Maybe you’ve transferred money in seconds, traded stocks right from your phone or had your loan approved by a chatbot—this is FinTech. Financial technology, or FinTech, is innovating the way we bank, invest and insure and spend. The question is—are we ready?

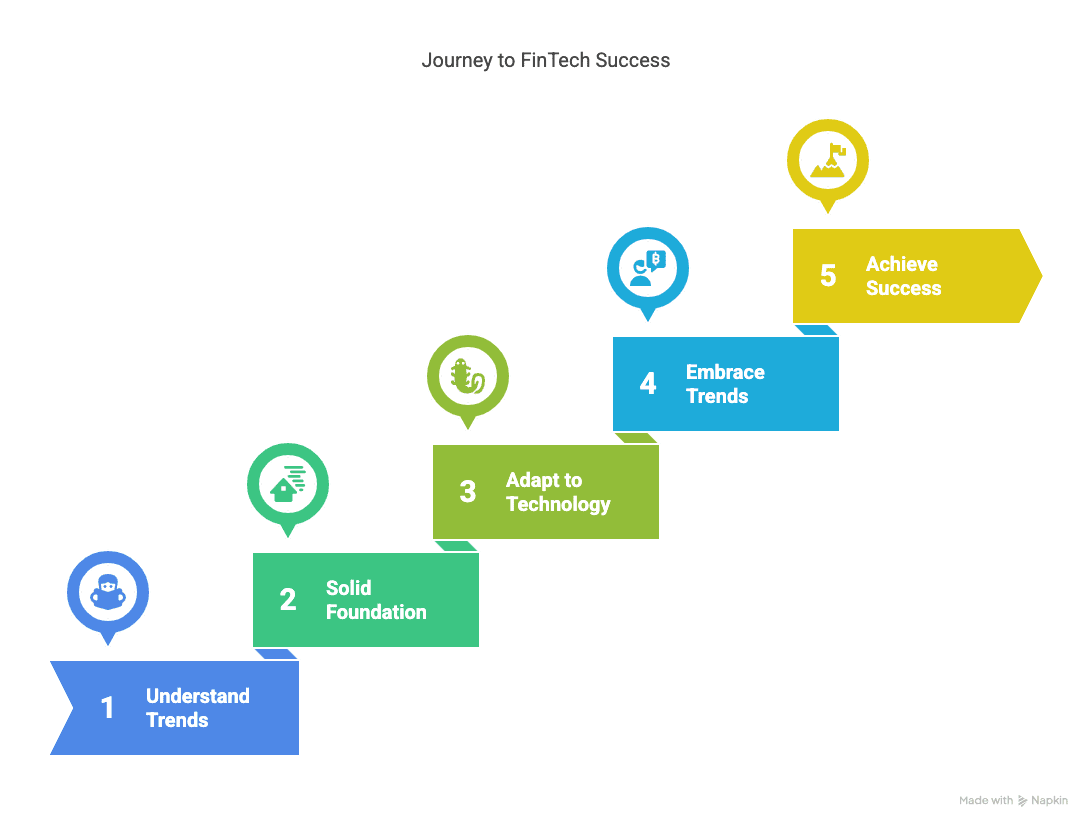

We will look at the top 5 FinTech trends that are shaping the future of finance. These trends range from AI investment and advise tools to security layers based on blockchains. These are not trends or buzzwords—they are opportunity spaces for different careers. If you’re pursuing or considering a PGDM in Finance, you will also see the relevance of having the right curriculum to guide you through finance as it evolves rapidly.

Table of Contents

- Artificial Intelligence: Redefining Financial Intelligence

- Blockchain: Building Trust Through Technology

- Digital Banking: The New Banking Normal

- RegTech: The Rise of Compliance Automation

- How PGDM in Finance Futureproofs Your Career

- Key Takeaways

- FAQs

- Conclusion

Artificial Intelligence: Redefining Financial Intelligence

The integration of AI into finance is not just improving efficiency—it’s transforming entire business models. From automating credit scoring to detecting fraud in real time, artificial intelligence is creating smarter, faster, and safer financial ecosystems.

AI algorithms now help banks analyse customer data to create personalised product offerings. Wealth managers use robo-advisors to assist clients in making data-backed investment decisions. Even back-office operations are becoming intelligent, saving time and reducing human error.

Real-World Applications of AI in Finance

- Fraud detection systems that flag suspicious transactions in milliseconds.

- Chatbots providing 24/7 customer service across digital platforms.

- Predictive analytics to manage investment risks and returns.

- Algorithmic trading platforms powered by real-time market data.

External Link: Forbes: How AI Is Changing Finance

Blockchain: Building Trust Through Technology

When we talk about transparency and security in the financial world, blockchain immediately comes to mind. Initially introduced as the backbone of cryptocurrencies.. blockchain has now evolved into a FinTech essential.

Blockchain enables decentralised, tamper-proof ledgers that make transactions traceable and secure. It’s revolutionising everything from cross-border payments to smart contracts and digital identity verification.

Blockchain in Finance – What’s Changing?

- Settlement Times: Reduced from days to seconds for global transactions

- Middlemen: Eliminated in many financial operations, cutting costs

- Smart Contracts: Auto-executing contracts reduce paperwork and delays

- Digital Identity: Secure, verifiable customer onboarding

| Use Case | Impact Area | Industry Adoption |

| Cross-border payments | Speed & Cost | High |

| KYC processes | Identity verification | Growing |

| Smart contracts | Legal automation | Early stage |

External Link: World Economic Forum on Blockchain

Digital Banking: The New Banking Normal

In the past, banking meant standing in long queues. Today, thanks to digital banking, everything from account opening to loans happens on your phone. The traditional banking model is being upended by neobanks and digital-first platforms.

