Fiscal prudence plays a crucial role in the growth and sustainability of any business. Managing finances in an organization can get complex and challenging as it expands across new geographies and segments. The use of new technology also adds to the regulatory complications. The services of a financial analyst can help a firm to obtain valuable insights into its historical performances and future projections.

Financial analysts help firms to monitor the overall financial health of a business. Investment banking firms are always on the lookout for talented financial analysts to join their organizations.

Let’s delve deeper into the role of a financial analyst and how one can set foot in the right direction for becoming a financial analyst in India.

What Does a Financial Analyst Do?

The primary responsibility of a financial analyst is to analyze tons of financial data related to a business and create financial models to make predictions based on historical and current data. The roles and responsibilities of a financial analyst are usually quite broad and have various facets. It varies depending on factors such as type of organization/industry, job position, etc.

A financial analyst also works along with the accounting department to ensure error-free financial reporting. Investment banking firms dealing in the money market or capital market are among the top employers for financial analyst professionals. The capital market is primarily focused on long-term assets whereas the money market entails short-term borrowing and lending.

What does It Take to Become a Financial Analyst?

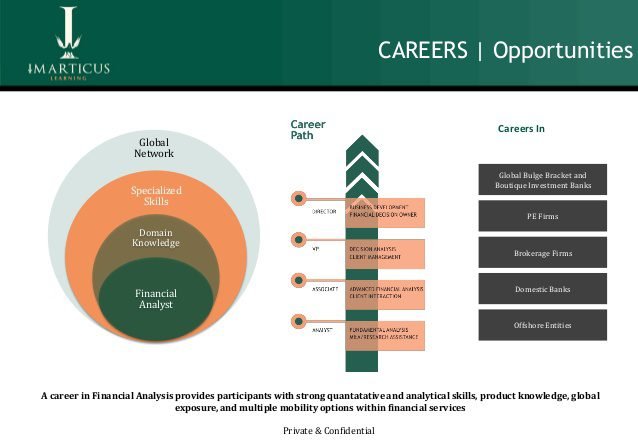

Given the growing reliance of investment banking firms on data, there is a huge demand for financial analyst professionals in India. There are plenty of factors that might influence your course to become a financial analyst. If you have a strong academic background with a good command over subjects such as economics, maths, accountancy, business, etc. you are already on the right path. Some of the important considerations that can help you grow your career in this field are as follows.

- Earn a bachelor’s degree in relevant discipline

If you are still studying and haven’t completed your bachelor’s degree, you should opt for a bachelor’s program in either economic, statistics, maths, accountancy, etc. This will help build a robust base required to excel as a financial analyst. You can even search for a more specialized bachelor’s degree to boost your prospects.

- Get the required certifications

Now a bachelor’s degree will surely help you build a strong base but specialized certifications are highly recognized and set you apart from the crowd. It eases your entry into the doors of the best investment banking institutions. In addition to this, it is highly pragmatic and factors in the recent changes in the finance landscape to provide you with precise knowledge regarding the industry. Some of the widely recognized certifications include the CFA certification, FRM certification, etc.

- Enroll in an investment banking course

Investment banking courses are specially curated for financial analyst professionals. It takes a comprehensive approach to impart knowledge related to the financial markets. It also helps you understand the complexities involved in a Trade Life Cycle. The investment banking courses with placement options are not just theoretical but also give you a pragmatic view of the industry. It helps to develop the technical and soft skills required to succeed as a financial analyst in the contemporary.

Investment banking courses are specially curated for financial analyst professionals. It takes a comprehensive approach to impart knowledge related to the financial markets. It also helps you understand the complexities involved in a Trade Life Cycle. The investment banking courses with placement options are not just theoretical but also give you a pragmatic view of the industry. It helps to develop the technical and soft skills required to succeed as a financial analyst in the contemporary.

In a Nutshell

Becoming a financial analyst in India can get challenging if you are relying on the traditional approach. The modern age firms require you to have an in-depth understanding of the present-day scenario. The best approach here is to enroll in investment banking courses with placement to get a chance to work with reputed organizations in the industry. One can easily opt for Imarticus investment banking courses online and boost their employment prospects as it also provides job assurance.

An online MBA course caters to this thought process. Hence, it is convenient to find more individuals nowadays who opt for an online MBA degree. But unfortunately, many get into it without considering what it entails and whether or not it is the right course or

An online MBA course caters to this thought process. Hence, it is convenient to find more individuals nowadays who opt for an online MBA degree. But unfortunately, many get into it without considering what it entails and whether or not it is the right course or  Do you think

Do you think

Here’s help in the form of a starter guide about the 5 most in-demand skills in the industry.

Here’s help in the form of a starter guide about the 5 most in-demand skills in the industry. Some of the most common languages used in fintech are JavaScript, Python, and SQL. You can learn more about them through easily available

Some of the most common languages used in fintech are JavaScript, Python, and SQL. You can learn more about them through easily available

Explore more

Explore more

Why do you want to be a financial analyst?

Why do you want to be a financial analyst?

What is Money Laundering?

What is Money Laundering?

In this article, we’ll see how you can get an MBA degree without breaking a bank.

In this article, we’ll see how you can get an MBA degree without breaking a bank.  Given the fact that a lot is going to change about human interaction after the COVID-19 era, one can see online MBA courses as the future leader of management courses.

Given the fact that a lot is going to change about human interaction after the COVID-19 era, one can see online MBA courses as the future leader of management courses.

There are a variety of career parts to pursue in the sphere that is Machine Learning and the positions offered are very rewarding.

There are a variety of career parts to pursue in the sphere that is Machine Learning and the positions offered are very rewarding.