Finance careers usually do not begin with certainty. They begin with small, practical decisions. Which course fits my schedule? Which qualification do employers here actually recognise? Which path allows progress without putting life on hold? For many students and early professionals, ACCA in Chennai enters the picture at this exact stage.

Chennai already has the kind of roles ACCA trains people for. Reporting teams, audit support functions, compliance desks, shared service centres. These are not hypothetical opportunities. They exist today, and they rely on structured accounting knowledge rather than speculative skills. That alignment is one of the reasons ACCA feels relevant here.

Many students approach ACCA cautiously. They are not chasing labels. They are trying to avoid dead ends. They want a qualification that keeps options open across roles, industries, and even countries, while still being useful in the Chennai job market. ACCA fits that requirement because it builds skills that are already being used on the ground.

There is also a misconception that ACCA is meant only for people planning to move abroad. In reality, a large number of professionals completing ACCA in Chennai continue working here. They move from entry-level accounting roles into reporting, audit coordination, financial control, and process ownership. The qualification does not replace experience. It strengthens it.

Confusion usually sets in when all of this is presented without structure. Fees are mentioned without context. Institutes are listed without explaining the differences. Colleges advertise integration without clarifying exemptions. Job outcomes are discussed without timelines. Students end up making decisions based on incomplete information. This blog exists to put those pieces together in one place.

→ How does the ACCA course work when pursued from Chennai?

→ How do exams, coaching, colleges, internships, and jobs connect in a realistic sequence?

→ What costs are fixed, what choices are flexible, and where most students misjudge effort?

ACCA is not a shortcut. It is a system. When understood properly, it allows steady progress without forcing extreme trade-offs. The sections ahead explain the system as it functions in Chennai, so that choosing ACCA in Chennai becomes a considered decision rather than a leap based on assumptions.

What Is ACCA and Why It Works Well as a Career Pathway in Chennai

Before getting into colleges, coaching, fees, or jobs, it helps to clearly understand what is ACCA and what it is designed to do. Many decisions around ACCA in Chennai become easier once the structure of the qualification is clear.

ACCA stands for the Association of Chartered Certified Accountants. It is a global professional qualification in accounting, finance, audit, and management. Unlike degree programs that focus on time spent in classrooms, ACCA is built around competency. You progress by demonstrating skill through exams and practical experience, not by completing semesters.

This design is one reason ACCA adapts well to Chennai’s academic and work environment. Students can pursue it alongside college, internships, or full-time roles without stepping away from everything else.

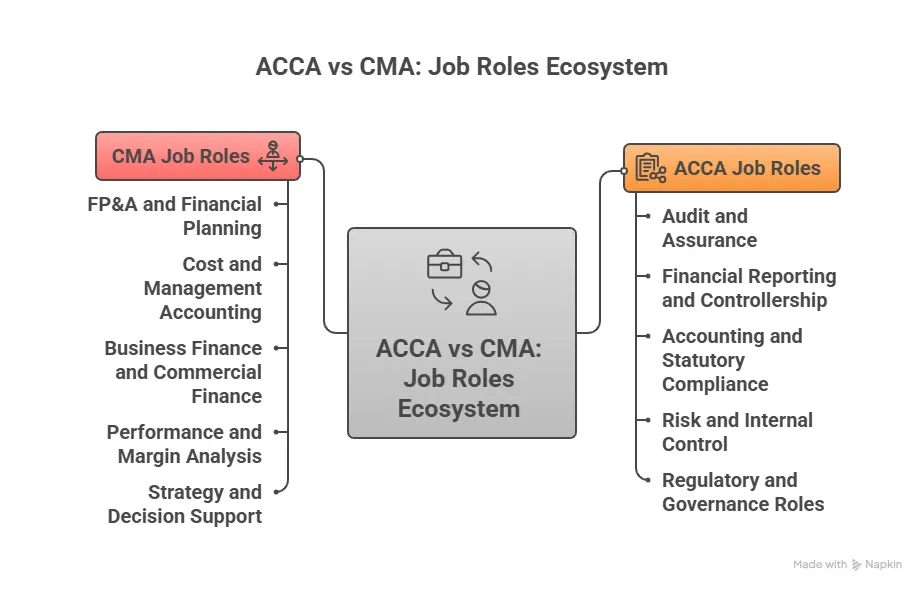

At its core, ACCA prepares professionals for roles that sit at the intersection of numbers, regulation, and decision-making. That includes accounting, financial reporting, audit & taxation, performance analysis, and financial management. These are not niche roles. They are functions that exist in almost every organisation operating in Chennai today.

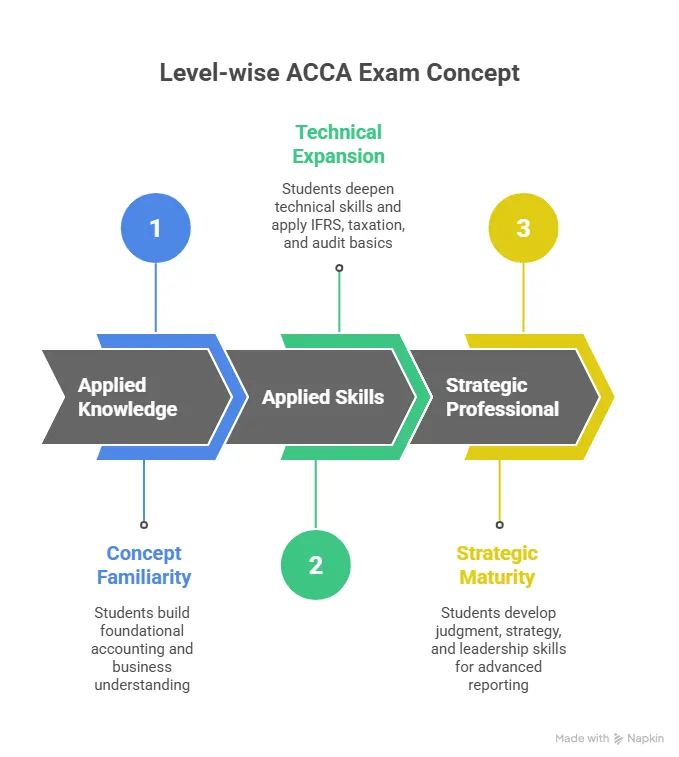

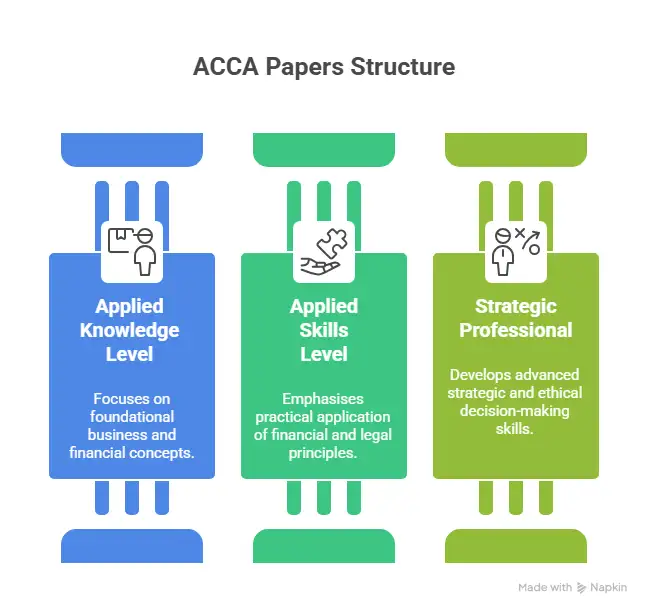

How the ACCA Qualification Is Structured

ACCA consists of 13 papers, grouped into three levels. Each level builds on the previous one, moving from fundamentals to professional judgement.

