Most BCom graduates reach a point where marks are no longer the main question. The real question becomes, what can I actually do with what I know? That is usually where thoughts around CMA after BCom begin to feel relevant.

During BCom, we spend years learning how to prepare accounts, calculate ratios, and understand financial statements. Then one day in a real workplace, someone asks a different kind of question.

→ Why did our costs go up even though production stayed the same?

→ Why are we making sales but still short on cash?

→ Should we launch this new product or wait?

These are not bookkeeping questions. These are decision questions. That is the space CMA prepares you for.

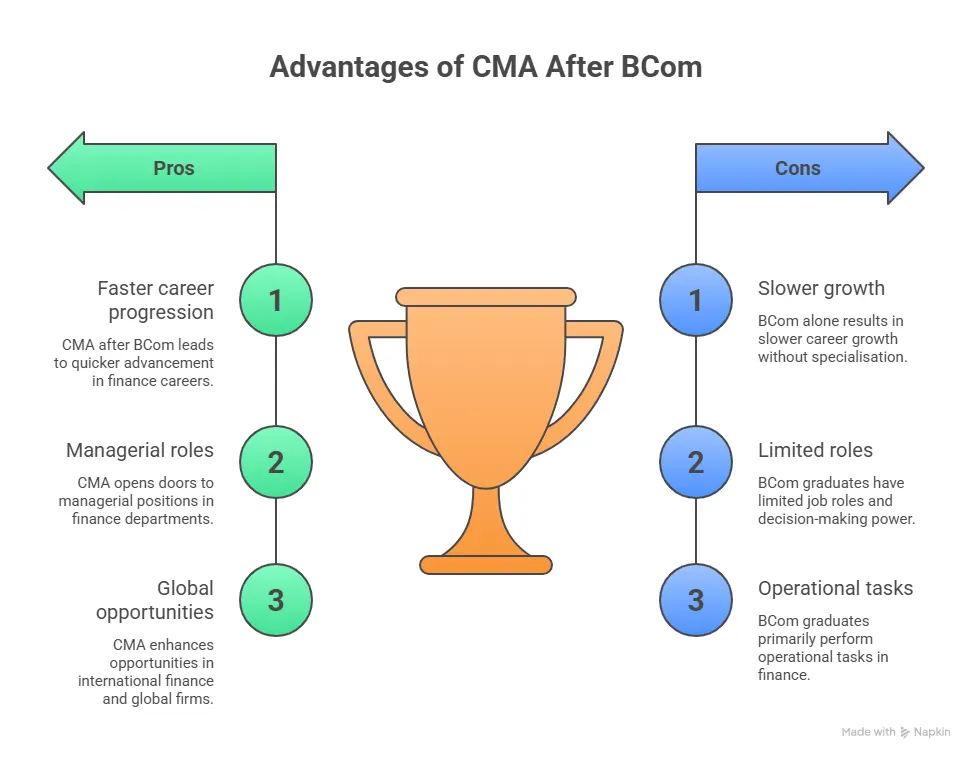

Over time, the combination of your BCom base and a CMA certification shapes a different professional identity. You are no longer just someone who records transactions. You become someone who helps businesses decide what to do next with their money. That role carries responsibility, but it also brings growth and respect in the workplace.

Choosing the right professional path after graduation can feel confusing, especially with so many options in finance and accounting. This blog breaks down everything you need to know about pursuing CMA after BCom, from understanding the qualification and eligibility to planning exams, preparation strategy, career roles, and long-term growth.

Did You Know?

According to the Institute of Management Accountants, CMAs often work in roles like financial analyst, cost accountant, and finance manager. These roles focus on planning and decision support.

What the CMA Qualification Focuses On

As you explore CMA after BCom, it helps to clearly understand ‘what is CMA?’ and why it holds strong value in the finance world. CMA stands for Certified Management Accountant. It is a professional qualification focused on management accounting, financial planning, and business decision support.