Digital banking focuses on convenience, personalisation, and speed. These banks use FinTech trends to offer seamless user experiences, making them highly attractive, especially to Gen Z and millennials.

Key Features Driving Digital Banking Adoption

- 100% online account opening and onboarding

- Real-time payments and instant money transfers

- Mobile-based budgeting and credit tools

- Minimal fees and higher interest rates for savers

| Traditional Bank | Digital Bank |

| Branch visits | Fully app-based |

| 2–5 day processing | Instant processing |

| High fees | Minimal or zero fees |

External Link: McKinsey on Digital Banking Growth

RegTech: The Rise of Compliance Automation

The financial industry is one of the most regulated sectors in the world. Enter RegTech—a FinTech subdomain that uses technology to streamline compliance. Whether it’s real-time monitoring or regulatory reporting, RegTech helps companies avoid fines and operate ethically.

This innovation is crucial, especially as global financial regulations become stricter and more complex. RegTech solutions are now embedded in AML, fraud prevention, and risk management frameworks.

RegTech in Action

- Real-time monitoring of transactions for suspicious activity

- Automation of regulatory filings and documentation

- AI-powered risk scoring for customer due diligence

- Alerts for changes in global compliance laws

Benefits of RegTech in Financial Services

- Reduces manual compliance errors

- Enhances transparency in operations

- Cuts down on auditing time and cost

- Keeps institutions up-to-date with changing laws

How PGDM in Finance Futureproofs Your Career

Now that we’ve explored the top FinTech trends, it’s time to connect the dots—how can a PGDM in Finance prepare you for this fast-moving future? The answer lies in the curriculum, industry exposure, and tech-forward approach most modern programs offer today.

A PGDM in Finance typically combines foundational financial theory with practical training in technologies like AI, blockchain, and digital banking. Many B-schools now offer FinTech labs, live projects, and certifications that align with global industry needs.

PGDM Course Curriculum vs FinTech Needs

| FinTech Skill | PGDM Offering |

| AI and Data Analytics | Courses on Financial Modelling & Machine Learning |

| Blockchain Applications | Electives in FinTech and Decentralised Finance |

| Regulatory Compliance | Risk Management and Compliance Training |

| Digital Banking Tools | Simulations and Lab-Based Learning |

How PGDM Programs Integrate FinTech

- Offer hands-on tools like Python, R, Tableau for data analytics

- Encourage capstone projects focused on FinTech problem-solving

- Facilitate internships with FinTech startups and banks

- Partner with companies for guest lectures and mentorship

The future of finance demands not just knowledge but adaptability—and that’s precisely what a PGDM equips you with.

Key Takeaways

- FinTech trends are redefining roles, operations, and expectations across the finance sector.

- AI is powering smarter decisions, risk management, and customer experiences.

- Blockchain ensures security, transparency, and speed in financial transactions.

- Digital banking is becoming the preferred mode for the next generation.

- RegTech helps financial firms stay compliant in an ever-changing regulatory environment.

- A PGDM in Finance equips students with both financial acumen and technological fluency to thrive.

FAQs

1. What are FinTech trends and why are they important?

FinTech trends include -technologies, practices or methods that disrupt and shape the financial services industry today, such as artificial intelligence (AI), blockchain and digital banking. FinTech trends are important because they affect employee roles, financial products and services and consumer expectations in financial services.

2. How does AI improve financial services?

AI improves financial services by allowing for real-time business decision making, better fraud detection, customer service and automating processes/activities such as credit assessments and investing analysis, and providing more comprehensive knowledge bases for bank and financial services employees.

3. Why is blockchain secure for financials?

Blockchain uses distributed ledgers that ‘can’t be changed’ and the transactions are encrypted. This makes tampering with records of transactions very difficult and giving trust and security in financial applications.

4. What skills do I need to learn to stay current in FinTech?

Skills include data analysis / analytic skills; coding skills like Python and R; blockchain; compliance and regulatory; and financial modeling. These are all included in a PGDM in Finance program.

5. Is digital banking replacing traditional banks?

Digital banking is flourishing, but it is strong enough and developing to complement, not replace, traditional banking. Traditional banks must engage with digital-first strategies to help them remain relevant.

6. What is RegTech, and who should use it?

RegTech (regulatory technology) is designed for financial institutions to help with compliance. Banks, insurance companies & FinTech firms must implement RegTech to improve risk management – along with complying with regulations.

7. Can you land a job in FinTech with a PGDM in Finance?

Yes, absolutely. Many PGDM programs include FinTech specializations, industry projects, and exposure to the tools that match the existing job titles in FinTech (data science, risk management, digital banking).

8. What is PGDM? How is it different from MBA in Finance?

There are similarities. They are both postgraduate courses in management. Generally speaking, PGDMs are more focused on industry, and PGDM courses have the ability to change/update their curriculum to keep pace with industry demands and/or new-age topics like FinTech trends.

9. Which companies hire PGDM graduates for FinTech roles?

Top recruiters include Paytm, Razorpay, Goldman Sachs, JPMorgan, HDFC, and emerging startups in digital banking and blockchain space.

10. Are PGDM programs globally recognised for FinTech education?

Yes, many PGDM programs collaborate with international institutions and corporations to provide certifications and exposure aligned with global FinTech developments.

Conclusion

The world of finance is undergoing more change than ever before – and FinTech trends are at the forefront of the change. From cognitive automation and secure blockchain networks to fully digital banks, there will be a future of not just digitally led but FinTech-driven finance. To be successful, you will need more than curiosity; you will need capability.

A postgraduate diploma in management (Finance) will be your platform, blending technical skills with business understanding ensuring that you are not just job-ready but future-ready too. The Finance industry is shifting, but those who adapt to the change, and equip themselves to it, will lead the next chapter of finance.