Table of Contents

If you’re looking to future-proof your career in finance, the FRM certification is more than just a badge — it’s a skills powerhouse. The Financial Risk Manager (FRM®) program doesn’t just teach theory; it transforms the way you analyse, manage & mitigate risk in real-world scenarios.

Let’s unpack the essential Risk Management Skills you’ll gain through the FRM journey & why they’re vital in today’s volatile economic climate.

What Are Risk Management Skills?

Risk Management Skills are the tools & techniques professionals use to identify, assess, prioritise, and mitigate financial threats. These include analytical thinking, market knowledge, quantitative modelling, regulatory understanding, and decision-making under pressure.

In the FRM course, these skills are taught through practical, scenario-driven modules designed by industry leaders.

What Do You Learn in the FRM Program?

Here’s a snapshot of FRM program learning outcomes:

| Core Area | Skill Developed |

| Foundations of Risk Management | Risk frameworks, Basel norms |

| Quantitative Analysis | Probability, statistics, regression |

| Financial Markets and Products | Derivatives, options, swaps, hedging |

| Valuation and Risk Models | VaR, stress testing, sensitivity analysis |

| Operational and Liquidity Risk | Scenario planning, liquidity planning |

| Current Issues | ESG, cyber risk, fintech disruptions |

These modules form the foundation of your FRM professional skill set and prepare you for complex roles in financial services.

FRM Skills List: What Makes You Industry-Ready?

Here’s a concise FRM skills list that recruiters actively look for:

| Category | Skill |

| Technical | Statistical Modelling, Excel, Python |

| Analytical | Data Interpretation, Problem Solving |

| Regulatory | Basel III, IFRS, Risk Compliance |

| Strategic | Decision-Making, Scenario Analysis |

| Communication | Report Writing, Stakeholder Briefing |

These are not just theoretical — the skills learned in FRM course are tested in exam case studies and then applied directly in professional settings.

Curious how this compares to CFA? Here’s a deep dive: FRM vs CFA: Everything You Need to Know

Risk Management Skills for FRM: How Are They Taught?

The risk management skills for FRM aren’t taught through rote learning. Instead, the program uses:

- Case-based learning

- Real-world financial data

- Mock portfolios

- Market event simulations

These methods build your financial risk management competencies in a practical, job-relevant way.

Plus, FRM-certified educators ensure that the learning isn’t limited to textbooks. You’ll engage in solving problems that mimic actual financial crises — sharpening your decision-making instincts.

Why These Skills Matter: Key Skills for Risk Managers

If you’re aiming to work at places like Goldman Sachs, Morgan Stanley, or RBI, you’ll need more than technical knowledge. The key skills for risk managers also include:

- Emotional intelligence

- Regulatory foresight

- Crisis communication

- Ethical decision-making

The FRM program equips you with both the hard and soft skills essential to thriving in these environments.

Watch this video for real-world FRM insights: FRM Salary Expectations – YouTube

FRM Professional Skill Set vs Traditional Finance Degrees

Let’s compare what you learn in the FRM program versus typical finance degrees:

| Skill Type | Traditional Degree | FRM Program |

| Quantitative Modelling | Limited | In-depth, practical application |

| Regulatory Knowledge | Basic overview | Detailed, updated frameworks |

| Market Risk Tools | Conceptual | Simulation & case-based use |

| Risk Communication | Rarely covered | Core part of learning |

| Scenario Planning | Minimal | Regularly practiced |

Clearly, the FRM professional skill set offers a sharper, more practical edge.

Want to check your readiness? Here’s what you should know: How Hard is the FRM Exam?

Where to Learn These Skills

To get trained on the skills learned in FRM course, it’s important to choose the right provider.

We recommend the FRM Certification Course by Imarticus Learning, India’s first and only authorised GARP prep provider.

