As we progress in the digital age, the evolution of the banking and finance career sector is becoming even clearer. The World Bank released a report that indicates that, by 2030, 70% of all banking jobs will require digital skills. This projection provides a strong blueprint for those looking to build a future in this sector. Embracing digital skills in banking has become a necessity and not an option. Digitalisation also represents more than the advancement of technology; instead, there is a profession-wide evolution of skills towards a new banking reality. Given these critical changes in the industry, we have to understand and prepare ourselves for the future. This blog will explore how to future-proof your banking career, so you can be equipped with the required digital skills as we start to navigate a rapidly changing banking world. So, if you’re beginning your career journey or simply looking to elevate your current position, now is the time to ride the digital wave transforming the banking sector.

Digital Revolution In The Banking Sector

The digital revolution is quickly changing the banking sector, and the demand for professionals with digital skills is rising. The World Bank report projects that by 2030, 70% of all banking jobs will require digital skills. This unprecedented change offers both challenges and opportunities for people pursuing a banking and finance career. First of all, technology is redefining traditional banking roles. Data analysis, digital marketing, and cybersecurity are now fundamental banking skills. For example:

- Data Analysis – Banks are applying Big Data to help drive decisions, predict trends, and mitigate concerns in the delivery of customer service. With this level of investment made into data analysis, this translates into a high labour market demand for professionals with data analysis capabilities.

- Digital Marketing – As banking extends beyond the branch or phone, digital marketing skills are essential for engaging customers and building a strong digital brand.

- Cybersecurity – As digital transactions grow, so do cyber threats. As such, professionals with cybersecurity skills are in high demand to protect financial data.

To be successful in the future of banking careers, it is going to be vital for you to adapt to a new way of working and develop your skills to move forward. Several online platforms are now offering courses in data analysis, digital marketing, and cybersecurity that can help you advance your banking and finance career.

Also, you will need to have a customer-first mindset and be able to adapt to new tools and technologies. The future of careers in banking will no longer be based on just hard digital capabilities, but on having the right mindset to innovate, change, and navigate a new way of working.

Preparing for digital transformation in the banking sector

Technology has changed the nature of careers in banking and finance exponentially. Digital skills are no longer only an advantage; they are now a necessity. Many reports, including one from the World Bank, have predicted that the digital transformation will impact about 70% of jobs in banking by 2030. Financial establishments are continuously looking for individuals who can effortlessly navigate the digital realm while placing great attention to the following skill sets:

- Data Analysis: Comprehending and interpreting complex data sets is essential in the banking industry. This entails familiarity with data analytics tools and knowledge of predictive modelling.

- Cybersecurity: As banks’ operations go online, so does the increased potential for cyber attack. So, cybersecurity skills are highly sought after to protect sensitive financial information.

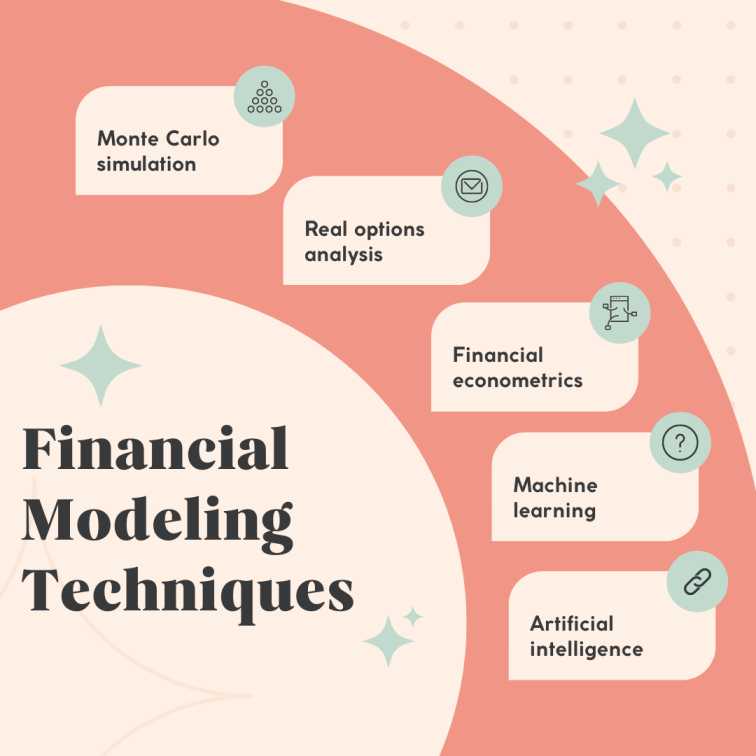

- Artificial Intelligence and Machine Learning: These technologies are transforming the banking industry, making skills in artificial intelligence and machine learning increasingly important.

