Table of Contents

- Introduction

- CPA Exam Preparation Tips for Indian Aspirants

- How to Clear CPA in First Attempt

- Best CPA Study Materials for 2025

- Effective CPA Exam Strategy 2025

- Creating a US CPA Study Plan that Works

- Top CPA Exam Success Tips

- Useful CPA Exam Resources

- Job Prospects: CPA vs CMA Jobs in India

- FAQs

- Key Takeaways

- Conclusion

Introduction

Passing the US CPA exam on the first attempt is a dream for many finance aspirants, especially those from India who are seeking international credentials to accelerate their careers. But let’s face it—the CPA exam isn’t easy. It’s a marathon of dedication, smart strategy, and consistent preparation. What if we told you there’s a way to approach this challenge methodically and boost your chances of clearing it on the first go?

In this blog, we’ll decode everything you need to know to ace the US CPA exam in your first attempt. From the CPA exam preparation tips to the best CPA study materials, we’ll walk you through the must-have tools, tested strategies, and a practical study plan. Whether you’re a student or a working professional, this guide is tailored for you.

CPA Exam Preparation Tips for Aspirants

It can be exhausting to study for the CPA exam while also managing your life and current obligations. But with a proper plan, even Indian candidates can break the code and succeed. Many students do not appreciate the cultural and educational shifts when preparing for an international certification such as the CPA.

For your consideration, the CPA is divided into 4 sections, AUD, BEC, FAR and REG, which is a critical consideration for defining a study plan. Managing your time, understanding how you will use your 4 hours for each section, and disciplined preparation are your friends!

CPA Exam Format and Time Allocation

| Section | Full Form | Time Allotted | Question Types |

| AUD | Auditing and Attestation | 4 hours | MCQs + Task-based Sims |

| BEC | Business Environment and Concepts | 4 hours | MCQs + Sims + Written Communication |

| FAR | Financial Accounting and Reporting | 4 hours | MCQs + Task-based Sims |

| REG | Regulation | 4 hours | MCQs + Task-based Sims |

How to Clear CPA in First Attempt

The question, “How to clear CPA in first attempt?” often comes down to one word: consistency. Many CPA candidates falter not because of lack of knowledge but due to inconsistent study schedules or burnout. Treat your CPA journey like a 9-5 job: show up every day, track your progress, and take breaks to avoid fatigue.

Engage in active recall, spaced repetition, and solve at least 1,000 practice questions per section. A mock test every two weeks simulates exam conditions and builds confidence. Keep reviewing your mistakes—they’re your most honest teachers.

