If you sit down with ten ACCA students and ask them how long the ACCA Course takes, you’ll hear ten different answers. One will say 18 months. Another will confidently promise you 2 years. Someone else will whisper, “3 years… if you don’t lose momentum.”

And honestly? They’re all right.

ACCA isn’t a one-speed qualification. It behaves more like a career accelerator that adapts to the person pursuing it. A commerce student taking two papers every session moves differently from a working professional attempting one. A CA Inter candidate with exemptions races ahead in a way a 12th-pass beginner cannot.

That’s the beauty of ACCA. It stretches when you need time, and it moves fast when you’re ready.

What many students don’t realise is this:

ACCA isn’t designed to measure how quickly you study; it’s designed to measure how intelligently you plan.

The qualification is now recognised in 180+ countries, used by more than 9,000 approved employers, and aligned to global standards like IFRS. A survey by ACCA Global noted that 7 out of 10 CFOs prefer candidates trained in international reporting and strategic finance frameworks, exactly what ACCA builds.

And thinking like a professional takes time, but not as much time as most students fear.

That brings us to the question every ACCA aspirant types into Google at some point:

“How long does the ACCA course actually take?”

Not the ideal timeline. Not the brochure timeline.

But the real, background-based, exemption-based, experience-based, life-friendly timeline.

That’s exactly what this guide breaks down: clearly, practically, and with examples from real student journeys.

By the end, you won’t just know the ACCA course duration.

You’ll know your personalised duration, the fastest route for your profile, the effect of exemptions, the best exam sequencing, and the smart study habits that determine whether your journey takes 18 months or 36 months.

What is the ACCA Course?

Ask any student, “What is ACCA?” and most will say something like:

“An accounting qualification from the UK… I think?”

But the ACCA Course is much bigger, deeper, and more forward-looking than that simple line suggests.

At its core, ACCA, the Association of Chartered Certified Accountants, is a global professional qualification built to shape finance leaders who can work anywhere in the world. Over 247,000 members and 526,000 students study ACCA across 180+ countries because it blends accounting, strategy, analytics, ethics, and leadership into one continuous skill path.

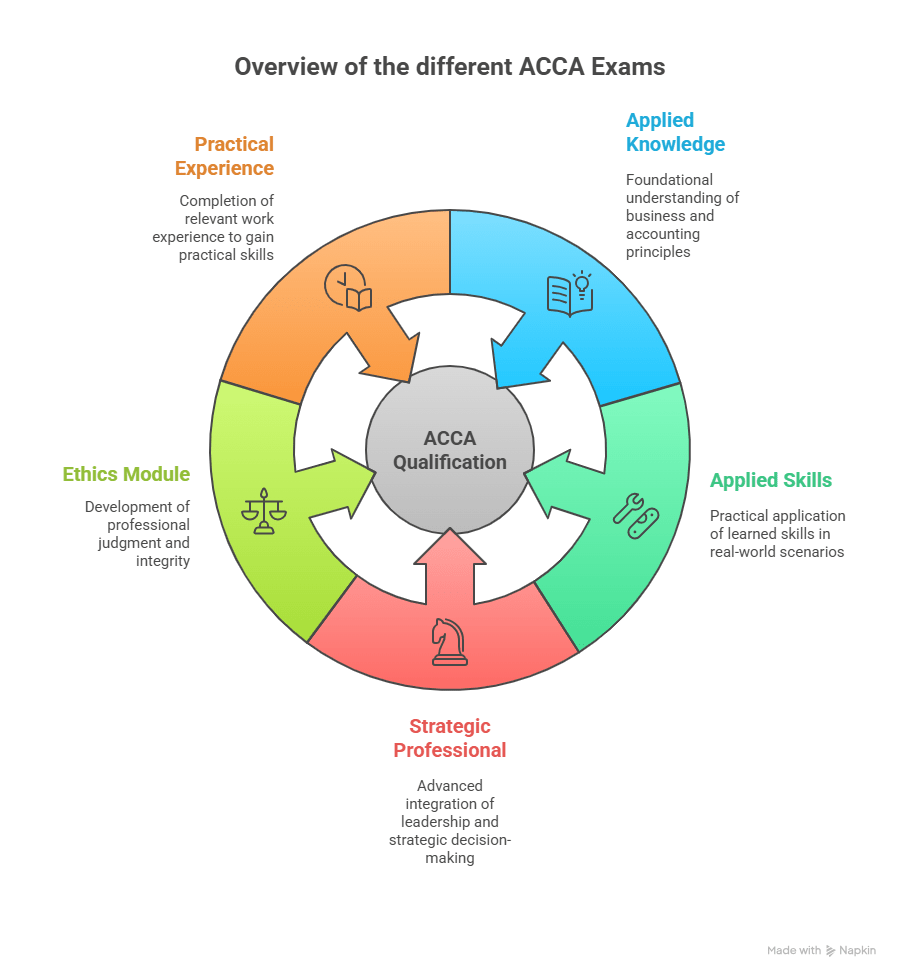

The best way to understand the ACCA course is to think of it as a training system, not a set of exams. It’s designed to teach you:

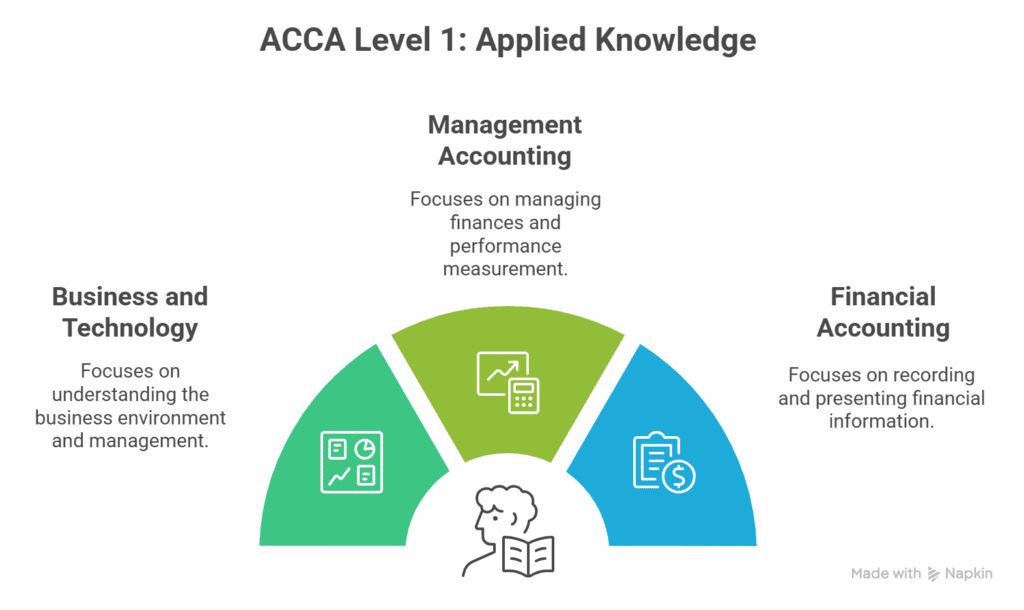

1. Get the fundamentals right (Applied Knowledge)

These papers develop the core vocabulary of finance.

Students often underestimate this level because the names sound benign, but this is where ACCA builds your conceptual sharpness.

You study:

- Business & Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)

Imagine building a house. This level is the foundation cement: invisible later, but absolutely irreplaceable.

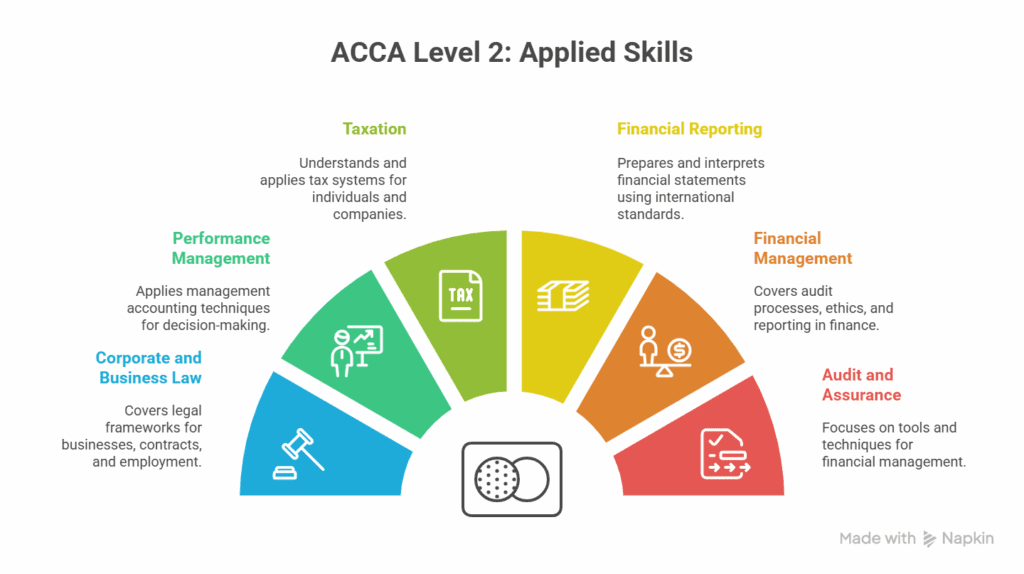

2. Build professional-grade skills (Applied Skills)

These subjects expose you to the accounting engine of a real organisation. Case scenarios start appearing. Analytical questions take centre stage.

You study:

- Corporate & Business Law (LW)

- Performance Management (PM)

- Taxation (TX)

- Financial Reporting (FR)

- Audit & Assurance (AA)

- Financial Management (FM)

Almost every role in finance: internal audit, financial reporting, treasury, compliance, and controllership pulls directly from this set.