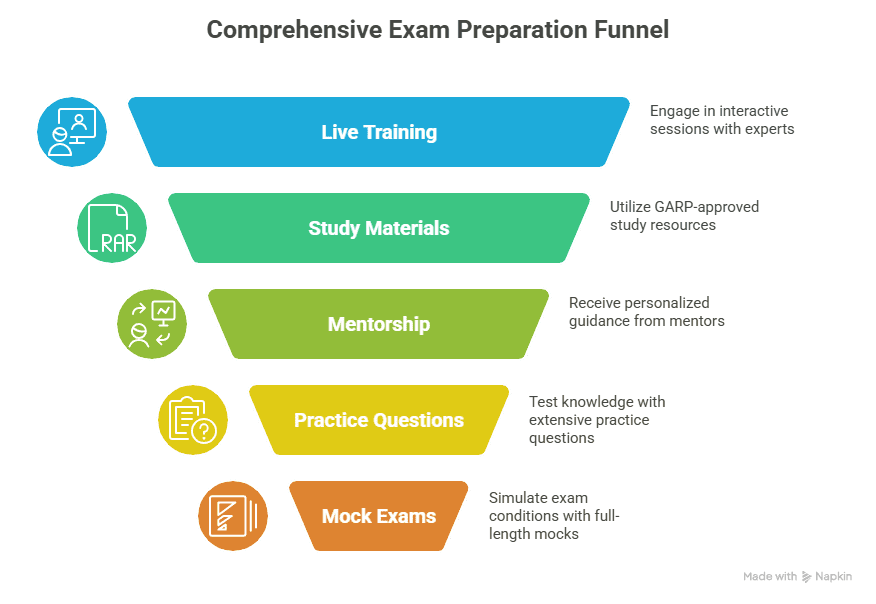

What You Get:

- 200+ hours of live expert training

- GARP-approved study materials

- Personalised mentorship

- 4000+ practice questions

- 8 full-length mock exams

- Career bootcamp + placement assistance

This is where you build the FRM skills list you need to get noticed in top firms.

Career Impact of FRM Program Learning Outcomes

The FRM program learning outcomes translate directly into better job roles and faster promotions.

| Role | Relevant Skill Gained |

| Credit Risk Analyst | Probability, exposure analysis |

| Market Risk Manager | VaR, back-testing, volatility measures |

| Treasury & Liquidity Manager | Liquidity metrics, ALM frameworks |

| Regulatory Risk Analyst | Basel compliance, reporting frameworks |

| Investment Risk Manager | Portfolio stress testing, hedging tools |

Every skill has a job tied to it. That’s the power of structured risk management skills.

FAQs

1. What’s included in the FRM skills list?

Stuff like risk modelling, financial analytics, regulatory frameworks, and stress testing — all job-ready.

2. Are the skills learned in FRM course practical?

Totally. It’s not just theory; everything is tied to real-world finance scenarios.

3. What are the key risk management skills for FRM students?

Quant analysis, market risk tools, decision-making under pressure, and compliance knowledge.

4. How do financial risk management competencies help in jobs?

They make you the go-to person for solving complex risk issues — and that gets noticed!

5. Do FRM program learning outcomes align with industry needs?

Yes, 100%. The curriculum is designed with what banks and financial firms actually want.

6. What’s a typical FRM professional skill set?

Think VaR, scenario planning, credit risk, and strong regulatory understanding — it’s a full package.

7. Why does the FRM skills list stand out from other finance courses?

Because it’s deep, current, and built for professionals dealing with real-time risk.

8. Are risk management skills for FRM helpful for freshers too?

Absolutely. Even at entry level, they give you a serious edge over others.

Final Thoughts

If your goal is to break into or grow within finance, the Risk Management Skills taught in the FRM program are indispensable. They equip you to:

- Understand complex financial systems

- Make informed decisions under uncertainty

- Navigate global regulatory environments

- Communicate risk clearly and confidently

The FRM is more than a credential — it’s a transformation in how you think, analyse, and act in the face of financial uncertainty.