One sector which was the first to bring about technological changes in its mode of operations or management was Finance. Ever since the introduction of technology to this sector, the entire department has been revamped and the expected growth of the Fintech global market is 26.2% CAGR (Compound Annual Growth Rate) between 2022 to 2030. So if you were planning a career in the Fintech sector, now would be the ideal time to give a jump start on your dreams, and opting for various Fintech courses online is the ideal first step. However, before you make up your mind on a course, there are a few things to be aware of. This article covers all the essentials of any online Fintech course.

Fintech certification course: What is it all about?

In the simplest of terms, the Fintech industry is all about using technology to smoothen the financial operations of a company or business. Fintech courses are those courses that help you to specialise in this field and give you an opportunity to learn the various skill sets required to set foot in this sector.

What to look for before enrolling in a Fintech online course?

While browsing through the multiple options of Fintech courses you might get intimidated owing to the broadness of this niche. So here are a few factors which you should keep in mind before choosing your course:

Your requirements and preferences

The ecosystem of the Fintech industry is a varied one, which makes it very important for you to understand your preferences and interests beforehand. Based on your requirements, capacity and interest you should choose the stream, and not the other way around. For example, if your interest lies in Wealth Technology or Wealth Tech, then you have to choose an online Fintech course that focuses on that segment. However, if your preferred field is Lending or Digital Banking, then you need to choose your course accordingly.

Duration of the course

The next important thing to consider is course duration. Fintech course durations range from shorter ones of 6 to 12 months or longer to full-fledged courses of almost 4 years. If short-term courses are the ones you are looking for, then the Fintech course offered by Imarticus is your ideal one. Imarticus runs the core module, where the basics are taught at a duration of only 100 hours, while in-depth learning is provided by the pro module which runs for 140 hours.

Practical training

Another factor to consider before finalising your Fintech course is whether the course is paired with any hands-on training or experience or not. With a course that offers proper hands-on experience, you will ensure that your theoretical knowledge is properly transcribed into a practical one.

What topics are taught in online Fintech courses?

Fintech courses are job-oriented, and thus its curriculum is curated by keeping in mind the need for both theoretical and practical knowledge. Any online Fintech course, like the professional certificate in Fintech offered by Imarticus, covers the following subject areas:

- Risk management

- Understanding the startup ecosystem

- Law and policy

- Fintech security and regulation

- Banking and financial services

The Imarticus Fintech course also offers hands-on training on various in-demand technologies like RPA, Machine Learning, Cloud Computing, Blockchain and likewise.

A career in Fintech: Array of job opportunities

After finishing your online Fintech course, you can pursue any job profile in any of the following business models:

- Transaction delivery

- Asset management

- Digital wallet

- Payment gateways

The various job profiles include:

- Cloud Manager

- Data Scientist

- Product Engineer

- Product Manager

- Sales

This is only the tip of the iceberg, and with the rapid growth in this sector, newer job profiles and business models are coming up now and then.

Why choose an online Fintech course over an offline one?

If you’re confused about whether to opt for an offline or online Fintech course, be assured that this dilemma is quite common. Both modes have their own sets of advantages and disadvantages, yet the online one wins the race owing to the following added benefits:

- An online Fintech course is flexible and thus convenient. Such a course offers you the opportunity to learn at your own pace and time.

- Next is cost savings. Not only are online courses less expensive than offline ones, but you also save travel costs.

- Most online Fintech courses are paired with exhaustive career services and scopes of networking with peers, professionals and industry experts.

Bottom line

The Fintech sector is rapidly evolving with time, and to stay afloat, you must be well equipped with appropriate knowledge, current changes and an ability to upskill yourself and adapt to the changes. The correct Fintech course will help you achieve the same with ease, which will not only act as a supplement to your knowledge base but also give a picture of your interest to work in the field to your potential employers.