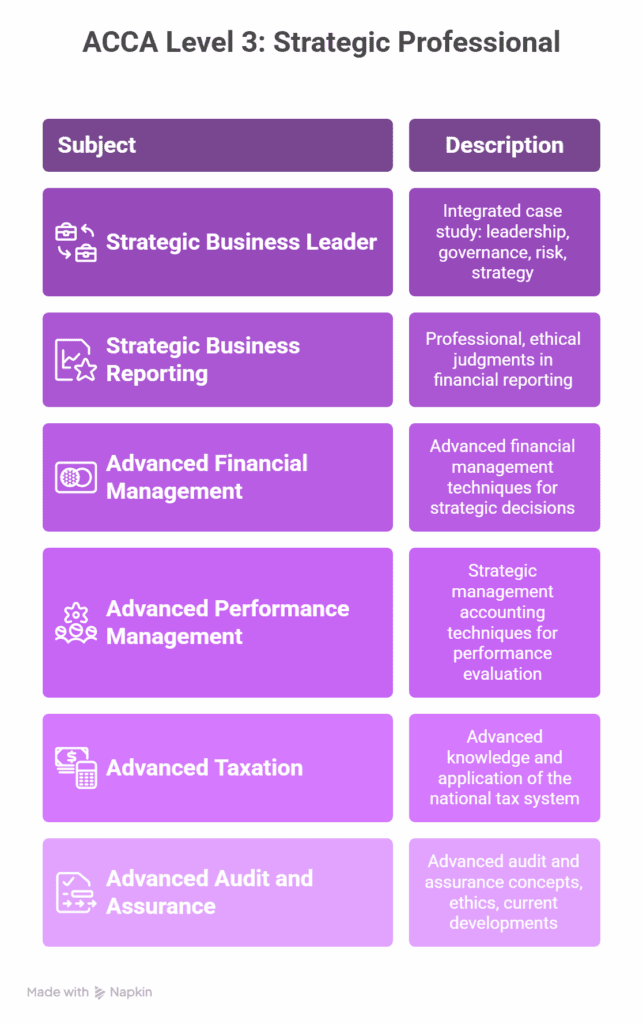

3. Learn to think like a leader (Strategic Professional)

This is the level that transforms candidates into decision-makers.

You study:

Plus choose two from:

- Advanced Audit (AAA)

- Advanced Performance Management (APM)

- Advanced Taxation (ATX)

- Advanced Financial Management (AFM)

This level mirrors real boardroom thinking: managing risks, linking strategy to numbers, and defending recommendations.

Here is a video that breaks down the ACCA course and all its details:

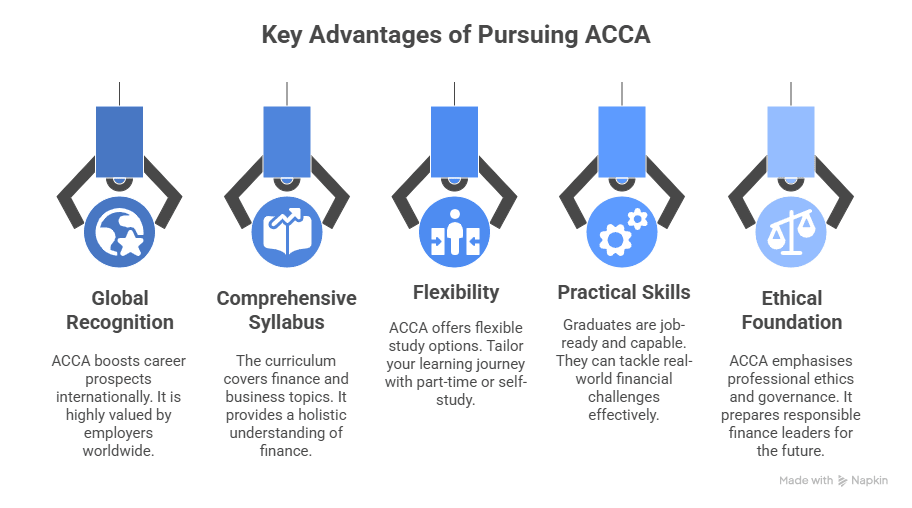

What Your ACCA Syllabus Intentionally Trains You To Become

The ACCA syllabus is a deliberate progression that reshapes the way you analyse, question, and solve real financial problems. You begin by understanding numbers, then evolve into someone who interprets them, and ultimately grow into someone who can influence decisions made in boardrooms. By the time you complete the ACCA Course, you’re not just exam-ready, you’re industry-ready, future-ready, and trained to think like a complete finance professional.

The ACCA syllabus builds five competencies simultaneously:

- Technical Accounting Expertise

IFRS, consolidation, taxation policies, and audit testing. - Analytical Decision-Making

Variance analysis, risk assessment, and strategic case evaluation. - Ethical & Professional Judgment

Reinforced by the mandatory Ethics and Professional Skills module. - Business Leadership

Scenario-based questions involving governance, risk, and control. - Digital Fluency

ACCA now integrates analytics, data interpretation, and emerging tech concepts.

A recruiter doesn’t hire you for knowing “one subject.”

They hire you because the qualification shapes you into someone who can interpret a balance sheet, challenge a budget, improve internal controls, and forecast business outcomes with confidence.

This is what separates an ACCA candidate from a regular BCom/MBA graduate. Watch the video below to find out about high-paying jobs that the ACCA course offers:

ACCA Course Structure: How the Journey Progresses From Start to Finish

The ACCA Course is organised in a way that mirrors how real finance careers grow. You begin with the Applied Knowledge papers, which give you the basic tools: how financial statements work, how costs behave, and how businesses function.

Then you step into the Applied Skills level, where the subjects start looking a lot like the tasks junior analysts, auditors, or accountants handle every day. By the time you reach the Strategic Professional level, the focus shifts to case-based thinking, drafting reports, analysing risks, and making decisions the way senior finance teams do. Mastering these levels enables you to explore a vast range of career opportunities with ACCA around the globe.

