Table of Contents

Table of Contents

- Introduction

- The Rise of Financial Data Analysis in FinTech

- Predictive Financial Analytics: Anticipating Trends Before They Hit

- Regulatory Technology (RegTech) Solutions: Ensuring Compliance in a Digital World

- Alternative Data Integration in Finance: Going Beyond Traditional Metrics

- Dynamic Financial Analysis (DFA) Techniques: The Real-Time Game Changer

- Cloud-Based Financial Analytics Platforms: Agility Meets Accuracy

- Machine Learning in Credit Scoring: Precision in Lending Decisions

- Blockchain-Enhanced Financial Transparency: Trust through Tech

- Key Takeaways

- FAQs

- Conclusion

Introduction

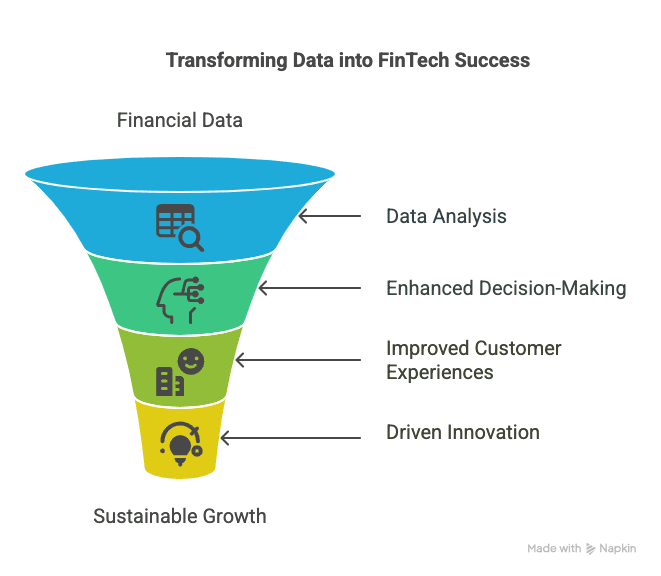

Every modern FinTech revolution begins with a seemingly simple question: What do the numbers say? In today’s digitally driven economy, the answer lies not just in traditional spreadsheets or quarterly reports, but in deep, continuous financial data analysis. This analytic engine fuels decision-making throughout the industry–from predicting future market trends to developing customer-centered lending models.

The FinTech space that was, not long ago, defined by audacious innovation and disruption is now evolving to the status of a well-formed data ecosystem. Finance data analysis is key to forming strategies, mitigating risks, and increasing profits. Let’s examine how the FinTech has embraced advanced techniques and tools to convert raw data into meaningful business outcomes.

The Rise of Financial Data Analysis in FinTech

As FinTech companies scale, their access to real-time and historical data expands. But raw data alone isn’t enough. The true power lies in extracting insights through structured financial data analysis. That means that an agile company with data-driven decision abilities will analyze financials, customer behavior, transaction history, market indicators, and alternative data sets for its advantage.

For the newer FinTechs, this analysis stands as a nexus between profit and loss, risk exposure, customer lifetime value, and compliance issues. It facilitates real-time monitoring and forecasting-everything the industry needs because the Incubator-type sector of FinTech thrives on rapid innovation and adaptation.

Impact of Financial Data Analysis Across FinTech Functions

| FinTech Function | Role of Financial Data Analysis |

| Credit Scoring | Accurate borrower risk profiling |

| Fraud Detection | Identifying anomalies instantly |

| Investment Apps | Portfolio forecasting |

| Payment Systems | Cost optimization & compliance |

| InsurTech | Claim prediction & pricing models |

Predictive Financial Analytics: Anticipating Trends Before They Hit

Gone are the days of reacting to market changes. With predictive financial analytics, FinTech firms now anticipate future scenarios, enabling pre-emptive actions. This involves using past financial data, customer trends, and market indicators to forecast outcomes with high accuracy.

When paired with financial data analysis, predictive models help startups allocate resources more efficiently, build resilient product strategies, and optimise customer acquisition costs. These analytics solutions are crucial for personalised financial services and dynamic pricing models.

