I often meet students who want a global finance career yet feel stuck at the starting line. They search for how to do ACCA and find bits of advice that feel scattered. I like to explain the path in a way that feels like planning a long trip. You first pick the destination. Then you check your tickets. Then you pack the right things. The ACCA journey works in the same way.

To really understand the ACCA certification, you have to step away from textbooks for a moment and think about how businesses work in real life. Every company, big or small, runs on financial decisions.

→ How much can we spend?

→ Where should we invest?

→ Are we making a profit the right way?

→ Are we following the law?

These questions are not answered by guesswork. They are handled by trained finance professionals who understand numbers, rules, and risks.

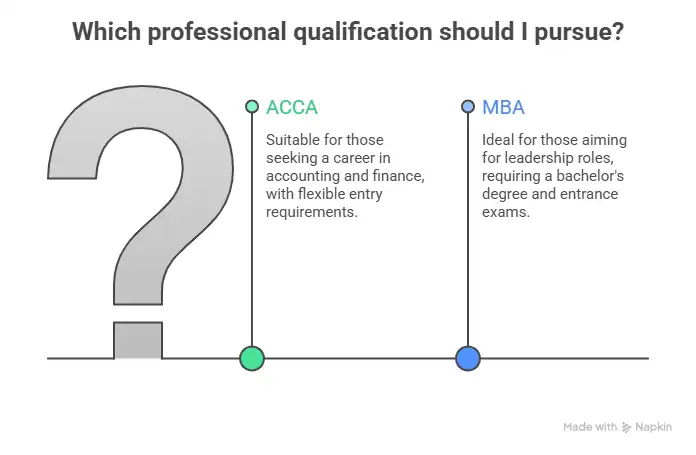

That is where the Association of Chartered Certified Accountants comes in. ACCA is a global professional qualification designed to prepare people for those exact responsibilities. It is built around international accounting standards, financial management, audit, taxation, and business strategy. So when I think about how to do ACCA, I am not just planning to pass a set of papers. I am preparing for a role that involves financial responsibility and professional trust.

With that clarity in place, the next parts of this guide focus on the practical side. Eligibility, registration, exam structure, study planning, costs, and career paths will all make more sense because they connect back to a clear goal rather than feeling like isolated tasks.

Did you know?

ACCA has over 240,000 members and more than 540,000 students worldwide, according to the ACCA official. This shows how global the network is.

What The ACCA Qualification Really Involves

Before I figure out how to do ACCA, I need to understand what I am signing up for clearly. Many students jump straight into exam planning without knowing the full picture. That often leads to confusion later. So first, here is a simple explanation of what is ACCA? and why this qualification holds global value.

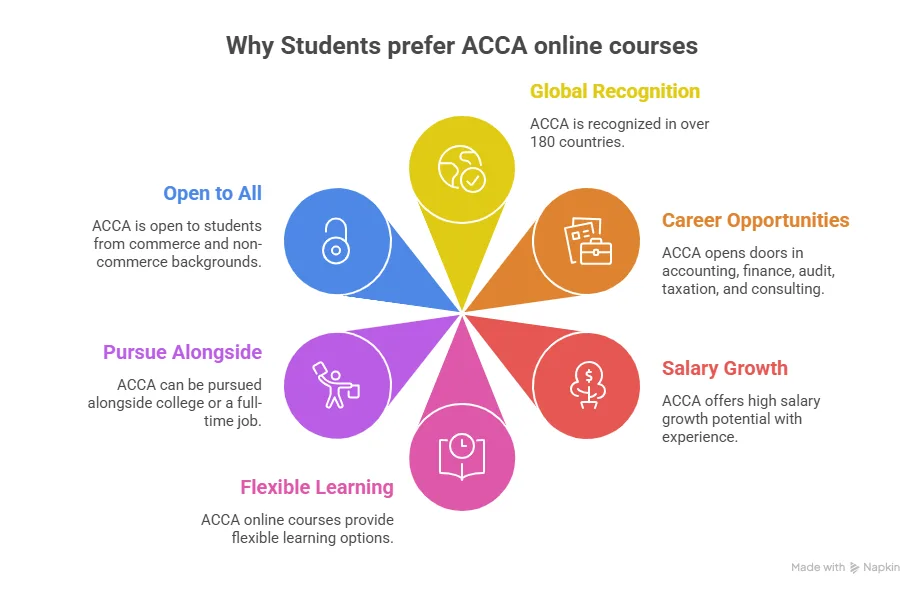

The Association of Chartered Certified Accountants is a professional accounting body based in the United Kingdom. It offers an internationally recognised qualification in accounting and finance. Members work in companies, audit firms, banks, startups, and multinational corporations. You can truly think of ACCA as a global passport for finance professionals, as it enables you to work in 180+ countries globally. It shows that you understand accounting rules, financial management, audit & taxation, and business strategy at an international level.

