Fintechs are financial services or products that technology provides. There is no definitive definition, but the term “fintech” has become very popular in finance and banking circles over the last few years. This blog post will explore the five things learners could do to catch up with fintech innovations.

What are fintech innovations?

Fintech innovations have three categories:

- Payments and money transfers

- Lending and borrowing

- Wealth management and investment

These categories include a range of different fintech products and services.

The rise of fintech:

Fintech started to boom after the Global Financial Crisis (GFC) in 2008. At that time, there was a need for financial institutions and banks to innovate their business models so they would not get outcompeted by new players from outside traditional finance circles. Before GFC, big banks and financial institutions didn’t have to innovate because they were the only players in town.

Here are five things that learners could do to catch up with fintech innovations:

#1. Learn about the different types of fintech products and services

It’s essential to understand the different types of fintech products and services. It will help you know how fintech is changing traditional finance, and it will also give you ideas for potential business models that you could startup.

#2. Use fintech products and services

Once you have a basic understanding of fintech, it’s essential to start using the products and services. It will help you understand how they work and benefit you.

For example, if you’re interested in mobile payments, start using Apple Pay or Android Pay apps.

#3. Attend fintech events and meetups

Attending fintech events and meetups is a great way to learn more about the latest innovations in space. You’ll also hear from industry experts, and you’ll also have the opportunity to network with other people interested in fintech.

Some of the best events include the Finnovasia conference in Hong Kong and the Singapore Fintech Festival. You can also check out websites like Fintech Weekly, which lists all the upcoming fintech events worldwide.

#4: Follow fintech leaders on social media

Following fintech leaders on social media is a great way to stay up-to-date with the latest innovations in the space. You’ll get insights into what they’re working on, and you’ll also learn about new products and services.

#5: Read books about fintech

There has been a surge of new books that explore the topic of fintech. Why not pick up one or two and learn more if you’re interested? Reading these will give you an even deeper understanding of how technology disrupts traditional finance.

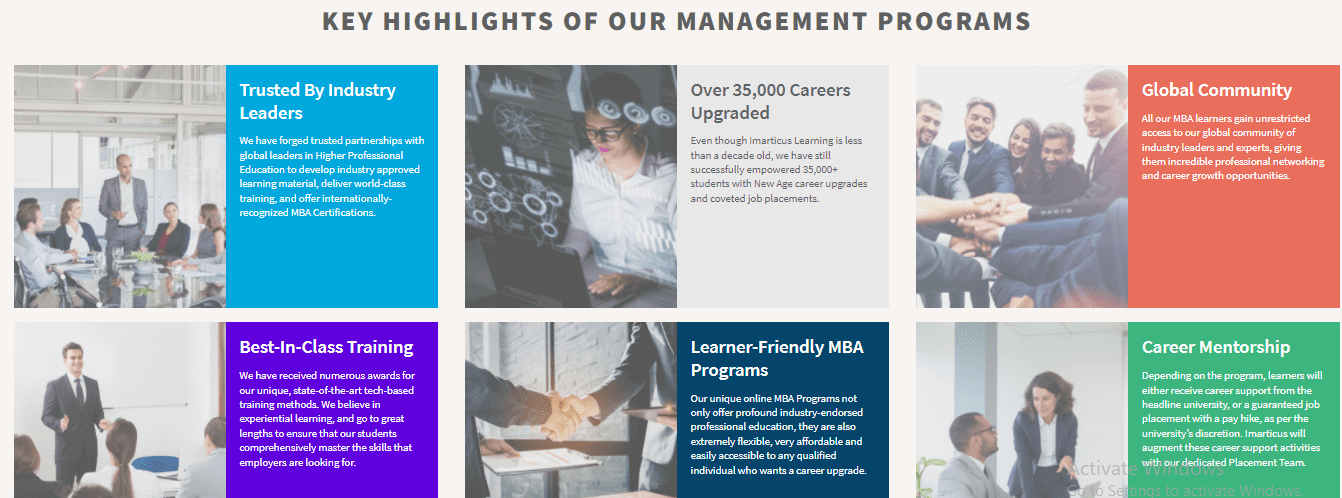

Discover MBA in Fintech course with Imarticus Learning

The MBA in FinTech course allows students to apply what they’ve learned to real-world business challenges and circumstances. If students want to be a FinTech specialist and boost their professional chances, their quest stops here, and a fantastic FinTech learning experience begins.

Course Benefits for Learners:

- This distance learning MBA program covers every critical industry component while also providing hands-on experience with cutting-edge technologies like APIs, Blockchain, Cloud Computing, AI, Machine Learning, RPA, IoT, and Big Data.

- Students get access to Fintech networking events, job boards, and webinars to help them make the most of their Fintech education and open doors to new employment prospects.

- This robust distance learning MBA program extensively examines the many paradigms of New Age FinTech, providing students with a high-quality learning experience.

Contact us via the chat support system, or drive to one of our training centers in Mumbai, Thane, Pune, Chennai, Bengaluru, Delhi, and Gurgaon.

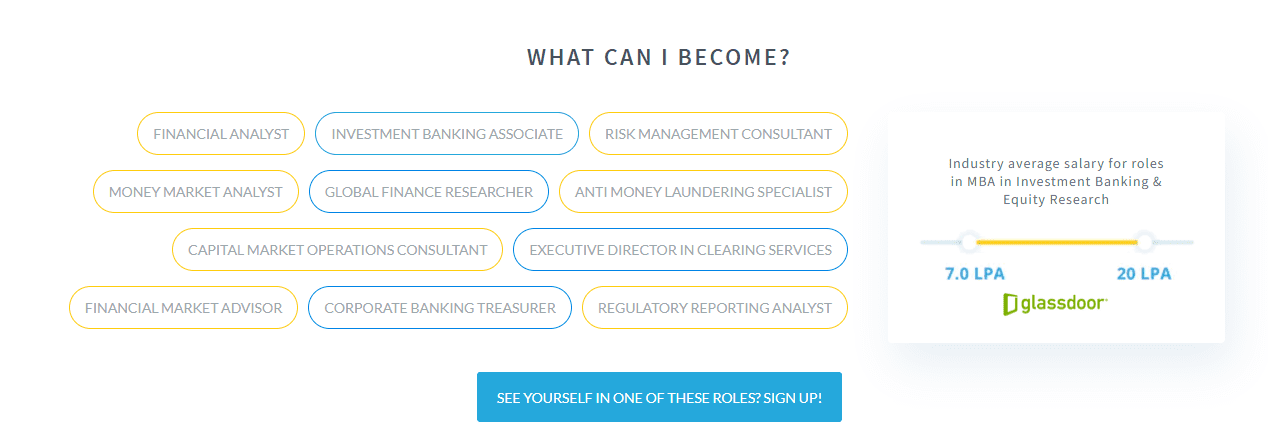

Each of these profiles is prospective high salaried jobs or the ones that open up better professional growth. Many of the

Each of these profiles is prospective high salaried jobs or the ones that open up better professional growth. Many of the

What do you mean by cultural adaptations of the internet?

What do you mean by cultural adaptations of the internet? Additionally, society can influence online education in those different societies to have different rules about the role of technology.

Additionally, society can influence online education in those different societies to have different rules about the role of technology.

This query is always in the mind of students. What after B.Com?

This query is always in the mind of students. What after B.Com?

We will answer the questions related to distance MBA, for example, whether you can pursue your career or not after completing a distance MBA program in India & abroad. We will also discuss the pros and cons of pursuing an

We will answer the questions related to distance MBA, for example, whether you can pursue your career or not after completing a distance MBA program in India & abroad. We will also discuss the pros and cons of pursuing an