While a BCom degree builds your foundation in accounting and commerce, CMA adds a layer of strategic and analytical skills that businesses use to improve performance. Here is a simple overview of what CMA focuses on.

| Area of Learning | What It Means in Simple Words |

| Cost Management | Understanding where money is spent and how to reduce waste |

| Budgeting | Planning future income and expenses |

| Performance Analysis | Measuring whether business goals are being achieved |

| Financial Decision Making | Helping companies choose the best financial options |

| Internal Controls | Ensuring financial processes are accurate and safe |

CMA professionals are often involved in planning rather than just reporting. They help managers decide how to allocate money, control costs, and improve profitability.

To make this more relatable, think of a household budget. Someone earns income, but another person tracks expenses, plans savings, and avoids overspending. A CMA performs a similar role inside a company, but on a much larger scale.

Here are the types of responsibilities CMA professionals typically handle.

- Preparing and managing budgets

- Analysing financial performance

- Studying cost behaviour

- Supporting investment decisions

- Improving financial efficiency

This is why students who pursue CMA after BCom often move into roles that combine financial accounting knowledge with business strategy. It shifts your role from record-keeping to decision support.

Choosing the right order for your exam attempts can make preparation more structured and less stressful. A clear comparison of the US CMA Part 1 and US CMA Part 2 helps you understand differences in syllabus focus, difficulty level, and study approach.

Why Many Students Consider CMA after BCom

I notice that BCom graduates already understand financial basics. This makes the CMA course eligibility after BCom very practical. You do not start from zero. You build on what you already know.

Some reasons students choose this path:

- They want a global credential in management accounting

- They prefer corporate roles over audit practice

- They like working with data and business strategy

- They want better salary growth in finance roles

CMA Eligibility After BCom

Understanding CMA eligibility brings clarity before starting your preparation. The good part for commerce graduates is that the academic foundation you already have makes the process straightforward. Students pursuing CMA after BCom usually meet the education requirement right away and can begin the exam journey without delay.

Here is a clear breakdown of the eligibility requirements for the US CMA certification.

| Requirement Type | Details |

| Educational Qualification | A bachelor’s degree from an accredited college or university. A BCom degree qualifies. |

| Entrance Exam | Candidates must pass both parts of the CMA exam. |

| Work Experience | Two continuous years of professional experience in management accounting or financial management. This can be completed before or within seven years of passing the exams. |

| Professional Membership | Active membership with the Institute of Management Accountants is required. |

| Ethics Requirement | Candidates must comply with the IMA Statement of Ethical Professional Practice. |

This structure allows BCom graduates to begin exams early and gain experience alongside, making the journey flexible and practical for students as well as working professionals.

Interesting Insight→ A report by the US Bureau of Labour Statistics shows steady demand for accountants and auditors in the coming years. This includes management accounting roles that CMAs often fill. You can read more on the employment outlook for accountants.

Admission Process for CMA After BCom

Starting CMA after BCom involves a few formal steps with the global certifying body. The process is simple when followed in order. Each step moves you closer to becoming exam-ready and eventually certified.

Step 1. Become a Member of IMA→ You first need to join the Institute of Management Accountants. Membership is required before registering for the CMA program.

Step 2. Pay the CMA Entrance Fee→ This is a one-time program enrollment fee. It allows you to enter the CMA track and access exam registration.

Step 3. Register for Exam Parts→ You can register for Part 1 and Part 2 in separate exam windows based on your preparation.

Step 4. Schedule Your Exam→ After registration, you book your exam date at an authorised testing centre.

Step 5. Complete Work Experience→ Two years of relevant work experience in finance or management accounting is required for certification. This can be completed before or after passing exams.

| Step | Action Required | When to Do It |

| 1 | IMA Membership | Before exam registration |

| 2 | Pay CMA Entrance Fee | Once at the start |

| 3 | Register for Exam Part | Before each exam attempt |

| 4 | Schedule Exam Date | Within the chosen exam window |

| 5 | Submit Work Experience | Before receiving certification |

Also Read: How to choose the Best CMA Review Course for Your Preparation

Exam Structure of the US CMA

The US CMA exam has two parts. Each part tests both knowledge and application. The structure is designed to check how well you understand concepts and apply them in business situations.