Level 1: Applied Knowledge

3 foundational subjects

- BT – Business and Technology

- MA – Management Accounting

- FA – Financial Accounting

Exam Format: On-demand computer-based exams.

Difficulty: Beginner-friendly.

Level 2: Applied Skills

6 intermediate subjects

- Corporate & Business Law

- Performance Management

- Taxation

- Financial Reporting

- Audit and Assurance

- Financial Management

Exam Format: Session-based exams (March, June, September, December)

Difficulty: Concept + application-heavy.

Level 3: Strategic Professional

4 advanced-level subjects

- Strategic Business Leader (Core)

- Strategic Business Reporting (Core)

- 2 Optional Papers (APM, AFM, AAA, ATX)

Exam Format: Case-study and professional judgment-based.

Difficulty: High; requires scenario thinking and analysis.

ACCA Course Duration Explained

The ACCA Course is modular. A driven candidate can finish it in 18–24 months, while a working professional might take 30–36 months. The variation is based on four factors:

1. Background-based exemptions

BCom/BAF students typically receive 3–5 exemptions.

MBA/CA Inter candidates may receive 6–9.

Non-commerce graduates usually begin with zero.

2. How many papers do you take per exam session

You may sit for:

- Up to 4 papers per session

- Up to 8 papers per year

This flexibility changes everything.

3. Whether you’re studying full-time or part-time

A full-time student can take 2–3 papers per session.

A working professional may prefer 1 paper at a time.

4. Resits

Pass rates globally hover around:

- Applied Knowledge: 65%

- Applied Skills: 50–55%

- Strategic Professional: 40–50%

Even a single resit can increase your ACCA time duration by 3 months. This is why mentorship-based coaching tends to shorten total duration.

ACCA Course Duration: How Long Does It Take to Complete the ACCA Journey?

Every ACCA journey runs at its own pace, and the duration depends heavily on where you’re starting from, how many exemptions you receive, and how many papers you can manage each exam window.

Instead of giving a one-size-fits-all number, this breakdown helps you understand the timeline that aligns with your background, schedule, and study style, so you can plan the ACCA Course realistically from day one. Whether you’re someone who wants to understand how to do ACCA after 12th or a mid-career professional looking for a strategic jump!

Below is an easy-to-understand mapping for students deciding how much time they realistically need:

| Profile | Estimated ACCA Time Duration |

| 12th Pass (Commerce) | 3–3.5 years |

| BCom/BAF Graduate | 2–2.5 years |

| MBA (Finance) | 1.5–2 years |

| CA Inter Cleared | 1.5–2 years |

| Non-commerce Graduate | 3–4 years |

| Working Professionals | 2–3 years, depending on workload |

Pass Rates Across ACCA Levels

When planning your preparation for the ACCA Course, it’s important to understand how pass rates vary across levels and papers. This helps you set realistic expectations and allocate your effort wisely.

Key Insights at a Glance

- Foundation / Applied Knowledge papers tend to show higher pass rates, often above 60–80%.

- Applied Skills and Strategic Professional levels generally register pass rates in the 40–55% range, indicating greater difficulty and need for deeper preparation.

- Some papers consistently show lower pass rates (especially optional Strategic Professional papers), signalling higher complexity and application-intensive content.

Recent Pass Rate Table by Level:

(Source)

Why the Variation in Pass Rates Matters

- The high pass rate for BT (~88 %) reflects its foundational nature and broader accessibility.

- Lower pass rates for FR, AFM and similar papers reflect greater complexity, case-based scenarios, and advanced application requirements.

- Understanding this helps you plan study time: for tougher papers, you should allocate more resources, and consider joining a structured programme like the one at Imarticus Learning to maximise your chances.

ACCA Course Duration: How Long Students Actually Take

When you look beyond official timelines and speak to students in real study groups, coaching classes, or audit firms, you notice a clear pattern: everyone’s ACCA journey settles into its own rhythm.

This section captures those real timelines based on how students actually study, attempt papers, and balance responsibilities, giving you a practical reference for what’s genuinely common

Scenario 1: Final Year BCom Student

- 3 exemptions

- Takes 2 papers per session

- Usually finishes in 30-32 months

Scenario 2: Working MBA Professional

- 4-6 exemptions

- Prefers 1 paper per session

- Usually finishes in 24-28 months

Scenario 3: CA Inter Student

- 5–7 exemptions

- Strong conceptual base

- Usually finishes in 18-22 months

Scenario 4: Non-Commerce Student

- No exemptions

- Needs more foundation building

- Usually finishes in 36-40 months

The following visual gives an overview of the preparation timeline for your ACCA journey.

Factors that Might Influence ACCA Course Duration and How To Avoid Them

Finishing the ACCA Course on time isn’t just about how hard you study; it’s shaped by a mix of practical, everyday factors that quietly stretch your timeline.

Things like exam spacing, unexpected retakes, inconsistent study routines, work pressure, or even choosing the wrong paper combinations can slow down your progress without you realising it. Therefore, it is important to understand the essential skills and knowledge of ACCA training.