How ACCA Is Structured

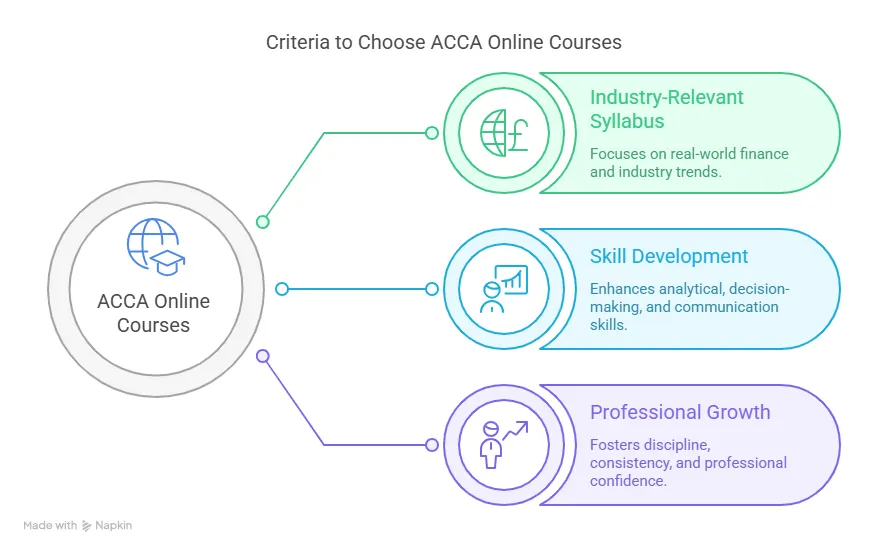

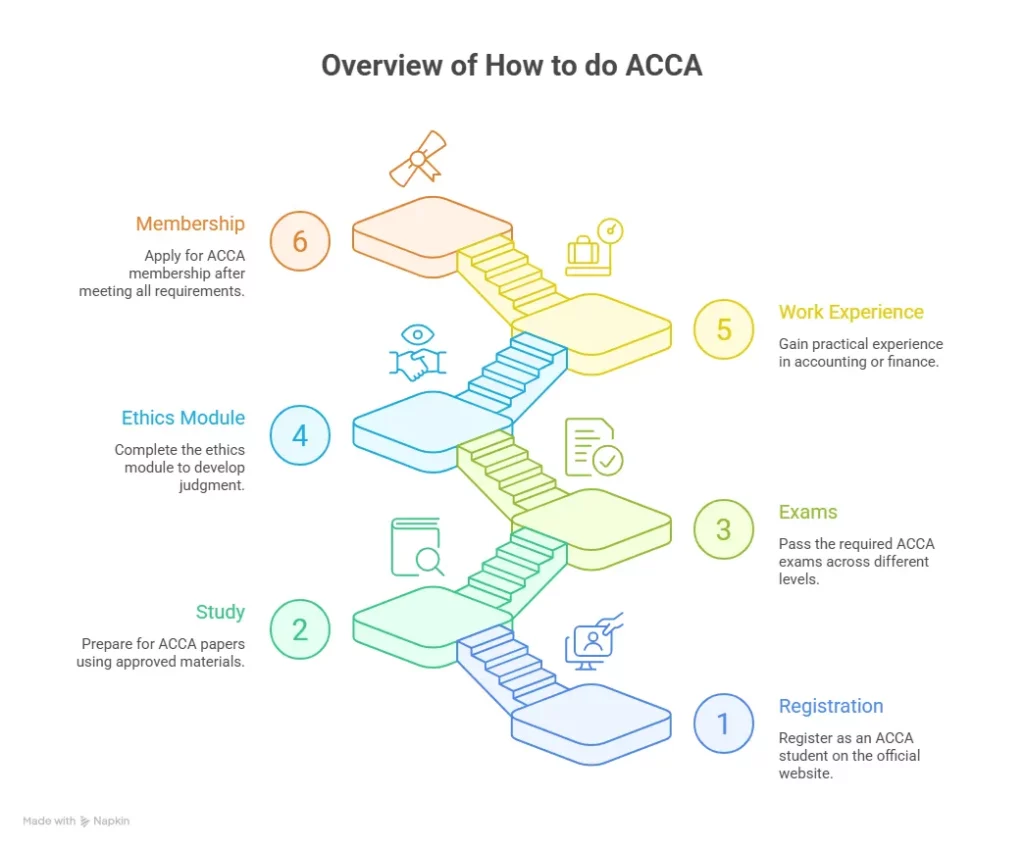

The ACCA course details are divided into levels. Each level builds deeper knowledge and stronger practical skills.

- Applied Knowledge level: This is the ground floor. You learn basic accounting. You learn business rules. You learn how money flows in a company.

- Applied Skills level: This is the middle floor. Topics become deeper. You study taxation. You study performance management. You study audit.

- Strategic Professional level: This is the top floor. You solve case studies. You think like a finance leader. You apply judgment.

Each level needs focus. Rushing through rarely works. Along with exams, you also complete an Ethics module and gain practical work experience. These make sure you are ready for real workplace responsibilities, not just theory.

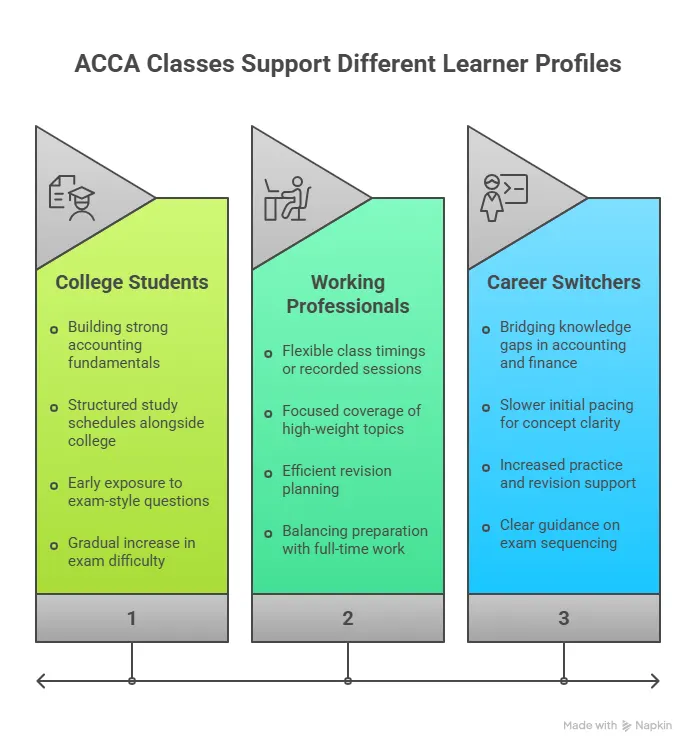

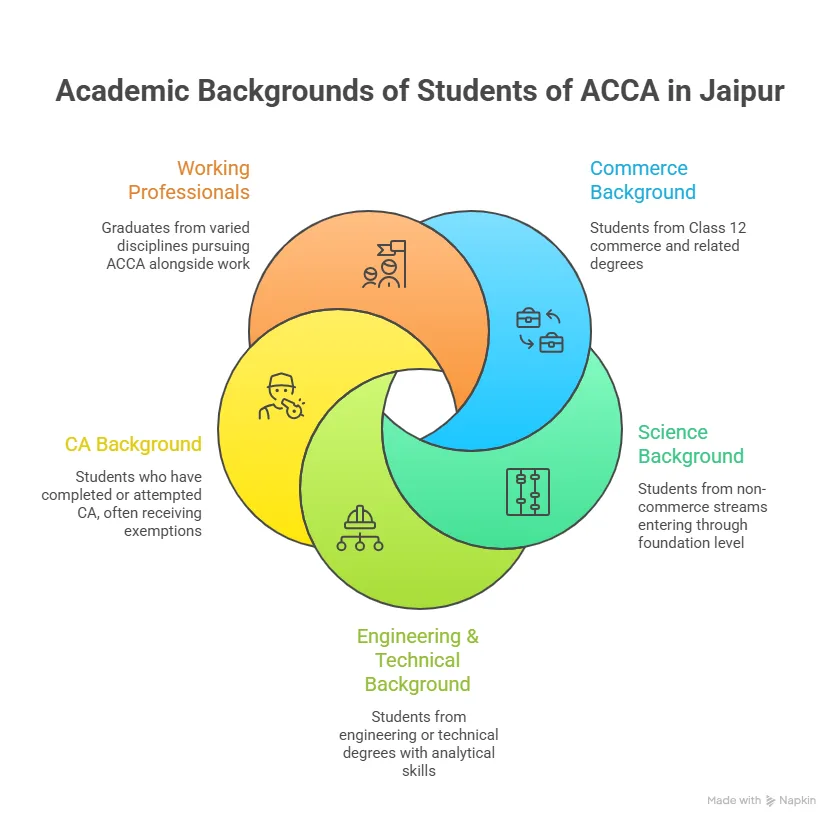

Who Usually Chooses ACCA

Students from different stages of education can start ACCA.

