Digital payments are now being used in almost every business, whether you are shopping online or in person. A study showed an estimated annual growth rate of 23.8% of the global mobile payment market will be observed between 2021 and 2026.

A payment gateway is an interface between businesses and customers, allowing companies to receive payments. It helps in maintaining the integrity and security of sensitive financial information.

A payment ecosystem supports all digitally made payments, making the payment process smooth and efficient for merchants and consumers.

Programmable payments are a new frontier in payment technology, offering customers financial advantage and maximum flexibility. To make programmable payments more efficient, blockchain technology is being used. This blog will address digital payment methods in detail.

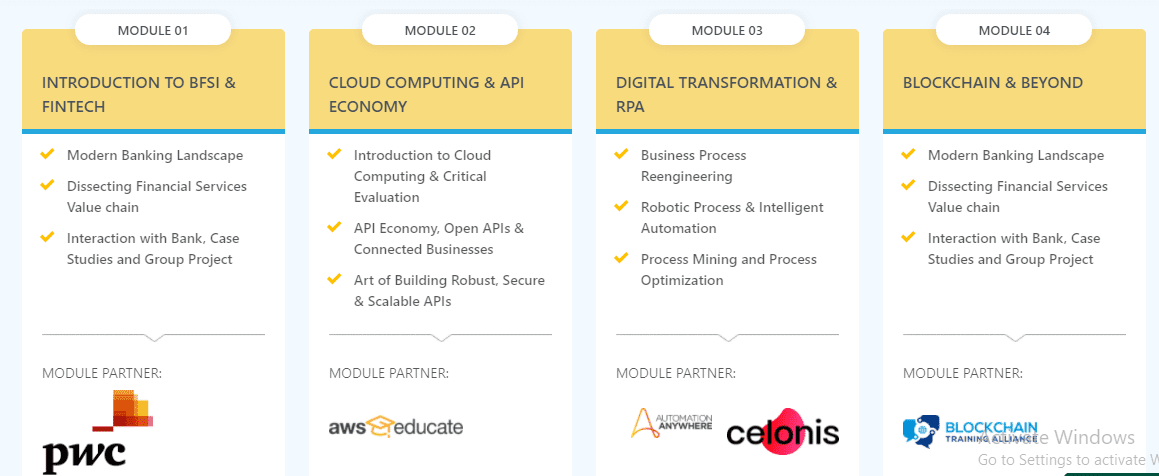

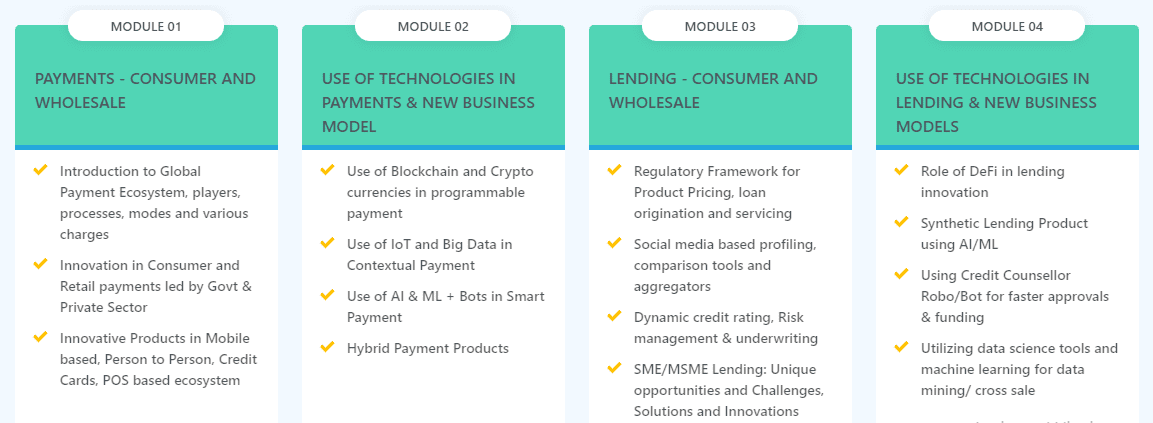

If you want to build a career in the fintech industry, enrolling in financial technology courses can help you understand the various digital payment methods.

What is a payment gateway?

A payment gateway can be defined as an online service which allows merchants to accept payments from their customers via websites or mobile applications. It serves as an intermediary between the merchant and the financial institute which processes the payment.

This transaction processing technology acquires, stores and transmits the customer’s card information to the acquirer. It also notifies the customer about the payment acceptance or declination. Payment gateways use data encryption to protect the confidential payment data of the customer.

In online stores, the payment gateways are the ‘checkout’ portals used to enter card information for services. In physical stores, the payment gateways have a point-of-sale (POS) terminal, which accepts card information.

How does a payment gateway function?

