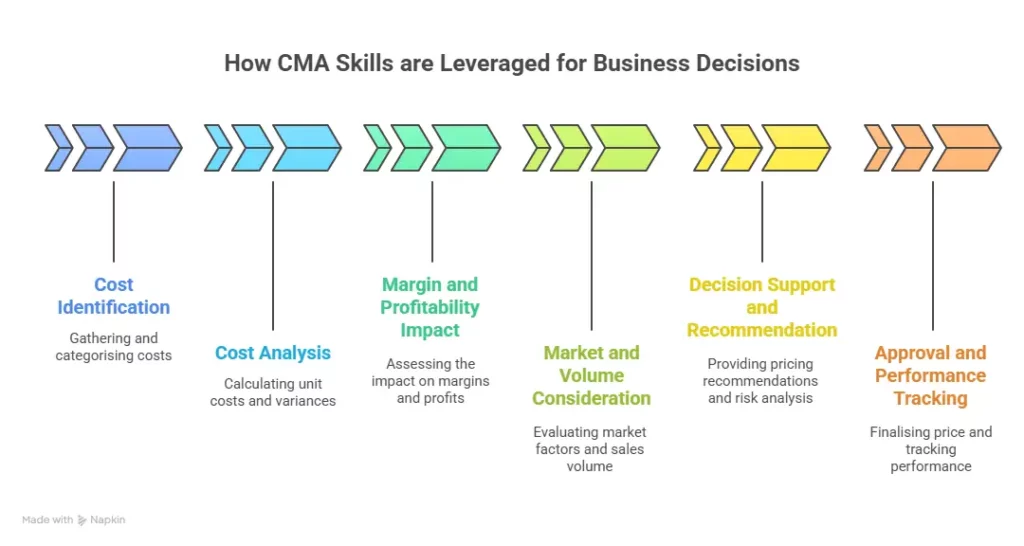

Before we talk about specific titles for CMA jobs in India, it helps to see how organisations plug CMAs into their structure. Most firms in India use CMAs in four broad buckets of responsibility.

Here is a short description of the most common buckets before we go into detailed roles. This list helps you map your own strengths to real work.

- Strategic finance and FP&A

- Costing and financial planning

- Governance and controls

- Analytics and business partnering

Now, let me break these down into the kinds of roles that show up in CMA job opportunities in India. I will also explain how companies and your role will leverage the specific CMA skills that you have gained thoroughly during your CMA course duration:

1. Strategic finance and FP&A roles

These roles sit close to the P&L. You support budgets, forecasts and “what if” analysis for management. You see this in roles like:

Here is a simple list to show how these roles appear in job descriptions.

- Financial Planning and Analysis Associate

- Business Finance Analyst

- Management Accountant

- Junior Finance Business Partner

In most of these roles, you spend your day building models, reviewing variances, and joining review calls where business heads want quick, clear answers. Many US CMA jobs in India fall into this bucket because global companies trust the CMA framework for decision support. It emphasises cost management, financial planning, performance analysis, and strategic control, the same areas where modern finance teams spend most of their time.

2. Costing and plant/factory finance roles

If you enjoy the nuts and bolts of how money moves through production, this set of CMA Jobs in India will feel very natural. Some typical titles are:

- Cost Accountant

- Plant/Factory Finance Executive

- Inventory and Cost Control Analyst

- Management Accountant in manufacturing units

You work closely with operations teams, store managers and the supply chain management teams. You track standard cost, variance, wastage, and capacity utilisation. For many manufacturing and FMCG firms, job opportunities after CMA in India start right here at the plant or factory level.

3. Governance, risk and internal audit

A different cluster of roles focuses more on control, risk management, and compliance. These are perfect for people who enjoy systems.

To make this easy to scan, here is a small list of how such roles appear:

- Internal Audit Associate

- SOX Compliance Analyst in GCCs

- Risk and Controls Analyst

- Process Improvement and Controls Executive

Many global capability centres in India like to hire CMAs for this work because they understand control frameworks and documentation standards used worldwide. That is why US CMA job opportunities in India are often tagged to internal audit, SOX or enterprise risk projects.