Over the years, I’ve seen five things delay students more than the syllabus itself:

- Taking only one exam per year out of fear

This adds unnecessary time. - Long breaks between exam attempts

Momentum is one of the strongest predictors of ACCA success. - Blind preparation without exam technique training

Many students study but do not learn how to write answers that examiners reward. - Ignoring digital tools

ACCA exams are computer-based; Excel-like proficiency matters. - Not attempting the Ethics Module early

Many postpone it and end up delaying membership.

How Candidates Move Through the ACCA Course

The ACCA Course is wonderfully flexible because it supports every type of student. Whether you are starting after Class 12, midway through college, or already working in industry, ACCA adapts to your pace.

Below is a step-by-step map that students follow from registration to membership. This is the first time many readers see the entire journey structured cleanly.

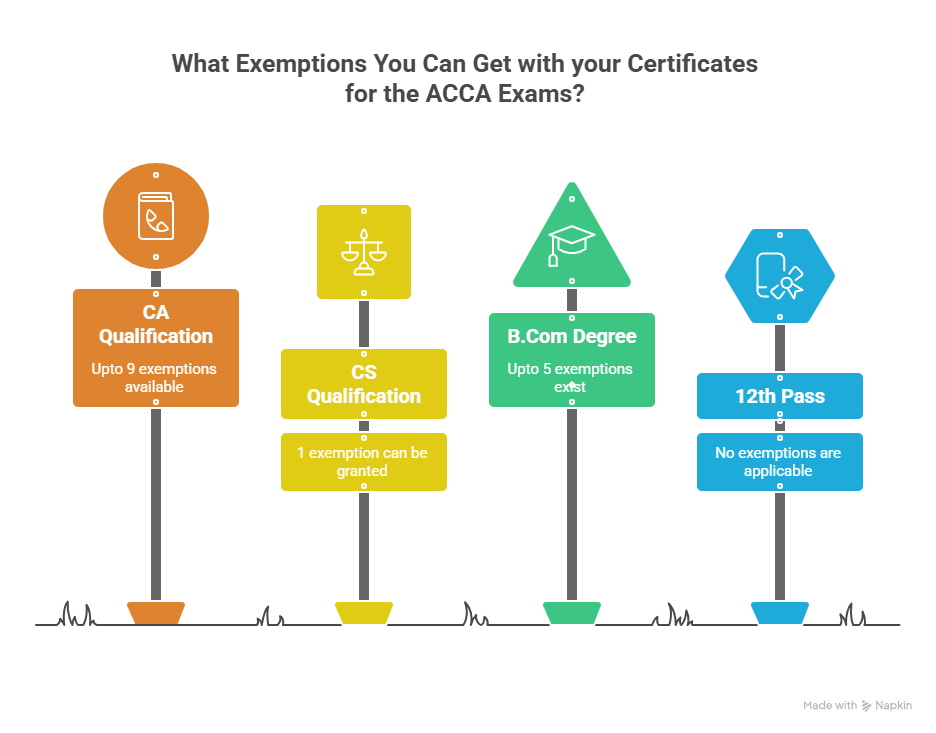

Step 1: Registration + Exemptions

ACCA evaluates your previous education and grants exemptions accordingly.

This is the point where your ACCA course duration changes dramatically.

Typical exemption patterns:

| Qualification | Expected Exemptions |

| Class 12 (Commerce) | 0 |

| BCom/BBI/BAF | 3–5 |

| MBA (Finance) | 4–6 |

| CA Inter | 6–9 |

| CA (Qualified) | 9 |

You can verify their exact exemptions on the ACCA Exemption Calculator to check for the specific exemptions you’re eligible for.

Step 2: Attempting the 13 Papers (Structure With Strategy)

This is where the ACCA Course becomes highly personal.

Students must choose between:

- 1 paper per session

- 2 papers per session

- 3 papers per session

- Mixing Applied Skills and Strategic Professional

Your paper sequencing affects everything: study load, retake probability, work pressure, and overall timeline.

Below is the mentor-tested sequencing plan that creates the best score stability:

Applied Knowledge Sequence

- Business & Technology

- Management Accounting

- Financial Accounting

Applied Skills Sequence

- Corporate & Business Law

- Financial Reporting

- Performance Management

- Taxation

- Audit & Assurance

- Financial Management

Strategic Professional Sequence

- Strategic Business Leader (mandatory)

- Strategic Business Reporting (mandatory)

- AFM/APM/ATX/AAA (optional 1)

- AFM/APM/ATX/AAA (optional 2)

Students frequently ask, “Should I attempt SBL early?”

The answer: SBL becomes meaningful only when your FR, PM, AA and governance fundamentals are strong. That’s why the above sequence offers stability.

Competitors rarely explain logical sequencing, making this section uniquely valuable for SEO and user retention.

Step 3: Ethics and Professional Skills Module (EPSM)

Every ACCA student must complete the EPSM before membership.

The EPSM is not just a formal requirement; it boosts Strategic Professional pass rates significantly.

ACCA’s own data shows that students who complete EPSM before SBL/SBR score 10–20% higher on average (Source: ACCA Global, “EPSM Impact Study”).

Step 4: Practical Experience Requirement (PER)

PER is what formally transforms a learner into a professional.

To gain membership, you must:

- Complete 36 months of relevant work experience

- Achieve 9 Performance Objectives (POs)

- Get your experience signed by an approved mentor

Students often fear PER. The truth?

Most finance or accounting roles automatically cover the required POs, whether in audit, FP&A, accounts, taxation, risk, or controllership.