Common Mistakes to Avoid

- Over-relying on passive reading

- Skipping mock tests

- Not revisiting weaker topics

- Ignoring task-based simulations

- Poor time management during study hours

Best CPA Study Materials for 2025

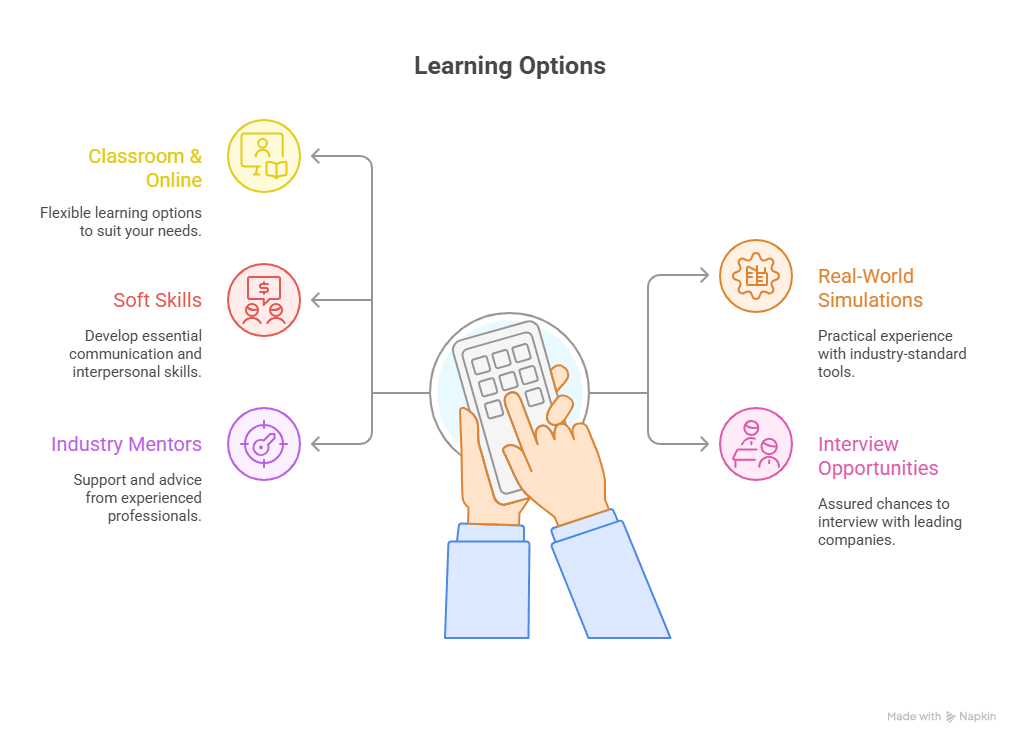

Access to the best CPA study materials can significantly impact your performance. Thankfully, there are now adaptive platforms that provide customised content based on your progress. Choose materials that are up-to-date with CPA exam strategy 2025 standards.

It’s wise to invest in at least one well-known prep provider. Look for ones that offer live classes, practice tests, and simulations aligned with real exam difficulty.

Top-Rated CPA Study Resources (2025)

| Provider | Features | Price (Approx.) |

| Becker | Live + On-demand, AI-adaptive learning | INR 1.2L+ |

| Wiley | Extensive test bank, flashcards, app access | INR 90K+ |

| Gleim | Deep content review, cost-effective | INR 70K+ |

Effective CPA Exam Strategy 2025

Adopting a tailored CPA exam strategy 2025 is key for staying ahead. Unlike previous years, the 2025 version of the exam includes new simulation types and places a greater emphasis on practical knowledge.

Stay updated by subscribing to official AICPA newsletters and joining CPA student forums. Collaborate with peers—group discussions can clarify complex topics. Stick to a monthly schedule where each week focuses on specific sub-topics.

Strategy Building Blocks

- Weekly topic targets and goals

- Integrated mock test planning

- Monthly topic-wise SWOT analysis

- End-of-day review journals

Creating a US CPA Study Plan that Works

Every successful CPA candidate swears by a robust US CPA study plan. But let’s be honest—there’s no one-size-fits-all. Your plan should reflect your daily routine, peak focus hours, and weak subjects. Study smarter, not harder.

Divide your study time into active learning (reading, watching lectures) and passive review (flashcards, summaries). Incorporate at least one rest day per week.

Sample Weekly Study Plan

- Monday-Wednesday: Core concepts (2 hrs/day)

- Thursday: Practice questions (3 hrs)

- Friday: Doubt clearing + revision (2 hrs)

- Saturday: Mock test (4 hrs)

- Sunday: Review errors + rest

Top CPA Exam Success Tips

Want practical and powerful CPA exam success tips? Here’s a list of golden rules shared by top scorers and CPA trainers globally. Stick to these and you’re on your way to conquering the exam.

- Begin with FAR or AUD for foundational understanding

- Mix hard and easy topics to stay motivated

- Track every hour of study using digital planners

- Limit social distractions

- Avoid excessive study marathons—they lead to burnout

- Keep updating your knowledge with the latest AICPA changes

- Watch YouTube explainer videos for complex topics

- Use Pomodoro technique (25-5) for high focus blocks

Useful CPA Exam Resources

Curated CPA exam resources can reduce your prep time significantly. Make the most of these options that provide real-world practice, topic clarity, and updated info.

