When you first start exploring global finance roles, one phrase that will keep appearing in your research is the ACCA career. You may wonder why this particular qualification is being talked about so much and whether it is really different from traditional accounting paths.

When you go deeper, you’ll understand that ACCA isn’t just about learning debit and credit. It’s about learning how businesses think, how financial decisions shape organisations, and how finance professionals can influence real strategy.

What truly stood out to me was how internationally focused the qualification is. Instead of being limited to a single country’s system, ACCA prepares you to work with global accounting standards, ethical frameworks, and cross-border business practices. That kind of exposure changes the way you look at your future.

One key reason for its popularity is that ACCA is a global qualification trusted by employers across major financial markets.

In this blog, I’ll walk you through everything you need to know about the career opportunities after clearing ACCA.

📊ACCA Facts – 52% of respondents see accountancy as a springboard to running their own businesses.

Why Should You Choose ACCA Certification Over Other Options

Before you understand the value of an ACCA Career, you need clarity on what is ACCA and what the ACCA Course actually trains you for.

ACCA is globally known for developing highly skilled chartered certified accountants who are trained to think strategically, operate ethically, and adapt to complex international business environments. The syllabus trains you to analyse and prepare financial statements that support real business decisions.

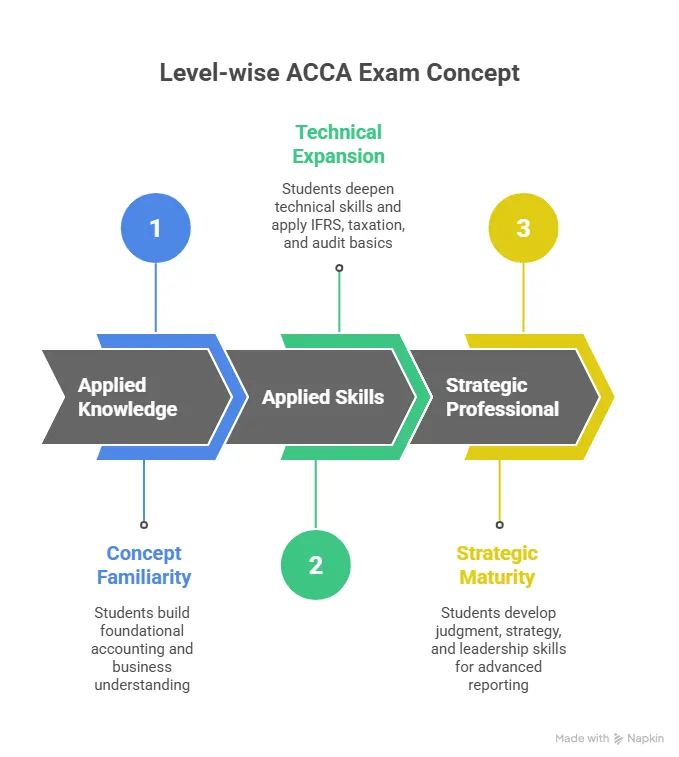

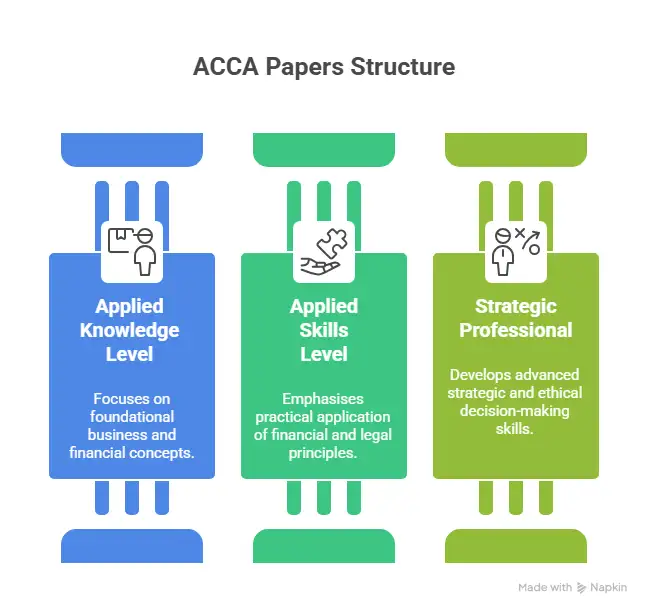

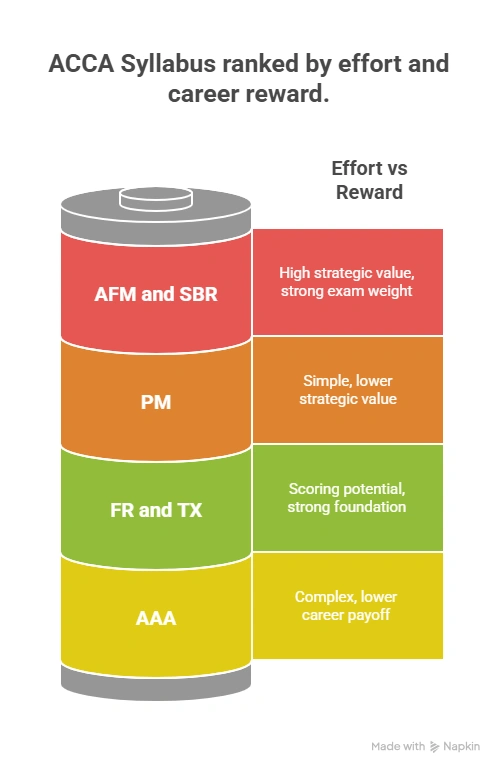

The ACCA course is divided into levels that sharpen you progressively:

| ACCA Level | Focus Area |

| Applied Knowledge Level | Builds the foundation of core finance concepts |

| Applied Skills Level | Focuses on practical accounting, taxation, and auditing skills |

| Strategic Professional Level | Develops leadership, risk management, and strategic decision-making skills |