Typical roles that count for PER:

- Accounts Executive

- Audit Associate

- Finance Analyst

- Tax Analyst

- FP&A Intern

- Risk and Compliance Trainee

- Reporting Analyst

Imarticus Learning integrates mentorship-oriented guidance into its ACCA program, helping students document POs correctly and stay PER-ready while studying.

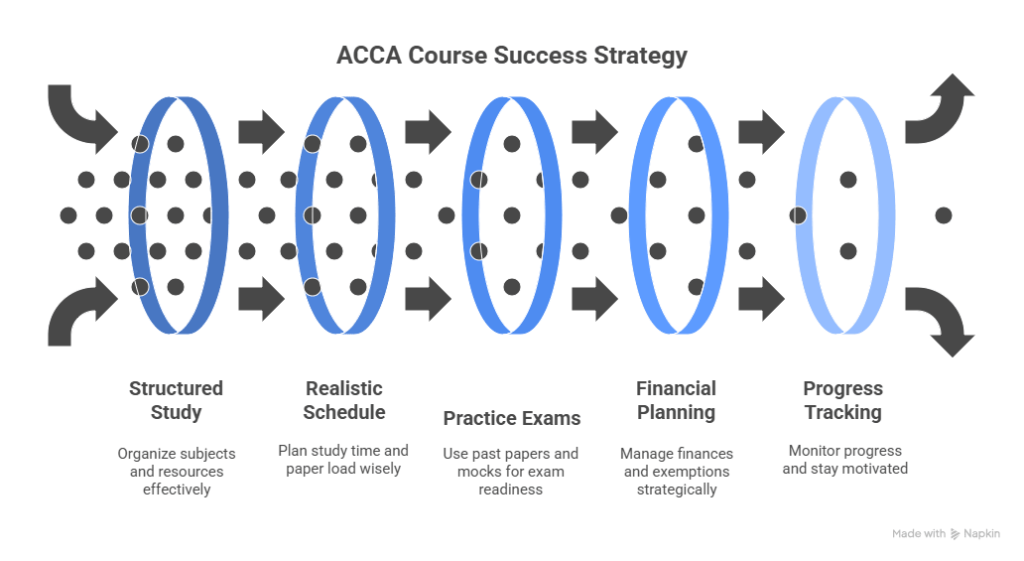

How To Complete the ACCA Course Faster: A Strategy That Actually Works

Every student wants to finish quickly without sacrificing understanding.

Here is the blueprint that consistently brings students to 18–24 months of completion.

1. Maximise exemptions (if possible)

If you’re eligible for 3, 5, or even 9 exemptions, claim them without hesitation. Students sometimes opt to “study everything” from scratch. This adds unnecessary time.

2. Attempt 2 papers per session (when feasible)

This is the most effective way to reduce ACCA course duration.

The sweet spot pairing that has worked for most students:

Ideal Applied Skills Combinations:

- FR + PM

- TX + FM

- AA + LW

Ideal Strategic Professional Combinations:

- SBL + APM

- SBR + AFM

These combinations balance numerical and theory-heavy papers.

3. Maintain continuity

Three-month breaks between papers increase failure probability dramatically.

The brain remembers best when the exam cycle remains active.

4. Use computer-based practice from Day 1

ACCA exams are digital, and speed matters.

Students who practise typing answers and creating workings directly on the system consistently reduce retakes and therefore total ACCA duration.

5. Complete the Ethics Module before the Strategic Professional

This improves:

- case interpretation

- judgement skills

- report writing

- marking logic

Here is a video breakdown of the ACCA exam pattern to help you on the go:

Optimal Exam Scheduling for ACCA Course

Here is the real plan students can follow:

If you want to finish ACCA in 18 months:

- Session 1: 2 papers

- Session 2: 2 papers

- Session 3: 2 papers

- Session 4: 2 papers

- Full year PER: Continuously

- Strategic Professional: Final 6–8 months

If you want to finish in 24 months while working:

- Attempt 1–2 papers per session, depending on workload

- Spread Strategic Professional across 3 sessions

- Complete EPSM before first SP paper

If you want a relaxed 3-year timeline:

- Attempt 1 paper per session

- Maintain PER throughout

- Complete EPSM anytime after Applied Skills

This visual will give you an understanding of planning your exams efficiently, which subjects you should focus on, and when you should actually take the exam:

PER (Practical Experience Requirement): Your Playbook for Completing It Smoothly

Most students know they need 36 months of experience.

Few know how to collect it efficiently.

Where Students Usually Gain PER

| Industry | Sample Roles |

| Big 4 Audit Firms | Audit Associate, Assurance Analyst |

| MNC Finance Teams | FP&A Analyst, Reporting Intern |

| Banks | Credit Analyst, Operations Analyst |

| Startups | Accounts Executive, Finance Generalist |

| Mid-sized CA Firms | Audit Trainee, Tax Assistant |

How to Log Experience Without Errors

- Document tasks monthly using ACCA’s MyExperience portal.

- Align each task with relevant performance objectives.

- Keep your supervisor updated: students often forget to get sign-offs.

- Revisit objectives before taking Strategic Professional exams to align skills.

The earlier the PER is started, the shorter your ACCA course duration becomes.