4. Analytics and business partnering

This is the fastest-growing part of CMA job opportunities in India. Finance teams today sit on a lot of data. Leaders want people who can turn that data into stories and decisions.

You see titles like:

- Financial Data Analyst

- Revenue Operations Analyst

- Commercial Finance Analyst

- Pricing Analyst

In these roles, you mix core finance knowledge with tools like Excel, Power BI, Tableau or SQL. The CMA curriculum already points you toward analytics, but the job market now rewards you when you can show hands-on work in these tools. And if you’re still wondering what value this certification provides in real-world job hunting and getting CMA jobs in India, have a look at the video below:

Sectors that Hire CMAs in India

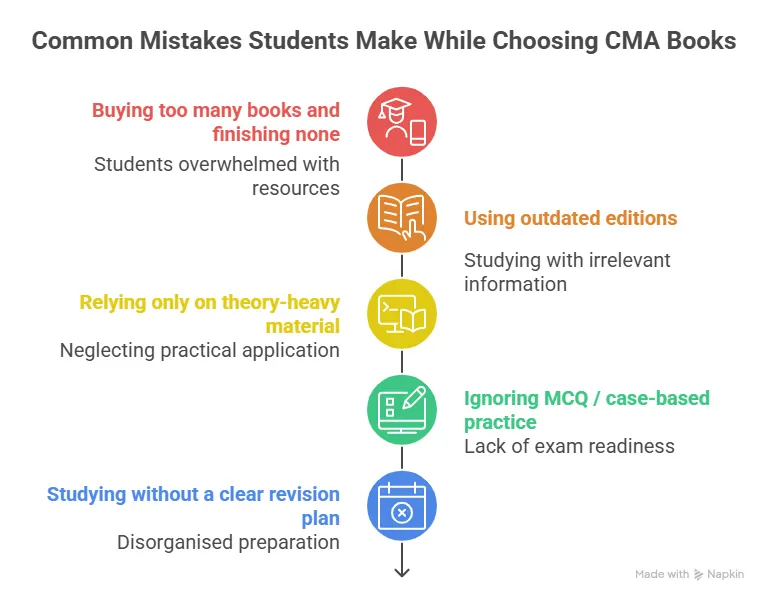

When you explore CMA Jobs in India, don’t just think of it as about job titles. It is more in terms of sectors that are creating sustainable hiring pipelines.

Before we go into the list, keep one idea in mind. Sectors move in cycles, but the need for cost-conscious, analytical finance talent has been rising across industries.

Key sectors where CMA fresher jobs in India often show up:

- Manufacturing and automotive

- IT and ITES

- Global capability centres of MNCs

- E-commerce and consumer internet

- BFSI and NBFCs

- Consulting and KPOs

Manufacturing and automotive still love cost accounting skills. GCCs and ITES centres push more FP&A and management reporting work to India every year.

Did You Know?

Studies from IMA’s salary survey show that CMAs globally earn a clear premium of 21% over non-certified peers, which is visible in India too when you look at MNC and GCC roles.

Where fresher hiring actually happens

Before we list the channels, remember this. Most CMA fresher jobs in India are hiring sit inside structured funnels. You need to place yourself in front of these funnels rather than waiting for a random job post.

Common fresher entry channels:

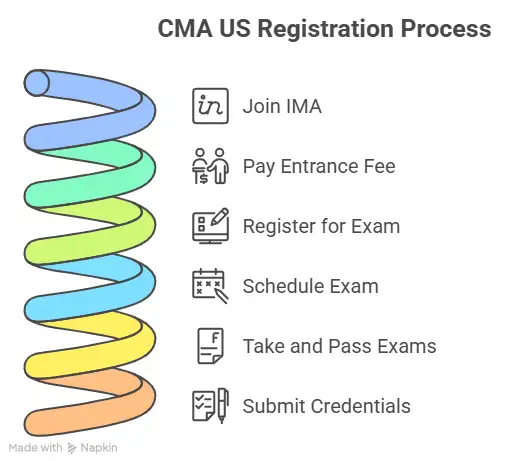

- Campus drives of The Institute of Cost Accountants of India

- Off-campus drives through training partners and academies

- Big 4 and mid-tier consulting firms

- Captive GCCs of global brands

- Indian large corporates in manufacturing and FMCG

- Startups that want strong finance generalists early

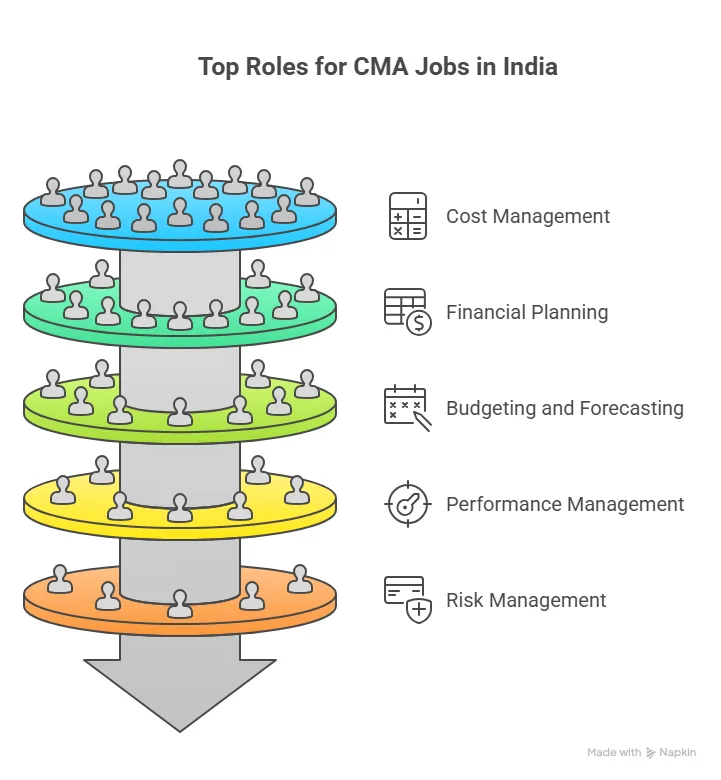

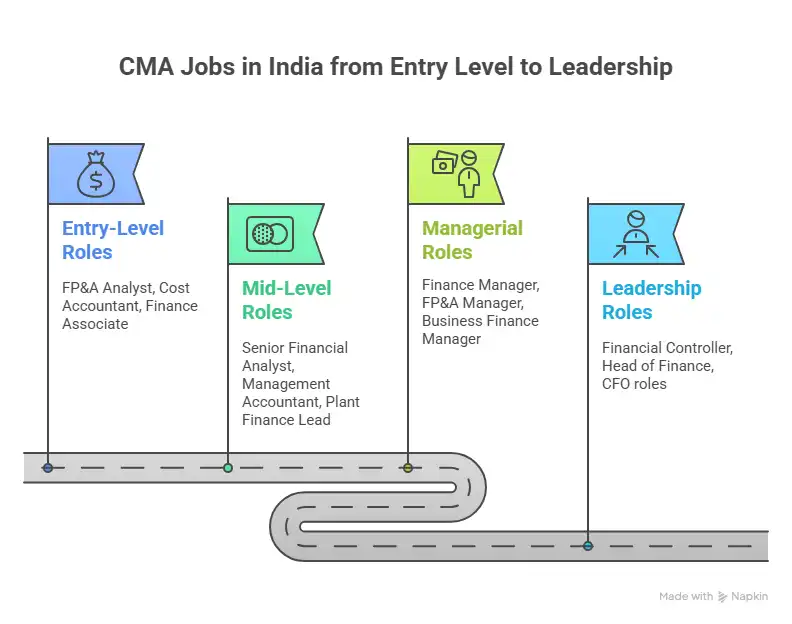

For example, the official placement programmes of the cost accountants’ institute have highlighted fresher cost roles with starting packages beginning at around ₹5.5 LPA in earlier seasons. These base figures show that CMA Jobs in India start at a level that is competitive with many other finance routes for serious candidates. Here is an overview of the top roles that you can get with your CMA certification in India:

Did you know?

