Recent times have seen unprecedented growth and popularity of Big Data, making it an indispensable domain of almost every industry. With an overwhelming amount of data available around us, businesses are focusing on using this valuable resource most efficiently.

That being said, a concomitant rise in demand for skilled data analysts has led to the inevitable mushrooming of data science courses in India.

If you are looking for a comprehensive data analytics course or data science course in India, Imarticus can help you take the first step towards your goal. With its extensive, industry-approved, and experiential Post Graduate Program In Data Analytics and Machine Learning, future Data Scientists are sure to gain immense professional benefits.

About the Data Analytics and Machine Learning Course

According to Statista, the global Big Data market is predicted to grow to US$ 103 billion by 2027, a figure more than twice its expected market size in 2018.

The need of the hour for budding and working data science professionals is a robust data science course with placement assurance. That’s where Imarticus comes to the rescue. The PG program in data analytics and machine learning is designed to help future data scientists learn the foundations and real-world applications of the discipline.

Suitable for fresh graduates and working professionals, the data analytics course seeks to nurture the most in-demand employment skills in data science and analytics with assured interview opportunities and guaranteed job interviews.

What’s Unique About the Program?

Here’s what makes the Imarticus PG Program In Data Analytics and Machine Learning stand out from any other data science course in India:

Here’s what makes the Imarticus PG Program In Data Analytics and Machine Learning stand out from any other data science course in India:

Guaranteed Interview Opportunities

With over 400 placement partners, Imarticus assures guaranteed interview opportunities for candidates who complete the course successfully.

Learn Job Relevant Skills From Industry Experts

Learners are empowered with critical job-relevant skills through multiple in-class industry-oriented projects, case studies, capstone projects, hackathons, training sessions, discussions, and much more.

Extensive Career Support

Imarticus offers an extensive preparation guide to learners through different career services such as preparation workshops, capstone projects, career mentoring, mock interviews, and a lot more.

Flexible Learning Batches

Weekdays are for the fresh graduate program (6 months, full-time), and the program for working professionals (9 months, part-time) is delivered on weekends.

Curriculum Highpoints

- The curriculum for early-career professionals or fresh graduates includes:

SQL Programming, Python Programming, Statistics, Machine Learning with Python, R and Data Science, Big Data and Hadoop, Big Data Analytics with Spark, Data Visualization with Tableau, Data Visualization with Power BI, Placement Preparation, and Capstone Project.

- Professionals with 0-5 years of experience have advanced curricular elements as follows:

SQL Programming, Python Programming, Statistics, Machine Learning with Python, Neural Network and Deep Learning, Machine Learning on Cloud, AI (NLP and Computer Vision), Data Visualization with Tableau, Placement Preparation, and Capstone Project.

Conclusion

The Big Data revolution has taken the business and IT world by storm and is here to stay. Enroll with Imarticus Learning to make your career in data science and machine learning future-proof by learning from the best in the industry.

With a sea of data science courses available out there, make sure that you choose a data science course with job assurance

With a sea of data science courses available out there, make sure that you choose a data science course with job assurance

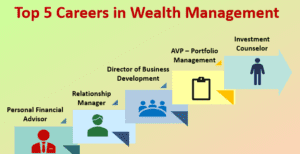

Their job duties include saving money for college, budgeting, retirement planning, insurance planning, etc. Their clients are normal people who want to use their income in a planned way so that they could achieve their life goals or some short-term goals.

Their job duties include saving money for college, budgeting, retirement planning, insurance planning, etc. Their clients are normal people who want to use their income in a planned way so that they could achieve their life goals or some short-term goals. There are a plethora of

There are a plethora of

They also conduct skill assessments and competency mapping so as to create a comprehensive learning framework to prepare the new employees and also the existing employees with relevant future skills, dedicated delivery analysts, and account managers to ensure seamless delivery of training.

They also conduct skill assessments and competency mapping so as to create a comprehensive learning framework to prepare the new employees and also the existing employees with relevant future skills, dedicated delivery analysts, and account managers to ensure seamless delivery of training.

They focus on the financial relationships of his/her client. They keep analysing the market and ping their clients whenever a good investment opportunity occurs. They also work in investment banks advising clients on whether to invest in any particular venture or not.

They focus on the financial relationships of his/her client. They keep analysing the market and ping their clients whenever a good investment opportunity occurs. They also work in investment banks advising clients on whether to invest in any particular venture or not.