Expert Insight → Many students assume PER is complicated. In practice, it is easier than most academic stages, especially if guidance is available.

Real Job Roles That Use ACCA Course Skills

One of the strongest advantages of the ACCA Course is how directly its subject list translates into real workplace responsibilities. The concepts you learn in each paper aren’t academic exercises; they show up in audit files, management reports, tax computations, budgeting decks, and financial statements you’ll handle in your first job.

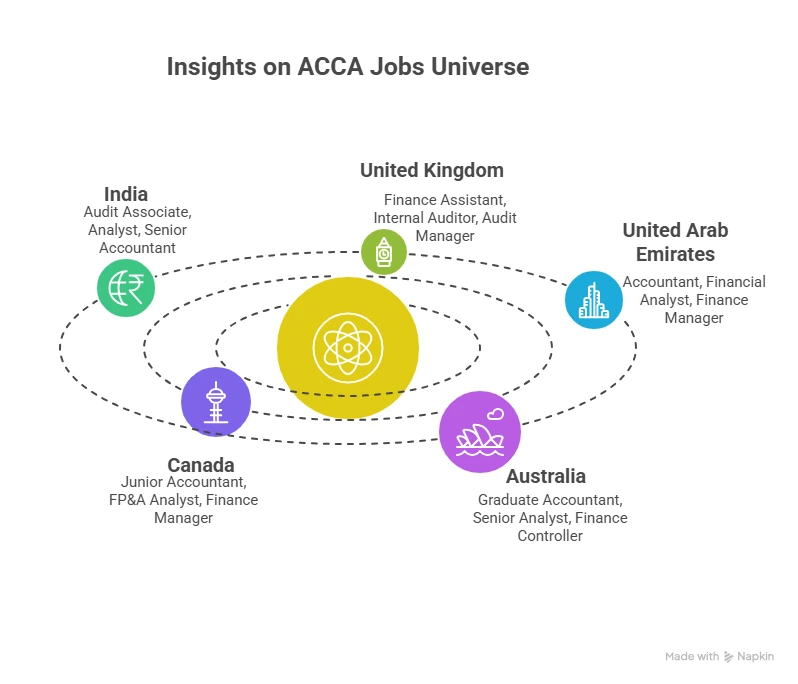

ACCA is a global certification that allows you to work in 180+ countries around the world. This section connects the skills you build across ACCA levels with the roles and tasks you’ll encounter in the real world, so you can clearly see how your studies shape your career from day one.

| ACCA Paper | Real Industry Skill | Where It’s Used |

| FR | IFRS application | Reporting teams, Big 4 assurance |

| PM | Cost control & budgeting | FP&A, manufacturing finance |

| AA | Audit evidence & testing | Internal/external audit |

| SBR | Strategic reporting | MNC finance, regulatory roles |

| SBL | Leadership & governance | Management roles, consulting |

| FM | Treasury & capital budgeting | Corporate finance |

FAQs about the ACCA Course

Students exploring the ACCA often have similar doubts about eligibility, duration, difficulty, career scope, and long-term prospects. This section brings together the most frequently asked questions about the ACCA course, answered clearly and practically, so you have a complete understanding before beginning your ACCA journey.

What is the ACCA course?

ACCA is a globally recognised professional accounting qualification offered by the Association of Chartered Certified Accountants (UK). It covers financial reporting, auditing, taxation, management accounting, and strategic leadership. Students choose ACCA because it offers international mobility and flexible exam scheduling. With guided mentorship and structured learning support at Imarticus Learning, clearing ACCA becomes significantly more achievable for beginners and working professionals.

Is ACCA better than CA?

The ACCA Course is internationally recognised, flexible, and aligned with global accounting standards like IFRS, making it ideal for careers in multinational companies. CA is more India-focused with deeper coverage of Indian taxation and law. Neither is “better”—the choice depends on whether you want global or domestic career opportunities. Many students prefer ACCA because the structure, resources, and faculty support from institutions like Imarticus Learning make the journey smoother.

How many years is the ACCA course?

The typical duration for ACCA is 2–3 years, depending on exemptions, study pace, and exam planning. Class 12 students may take 3–3.5 years, while CA Inter and commerce graduates complete it faster. With structured study plans and faculty-led exam preparation at Imarticus Learning, students usually finish the course within the optimal timeline.

Who is eligible for ACCA?

Anyone who has completed 10+2 with 50% marks, including at least 65% in English and Mathematics/Accounts, is eligible for the ACCA Course. Non-commerce students or those who don’t meet the criteria can join through the FIA (Foundation) route. Imarticus Learning guides students on the best entry path and helps them maximise exemptions based on their academic background.

Is ACCA full of math?

No, the ACCA course is not math-heavy. It focuses more on logic, analysis, finance, and accounting principles rather than advanced mathematics. Basic numerical skills are needed, but students do not require higher-level math. With the conceptual teaching approach at Imarticus Learning, even non-math students succeed comfortably.

