Walk through Bandra Kurla Complex on a weekday morning, and you will feel the pace before you even see an office lobby. Phones ring, cabs stop and go, people in formal wear speak in short, sharp sentences about numbers that most people only read in headlines. This is the daily rhythm of investment banking in Mumbai. It runs on urgency, precision, and timing.

I often compare this field to air traffic control. Many planes move at once. Each carries value. Each needs the right path and timing. One wrong signal can cause delays or risk. Investment bankers guide money instead of aircraft. They decide how companies raise funds, merge, or sell parts of their business. In a city like Mumbai, where capital markets, regulators, and corporate headquarters sit close together, these decisions move fast and carry weight.

Why does an Investment Banking Course in Mumbai matter so much here? Because the financial system of India pulses through this city. Major banks, global funds, domestic conglomerates, and market exchanges operate within a few kilometres of each other. That physical closeness creates faster meetings, quicker negotiations, and stronger networks. It shapes how investment banking in Mumbai functions day to day.

If you are reading this, you are likely curious about whether this career fits you.

Do you enjoy solving puzzles with numbers?

Can you focus for long stretches?

Are you comfortable asking questions when something does not add up?

These small traits often matter more than any single degree. An investment banking course in Mumbai rewards people who combine technical skill with clear thinking under pressure.

This blog breaks down how the ecosystem works, where jobs exist, which firms operate here, how salaries differ, and how training can prepare you. The goal is simple. By the end, you should be able to picture what a real day in an investment banking career in Mumbai looks like and decide how you want to step into that world.

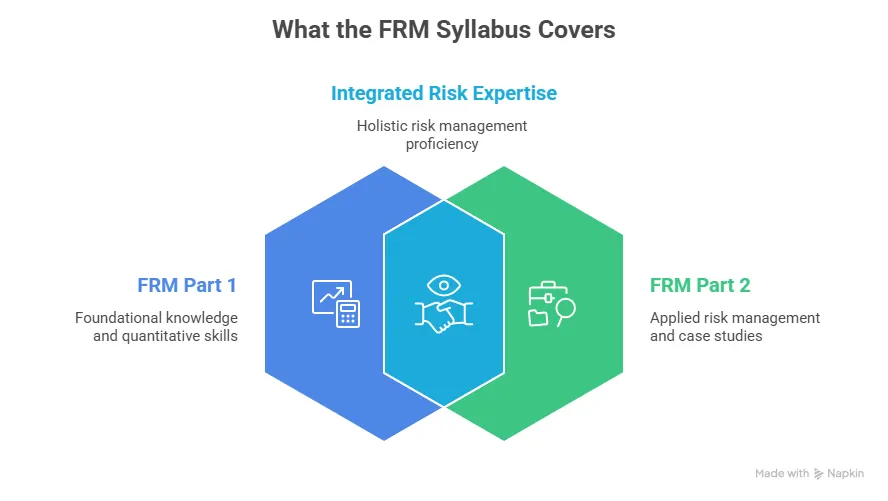

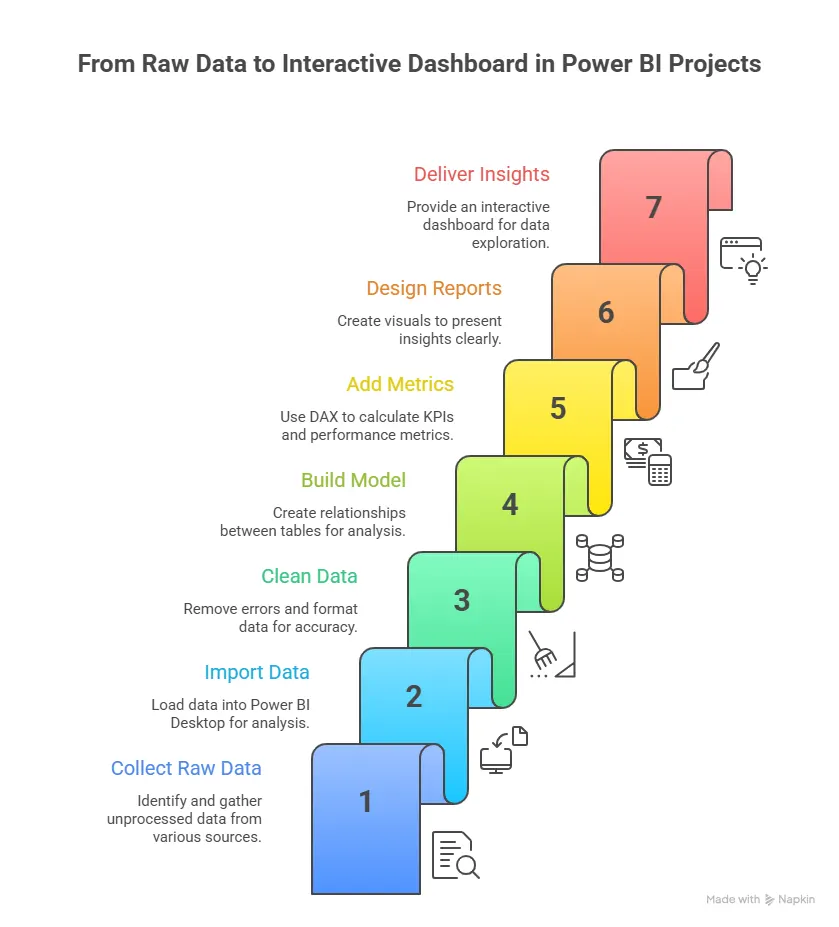

How Courses Prepare You for Investment Banking in Mumbai

Before stepping into real deal rooms, most people first try to understand what is investment banking in a practical sense. Not just theory from textbooks, but how valuation, fundraising, and mergers work in real situations. That is where ’investment banking courses in Mumbai’ come in. These programs sit right between college learning and actual investment banking in Mumbai job roles.

