Introduction: Welcome to the Era of AI-Driven Investing

What if a machine, not a person, made the largest money choice in your life? This machine never sleeps, never fears, and never skips a fact. Say hi to a new mix of Money and AI. Here, the old ways of putting money in are changed by code, steps, and data analysis that is always on.

Those days when wealth managers depended on intuition or past data are over. In today’s era, Finance and AI are combining to develop systems that forecast, automate, and even outsmart human investors. From robo-advisors to algorithmic trading and sentiment analysis, we are heading towards an era where artificial intelligence doesn’t just support—it dictates.

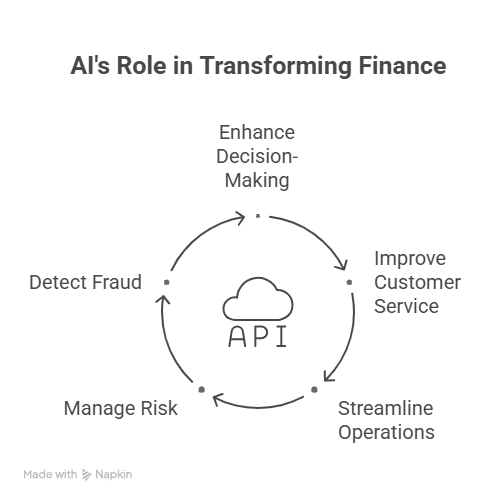

Artificial Intelligence’s Role in Finance

The money world has always grabbed new tech fast, but AI has pushed its change faster and further than before. AI is great at handling huge loads of data quickly and finding details that people can’t. Now, banks, funds, and money firms use AI to catch cheats, check risk, and fine-tune their plans. By mixing money work with AI, they make choices that are not just quick but very smart. According to a McKinsey report, financial institutions may capture $1 trillion in additional value through AI adoption by 2030 (source).

Key Use Cases of AI in Finance

- Predictive analytics for stock market movements

- Real-time fraud detection platforms

- Credit scoring and underwriting automation

- Portfolio management through robo-advisors

- Automated compliance and regulatory screening

- News and social media sentiment analysis

- Customer service and chatbots automation

- Algorithmic trading platforms

- Risk modelling and stress testing

- Insurance claim evaluation

Rise of AI-Driven Investing: A Game Changer

AI investing is the employment of machine learning algorithms and models to make investment choices based on data without human influence. These models are set to learn and improve continually with new data, having a serious advantage over volatile markets.

The use of Finance and AI in asset management is increasing at a fast pace. AI assists in removing emotional prejudice, processing alternative data (such as satellite imagery or customer behaviour), and making trades in milliseconds. Companies such as BlackRock and Renaissance Technologies are already utilizing AI intensely to produce alpha.

By Forbes, almost 60% of institutional investors think AI will become critical to producing future returns (source).

Financial Technology Trends Shaping the Industry

The marriage of Finance and AI is being propelled by major trends in financial technology. From blockchain to deep tailoring, the scene is growing fast. As new fintech firms and old players take on AI, we’re seeing huge new ideas. Two big shifts are the rise of easy AI tools that need no code and the move to include finance inside other services. Both trends allow for faster deployment and greater scalability of AI-driven investing solutions.

Emerging Fintech and AI Trends

- AI-driven ESG investment models

- Predictive customer behavior modeling

- No-code AI for banks

- Blockchain and AI integration for intelligent contracts

- AI-powered underwriting for loans and insurance

- Generative AI for customized financial guidance

- Quantum computing potential in trading

- Cloud-native AI investment platforms

Automated Investment Strategies: Precision at Scale

Automated investment plans are constructed with pre-established rules and input data to control portfolios with little or no human intervention. These plans, most commonly applied by robo-advisors and institutional investors, are capable of rebalancing portfolios, tax-loss harvesting, and making trades based on market signals.

The integration of Finance and AI guarantees these computerized systems never sit still. They evolve. A machine learning model, say, can change asset mixes based on geopolitical developments, inflation data, or social media sentiment—something that human managers just aren’t able to do in real time.

The Future of Wealth Management with AI

Finance AI are revolutionizing wealth. High net worth as well as mass affluent investors are increasingly preferring digital platforms that provide 24/7 advice, data-driven recommendations, and transparency.

AI is making hyper-personalized investment offerings possible. Two individuals of the same age and income, for example, may receive very different portfolio suggestions based on their objectives. Risk tolerance. Even personality characteristics inferred from digital trails.