| Level | Number of Papers | Focus Area |

| Applied Knowledge | 3 | Accounting basics and business understanding |

| Applied Skills | 6 | Financial reporting, audit, tax, performance |

| Strategic Professional | 4 | Leadership, strategy, and advanced application |

This structure explains why ACCA in Chennai attracts both fresh students and working professionals. You are not required to complete everything at once. Exams are attempted paper by paper, allowing steady progress.

What ACCA Trains You to Do in Real Terms

Instead of thinking about ACCA as an exam series, it helps to see it as skill training mapped to real roles.

ACCA trains you to:

- Read and prepare financial statements

- Understand how audits work in practice

- Interpret business performance, not just calculate it

- Apply accounting standards to real scenarios

- Communicate financial insights clearly

These skills align closely with how finance teams function in Chennai, especially in audit support, reporting, compliance, and shared services.

With syllabus updates, exam formats, and practical requirements evolving, understanding how ACCA is structured in 2025 helps students plan their attempts with clarity. This perspective outlines what stays consistent, what has changed, and how those changes affect preparation and progression for students pursuing ACCA today.

Why ACCA Is Different From Traditional Accounting Degrees

Many students already hold or are pursuing degrees, which raises a fair question. Why add ACCA?

The difference lies in application depth. Degrees introduce concepts. ACCA tests how those concepts are applied under professional conditions. Exams are scenario-driven, time-bound, and judgment-focused. This prepares students for work environments where answers are rarely straightforward.

That is why ACCA in Chennai is often pursued alongside BCom programs, after graduation, or after doing CA, especially by those comparing long-term roles and global exposure through a CA vs ACCA lens. The two complement each other rather than overlap fully.

Who ACCA Is Meant For in Chennai

ACCA does not suit only one type of learner. It works best for people who value flexibility and long-term growth.

It suits:

- Students planning BCom with ACCA in Chennai

- Graduates looking to specialise in accounting or finance

- Working professionals seeking global recognition

- Learners aiming for audit, reporting, or finance operations roles

Because the qualification is modular, students can adjust the pace without losing progress. This matters in a city where many learners balance education with work or family responsibilities.

Exam Centres and Administrative Support for ACCA in Chennai

One of the most practical advantages of pursuing ACCA in Chennai is exam accessibility. The city has approved computer-based exam locations, making it easier for students to plan attempts without travel stress.

The presence of an ACCA exam centre in Chennai matters more than it sounds. Exams are held multiple times a year, and students can choose sessions that fit their academic or work schedule. This flexibility supports those balancing internships, college, or entry-level jobs.

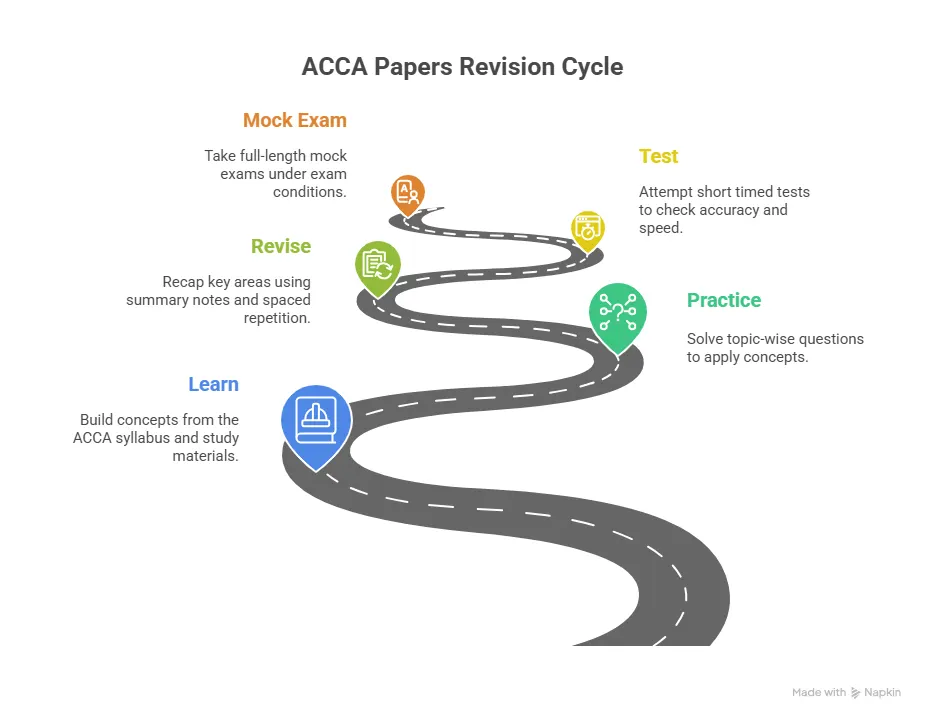

ACCA Books and Study Resources Available in Chennai

Another gap many blogs ignore is access to learning material. Students worry whether they will need to import books or rely entirely on digital content. In reality, ACCA study material and books in Chennai are widely available through authorised publishers, coaching institutes, and local academic stores.

Most ACCA coaching classes in Chennai provide a blended model:

- Printed study texts for core reading

- Digital question banks for practice

- Mock exams aligned with ACCA standards

ACCA-approved publishers such as Kaplan and BPP outline official syllabus coverage on their sites, including updates aligned with each exam session.

For many students, physical books still matter. Highlighting, annotating, and revisiting pages before exams feels more natural than scrolling endlessly on a screen. Chennai’s academic ecosystem supports this preference well.