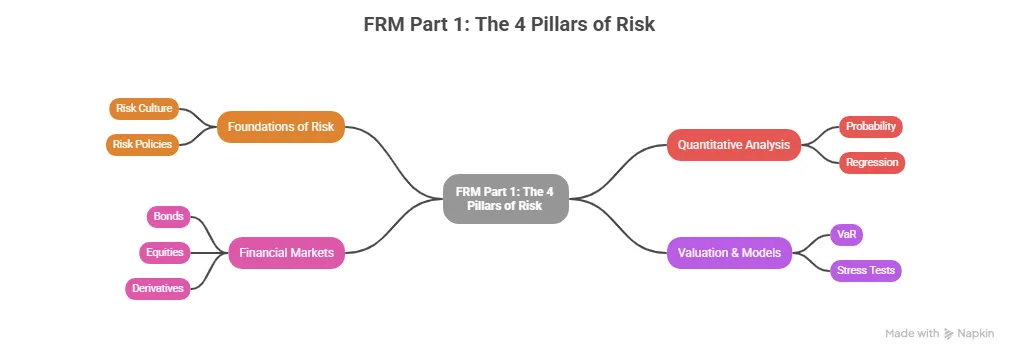

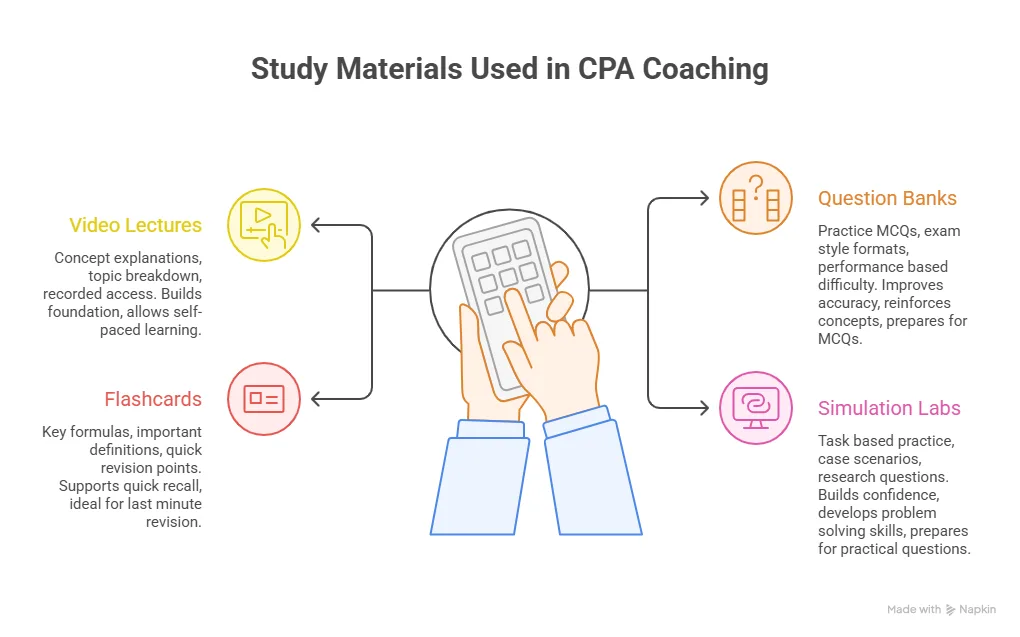

What These Courses Usually Teach

Good programs focus on applied skills, not just definitions.

- Financial statement analysis

- Company valuation using real data

- Excel and financial modelling

- Pitch book creation

- Basics of mergers and acquisitions

- IPO process understanding

These topics connect directly to daily tasks inside investment banking firms in Mumbai.

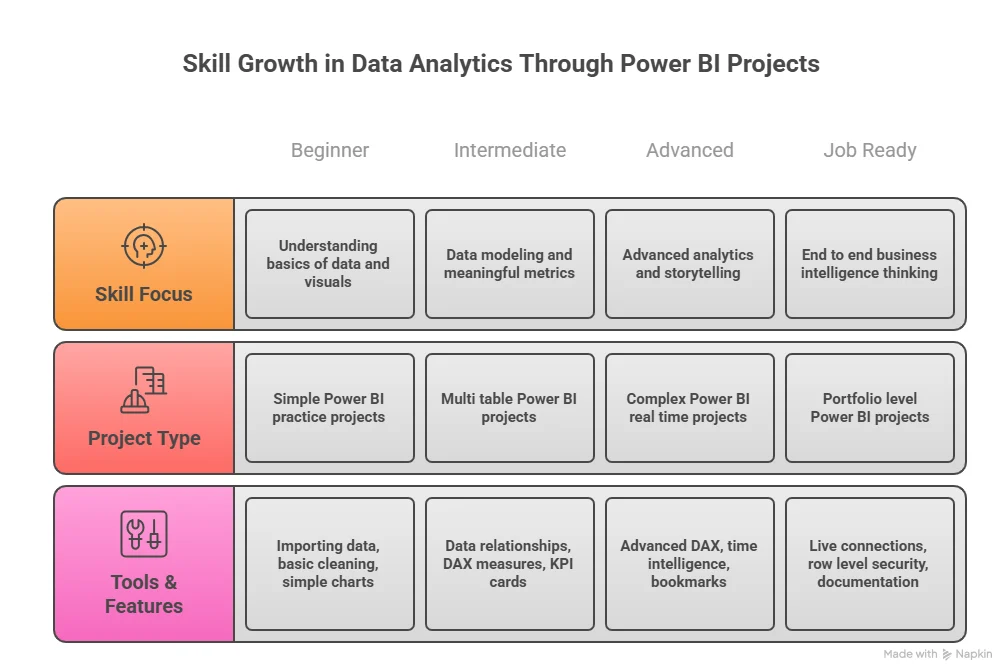

Types of Investment Banking Courses in Mumbai

Different learners need different formats. Some want fast skill-building. Others want deeper programs with placements.

| Course Format | Duration | Ideal For |

| Short-term certification | 3 to 6 months | Students building core skills |

| Industry diploma | 6 to 12 months | Career switchers |

| Internship-linked program | Varies | Learners wanting work exposure |

Many students compare the investment banking courses in Mumbai fees before enrolling. Fees differ based on faculty experience, software access, and placement support.

Before exploring careers and firms, it helps to clearly understand what investment banking actually involves on a day-to-day basis. A simple breakdown of what these professionals do, how their responsibilities differ by level, and how their work impacts businesses can make the world of investment banking in Mumbai much easier to grasp.

Why the City Drives Finance Careers in Investment Banking

Money flows where business grows. Mumbai hosts banks, funds, and global firms. According to Statista, India saw strong growth in equity fundraising in recent years. Many of those deals passed through desks here. That keeps investment banking in Mumbai strong.

Here is what makes the city special for finance work. Before this list, let me explain why location matters. When firms sit close, decisions move faster. Meetings happen face-to-face. That builds trust.

