Introduction

Let’s be honest – regulatory compliance is everyone’s least favourite area of finance. Geography may have gifted us a large ocean barrier, but finance is a global industry, with numerous regulation sources, it’s an overwhelming space to have compliance.

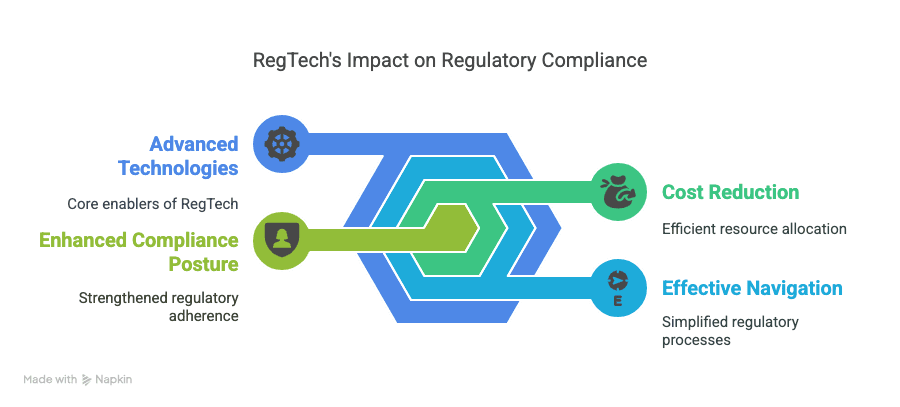

Long-term, complex rules, change all the time, and not to forget the high cost of remaining in compliance – all pain points for banks, fintechs, and from a past experience with an unexpected audit, almost all finance industry participants. Not to sound overly ambitious, but what if technology can make this easier, more efficient, and smarter? Welcome to RegTech – or Regulatory Technology, the next giant leap forward in the evolution of regulatory compliance.

RegTech should not be taken lightly – again this is not a buzzword; this is noteworthy. RegTech is the idea of using new technology to simplify regulatory processes of compliance, reduce compliance costs and increase transparency. To do it simply – automation, AI, data analytics, and blockchain can all be used collaboratively by organizations to shape a compliant environment in support of the regulation and its sector without stifling innovate.

Table of Contents

- What Is RegTech?

- RegTech Master’s Program: Future-Proofing Compliance Careers

- FinTech Compliance Engineering: Bridging Tech and Regulation

- AI-Driven Compliance Solutions: The Power of Intelligence

- Blockchain for Regulatory Compliance: Trust Through Tech

- Digital KYC & AML Strategies: Speed Meets Security

- Regulatory Data Analytics in FinTech: Making Data Work Smarter

- RegTech Innovation and Leadership: Pioneering the Future

- Key Takeaways

- FAQs

- Conclusion

What Is RegTech?

RegTech refers to the use of technology to streamline and improve regulatory processes.. especially in the financial sector. It’s designed to help institutions comply with regulations efficiently and cost-effectively.

Initially, RegTech emerged as a subset of FinTech. However, it quickly established its own identity by addressing growing concerns around regulatory overload, risk management, and compliance costs. According to a report by Deloitte, financial firms spend 10% to 15% of their workforce on compliance alone. RegTech helps reduce this load significantly.

Key Features of RegTech

| Feature | Description |

| Automation | Replaces manual compliance processes with efficient digital workflows. |

| Real-Time Reporting | Enables faster response to regulatory changes and incidents. |

| Advanced Analytics | Offers deep insights for decision-making and predictive compliance. |

| Secure Data Handling | Ensures protection of sensitive compliance-related data. |

| Scalability | Easily adaptable to changing regulations and organisation size. |

RegTech Master’s Program: Future-Proofing Compliance Careers

Professionals aiming to thrive in the age of digital regulation must invest in structured education, and that’s where a RegTech Master’s Program becomes essential. These programs offer comprehensive knowledge across- legal frameworks, tech solutions & implementation methodologies.

Enrolling in a RegTech Master’s Program provides learners with the foundational understanding of how technologies like AI and blockchain apply to compliance. It also develops analytical, strategic, and leadership skills to navigate an evolving regulatory landscape.

Benefits of a RegTech Master’s Program

- Gain hands-on experience with compliance tools and platforms.

- Learn to design and deploy tech-led regulatory frameworks.

- Understand global regulatory differences and risk frameworks.

- Build a career in compliance leadership or consultancy.

- Stay updated with live industry case studies and expert sessions.

FinTech Compliance Engineering: Bridging Tech and Regulation

FinTech Compliance Engineering is the engineering backbone of RegTech. It combines deep knowledge of financial regulation with strong technical skills to develop compliance systems that are scalable, secure, and automated.

As financial products evolve, compliance engineers build the infrastructure that ensures these innovations don’t fall foul of regulators. This field is in high demand as companies expand their RegTech capabilities.

Common Tools Used in FinTech Compliance Engineering

| Tool | Function |

| Python & R | For scripting compliance algorithms and analytics. |

| SQL & NoSQL | To store and retrieve regulatory data efficiently. |

| APIs | Facilitate secure integration with regulatory databases. |

| Docker & Kubernetes | For scalable and containerised deployment of compliance systems. |

AI-Driven Compliance Solutions: The Power of Intelligence

Artificial Intelligence is transforming compliance from reactive to proactive..AI-driven Compliance Solutions analyse vast amounts of regulatory data in real-time, detect anomalies & even predict potential risks.

AI allows institutions to interpret complex rules quickly and apply them consistently across processes. From chatbots that handle basic compliance queries to machine learning models that identify suspicious activity, AI is central to RegTech’s evolution.

Examples of AI Applications in RegTech

- Natural Language Processing (NLP) for interpreting regulatory texts.

