Sales play a vital role in driving success for business leaders. It’s not just about selling, but also understanding customer needs, creating effective strategies, and building meaningful relationships. Sales is the lifeblood of an organisation, ensuring its financial health.

Strategic decision-making revolves around sales, market strategy, distribution, and channel choices. Market strategy focuses on product positioning, assessing competition, and tailoring offerings for target audiences. Distribution strategies determine how products reach consumers through various channels like retail, e-commerce, and logistics solutions. Choosing the right channels involves considering direct sales forces, partnerships, and digital platforms.

This blog will provide a comprehensive view of sales with market strategy, distribution, and channel choices. If you’re someone looking for a career in this field and want to join a comprehensive sales & marketing management program, understanding sales and its connection to market strategy is crucial for your leadership journey.

Crafting a Winning Market Strategy

A successful business relies on a strong market strategy, which forms the foundation for entering, establishing, and growing in the marketplace. The primary step in developing this strategy involves conducting robust market research and analysis. This includes gathering and analysing information about market conditions, consumer behaviour, and industry trends to gain a comprehensive understanding of the business environment.

Market Research and Analysis

Effective market research and analysis are essential for developing a robust business strategy. It is crucial to identify your target audience and create ideal customer profiles to gain a deep understanding of their demographics, preferences, and buying behaviour. This knowledge empowers you to tailor your marketing and sales strategies to resonate with your target market effectively.

In addition, conducting a thorough competitor analysis is vital. This involves identifying your direct and indirect competitors, analysing their strategies, and identifying their strengths and weaknesses. Obtaining this information provides a competitive advantage, allowing you to differentiate your offerings and excel in the market.

To stay ahead, it is crucial to stay informed about market trends and industry insights. This proactive approach helps identify emerging opportunities and potential threats, enabling you to quickly adapt your strategies to evolving market dynamics. By incorporating this comprehensive approach to market research and analysis, you pave the way for significant growth and success in your business.

Setting Clear Sales Goals

Understanding your market, audience, and competition is vital, but it’s just the start. The next important step in your sales strategy is setting clear, strong sales goals that adhere to the SMART framework. SMART goals are specific, measurable, achievable, relevant, and time-bound.

Being specific means clearly stating what you want to achieve, while measurability involves defining measurable indicators of success. Goals should be achievable yet aspirational, and they must align with your overall business objectives. Each goal should also have a defined timeline for completion.

However, setting goals alone is insufficient. A dynamic sales strategy requires effective mechanisms for measuring and tracking progress. Regularly evaluating your performance against these SMART goals allows you to celebrate milestones, identify areas for improvement, adapt strategies as needed, and maintain momentum toward your objectives. This ongoing process of analysis and adjustment forms the foundation of a resilient and results-driven sales strategy.

Developing a Unique Value Proposition

Crafting a unique value proposition (UVP) means effectively communicating the practical and distinctive value your product or service offers customers. It should clearly distinguish you from competitors and answer the question, “Why should I choose you?”

Your UVP serves as a guiding light, helping customers understand how your product or service meets their needs, delivers exceptional benefits, and surpasses other options in the market. It’s not just about highlighting features but expressing the unique benefits that resonate with customer pain points, aspirations, and desires.

Differentiation is key to creating a compelling UVP. To stand out in a crowded marketplace, your product or service needs to offer something unique that competitors can’t or won’t provide, like innovative features, superior customer service, or a distinctive business model.

When communicating your UVP, it’s crucial to be clear and concise. It should be a memorable statement that encapsulates the essence of your product or service’s unique value. This message should be consistently reinforced across all marketing and sales platforms, from your website and social media channels to email campaigns and sales pitches.

Remember, your UVP is not a one-time statement. It evolves over time as your business, market, and customers change.

Crafting an Effective Distribution Strategy

Crafting an effective distribution strategy requires a deep understanding of your product, your target customers, and the market at large. It’s about ensuring that your product reaches the consumer at the right time, in the right place, and in the condition and quantity needed. A well-structured distribution strategy can greatly enhance your business reach, visibility, and profitability.