- Commerce students after 12th

- BCom and MCom graduates

- CA or CMA students wanting global exposure

- Working professionals in accounting roles

This wide entry range explains why searches like how to do ACCA after 12th and how to do ACCA after CA are so common.

Getting clarity at the beginning makes the rest of the ACCA journey much easier to navigate. Understanding the levels, exam format, and career relevance gives a clearer picture of what to expect before moving into detailed preparation plans.

Who Can Start ACCA In India?

Students often ask me how to do ACCA after 12th. The good news is that commerce students can start right after school. You need English and Maths marks that meet ACCA course eligibility. If someone does not meet them, there is a foundation route. I can also put it like this. If the main door is closed, there is a side door that leads to the same building.

Graduates also join. Many want to know how to do ACCA after BCom. In this case, some papers may be exempt. That means you skip a few early exams. It saves time. It saves money. Chartered Accountants ask how to do ACCA after CA. They usually receive more exemptions. Their past studies already cover many topics. Still, they must pass advanced papers. Those papers test global standards.

Simple View Of Entry Routes

Before choosing a path, it helps to see options clearly. Here is a quick guide.

| Path | Can Start ACCA | Extra Notes |

| 12th Commerce | Yes | May start at the foundation or applied level |

| BCom Graduate | Yes | Possible exam exemptions |

| CA Qualified | Yes | Higher exemptions likely |

| Non Commerce | Yes | May need foundation level first |

This table helps when someone wonders how to do ACCA with BCom or after another degree. The route changes, but the final goal stays the same.

Registration Basics Of The ACCA Qualification

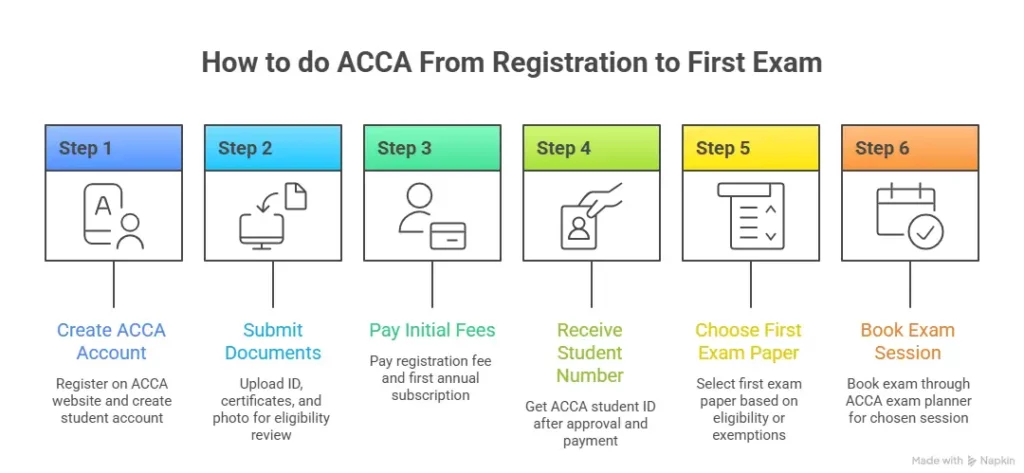

When students search for how to do ACCA registration, they expect a complicated form. It feels simpler when broken into steps. I compare it to opening a bank account online.

You create an account on the ACCA website. You upload documents. You pay a registration fee. You receive a student number. That number stays with you for the full journey.

Here is what you usually need:

- Passport or ID proof

- Academic mark sheets

- Passport-size photo

- Payment method for fees

Once registered, you can book exams and track progress.

Also Read: How Difficult Is the ACCA Syllabus Really?

How To Do ACCA After 12th

Starting ACCA right after school is possible for commerce students who meet ACCA’s minimum marks requirement in English and Mathematics. If those marks are not met, the Foundation in Accountancy route provides an alternative entry path. This makes the qualification accessible even if school scores are not perfect.

At this stage, the focus is on building strong basics in financial accounting and business before moving into advanced papers. Students entering early also get more time flexibility to complete exams alongside college.

| Step | What You Do | Details |

| Check Eligibility | Review 12th marks | Minimum required marks in English and Maths as per ACCA entry criteria |

| Alternative Route | Foundation in Accountancy (FIA) | Entry pathway if direct eligibility is not met |

| Register | Create an ACCA account | Register as a student on the official ACCA website |

| Start Level | Applied Knowledge exams | Begin with Business & Technology, Management Accounting, and Financial Accounting |

| Progression | Move to higher levels | After clearing the early papers, continue to Applied Skills |

Also Read: Can I Pursue ACCA Right After 12th?

How To Do ACCA After BCom

A BCom degree gives a strong base in accounting and finance, so many graduates receive exemptions from some early ACCA papers. This reduces the number of exams needed and shortens the overall journey.

Students should apply for exemptions during registration by submitting academic transcripts. Even with ACCA exemptions, it is helpful to revise basic topics to prepare for advanced papers.

| Step | What You Do | Details |

| Apply for Exemptions | Submit BCom mark sheets | ACCA reviews subjects studied to grant paper exemptions |

| Registration | Register as an ACCA student | Exemptions are processed during account setup |

| Starting Level | Usually Applied Skills | Depends on the number of exemptions granted |

| Study Focus | Stronger technical subjects | Taxation, Performance Management, Financial Reporting |

| Progression | Move to Strategic Professional | After clearing the Skills level papers |

How To Do ACCA After CA

Qualified Chartered Accountants often receive the highest number of exemptions because their prior studies cover many technical areas. This allows them to begin directly at the Strategic Professional level in many cases.

However, advanced ACCA papers focus on international standards and strategic decision-making, so preparation still requires dedicated effort.

| Step | What You Do | Details |

| Exemption Claim | Submit CA qualification proof | ACCA grants multiple paper exemptions based on prior qualification |

| Registration | Register with an exemption request | Most early and skills-level papers may be exempt |

| Starting Level | Strategic Professional exams | Typically begins with essential and optional professional papers |

| Study Focus | Global standards and strategy | Advanced audit, financial management, and strategic business leadership |

| Final Requirement | Complete ethics and PER | The work experience and ethics module is still required for membership |

Also Read: Why ACCA UK Certification Is a Must-Have for Aspiring Accountants

How Long Does The ACCA Journey Take?

Students always ask how long it takes to do ACCA. I give a range. Most students take three to four years. Some finish faster with exemptions. Some take longer due to work or personal breaks.