Recommended Tools and Platforms

- AICPA Official Site: https://www.aicpa.org

- NASBA: https://www.nasba.org

- Accounting Today – CPA News: https://www.accountingtoday.com

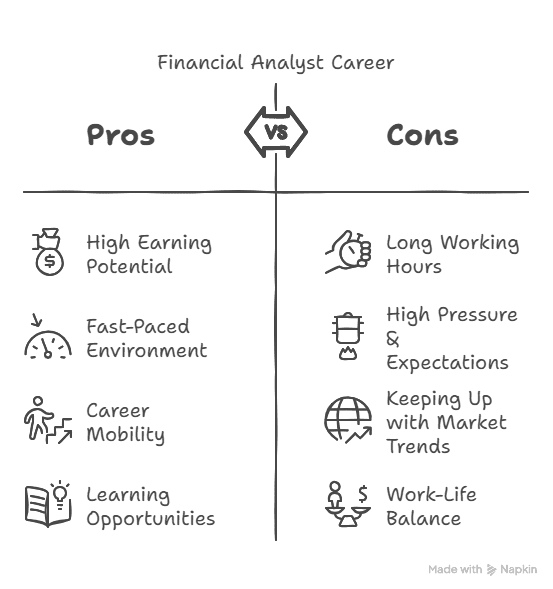

Job Prospects: CPA vs CMA Jobs in India

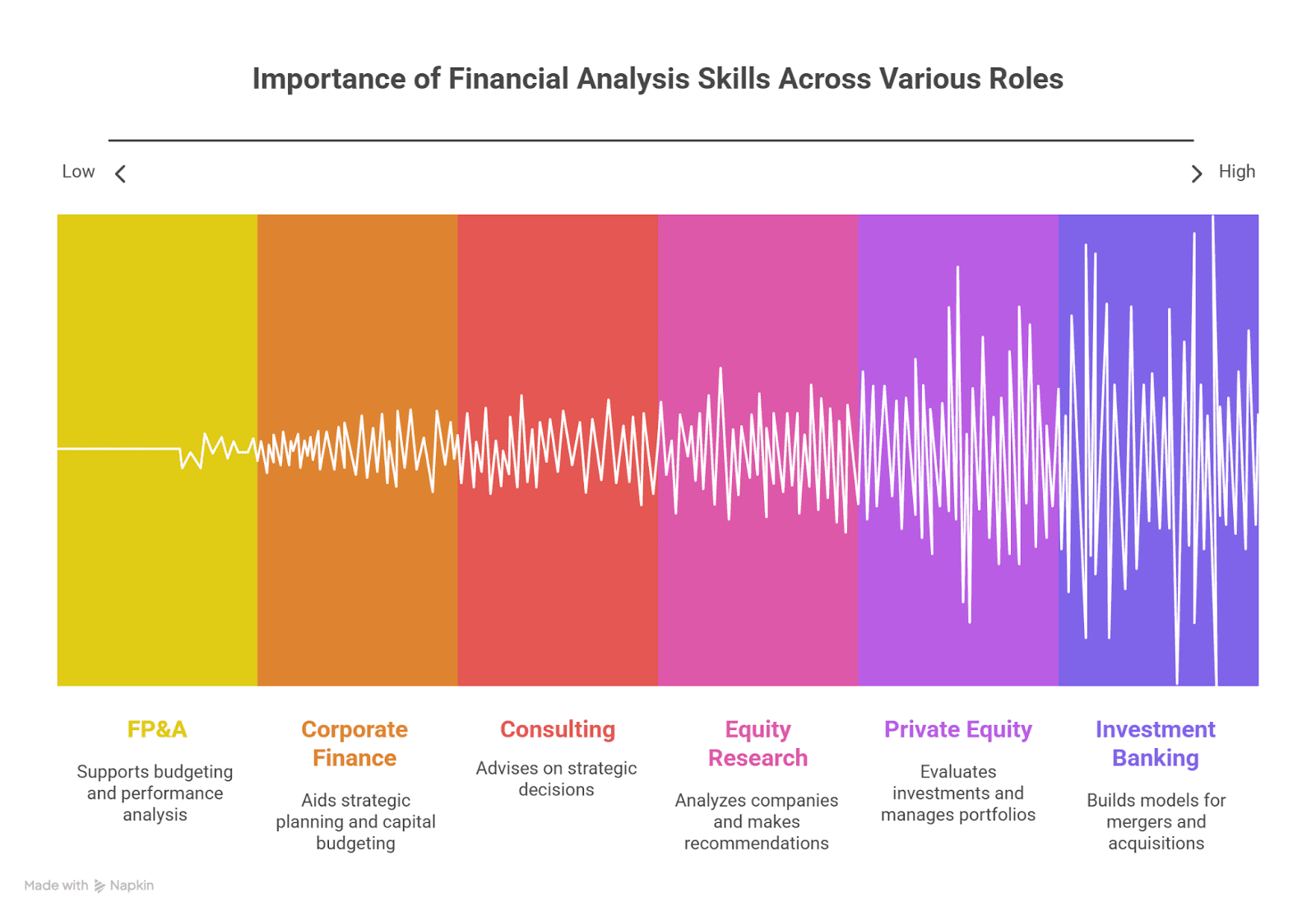

While CPA opens doors globally, especially in the US and Big 4s, CMA jobs in India are equally competitive and rewarding. Both offer unique advantages and can lead to leadership roles in finance and accounting.

CPAs are often hired for roles in auditing, financial analysis, and regulatory reporting. On the other hand, CMA jobs focus more on cost management, internal controls, and decision-making support.

CPA vs CMA Comparison

| Criteria | CPA | CMA |

| Focus Area | Auditing, Taxation, Reporting | Cost Control, Strategic Analysis |

| Global Recognition | High (especially US) | High (especially MNCs) |

| Duration | 12-18 months | 12 months |

| Salary Range (India) | INR 6L – 12L+ | INR 5L – 10L+ |

FAQs

1. How many hours should I study for the CPA exam?

You should ideally aim for 300-400 total study hours, split across 3-4 months per section. Consistency is more important than daily volume.

2. Can I work while preparing for CPA?

Yes, many professionals manage CPA prep alongside jobs. You’ll need a solid study plan and weekend focus blocks.

3. Is CPA harder than CMA?

CPA is more comprehensive, but CMA is also rigorous. Each tests different skills.

4. Are Indian B.Com students eligible for CPA?

Yes, but you may need additional credits or a master’s degree depending on the US state board’s requirements.