- Pattern recognition for fraud detection.

- Predictive analytics for risk modelling.

- Automated report generation for regulatory filings.

According to PwC, 70% of financial services firms are investing in AI to support their compliance functions. (Source)

Blockchain for Regulatory Compliance: Trust Through Tech

Blockchain technology is one of the most impactful RegTech developments in Regulatory Compliance. The advantages of transparency, immutability, and decentralization make Blockchain the best choice for secure audit trails and data integrity Blockchain technology provides a mechanism for compliance records to be created so that they cannot be changed or deleted. This additional layer of trust between the institution and regulators is heightened in areas of digital identity, KYC, and transaction auditing.

Benefits of Blockchain in RegTech

- Immutable and verifiable transaction records.

- Simplified audit processes.

- Secure sharing of data across institutions.

- Real-time visibility for regulators.

The World Economic Forum suggests blockchain could reduce compliance costs by 30% in the next five years. (Source)

Digital KYC & AML Strategies: Speed Meets Security

Digital KYC & AML Strategies are critical pillars of any RegTech system. Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements are complex and time-consuming, but automation is changing that.

Digital KYC uses facial recognition, e-signatures, and OCR to verify customer identity almost instantly. AML systems now leverage big data and AI to monitor transactions and flag suspicious behaviour more accurately.

Innovations in Digital KYC & AML

- Biometric ID verification.

- Real-time transaction monitoring.

- Machine learning for anomaly detection.

- Digital onboarding with minimal documentation.

A recent report by Thomson Reuters states that automating KYC can reduce onboarding time by 50%. (Source)

Regulatory Data Analytics in FinTech: Making Data Work Smarter

Data is at the heart of modern compliance. Regulatory Data Analytics in FinTech focuses on harnessing structured and unstructured data to detect patterns, identify risks, and ensure regulatory alignment.

These analytics tools transform vast volumes of regulatory information into actionable insights. With dashboards and visualisations, compliance teams can prioritise tasks and detect blind spots more easily.

Core Uses of Regulatory Data Analytics

- Monitoring regulatory breaches in real-time.

- Automating the preparation of audit reports.

- Risk scoring and alerts based on behavioural analysis.

- Benchmarking compliance performance across business units.

RegTech Innovation and Leadership: Pioneering the Future

True transformation requires forward-thinking leaders. RegTech Innovation and Leadership are about cultivating visionaries who can champion change, invest in the right tools, and embed a culture of compliance-first thinking.

Leaders in this space must blend technical understanding with strategic foresight. Whether you’re an aspiring compliance head or a fintech founder, leading RegTech initiatives means influencing policy, product, and people.

Skills Required for RegTech Leadership

- Deep understanding of global regulations.

- Fluency in tech adoption and integration.

- Ability to interpret regulatory changes quickly.

- Strong communication to align teams and stakeholders.

Key Takeaways

- RegTech is reshaping compliance through AI, blockchain, and big data.

- Programmes like the RegTech Master’s Program help professionals stay ahead.

- FinTech Compliance Engineering creates the technical foundation for compliant financial innovation.

- Solutions like AI-Driven Compliance, Digital KYC, and Blockchain-based systems are making compliance faster, smarter, and cheaper.

- Leadership and innovation are essential to successful RegTech implementation.

FAQs

1. What is RegTech in plain language?

RegTech is an acronym for Regulatory Technology & denotes the application of cutting-edge technologies such as- AI, blockchain & data analytics to enable financial institutions to be more cost-effective and efficient in their compliance with regulations.

2. How is RegTech different from FinTech?

Whereas FinTech targets the use of technology in financial products and services -RegTech is solely aimed at applying technology to tackle regulatory and compliance problems.

3. Who are RegTech solutions being used by?

Banks, insurance companies, asset managers, regulators, fintechs & even large corporates utilize RegTech in order to simplify compliance processes and more efficiently manage risk.

4. What is the contribution of AI to RegTech?

AI facilitates the automation of: tedious compliance tasks, the interpretation of legal texts, fraud detection, and alerting suspicious behavior through the processing of enormous amounts of data in real-time.

5. Is blockchain critical to RegTech?

Though not necessary.. blockchain greatly improves transparency and trust, particularly in forming permanent audit trails and making it easier to share data among institutions.

6. What is Digital KYC in RegTech?

Digital KYC makes use of digital technologies such as -facial recognition, document scanning, and biometrics to rapidly authenticate customer identities at onboarding.

7. What skills are needed for a career in RegTech?

Data analytics, programming, understanding of regulations, and digital transformation – are essential for a successful career in RegTech.

8. Do RegTech professionals have any certifications?

Yes, certification programs like the RegTech Master’s Program provide extensive training and hands-on experience with next-generation compliance systems and solutions.

9. Can startups implement RegTech?

Certainly. Most RegTech solutions are cloud-based and scalable, so even startups with slim compliance budgets can implement them.

10. What does the future of RegTech hold?

RegTech will keep on developing with improvements in AI, automation, and predictive analytics and become increasingly integrated into business operations on a daily basis and financial innovation.

Conclusion

The financial sector is experiencing major upheaval, and that means the manner of regulating has to change too. RegTech is a promising new paradigm that integrates compliance and innovation into industry value. From the application of AI to streamline compliance risk, or digital KYC, or blockchain to better secure records, or simply a trove of data that could produce insights for compliance and regulatory purposes, the RegTech ecosystem is in transition, and dynamic as can be. Now is the time that practitioners and institutions need to ramp up their own Rubik’s cube strategies for how they will adopt these sort of technologies, as future compliance in a RegTech ecosystem will not just be a checkbox as we once knew it, but will be a matter of directional advantage.