Investment banking offers a captivating career in finance, serving as a vital player in the financial world. With its significant role in facilitating major transactions and offering strategic advice to diverse industries, this field presents rewarding opportunities.

Let us take a look at what is investment banking and the many possibilities awaiting you in the world of investment banking careers.

What is Investment Banking?

Investment banking encompasses extensive financial services primarily centred around raising capital and offering counsel to corporations, governments, and affluent individuals. Engaging in transactions within the capital markets can be intricate, with numerous regulatory challenges to overcome.

Consequently, corporations and various entities frequently enlist the assistance of investment banks to facilitate these processes.

Recognizing what is investment banking and the opportunities it offers to shape successful financial transactions and business strategies through specialized services is important to make a great career in the field of banking.

Investment Banking Functions and Operations

An investment bank is like a middleman between investor and issuer and helps clients raise money through debt and equity offerings.

IPOs (Initial Public Offerings)

- Companies hire investment banks to issue IPOs and raise capital.

- Investment banks assist in underwriting, setting offer prices, and creating a market for the stock.

Mergers and Acquisitions (M&A)

- Investment banks facilitate M&A deals between companies.

- They play critical roles in valuing companies, strategising the merger process, and raising funds for M&A transactions.

Risk Management

- Investment banks help manage financial risks like currency, loans, and liquidity.

- They identify loss areas and control credit risks for effective risk management.

Research

- Equity research is vital for providing company ratings to aid investor decision-making.

- Investment banks offer research reports on companies’ performance and market trends.

You can play a vital role in shaping financial markets and supporting businesses through a career in investment banking. Understanding what is investment banking and exploring diverse functions and opportunities to excel in this dynamic field will help you become an efficient Investment Banker.

What is Investment Banking’s Role in the Financial Industry

Investment banking professionals are critical in stock offerings, SEC documentation, M&As, and guiding clients toward lucrative investment opportunities. They ensure smooth execution and handle essential financial and ownership details.

Key Players in Investment Banking

Key players in investment banking include investment banks, corporate clients, institutional investors, retail investors, regulatory authorities, private equity firms, hedge funds, venture capital firms, law firms, and rating agencies. They collaborate to facilitate financial transactions and provide strategic advisory services in the industry.

Core Investment Banking Services

Mergers and Acquisitions (M&A)

M&A, an integral facet of investment banking services, revolves around the convergence of companies through multifaceted transactions encompassing acquisitions, mergers, divestitures, and joint ventures. Investment banks play a pivotal role in guiding clients through these intricate deals.

These financial institutions undertake comprehensive valuation analyses, meticulously identify potential targets or buyers, adeptly negotiate agreements, and astutely oversee the entire process to ensure seamless execution. The realm of Mergers and Acquisitions demands intricate understanding, financial finesse, and astute strategising. Investment bankers leverage their expertise to craft advantageous deals, optimise synergies, and mitigate risks for their clients.

Delving into the intricacies of M&A, investment banks facilitate strategic decisions that reshape industries and redefine business landscapes. By offering insights, market intelligence, and transactional prowess, they empower clients to navigate the complex terrain of M&A with confidence.

Find out more about mergers and acquisitions here.

Capital Markets and Fundraising

In investment banking services, companies receive valuable assistance in raising capital through diverse avenues, such as issuing stocks, bonds, and other financial instruments. Investment banks excel in structuring these offerings, setting optimal pricing, and identifying suitable investors.

Additionally, investment banks play a crucial role in facilitating secondary market transactions, enabling the smooth buying and selling of securities on stock exchanges. To be highly sought after by companies worldwide, understanding what is investment banking specializations like capital markets and fundraising are essential.

Fundraising is crucial for both governments and private companies when they are in need of funds or a stable cash flow for various projects or for future endeavours. Investment bankers are also essential for guiding companies when investing in other companies or external projects.