How Students Commonly Enter the ACCA Pathway in Chennai

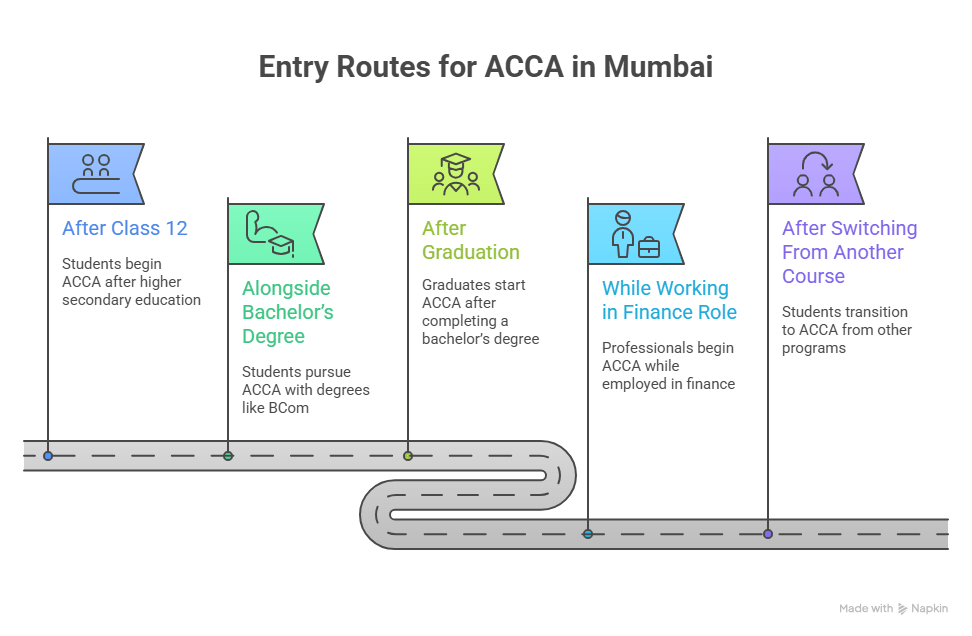

Students usually enter ACCA in Chennai through one of three routes:

- After Class 12

- Alongside BCom

- After graduation or during work

The popularity of BCom with ACCA in Chennai has increased because colleges integrate ACCA papers into the academic timetable. Several BComs with ACCA colleges in Chennai follow this structure, allowing students to graduate with a degree while progressing through ACCA levels.

This integration reduces academic overload and helps students apply theory in a practical context. It feels similar to learning to drive while already commuting daily rather than practising only on empty roads.

For students looking to combine academic grounding with professional progress, the BCom plus ACCA pathway offers a way to align degree studies with global accounting standards. It helps reduce duplication in learning, introduces ACCA concepts early, and allows students to graduate with stronger technical exposure and clearer career direction.

Chennai’s Advantage for Early Career Exposure

One reason ACCA training in Chennai holds value is the availability of entry-level finance roles. Chennai has a high concentration of shared service centres, audit support teams, and compliance units. These roles align closely with ACCA papers in financial reporting, audit, and taxation.

Internships often begin after the Applied Skills level. Many students pursuing an ACCA internship in Chennai find opportunities within mid-sized firms and MNC back offices. While internships are not guaranteed, the local ecosystem increases exposure, strengthening your ACCA skills.

Did You Know?

According to the Hays India Salary Guide, finance and accounting roles continue to see steady hiring in South India, particularly in metro cities with strong service sector presence.

What Fees, Coaching, and Job Outcomes Look Like for ACCA in Chennai

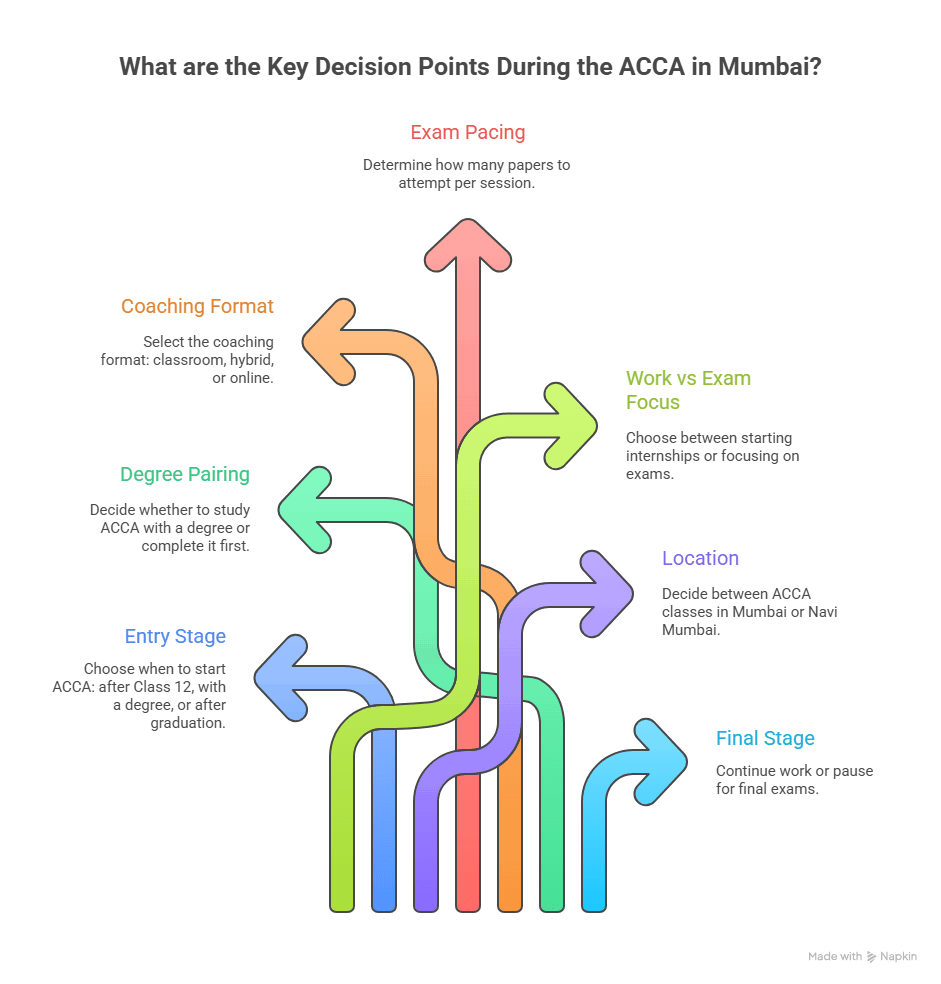

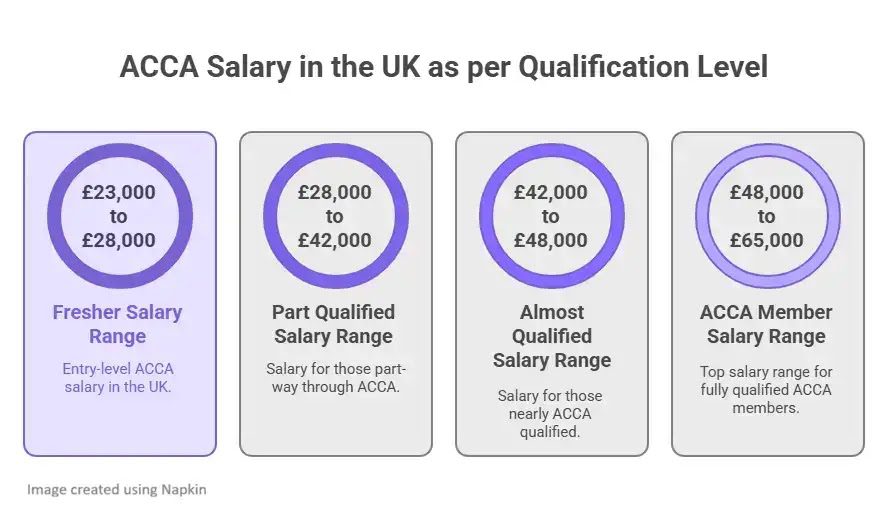

Once ACCA in Chennai moves beyond eligibility and course structure, what starts to matter is how it fits into everyday reality. Fees decide how many papers can be taken at a time. ACCA coaching affects how steady preparation feels week after week. Early job roles influence confidence more than titles do.