Some reports on US CMA practitioners in India quote fresher ranges of ₹6 to 10 LPA in large firms, with higher bands in Big 4 and GCC environments.

Mapping Roles to Skills and Pay Bands

To keep the picture practical, I like to use a simple role-to-skills matrix for early and mid-level roles for CMA jobs in India. This is not a promise; it is a direction map that connects your preparation to real jobs.

The table below gives an approximate view of how typical early roles relate to skills, and the indicative CMA salary in India ranges.

| Role type | Typical early title | Daily core skills | Average Salary |

| FP&A and strategic finance | FP&A Analyst, Business Analyst | Budgeting, forecasting, Excel models, decks | ₹6 to 10 LPA |

| Costing and plant/factory finance | Cost Accountant, Plant/factory Finance | Standard costing, variance checks, and inventory | ₹5.5 to 9 LPA |

| Governance and internal audit | Internal Audit Associate | Process mapping, controls testing, and reports | ₹6 to 9 LPA |

| Analytics and business partnering | Financial Data Analyst | BI tools, dashboards, revenue and margin analysis | ₹6.5 to 11 LPA |

(Source: Glassdoor, AmbitionBox, Naukri)

When you read any new job post now, try to place it in one of these buckets. You will see that most jobs fit cleanly into this grid. Salary expectations do play an imminent role while job hunting, across almost all sectors and kinds of jobs. You will get a level deeper salary insights for your CMA jobs in India hunt below:

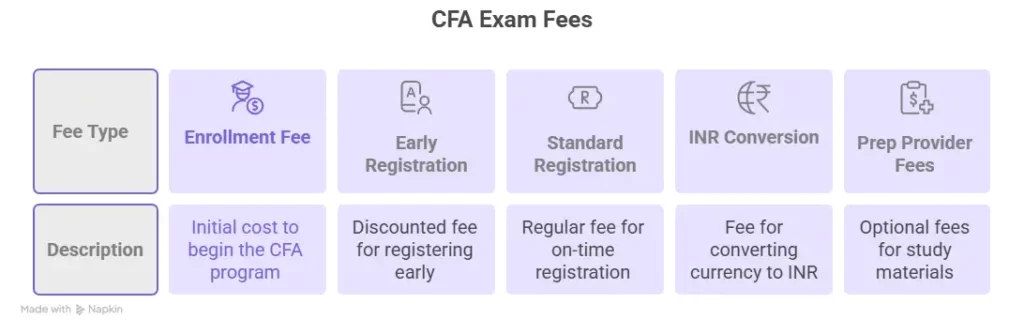

Salary, Growth Paths And How To Position Yourself

Once the market picture is clear, the next logical question is simple. How do CMA Jobs in India translate into real earning power and growth over time?

I like to break this into three levels: starting point, mid-career lift, and leadership potential. This helps you understand clearly what is the value of CMA and its impact on job and salary prospects.