Exam Format Overview

| Component | Details |

| Number of Parts | 2 |

| Exam Type | Computer-based |

| Question Format | Multiple-choice + Essay |

| Duration per Part | 4 hours |

| Scoring Range | 0 to 500 |

| Passing Score | 360 |

Question Breakdown Per Part

| Section | Number of Questions | Time Allocation |

| Multiple Choice | 100 | 3 hours |

| Essay Questions | 2 scenarios | 1 hour |

Essay questions test your ability to explain calculations and reasoning, not just select answers.

Also Read: What do you need to do to pass the US Certified Management Accountant course?

Understanding the Structure of the CMA Course

When planning how can I do CMA after BCom, structure matters. The course is divided into exam parts. Each part tests a different skill set. I compare it to learning to drive. First, you learn traffic rules. Then you practice on the road. Finally, you handle highways. CMA builds knowledge in layers like that. The exams test both theory and application.

| Exam Part | Main Focus | Real Life Example |

| Financial Planning | Budgeting and forecasting | Planning yearly expenses for a company |

| Performance Management | Cost control and analysis | Finding why profits dropped |

| Financial Decision Making | Investment and risk | Choosing between two projects |

Syllabus of the US CMA

The CMA syllabus focuses on management accounting, financial planning, and decision-making skills used in real businesses.

Part 1. Financial Planning, Performance, and Analytics

| Topic Area | What You Learn |

| External Financial Reporting | Financial statements and reporting standards |

| Planning, Budgeting, and Forecasting | Budget preparation and financial planning |

| Performance Management | Cost control and variance analysis |

| Cost Management | Cost behaviour and costing systems |

| Internal Controls | Safeguarding assets and risk control |

| Technology and Analytics | Data analysis and tech tools in finance |

Part 2. Strategic Financial Management

| Topic Area | What You Learn |

| Financial Statement Analysis | Interpreting financial performance |

| Corporate Finance | Investment and financing decisions |

| Decision Analysis | Choosing between business alternatives |

| Risk Management | Identifying and managing risks |

| Investment Decisions | Capital budgeting techniques |

| Professional Ethics | Ethical decision-making in finance |

Each part connects strongly with real job responsibilities, which is why students pursuing CMA after BCom often find the syllabus practical and career-focused.

Can We Do CMA After BCom Without Work Experience

This is one of the most searched questions linked to whether we can do CMA after BCom. The answer is yes for starting exams. Work experience is required for certification, not for sitting in exams. Many students begin preparing for CMA after BCom during their first job or even right after graduation because the exam registration does not require prior full-time experience.

This gives you the flexibility to focus on clearing exam parts first and then complete the required professional experience alongside your career. Roles in areas like financial analysis, budgeting, cost accounting, or internal reporting usually count toward this requirement, which means your early career steps can align naturally with the certification process.

Also Read: Why is the US CMA Course trending among accounting aspirants?

Course Duration of CMA After BCom

Time planning becomes important when choosing the CMA course duration after BCom. Many students try to rush. That creates stress. The CMA duration after BCom depends on how fast you clear exams. Some complete it within a year. Others take longer due to their job or studies.

| Study Situation | Typical Time to Complete Exams | What This Usually Means |

| Full-time student | 12 to 18 months | Preparing consistently and attempting both exam parts in consecutive testing windows |

| Working professional (moderate pace) | 18 to 24 months | Balancing job and study with one part at a time |

| Working professional (slow pace) | 24 to 36 months | Longer preparation gaps due to workload or personal commitments |

It is important to note that the US CMA program has only two exam parts, and each part can be taken in separate testing windows during the year. Many students choose to complete one part every 6 to 9 months, depending on comfort with the syllabus.

The CMA course duration after BCom in India or abroad depends on study habits. CMA needs understanding more than memorising. I use a simple rule. Study a concept. Solve problems. Teach it to someone. This cycle improves clarity. Short daily study works better than long weekend sessions. Even one hour daily can build strong retention.