This section looks at these parts the way students experience them while studying, not as isolated topics, but as things that shape how manageable the ACCA exam journey feels.

Coaching Formats Available Across Chennai

When discussing ACCA coaching in Chennai, it is important to understand that there is no single format. Different students need different levels of structure.

Common coaching formats include:

- Weekday classroom sessions for college students

- Weekend batches for working professionals

- Hybrid models with recorded and live classes

Most ACCA coaching centres in Chennai now design batches around exam windows rather than fixed academic years. This allows flexibility if a student decides to pace exams more slowly or faster.

The term ACCA academy in Chennai is often used for institutes that provide end-to-end support, including exams, ethics module guidance, and placement assistance. Students should always check whether an institute is an approved learning partner listed by ACCA rather than relying on marketing labels.

Understanding ACCA Course Fees in Chennai in a Practical Way

When students ask about ACCA course fees in Chennai, they often expect one single number. In reality, the cost works more like maintaining a vehicle. There is an upfront purchase, recurring servicing, and optional upgrades depending on how smooth a ride you want.

The total cost of ACCA in Chennai usually includes four layers. Before getting into numbers, it helps to understand what each layer represents and why skipping clarity here often leads to frustration later.

The Four Cost Layers in ACCA

- Registration and subscription paid to ACCA

- Exam fees paid per paper

- Coaching and training costs

- Study material and mock exams

Below is a broad cost range students typically see while pursuing the ACCA course in Chennai.

| Cost Component | Approximate Range | What It Covers |

| ACCA registration and annual fees | ₹ 30,000 – ₹40,000 | Global registration and student subscription |

| Exam fees for 13 papers | ₹2.5 – ₹3.2 lakhs | Paid per attempt |

| Coaching and training | ₹1.5 – ₹3.5 lakhs | Depends on the format and the institute |

| Books and mock exams | ₹40,000 – ₹70,000 | Printed and digital resources |

This is why conversations around ACCA course fees in Chennai should always include what is optional and what is unavoidable. Coaching is a choice. Exam and registration fees are not.

How Coaching Models Affect Cost and Outcomes

The type of ACCA coaching in Chennai chosen has a direct impact on both cost and learning experience. Chennai offers one of the widest ranges of formats in India. Most ACCA coaching centres in Chennai operate under three models.

- Classroom-Based Coaching: This model suits students who prefer fixed schedules and face-to-face interaction. Many ACCA coaching classes in Chennai tied to colleges fall under this format. It works well for students doing BCom with ACCA in Chennai, as academic calendars and ACCA papers move in sync.

- Hybrid Coaching: Hybrid coaching mixes recorded lectures with live doubt-clearing sessions. This model is popular among working professionals and final-year college students. Several learners consider this the most balanced ACCA Chennai coaching format because it allows flexibility without complete self-study.

- Fully Online Coaching: This model focuses on recorded content, digital mocks, and minimal live interaction. It suits disciplined learners who already have accounting exposure. Institutes positioned as an ACCA academy in Chennai often provide hybrid or classroom-heavy formats with added academic tracking.

The time it takes to complete ACCA in Chennai can vary widely depending on when a student starts and how they balance studies with college or work. Looking at different student profiles helps set realistic expectations around pacing, exam attempts, and overall progression:

How to Evaluate the Best ACCA Institute in Chennai

Many articles list names when talking about the best ACCA institute in Chennai. That approach rarely helps a student make a confident decision. What matters more is how an institute fits a learner’s daily routine and academic background.

When evaluating an ACCA institute in Chennai, I usually break the decision into five simple checks.

- Academic Continuity: Does the institute offer a structured path from the first paper to the last, or does support fade after early levels?

- Faculty Alignment: Are the trainers specialised by paper, or does one person handle multiple subjects?

- Exam Support: Does the institute guide exam booking, ethics module completion, and administrative deadlines?

- Placement Exposure: Does the institute support internships and entry-level roles, especially for ACCA jobs in Chennai?

- Learning Pace: Are there batch options that match your personal speed?

Imarticus Learning positions itself strongly in this area by offering integrated academic planning, industry-aligned training, and career-focused support. Their ACCA program in Chennai is structured to support both fresh students and working professionals seeking global exposure.