Before looking at the ACCA course duration, it helps to remember that ACCA is flexible. The duration depends on exemptions, study pace, and personal schedule. Some students move quickly with fewer papers. Others take a steady approach while working or studying alongside.

| Student Situation | Papers to Complete | Typical Pace | Estimated Duration |

| After 12th (No Exemptions) | Up to 13 exams | 2 papers per session | 3.5 to 4 years |

| BCom Graduate (Some Exemptions) | Around 9 to 11 exams | 2 papers per session | 2.5 to 3.5 years |

| CA Qualified (Many Exemptions) | Around 4 to 6 exams | 1 to 2 papers per session | 1.5 to 2.5 years |

| Full-Time Student | Flexible load | 2 to 3 papers per session | 2.5 to 3 years |

| Working Professional | Limited weekly study time | 1 to 2 papers per session | 3 to 4 years |

Important Note:

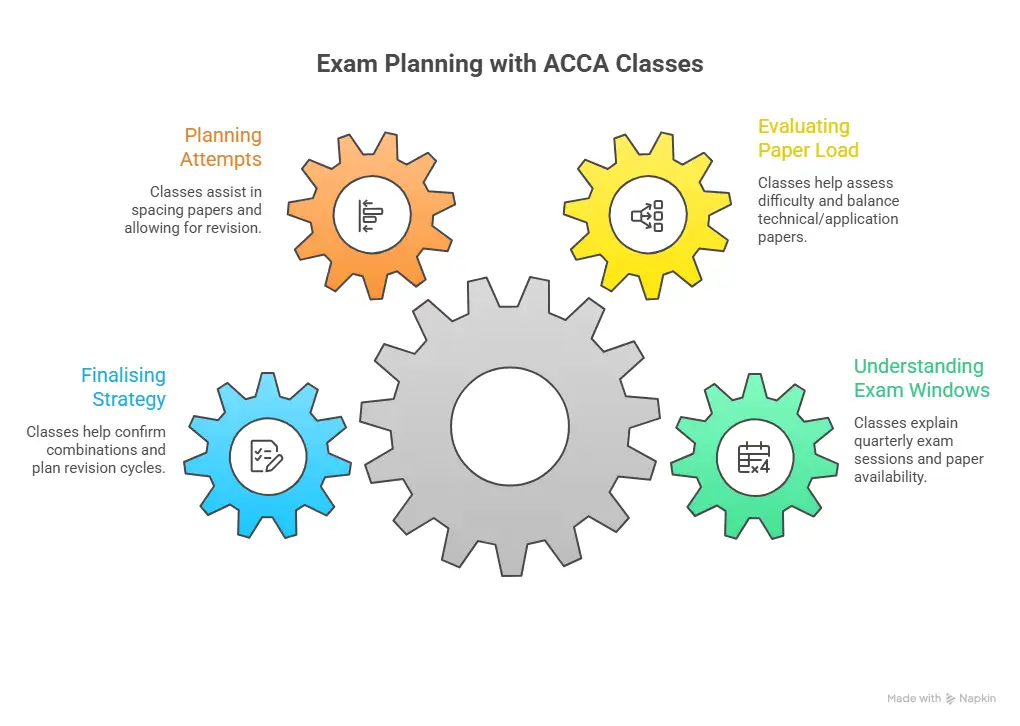

ACCA allows four exam sessions each year. Students can choose how many papers to attempt per session, depending on their preparation level. In addition to exams, the Ethics and Professional Skills Module and Practical Experience Requirement must be completed, which can run alongside exam preparation and does not usually extend the total timeline if planned early.

A Clear First Action Plan

When someone feels lost about how to do the ACCA course in India, I share a starting checklist.

- Check eligibility and exemptions

- Register on the ACCA official site

- Choose the first two papers

- Decide study method

- Create a weekly study timetable

Finding the right study support does not always mean spending more. Using them wisely alongside a structured study plan can make preparation more efficient and help build confidence before each exam attempt.

Picking The Right First Exams For ACCA

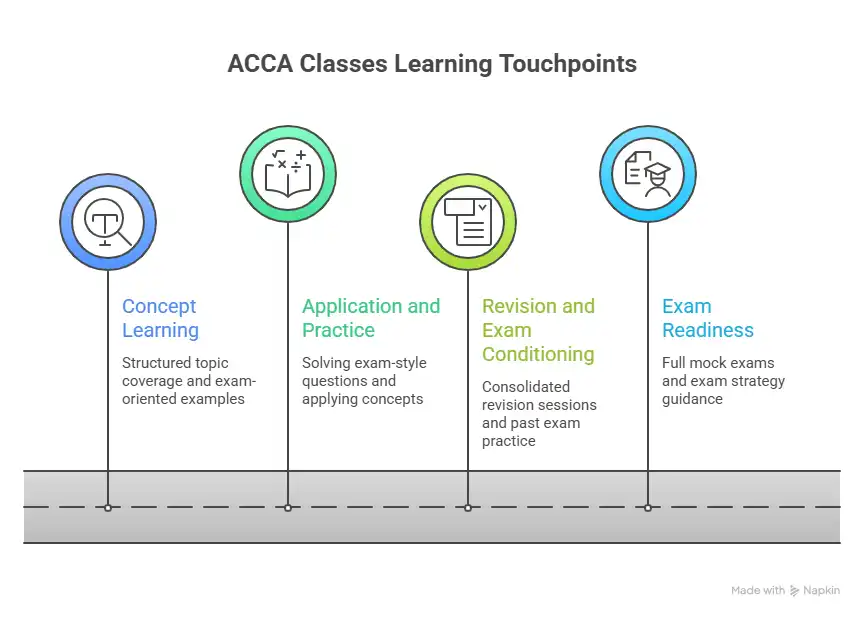

After registration, the next big question is how to plan studies without feeling buried under books. I like to treat the ACCA syllabus like a long road trip. You do not drive the whole distance in one day. You cover small stretches. You stop. You refuel. Then you move again.

When thinking about how to do ACCA exams in the best order, I suggest starting with subjects that build confidence. Early papers teach core ideas that appear again later. These papers usually include:

- Business and Technology

- Financial Accounting

- Management Accounting

These feel familiar to commerce students. They form the base for advanced topics. If you are figuring out how to do ACCA after 12th, these subjects ease you into the system. For graduates exploring how to do ACCA after BCom, exemptions may remove some of these papers. In that case, the next level begins sooner. It is still wise to revise the basics before moving ahead.

Making A Weekly Study Routine

Many students ask, ‘How many hours do you need to study for ACCA?’ and still manage college or work. Here is a simple weekly pattern.

| Day | Task |

| Monday | Read the theory for one topic |

| Tuesday | Practice questions from that topic |

| Wednesday | Revise mistakes |

| Thursday | New topic study |

| Friday | Question practice |

| Saturday | Mock test or revision |

| Sunday | Light reading or rest |

This plan supports anyone learning how to do ACCA online while balancing other duties.