Also Read: Advance Your Accounting Career with the US CMA Course

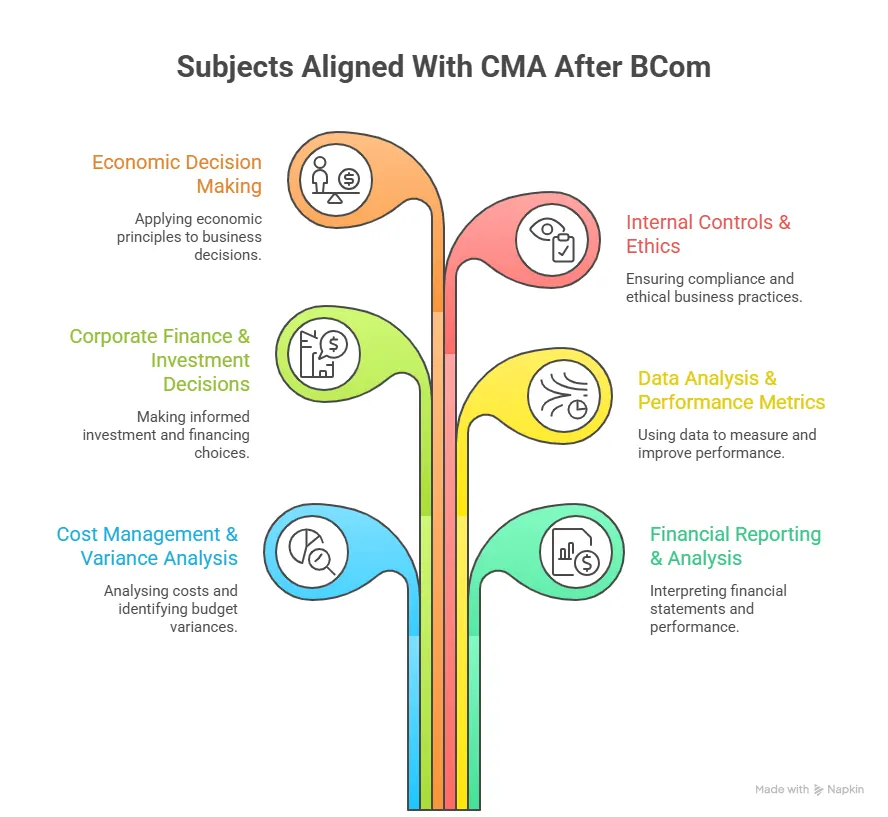

How BCom Subjects Help in CMA

A BCom with CMA combination works well because many subjects overlap. Financial accounting, cost accounting, and business math already give a base.

Here are examples of how the CMA course subjects with BCom knowledge connect:

- Cost accounting basics help in performance management

- Financial management topics support investment decisions

- Statistics help in data analysis

It feels like revising old chapters and then learning how to apply them in real business situations.

Exam Planning for CMA After BCom

When planning CMA after BCom, eligibility is the first checkpoint. Most commerce graduates already meet the academic requirement. A bachelor’s degree is enough to begin the process. This makes the CMA course eligibility after BCom simple and direct. The experience requirement can be completed before or after exams. Many students start exams first and gain work experience alongside.

Also Read: Is the CMA Certification Truly Globally Recognised?

Planning the Exam Timeline

The CMA course duration after BCom depends on exam planning. CMA exams are offered in testing windows during the year. Missing a window delays progress.

I treat exam planning like booking train tickets. If you miss the date, you wait for the next train.

Here is a simple planning approach.

| Step | Action |

| Month 1 | Register and collect study material |

| Months 2 to 5 | Prepare for Part 1 |

| Month 6 | Take Part 1 exam |

| Months 7 to 10 | Prepare for Part 2 |

| Month 11 | Take Part 2 exam |

This plan suits full-time students. Working professionals may extend the timeline. Details about exam windows are on the CMA exam information page.

How to Study Without Feeling Overwhelmed

Many students ask how can I do CMA after BCom while managing other responsibilities. The key is structure. I break the study into three layers.

- Concept learning

- Practice questions

- Mock exams

For planning a study routine around the above three layers, here is a method that I personally recommend that reduces stress and builds confidence. Remember that consistency matters more than long study hours.