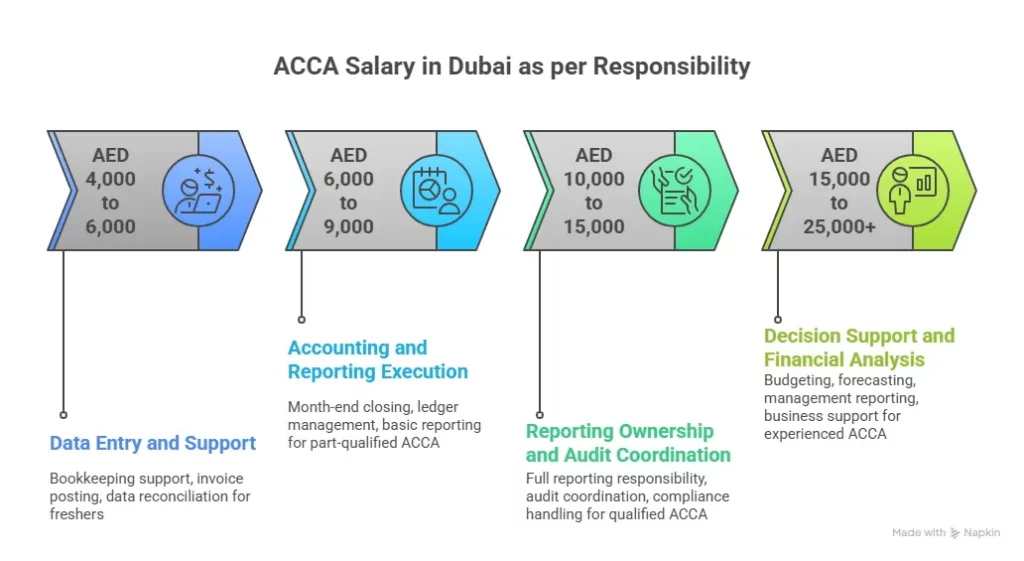

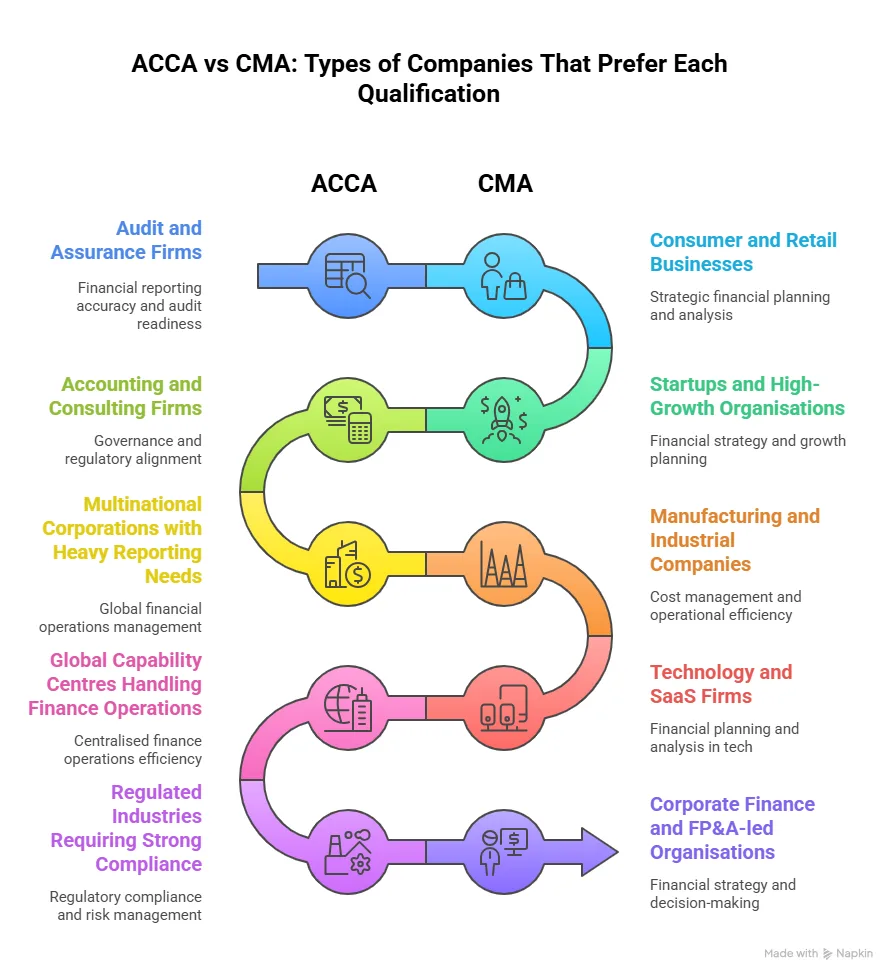

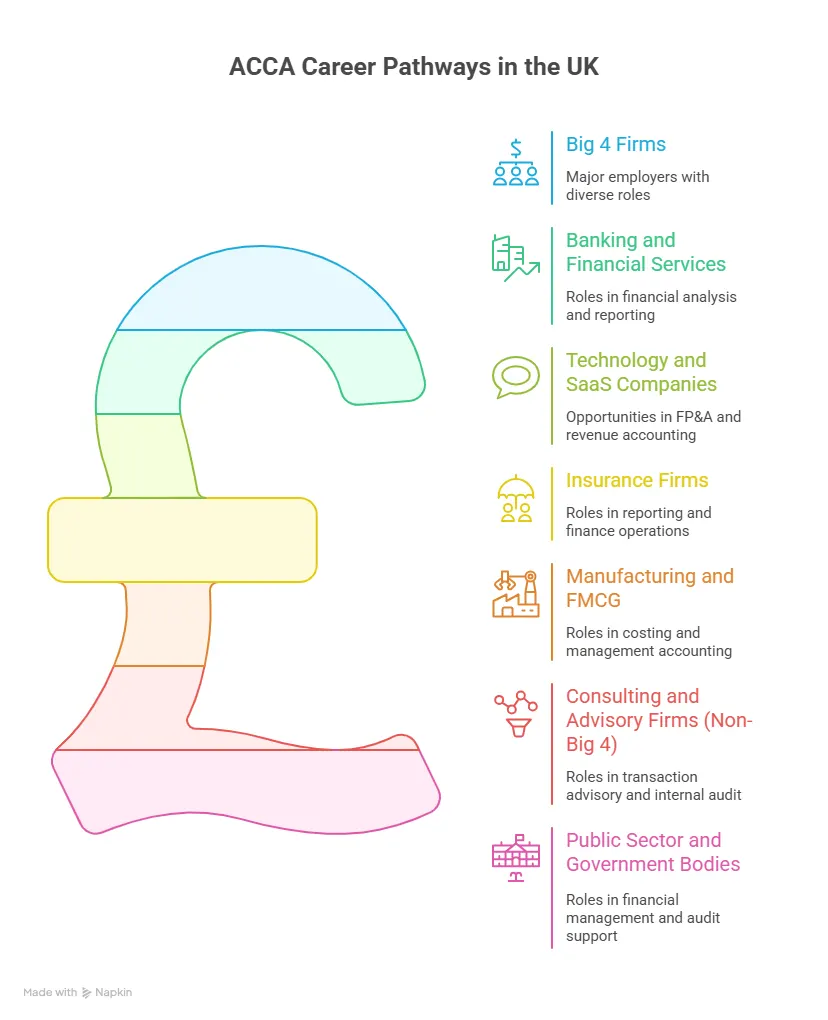

ACCA Jobs in Chennai and Role Progression

A common fear is whether ACCA jobs in Chennai exist beyond theory. The city’s finance ecosystem answers this quietly through hiring trends rather than advertisements.

Chennai hosts:

- Audit support teams for Big Four firms

- Shared service finance centres

- Compliance and reporting units for global corporations

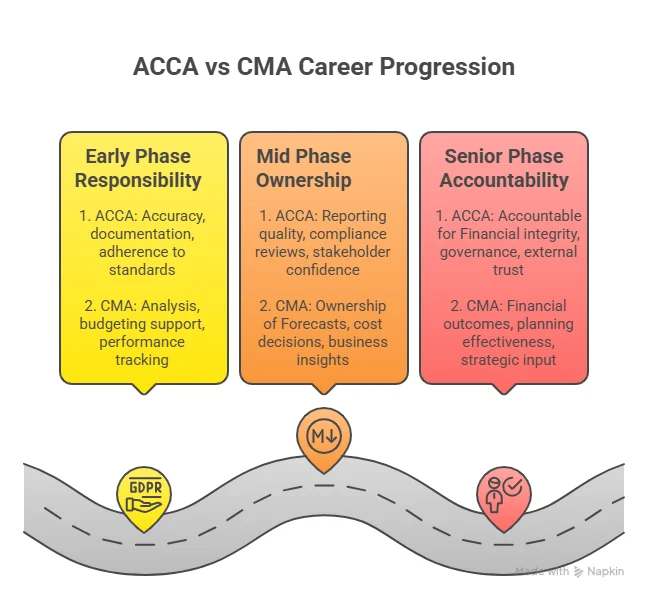

Entry-level roles often align with Applied Skills papers. As students progress toward Strategic Professional, roles expand into analysis, advisory support, and financial control.

