Selecting the Best FRM training in India is a crucial step for financial professionals seeking risk management excellence.

The finest institute is not only there to address all aspects of the syllabus but also includes mentorship, practice tests and industry experience.

This comprehensive guide offers a step-by-step approach to selecting the ideal program, identifies leading providers, provides tested FRM exam preparation tips, and outlines the steps to launch a fulfilling Career in financial risk management.

What Is the FRM Certification Course India?

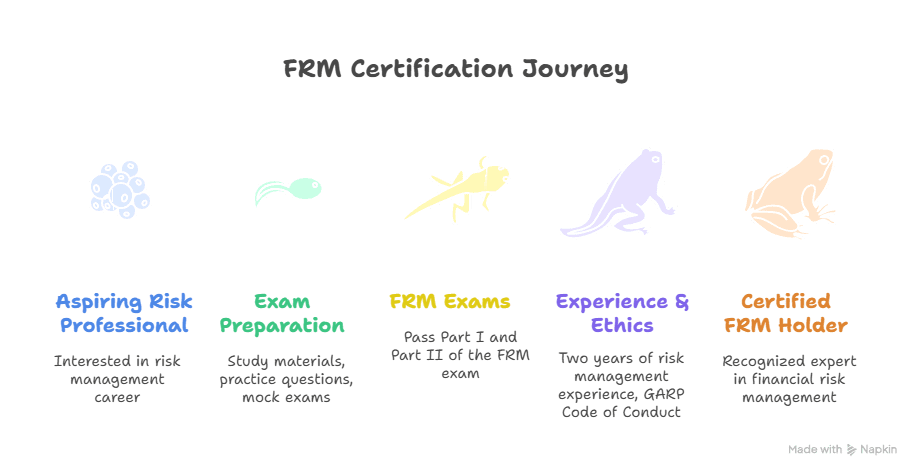

A FRM certification course in India prepares candidates with the expertise to measure, control and hedge financial risks.

Main features:

- GARP‑aligned syllabus: Part I—Essentials of Risk Management, Quantitative Analysis, Financial Markets & Products, and Valuation & Risk Models; specialised topics in Part II.

- Exam format: Two computer‑based tests—Part I (100 questions) and Part II (80 questions), each four hours long.

- Practical experience: Two years of work experience in the relevant field (prior to or within ten years after the exam) for certification.

- Global recognition: Appreciated by banks, asset managers, regulators and corporates; more than 160,000 FRM professionals worldwide.

Advantages of FRM Coaching

Enrolling in a program with clear advantages of FRM coaching gives you:

- Structured coverage of every GARP topic, including new market‑risk frameworks.

- Expert faculty: Practising risk managers share live case studies.

- Mock tests & analysis: In‑depth report cards identify weak points.

- Career guidance: Resume building sessions, mock interviews and alumni connections.

Research suggests guided contenders outperform self-study rivals by 20% on mock-exam attempts.

How to Choose the Best FRM Coaching in India

Remember these points while comparing any Best FRM coaching institute in India:

- Faculty experience: Look for faculty with 10+ years of risk experience.

- Study material quality: Best notes in the industry, practice quizzes and video lectures.

- Doubt‑clearing sessions: One‑to‑one or small group guidance.

- Mode of delivery: Flexibility in online, classroom or hybrid.

Compare transparently on fees, batch size, pass‑rate data and student testimonials before committing.

Global Market Outlook & India Job Growth

Career planning is facilitated by an understanding of demand:

The size of the global risk management market was USD 15.4 billion in 2024 and is expected to rise to USD 51.97 billion by 2033 at a CAGR of 14.6%. (Source)

The BFSI sector in India will grow by 9% in 2025, creating thousands of new risk-specialist jobs.

Salary Information: New FRMs in India get ₹6–10 lakh, mid-career professionals ₹12–20 lakh, and senior risk managers more than ₹30 lakh annually.

Salary Bracket based on Job

| Job | Experience | Average Salary (₹) |

| Risk Analyst | 0–2 years | ₹6–8 lakh |

| Credit Risk Manager | 3–5 years | ₹10–15 lakh |

| Market Risk Manager | 5–8 years | ₹15–22 lakh |

| Operational Risk Specialist | 2–4 years | ₹8–12 lakh |

| Senior Risk Consultant | 8+ years | ₹25 lakh and above |

FRM Exam Prep Tips

Take these FRM exam prep tips on board to pass:

- Develop a solid study schedule: Spend 2–3 hours a day on theory, practice and revision.

- Analyse mock-test results: Identify areas where you get less than 60% and go back to basics.

- Combine resources: Absorb institute study material and sites such as Bionic Turtle and Kaplan Schweser.

- Study groups: Regular peer sessions have high motivation and clarify doubts.

- Practice as real exams: Attempt full-length timed mocks once a month to develop endurance for exams.

Exam Difficulty & Pass Rates

- The Part I pass rate of 44% indicates the difficulty of the quantitative content.

- 56% pass rate for Part II, centred on case studies and practical principles.

With 300+ study hours, students achieve a 30% improvement in passing rates, according to international surveys.

Distinct Practical Approach: ESG & AI Risk Modules

A distinct feature is the integration of ESG risk and AI-risk frameworks:

- ESG risk workshops: Gain insights on climate, social‑impact and governance‑failure case studies.

- AI risk labs: Practical training in algorithmic bias, model‑validation and real‑time monitoring.

- Regulatory updates: Get ahead of new standards such as Basel III and SFDR.

This is ensured to position you at the forefront of both past and new risk areas, thus future‑proofing your knowledge.

Developing Your Career in Financial Risk Management

A promising career in financial risk management is a combination of certification and practical experience:

- Networking: Attend GARP chapters, webinars and risk forums.

- Continuous learning: Study journals such as the Journal of Risk Model Validation (JRMI).

- Hands-on activities: Finish capstones in VaR modelling or credit-risk simulations.

- Diversify credentials: Use FRM with CFA or CAIA to diversify career opportunities.

- Mentorship: Take guidance from experienced FRM professionals on LinkedIn and industry conferences.

How Imarticus Learning Stands Out

Imarticus Learning’s FRM preparation program stands out by:

- Experienced mentors: Learn from faculty and leaders who provide real-world experience.

- Weekly mock exams: Regular exams with extensive analysis and tailored action plans.

- Individual doubt-clearing: One-on-one personalised mentoring to solve individual problems.

- Career guidance: Resume-building workshops, LinkedIn optimisation, and interview coaching.

Frequently Asked Questions

What is the FRM exam structure?

Part I is for tools; Part II is for case studies and applications.

How do I enrol for a FRM certification course in India?

Register on GARP’s website and choose an approved education partner.

What are the qualification requirements to become a FRM charterholder?

A bachelor’s degree (equivalent) and two years’ work experience.

How long are coaching courses?

Usually 4–6 months, depending on the institute and delivery mode.

Can I study online?

Yes—leading institutes provide live classes, recorded lectures and discussion forums.

What are the most important FRM exam prep tips?

Adhere to a disciplined study plan, regular mock exams and group studies.

How does coaching benefit career?

It guarantees all-inclusive coverage, exam preparedness, and worldwide networking.

Conclusion

Choosing the Best FRM coaching in India forms the stepping stone for a successful Career in financial risk management and a path to a gratifying career in global finance.

Key Takeaways:

- Comprehensive Curriculum: Completely GARP‑aligned and updated.

- Expert Mentorship: Industry experts mentor you.

- Market Demand: USD 15.4 billion market growing at 14.6% CAGR.

Ready to take over the world of global risk? Join Imarticus Learning’s FRM preparation program today and change your career.