- Study one topic per session

- Solve practice questions right after learning

- Revise weak areas every week

- Take a mock test after finishing each section

Common Mistakes Students Make

While planning the CMA duration after BCom, some errors slow progress. Here are mistakes I often see.

- Delaying exam registration

- Studying theory without practice

- Ignoring mock exams

- Trying to memorise instead of understanding

- Skipping revision

Avoiding these mistakes saves months of effort.

Also Read: 7 perks of opting for a certified management accountant course online

Cost Planning for CMA After BCom

Financial planning matters before starting the CMA course duration after BCom in India. The CMA course fees include registration, exam fees, and study material.

| Cost Component | Approximate Range in INR (₹) |

| IMA Membership Fee (annual) | ₹4,000 – ₹25,000 |

| CMA Entrance Fee (one-time) | ₹15,000 – ₹30,000 |

| CMA Exam Fee – Part 1 | ₹30,000 – ₹45,000 |

| CMA Exam Fee – Part 2 | ₹30,000 – ₹45,000 |

| Total Core IMA/CMA Exam Costs | ₹75,000 – ₹145,000 |

| Study Material & Review Resources | ₹10,000 – ₹40,000 |

| Optional Coaching / Test Prep | ₹20,000 – ₹80,000 |

| Overall Estimated Budget Range | ₹105,000 – ₹265,000 |

A Few Things to Keep in Mind While Planning Your Costs

- Membership Fee: Depends on student vs professional membership and currency fluctuations.

- Exam Fees: These are per exam part and vary based on when you register (early vs standard).

- Study Material: Self-study resources and review books fall in this range.

- Coaching: Optional classroom or online programs vary widely depending on the provider and mode.

This range helps you estimate the overall financial commitment when planning CMA after BCom, so you can budget realistically for both official fees and preparation resources.

Understanding the cost structure is an important part of planning your CMA journey. A clear breakdown of US CMA exam fees helps you budget better and avoid last-minute surprises. Knowing where your money goes makes the entire preparation process feel more organised and manageable.

Career Direction with CMA After BCom

While pursuing CMA after BCom, try to work in roles related to finance or accounting. Even internships help. Here are job roles that match CMA learning.

| Job Role | What You Do in Simple Words |

| Cost Accountant | Track product costs and suggest savings |

| Financial Analyst | Study financial data and guide decisions |

| Budget Analyst | Prepare and monitor budgets |

| Finance Manager | Oversee financial planning and reporting |

| Business Analyst | Connect financial data with business strategy |

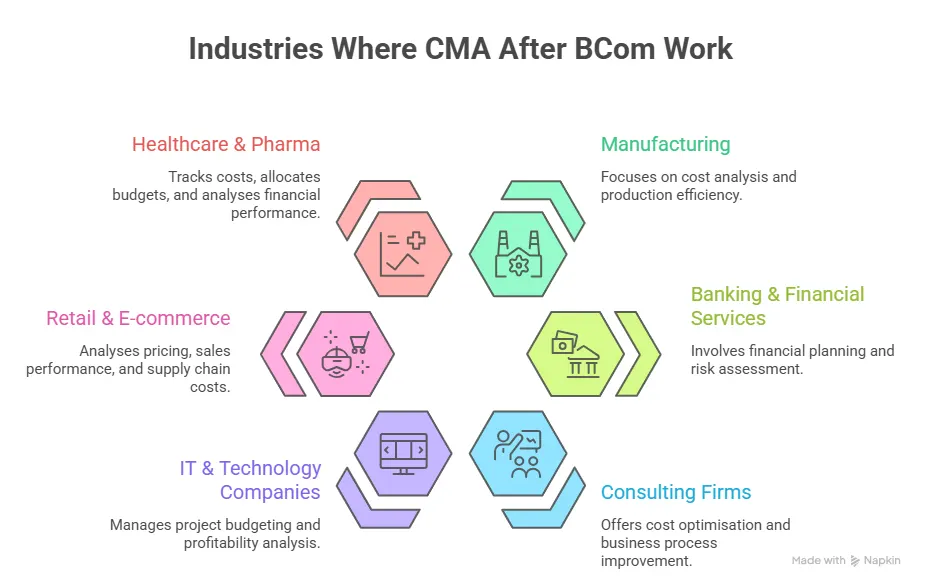

These roles build the experience required for certification. They also make exam concepts easier to understand. It helps to understand the work environment. CMAs work in corporate offices, manufacturing firms, consulting companies, and multinational organisations.