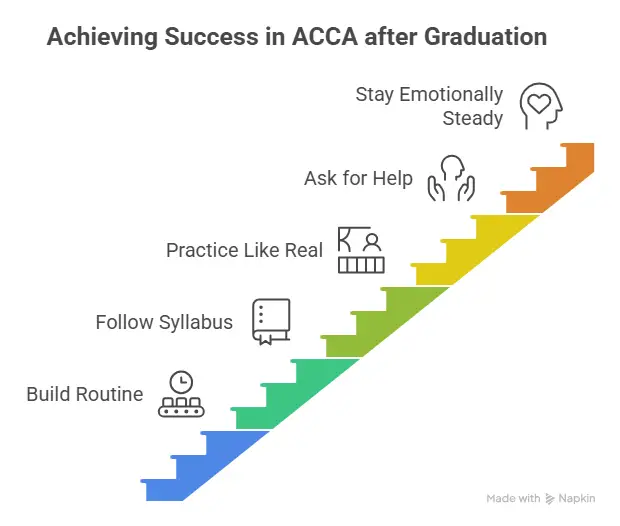

Preparing for ACCA exams often feels overwhelming at first, especially when aiming to clear papers on the first attempt. Understanding how to manage time during preparation, avoid common mistakes, and use practice questions effectively helps build both confidence and accuracy before exam day.

Understanding The ACCA Exam Format

Before students book a paper, they must know how the exam works. This removes fear. Most ACCA exams are computer-based. Questions include multiple choice, case studies, and written answers. Time management matters as much as knowledge.

I often suggest practising on the ACCA practice platform. It feels like a rehearsal before a stage show. You know where the buttons are. You know how to type answers. This is important when planning how to do ACCA exams with confidence.

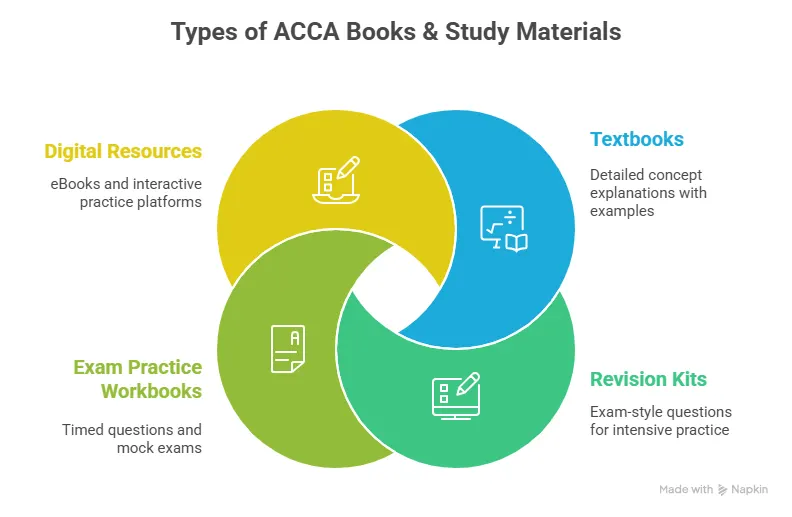

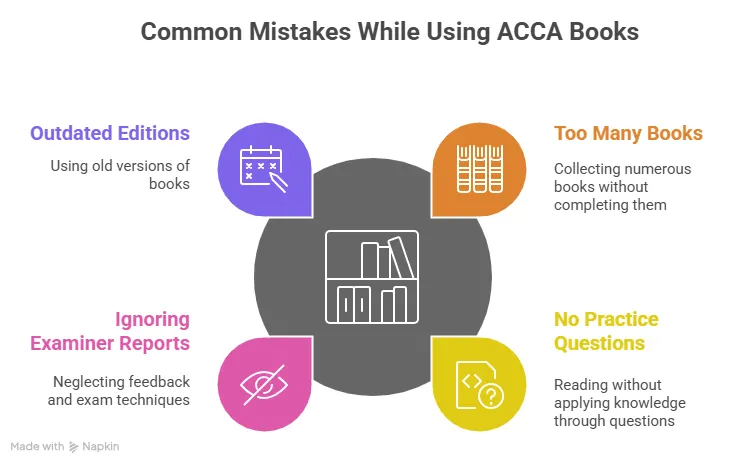

Choosing The Right Study Material

The ACCA syllabus is wide. Choosing the right ACCA study material saves time. I suggest using:

- Approved study texts

- Exam kits with past questions

- Short revision notes

- Video lectures for difficult topics

Structured programs from Imarticus Learning guide students through each paper with planned schedules. This helps when someone feels unsure about how to do ACCA course without missing topics.