Financial Modelling

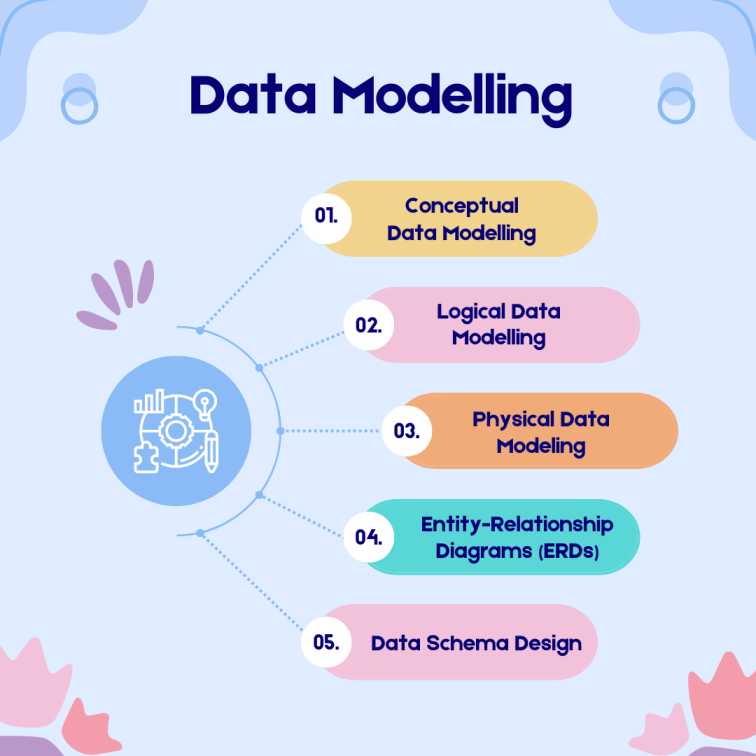

Financial modelling is a core aspect of investment banking services, involving the creation of detailed numerical representations of a company’s financial performance. Investment banks utilise these models to forecast future financial scenarios, analyse investment opportunities, and assess the potential impact of various strategies and decisions.

Financial models encompass a range of elements, including revenue projections, expense forecasts, cash flow analysis, and scenario simulations. Investment banks employ advanced software and tools to build and manipulate these models, allowing them to make informed recommendations to clients.

Financial modelling also helps in simulating business scenarios or probable profit and loss based on different financial decisions or combinations of business decisions.

Find out more about what is investment banking’s role in financial modelling here.

Valuation and Investment Analysis

Within the realm of what is investment banking services, valuation and investment analysis are key components. These practices involve the meticulous assessment of assets, companies, and investment opportunities to determine their intrinsic worth and potential for generating returns.

Investment banks employ various methodologies for valuation, such as discounted cash flow (DCF) analysis, comparable company analysis (comps), precedent transaction analysis, and asset-based valuation.

By learning what is investment banking valuation methods, investment professionals scrutinise financial data, market trends, and industry benchmarks to arrive at accurate and well-founded valuations.

Analysing investments is essential for businesses and governments to find out if a certain business or financial investment can cause future losses, thus being able to help organisations avoid financial loss or achieve profitability.

Find out more about what is investment banking analysis and valuation methods, such as DCF valuation, here.

Other Essential Investment Banking Services

Corporate Finance and Advisory Services

Investment banks deliver specialised financial counsel to corporations concerning corporate restructuring, capital allocation, financial risk management, and broader financial strategies.

These tailor-made services cater to each client’s unique requirements and frequently entail in-depth financial analysis and extensive market research.

To excel in this field, consider learning what is investment banking and getting trained and certified for comprehensive expertise.

Underwriting and Securities Offerings

Investment banks offer underwriting services for companies launching new securities like stocks or bonds. Underwriting involves selling these securities to investors, with the investment bank bearing the financial risk.

Financial Restructuring and Debt Advisory

Financial restructuring involves a carefully planned strategic overhaul of a company’s capital structure and operations to tackle economic difficulties and avoid bankruptcy.

The main goal is to maximise the efficient utilisation of financial resources and improve the company’s financial health.

This multifaceted process includes various essential components:

- Debt restructuring

- Equity infusion

- Asset sales and divestitures

- Cost-cutting measures

- Business reorganisation

What is Investment Banking Process and Transactions

Deal Lifecycle in Investment Banking

Investment bankers begin by identifying potential opportunities and establishing client relationships. Deal origination methods include networking, referrals, market research, and leveraging industry expertise.

Due Diligence and Deal Structuring

After securing the mandate, investment banks conduct comprehensive due diligence on the client’s business, financials, and market position. It aids in structuring the deal appropriately determining suitable financial instruments, pricing, and transaction terms.

