Table of Contents

Table of Contents

- Introduction

- Understanding Financial Reporting in Accounting

- CPA Financial Reporting: Building Your Foundation

- Key CPA Skills: What Sets Top CPAs Apart

- Why the Importance of Financial Reporting Can’t Be Ignored

- CPA Accounting Expertise: Real-World Impact

- CPA Skills for Success in the Job Market

- Accounting and Financial Reporting: An Evolving Relationship

- FAQs on Financial Reporting & CPA Skills

- Key Takeaways

- Conclusion

Introduction

So, you are thinking of taking up CPA as your career or probably boosting your finance. It’s really a good idea—in this era of fast-paced finance. Be it a student dreaming about global opportunities or a professional transitioning into the accounting sector, financial reporting has become a compulsory rather than an optional skill set. Within a few years, the demand for CPAs is expected to increase enormously, where companies will look for more than just theoretical knowledge – they will want a sharp, quick mind that can interpret financial data, tell a story through numbers, and convey the vision with accuracy.

This blog will help you know about the fact that financial reporting is not just another subject within the CPA syllabus – it is the backbone of CPA accounting expertise. It will break it down step-by-step.

Understanding Financial Reporting in Accounting

In an organisation, financial reporting constitutes preparing statements that reflect the financial status to the management, investors, regulators, and the general public. It manifests as transparency and accountability as well as making a significant impact on strategic decision-making by the organisation.

For anyone serious about accounting, understanding financial reporting in accounting is critical. This section dives into what it is, why it matters, and how it’s changing in today’s tech-driven landscape.

Key Components of Financial Reporting:

| Component | Description |

| Income Statement | Shows profitability over a specific period |

| Balance Sheet | Provides a snapshot of financial position at a given time |

| Cash Flow Statement | Tracks the flow of cash in and out of the business |

| Shareholders’ Equity | Represents company’s value to shareholders |

External Source: IFAC’s Guide to Financial Reporting provides insights into global standards that CPAs must follow.

CPA Financial Reporting: Building Your Foundation

If you’re preparing for the CPA exam or working in the field -you’ll know that CPA financial reporting is one of the core sections tested. It requires not just knowledge, but application.

A solid foundation in financial reporting empowers CPAs to analyse data, recognise red flags, and deliver credible financial statements. Especially for candidates aiming for international roles, mastering this section can be a game-changer.

Why CPA Financial Reporting Matters:

- It covers U.S. GAAP and IFRS standards

- Prepares you for roles in audit, assurance, and compliance

- Enhances your ability to work with multinational teams

External Source: Stay updated with AICPA’s Financial Reporting Updates

Key CPA Skills: What Sets Top CPAs Apart

CPA professionals are more than just number crunchers—they’re strategic thinkers. The key CPA skills needed today go beyond basic accounting. They involve technology, communication, and regulatory understanding.

Whether you’re working in India or abroad, these skills are vital for a successful CPA journey.

Top CPA Skills Required:

- Analytical Thinking: For decoding complex financial data

- Technical Proficiency: In tools like Excel, SAP, QuickBooks

- Regulatory Knowledge: Understanding of global standards (IFRS, GAAP)

- Communication Skills: To explain numbers to non-finance stakeholders

- Ethical Judgment: A non-negotiable skill in financial reporting

Did You Know? According to a Deloitte survey, over 70% of CFOs expect finance professionals to have both technical and soft skills in today’s hybrid work models.

Why the Importance of Financial Reporting Can’t Be Ignored

The importance of financial reporting lies in how it guides business decisions, investor confidence, and economic stability. For CPAs, this is where you prove your value—not just in doing the math but interpreting what the numbers mean.

Inaccurate or delayed reporting can shake investor trust, cause legal troubles, or even shutter companies. This is why organisations place a premium on CPA skills for financial reporting.

Benefits of Strong Financial Reporting:

- Ensures compliance with laws and regulations

- Helps in budgeting and forecasting

- Attracts investors and funding

- Promotes internal control and audit readiness

CPA Accounting Expertise: Real-World Impact

Your CPA accounting expertise is like a toolkit—and financial reporting is one of its most powerful tools. From mergers and acquisitions to internal audits, your ability to interpret reports can shape company futures.

Multinational firms and Big Four companies increasingly demand CPAs who are fluent in global reporting standards.

Where Financial Reporting Makes an Impact:

| Industry | Application of CPA Expertise |

| Banking & Finance | Analyzing financial health, loan decisions |

| Corporate Finance | Strategic planning, investor relations |

| Audit Firms | Ensuring regulatory compliance and accuracy |

| Startups | Financial modeling and pitch readiness |

CPA Skills for Success in the Job Market

With globalisation and financial reforms, the finance sector is evolving rapidly. Employers seek professionals with top-notch CPA skills for success, especially those who understand financial reporting.

Financial reporting allows CPAs to work in roles that were once exclusive to foreign professionals. And with India moving closer to full IFRS adoption, the demand for these skills is only rising.