Payment gateways use a complex, multistep process, which helps ensure the transaction is accurate, secure and efficient. Here is an overview of how payment gateways work:

- When customers enter their card details for a purchase, the web browser immediately encrypts it. This data is then set to the web server of the vendor. SSL (Secure Socket Layer) encryption ensures safety during this step.

- The secure order information is then transmitted to the payment gateway. The payment gateway sends this encrypted data to the business’s processor through an SSL connection.

- The payment process of the business forwards the data to the appropriate credit card network. The data is then sent to the bank, which issues the customer’s card through the network.

- The concerned bank is sent an authorisation request, and they send the processor a response code. This code indicates the acceptance or declination due to insufficient funds or a stolen or lost card.

- The payment gateway gets confirmation from the customer’s bank that the payment has been approved. It responds to the business interfaces, generally their website or ecommerce platform. This is when the payment is officially considered processed.

Several credible fintech courses will help you understand the process of payment gateways working in detail.

What is the global payment ecosystem?

In simple words, the modern global payment ecosystem is an internationally interconnected system of banking organisations, non-banking financial organisations and technology which facilitates the transfer of monetary funds.

The transferred funds might have different forms, such as credit card payments, cash, electronic transfers (EFTs), mobile wallets, etc.

The global payments ecosystem consists of a number of entities which are interacting during the payment process. These entities are issuers, acquirers, payment networks, payment gateways, payment processors, facilitators, value-added resellers (VARs), independent sales organisations (ISOs), integrated software vendors (ISVs) and member service providers (MSPs).

The global ecosystems are governed by several local, regional, national and international laws covering everything from privacy, security and taxation issues.

How does the ecosystem make global payments more secure?

Payments and transactions can be carried out physically using credit or debit cards with a card reader or through online transactions. It is done through a bank or a private server with a virtual payment system for facilitating and securing payments.

The payment service keeps information such as the transaction amount, the vendor and the buyers, the location of the transaction and any fraud attempts (if any). This information can, however, be retrieved by the company, vendor or business. This provides complete transparency, peace of mind and insights into the transaction history, which can be retrieved whenever needed.

If something goes wrong, such as transaction failure, detection of a fraud attempt or something else, the exact cause can be identified by local and online support teams.

Acquiring a fintech certification can help you understand how global payment ecosystems work.

What are programmable payments?

Programmable payments have been developed to respond to the fast-evolving digital payments landscape. It allows people to link multiple bank accounts and payment sources to a particular card. This makes it easier for cardholders to track their monetary funds and enjoy the benefits of all their accounts.

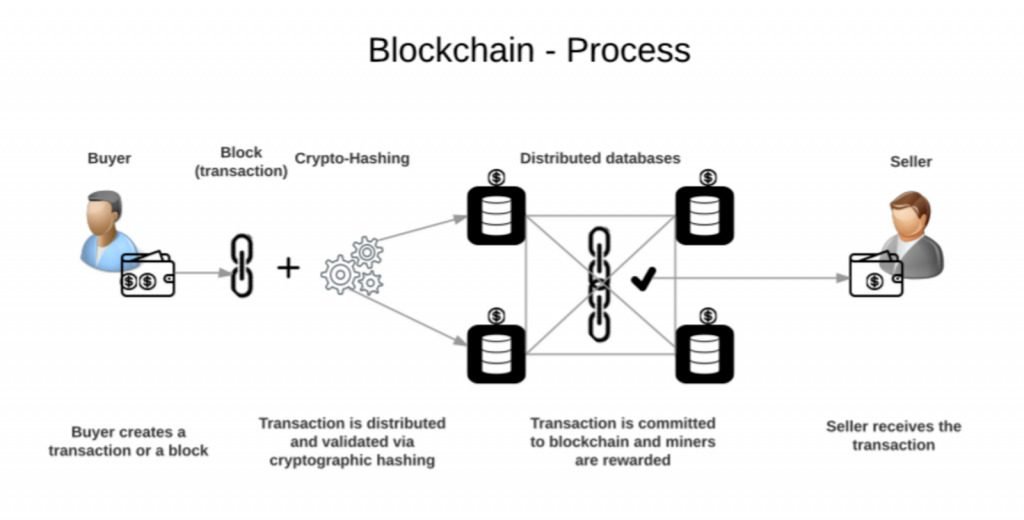

Use of blockchain in programmable payments

Blockchain offers several advantages, such as security and transparency; hence, it is a very suitable method used in the payments and finance industry. Financial technology courses will help you understand blockchain and its application in payments. Using blockchain technology for programmable payments has a number of advantages, such as:

-

Removes intermediates

Mediators are needed for the current payment systems. Even though mediators help maintain the authenticity of a payment, they also offer a number of drawbacks, such as:

- The service that they offer is chargeable.

- Increases the transaction time.