1. Early career: reading salary offers with a clear head

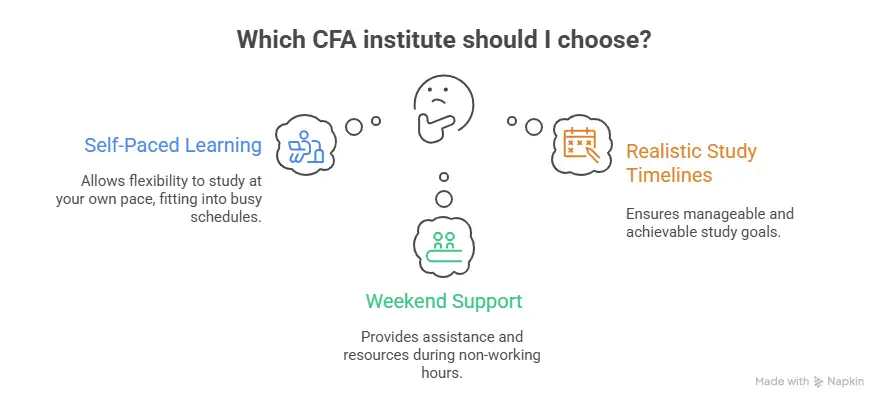

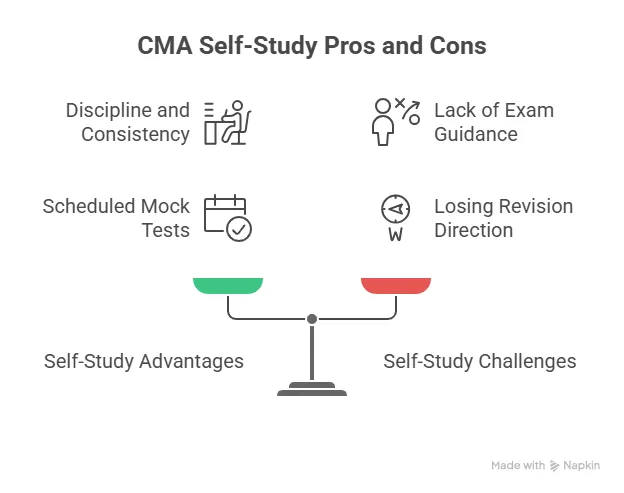

As a fresher, it is easy to look at a single number and feel either thrilled or disappointed. When exploring CMA jobs in India, I would suggest splitting any offer into three parts: fixed pay, variable pay, and learning value.

The list below shows what to review in an offer letter for CMA roles in India.

- Fixed CTC figure and what part of it is truly take-home

- Performance-linked bonus, incentives or project-based payouts

- Benefits like health cover, food, transport, and professional course support

- Exposure level of the role and who you will work with daily

Many sources across the market indicate that the average CMA jobs salary in India for freshers sits roughly in the ₹6 to 10 LPA range in larger companies and GCCs, with ₹5 to 7 LPA bands also common in mid-sized firms or non-metro cities.

If an offer seems below this band, you should ask yourself: Is there a high learning value in the role? Is there a clear path to move into a better band within 18 to 24 months? If the answer to both is yes, I still see a strong case to accept, especially in a tight market. And this helps you understand the CMA career scope with more clarity.

2. Mid-career: lifting your band through skills and context

After two to five years, the story changes. At this stage, you are not just a cost centre. You are expected to influence decisions. That is when the salary band and your actual impact begin to align.

Surveys from institutes and training providers often show average CMA compensation in India at or above the ₹8 to 10 LPA mark by this stage, with many profiles crossing into ₹12 to 18 LPA bands in metro cities and high-value roles.

At this level, you start seeing more specialised CMA job opportunities in India, such as:

- Senior FP&A analyst supporting a region or a global BU

- Finance business partner for a product line or geography

- Senior cost and management accounting specialist

- Commercial finance roles tied to sales, pricing or contracts

- Internal audit seniors and risk leads

If you hold a US CMA and have experience in shared services or GCCs, several US CMA jobs in India also open up at this level with cross-border exposure.

3. Senior roles: how far can you go with a CMA in India

People often ask where the ceiling lies for CMA Jobs in India. When you look at the top of the pyramid, you see CMAs in roles like:

- Finance controller

- Head of FP&A

- CFO in mid-sized or even listed firms

- Director-level roles in GCCs or consulting

A certification alone will not take you there, but it plays a strong supporting role when combined with execution, leadership and industry depth, all contributing to the CMA benefits that you get. For many professionals, CMA US jobs in India or the India CMA routes both act as launch pads for senior finance careers, as shown below:

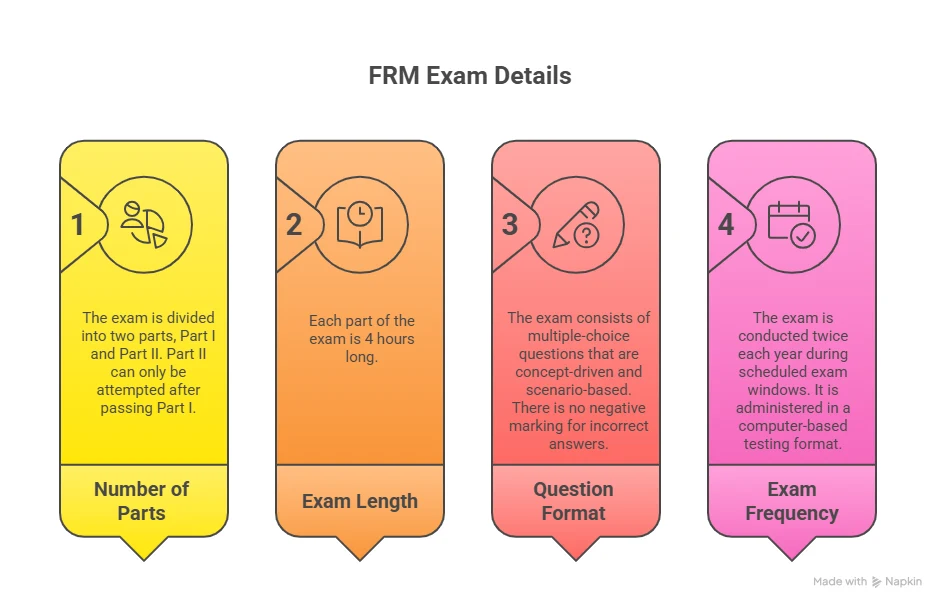

Salary Bands for CMA Jobs in India by Experience

It helps to see the journey as stages rather than isolated numbers. The table below is a directional snapshot of CMA jobs in India’s salary bands by experience level.

This table maps experience stages against common work profiles and an approximate CMA job salary in India with respect to various CMA skills that you have.

| Experience level | Typical roles | Example profiles | Average Salary |

| 0 to 2 years | Analyst, junior accountant, cost exec | FP&A analyst, cost accountant, AR analyst | ₹5.5 to 9 LPA |

| 2 to 5 years | Senior analyst, assistant manager | Senior FP&A, plant/factory finance, internal audit | ₹8 to 15 LPA |

| 5 to 10 years | Manager, senior manager | Finance manager, controller track roles | ₹15 to 30 LPA |

| 10+ years | Controller, head of finance, CFO track | BU finance head, GCC director, CFO | ₹30+ LPA (very role-specific) |

(Source: Glassdoor)

Why CMA Skills Add Extra Value

When we talk about salary bands and growth, what really elevates a CMA above a number-on-paper qualification is the ability to deliver strategic value. For example, CMAs trained in essential project selection methods (cost-benefit analysis, NPV/IRR, DCF, and other techniques) help organisations pick profitable investments and control costs efficiently.

Professionals who bring these skills to the table often fast-track into mid and senior level roles, which explains why CMA jobs in India frequently cross ₹20 LPA in just 5-7 years, especially in sectors like manufacturing, consulting or GCCs.

These ranges align broadly with CMA-focused salary write-ups that track fresher and experienced bands in India.

A Practical Playbook For Landing CMA Jobs In India

By now, the picture is clear. The market has demand, salaries are competitive, and there are many CMA job opportunities in India across sectors. The missing piece is often a concrete action plan.