Negotiations and Closing Processes

Investment bankers initiate negotiations with potential buyers, sellers, or investors, finding common ground on price and deal specifics. Once a consensus is reached, the deal is executed through legal agreements and contracts.

Post-Deal Integration and Management

After closing the deal, investment bankers may assist with post-merger integration (M&A) or ongoing management of issued financial instruments. Post-deal integration ensures a seamless transition and maximises transaction benefits.

Throughout the deal lifecycle, investment bankers offer clients strategic guidance, financial expertise, and market insights. They collaborate with stakeholders, including legal teams, regulators, and financial institutions, ensuring compliance with relevant laws and regulations.

To understand what is investment banking and gain expertise in its fundamentals, consider enrolling in comprehensive training and banking courses.

Investment Banking in Different Sectors

Investment banking is vital across diverse industries, facilitating crucial financial activities and providing strategic advice.

Here is a brief overview of what is investment banking’s significance in specific sectors:

Investment Banking in Technology and Startups

In this dynamic sector, investment banks support startups and tech companies with capital raising, mergers, acquisitions, and strategic advisory services, empowering innovation and growth.

Investment Banking in Real Estate and Infrastructure

Investment banks enable real estate developers, investors, and infrastructure firms to raise funds, structure deals, and execute transactions for projects, driving progress and development.

Investment Banking in Healthcare and Pharmaceuticals

In the healthcare industry, investment banking aids pharmaceutical, biotech, and medical device companies with IPOs, mergers, licensing deals, and partnerships, fostering advancements in medical research.

Investment Banking in Energy and Utilities

For energy companies, investment banks provide financial services, including project finance, M&A, and capital raising, supporting the growth and expansion of renewable energy initiatives and traditional utility operations, thus contributing to sustainable energy development and meeting global energy demands.

Investment Banking in Consumer Goods and Retail

Investment banks in consumer goods and retail provide financial services, including M&A, IPOs, and strategic advisory, supporting business growth and competitiveness in this sector.

Investment Banking Regulatory Environment

Role of Regulatory Authorities in Investment Banking

Governmental organisations, known as regulatory bodies, uphold the laws and ordinances that apply to investment banks and other financial organisations. They are responsible for encouraging transparency, safeguarding customers and investors, and stopping systemic hazards in the financial system. The SEC in the US and the FCA in the UK are two examples.

Compliance and Legal Considerations

Investment banks must adhere to various regulations covering securities offerings, disclosure requirements, trading practices, anti-money laundering (AML) measures, and data protection.

Dedicated compliance departments within investment banks ensure strict adherence to these regulations and internal policies. Non-compliance may lead to penalties, fines, and damage to the bank’s reputation.

Basel III and Capital Adequacy Requirements

Basel III represents a set of international banking regulations formulated by the Basel Committee on Banking Supervision. It aims to enhance banks’ resilience by strengthening risk management and raising capital adequacy requirements.

These regulations establish minimum capital standards, including shared equity, Tier 1 capital, Tier 1 capital, and total capital, to ensure banks possess sufficient money to withstand financial shocks and maintain stability.

Market Regulations and Risk Management

Being aware of what is investment banking activities that are subject to regulations covering market manipulations, insider trading, and the use of complex financial instruments like derivatives is crucial.

Investment banks must implement robust risk management practices encompassing credit, market, operational, and liquidity risks to ensure compliance.

What is Investment Banking Operations and Back-Office Functions

Trade Settlement and Clearing

Trade settlement and clearing are essential processes in the post-trade phase of financial transactions. After the trade is executed, settlement involves the exchange of cash and securities between the buying and selling parties. Clearing consists of confirming, matching, and validating trade details to ensure accuracy.

Investment banks use clearinghouses and custodian banks to facilitate these processes, which are crucial for reducing counterparty risk and ensuring the timely and accurate completion of trades.

Transaction Confirmation and Reconciliation

Transaction confirmation validates trade details sent to both parties to ensure agreement. Reconciliation compares data from various sources, resolving discrepancies to maintain accuracy and data integrity.

Operations Risk Management

Operations risk management aims to identify, assess, and mitigate risks related to investment banking operations. It includes risks associated with processing errors, technology failures, data breaches, fraud, regulatory compliance, and other operational aspects.