Understanding Distribution Channels

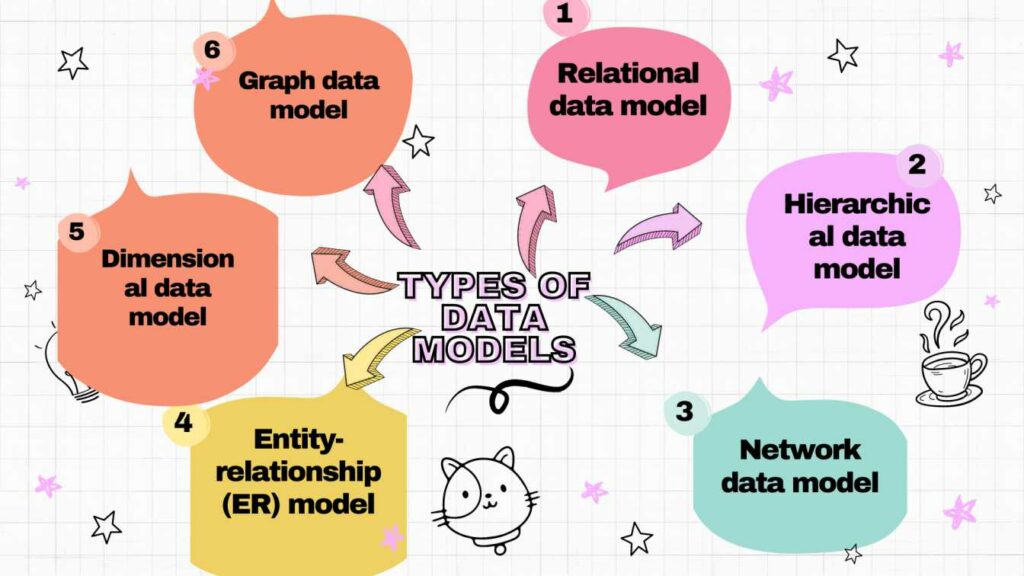

Understanding distribution channels forms the backbone of a successful distribution strategy. In its most basic form, a distribution channel signifies the route a product follows from its production source to the eventual consumer. It’s essential to note that this journey often involves several intermediaries, including but not limited to retailers, wholesalers, and distributors.

Distribution channels come in various forms, each with its unique benefits and potential challenges. These channels can be broadly categorised into direct, indirect channels, and hybrid channels. Here’s a quick explanation of the channels.

Direct channels refer to the direct sale of products to customers, either through the producer’s online store or a physical retail outlet. This direct approach bypasses intermediaries, providing more control over the sales process and potentially leading to increased profit margins.

Indirect channels involve third-party intermediaries like distributors, wholesalers, or brokers. They connect manufacturers with retailers who sell the product to consumers. While they can expand product reach and distribution efficiency, using indirect channels may result in reduced control over sales and potentially lower profit margins due to intermediary fees.

Hybrid channels offer a strategic combination of direct and indirect channels, resulting in wider market reach and improved penetration. This approach involves selling products directly to consumers while also utilising intermediaries to target different market segments. By leveraging this approach, businesses can maximise their sales potential and effectively cater to diverse customer needs.

The selection of the appropriate distribution channel is a strategic decision that can significantly impact a business’s success. Factors such as the nature of the product, the target market, the competitive landscape, and cost considerations all play crucial roles in this decision-making process. Essentially, businesses aim to identify the most effective and efficient way to place their products in their customers’ hands. Understanding distribution channels and making informed choices on channel selection are thus key to achieving this goal.

Creating a Distribution Channel Strategy

Creating a distribution channel strategy is a crucial aspect of any business’ sales operations. This strategy guides the process of moving products from the manufacturer to the consumer, ensuring that the product is available to the customer when and where they need it. The first step in this process is identifying the right distribution partners. These could be wholesalers, retailers, or even direct-to-consumer sales platforms, depending on the nature of your product and target audience.

Once suitable partners have been identified, the next step is channel management and relationship cultivation. This involves maintaining open lines of communication, aligning goals, settling conflicts, and ensuring that all parties involved are satisfied with the arrangement. The effectiveness of channel management can greatly impact the success of your distribution strategy.

The final step in crafting a distribution channel strategy involves managing distribution logistics and supply chain management processes. This includes the storage, transportation, and delivery of goods. Efficient supply chain operations ensure that products are delivered to customers in a timely manner, a factor that can significantly enhance customer satisfaction and loyalty. Therefore, companies should focus on optimising their logistics and supply chain management as part of their overall distribution strategy.

Evaluating Distribution Performance

Evaluating the performance of your distribution strategy is crucial to guarantee its efficiency and effectiveness. This assessment involves analysing key metrics that offer valuable insights into the success of your strategy. These metrics encompass various factors that illuminate different aspects of your distribution efforts. They include:

Sales Volume: The sales volume reflects how well your distribution strategy is performing in generating revenue. A steady increase in sales volume is a positive sign, but remember to consider other metrics for a comprehensive view.

Market share: Market share measures your brand’s presence and influence in the target market. A growing market share indicates effective competition with other industry players.

Growth rate: The growth rate shows the momentum of your distribution strategy. A positive growth rate means an expanding customer base or increased product consumption.

Customer satisfaction: High customer satisfaction indicates efficient product delivery, meeting customer expectations, and providing a positive experience. Use customer feedback and surveys to gauge this metric.

Continual improvement and optimisation are key to distribution success. This means regularly monitoring and adjusting your strategy based on discussed metrics. Critical analysis of distribution channels, streamlining processes, and eliminating inefficiencies are all part of this ongoing optimisation. It helps your company become more agile and resilient, able to withstand market fluctuations.