Predictive Use Cases in FinTech

- Forecasting credit defaults using transactional behaviour

- Anticipating seasonal cash flow trends in SMEs

- Projecting churn rates for digital wallet users

- Predicting insurance claims for InsurTech firms

- Assessing loan performance before disbursal

- Forecasting interest rate volatility

- Budgeting marketing campaigns based on ROI patterns

External Link: Deloitte – Financial Forecasting

Regulatory Technology (RegTech) Solutions: Ensuring Compliance in a Digital World

FinTechs operate in a complex regulatory environment that evolves constantly. Regulatory Technology (RegTech) solutions powered by financial data analysis allow businesses to stay ahead of compliance mandates. These tools automate monitoring, flag potential violations, and generate timely reports for regulatory bodies.

RegTech integrated with advanced analytics can also track changes in regulations across geographies, automatically adjusting internal compliance frameworks. This reduces manual oversight, enhances accuracy, and minimises fines or legal issues.

Core RegTech Capabilities Supported by Financial Data Analysis

| RegTech Function | Benefit |

| KYC/AML Automation | Fast onboarding, reduced fraud |

| Transaction Monitoring | Instant anomaly detection |

| Regulatory Reporting | Timely, accurate disclosures |

| Risk Assessment | Continuous compliance scoring |

External Link: World Economic Forum on RegTech

Alternative Data Integration in Finance: Going Beyond Traditional Metrics

FinTechs are increasingly combining financial data analysis with non-traditional data sources like- mobile usage, social media activity, utility payments, and even geolocation data. This is known as Alternative Data Integration in Finance & it’s transforming credit scoring, investment decisions, and fraud detection.

By analysing this broader dataset, FinTechs can reach the underbanked, create more nuanced customer profiles, and offer more inclusive financial products. These insights help companies tailor financial solutions that reflect the real-world behaviour of their users.

Alternative Data Sources Driving FinTech Innovation

- eCommerce transaction records

- Ride-sharing and travel history

- Social media sentiment

- Smartphone metadata

- Rental and utility payment history

- Satellite imagery for agri-loans

- App usage and in-app payments

External Link: Forbes – Alternative Data

Dynamic Financial Analysis (DFA) Techniques: The Real-Time Game Changer

Dynamic Financial Analysis (DFA) techniques introduce a continuous and flexible model of financial scenario analysis. Unlike static financial planning, DFA uses live data feeds to model potential outcomes under varying economic and market conditions.

These techniques are particularly powerful in insurance, lending, and trading platforms. Combined with financial data analysis, they help FinTech leaders test strategic responses under simulated stress conditions, improving resilience and crisis planning.

DFA vs Traditional Financial Analysis

| Feature | Traditional Analysis | Dynamic Financial Analysis |

| Frequency | Quarterly/Annually | Real-time/Continuous |

| Scenario Flexibility | Limited | High |

| Data Source Integration | Manual | Automated APIs |

| Decision Making Speed | Slower | Immediate |

Cloud-Based Financial Analytics Platforms: Agility Meets Accuracy

The transition to cloud-based financial analytics platforms has democratised access to sophisticated financial tools. These platforms allow FinTech companies of all sizes to store, analyse, and visualise massive volumes of financial data in real time.

By centralising operations and enabling remote collaboration, cloud solutions reduce infrastructure costs while increasing scalability. Embedded financial data analysis tools enhance strategic insights, allowing teams to respond to customer needs and regulatory changes more swiftly.

Benefits of Cloud-Based Analytics in FinTech

- Real-time data sharing across global teams

- Seamless integration with CRM and ERP systems

- Scalable computing for large datasets

- Improved data governance and audit trails

- Reduced IT and maintenance overheads

- Enhanced cybersecurity protocols

Machine Learning in Credit Scoring: Precision in Lending Decisions

Traditional credit scoring models rely heavily on outdated financial metrics. With Machine Learning in Credit Scoring, FinTechs can now evaluate borrowers using advanced behavioural patterns, social data, and real-time financial activities.