Robust risk management practices are essential to prevent financial losses, reputational damage, and regulatory sanctions.

Trade Support and Middle Office Functions

The middle office in investment banking supports the front-office activities (e.g., traders, sales, etc.) by providing risk management, trade support, and analytics.

Middle office functions may involve monitoring and managing market, credit, and operational risks associated with trading activities. It also handles collateral management, ensuring sufficient collateral for trading activities and mitigating counterparty credit risk.

For a rewarding career in banking, consider getting a comprehensive grasp of what is investment banking by pursuing an investment banking course to gain valuable knowledge and skills essential for this dynamic industry.

What is Investment Banking Technology and Digital Transformation

Fintech Innovations in Investment Banking

Fintech has revolutionised investment banking with online platforms for capital raising, peer-to-peer lending, and alternative finance solutions. These disruptions provide faster, more efficient, cost-effective financial services, challenging traditional models for investors and businesses.

Automation and Artificial Intelligence (AI) in Operations

Automation and AI technologies have brought remarkable improvements to investment banking operations. Tasks like data entry, trade settlements, and reconciliation have been streamlined with Robotic Process Automation (RPA), leading to faster processing and reduced errors.

AI-powered algorithms assist in trading, portfolio management, and risk assessment, empowering data-driven decision-making.

Blockchain and Distributed Ledger Technology in Investment Banking

The transformative potential of blockchain technology has been recognised in investment banking, particularly in transaction settlement and post-trade operations.

By offering secure and transparent record-keeping through decentralised and immutable ledgers, blockchain minimises the need for intermediaries and enhances trust between parties. It enables faster and more efficient securities settlement while lowering the risk of fraud.

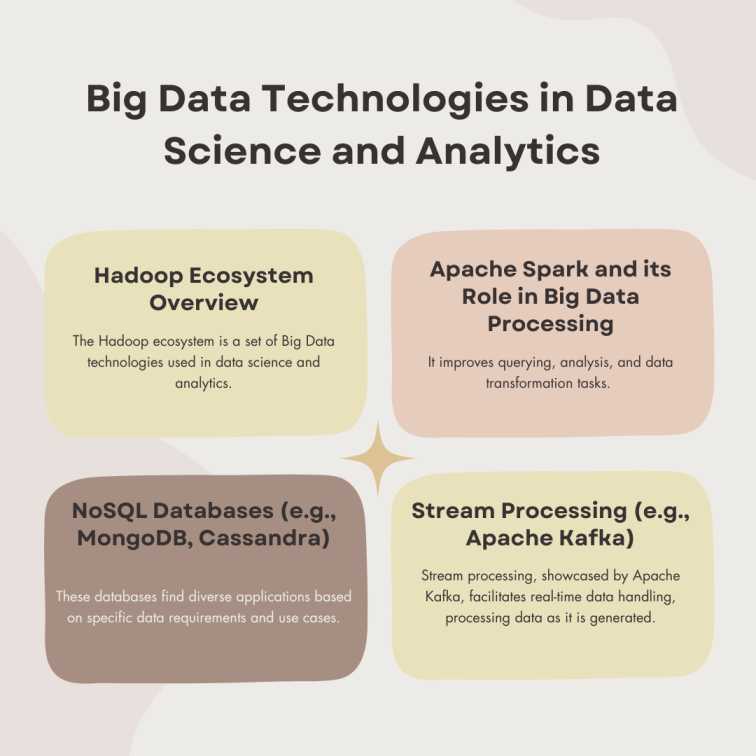

Data Analytics and Machine Learning Applications

Investment banks have embraced data analytics and machine learning to gain deeper insights into market trends, customer behaviour, and risk management. The analysis of big data aids in informed investment decisions, optimising trading strategies, and offering personalised services to clients.

Among other critical applications, machine learning algorithms are instrumental in credit risk assessment, fraud detection, and portfolio optimisation.

Investment Banking Career Paths and Skills

Roles in Investment Banking (Analyst, Associate, VP, Managing Director)

Investment Banking Analyst

Analysts in investment banking are entry-level professionals who conduct financial analysis, build models, prepare pitch materials, and assist with due diligence for transactions. They usually hold bachelor’s degrees in finance, accounting, economics, or related fields.