- Blockchain and Cryptocurrency: As banks continue to adopt blockchain technology and deal with cryptocurrencies, professionals who are knowledgeable in these areas are in high demand.

Increased digitalisation of the banking industry is not just about the technology being implemented but also a movement away from traditional and developed ways of working, i.e. adopting new ways of working, thinking digitally, and promoting innovation. Therefore, those contemplating a career in banking and finance need to ensure they are equipped with the necessary digital skills to enter this new arena. That means formal education, online courses, or self-learning, it doesn’t matter, it will all help. The time to start is now.

Preparing for a Future in Financial Technology

In an increasingly digital landscape, a career in banking and finance isn’t all about just crunching numbers anymore – you’ll need a multi-faceted mix of financial knowledge, technological understanding, and innovation. The World Bank predicts that by 2030, 70% of banking jobs will require digital skills. To secure a place in the future of banking technology, it is essential to understand the changing requirements and adapt accordingly. If you are hoping to enter the door of fintech careers, here are some ideas to get you started:

- Digital literacy: Proficiency in digital tools and platforms is not optional. The banking and finance industries will be reliant on digital tools in the future, particularly in areas such as cloud computing, data analytics, and machine learning.

- Be aware: The fintech sector changes rapidly, so staying updated on the latest trends, such as blockchain and AI—be sure to read articles published about them—will keep you ahead of the game.

- Develop your soft skills: The fintech sector will also consider your soft skills, for example, thinking creatively, solving problems and being flexible, in addition to your technical ability.

- Obtain relevant qualifications: Consider whether a degree, certificate or course of study in financial technology, data science, or any specific field that pertains could be helpful. Many institutions offer courses that are specially prepared for students exploring careers in banking technology.

In conclusion, the career path in traditional banking and finance is changing rapidly, mainly due to the central role of technology in these sectors. Therefore, the individuals who will succeed in this exciting, future-focused industry are those who can combine their understanding of finance with their ability to understand digital tools and trends.

Developing Digital Skills: A Requirement For Banking and Finance Career Positions

Upskilling – or developing new skills – has now become a necessity for most roles in banking. It is essential to remain competitive, as banking jobs are evolving to incorporate tools and technologies that transform every sector. The World Bank estimates that 70% of all banking jobs will require digital skills by 2030. For those looking to upskill for a banking and finance job, there are several main areas to concentrate on:

- Data Skills: With the rise of big data comes the ability to analyse and interpret this data. Data skills will allow professionals to make informed decisions, identify trends and tailor services for their clients.

- Cybersecurity: The finance sector is at high risk for potential cyber threats, especially when considering recent news headlines about security breaches and attacks. Cybersecurity skills can cover knowledge of the latest security protocols as well as identifying and limiting potential threats.

- Fintech Acumen: Knowledge in innovative solutions like blockchain, artificial intelligence (AI) and mobile banking technology is essential as they are changing how traditional banking activities can be done.

- Digital Communication: As more customer communications move online, understanding digital communication tools is a key competency. Today’s banks utilise social media channels, chatbots and email for communication.

Upskilling for banking jobs improves employability and workforce readiness for the future of work in banking. Through developing digital skills, you will have laid the groundwork for a successful, resilient banking and finance career. It’s no longer enough to keep up with changes and increasing demands on the banking sector; it’s about staying ahead, ready to take advantage of changes.

Getting Ready for a Digital Future in Banking

As we look to the end of this decade, we anticipate seeing significant changes to the landscape of careers in the banking and finance sector. According to the World Bank’s forecasts and modelling, roughly 70% of banking jobs are predicted to require digital skills by 2030. This rapidly evolving trend also highlights the importance of the banking and finance industry preparing for a digitised future.