Machine learning models trained on financial data analysis uncover nonlinear relationships and hidden risks in applicant profiles. These systems constantly improve their accuracy as more data is fed, resulting in fairer, faster, and more flexible lending decisions.

Traditional vs Machine Learning Credit Scoring

| Criteria | Traditional Models | ML-Based Models |

| Data Sources | Credit reports | Multi-source, real-time |

| Adaptability | Static | Continuously evolving |

| Accuracy | Moderate | High |

| Bias Reduction | Low | Adaptive fairness models |

Blockchain-Enhanced Financial Transparency: Trust through Tech

At the intersection of trust and technology lies Blockchain-Enhanced Financial Transparency. By leveraging immutable ledgers and smart contracts, FinTechs are ensuring every transaction is traceable, secure, and verifiable.

When combined with financial data analysis, blockchain enables efficient auditing, fraud detection, and transparency in investment processes. It particularly benefits peer-to-peer lending, trade finance, and digital asset exchanges, where integrity and trust are paramount.

Blockchain Use Cases in Financial Transparency

- Tamper-proof audit trails

- Automated compliance via smart contracts

- Instant reconciliation across partners

- Transparent investment reporting

- Cross-border transaction verification

- Secure digital ID verification systems

Key Takeaways

- Financial data analysis is central to decision-making in modern FinTech.

- Predictive analytics enable accurate forecasts and early risk detection.

- RegTech and blockchain innovations are reshaping compliance and trust.

- Alternative and cloud-based data sources enhance strategic agility.

- Machine learning and DFA bring real-time, personalised financial insights.

FAQs

1. What is financial data analysis in FinTech?

Financial data analysis in FinTech is defined as -analyzing financial data from diverse sources to derive actionable insights that aid business decisions, minimize risks, and better customer experiences.

2. How does predictive financial analytics benefit FinTech firms?

Predictive financial analytics enables FinTech companies to predict trends in markets, user activity & risk factors ahead of time, thus making informed proactive decisions that increase profitability and operational effectiveness.

3. What is the contribution of RegTech to financial data analysis?

RegTech ensures automated compliance by real-time analysis of financial data, which makes FinTechs able to efficiently comply with regulations while preventing expensive fines.

4. Why is alternative data significant in financial services?

Alternative data broadens the decision making universe by adding non-conventional sources such as mobile usage and utility bills, which yield richer and more comprehensive financial portraits.

5. What is Dynamic Financial Analysis (DFA)?

DFA is a real time scenario planning approach that employs real-time data feeds to model financial outcomes across various market scenarios, facilitating nimble and risk-aware decisions.

6. What are cloud-based financial analytics platforms?

These are cloud-hosted software platforms through which FinTech companies can conduct robust financial data analysis with scalability, lower IT expenses, and remote access.

7. Software-enhanced credit scoring models: how are they better?

Machine learning algorithms learn from large real-time financial data to discover patterns and make lending decisions that are more accurate and less biased than conventional models.

8. What is the benefit of using blockchain in financial data analysis?

Blockchain offers secure, transparent transaction records, which when analysed, enhance fraud detection, audibility, and overall financial system integrity.

9. Will small FinTech startups gain from financial data analysis?

Yes, with the emergence of cloud-based platforms and open-source software, even nascent FinTechs can take advantage of financial data analysis to drive better forecasting and product strategy.

10. How does data analysis influence investor confidence in FinTech?

Strong data analysis raises transparency, delivers reliable forecasting, and improves governance—and all of these contribute to more robust investor trust and funding opportunities.

Conclusion

The advancement of referenced financial data analysis has shifted FinTech from a disruptor to a data-fueled market leader. Technologies such as machine learning, cloud technology, and blockchain will refine their methods of associated predictive analytics and utilization of data for powerful decision making in Fintech. The evolution of those technologies together with financial analytics will closely characterize the next evolution of technological innovation in FinTech. Success will require companies to learn how to not just collect data, but ultimately learn it, leverage it, and to act on it. For in FinTech, the future is undoubtedly data-driven, and isn’t simply digital.