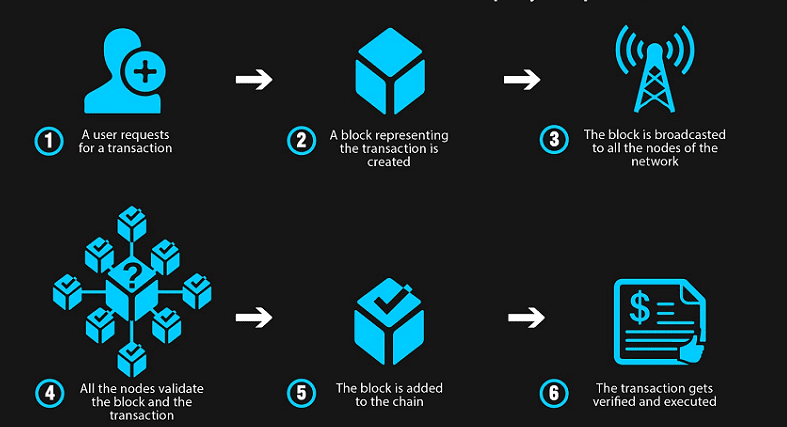

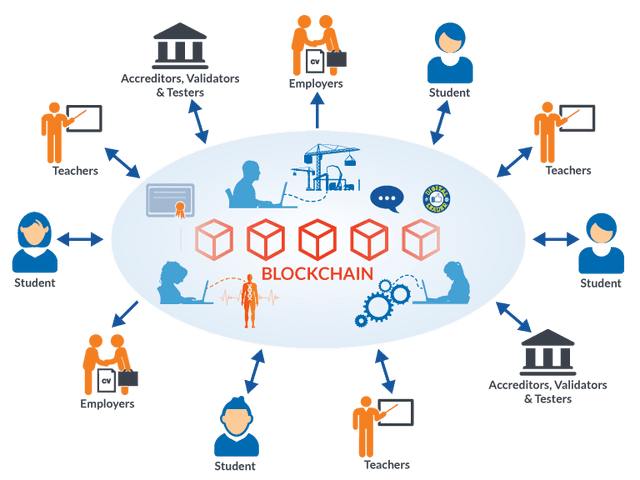

Blockchain technology is simply decentralization of data that is achieved by collecting the data on multiple systems. Due to the lack of centralized data, hackers find it very hard to penetrate the security walls of the application that are safeguarded by the blockchain advancements. Due to its robust and reliable nature, many industries including health, real estate, finance, and other industries are adapting to it. As a result, there is a huge career scope in this domain.

Why Blockchain Technology is The Catch Today

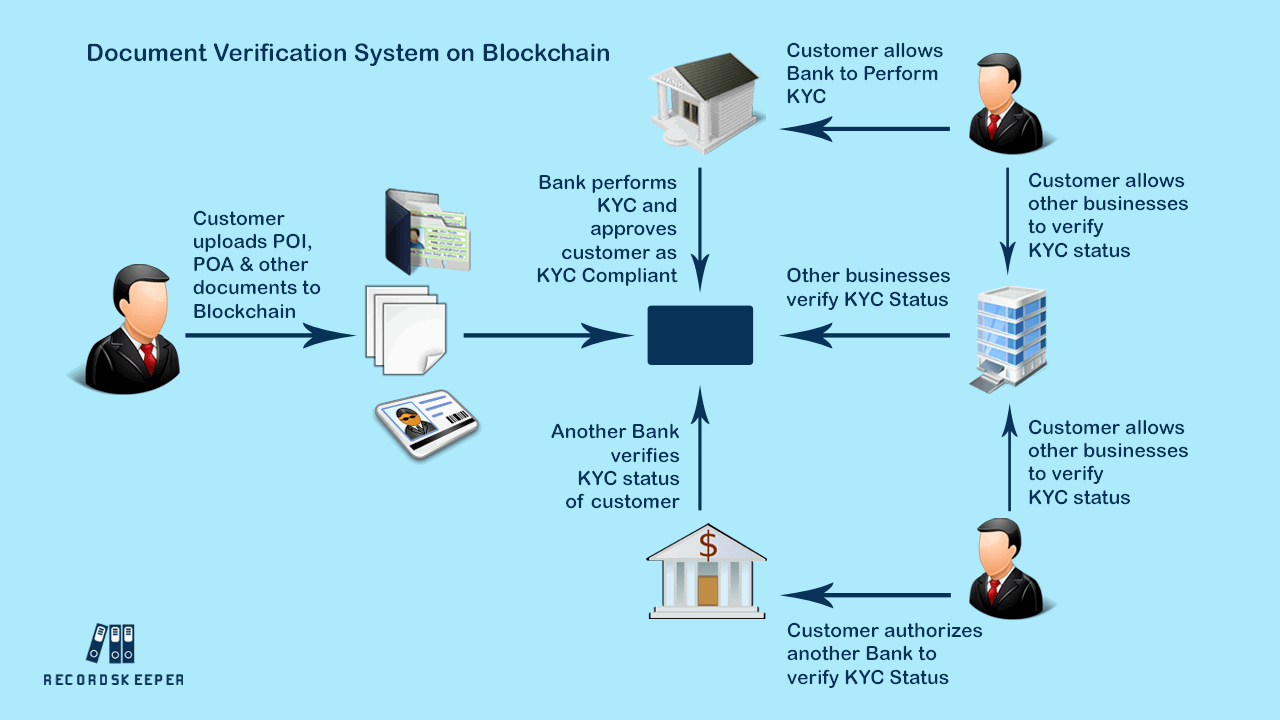

Financial companies and top banks in the world are leveraging blockchain technology to implement a higher level of cybersecurity in their transactions. This technology can not only be shared by different users, but every bit of data needs to be authenticated completely before entering the network.