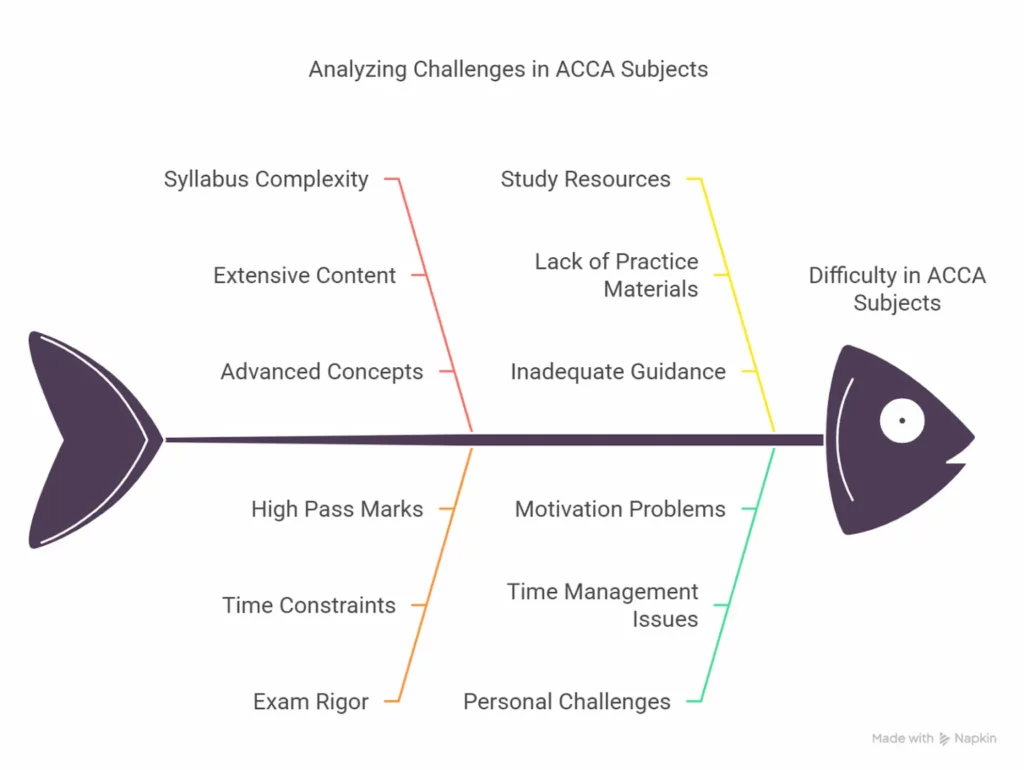

This structure is designed to prepare you for real-world career opportunities, not just academic exams. The moment you start the preparation for the ACCA course, you begin building the mindset required for a strong career after ACCA. When I compared different accounting qualifications, what stood out about ACCA Certification was how practical it felt.

Unlike theory-heavy courses, the challenges in the ACCA course actually prepare you for real-world roles. It covers everything – from financial reporting and IFRS to business strategy, audit, and ethics. That’s when I realised that choosing ACCA wasn’t just about a job title; it was about being prepared for serious responsibility early on.

For anyone eyeing top finance roles, here’s a must-watch video that walks you through how to ace a Big 4 interview as an ACCA professional – packed with real-world tips and insights.

Exploring ACCA Career Options Beyond Just “Big 4”

Let me be very honest – the Big 4 obsession is outdated. Yes, the Big 4 firms hire a lot of ACCA professionals. But limiting your ACCA career options only to them would be a mistake.

Most people assume that an ACCA only leads to Big 4 audit firms. I thought that too. But while researching deeper, I discovered how wide the career options after completing ACCA really are.