Below is a simplified view of role progression linked to ACCA course details and levels.

| ACCA Level | Typical Roles in Chennai |

| Applied Knowledge | Accounts executive, finance trainee |

| Applied Skills | Audit associate, reporting analyst |

| Strategic Professional | Senior analyst, finance manager track |

The first role an ACCA student takes up in Chennai is often less about titles and more about learning how finance teams actually function. Early responsibilities usually focus on reporting support, audit documentation, and process work:

Internships and Practical Exposure in Chennai

Internships form a critical bridge between exams and employment. ACCA internship in Chennai opportunities usually emerge through three channels.

- Mid-sized accounting firms

- Corporate finance teams

- Shared service centres

Students pursuing ACCA training in Chennai often access internships after completing 6 to 9 papers. While internships are not mandatory for exam completion, they are essential for confidence and skill application.

The experience of applying ACCA concepts at work feels similar to learning to swim. Reading about strokes helps, but actual movement in water builds control and confidence.

For working professionals, ACCA often needs to fit around long hours, shifting deadlines, and limited study time. A clear roadmap helps break the qualification into manageable phases, showing how exams, preparation, and work responsibilities can move together without constant burnout or disrupted progress.

ACCA Coaching Classes and Integrated Degree Models in Chennai

The rise of ACCA coaching classes in Chennai offering integrated programs has changed how students plan long-term education.

Several ACCA course colleges in Chennai partner with universities to embed ACCA papers into BCom programs. This approach allows students to reduce overall study time and cost.

The appeal of BCom with ACCA colleges in Chennai lies in three areas:

- Dual qualification within a fixed timeline

- Reduced academic duplication

- Better internship readiness

Students considering BCom with ACCA in Chennai should check whether ACCA exemptions are officially approved by ACCA.

Did You Know?

ACCA exemptions can reduce up to nine papers depending on academic background.

How Exemptions Work for ACCA in Chennai

One of the most misunderstood parts of ACCA in Chennai is exemptions. Many students hear that papers can be skipped and assume this happens automatically. Exemptions are granted only when prior education closely matches ACCA syllabus standards.

Students entering ACCA in Chennai after a BCom, BBA, or MCom may receive exemptions at the Applied Knowledge or Applied Skills level. This depends on the university, subjects studied, and grading structure. ACCA publishes a live exemptions database that changes when syllabi change, which is why checking eligibility before enrolling is important.

Choosing Optional Papers at the Strategic Level

At the Strategic Professional level, students pursuing ACCA in Chennai must choose two optional papers. This decision shapes career direction more than people expect.

Common optional combinations include:

- Advanced Financial Management for finance and treasury roles

- Advanced Performance Management for business analysis

- Advanced Taxation for compliance and advisory

- Advanced Audit and Assurance for audit-aligned careers

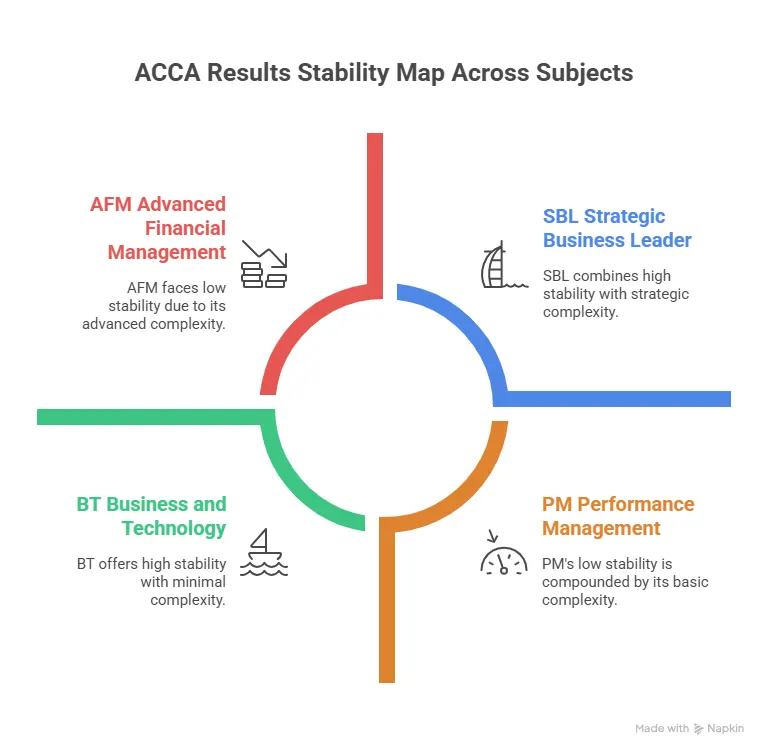

The choice should reflect the type of ACCA jobs in Chennai that a student is targeting. Chennai’s market has strong demand for audit support, reporting, and shared services, which often align with audit and performance-focused papers.

Several ACCA coaching centres in Chennai guide students on optional selection based on local hiring patterns rather than global theory alone. This practical alignment often reduces confusion and exam fatigue.

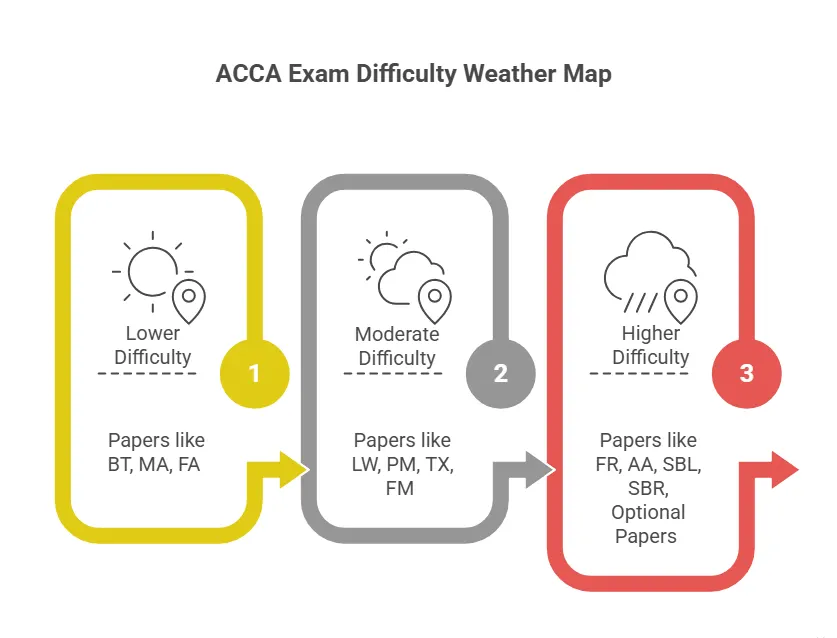

Which ACCA Papers Feel the Most Challenging

Difficulty in ACCA is rarely about intelligence. It is more about how concepts stack over time. Students preparing for ACCA in Chennai often find papers that demand interpretation harder than those that test rules.