Investment Banking Associate

Associates are more experienced than analysts and take on additional responsibilities in deal execution and client management. They work closely with senior bankers and often supervise analysts. Associates usually have an MBA or relevant master’s degree and prior experience in finance or investment banking.

Investment Banking Vice President (VP)

Vice Presidents are senior members of the investment banking team who lead deal teams, oversee transaction execution, and play a key role in business development. They are responsible for managing client relationships and providing strategic advice. VPs have significant experience in investment banking or related fields.

Investment Banking Managing Director (MD)

Managing Directors are top-level executives in investment banking responsible for leading and managing the entire division. They focus on business strategy, relationship management with significant clients, and setting overall goals for the division. MDs have extensive experience in investment banking and a successful track record.

Skills and Qualifications for Investment Banking Professionals

Financial acumen: Investment bankers must possess a deep understanding of financial concepts, including financial statement analysis, valuation techniques, and capital markets. They must interpret complex financial data and trends to provide sound financial advice to clients.

Problem-solving: Investment bankers face intricate deals with potential unexpected challenges. Problem-solving skills are essential to navigate complexities, find innovative solutions, and ensure successful deal execution.

Bachelor’s degree in finance or related field: Most investment banking roles require a bachelor’s degree in finance, economics, business, or a related discipline. A solid educational foundation equips professionals with fundamental knowledge in finance and accounting.

Relevant work experience: Many investment banking positions seek candidates with prior experience in finance, investment analysis, or related roles. Internships, finance-related projects, or work in financial institutions can provide valuable exposure and enhance the candidate’s profile.

Licensing or certifications: Certain roles in investment banking may require a licence or certifications. The Chartered Financial Analyst (CFA) certification is also highly regarded in the industry.

Career Development and Advancement

The career progression in investment banking typically follows a well-defined trajectory, starting as an analyst and ascending to higher roles like associate, VP, and ultimately, managing director or senior leadership positions.

This advancement is contingent on exceptional performance, deal execution expertise, successful business development, and strong leadership abilities.

Specialisation opportunities:

Investment banking professionals can specialise in specific sectors like technology, healthcare, or real estate, opening up more prospects within those industries. Becoming a subject matter expert enhances career growth and widens potential opportunities.

What is Investment Banking Trends and Challenges

Emerging Trends in Investment Banking

Digital transformation: Investment banks increasingly embrace digital technologies and automation to streamline operations, enhance client experiences, and improve efficiency. Fintech innovations, artificial intelligence, and blockchain are reshaping various aspects of investment banking processes.

ESG investing: Environmental, Social, and Governance (ESG) considerations have gained prominence in investment decisions. Investors increasingly focus on companies’ sustainability practices, ethical standards, and social impact. Investment banks incorporate ESG factors into their research, valuation models, and client advisory services.

Private capital markets: There is a growing interest in private capital markets, with investors seeking opportunities in venture capital, private equity, and direct investments in private companies. Investment banks are increasingly involved in fundraising and advising in these private markets.

Cross-Border deals: Globalisation has increased cross-border mergers and acquisitions, requiring investment banks to navigate complex regulatory environments and cultural differences to facilitate international transactions.

Challenges and Opportunities in Investment Banking

Adhering to complex regulations: Investment banks grapple with the intricacies of financial regulations, striving to ensure compliance with AML and KYC requirements while upholding ethical practices.

Managing market volatility: The investment banking industry is susceptible to market fluctuations, necessitating effective risk management strategies to safeguard banks and clients from volatility.

Coping with intense competition: Fierce market competition creates fee pressure and narrow profit margins. Banks must distinguish themselves through specialised services, top-tier advisory, and innovative technology.

Impact of Global Economic and Market Conditions

Global economic and market conditions significantly influence investment banking activities. Economic downturns can reduce deal activity, affect capital raising, and increase credit risks.

Conversely, periods of economic growth can drive M&A transactions and investment opportunities.

Environmental, Social, and Governance (ESG) Considerations

ESG considerations have a profound impact on investment banking. Investors increasingly prioritise sustainable and responsible investments, influencing deal-making and capital allocation decisions. Investment banks incorporate ESG factors into their research, risk assessments, and client recommendations.