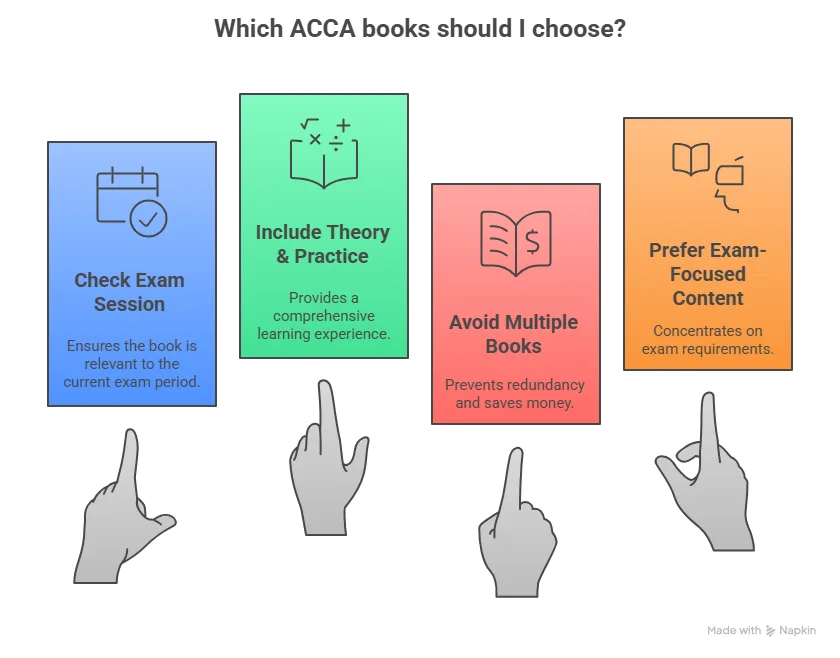

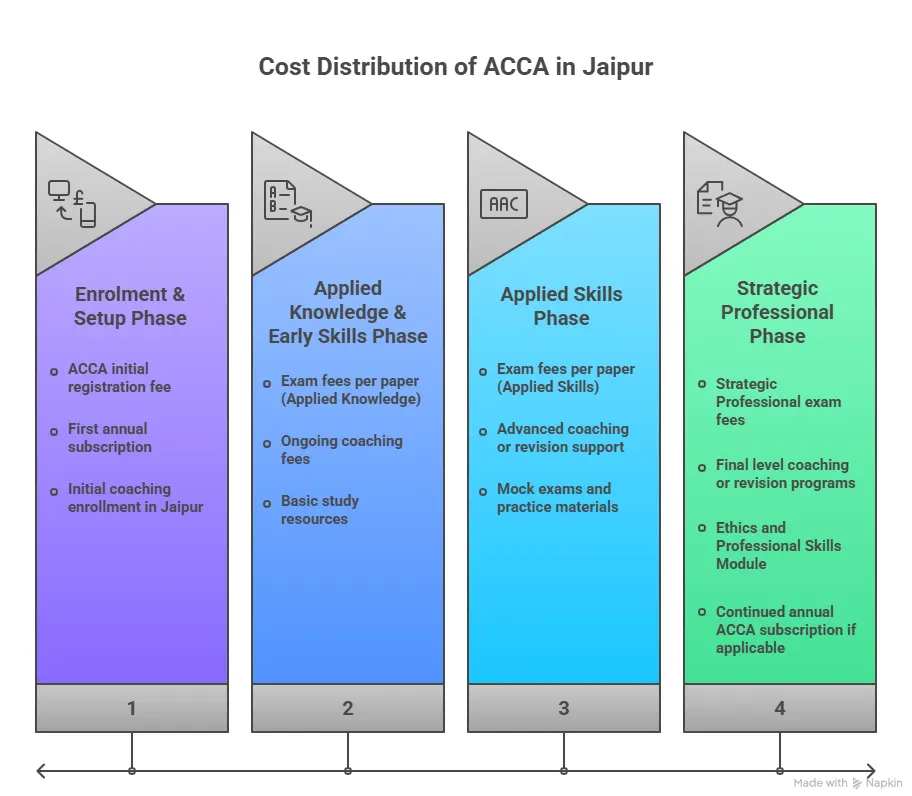

Handling Exam Booking And Payments

Another doubt I hear is how to do payment in ACCA and book exams correctly. The ACCA portal shows exam entry deadlines. There are early and standard booking dates in the ACCA course fees. Early booking costs less.

Payment can be made using international cards or other accepted methods on the ACCA portal. Always keep a screenshot of the payment confirmation. It helps in case of technical issues. Booking early also gives you time to prepare mentally. Late booking often leads to rushed study.

Having a clear exam plan can make ACCA preparation feel far more manageable. Knowing how the papers are structured, how often exams are held, and how to space attempts across sessions helps reduce last-minute pressure. A well-thought-out strategy that balances study time, practice, and revision can improve confidence and keep progress steady throughout the qualification.