- Bandra Kurla Complex houses global banks

- Fort area hosts legacy financial offices

- Lower Parel has many advisory firms

- Navi Mumbai is growing for back-office roles

This mix supports front-end and investment banking operations jobs in Mumbai.

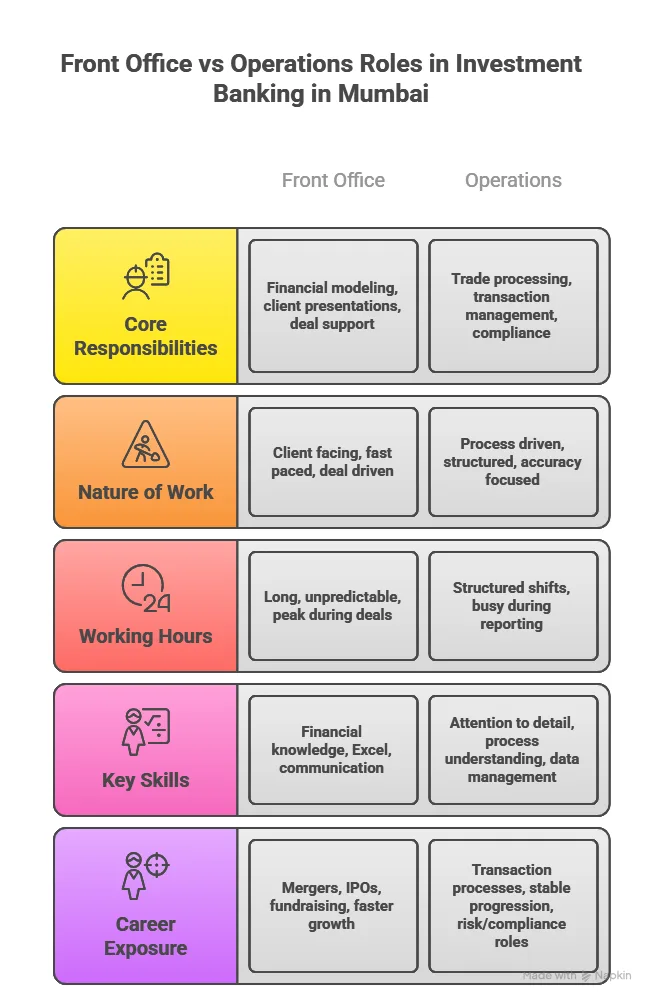

Types of Work I See Daily

Not all bankers do the same job. Some raise money. Some value firms. Some manage deals after signing. Let me break this down in a simple table so it is easy to see.

| Role | What I Actually Do | Where It Fits |

| Analyst | Build financial models | Deal support |

| Associate | Check numbers and pitch | Client work |

| Vice President | Lead discussions | Execution |

| Operations | Process trades and data | Backend support |

Many fresh graduates look for investment banking jobs in Mumbai for freshers in analyst roles. These roles teach valuation and deal flow.

Big Firms and Boutique Firms

I often get asked about the difference between large firms and smaller advisory houses. Both operate within investment banking in Mumbai. Large firms handle billion-dollar deals. Boutique firms focus on niche sectors. Both hire talent. Below is a quick overview to make this clear.

- Global investment banks in Mumbai handle cross-border deals

- Indian investment banking firms in Mumbai focus on domestic growth

- Boutique investment banks in Mumbai work in sectors like healthcare or tech

- Many investment banking companies in Mumbai offer advisory plus capital raising

These trends keep investment banking in Mumbai in demand.

Did You Know?

India recorded strong IPO activity in recent years, as reported by EY Global IPO Trends. Mumbai handles a large share of these listings. Deal teams here often work with overseas investors

Career Outcomes with Investment Banking in Mumbai

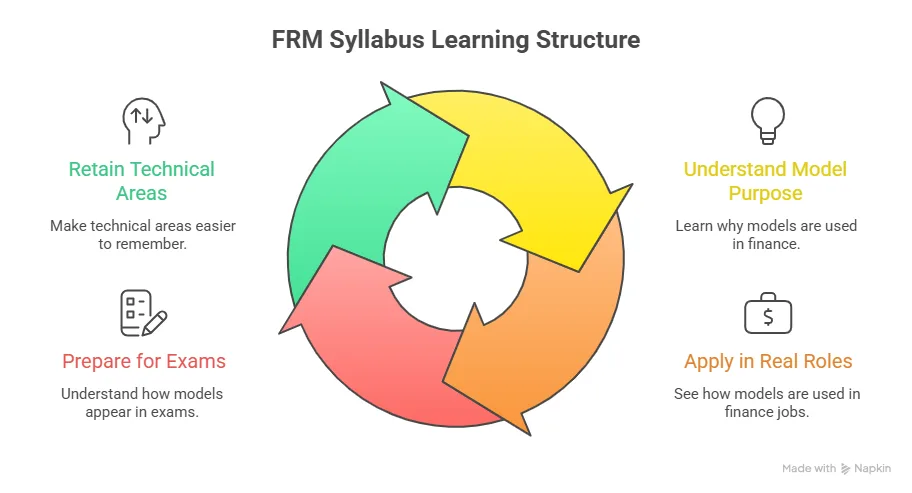

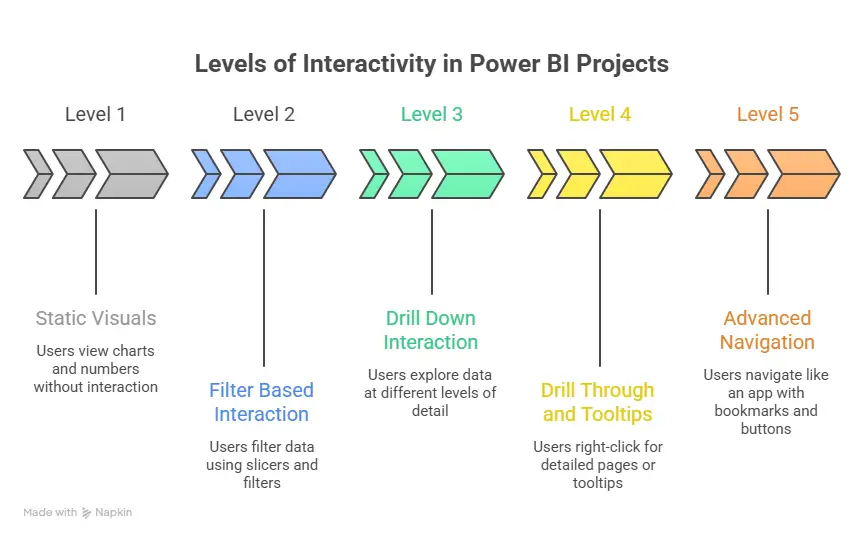

Training fills the gap between academic theory and the expectations of investment banking companies in Mumbai. Think of learning to swim on land versus in water. Real practice makes the difference.