Adapting to market changes is also crucial for a successful distribution strategy. The market is constantly evolving due to consumer behaviour, technology advancements, and competitor activities. Keeping your distribution strategy flexible and responsive is essential. Regular evaluations and prompt adjustments ensure that your strategy remains effective and relevant in a rapidly changing market.

Strategic Channel Choices

Direct distribution channels may seem appealing at first, but they may not always be the best choice for businesses in various sectors such as finance, food and beverage, and medical devices. These industries are often subject to regulations that dictate how their products or services are delivered to the end user. In this discussion, let’s explore different distribution channels and how to assess their suitability for your marketing strategy.

Retail Distribution: Positioning your product in a retail outlet can be a powerful strategy. However, it’s important to understand that getting shelf space in major chains like Walmart or Target is not as simple as making a request. These chains typically source their products from distributors and wholesalers, which means there are multiple channels to navigate. While retail distribution is advantageous for businesses that sell physical products, it’s crucial to be aware of the intense competition, especially when vying for space in a large retail chain.

Direct Marketing: This approach involves directly engaging with potential consumers, providing them the chance to buy without any intermediaries. These strategies typically include product catalogues, marketing calls, or direct sales. It is important to note that managing direct marketing might require more effort and resources. By adopting this approach, businesses can establish direct connections with customers, enhance customer loyalty, and gain valuable insights for future marketing efforts.

Dealer Network: This option is particularly advantageous for businesses that lack a large or experienced sales team or those that offer specialised products. For example, insurance companies heavily rely on a network of brokers to sell their policies. This approach allows them to reach a wider customer base and ensure their offerings are accessible to a diverse range of customers.

Website Store: This online platform is available to both business-to-consumer (B2C) and business-to-business (B2B) brands. It provides startups with the opportunity to directly connect with consumers, while also allowing established businesses to discover new sources of revenue.

Wholesale Distribution: Wholesale distribution, despite its involvement in lengthy channels, can bring about substantial advantages when aligned with compatible partners. Wholesalers typically procure and sell products in bulk to retailers, while distributors offer a broader range of services. This collaboration can be beneficial for businesses as it provides a simplified and efficient means of reaching a wider customer base. By leveraging the expertise and resources of wholesalers and distributors, companies can streamline their operations, improve market reach, and optimise their overall distribution strategy.

E-Commerce Site: Online marketplaces such as Amazon and Etsy have gained significant popularity as platforms for sellers of physical goods. These platforms offer a wide range of consumer reach and helpful tools, allowing businesses to connect with users who have high purchase intent. In other words, these platforms provide sellers with access to a large number of potential customers and convenient features to facilitate their sales.

Value-Add Resellers (VARs): Value Added Resellers (VARs) buy inventory from companies and enhance or bundle it with their own services. This collaboration can assist businesses in accomplishing goals like expanding market presence or securing recurring revenue from a VAR buyer. In other words, by partnering with VARs, companies can leverage their expertise and resources to gain a competitive edge in the market and generate steady income streams.

Choosing the appropriate distribution channel is a crucial strategic decision that takes into account the nature of the product or service, the target audience, and the company’s available resources. It’s important to carefully consider these factors in order to effectively reach customers and deliver value.

Finding the Right Balance for Businesses

Most businesses combine direct and indirect channels in their sales and marketing strategy. For example, a craft brewery may work with distributors, wholesalers, and retailers, while also selling directly to customers at an on-site website. Similarly, agricultural producers can sell their products at farmer’s markets and work with distributors at the same time.

When developing a distribution strategy, it’s crucial to consider different combinations of direct and indirect channels. However, it’s important to avoid conflicts and understand the requirements of each channel. Also, don’t overwhelm yourself, especially if you’re just starting out. If you plan to introduce new channels, do it gradually and set performance standards and expected costs. Remember that industry-specific factors will influence your decision-making process.

Conclusion

The success of a sales organisation greatly depends on the synergy of sales strategies. It involves taking a holistic approach by combining different sales methods, tactics, and technologies into one seamless system. As sales leaders, understanding and implementing this synergy can result in increased profitability, improved customer relationships, and a competitive edge in the ever-changing market. Remember, achieving strategic synergy lies in integrating strategies, not just selecting them. Therefore, continuous learning, adaptation, and innovation should be central to a sales leader’s approach.

Are you looking to start a career in this field? Or looking for a sales and marketing management program to upskill?

Imarticus Learning is the perfect place for you!

The Executive Management Programme In Sales & Marketing Leadership, conducted in collaboration with IIM Lucknow, is designed for ambitious executives who have demonstrated strong managerial skills and aspire to become business leaders. This program enables participants to enhance their leadership capabilities and effectively navigate organisations.

The IIML sales leadership program utilises experiential learning methodologies, incorporating case studies and simulations from renowned institutions such as Wharton Interactive, StratX, and Imarticus Game Studio. The program’s primary focus is on fostering a deep understanding of sales and marketing, strategic thinking, effective people management, and execution skills.

Are you ready to get started? Contact us today!