Financial Analysis Prodegree™

Build your expertise in Financial Modelling, Corporate Finance & AI

Application Deadline:

Duration

4 Months

Learning Mode

Weekend Live Sessions

Scope

Career opportunities in India & Abroad

Duration

4 Months

Learning Mode

Weekend Live Sessions

Scope

Career opportunities in India & Abroad

The critical skill powering business decisions today

Financial analysis turns data into insights, helping businesses drive growth, manage risks, and stay ahead in a fast-changing world.

Proof in the Numbers

93% of CXOs

say financial modelling drives strategic decisions

15.4 LPA**

is the average salary for financial analysts in India

9%

growth in financial analyst roles by 2033, Top 10% earn over ₹26 LPA**; top 1% cross ₹57 LPA**

Roles you’ll be ready for

Here's what makes this prodegree stand out

Get Started

Be part of a thriving alumni community

Over 6,000 professionals have already transformed their careers through the Financial Analysis Prodegree in collaboration with KPMG in India. Upon enrollment, you join a powerful network of finance professionals across industries and experience levels.

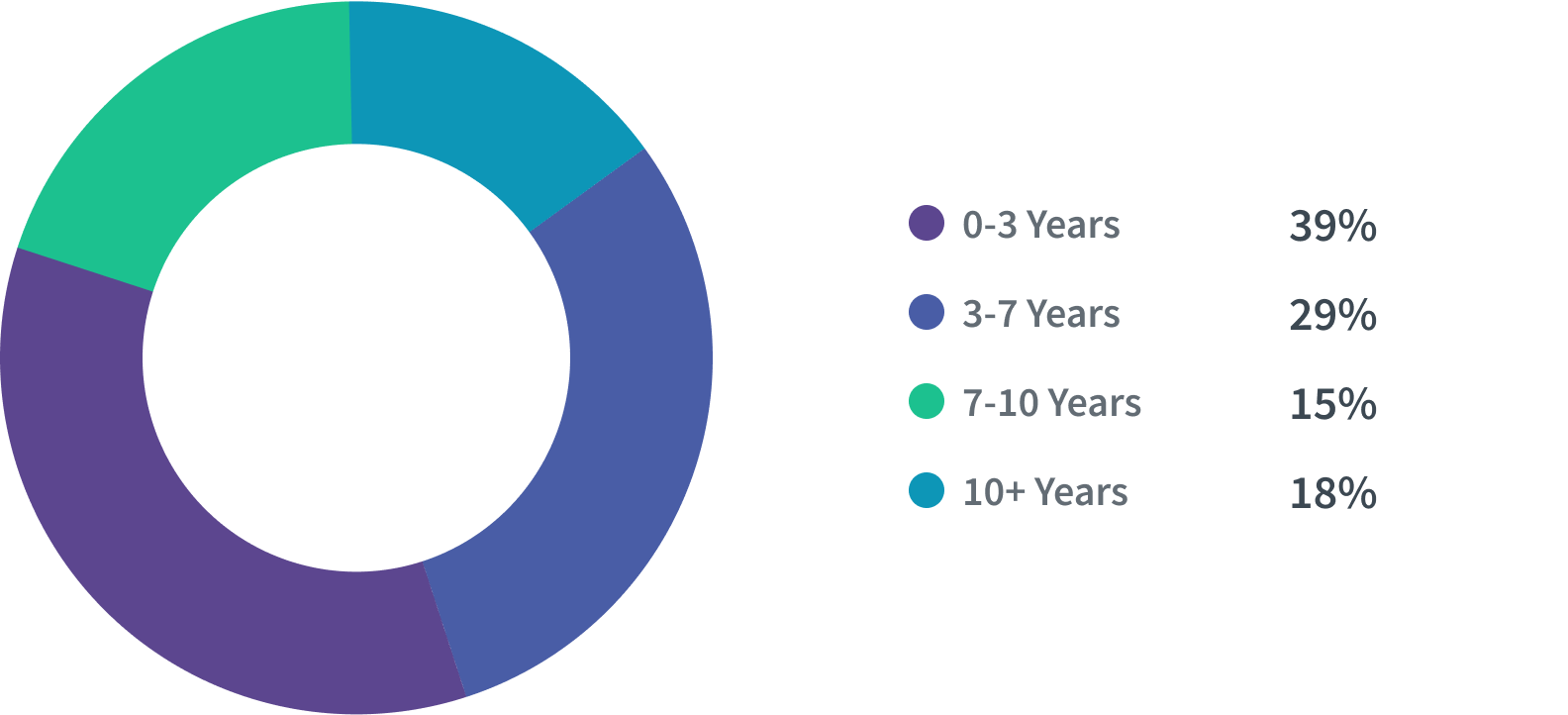

Work experience

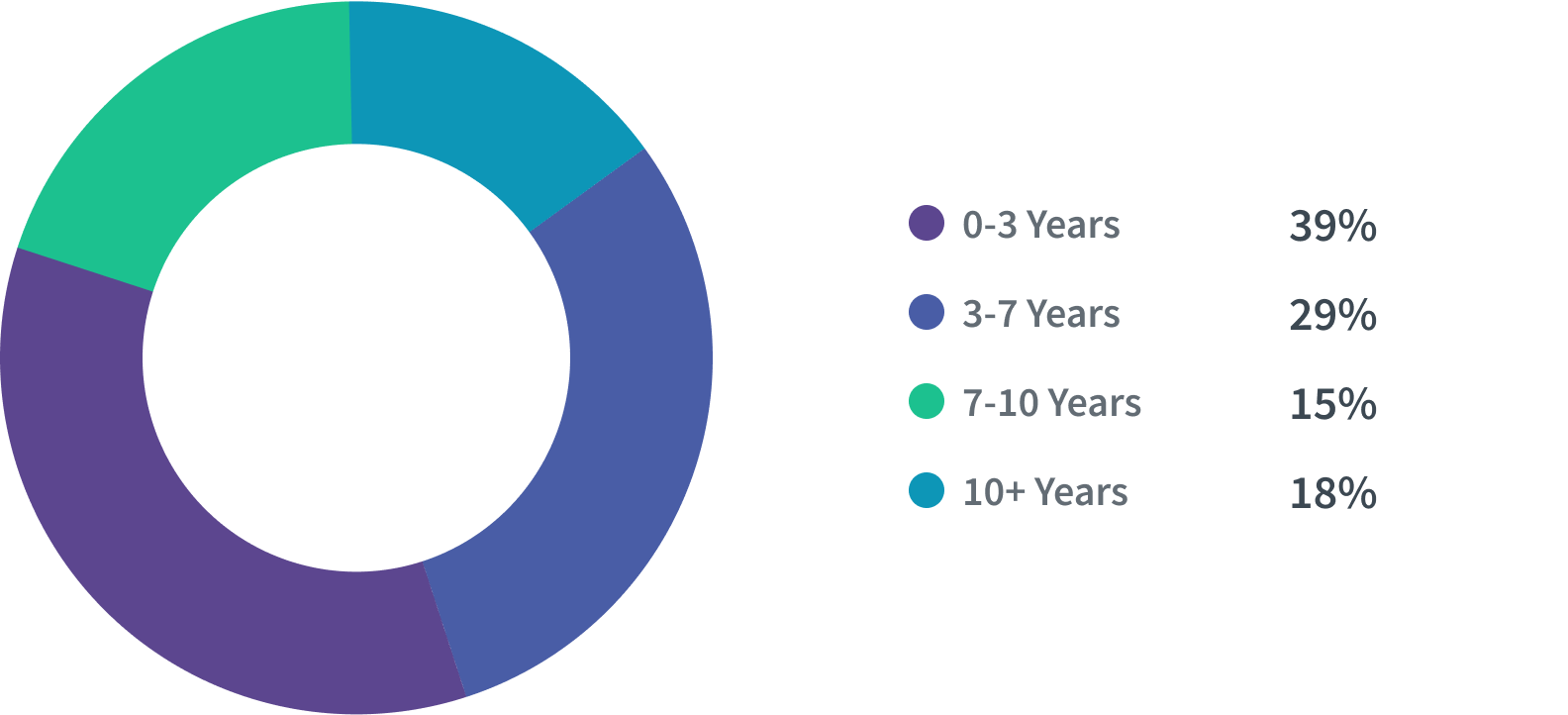

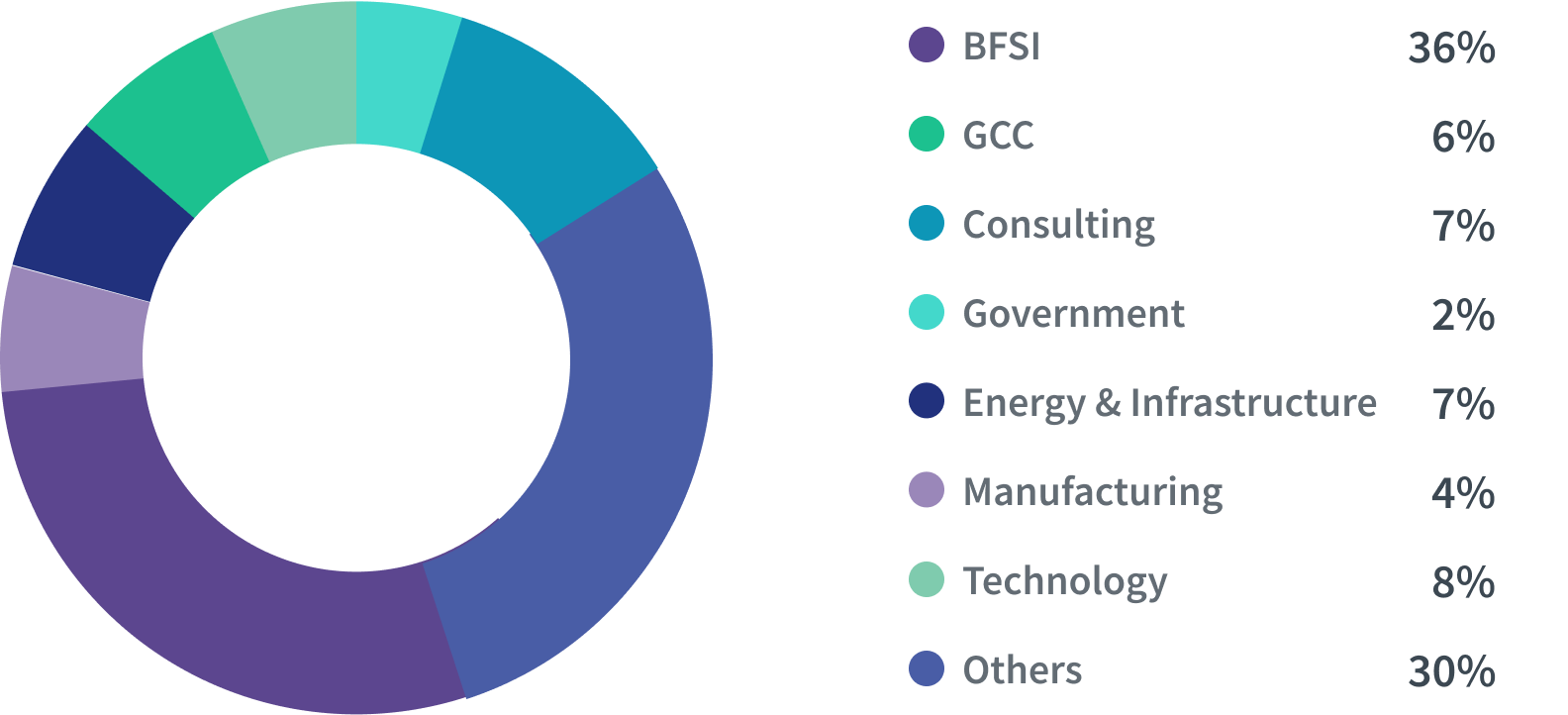

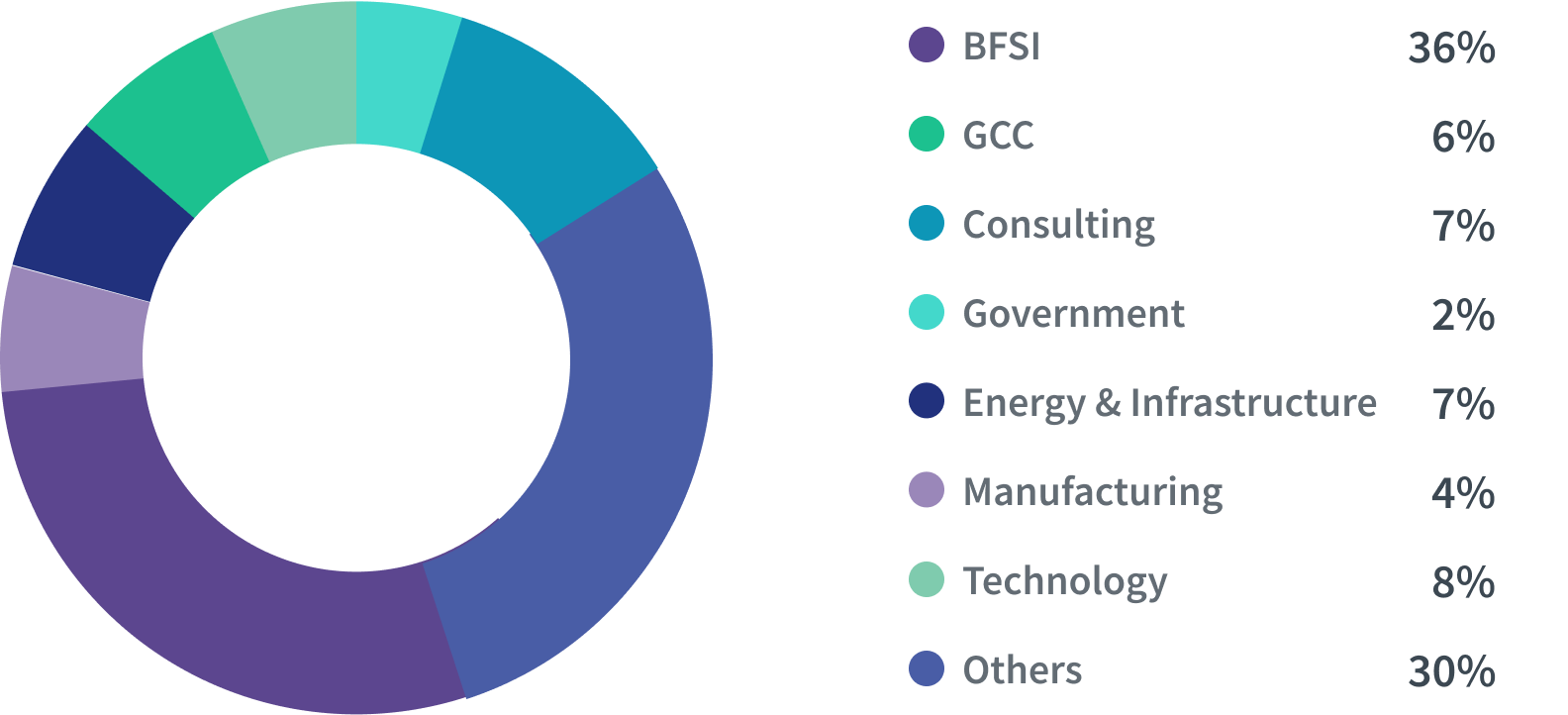

Industries our learners come from:

KPMG in India’s legacy of shaping excellence in financial analysis

The program ensures global standards through case studies, workshops, and real-world insights.