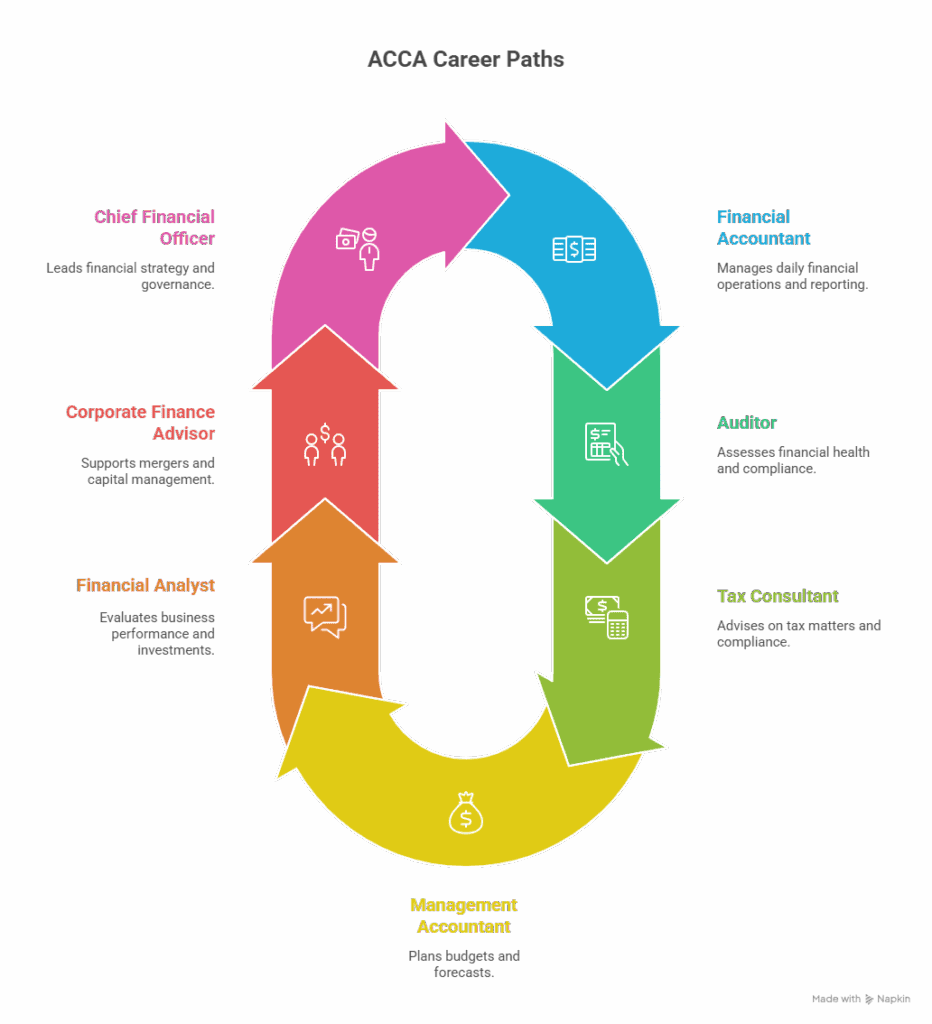

Some of the paths I came across included:

- Financial Analyst roles in MNCs

- Internal Audit & Risk Consulting

- Corporate Finance & Strategy roles

- Start-ups and fintech companies

- NGOs and public sector finance

And what amazed me was learning about ACCA Career Journeys, where professionals completely skipped the traditional audit path and moved straight into consulting, business strategy, or startup finance leadership.

Alternative ACCA Career Tracks: Start‑Ups, SMEs and Impact Sectors

If you only look at the Big 4, you’ll miss some of the most dynamic opportunities ACCA professionals are tapping into today. Many ACCA qualifiers are choosing to join high‑growth start‑ups as Financial Controllers, Business Advisors, or Internal Auditors – roles where they handle everything from cash‑flow planning and budgeting to compliance and risk management from day one.

Small and medium‑sized enterprises (SMEs) are an underrated playground for ACCA talent. In SMEs, you typically wear multiple hats, move up faster, work closely with founders or senior management, and build a much broader skill set compared to a narrow role in a large, structured setup.

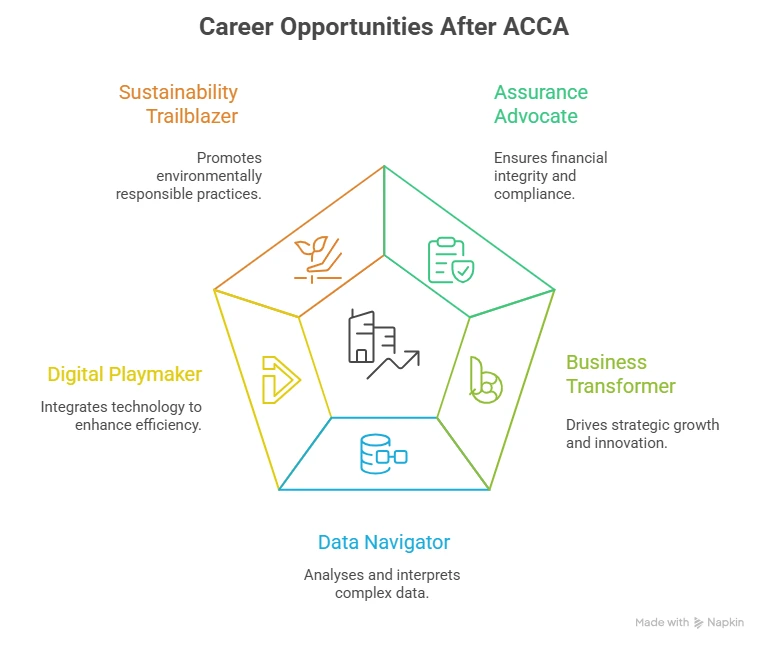

📊ACCA’s Future Ready Report identifies five emerging career zones: Assurance Advocate, Business Transformer, Data Navigator, Digital Playmaker and Sustainability Trailblazer.