As per Deloitte, wealth management companies which adopt AI will enjoy a 30% productivity edge over their non-AI-adopting counterparts by 2027 (source).

Conventional vs AI-Based Investment Models

Below is a side-by-side analysis of how AI and Finance models vary from conventional ones:

Traditional vs AI-Driven Investment Strategies

| Factor | Traditional | AI-Driven |

| Approach | Human intuition, past data | Algorithmic, real-time data |

| Speed | Slow, manual | Instant, automated |

| Scalability | Limited by human effort | Handles millions of accounts |

| Adaptability | Periodic, reactive | Continuous, real-time learning |

| Bias | Prone to emotion | Data-driven, emotion-free |

| Personalisation | Broad segments | Hyper-personalised |

| Data Used | Structured only | Structured + unstructured |

| Cost | High advisory fees | Low, automation-led |

| Access | Mostly HNWIs | Open to all via fintech |

| Transparency | Depends on advisor | Built-in explainability |

This table shows the extreme difference in methodology, speed, scalability, and responsiveness between traditional and AI-based investment approaches. You can see, of course, that the future belongs to automation and intelligence.

Advantages of Finance and AI Integration

The mix of Finance and AI adds big gains above better results. It opens up access to investing tips, cuts down on costs, and lifts choices over all types of assets.

Main Gains

- Speed: AI can go through live data in a snap.

- Scalability: Systems can take care of lots of accounts at once.

- Accuracy: Choices built on data cut down on mistakes.

- Efficiency: Work done by robots saves time and cash.

- Transparency: AI setups can show clear logs and reasons.

- Customisation: Plans are made to fit a person’s needs.

Challenges and Ethical Considerations

As powerful as Finance and AI can be, challenges remain. One major issue is data bias—if the data fed into the model is flawed, the outcome will be too. Moreover, lack of regulatory clarity around AI models poses risks, especially in highly sensitive sectors like finance.

There’s the fear of job replacement, too. While AI replaces many jobs, it also creates new ones—AI trainers, ethicists, and algorithm auditors will be hot commodities.

FAQs

Q1. What is AI currently being used for in financial markets?

AI is used in jobs like stock tips, scam checks, auto trading, robot help, and smart money plans. It lets firms and money men make good, quick choices.

Q2. Are there real-world applications of AI in investing?

Robo-advisors such as Betterment and Wealthfront utilize AI for portfolio management, and hedge funds utilize AI to provide trading signals and measure risk based on alternative data sources.

Q3. Can AI substitute human financial planners?

AI can help and run many tasks that helpers do, but feelings, trust, and smart calls stay key—so AI helps more than it replaces.

Q4. Can AI be trusted in turbulent markets?

Yes, particularly if it is trained on huge historical data sets. Nevertheless, rare black swan events might still confound AI models, so hybrid human-AI models are best.

Q5. How does AI improve wealth management?

AI speeds up money help by giving very tuned advice, good money shifts, and smart views that change plans early.

Q6. Can AI-based strategies be accessed by retail investors?

Yes, absolutely. Robo-advisors and fintech mobile applications provide AI-based portfolios to individual investors at a lower cost than traditional advisors.

Q7. What are the risks posed by AI in finance?

Big worries are data privacy, unfair code, clear choice in models, and too much use of machines with no human help.

Q8. Can AI anticipate market crashes?

AI can discover patterns that could signal risk, but anticipating sudden crashes with exactness remains a notch away from its reach, though it’s advancing quickly.

Q9. How is AI regulated in finance?

Regulations are continuously changing, but most financial institutions now require algorithm auditing, AI decision-making explainability, and ethical usage of consumer information.

Q10. How do I read more about Finance and AI?

You can take senior-level fintech courses that cover AI and finance—like this MSc. in Fintech program by Imarticus Learning that constructs next-gen fintech leaders.

Key Takeaways

- Finance and AI are radically redefining the way investments are made.

- AI-based investing introduces precision, velocity, and emotional objectivity.

- Leading financial technology trends enable wider adoption of AI in wealth management.

- Automated investment plans offer scalable solutions for every type of investor.

- The future of wealth management will be hyper-personalised and technology-driven.

- Ethical principles and regulatory infrastructures will guide ethical use of AI.

Conclusion

The money world is changing, and AI is key to this change. From very custom plans to smart guessing that beats people, Money and AI are making a path for a bright, quick, and open money future. If you put money in, manage wealth, or love fintech, taking up AI is a must now.

If you want to join this cool future, think about being part of Imarticus Learning’s MSc in Fintech. It will let you build a job where money, tech, and new ideas meet.