Table of Contents

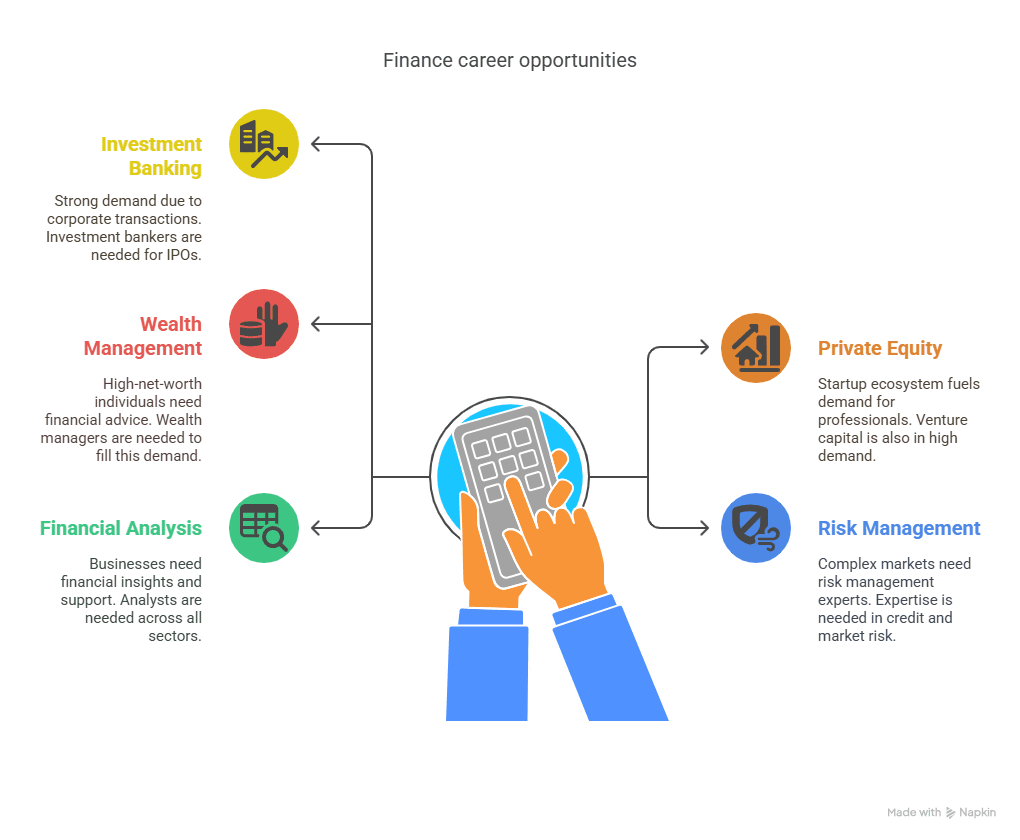

With instant shifts occurring in the economic times, professional opportunities in finance are being unveiled like never before. India’s financial environment has experienced unhibited growth during the past decade on the strength of innovation power, technology rise, and globalizations. Keeping pace with this trend, increased demand is being sought after for professionally qualified individuals with thorough knowledge in finance — high-risk areas such as investment banking to be specific.

The banking industry has seen a 22% increase in hiring activity year-over-year, as per a report by 2023 Naukri. Blue-chip investment firms to start-up fintech companies, all are looking for fresh blood with the stuff to understand the sophistication of financial markets, regulation, and business.

But getting into this profession requires more than schooling. It requires industry training, strategic planning, and hands-on experience — the type that Imarticus Learning’s top-rated course, Certified Investment Banking Operations Professional (CIBOP), offers.

In this blog, we’ll explore the various dimensions of finance career opportunities, the rise of investment banking as a career path, the importance of specialised training, and how India is becoming a global hub for financial talent.

What Makes Finance a High-demand Career in India?

Indian finance industry accounts for close to 6% of India’s GDP, and since there is rising digitalisation, the industry is expected to grow. There are several reasons why career opportunities in finance are on the rise:

Fintech revolution: With over 9,000 fintech organisations in India, the gap between conventional finance and technology is disappearing at an incredibly rapid pace.

Foreign Investment: As a result of the record FDI inflows, Indian finance talent familiar with local markets is needed by multinational corporations.

Digital Banking: Online banks are a reality now, and digital-first banks have led to the creation of data analytics, compliance, fraud management, and operations job opportunities.

These macro trends form part of healthy hiring in investment banking analysts, risk managers, settlement associates, and wealth advisors. Early careerists and freshers today are entering finance not just for security but also for quicker growth.

And sure enough, front-line investment banker hiring offers increase to ₹9 LPA — an odd figure for so-called 0-3 years of experience applicants.

How to Build a Career in Investment Banking?

The field of investment banking is one of the most lucrative and demanding within the broader category of finance career opportunities. It requires a unique blend of analytical thinking, regulatory knowledge, and technical expertise. If you’re someone who enjoys high-stakes decision-making, market dynamics, and financial modelling — this might be the career path for you.

Resume for Investment Banking: What Matters?

It is crucial to create a strong resume for investment banking. Most recruiters seek:

- Economics, finance, and accounting degree

- Professional certification or training such as the Certified Investment Banking Operations Professional (CIBOP) program

- Hands-on experience with live regulatory reports, risk evaluation, KYC, and settlement trades

- Knowledge of software such as Excel, Bloomberg, or Python (for data-intensive jobs)

- Junior or internship experience in working in a bank

Recall that your resume must be action-oriented. Quantify your achievement in tangible numbers like “streamlined reconciliation reports saving 20% of time.”