ACCA Career Landscape in India

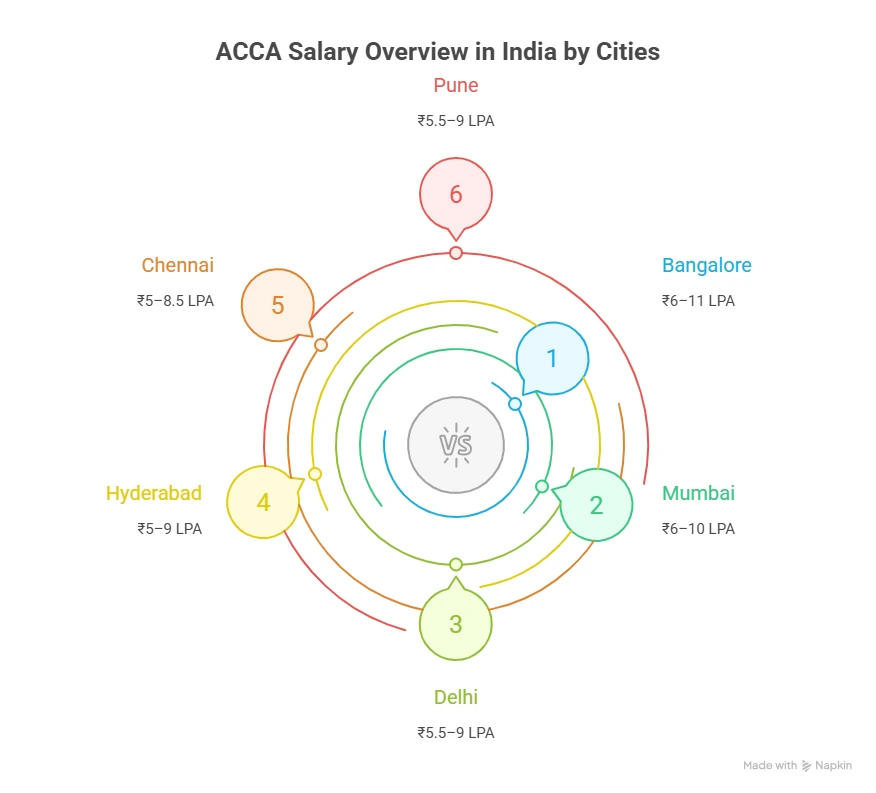

If you’re planning to build your base in India, ACCA is becoming more relevant every year. This table gives you a clear overview:

| Aspect | Details |

| ACCA Recognition | Recognised in 180+ countries, making it a truly global qualification with strong acceptance in India. |

| Demand in India | Growing demand due to the rise of global firms and shared service centres (SSCs) across major Indian cities. |

| Popular Job Roles | Statutory Reporting, Financial Controllership, Financial Analytics, Global Process Ownership. |

| Top Hiring Sectors | Big 4 firms, multinational corporations (MNCs), global banks, consulting companies, and captive finance centres. |

| Key Advantage in India | Strong preference for professionals with IFRS knowledge and cross-border financial exposure. |

| Future Outlook | Rising demand as Indian companies expand globally and foreign investments continue to grow in the Indian market. |

Becoming an ACCA member is not just about passing exams – it reflects your commitment to global ethical standards, continuous learning, and professional excellence in finance.

This is why employers across the world actively look for chartered certified accountants, as they bring a strong combination of technical expertise, business understanding, and global reporting capability.

Career After ACCA: What It Actually Looks Like

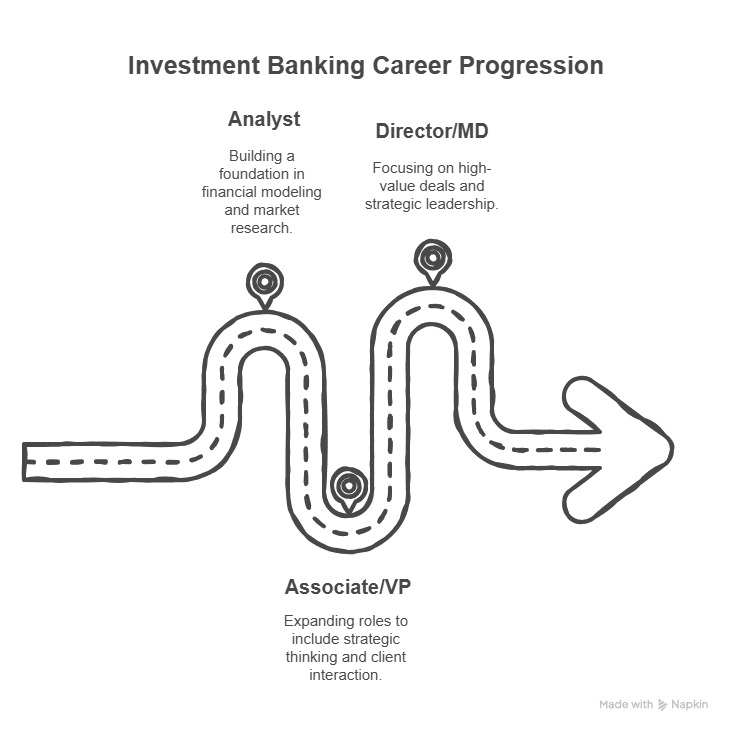

People often imagine that once you finish ACCA Certification, life magically becomes easy. The biggest question everyone has: What does Career After ACCA really look like?

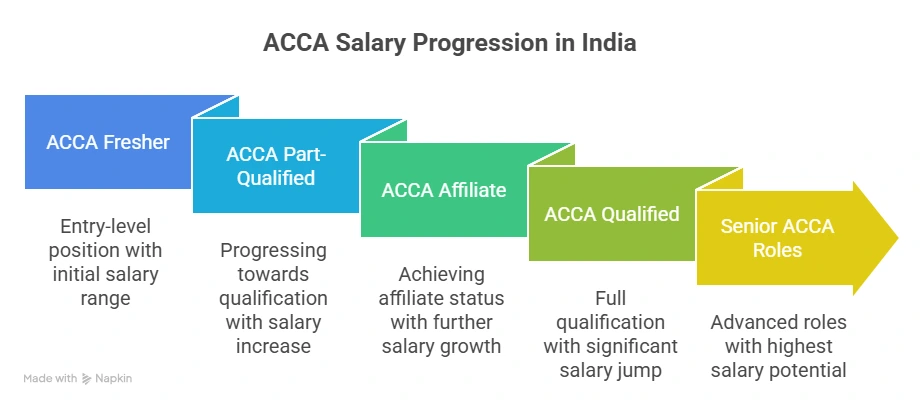

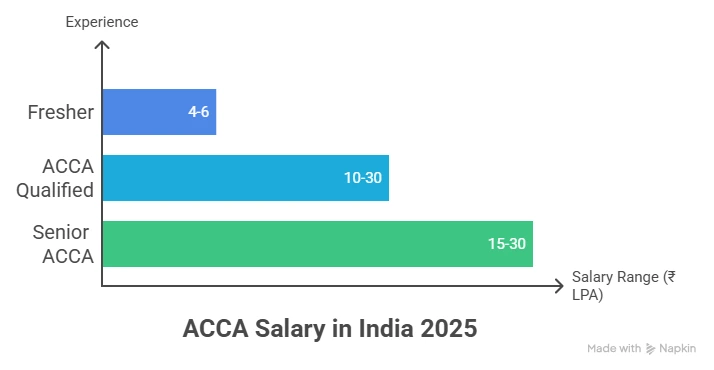

Here’s the honest answer: Once you complete your ACCA Certification, you won’t stay stuck in entry-level roles for long. That’s only the beginning of your Career After ACCA. That’s when I truly understood how flexible an ACCA Career Path can be.