5. What’s the passing rate for CPA?

The average CPA exam passing rate globally is around 50%, varying by section.

6. Is Becker the best CPA prep provider?

Becker is highly recommended due to its structured content and high pass rate history.

7. Can CPA certification help with US relocation?

Yes, it improves your chances with US-based firms and immigration opportunities.

8. Are task-based simulations tough?

They can be tricky. Practice and familiarity are key.

9. How often is the CPA exam updated?

Typically once a year, but minor tweaks happen throughout.

10. Do CPA holders earn more than CMA in India?

Generally, yes. But it also depends on job profile, company, and industry.

Key Takeaways

- Passing the CPA exam on your first attempt requires a disciplined, strategic, and smart approach

- Using CPA exam preparation tips tailored for Indian aspirants gives a competitive edge

- Stay updated with CPA exam strategy 2025 and align your tools accordingly

- Choose best CPA study materials that fit your learning style

- Compare CPA and CMA jobs before planning your long-term career path

Conclusion

Cracking the CPA exam on the first attempt is absolutely doable with the right mindset, strategy,

and resources. Whether you’re a fresher or a working professional in India, the roadmap outlined here equips you with all essentials—from CPA exam success tips to effective US CPA study plans. Remember, success doesn’t come from just hard work—it comes from the right work.

So, get started today. Plan smart, study well, and your first-attempt CPA pass will be more than just a dream. It will be your reality.