Papers commonly perceived as challenging include:

- Financial Reporting due to volume and standards

- Strategic Business Leader due to case-based judgment

- Advanced Audit due to application depth

Students supported through structured ACCA coaching in Chennai at Imarticus Learning usually manage the toughest ACCA syllabus and papers better because preparation focuses on exam thinking rather than memorisation.

Role of ACCA Training and Skill Development in Chennai

Professional growth does not come only from clearing exams. ACCA training in Chennai increasingly includes soft skills, spreadsheet modelling, and reporting tools.

Many institutes now integrate:

- Excel and financial modelling basics

- Business communication workshops

- Interview preparation sessions

This matters because ACCA jobs in Chennai often sit within teams that serve global stakeholders. Clear reporting and communication are valued as much as technical accuracy.

Imarticus Learning focuses on combining exam preparation with industry-aligned training, which helps learners transition smoothly from classroom to workplace.

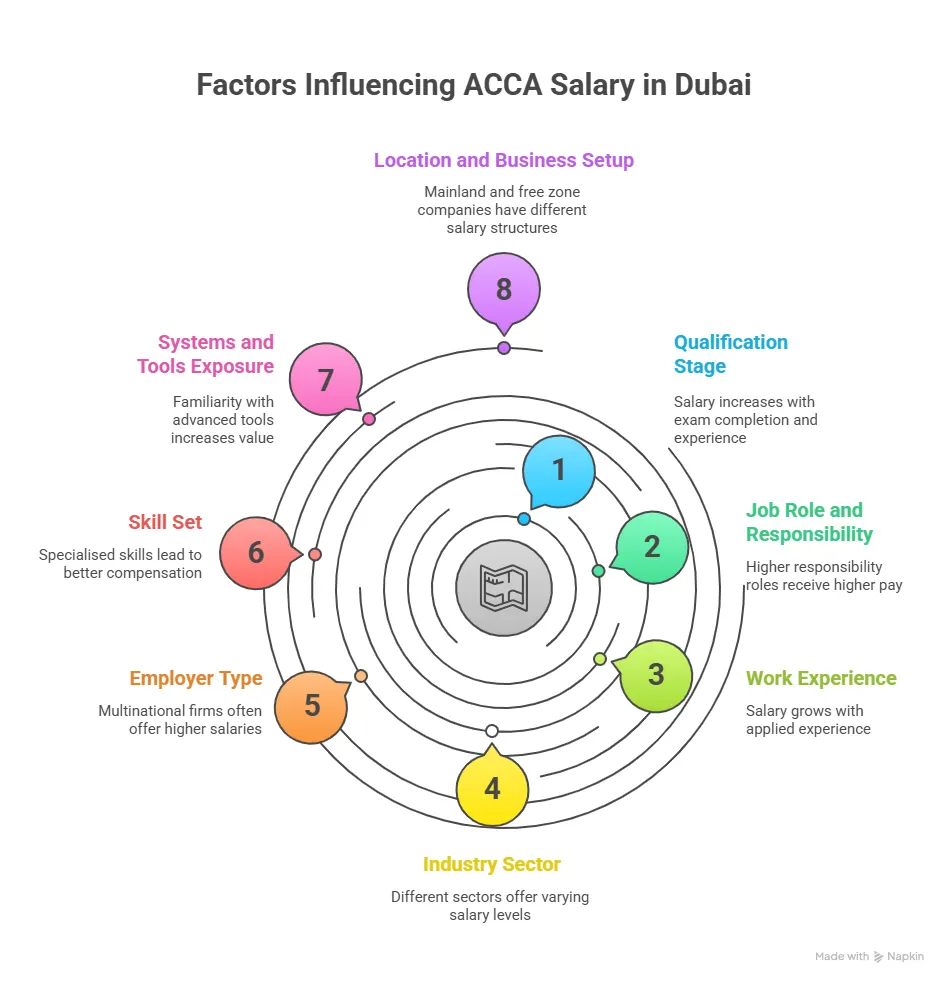

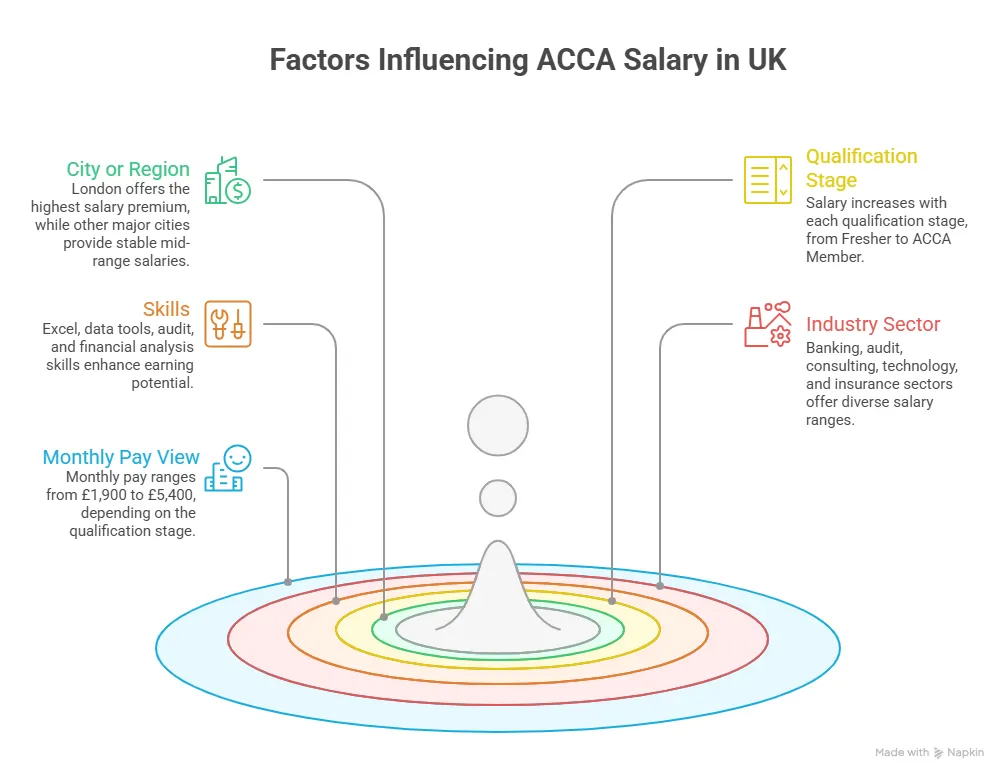

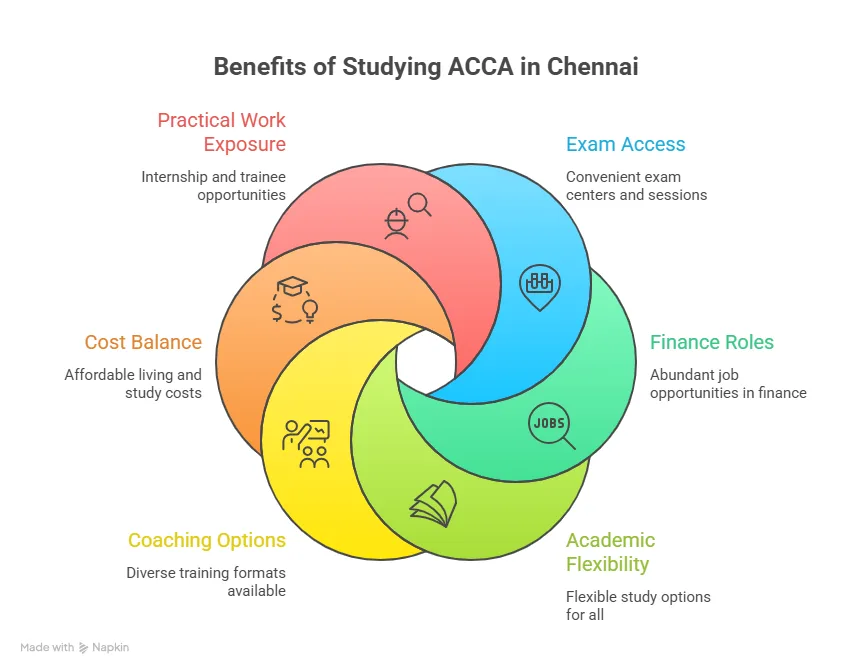

How Chennai Compares as a City for ACCA Aspirants

Students often ask whether Chennai is the right city for ACCA compared to other metros. ACCA in Chennai benefits from a balance of opportunity and affordability, adding to the ACCA employability factors.

Chennai offers:

- Lower living costs compared to Mumbai and Bangalore

- Strong presence of finance shared service centres

- Stable academic ecosystem with long-term institutions

This balance supports students pursuing ACCA classes in Chennai while managing internships or part-time roles. For many, the city allows focus without excessive financial pressure.

Studying ACCA in Chennai offers practical benefits and career opportunities that often matter more over time, from local exam access and flexible learning options to steady exposure to finance and accounting roles:

FAQs About ACCA in Chennai

This section brings together everything discussed about ACCA in Chennai. It addresses the most frequently asked questions, helping you with clarity on how exams, preparation, and career planning align, and points toward the kind of structured support that helps students move forward with confidence.

What is the ACCA course fee?

The total ACCA course fee in Chennai typically ranges between ₹4.5 lakhs and ₹6 lakhs. This includes a one-time registration fee of about ₹8,000, an annual subscription of around ₹13,000 per year, and exam fees that range from ₹9,000 to ₹27,000 per paper, depending on the level. Over 13 papers, exam fees usually add up to ₹2.5–3.5 lakhs. Imarticus Learning often helps students plan these costs in advance so there are no financial surprises during the ACCA in Chennai journey.

Who is eligible for ACCA?

Eligibility for ACCA in Chennai starts at the Class 12 level with commerce subjects, though graduates from non-commerce backgrounds can also enrol through foundation routes. Many students pursuing the ACCA course in Chennai come through BCom or professional pathways that offer exemptions. Imarticus Learning helps students understand eligibility and exemption mapping before registration.

What are the 13 subjects in ACCA?

The ACCA in Chennai qualification consists of 13 subjects across Applied Knowledge, Applied Skills, and Strategic Professional levels. These subjects cover accounting, audit, taxation, performance management, financial reporting, and strategic leadership. The structure ensures gradual skill development from fundamentals to advanced professional judgement.