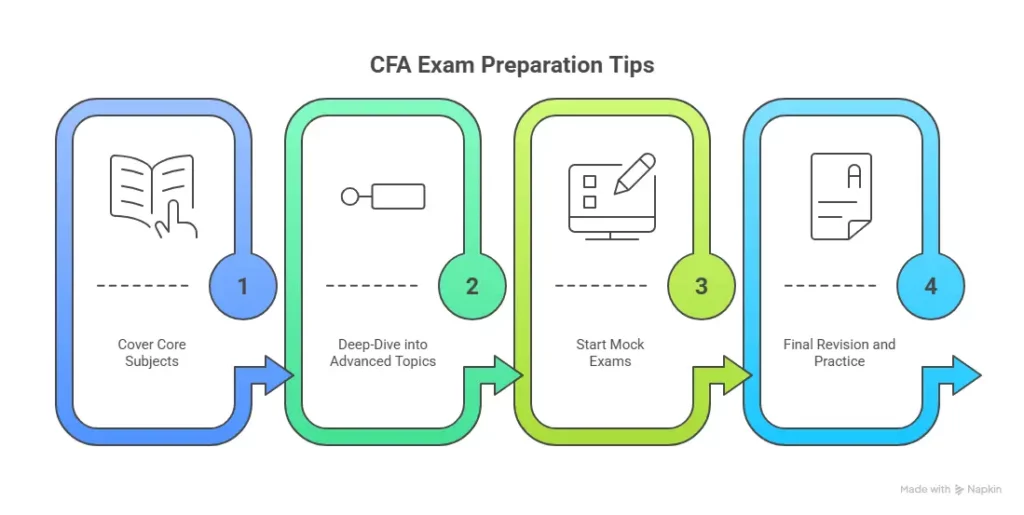

Building a 12-month roadmap for CMA job hunting

I like to work with a one-year horizon. Even if you are still preparing for the exam, use this period to build your job story.

This roadmap assumes that you are serious about converting your CMA into a role within the next 6 to 12 months.

12-month action roadmap

- Months 1 to 3

- Finish core CMA concepts on costing, FP&A and performance management

- Build one solid Excel model per month, such as a multi-step income statement or cash flow forecast

- Start a simple LinkedIn posting habit on what you are learning

- Months 4 to 6

- Add one BI tool to your toolkit, for example, Power BI or Tableau

- Recreate a company’s segment report using its annual report as a base

- Shortlist 30 to 40 companies that frequently post CMA Jobs in India and track their career pages

- Months 7 to 9

- Apply for internships, live projects or virtual projects in FP&A, costing, or internal audit.

- Do at least three mock interviews focused on management accounting and scenario questions.

- Rewrite your resume to highlight concrete outputs like dashboards, models and reports.

- Months 10 to 12

- Intensify applications across portals, company sites and referral networks

- Target both Indian CMA-aligned firms and employers with CMA US jobs in India if you hold a US CMA

- Evaluate offers not only on CMA jobs in India salary figures, but also on manager quality and exposure

This simple sequence keeps you moving every month and builds a profile that recruiters can trust.

How to position yourself on LinkedIn and in resumes

When recruiters search for CMA Jobs in India, they usually scan hundreds of profiles. You need to make their work easy.

Here is a short explanation before the bullets. These are small but strong changes that make your profile more search-friendly.

Practical tweaks that help:

- Put “CMA” and your specific variant in your headline, along with “FP&A / Costing / Finance Analyst”.

- Add keywords like CMA fresher jobs in India and CMA job opportunities in India in your about section in a natural way.

- List your tools clearly: Excel, Power BI, SAP, Oracle, or any ERP you have touched.

- Under each project, mention the business question, your analysis, and the impact in numbers.

On the resume side, you should have one clear page that answers three questions. What problems can you solve on day one? What tools do you know? Where have you applied them, even in a small setting?

FAQs On CMA Jobs In India

This section brings together clear answers to the most frequently asked questions around CMA jobs in India, covering roles, hiring sectors, demand, salary potential, and how the qualification fits into real career paths.

What are the jobs after CMA India?

After completing CMA in India, you can step into a wide set of roles such as FP&A analyst, management accountant, cost accountant, plant/factory finance executive, internal audit associate, financial data analyst and commercial finance analyst, all of which sit firmly under the growing umbrella of CMA Jobs in India. These roles appear across sectors like manufacturing, ITES, e-commerce, BFSI and GCCs, and often involve budgeting, forecasting, variance analysis, cost control, pricing support and dashboard creation.

Which company hires CMAs in India?

