Breaking into the finance industry isn’t just about completing a course. The real challenge? Cracking that investment banking interview.

If you’ve recently completed a structured programme—like the Certified Investment Banking Operations Program (CIBOP) by Imarticus Learning—you’re already ahead of the curve. But training is only half the game. The rest depends on how you present your skills, handle high-pressure questions, and align your story with the investment bank’s needs.

This guide walks you through a practical, realistic approach to help you land a banking job after training, using structured preparation, updated stats, and recruiter-backed insights.

Why Are Investment Banking Interviews So Competitive?

Let’s start with a reality check. According to eFinancialCareers, investment banks like Goldman Sachs receive over 300 applications for a single analyst role. That’s a selection rate of 0.3%.

Even for mid-tier banks, competition is stiff, with most entry-level roles drawing over 70 applicants. Combine that with the rise of AI-driven screenings like HireVue, and it’s clear—training alone isn’t enough anymore.

So, what makes you stand out?

Your ability to turn that training into relevant, business-ready outcomes is the differentiator.

Top 10 Investment Banking Interview Questions You Need to Know | Key Questions & Tips!

Turn Training Into an Interview Edge

Programs like Imarticus Learning’s CIBOP aren’t just about technical skills. They’re designed to prepare you specifically for investment banking job preparation.

Key benefits that you can translate into your interview narrative:

- Real-world simulations of trade settlements and risk management

- Mock interviews with industry mentors from global banks

- Access to a network of 1,000+ hiring partners and alumni currently working in investment banking

If you can clearly express the ROI of your training/programs in interviews, you’re no longer “just another applicant”—you’re a “ready-to-deploy asset”.

What Interviewers Are Actually Looking For

Banks have razor-sharp criteria. It’s just not enough to know the answers—you need to show them you understand the “why” behind each answer.

Here’s what they evaluate:

- Structured thinking under pressure

- Communication clarity – no jargon, only impact

- Commercial awareness – how you think like a banker, not a student

- Technical fluency – from accounting to risk to deal execution

- Behavioural maturity – teamwork, accountability, ethics

The 90-Second Pitch That Hooks Interviewers

This is where most candidates fumble. A strong opening answer sets the tone for the entire interview.

Use the S-F-F-F formula:

- Start with what drew you to finance your personal story or personal reason

- Frame how your training backed that interest

- Focus on 2–3 relevant skills or projects

- Finish with how you’re aligned with this role

Example:

“During the CIBOP program, I worked on a live simulation where I processed and reconciled a multi-currency trade. It helped me understand the risk controls behind post-trade operations. This experience, paired with my accounting fundamentals, makes me confident I can hit the ground running in a settlement operations analyst role.”

Table: Common Investment Banking Interview Questions & What They Reveal

| Interview Question | What It Tests | How to Prepare |

| Walk me through a DCF | Valuation understanding | Learn drivers & assumptions |

| 3 financial statements | Integration skills | Map out a ₹100 depreciation |

| Pitch a stock | Market analysis | Follow latest quarterly calls |

| What happens post-trade? | Ops and risk logic | Know clearing, matching, fails |

| Biggest mistake you made? | Accountability | Use STAR method with real impact |

5 Advanced Investment Banking Interview Tips

- Rehearse under time pressure

Answer technical questions in under 90 seconds—banks want concise, not academic. - Watch yourself on video

Use platforms like HireVue to practice. Watch for filler words, body language, and structure. - Build a market POV

Know the latest RBI policies, G-sec yields, or a recent M&A deal involving the bank. Mentioning this creates peer-level rapport. - Use numbers in behavioural answers

Instead of “I helped streamline a report,” say “I reduced error rates by 30% through a VBA-based tracker during training.” - Always ask a forward-looking question

Interview ending? Ask: “How is the bank evolving post-settlement compliance with CSDR norms?”