- Practice building models under time limits

- Learn to explain numbers clearly

- Understand deal documents used in live projects

- Prepare for technical interview rounds

These skills in investment banking matter when applying for investment banking analyst jobs in Mumbai or even investment banking jobs in Mumbai for freshers.

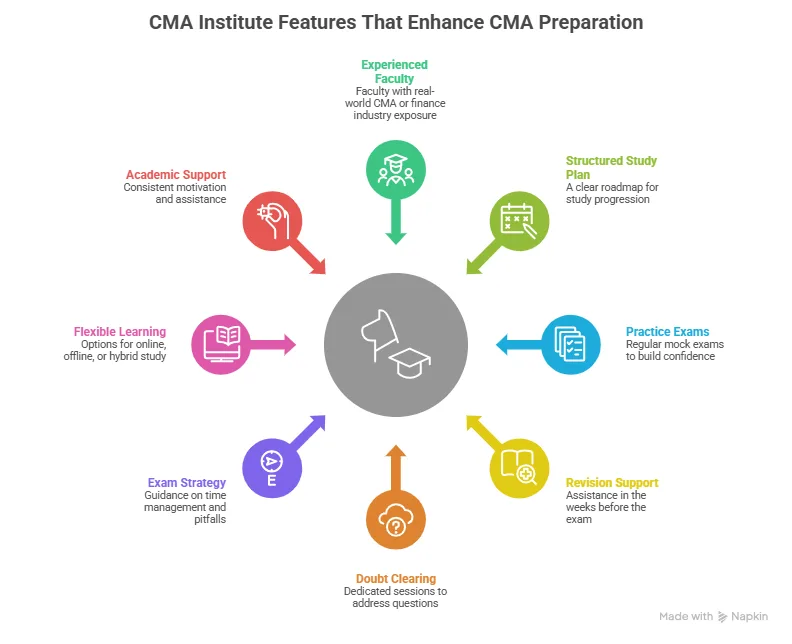

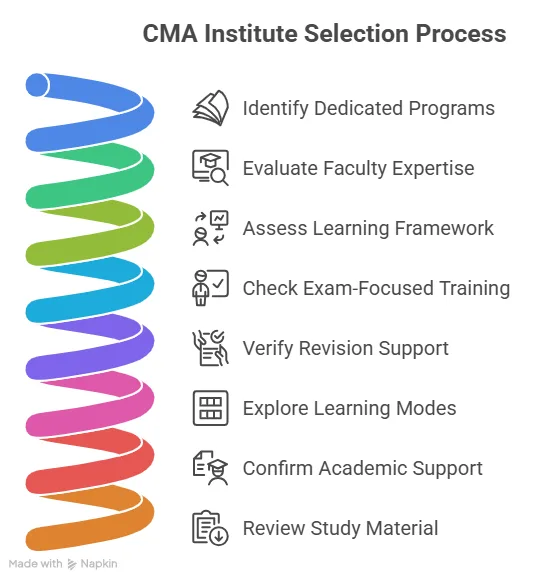

Choosing the Right Investment Banking Institute in Mumbai

Not all programs are equal. Some focus heavily on theory. Others prepare you for real hiring rounds. Here is what many learners look for when selecting an investment banking institute in Mumbai.

- Curriculum aligned with industry tasks

- Trainers with deal experience

- Live projects or case studies

- Placement assistance or internship pathways

Programs from training providers such as Imarticus Learning are often explored by students who want structured preparation aligned with hiring needs in investment banking in Mumbai.

Also Read: Investment Banking vs. Commercial Banking: Know the Difference

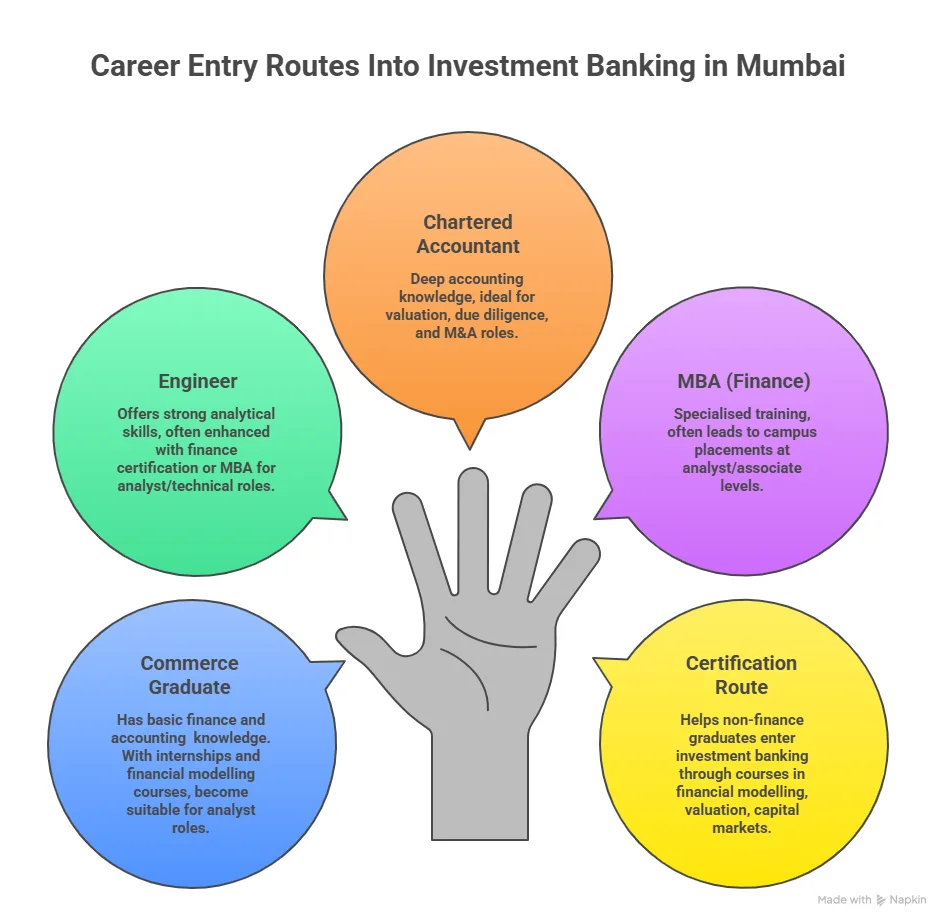

Career Entry Points for Investment Banking in Mumbai

I see multiple paths into this field. There is no single gate. Think of entering a cricket team. Some players join via school. Some through clubs. Some through performance in local matches.