Case Studies and Real-World Examples

Successful Investment Banking Transactions

Amazon acquiring Whole Food

In a groundbreaking move, Amazon executed a momentous acquisition of a widespread network of Whole Foods supermarkets, valued at an astounding $13.7 billion. Though the inception of this collaboration encountered certain obstacles, the outcome served as a transformative catalyst for Amazon’s trajectory.

By joining Whole Foods, Amazon significantly expanded its online shopping operations and gained a formidable offline presence. The acquisition opened the doors for Amazon to venture into the fiercely competitive grocery and food industry, giving them a substantial advantage.

Disney and Marvel/Pixar

Disney has showcased its prowess in acquiring other successful companies, cementing its status as an entertainment powerhouse. In a significant deal in 2006, Disney acquired Pixar for an impressive $7.4 billion. This collaboration led to the release of blockbuster hits such as WALL-E and Toy Story 3, generating astounding revenues in the billions.

Building on the success of the Pixar acquisition, Disney repeated the feat by acquiring Marvel Entertainment three years later. The subsequent Marvel films broke records at the box office and brought in billions in revenue.

These acquisitions have proven to be a strategic masterstroke for Disney, solidifying its position as a dominant force in the entertainment industry, with each successful blockbuster further affirming its triumphant approach to growth.

Notable M&A Deals and Capital Market Offerings

Notable M&A Deals

Vodafone and Mannesmann (1999) – $202.8B

In 2000, Vodafone acquired Mannesmann for approximately $203 billion, making it the largest acquisition ever. This deal positioned Vodafone as the world’s largest mobile operator and influenced numerous mega deals in the mobile telecommunications industry.

AT&T and Time Warner (2018) – $108B

In 2018, AT&T’s merger with Time Warner for $108 billion faced antitrust scrutiny, unlike Time Warner’s previous controversial merger with AOL. The AT & T-Time Warner deal was more carefully considered, with AT & T’s more robust financial position.

Notable Capital Market Offerings

Saudi Aramco IPO (December 5th, 2019)

- Raised $25.6 billion in capital.

- Current valuation in 2023: $1.93 trillion.

- Largest IPO of all time.

- The stock performed well, with close to 10% annual growth.

Alibaba Group IPO (September 19th, 2014)

- Raised $21.7 billion in capital, with a $167.6 billion valuation.

- Highly hyped IPO, finishing 38% above initial listing price on the first day.

- Current valuation in 2023: $272.9 billion.

- Faced challenges due to political turbulence in China.

What is Investment Banking Best Practices and Lessons Learned

Best Practices

Due diligence: Conducting comprehensive due diligence is crucial before engaging in any transaction. Understanding what is investment banking deal’s financial, legal, and operational aspects helps mitigate risks and uncover potential issues.

Ethical conduct: Upholding high ethical standards is fundamental in investment banking. Transparency, honesty, and fair dealing build trust with clients and foster a positive reputation in the industry.

Market intelligence: Staying informed about what is investment banking market trends, regulatory changes, and economic conditions is vital for offering valuable insights to clients and making informed investment decisions.

Lessons Learned

Timing matters: The timing of a deal can significantly impact its success. Market conditions, economic fluctuations, and geopolitical events can influence the outcome, emphasising the importance of strategic timing.

Client education: Ensuring clients fully understand what is investment banking complexities and risks of investment opportunities, helping them make more informed decisions and reduce misunderstandings later.

Communication is key: Effective communication with clients and internal teams is crucial for managing expectations, aligning strategies, and resolving potential conflicts.

Conclusion

The world of investment banking offers a plethora of opportunities for aspiring professionals. However, excelling in this dynamic field requires a strong foundation of skills and knowledge of what is investment banking. That’s where Imarticus Learning’s Certified Investment Banking Operations Professional course comes into play.

With Imarticus Learning’s comprehensive investment banking certification, aspiring professionals can gain a competitive edge in the industry.

Moreover, the added advantage of Investment banking internships ensures graduates are well-positioned for exciting career opportunities in investment banking.

Whether you are just starting your career or seeking to advance in the field, Imarticus Learning’s investment banking course can be your pathway to success in the fast-paced world of investment banking.

Visit Imarticus Learning today to learn more about certification in investment banking.