- Changing Skillsets: Banking no longer only provides a tick-board for numbers and financial regulations. By 2030, there will be a great demand for professionals with skills in data analytics, artificial intelligence and/or blockchain. The banking sector will become increasingly digitised, and skills in navigating these new realities will be essential.

- Changing Job Roles: Traditional banking roles will also be impacted, where a bank teller’s role may now involve not just face-to-face customer service, but also proficiency in various digital banking applications.

- The Rise of Fintech: Fintech has been disrupting the banking industry for several years, and its impact on careers in banking and finance is expected to be significant by 2030. As a result, many industry roles will need to adapt to these new technologies.

Evolving changes in the banking and finance sector present both obstacles and opportunities for people choosing to pursue a career in banking and finance. Professions will adjust to adapt to the digital disruption of financial services rapidly, and individuals will need to earn new up-skilling and educational qualifications. Lifelong learning and building comfort with digital tools will ensure employability and ultimately support the continued growth of the banking and finance sector in the digital age.

As we eagerly await the arrival of 2030, let us prepare to embrace this digital revolution and how these evolving trends will help you succeed in a career in banking and finance.

Navigating this banking and finance career path can be a deep, complex process, characterised by many challenges. Imarticus Learning’s highly regarded and well-structured banking and finance course is designed to make this journey possible by providing the knowledge and skills needed to be successful in the industry. This comprehensive course complements the topics we’ve covered in this blog, providing an appreciation for the subtleties of the financial sector. The program is structured for delivery to offer you both practical and theoretical knowledge from industry professionals. By taking this course, you give yourself the best chance of moving forward in your career, especially with the skills and abilities to stand out in the job market. This program is ideal for individuals who wish to explore banking and finance further, and gives you the best platform for you to make the most of your future. Enrich your career with this course, and move confidently forward towards fulfilling your purpose in the banking and finance sector.

FAQs

When the World Bank says, “70% of banking jobs will need digital skills by 2030”, what does that mean?

The World Bank indicates that due to rapid digitisation of the banking sector, the way jobs are created, developed, change and become obsolete will occur at a much quicker and possibly systematic pace. Therefore, based on current expected rates of digitisation, by 2030, approximately 70% of all roles in the banking sector will require some level of digital skills. Digital skills may not always be the apparent choice i.e. algorithms that process data or AI that communicates with customers (currently). Regardless of the job role, the career area of banking and finance is going to require digital skills, whether you are aware of it already or not.

Why is there going to be an increased need for digital skills in the banking and finance career area?

The banking and finance sector is in a state of rapid change, driven by technological advancements. With the increased use of digitisation and automation, there is a growing demand for people to leverage these technologies to make Banks and financial services work more efficiently and provide better customer service. Increased cyber threats also require banking professionals to have developed knowledge and understanding of digital security. Digital skills are no longer merely beneficial but essential in the banking and finance career area.

What digital skills can I expect to be sought after in the banking area?

The digital skills you are required to know can depend on the type of job role. However, some popular digital skills include data analytics, financial software, cybersecurity knowledge, blockchain and cryptocurrencies, and knowledge of AI and machine learning. Given that working remotely is becoming increasingly common in banking and finance, it is essential to be proficient in using digital and online communication and collaboration tools.

How can I prepare my digital skills for the changing banking area?

To prepare you for the changing area, start using various online digital media and resources to be informed of the latest digital trends in the banking and finance sector. Read articles, attend webinars, and visit industry events. In addition, consider professional courses to gain hands-on experience with various digital skills in banking and finance. Importantly, you must not only gain the relevant skills but also continuously update them, as the world of digital banking is constantly changing to keep pace with the new digital environment.

What are the career opportunities for candidates who have digital skills in the banking area?

Given the demand for digital skills, individuals skilled in digital technologies are more likely to have varied opportunities in the banking and finance career area. I expect to see roles available in areas such as digital banking, financial technology (fintech), cybersecurity, data analytics, and

Understanding the Difference Between Asset Management and Wealth Management

Understanding the Difference Between Asset Management and Wealth Management