- Campus placements from finance colleges

- Internships at investment banking firms in Mumbai

- Referrals from networking events

- Lateral moves from consulting or audit

Many freshers also explore investment banking courses in Mumbai to gain technical skills before interviews.

Daily Skills That Matter

Technical knowledge is important. So is behaviour.

- Excel and financial modelling

- Clear communication

- Ability to work long hours

- Attention to detail

These skills apply across investment banking jobs in Mumbai.

Also Read: Investment Banking Pay Compared to Other Finance Career Options

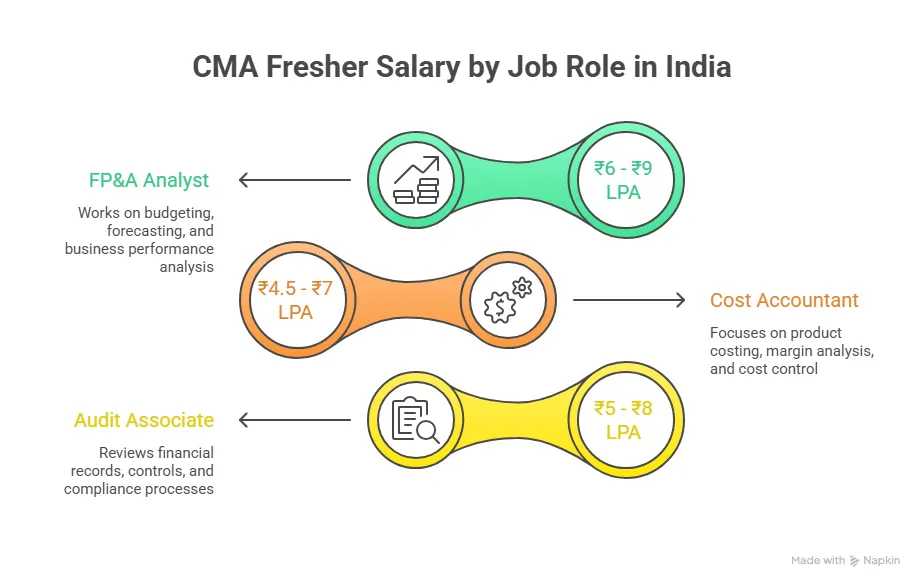

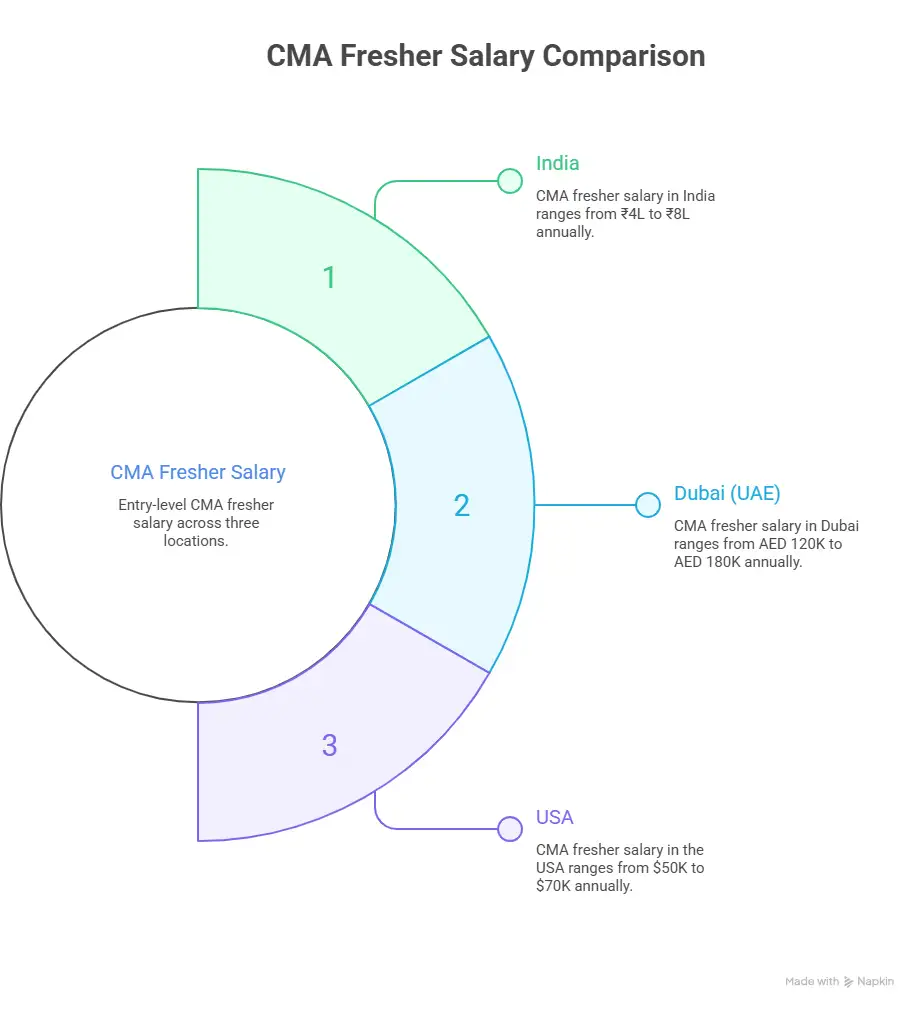

Salary Layers Across Roles

Compensation varies by function and firm type. Public sources like AmbitionBox and Glassdoor show wide salary bands for investment banking salary in Mumbai. Here is a simplified structure.

| Role | Typical Salary Range | Notes |

| Analyst | ₹9.5 – 24 LPA | Entry level, varies by firm; bonuses often push total higher |

| Associate | ₹14.8 – 45 LPA | Mid-level deal support and client tasks |

| Vice President | ₹40 – 70 LPA+ | Leadership and execution responsibilities |

| Director / Executive Director | ₹60 LPA – 1 Cr per annum | Senior deal leadership, client origination |

| Managing Director | ₹1Cr – 2Cr Per Annum | Top-tier role with high bonuses |

Pay at top investment banking companies in Mumbai often includes performance bonuses tied to closed transactions.