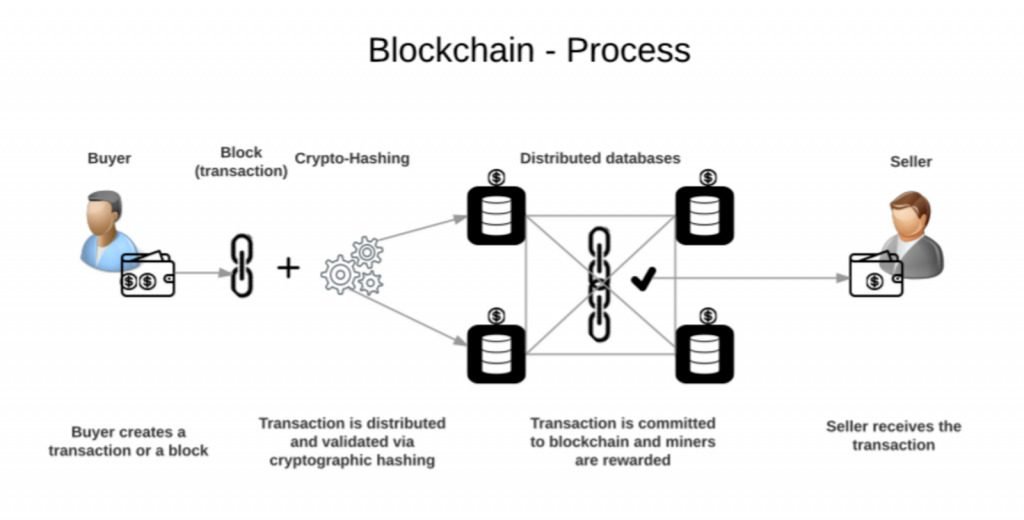

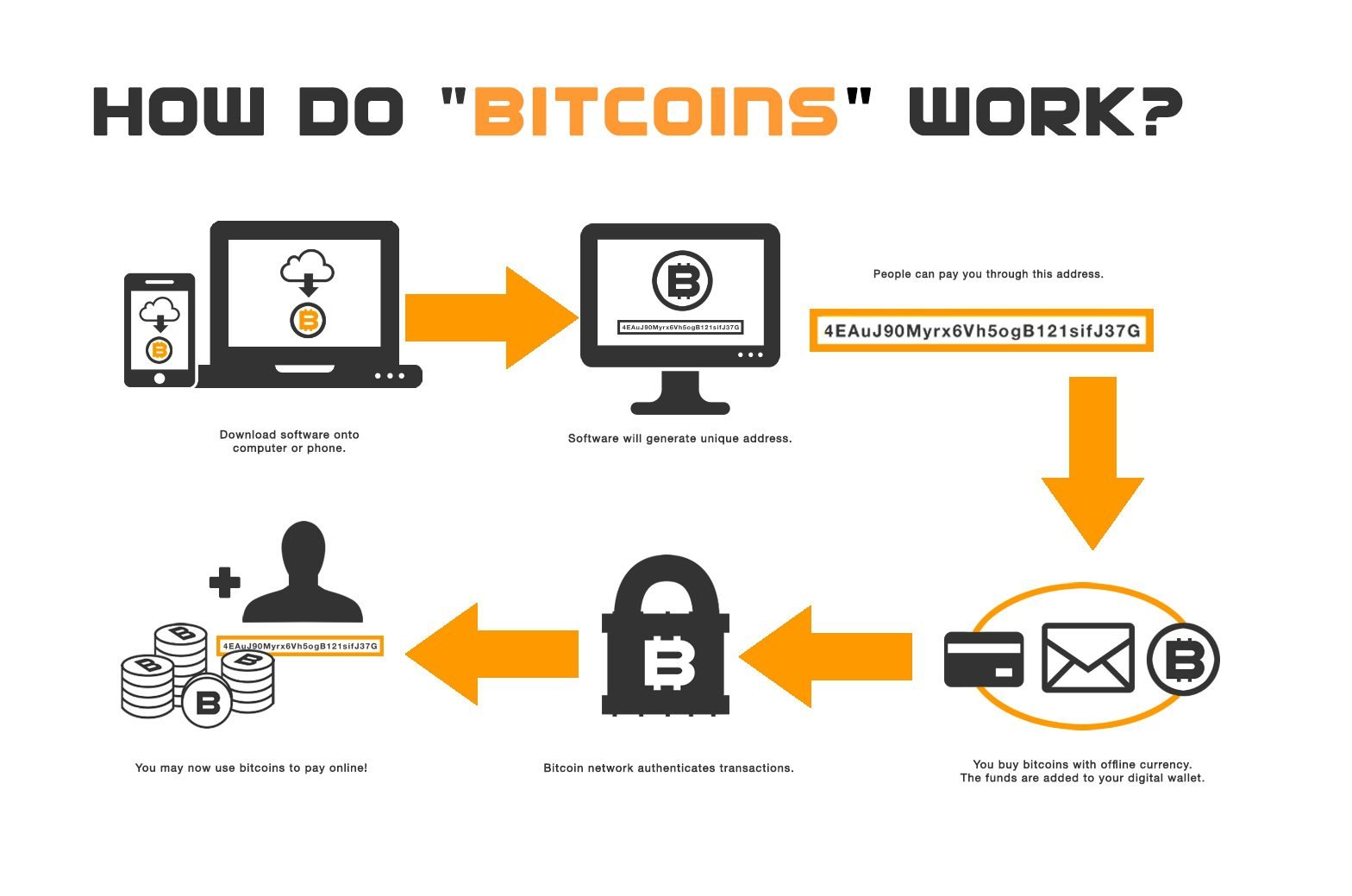

Most of the cryptocurrencies use Blockchain technology, which is decentralized and records transactions among computers. Cryptocurrencies are mainly used for

Most of the cryptocurrencies use Blockchain technology, which is decentralized and records transactions among computers. Cryptocurrencies are mainly used for  Further, cryptocurrencies are very much transparent. They have zero possibility of being stolen. The transactions can also be quicker and made with minimal transaction fees compared to banks or other financial organizations, which makes trade finance a much easier process.

Further, cryptocurrencies are very much transparent. They have zero possibility of being stolen. The transactions can also be quicker and made with minimal transaction fees compared to banks or other financial organizations, which makes trade finance a much easier process.

From healthcare to finance, companies in nearly every industry are looking to apply blockchain and get ahead of their peers.

From healthcare to finance, companies in nearly every industry are looking to apply blockchain and get ahead of their peers. There’s a bright scope for blockchain developers in India. If you’re interested in becoming a blockchain developer and want to learn what is blockchain, check out this

There’s a bright scope for blockchain developers in India. If you’re interested in becoming a blockchain developer and want to learn what is blockchain, check out this

For this, students can join vocational programs in Finance and Analytics from reputed institutions. Imarticus is one such renowned organization that is offering courses in these subjects to train students and make them job-ready for the business world. By learning these courses students get:

For this, students can join vocational programs in Finance and Analytics from reputed institutions. Imarticus is one such renowned organization that is offering courses in these subjects to train students and make them job-ready for the business world. By learning these courses students get: Fee Waiver on PG Classroom Programs – Up to 25% off

Fee Waiver on PG Classroom Programs – Up to 25% off