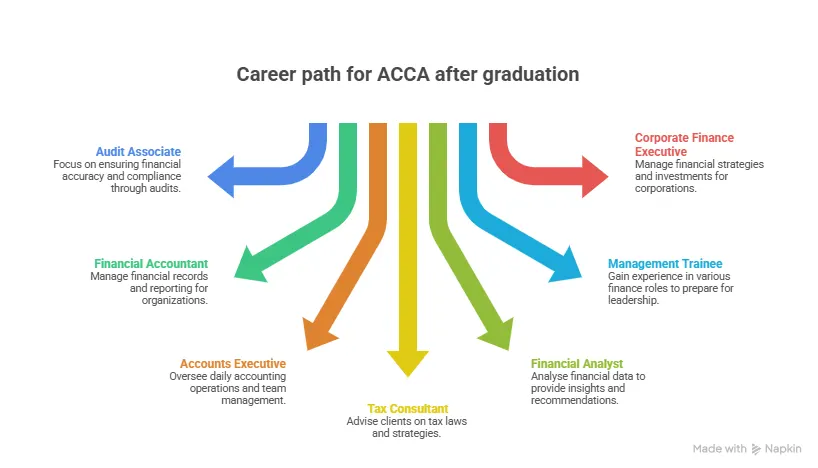

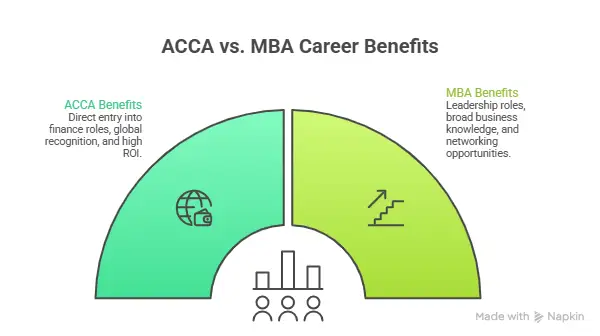

Career Paths After ACCA In India

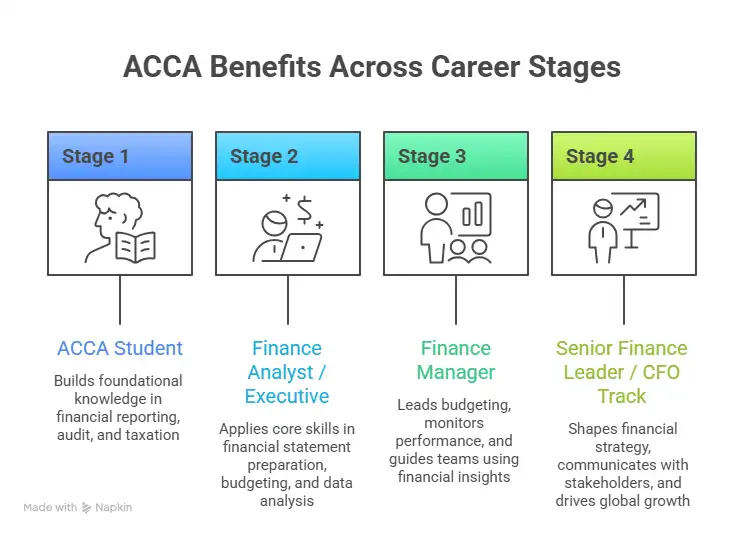

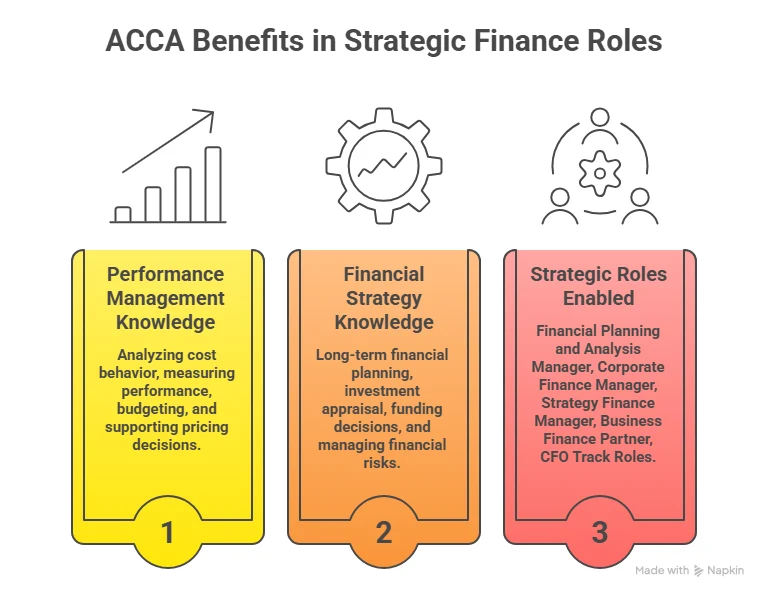

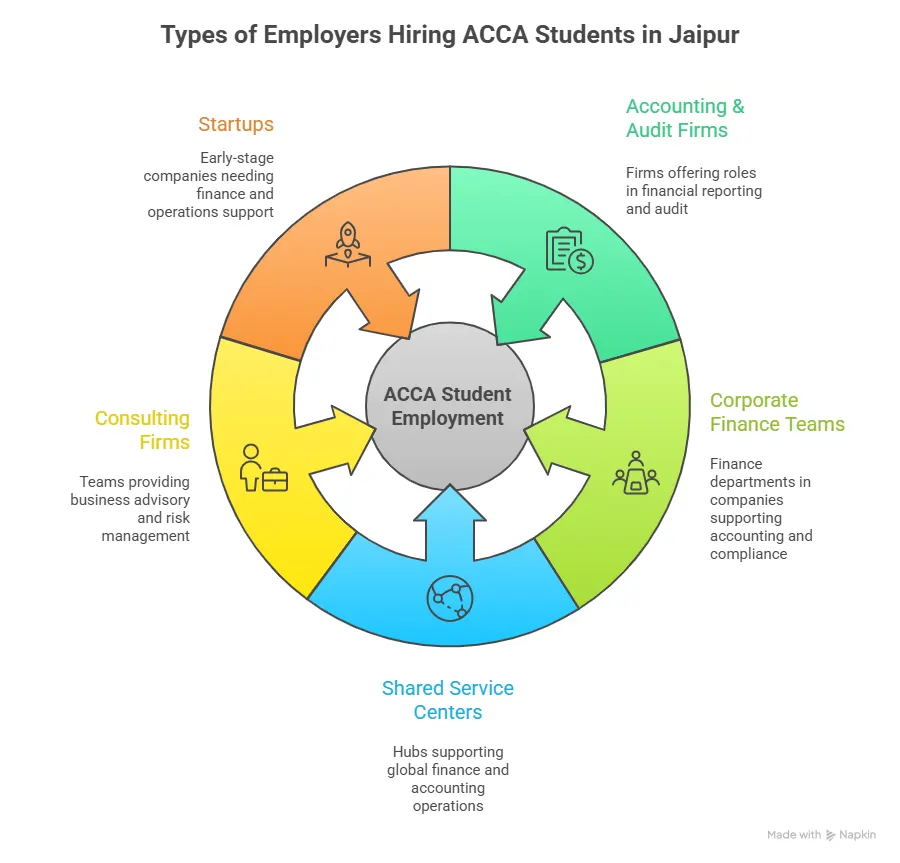

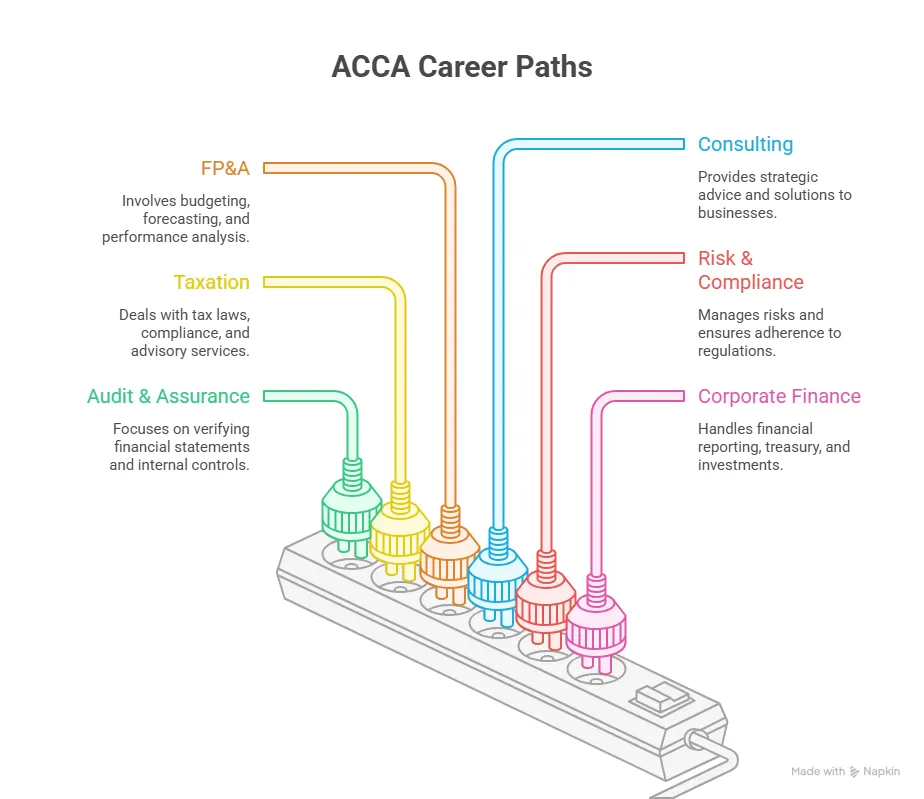

As the exams move to higher levels, career planning becomes just as important as studying. Many students focus only on passing papers. I also think about where the qualification will take me. When someone searches for how to do ACCA, they are often thinking about job roles, salary growth, and global options.

ACCA professionals work in many areas. Large companies, audit firms, startups, and consulting firms all hire them. Roles vary based on interest and skill. Here are common job areas in the ACCA career ecosystem:

- Audit and Assurance

- Taxation

- Financial Planning and Analysis

- Risk and Compliance

- Internal Audit

- Consulting

In India, many ACCA students start in audit or accounting roles and later move into management positions. The qualification builds strong reporting and analytical skills that companies value.

Opportunities Outside India

Some students aim to work abroad. In that case, understanding how to do ACCA in the UK or other countries helps. ACCA is based in the UK, so it is widely recognised there. Many Middle East and Southeast Asian companies also prefer ACCA professionals.

Working abroad often requires:

- Strong communication skills

- Knowledge of international accounting standards

- Relevant work experience

Planning early helps. Choosing roles that deal with global reporting standards adds value.

Did you know?