Where Most Hiring Happens

Front office roles get the spotlight. Support teams keep deals running.

- Advisory teams in large investment banks in Mumbai

- Sector-focused desks in boutique investment banking firms in Mumbai

- Risk management and compliance teams

- Data and reporting units handling investment banking operations jobs in Mumbai

Operations hiring has grown as regulation increases. Many such roles are based in central business districts and Navi Mumbai.

Top Firms People Track

Students often ask me about brand names. Reputation helps with learning exposure. Below is a general structure people follow when exploring the top 10 investment banks in Mumbai or the top investment banking firms in Mumbai.

| Category | Type of Work | Hiring Focus |

| Global Banks | Mergers and IPOs | Analysts and Associates |

| Indian Full Service Firms | Mid-market deals | Analysts and Sector Specialists |

| Boutique Advisory Firms | Niche sectors | Lean teams with high exposure |

Many job seekers search for a list of investment banks in Mumbai to understand this landscape. Others look for a list of boutique investment banks in Mumbai to find smaller deal teams with faster learning.

Breaking into investment banking takes more than just an interest in finance. Recruiters look for a mix of technical skills. For those aiming to start a career in investment banking in Mumbai, seeing how preparation, internships, and the right training come together often provides the clarity and motivation needed to take the next step.

How Boutique Firms Shape Careers in Investment Banking in Mumbai

Smaller teams give early responsibility. I have seen analysts speak to clients within a year. That is common inside investment banking boutique firms in Mumbai. Think of a small startup kitchen. Fewer staff means everyone cooks and serves. Learning speeds up. These firms often appear in a list of investment banking firms in Mumbai under advisory or corporate finance categories.

Roles That Freshers Target

Graduates often focus on analyst tracks. Many search for investment banking analyst jobs in Mumbai right after college.

- Financial modelling support

- Research on industries

- Preparing pitch books

- Supporting due diligence

These roles fall under investment banking jobs in Mumbai for freshers and form the base of most careers.

How Hiring Managers Screen Candidates

Screening goes beyond marks. Skills get tested live.

- Excel modelling tests

- Financial Accounting basics

- Case studies on mergers

- Market awareness

Candidates from strong investment banking training in Mumbai programs often perform better because they practice these formats.

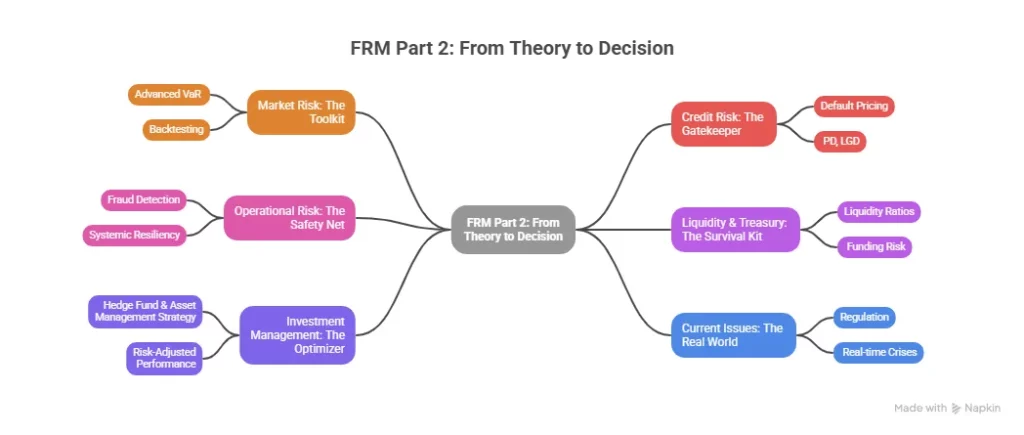

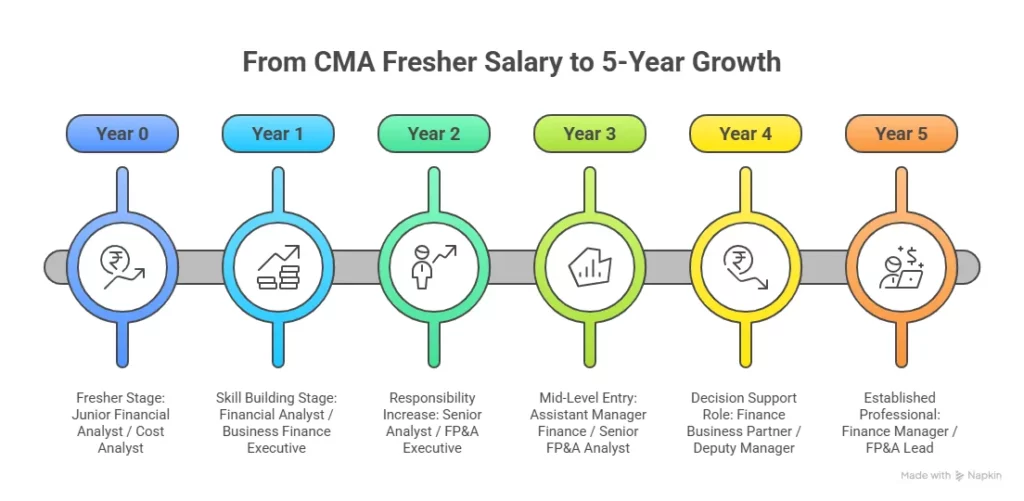

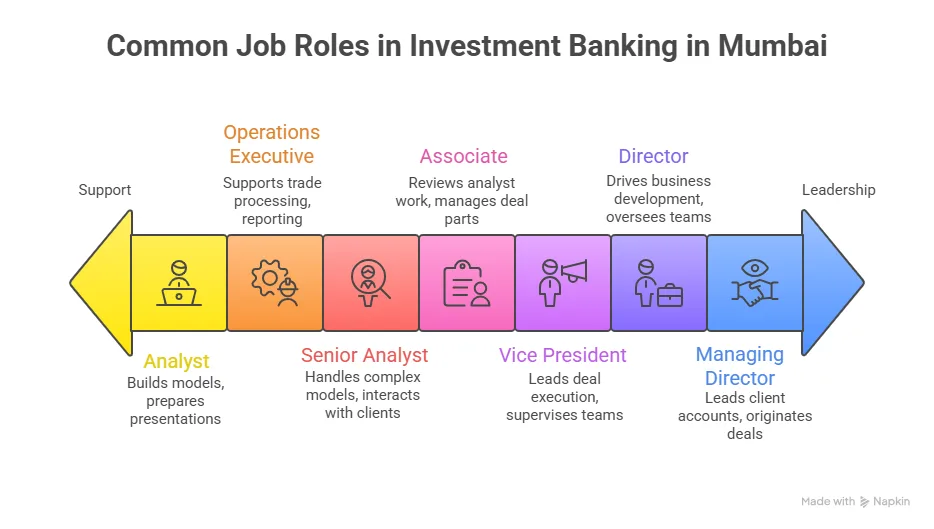

Growth Path Over Time

Careers grow in stages. Skills deepen. Responsibility rises. The scope of investment banking over time can look like:

- Analyst learns tools

- Associate manages tasks

- Vice President leads execution

- Director wins mandates

This ladder exists across investment banking companies in Mumbai, from global firms to boutique investment banks in Mumbai.

Also Read: The Impact of AI on Investment Strategies: A New Era in Finance

Course in Investment Banking in Mumbai That Students Consider

Different formats suit different learners. Some prefer classroom study. Others choose online practice.

| Course Type | Duration | Best For |

| Short-term certification | 3 to 6 months | Skill building |

| Diploma programs | 6 to 12 months | Career switchers |

| Internship-linked training | Varies | Practical exposure |

Students often compare investment banking courses in Mumbai in terms of fees before enrolling. Investment banking course fees vary based on faculty, tools, and placement support.

How Courses Help With Jobs

Recruiters test applied knowledge. Training helps candidates answer practical questions during investment banking jobs in Mumbai interviews.

- Build models quickly

- Explain valuation logic clearly

- Understand deal documents

- Speak confidently in interviews

These skills improve chances for investment banking analyst jobs in Mumbai.

What Good Training Covers

Skills decide who gets hired. Degrees alone do not close offers. That is why many students explore investment banking courses in Mumbai before interviews.

I explain training using a sports example. Raw talent helps. Coaching builds match fitness. Structured learning improves speed and accuracy for investment banking roles.

Financial statement analysis

- Valuation methods

- Excel and modelling

- Pitch book preparation

- Mergers and acquisitions basics

These topics appear in most investment banking training in Mumbai programs that focus on job readiness.

Balancing Cost and Return

Education is an investment. Returns depend on effort and market timing. Many candidates review the best investment banking courses in Mumbai alongside placement records. Programs with internship pathways often lead to interviews at investment banking firms in Mumbai.

| Course / Provider | Duration | Investment Banking Courses Fees (₹) | Placement Support |

| Certified Investment Banking Operations Professional (Imarticus Learning) | 3-6 months | ₹1,50,000 – ₹2,00,000 | Yes (7 interviews guaranteed) |

| General Investment Banking Course (multiple Mumbai providers) | ~3-6 months | ₹1,50,000 – ₹2,00,000 | Varies by provider |

| Short Certification / Online Specialised Courses | ~70-120 hours | ₹75,000 – ₹1,00,000 | Varies (may not include placement support) |

| Broad Investment Banking Diploma or Advanced Programs | 6-12 months | ₹2,00,000+ | Often includes project work/career support |

Certifications vs Degrees

Professional courses focus on tools. Degrees provide a broader theory. Both help.

- Finance degrees build fundamentals

- Certifications sharpen modelling

- Internships give you deal exposure

This mix prepares candidates for investment banking jobs in Mumbai for freshers.

Interview preparation plays a big role in breaking into investment banking in Mumbai. Getting familiar with the kinds of questions recruiters ask can make interviews feel more structured and less overwhelming, particularly for freshers aiming for analyst roles or students transitioning through investment banking courses in Mumbai.