Many companies hire for CMA Jobs in India across different sectors, including large Indian corporates, global multinational GCCs, Big 4 and mid-tier consulting firms, shared service centres and fast-growing startups. You will see demand in manufacturing giants, auto and consumer businesses, as well as IT service leaders, e-commerce firms and global banks that have finance and analytics teams based in Indian cities.

Does CMA have demand in India?

There is a steady and rising demand for CMA Jobs in India because companies want finance professionals who can handle management accounting, cost control, planning and performance management in a single profile. As more firms adopt data-driven decision-making, the mix of CMA knowledge and analytics strength keeps adding fuel to this demand. Imarticus Learning support this shift by helping candidates build applied skills alongside CMA preparation, which aligns closely with what employers now expect.

Is CMA a government job?

CMA itself is not a government job; it is a professional qualification that opens doors into both private and public sector jobs in India. Once you qualify, you can apply for roles in public sector undertakings (PSUs), government-linked enterprises and regulatory bodies, but you can also work in private companies. This mix of options means that job opportunities after CMA in India are flexible, and you can shift between public and private roles across your career based on interest and opportunity.

Can CMA work in banks?

Yes, many CMA professionals work in banks, NBFCs and other financial institutions, often in roles such as credit risk analysis, product profitability, branch and segment performance tracking, internal audit and regulatory reporting. Banks and NBFCs use CMAs to strengthen cost control and performance measurement frameworks, so you will see CMA job opportunities in India within risk teams, finance departments and analytics units.

Can CMA earn 1 lakh per month?

It is possible over time for CMA professionals to earn ₹1 lakh per month or more in India, especially when they move beyond fresher roles into mid and senior level CMA Jobs, such as finance manager, plant/factory controller, FP&A manager or BU finance head. Structured Learning with Imarticus can help you acquire the analytics and modelling depth that mid-level roles expect.

What can I do with my CMA license?

With your CMA license, you can build a career across a wide spectrum of CMA roles in India that involve planning, analysis, decision support and control, rather than just basic bookkeeping. You can work in FP&A, cost and plant/factory finance, internal audit, controllership, business partnering or analytics roles, and later move into leadership positions such as finance controller or CFO track roles. The same credential also helps you explore CMA US jobs in India if you hold a US CMA, particularly inside global capability centres and multinational finance teams.

Where does CMA make the most money?

CMAs generally make the most money in senior roles within large companies, especially in sectors like manufacturing, GCCs, consulting and high-growth consumer or tech businesses that offer premium CMA Jobs in India. Salary surveys highlight that experienced CMAs can move into the ₹20 LPA and above bands in leadership roles. Preparing for these trajectories requires exposure to real business cases and advanced analytics, where Imarticus Learning supports long-term career growth.

What is the passing score for the CMA exam?

The passing score for each part of the CMA exam is 360 on a scale of 0 to 500, and this benchmark is common to both global and India-focused communication about the course. Imarticus Learning helps you stay aligned with this scoring standard by combining exam-focused coverage with applied problem-solving practice.

Taking a Clear View Forward for CMA Jobs in India

Before wrapping this up, I want to emphasise that the most consistent signal across CMA jobs in India is balance. The roles are not driven by quick spikes or short-lived trends. They sit at the intersection of discipline, commercial awareness, and steady responsibility. Over time, that combination creates space to grow into work that influences decisions rather than just records outcomes.

What stands out across industries and experience levels is how similar the underlying expectations are. Organisations want people who can understand cost structures, explain performance shifts, and stay composed when numbers need interpretation.

Career progress in this space is usually shaped less by isolated exam results and more by how comfortably someone applies those concepts in real settings. Environments that reflect how finance teams actually operate tend to shorten the gap between preparation and performance.

For those navigating their CMA journey, choosing where and how to prepare often influences this transition. Structured learning ecosystems that combine conceptual clarity with applied thinking create a smoother handoff into professional roles. For your CMA course prep, Imarticus Learning helps you naturally find relevance, as a way to stay aligned with what the job market steadily asks for.