On the other hand, using the blockchain payment system, one can:

- Protect the authenticity of a transaction without any mediator

- Settle any transactions more efficiently.

- Facilitate peer-to-peer payments.

-

Security and transparency

Blockchain technology offers a high level of transparency. All the details of the transactions taking place via the blockchain network are as follows:

- Visible to everyone

- Storeed in the blockchain

- Immutable

Therefore, when making payments, you don’t need to worry about keeping any records since they get saved in the blockchain. They are kept safe, and they ensure data integrity.

-

Quick and safe cross-border payments

Making cross-border payments used to be a problematic area for a long time. It also has some challenges, such as:

- Various intermediaries involved

- Payment processing time is very long

- A very expansion option

- Lack of transparency

Using blockchain, one can:

- Blockchain payment systems reduce the payment processing time from days to a few hours to transfer funds quickly.

- Protects all the payment information since all transactions on the blockchain are immutable.

- Blockchain ensures high transparency and reduces the intermediaries in the payment process.

Conclusion

The digital payments landscape is exponentially evolving. Businesses worldwide are using digital payment methods to facilitate the payment process. The global payment ecosystem has made it easier to make not only national but international payments within a matter of seconds.

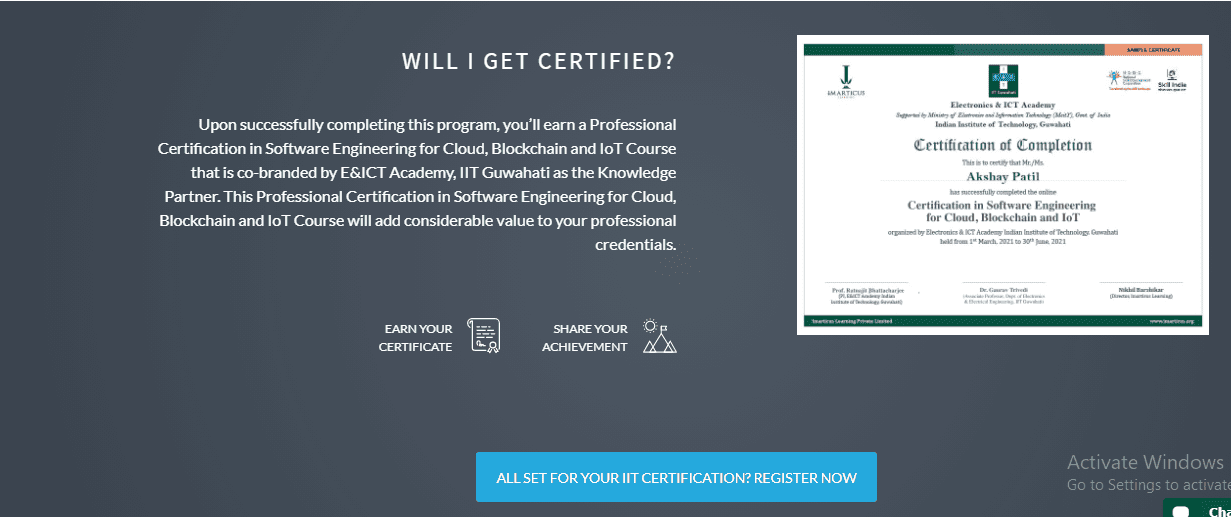

Experts are constantly working to make digital payment easier for the merchant and the customer. If you want to work in fintech, check out this Professional Certificate in Fintech by Imarticus. This fintech certification course offers its students an in-depth understanding of fintech and hands-on experience from industry experts.