As you grow in experience and move closer to becoming an ACCA member, your credibility in global organisations increases sharply, opening doors to leadership and international opportunities.

Most professionals move quickly from junior finance roles into positions like:

- Finance Manager

- Internal Auditor

- Business Controller

- Risk & Compliance Manager

- Finance Business Partner

Here’s what I’ve seen happen in real life:

Year 1-2 after certification:

- Junior accountant

- Audit associate

- Finance executive

Year 3-5:

- Finance manager

- Internal auditor

- Business analyst

Year 6+:

- Financial controller

- Strategy Head

- CFO-track roles

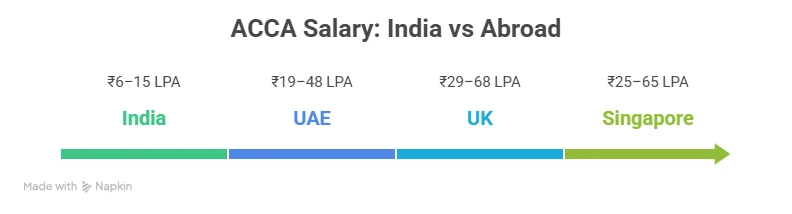

This is where career prospects really start to show. Your responsibility increases. Your impact grows. Your earning potential multiplies. A major attraction for many students is the competitive ACCA salary in India, which continues to grow as more multinational companies and global consulting firms expand their finance teams.

The career opportunities expand even faster when you combine the qualification with tools like Power BI, SAP, or financial modelling. This is why the ACCA career feels more future-proof than many traditional accounting careers.

With global recognition and practical skills, ACCA opens up diverse job opportunities across industries, countries, and business functions.

Industry Verticals Where ACCA Profiles Are in Demand

As you go deeper into the ACCA ecosystem, you’ll notice that the demand isn’t limited to traditional audit or tax. In finance and banking, ACCA professionals work on credit analysis, risk, capital planning, and investment decisions for large institutions and NBFCs.

ACCA professionals are actively hired outside core finance in industries like:

- Healthcare

- Retail

- FMCG

- Technology

ACCA talent is in demand to manage budgeting, cost optimisation, pricing strategy, and long‑term financial planning. Even government bodies and non‑profits bring in ACCA professionals to strengthen transparency, governance, and policy‑driven financial management.

To make things even clearer, here’s a video that breaks down the latest changes to the ACCA syllabus to help you understand what to expect before you plan your next steps.

The Skills ACCA Really Values

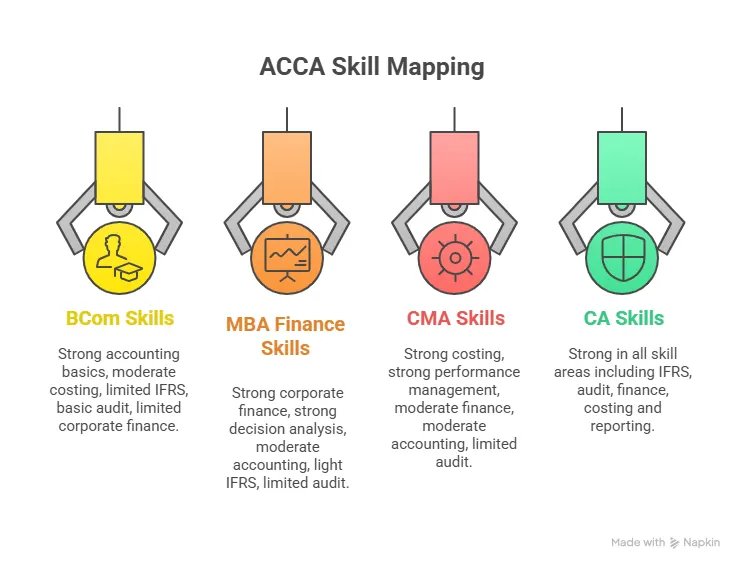

The wide range of ACCA course subjects ensures you build strong foundations in accounting, taxation, audit, performance management, and business strategy. One of the biggest misconceptions I see is that people think an ACCA Career is only for top students or math geniuses. That’s not true at all. What ACCA really values is:

- Consistency

- Curiosity

- Ethics

- Practical thinking

To really understand what makes this qualification so strong, you need to know ACCA course details and what the syllabus actually includes.

The course is not just about memorising formulas. You learn things like financial accounting, taxation, audit, performance management, and business law in a way that connects directly to real business problems. As you move ahead, the focus shifts towards strategic thinking, decision-making, and leadership skills, which is what makes ACCA professionals adaptable across different industries and roles.

