You become a financial risk manager by relying on the success of the FRM Certification, which is a certification offered by the Global Association of Risk Professionals (GARP).

MarketsandMarkets state that the risk management software market will reach USD 18.75 billion by 2025, growing at a 16.2% CAGR. Additionally, 72% of FRM certificate holders report career advancement within one year of certification.

To learn how to become a financial risk manager, we will walk you through it all—exam pieces, fees, skills, careers and salary trends.

What are the FRM Exam Details?

Format: Part I is 100 MCQ questions; Part II is 80 MCQ

Frequency: The FRM exam is conducted every May, August and November

FRM Exam Date, Format and Frequency

Part I: 100 questions, 4 hours

Part II: 80 questions, 4 hours

Topic Matter Covered: Quantitative analysis, market risk, credit risk, operational risk, risk modelling.

Practice with timed mock sheets to simulate actual exam conditions and make the best of time management.

FRM Certification Cost Explained

| Fee Type | FRM Exam Cost (USD) [Part I & II] | Notes |

| One-time Enrollment Fee | $400 | Paid once, first time registration only |

| Early Registration | $600 | Per exam part, if available |

| Standard Registration | $800 | Per exam part, main registration fee |

Technical and Soft Skills to Be a Risk Manager

You need technical and soft skills in combination to become a good financial risk manager:

- Quantitative Analysis: Excel VaR modelling, probability, and statistical mastery.

- Technical Skills: Stress-test and analyze via Excel, Python or R.

- Regulatory Awareness: Basel III/IV requirements and compliance rules comprehension.

- Critical Thinking: Assess scenarios and suggest mitigation.

- Communication: Present technical risk findings in an easy-to-understand manner to stakeholders.

Building these skill sets prepares you for the FRM exam specifics and achievement upon certification.

FRM Career Opportunities

With FRM Certified professionals opening up to numerous FRM career prospects in industries:

- Risk Analyst: Quantify and report credit, market and liquidity risks.

- Credit Risk Manager: Oversee credit portfolios and set lending criteria.

- Operational Risk Specialist: Optimise controls to minimise process failure.

- Quantitative Analyst (Quant): Create forecasting models in hedge funds.

These roles are highly coveted by firms such as HSBC, J.P. Morgan, and Deloitte by FRM charterholders.

Remuneration Trends of Financial Risk Management

Knowing the remuneration for financial risk management enables one to expect realistically:

- Entry Level: $60,000–80,000 per annum.

- Mid-Career: USD 90 000–120 000 per annum

- Senior Roles: USD 130 000+ per annum

New York and London-based senior risk managers earn as much as 25 % above global standards (Source).

Compensation in the Asia-Pacific region is 10–15 % below regional cost levels.

Solo Acumen: AI and ESG at Risk

There is a new solution for how to be a risk manager, along with accepting AI and sustainability:

- AI Integration: Over 60 % of banks plan to use machine learning for credit risk by 2026 (Euromoney).

- ESG Factors: Stress tests now consider environmental, social and governance metrics.

- Competitive Advantage: Knowledge of AI tools and ESG frameworks puts you a step ahead during job interviews.

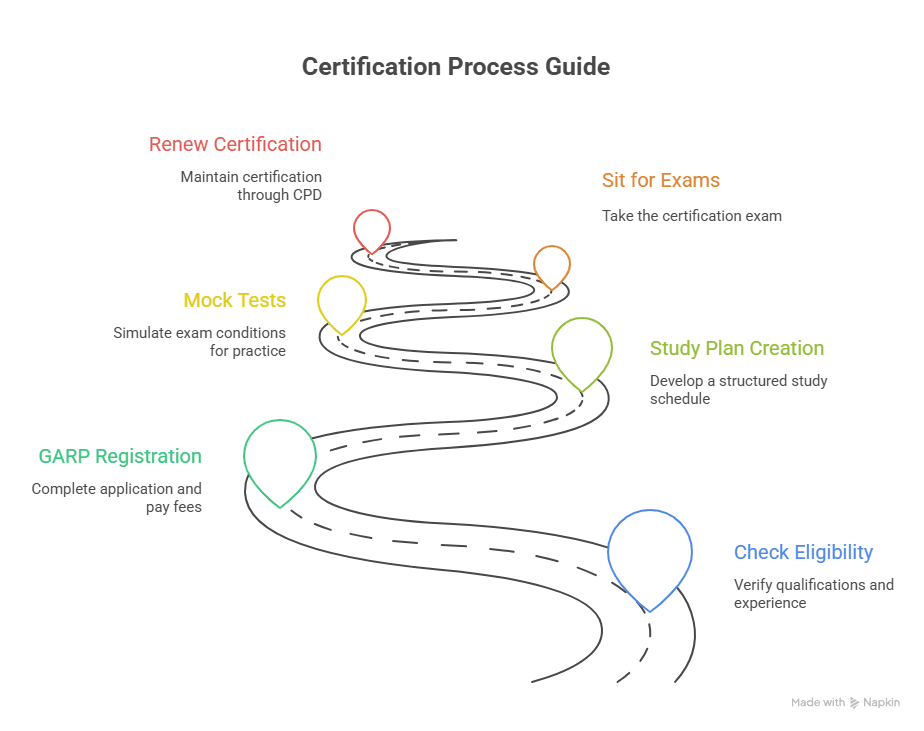

Step-by-Step Study Guide

Take this step-by-step guide to study in a structured way:

- Check Eligibility: Two years of work experience and a Bachelor’s degree in a related profession.

- GARP Registration: Apply and pay for registration and exam fees.

- Study Plan Creation: Allocate 200+ hours per section within 5–6 months.

- Mock Tests: Simulate exam-like situations and study mistakes in depth.

- Sit for Exams: Offer both parts in a single cycle to stay on track.

- Renew Certification: Earn 40 CPD credits every two years.

Frequently Asked Questions

What are FRM Certification’s qualification requirements?

A bachelor’s degree or two years’ direct finance experience.

How frequently is the FRM exam written?

Thrice in a year – May and November.

Can I write Part II exam without writing Part I?

No; Part I is a prerequisite for Part II.

What is the passing rate on the FRM exam?

Approximately 50–55 % per part.

Are interview requirements mandatory?

No, certification is exam-only.

How many CPD credits are needed?

40 credits every two years to maintain your FRM.

Is FRM worth it if I am not working in banking?

Yes, consultancies, corporates and fintech firms recruit FRM charterholders.

Conclusion

Becoming a financial risk manager through FRM Certification is a rewarding journey that blends quantitative rigour with strategic insight. With clear steps, robust preparation and ongoing learning, you’ll stand out in a competitive market.

Key Takeaways:

- Strategic Planning: A well-defined eight-step roadmap guarantees consistent momentum.

- Skill Fusion: Master quantitative techniques, regulatory aspects and communication.

- Career Benefits: See 20-30 % salary increases and diverse global roles.

Ready to achieve success? Join the FRM Certification Preparation Program now and start your success journey.