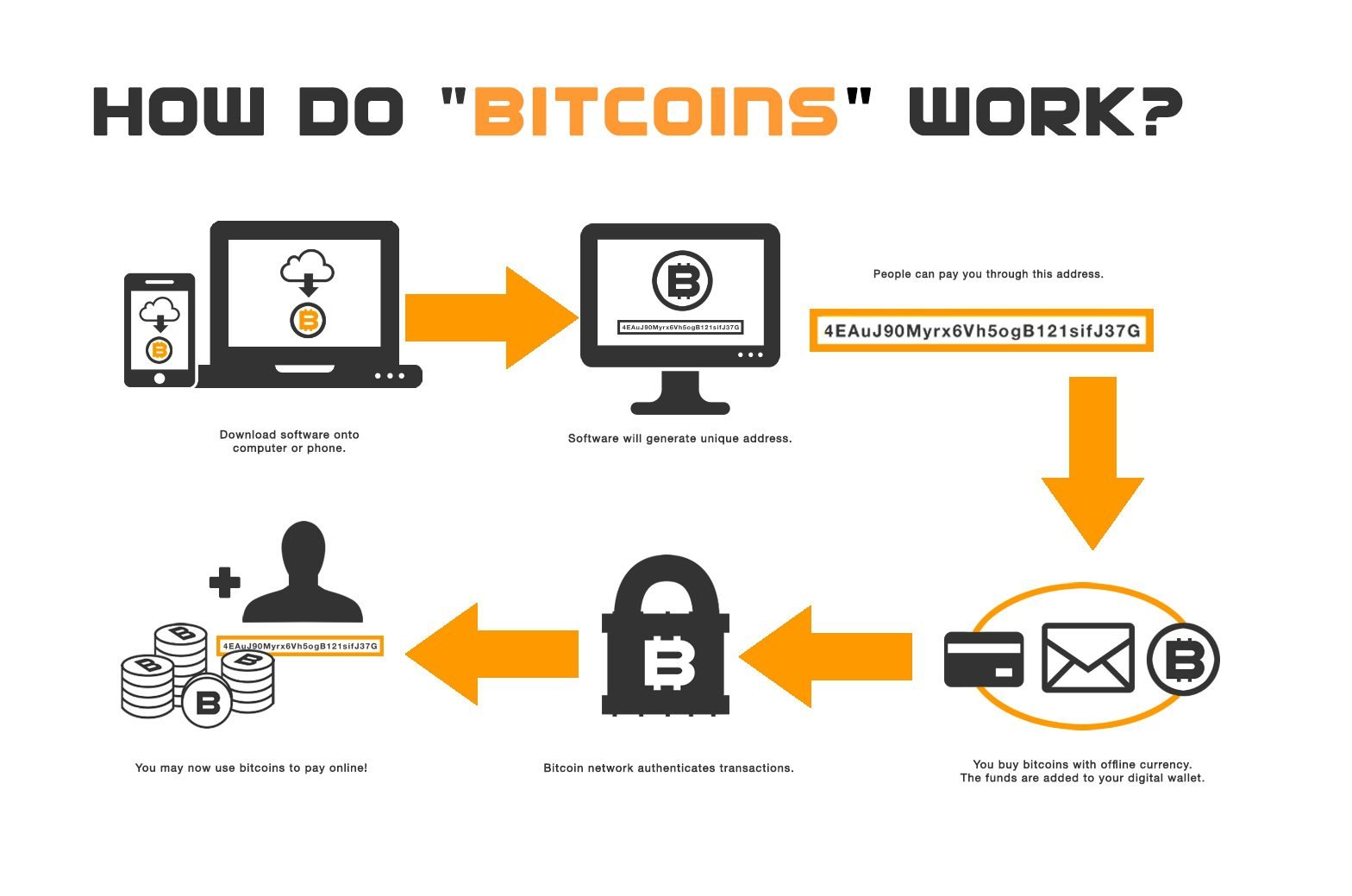

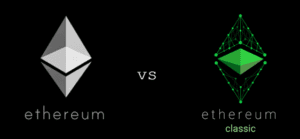

Most of the cryptocurrencies use Blockchain technology, which is decentralized and records transactions among computers. Cryptocurrencies are mainly used for

Most of the cryptocurrencies use Blockchain technology, which is decentralized and records transactions among computers. Cryptocurrencies are mainly used for  Further, cryptocurrencies are very much transparent. They have zero possibility of being stolen. The transactions can also be quicker and made with minimal transaction fees compared to banks or other financial organizations, which makes trade finance a much easier process.

Further, cryptocurrencies are very much transparent. They have zero possibility of being stolen. The transactions can also be quicker and made with minimal transaction fees compared to banks or other financial organizations, which makes trade finance a much easier process.

On the other hand, if a digital ledger is created through

On the other hand, if a digital ledger is created through

Enterprise Ethereum Alliance (EEA) is a support group formed by more than 200 market leaders such as Microsoft, Wipro, Intel, Accenture, JP Morgan, Thomson Reuters, Credit Suisse along with many start-ups and subject matter experts. They are all bound by a common factor; all of them believe in the potential of blockchain.

Enterprise Ethereum Alliance (EEA) is a support group formed by more than 200 market leaders such as Microsoft, Wipro, Intel, Accenture, JP Morgan, Thomson Reuters, Credit Suisse along with many start-ups and subject matter experts. They are all bound by a common factor; all of them believe in the potential of blockchain.

The curriculum of the course has been created in collaboration with industry experts. Students will be able to participate in live sessions and interact with professionals and academicians.

The curriculum of the course has been created in collaboration with industry experts. Students will be able to participate in live sessions and interact with professionals and academicians. The course is for 9 months and it prepares students to implement DevOps applications in diverse fields. The assignments and projects help students develop relevant skills for the software engineering industry. Working with industry professionals in interactive sessions will also allow students to have better exposure and hands-on experience.

The course is for 9 months and it prepares students to implement DevOps applications in diverse fields. The assignments and projects help students develop relevant skills for the software engineering industry. Working with industry professionals in interactive sessions will also allow students to have better exposure and hands-on experience. To

To