Can I skip ACCA papers?

Students enrolled in ACCA in Chennai can skip papers only through official exemptions granted by ACCA. Exemptions depend on prior education and approved university programs. Many students in BCom with ACCA colleges in Chennai receive exemptions for early level papers, which reduces the total exams but does not reduce learning responsibility. Careful exemption planning helps avoid gaps in knowledge later.

What is the hardest subject in ACCA?

Students with strong accounting foundations may find strategic papers challenging due to case analysis, while others find technical reporting papers demanding. Subjects like Strategic Business Leader and Financial Reporting are often perceived as challenging because they test judgment and clarity rather than memory. Structured ACCA coaching in Chennai with Imarticus Learning helps students build exam readiness for these papers.

Which city is best for ACCA in India?

The value of the ACCA Course in Chennai lies in its balanced ecosystem. Chennai offers strong academic institutions, exam access, and growing finance employment. While other cities also offer opportunities, students choosing ACCA in Chennai benefit from affordability, exam centre availability, and steady hiring in shared services and audit support roles.

Which is the best BCom college in Chennai with ACCA colleges?

There is no single best option for everyone pursuing ACCA in Chennai. The best BCom with ACCA colleges in Chennai are those approved for exemptions and aligned with ACCA standards. Students should evaluate curriculum structure, faculty support, and exam integration rather than names alone. Many colleges partner with training providers to strengthen academic delivery.

Which university is better for ACCA?

Universities supporting the ACCA Course in Chennai should be evaluated on exemption recognition, curriculum alignment, and academic support. ACCA publishes approved exemptions based on university programs, which is a reliable way to judge compatibility.

How All of This Comes Together for ACCA in Chennai

By now, ACCA in Chennai should feel less like a title and more like a working system. A sequence of decisions that stack over time. Exams that reward preparation rather than luck, and that is precisely why it works for so many people here.

Most students who succeed with ACCA do not have a perfect plan on day one. What they do have is a reasonable one. They understand the order of things. Papers before roles. Skills before titles. Experience alongside exams. Chennai supports this approach because the work here values reliability, clarity, and process. The qualification mirrors that expectation closely.

At this point, the useful question is no longer whether ACCA is recognised or whether jobs exist. Those answers are already visible in the market. The better question is how you want to move through the qualification. With structure or with trial and error. With clarity or with constant recalibration.

This is exactly where the right learning partner makes a difference. If you are serious about pursuing ACCA in Chennai, working with an institute that understands both the exam framework and the local job ecosystem matters. Imarticus Learning supports ACCA aspirants in Chennai with structured exam preparation, industry-aligned training, and career-focused guidance that goes beyond clearing papers.

ACCA does not demand that you rush. It demands that you show up consistently. Chennai offers enough space to do that without forcing extremes. When those two things align, progress feels quiet but dependable. And for most careers that last, that is exactly what you want.