According to ACCA’s global reports, members work in over 180 countries. That kind of reach means the qualification is not tied to one job market or economy. It gives professionals the flexibility to build careers across borders, industries, and financial systems

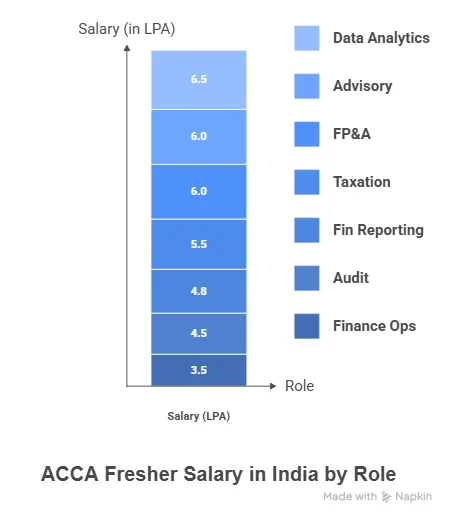

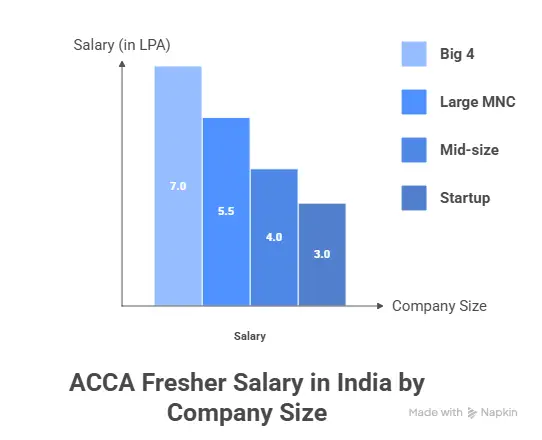

ACCA Salary Outcomes in India

ACCA salary in India depends on skill, city, and experience. Entry-level roles may offer moderate salaries. Growth comes with experience and specialisation.

| Experience Level | Typical Salary Range | What It Represents |

| Entry-Level (0-2 years) | ₹4 – 8 LPA | Fresh ACCA affiliates working in accounting, audit, and finance analyst roles in India |

| Mid-Level (3-5 years) | ₹10 – 15 LPA | Roles with greater responsibility, often in audit teams, FP&A, or tax functions |

| Senior-Level (5-8 years) | ₹15 – 25 LPA | Senior analysts, managers, and financial controllers |

| Leadership / Expert (8+ years) | ₹25 – 40 LPA+ | Finance directors, senior managers, and function heads |

| Big 4 & Top MNCs (varies with experience) | ₹6 – 25 LPA+ | Big 4 and large multinational firms often pay toward the higher ends of these ranges |

These stages show why long-term focus matters when planning how to do ACCA in India.

Long-Term Growth After Qualification

Once exams and experience are complete, ACCA membership opens leadership paths. Many professionals move into finance head roles. Some start their own consulting firms. Some enter teaching or training. Continuous learning remains important. Tax laws change. Reporting standards update. Staying current keeps ACCA skills relevant.

Also Read: Why Choose ACCA for Mastering the Art of Accountancy

Why Choose ACCA Preparation With Imarticus Learning

When I explain how to do ACCA, I always emphasise that the quality of preparation matters as much as dedication. Imarticus Learning’s ACCA Program prep is designed to address exactly this need for organised, practical, and outcome-oriented preparation.

Here are the key ways the ACCA Program by Imarticus Learning supports learners:

- Gold-Status ACCA Learning Partner: Imarticus Learning is recognised as a gold learning partner by ACCA itself, ensuring training quality aligns with global standards and official ACCA expectations.

- Industry Collaboration With KPMG in India: The curriculum includes real-world case studies and a joint certification developed with KPMG in India, giving learning practical relevance beyond exams.

- Kaplan-Powered Study Materials: Access to ACCA-approved content from Kaplan Publishing, including books, practice papers, MCQs, flashcards, videos, and on-demand sessions led by experienced faculty.

- Money-Back Assurance: For those committed to completing the professional-level papers, there is a money-back guarantee if the exams are not cleared as per the terms, reducing risk while you study.

- Placement and Internship Support: Strong placement or internship assurances are part of the programme, helping students transition from qualification to practical roles.

- Exposure to Top Hiring Partners: The programme connects learners with a wide set of hiring partners ranging from audit and consulting firms to multinational corporations, broadening career options.

FAQs on How to do ACCA

Before committing to a professional qualification, most people have practical doubts that need clear answers. From eligibility and exam difficulty to online study options and handling setbacks, these are the most frequently asked questions and addressing them properly makes the path forward less confusing.

How do I qualify for ACCA?

To qualify, I complete the required exams, finish the ethics module, and gain practical experience. Understanding how to do ACCA helps me plan each stage clearly. Many students begin their preparation with structured support from Imarticus Learning to stay on track with exams and skill development.

Is ACCA more difficult than CA?

Difficulty depends on interest, study style, and career goals. When I focus on how to do ACCA step by step, the journey feels manageable with steady effort. Coaching guidance from Imarticus Learning often helps learners stay consistent and confident through each paper.

How do I become an ACCA?

I register as a student, pass exams, complete ethics training, and record work experience. Learning how to do ACCA in a planned way keeps progress smooth. Many learners choose Imarticus Learning for structured classes and mentorship during preparation.

Is ACCA harder than a degree?

ACCA requires professional-level understanding and practical application. When I plan how to do ACCA with proper scheduling, the challenge becomes structured rather than overwhelming. Guidance programs from Imarticus Learning often help students balance study and work.

Can I study ACCA online?

Yes, online learning works well with discipline and good resources. I follow a schedule and attend virtual classes while learning how to do ACCA from home. Platforms like Imarticus Learning provide online sessions, recorded lectures, and doubt-solving support.

Can I get ACCA for free?

The qualification has official fees for registration and exams. While exploring how to do ACCA, I still use free practice questions and study groups to reduce extra costs. Scholarships and employer sponsorships may also help in some cases.

What if I fail an ACCA exam?

Failure means I review mistakes and improve my strategy for the next attempt. Staying focused on how to do ACCA the right way helps me come back stronger. Many students use revision support from Imarticus Learning after an unsuccessful attempt.

Can I do ACCA at home?

Yes, home study works with discipline, internet access, and proper materials. I create a routine and stay connected with mentors while learning how to do ACCA remotely. Online coaching from Imarticus Learning helps many home learners stay guided and motivated.

Beginning Your ACCA Path With Clarity

Standing at the start of a professional qualification can feel strange. There is excitement. There is doubt. There are many browser tabs open. At the same time, there is also clarity now. You know what ACCA involves. You know the exam structure. You know how long it can take and what kind of effort it requires. That makes a big difference.

It also helps to remember that no one prepares perfectly every week. Some days go exactly as planned. Some days feel slow. What matters is returning to the plan without guilt and continuing from where you paused. That consistency is what carries most students through.

Guidance can make this rhythm easier to maintain. A structured study plan, regular doubt-solving, and exam-focused practice reduce the time spent wondering what to do next. The ACCA Course prep through Imarticus Learning brings direction and accountability into the routine without making preparation overwhelming.

ACCA is a long-term investment in skill, credibility, and career mobility. The journey does not need to feel rushed. It needs to feel steady. Once the first step is taken, the rest becomes a series of manageable milestones rather than one giant leap. All that remains now is to begin, stay consistent, and let each completed stage build momentum for the next.