Logistic companies’use blockchain technology to track their containers across the world and it is also being implemented in the food and agro-based industries on a large scale.

Even HR recruiters are using this technology to verify the authenticity of the documents and to check their backgrounds. With a myriad of software services, blockchain is being used in different sectors such as medical, telecom and much more.

Popular Blockchain Technology Courses

The growth of Fintech in India has been substantial over the last decade, and therefore, today many financial institutions provide blockchain course training. Some of them also include blockchain certification in their curriculum. Students who have a background in networking or languages like Java and Python can learn about blockchain to meet the rising demand for blockchain developers, engineers, and designers in the market. These blockchain course are online-courses and popular in the career markets of today.

1. The Basic training: This fundamentals training in blockchains takes you through the evolution of blockchains and how they work. You may even find free courses that give you tutorials on blockchains through the online medium.

2. Certification courses: A Certified blockchain course is an option for aspirants making a career in fintech and wishing to learn applications and skills in blockchain technology aimed at developing solutions for real-time and industry-related problems. A computer science backing and graduation can help careers of investment bankers, DevOps people, software developers, investment bankers etc. make a career in the Fintech segment.

3. Certifications: Students and professionals who are interested in a blockchain course and certification can take up Blockchain council certification at Imarticus Learning, which is an online certification course for blockchain experts.

Fintech is a term coined from morphing words of Finance and Technology. The financial transactions sector is heavily impacted with blockchain technology making the transactions secure, rapid, immutable with excellent record keeping in distributed ledgers and cryptographically encoded blocks interlinked to each other in hash-tag codes. Almost all technologies like AI, VR, AR, IoT use the advantageous blessings of blockchain advantages to spur their growth and productivity. This, in turn, fuels the demand-supply gap for trained professionals and drives the payouts to unbelievable levels for the experts and well-trained professionals.

How Blockchain Technology Helps the Careers of Professionals:

A basic understanding of blockchain will prove insufficient for the professionals as they also have to apply their knowledge in real-world scenarios and issues. However, due to a serious dearth of blockchain professionals, companies are willing to hire people who have a technical or software background. Moreover, IT companies are also looking to hire freelancers on the basis of hourly pay to satiate the demand in the workforce.

Where opportunities exist:

The Fintech sector and industry need professionals and personnel in

• Emerging Technologies like cloud services, blockchains etc.

• Payments and digital financial transactions.

• Working in analytics of Big Data.

• Cryptos and virtual wealth management.

• Solutions and service providers.

Suitable job roles in high-demand:

• Managers of projects and product owners.

• Experts in data management.

• Business Development and Sales.

• Recruitment and HR sector.

• Experts in financial markets, debt capital markets, equity funding etc.

You can find openings in diverse verticals ranging from internship positions to Blockchain developers, Project Managers, Quality engineers, Web designers, Blockchain attorneys, engineers and more. This is precisely why a blockchain course can feed off the growing market demands for blockchain experts and provide a futuristic well-paying growth-oriented career.

Advantages of Doing a Fintech Certification

Certification in Fintech is a measure of your technical skills and aptitude for a career in the fintech industry which is evolving and has high personnel demands. Doing a good blockchain course like the Imarticus’ Fintech Prodegree will equip you with the fundamentals, concepts, theoretical and practical skills with coveted certifications that enhance your resume, job prospects, and career.

The advantage of mentoring by industry aces gives you the edge of experience learnt through techniques, tricks, best practices, skills, and lots of practice on cutting-edge trending applications and technologies. You will also need technical skills taught in these courses like skills in IoT, DevOps, Python, Big Data analytics, ML, and Hadoop.

Non-transferable skills are extremely important and properly aligned with your career and enterprise’s needs. You must have the following traits.

1. Excellent communication and interpersonal skills.

2. Creative and innovative problem-solving skills.

3. Team skills in contribution, and collaboration.

4. The dedication and ability for long work-hours under pressure, ambiguity, and lack of SOPs in a startup environment.

5. Integrity and financial discipline.

6. A team-player and quick learner of techniques and best practices.

Payouts: Definite standards in payouts are not present as of now. According to reports on Glassdoor, the payments are very appreciative and second to very few. However, with this evolving and rapidly expanding sector the demand for personnel is much higher than the supply positions thereby driving the demand for better salaries and promoting quick growth in Fintech careers.

Conclusion:

Careers are always the result of research and career choices. The present-day professionals are lucky to have sustained demand in the Fintech industries which encompass a gamut of verticals from insurance, digitized payments, real-estate, technological services, cloud storage and many more where there is undying job demand for analytics, software, and expertise in ML. Banks, financial stock markets and services supporting the Fintech industry are bound to see exponential growth in the next decade. Be prepared by doing a blockchain course with the Imarticus Academy.