Finance Job Interview Tips: Cracking the Code

Finance interview preparation is not theory. You must be able to back up:

- Investment product and financial transaction operational knowledge

- Awareness of new rules, compliance policy, and financial news

- Ability to verbalize your value to execute work like AML investigations or settlement operations

Best interview tips for finance are:

- Rehearse to respond with sample case study and technical questions (e.g., “Walk me through a trade settlement lifecycle”)

- Construct strong examples which illustrate leadership, problem-solving, and cross-functional working

- Rehearse strong questions on firm’s asset classes, risk policies, or client servicing models

Some of the CIBOP graduates mention that having such scenarios to work with such as moral banking and money laundering schemes using the power of practice provided them with that little something special needed to impress interviewers.

Role of Certifications in Finance Career Opportunities

With a competitive job market, certification is only the beginning. Practical experience is what finally separates the competition. That is where an industry-validated certificate such as CIBOP really comes into its own.

This is how the Imarticus Learning investment banking course is different from others:

- 7 Interview Guarantees: This guarantees students to be interviewed by actual decision-makers at leading firms

- 1000+ Employers: Goldman Sachs, JPMorgan, Barclays, and KPMG are among its prominent partners

- Project-First Approach: Learning takes place through live case studies of asset management, money laundering, and compliance

- Up to 60% Salary Hike: Graduates exhibit miraculous salary hikes after certification

With more than 50,000 students and nearly 1200+ batches placed successfully, Imarticus is revolutionizing experiential learning in finance in India.

Career Paths Within Investment Banking

There are many career paths in investment banking that mirror changes in finance career opportunities. There are front-office, middle-office, and back-office jobs — all of them playing significant roles in the banks’ value chain.

Key Roles in Investment Banking:

- Investment Banking Associate: Handles clients’ portfolios, makes pitchbooks, and assists in closing large deals

- KYC Analyst: Onboards customers to comply with regulatory needs, an essential step in fraud and risk avoidance

- Risk Management Consultant: Recognizes and controls market, credit, and operational risk

- Clearing & Settlements Analyst: Controls post-trade procedure to maximize trade life cycle administration

- Trade Surveillance Analyst: Detects suspicious behavior to discourage insider dealing and financial wrongdoing

With the right banking certification, i.e., CIBOP course, there are many different career options that can be applied for with open career development. From associate to VP of operations, the career is much established and actually rewarding.

Benefits of Pursuing a Banking Certification Like CIBOP

If you plan to get into a serious banking career, then the correct certification will provide a push. CIBOP certification is unique because it:

- Dual Course Duration: 3-month and 6-month course durations based on your speed

- Live Projects: Similar to trade-based money laundering, compliance audits, and ethical banking simulations

- Employment Readiness: 7 employment interviews guaranteed and resume writing support

- Placement Network: 1000+ Recruiters of India’s financial cities’ best

It’s not learning by itself — it’s a community for finance professionals with 0–3 years of experience.

India as a Global Investment Banking Hub

India is becoming a leading destination for foreign investment banking. Mumbai, Bengaluru, and Hyderabad are now being touted as the base of banking majors’ global capability centers (GCCs) like Goldman Sachs, Barclays, and Citi. It has led to gargantuan career opportunities in the financial sector for professionals in India.

The main reasons for that are:

- Economically sustainable and capable pool of talent

- English-speaking finance talent

- Business-friendly policies in favor of international FDI in finance

The result? Thousands of high-value jobs in KYC, risk, asset servicing, compliance, and operations.

Key Takeaways

- India is a hotbed of finance career prospects at the global level, and investment banking leads the way

- Salary for junior investment bankers can reach up to ₹9 LPA for certified individuals

- Imarticus Learning’s CIBOP is work-supported, project-based approach to leading finance companies

- Top-hands are KYC Analyst, Risk Manager, and Clearing Associate

FAQs

Q1: What is the starting salary in investment banking in India?

A: Certified experts get starting salaries between ₹6 LPA and ₹9 LPA city, role, and organization-wise.

Q2: Is the CIBOP course suitable for freshers?

A: Yes. For 0–3 years experienced candidates for sure-shot interviews for it.

Q3: How long is the CIBOP program?

A: Two variants — 3-month and 6-month variants to suit various learning requirements.

Q4: Do I need coding skills for finance jobs?

A: Not at all. Although coding is useful for data-driven banking career in banks, the majority of operational banking career is process, compliance, and trade-driven.

Q5: What kind of projects will I work on in the CIBOP program?

A: From money laundering through transactionals, ethical banking, KYC screening to settlement operations.

Q6: What roles can I apply for after completing the CIBOP course?

A: You can choose Investment Banking Associate, Client Onboarding Analyst, Regulatory Reporting Analyst, Risk Management Consultant, etc. The course prepares you for diversified operations-level job positions in the financial sector.

Q7: How does the CIBOP course support placements?

A: The course provides 7 interview promises, over 1000+ hiring firms’ connections, and personalized career counseling such as resume preparation and mock interviews for higher level positions.

Conclusion – The Time to Act Is Now

In an ever-evolving financial world at light speed, there is a wide window of opportunity out there for intelligent professionals. New to school or looking to transition careers from within a closely related industry to finance, never has the time been better to make the switch.

The most ideal strategy includes:

- Gaining a skill set in finance

- gaining certifications such as CIBOP which are employer-sponsored

- Networking and gaining high-impact professional careers with reliable career partners

If you are searching for a high-growth, high-responsibility career in finance, investment banking is the key to riches. And if you are soon to take the plunge within the next few months, Imarticus Learning’s Certified Investment Banking Operations Professional (CIBOP) course is where you start.

Ready to launch your finance career?

Find out more about Imarticus Learning’s CIBOP course today and get job-ready within 3 to 6 months.