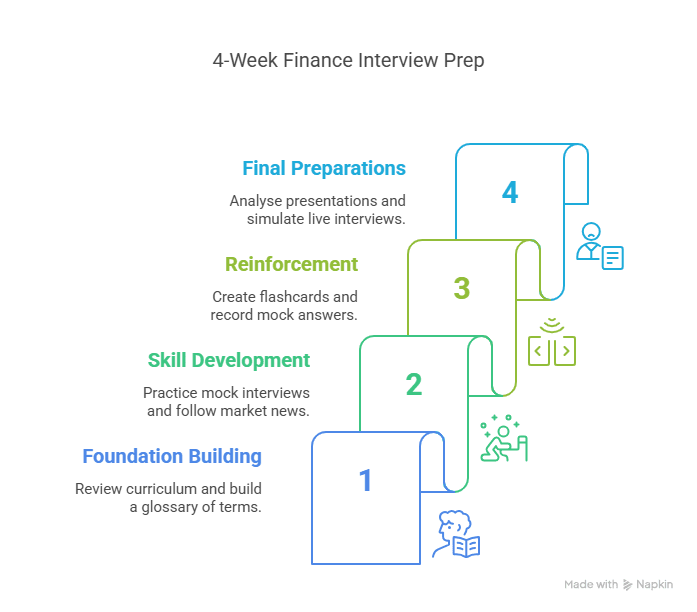

A 4-Week Plan for Finance Job Interview Preparation

Week 1:

- Review your training curriculum

- Build a glossary of 50 must-know terms

- Read 2 deal case studies

Week 2:

- Start daily 30-min mock interviews (technical + behavioural)

- Follow FT Markets and Bloomberg daily

Week 3:

- Create flashcards for ratios, models, and accounting concepts

- Record 5 mock HireVue answers

Week 4:

- Analyse 3 bank investor presentations

- Practise 1 live interview simulation with a friend or mentor

New Data Insight: Training + Targeted Prep = Real Placements

According to Imarticus Learning, 85% of students from the CIBOP programme secure job placements, many landing roles at firms like Morgan Stanley, State Street, and Societe Generale.

They don’t just teach you how the trade life cycle works—they simulate it. They don’t give you mock questions—they run actual mock interviews with banking veterans.

In short, it’s not just “education”—it’s industry alignment.

Optimised Featured Snippet: Top 5 Ways to Crack Investment Banking Interviews

- Structure every answer using STAR/CARL frameworks

- Master 10+ technicals like DCF, EBITDA, LBO, accretion-dilution

- Practise on HireVue or Zoom for video clarity and timing

- Follow up with thoughtful emails within 12 hours

- Use your training case studies to answer “real-world impact” questions

FAQs – Everything You Were Afraid to Ask

1. How long should I talk for the “Tell me about yourself” question?

Keep it between 75–90 seconds. It’s not your autobiography—it’s your value pitch.

2. What’s the best way to prepare for technical interviews?

Solve 2–3 modelling problems daily, use mock interviews, and explain concepts out loud to test clarity.

3. Should I mention the CIBOP programme during interviews?

Yes, but not just the name—mention what you did, not just what you learnt.

4. How can I demonstrate commercial awareness?

Mention a current economic trend (like RBI repo rate hikes) and its impact on investment decisions.

5. Is CFA Level 1 necessary for IB roles?

It’s a bonus—not a necessity. If you’ve done a specialised IB training, that often weighs more.

7. Can I switch to the front office after doing ops training?

Yes, many do. Just make sure you nail this role first and keep networking internally.

8. How important are certifications in the hiring decision?

They help you get shortlisted. But interviews are about communication, fit, and clarity.

9. Should I memorise answers or improvise?

Have a structure, not a script. Robots get rejected; thoughtful, structured speakers get offers.

10. How long before I hear back after an interview?

Anywhere between 2–10 days. But always send a thank-you email within 12 hours.

Conclusion: Your Offer Letter Isn’t Luck—It’s Strategy

You’ve done the hard part—trained for the job. Now, apply a layer of targeted investment banking interview tips to that foundation and you’ve got a real shot.

Key Takeaways

- Training helps you qualify, preparation helps you convert.

- Structure wins: STAR, CARL, and pitch formulas matter.

- You’re not just answering questions—you’re positioning value.

What’s Next?

Explore the full details of Imarticus Learning’s Certified Investment Banking Operations Program—designed to take you from classroom to trading floor with a placement-first mindset.

You’ve got the knowledge. Now, go get the offer.