Here are common sectors.

- Manufacturing and production

- Banking and financial services

- Consulting firms

- IT and service companies

- Retail and e-commerce

The demand for management accountants in the CMA career continues to grow. Reports on the Institute of Management Accountants site show that businesses value financial planning and analysis roles.

Did You Know?

Professionals with the CMA designation often report higher earning potential compared to non-certified peers in similar roles. (Source: The Institute of Management Accountants)

Salary Outcomes for CMA After BCom

The CMA salary depends on skills, city, and company size. A professional qualification usually improves earning potential over time.

According to insights shared by the IMA salary survey, certified professionals often earn more than non-certified peers in similar roles. Entry-level pay may start modestly, but growth becomes strong with experience. I think of it like planting a tree. Growth with a CMA fresher salary is slow at first. Later, it becomes steady and strong.

| Role / Experience Level | Typical Salary Range | Notes |

| Entry-Level (0–2 yrs) | ₹6 – 10 LPA | Fresh CMA professionals often start here in roles like Financial Analyst or Cost Accountant. |

| Cost Accountant | ₹6 – 10 LPA | Focus on costing, budgets and cost control functions. |

| Financial Analyst / FP&A Analyst | ₹8 – 12 LPA | Often involved in budgeting, forecasting and performance analysis. |

| Internal Auditor | ₹10 – 15 LPA | Roles involving controls, compliance, and risk analysis. |

| Mid-Level Professionals (3–7 yrs) | ₹10 – 18 LPA | Includes roles like Senior Analyst, Finance Manager, or Business Analyst. |

| Senior Finance Roles (7+ yrs) | ₹15 – 25 LPA | Leadership roles such as Finance Manager, Controller, or Strategic Finance roles. |

| Top Leadership Roles (Director/CFO) | ₹25 – 35 LPA+ | Senior decision-making positions in large corporations. |

Growth Path Over the Years

Career growth with the CMA course after BCom in India often follows a clear path.

| Experience Level | Typical Position |

| 0 to 2 years | Analyst or Executive |

| 3 to 5 years | Senior Analyst or Assistant Manager |

| 6 to 10 years | Finance Manager or Controller |

| 10 years | Finance Head or CFO level roles |

Career speed depends on performance and continuous learning.

Salary expectations often play a big role when deciding on a professional qualification. Looking at CMA salary trends in India and the USA gives a useful perspective on how location, experience, and industry influence earning potential.

Skills of CMA After BCom That Make a Big Difference

Technical knowledge alone is not enough. Soft skills improve career growth after the CMA in commerce.

Important skills include:

- Clear communication

- Data interpretation

- Problem solving

- Business understanding

- Time management

These CMA skills help convert numbers into useful insights.

Global Mobility with CMA After BCom

Many students wonder if the CMA USA course is better after BCom hons when thinking about global careers. The US CMA qualification is recognised in many countries. It supports roles in multinational firms. Working in global companies often involves budgeting, planning, and performance analysis. These areas match CMA training.

Also Read: Things You Need to Know About CMA Certification

Why Many Students Choose Imarticus Learning for CMA Preparation

When thinking about CMA after BCom, choosing where you prepare is as important as understanding the exam structure and timeline. A good preparation partner doesn’t just deliver video lessons. It provides clarity, guidance, structure, and confidence so that you understand concepts deeply and perform well on exam day. Here are the unique strengths that many learners appreciate in the Imarticus Learning CMA Program prep experience from the official course page and related resources.

Key Highlights of the Imarticus Learning US CMA Program prep

- Gold Learning Partner status with the Institute of Management Accountants (USA), meaning the curriculum quality, teaching standards, and training support meet global benchmarks.