About

100+

Years of legacy as a global audit, tax & advisory major

$36 Bn

Global revenues FY-23 across functions

5200+

Clients across public and private companies

The KPMG in India Advantage

Workshops by KPMG in India Practitioners

Learn directly from seasoned KPMG in India practitioners through live, application-focused sessions.

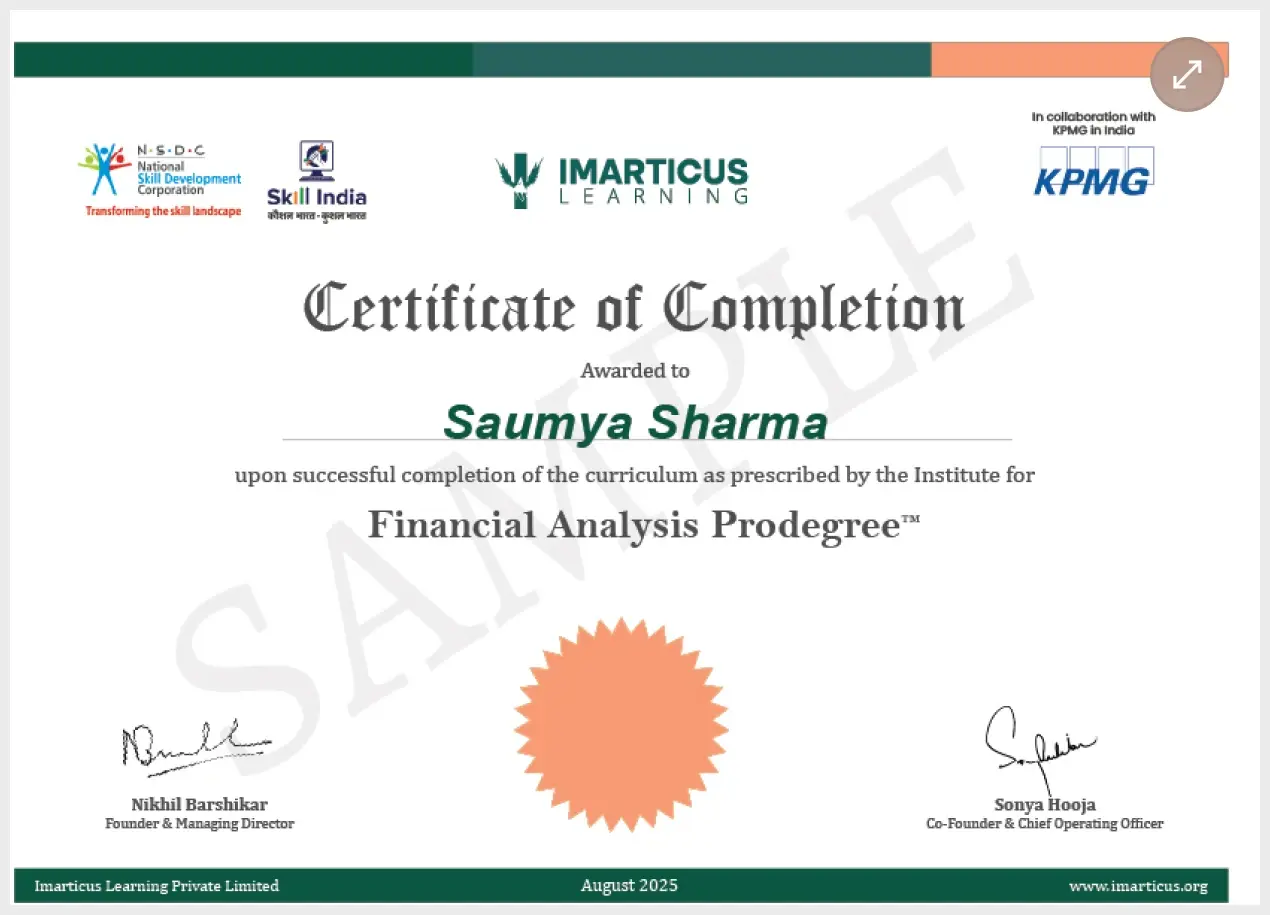

Joint Certification with KPMG in India

Receive a joint certificate which is recognised across the finance industry.