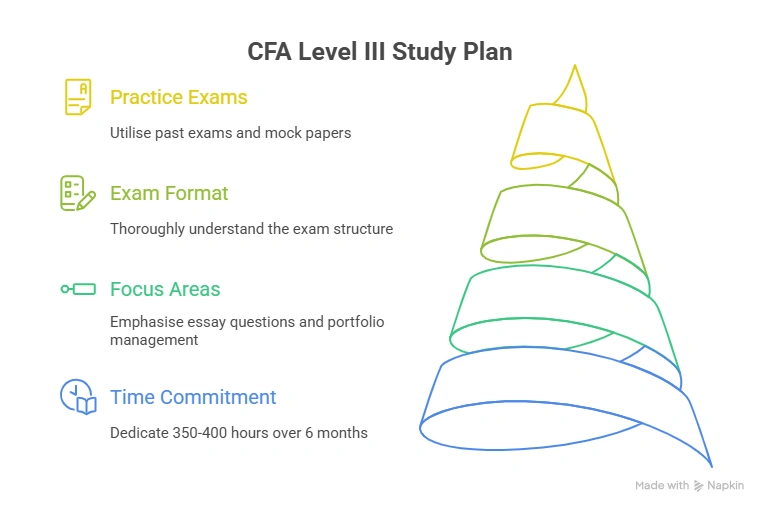

What ACCA Actually Demands From You

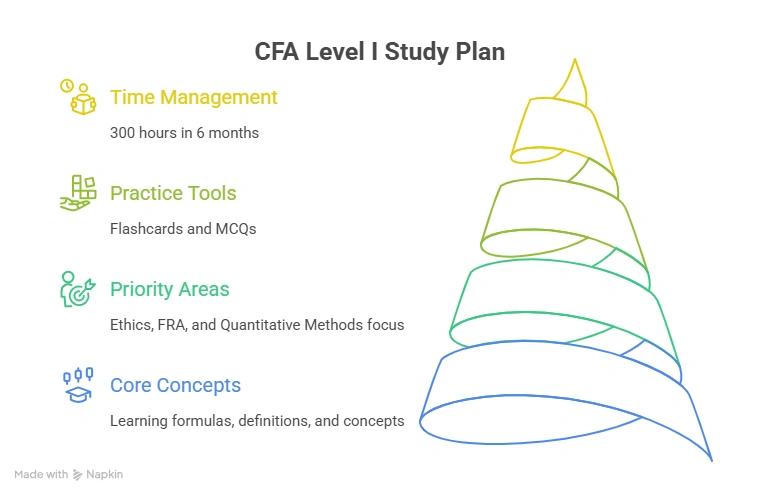

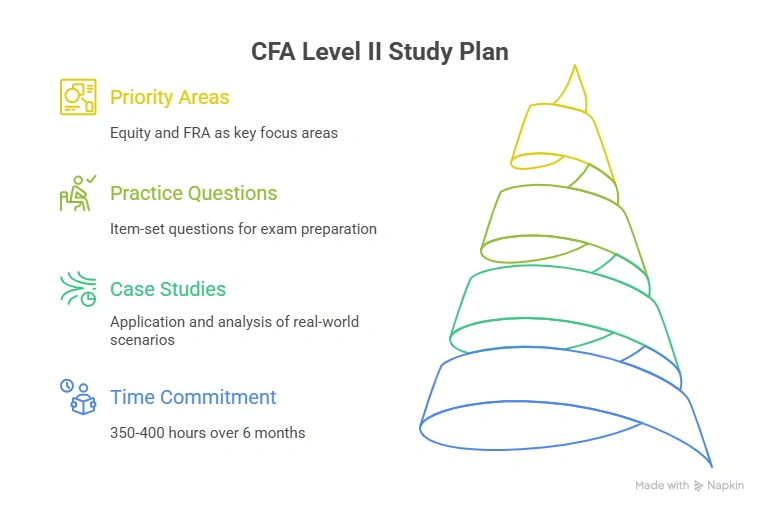

One thing most people don’t realise at the beginning is that ACCA isn’t only about clearing papers – it’s about proving you can operate like a real finance professional. Along with the exams, you need to complete a Practical Experience Requirement (PER), where you complete relevant work experience to build practical credibility and professional competence for about three years and map your responsibilities to ACCA’s performance objectives.

You also go through the Ethics and Professional Skills Module and later continue with CPD (Continuing Professional Development), which keeps your skills sharp even years after qualifying. Instead of seeing these as extra hurdles, think of them as structured milestones that signal to employers that you’re not just book‑smart – you’ve actually applied that knowledge in the real world.

The flexible ACCA course duration makes it easier for students and working professionals to balance studies with work experience and personal commitments.

Benefits of ACCA Career Fairs and Networking

One of the most underrated parts of the journey is the ACCA Career Fair ecosystem.

I learned that many institutions and learning partners organise placement drives, networking events, and industry connects. These forums introduce you to recruiters actively searching for ACCA-qualified talent.

Attending a Career Fair gives you direct exposure to:

- Hiring managers

- Global MNC recruiters

- Finance leaders

- Consulting firms

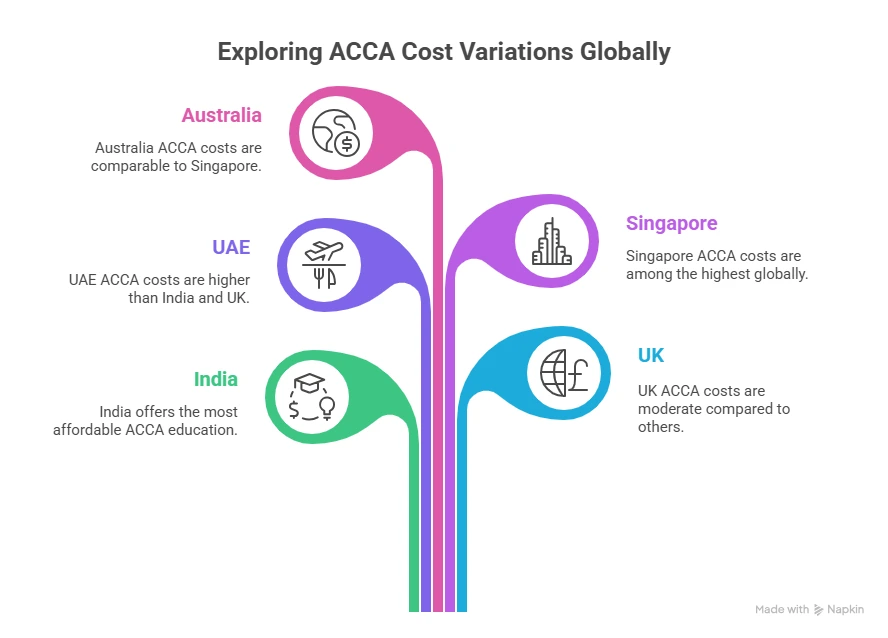

Another big reason? The ACCA career prospects are clearly global. Whether it’s the UK, UAE, Canada, or Australia, the qualification is recognised across major financial markets. What makes this even more accessible is the flexible ACCA course eligibility, which allows students from commerce, science, and even non-commerce backgrounds to begin the journey after their 10+2 or graduation. That combination of worldwide recognition and open entry pathways makes the flexibility of this career path genuinely rare.

Core Benefits of Choosing ACCA Early in Your Career

When you look at ACCA exams purely as a series of tests to clear, you miss the bigger picture of what it does for your career. The qualification is designed as a compact but powerful route that builds your fundamentals in accounting and finance while also preparing you for managerial and strategic roles.

Because ACCA is globally recognised in over 180 countries, you’re not stuck with one geography or one industry; you can move across public sector, NGOs, multinational banks, consulting, and corporate roles as your interests evolve. Add to that the flexibility of online learning and working‑professional‑friendly formats, and ACCA becomes a realistic upgrade path even if you’re already in a job and can’t afford to pause your career.

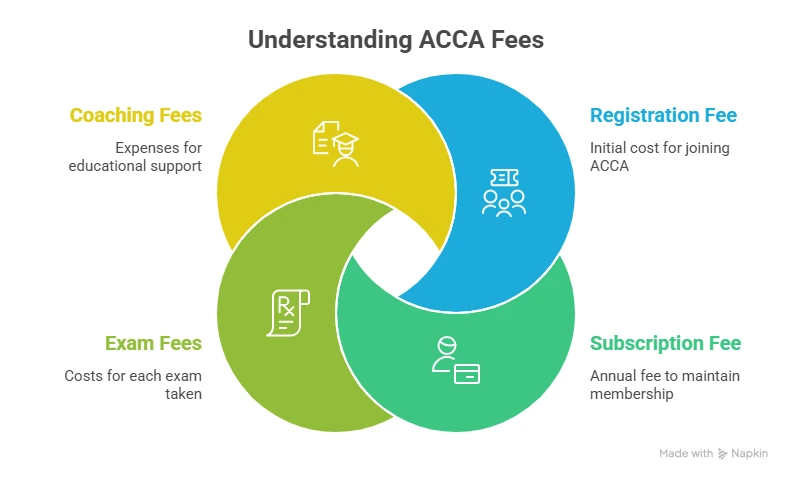

While planning your long-term growth, it’s also smart to factor in ACCA course fees, so you can align your investment with your career goals from the very beginning.

💡Did You Know? The job board of ACCA lists 21,004+ live vacancies globally.

How the ACCA Career Path Evolves Over Time

When someone pursues ACCA Certification, they’re not just learning accounting; they’re learning how businesses work at a strategic level. That’s what makes an ACCA Career so powerful compared to traditional degrees.

Through years of mentoring, I’ve seen students transform from unsure graduates into global professionals working across Dubai, London, Singapore, and Canada.

And the foundation of all that growth? A strategically built career path.

Now let’s talk about something serious: long-term growth. One reason I consistently recommend the ACCA course is that the career prospects don’t fade over time – they actually become stronger.

Because the ACCA syllabus is updated regularly, your ACCA subjects stay aligned with:

- Global accounting standards

- Sustainability reporting

- Digital finance tools

- Strategic risk management

That’s why ACCA career opportunities continue expanding even 10-15 years down the line. What I personally love about an ACCA Certification is how it evolves. In the beginning, you focus on technical roles – accounts, audit, or reporting. But as you grow, the career path naturally shifts towards:

- Leadership roles

- Strategic decision-making

- High-level financial planning

- Cross-border responsibilities

The longer you stay in the ecosystem, the stronger your career prospects become. Over time, ACCA offers professionals the flexibility to move into leadership, advisory, and international roles.