- Structured US CMA training developed in collaboration with KPMG in India, bringing real industry case studies and practical business scenarios into the classroom.

- A money-back guarantee option if you do not pass the US CMA exams after completing the course requirements, reflecting confidence in the training process.

- Opportunities for pre-placement bootcamps, soft skills training, and resume support that help you prepare not just for the exam but also for roles in finance teams.

- Exposure to a network of alumni and corporate partners where past learners have moved into roles at top firms such as Deloitte, EY, Accenture, JP Morgan, and more.

- Fees are structured with ease of payment and EMI options available to make the journey more accessible without financial strain.

If you are planning your preparation timeline and want a guided, structured, and industry-aligned experience, this training environment can help you stay focused and prepared through every step of the CMA path.

FAQs on CMA After BCom

Students often have practical doubts before starting their CMA after BCom journey, especially around eligibility, difficulty level, duration, and career outcomes. The answers below address the most common questions in a clear and simple way to help you make informed decisions with confidence.

Can we study CMA after BCom?

Yes, students can begin preparing for the CMA course after BCom once they complete their graduation. A commerce background supports an understanding of accounting and finance topics. Many learners join structured programs from institutes like Imarticus Learning to stay consistent with exam preparation. The degree meets the academic requirement, and work experience can be completed later while working in finance roles.

How many years is CMA after graduation?

The time needed for CMA after BCom depends on how quickly exams are cleared. Many students finish both exam parts within one to two years. Working professionals may take longer based on their schedule. Coaching support from Imarticus Learning can help students plan study timelines better and stay on track with exam windows.

How many papers are in CMA after BCom?

There are two main exam parts in CMA after BCom. Each part covers different subject areas related to financial planning and decision-making. Students usually prepare for one part at a time. Training programs at Imarticus Learning often break the syllabus into smaller modules to make learning manageable.

Is BCom with CMA difficult?

The journey of CMA after BCom requires discipline and practice. The difficulty level feels manageable when concepts are understood step by step. Commerce graduates already know basic accounting, which helps. Guided preparation through Imarticus Learning can make study plans clearer and reduce confusion during revision.

Is CMA more difficult than MBA?

The experience of CMA after BCom differs from that of an MBA. CMA focuses deeply on accounting and financial management topics. An MBA covers a wider range of business subjects. Students who enjoy working with numbers and analysis often find CMA suitable. Both paths need effort and consistent study.

Who is eligible to take CMA?

Graduates from recognised universities can register for CMA after BCom. Students from other streams can also apply if they meet the education rules. Work experience in finance or accounting is required for final certification. Imarticus Learning help students understand documentation and eligibility steps clearly.

Which type of BCom is best for CMA?

Any commerce degree supports preparation for CMA after BCom. Specialisations in accounting or finance provide a stronger base. Subjects like cost accounting and financial management make the transition smoother. The key factor is interest in management accounting and analysis.

How to become a CMA after BCom?

To complete the CMA after BCom, a student registers with the certifying body, prepares for both exam parts, and gains relevant work experience. A structured study plan, regular mock tests, and revision are important. Many learners choose guidance from Imarticus Learning to stay disciplined and exam-ready throughout the process.

Shaping a Finance Career with CMA after BCom

At this point, the journey of CMA after BCom probably feels clearer and more structured. You have seen how eligibility works, how to plan the CMA course duration after BCom, what subjects to expect, and how these skills connect to real roles in companies. What once looked like a big and confusing decision now feels more like a step-by-step path.

Regular self-checks can make preparation smoother. Small topic-wise tests and a few full-length mock exams before the real exam build familiarity. Over time, the exam pattern feels less unknown and more manageable.

Some learners prefer a structured learning setup to stay consistent. The CMA Course prep offered by Imarticus Learning can make preparation feel more organised and less overwhelming, especially when balancing other responsibilities.

Your BCom degree has already given you the base in accounting and finance. Adding CMA builds the ability to use that knowledge in planning, analysis, and decision support. With a clear plan and steady effort, this path can shape a stable and meaningful career in finance.