Built on Real-World Case Studies

Solve business challenges using the same frameworks top firms rely on.

What our leaders have to say

The objective of the collaboration between Imarticus and KPMG in India is to bridge existing skill gaps and enhance job readiness for candidates so that they can be placed at global financial houses.

Gaurav Vohra

Partner at KPMG in India

Next-level roles our alumni stepped into

Enrol Now

Our alumni work at

Curriculum built for high-impact finance careers

Understand the foundational concepts and career scope in financial analysis.

Gain essential Excel skills for data handling and basic financial analysis.

Develop a strong base in accounting principles and financial statements.

Interpret business performance using financial ratios and consolidated reports.

Learn to forecast financial elements based on business models and historical data.

Build structured, logical models to analyze business and investment cases.

Execute valuation using discounted cash flows and relative valuation models.

Apply strategic frameworks to assess business dynamics and positioning.

Learn how to analyse business growth using the BCG Matrix and understand how strategic decisions shaped Mahindra Group’s evolution into a global powerhouse.

Present financial data effectively using Excel and storytelling tools.

Understand M&A documentation, processes, and strategic synergies.

Perform equity analysis and write detailed research reports for investment decisions.

Analyse Reliance Industries’ financial statements to assess its performance, estimate fair value, and evaluate its investment potential.

Leverage GenAI and automation tools to streamline financial reporting and modelling

Download Curriculum

Immersive projects for skill-based learning

Apply your knowledge through assignments designed to match real business scenarios

See What Our Learners Have Built

Transform Your Financial Decisions with AI

Build models faster with AI

Leverage AI to create and refine financial models efficiently.

Automate workflows with Zapier

Reduce manual tasks and connect tools seamlessly.

Streamline reporting with GenAI tools

Generate clear, accurate financial reports using ChatGPT and Copilot.

Get hands-on with tools used by top analysts

Learn from real-world business scenarios

Learn from the best finance practitioners in the industry

Enquire Now

Real stories that inspire careers

Earn industry-recognised certification

Upon completing this program, you will be awarded the Financial Analysis ProdegreeTM Certification in collaboration with KPMG in India, as the knowledge partner. This will significantly enhance your professional credentials.

Programme Fees

Pay Now

FAQs

The Financial Analysis Prodegree in collaboration with KPMG in India is the ideal course for someone wanting to get into a client-facing role in finance functions such as those in Investment Banking. KPMG in India is involved in the FAP Program through curriculum design, program delivery, and content. A collaboration with such an industry leader ensures that the curriculum is timely and industry-relevant.

The core learning will happen via 140+ hours of virtual online lectures, depending on your preference. You will also have access to additional study material like video recordings of previous virtual classes, PowerPoint presentations, case studies, quizzes, and eBooks on the learning portal. You will be given extended access to a fully integrated online learning portal where all your learning material will be uploaded. You will need to log in to this learning portal using the credentials provided and navigate through it.

The Financial Analysis Prodegree is a 4-month training course done part-time (on weekends) via online mode. Please contact the nearest centre or our online hotline for more information.

The KPMG name and logo are trademarks of KPMG International Cooperative and are used under license by its independent member firms. Their inclusion in this programme is compliant with KPMG’s global trademark policies.

KPMG in India is not involved in the placement assistance offered through this program and does not guarantee employment, career advancement, or future earnings. Its role is limited to providing FAP preparation and training for a specified number of hours, without endorsing or committing to any salary expectations.

**All salary-related data presented has been sourced from credible job and employer review platforms, including Indeed.