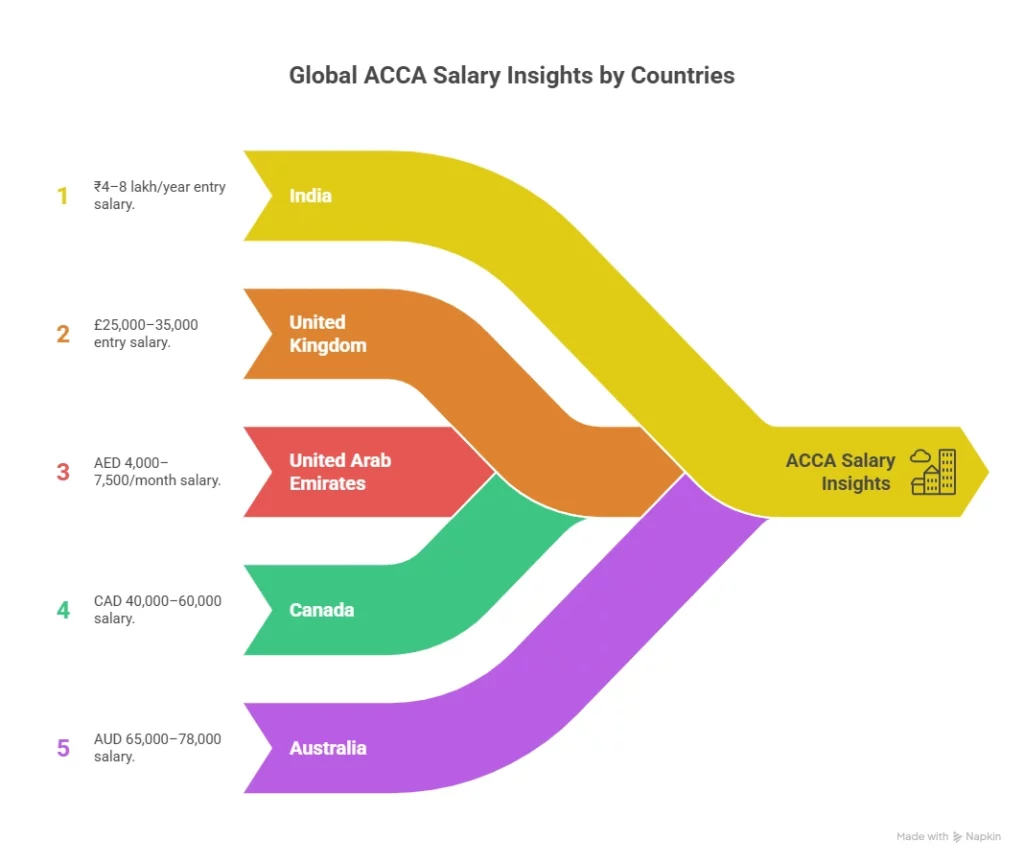

What is an ACCA salary?

Freshers completing the ACCA course in India typically earn between ₹5–8 LPA, while experienced ACCA professionals can earn ₹12–25 LPA depending on role and industry. In global markets, salaries scale even higher. Imarticus Learning’s placement assistance and industry-aligned training ensure students enter the market with strong skills and better job prospects.

What is the 7-year rule in ACCA?

The 7-year rule applies only to the Strategic Professional level of the ACCA Course. Once you pass your first Strategic Professional paper, you must complete the remaining ones within 7 years. Imarticus Learning’s structured timelines and exam strategies help students avoid delays and complete ACCA within the recommended timeframe.

What is the ACCA exam pass rate?

ACCA exam pass rates vary by paper, generally ranging from 35% to 55% at the Skills and Professional levels. Applied Knowledge papers have higher pass rates. Strong faculty guidance and mock exam practice, like what students receive at Imarticus Learning, greatly improve the chances of clearing each paper on the first attempt.

Does ACCA have demand in India?

Yes, the ACCA Course has a rapidly growing demand in India, especially across Big 4 firms, MNCs, fintech, and global capability centres value ACCA is valued because it follows international accounting standards, making graduates immediately job-ready. Imarticus Learning’s industry-driven curriculum ensures students match exactly what employers expect.

Is ACCA closing in 2026?

No, the ACCA Course is not closing in 2026. This is a common rumour caused by confusion over syllabus updates. ACCA regularly revises its syllabus to stay aligned with global standards, but it is not shutting down. Imarticus Learning keeps students updated on all ACCA changes so they remain fully compliant.

Can ACCA earn 1 crore?

Yes, ACCA professionals can earn ₹1 crore+ annually, especially in senior roles such as CFO, Finance Director, Audit Partner, or Global Reporting Lead in multinational firms. Achieving such roles requires expertise, experience, and continuous upskilling, something the ACCA Course builds strongly when supported by structured training from Imarticus Learning.

Which city is best for ACCA in India?

Major metro cities like Mumbai, Bangalore, Delhi NCR, and Hyderabad offer the best career and internship opportunities for students pursuing ACCA, thanks to Big 4 firms and global capability centres. However, since institutions like Imarticus Learning provide high-quality online ACCA coaching, students from any city can access premium training and placements.

Conclusion: Your ACCA Journey Begins With the Right Guidance

The ACCA Course opens doors to global finance careers, international mobility, and high-growth opportunities across industries. Understanding the course duration, syllabus, fees, exam structure, and long-term prospects helps you plan your journey with clarity.

With expert faculty, personalised mentorship, placement assistance, and structured learning support, Imarticus Learning helps students complete the ACCA journey confidently and effectively, whether you’re a 12th-pass student, graduate, or working professional.

If you’re ready to build a global career, start your ACCA Course journey with Imarticus Learning today.