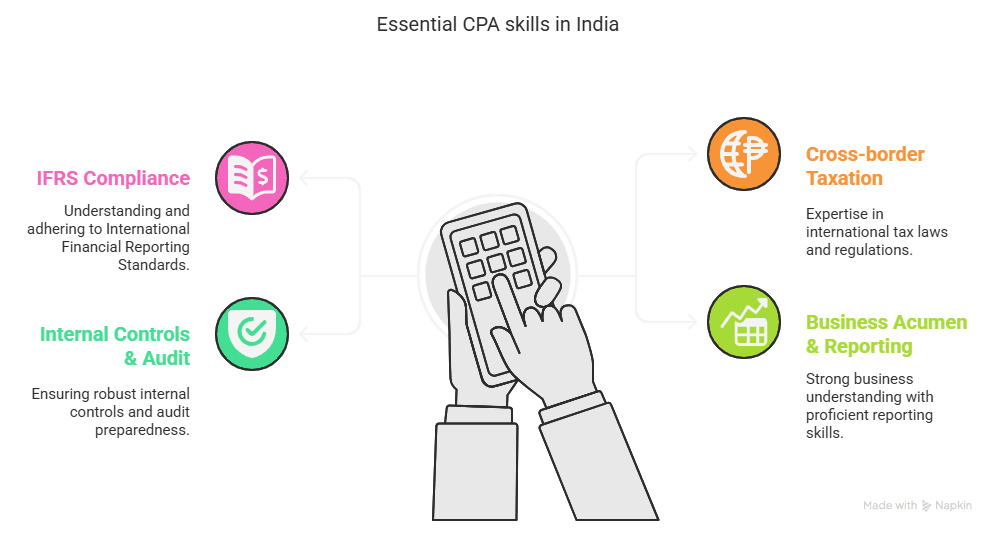

Key CPA Skills Needed:

- IFRS Compliance

- Cross-border Taxation Knowledge

- Internal Controls & Audit Readiness

- Business Acumen with Reporting Proficiency

Accounting and Financial Reporting: An Evolving Relationship

The world of accounting and financial reporting is not static. Technology, regulations, and market expectations are reshaping the landscape. As automation takes over routine accounting tasks, strategic financial reporting becomes the real differentiator.

For CPA professionals, this means upskilling and staying current with changes in reporting frameworks, AI tools, and data analytics.

Trends Reshaping Financial Reporting:

- AI and Automation in statement preparation

- Real-time Reporting with cloud platforms

- Sustainability Reporting becoming standard

- Blockchain Integration for secure ledgers

FAQs on Financial Reporting & CPA Skills

1. Why is financial reporting important for CPA professionals?

Financial reporting is important to CPA professionals.. as it establishes a system of reporting a company’s financial performance while ensuring compliance, transparency, and purposeful decision-making based on reliable information.

2. How does CPA financial reporting differ from general accounting?

General accounting focuses on recording transactions, while CPA financial reporting focuses on analysing and preparing regulated company reports or standardised statements adopted by regulators and investors.

3. Can I get a job from CPA with financial reporting skills?

Yes, many firms or MNCs employ and value CPA-certified employees who have financial reporting skills – especially those that have experience with IFRS or US GAAP.

4. Are financial reporting standards the same globally?

Not entirely—most countries follow either IFRS or GAAP, but CPA professionals must understand the nuances of both, especially in multinational environments.

5. What tools are used in financial reporting?

Common tools include Microsoft Excel, SAP, Oracle Financials, & QuickBooks – along with BI tools like Tableau and Power BI for data visualization.

6. Is CPA certification worth it for finance professionals?

Absolutely. A CPA credential boosts your credibility, expands global job opportunities, and makes you more competitive in fields like auditing, taxation, and financial reporting.

7. What are the challenges in mastering financial reporting?

Staying updated with – changing regulations, managing large data sets and interpreting complex financial events can be challenging but rewarding.

8. How often do financial reporting standards change?

Updates happen frequently. Professionals must stay current by following bodies like the IASB and FASB and taking regular CPE courses.

9. What is the future of accounting and financial reporting?

It’s moving towards real-time, tech-enabled, and sustainability-focused reporting. Skills in data analytics and automation will become critical.

10. Do all CPA exams include financial reporting?

Yes, financial reporting is a core part of the CPA exam—tested under the FAR (Financial Accounting and Reporting) section.

Key Takeaways

- Financial reporting is a foundational CPA skill with real-world application.

- On top are the professionals who flaunt a CPA certificate considering that there are verifiable needs all over the world regarding compliance.

- The trend lines for long-term success within career models, preparing the grounds for contributing to changing understandings of accounting and financial reporting.

- Specialisation in CPA financial reporting will give you an advantage in domestic and international employment scenarios.

- Trends like AI, sustainability, and blockchain are replacing the way CPAs deal with reporting.

Conclusion

Financial reporting is not merely a box to tick on the CPA route; it is an avenue toward achieving credibility, career advancement, and worldwide opportunities. For finance professionals, this competency paves the way to roles that require strategic thinking coupled with technical depth. As businesses continue to grow more complicated and global, we lean on those who can interpret and simplify the numbers and then share them effectively. Make sure that whether you are getting your CPA or are in the news cycle and want to upgrade your skills, you make financial reporting your priority because it is not just a skill, it is your superpower.