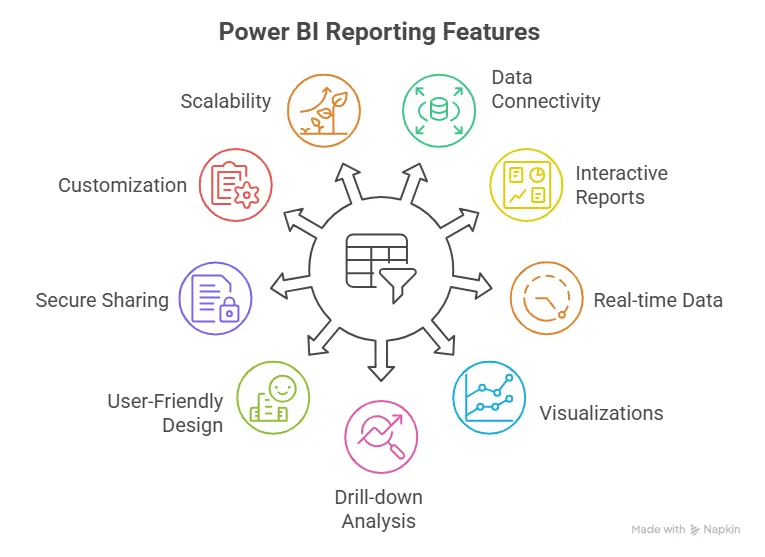

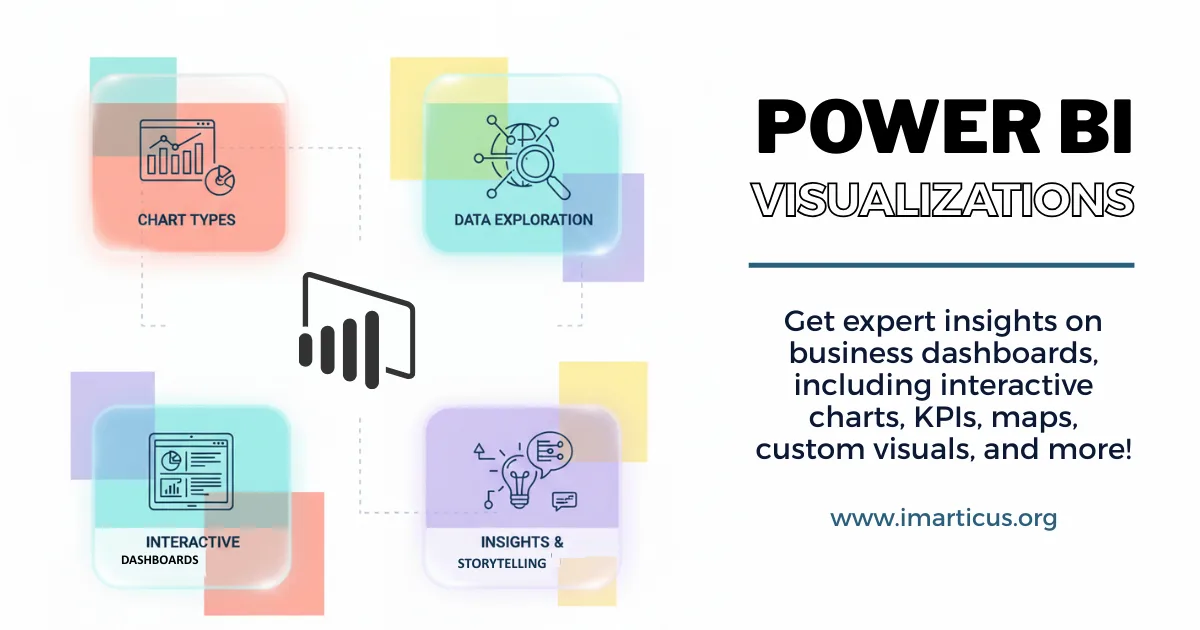

Why Choose Imarticus Learning for Investment Banking Preparation

When you think about preparing for investment banking in Mumbai, choosing the right learning partner matters. Programs that are tightly aligned with industry expectations and real job requirements make a noticeable difference. The Investment Banking Program in Mumbai from Imarticus Learning has been built to go beyond textbooks and help learners move confidently toward roles in global finance environments.

- Industry Aligned Curriculum covering investment banking operations, capital markets, deal workflows and compliance to build strength around real-world tasks.

- Flexible Learning Options with both classroom (weekdays and weekends) and live online delivery to fit different schedules.

- Job Assurance Support that includes a minimum number of guaranteed interview opportunities with hiring partners to help you step into roles at top firms.

- Practical Training Approach with case studies, simulation exercises, and project-based learning that mirror scenarios encountered inside investment banking firms in Mumbai.

- Placement Assistance, including soft skills sessions, resume development, and interview coaching, to increase your chances when applying for investment banking jobs in Mumbai.

- Certification that is recognised in the industry and complements globally recognised credentials, helping position you well for roles in investment banks or financial services firms.

Each of these elements adds value beyond basic theory. They focus on preparing you for what recruiters actually look for in investment banking roles in Mumbai and related positions across banking operations, middle office functions, and client servicing roles.

FAQs On Investment Banking in Mumbai

People curious about investment banking in Mumbai often have practical doubts before they decide to step into this career. So, let’s look at some frequently asked questions around salaries, entry routes, courses, stress levels, and long-term growth, especially for students and freshers trying to understand how this fast-paced industry actually works in Mumbai.

How much do investment bankers earn in Mumbai?

Pay varies by role and firm size within investment banking in Mumbai. Entry analysts earn a base salary plus bonus. Mid-level associates earn more with performance-linked incentives. Senior bankers earn large bonuses when deals close. Public platforms like Glassdoor and AmbitionBox show wide ranges because global banks, Indian firms, and boutique advisors all pay differently in investment banking careers in Mumbai.

Which college is best for investment banking in Mumbai?

Several colleges feed talent into investment banking through finance-focused programs. Strong commerce and finance institutes in Mumbai give students internship access and alumni networks. Many students also add industry certifications from training providers such as Imarticus Learning to strengthen job readiness for investment banking roles in Mumbai.

Which is better, CA or an investment banker?

CA and investment banking lead to different career tracks. CA focuses on accounting, auditing, and taxation. Investment banking focuses on deals, valuation, and capital raising. Some professionals combine both paths. A CA background can help in financial analysis roles within investment banking in Mumbai, while others enter directly through finance degrees and modelling skills.

How do I get into investment banking in Mumbai?

Entry into investment banking usually starts with finance education, internships, and technical skills. Candidates build strong Excel and valuation knowledge. Many complete internships at advisory firms or pursue job-focused certifications. Networking and referrals also help candidates access interviews for investment banking careers in Mumbai.

What are the top 3 investment banking courses in Mumbai that can help you get a placement?

Several programs prepare candidates for investment banking in Mumbai placements by focusing on modelling and deal skills. Courses that include live projects, internships, and placement assistance tend to help more. Some learners consider programs from Imarticus Learning, along with other established finance academies offering investment banking courses in Mumbai with career support.

How do I get into investment banking as a fresher?

Freshers enter investment banking in Mumbai by applying for analyst roles, internships, and trainee positions. Strong accounting basics, Excel modelling, and communication skills improve chances. Many freshers also complete investment banking courses in Mumbai to prepare for interviews and technical tests.

How do I get into investment banking in Mumbai from high school?

Students interested in investment banking courses in Mumbai can begin by choosing commerce or math streams, building strong analytical skills, and staying updated with business news. Later, they can pursue finance degrees and job-focused certifications. Early preparation helps when applying for internships related to investment banking courses in Mumbai.

Is investment banking a stressful job?

Work in investment banking in Mumbai can involve long hours and tight deadlines, especially during live deals. Teams manage multiple tasks at once, and client expectations stay high. Good time management and teamwork help professionals handle pressure in investment banking jobs in Mumbai.

Turn Your Ambition Into a Career in Investment Banking in Mumbai

The world of investment banking in Mumbai moves fast. Deals change. Markets react. Companies grow and merge. Behind all of this are teams who understand numbers, strategy, and timing. That is what makes this field both demanding and rewarding.

Careers here do not follow one fixed path. Some people enter through campus placements. Others come in through internships or lateral shifts. Many strengthen their foundation with structured learning before applying for investment banking jobs in Mumbai. What matters most is practical knowledge. Recruiters look for people who can build models, understand financial statements, and think clearly under pressure.

Mumbai gives access that few cities can match. Global banks, domestic leaders, and boutique advisors all operate here. That creates a wide mix of opportunities across investment banking firms in Mumbai, including front office roles and investment banking operations jobs in Mumbai. The exposure you gain in this city can shape your career for decades.

Preparation makes a visible difference. Candidates who practice valuation, accounting, and Excel in depth tend to perform better in interviews. That is why many aspirants explore focused training options before stepping into the hiring market. Programs offered by Imarticus Learning blend technical learning with interview preparation, which can make your transition into investment banking in Mumbai smoother. You’ll also gain industry-relevant skills and placement guidance while preparing for roles in this field.