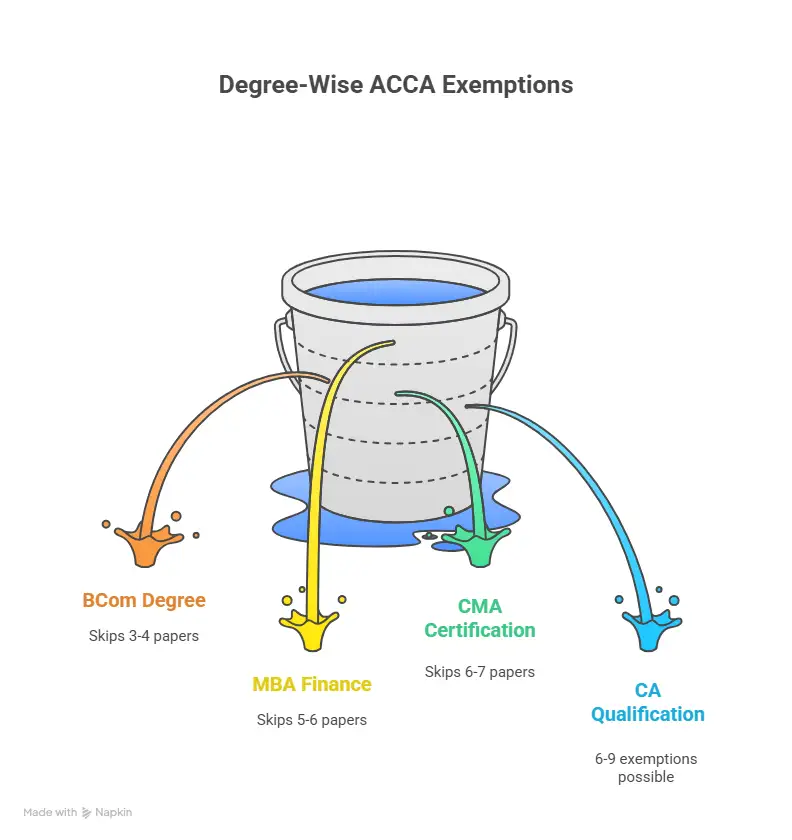

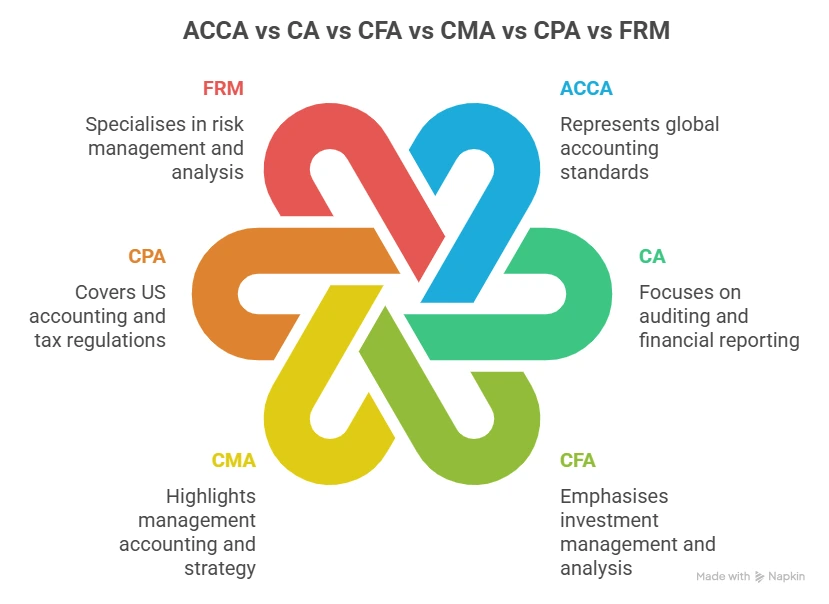

A clear comparison of CA vs ACCA helps you understand the differences in global recognition, flexibility, and long-term career mobility before choosing the right qualification.

Here’s a CA vs ACCA comparison covering course structure, eligibility, global career scope, industry roles, costs, pass rates, and flexibility – so you can choose the right path with confidence.

Why I Recommend ACCA Over Traditional Accounting Paths

The ACCA qualification is designed to develop well-rounded professional accountants who can handle technical, strategic, and leadership responsibilities with confidence.

Here’s a realistic comparison: Many traditional accounting courses tend to limit you to a specific country’s rules or a very narrow career track. An ACCA career works differently.

With ACCA, professionals benefit from:

- Global recognition.

- Flexible job roles.

- Fast career mobility.

- Better international salary exposure.

- Strong Career Growth After ACCA.

The practical structure of the ACCA syllabus, combined with its strong global focus, makes ACCA Certification highly relevant for today’s finance and business landscape.

Is the ACCA Career Worth It?

If you’re looking for flexibility, international opportunities, and long-term growth, then ACCA is absolutely worth considering. Instead of locking you into a single role, it allows you to explore multiple directions – from corporate finance and consulting to startups and global roles.

The real strength of ACCA career opportunities lies in its diversity. You’re not restricted to one geography, industry, or job function, and that’s what makes this qualification stand out.

How to Strategically Design Your ACCA Career Path

A strong ACCA Career Path should be designed, not left to chance. Here’s what I always recommend:

- Choose your first role based on learning, not salary.

- Focus on industries that are growing (tech, consulting, ESG, fintech).

- Use every job to build transferable skills.

- Stay active in networking communities and career fairs.

The more intentional you are, the stronger your career becomes. Over time, it became clear to me that with ACCA, the career path naturally creates broader opportunities – not just in terms of job roles, but in terms of industries, countries, and long-term growth. That’s exactly why so many ambitious finance professionals today see ACCA as more than a course; they see it as a serious, future-ready career decision.

The Real Skillset That Makes Your ACCA Career Powerful

Let’s be honest: the qualification alone won’t make you extraordinary.

The ACCA professionals focus on:

- Communication skills

- Financial storytelling

- Data interpretation

- Business mindset

When these are combined with ACCA Certification, your professional credibility increases sharply.

This is why career journeys of ACCA Professionals look so different from person to person – because they customise their skills according to their strengths.

📊ACCA Facts – 67% of respondents are interested in pursuing accountancy careers focused on environmental issues.

Why Choose Imarticus for your ACCA Career

Partnering with Imarticus Learning, an official ACCA learning facilitator, can elevate your ACCA preparation experience with structured mentorship, global content, and assured outcomes.

Key Advantages of the ACCA Course with Imarticus:

- Guaranteed placement after completing two ACCA levels.

- No-limit passing guarantee with free reappear sessions.

- Pre-placement bootcamps and interview preparation for job readiness.

- Simulation-based global curriculum recognised ACCA content, with real-world case studies and industry-led training.

- Dual certification – ACCA joint certificate offering with KPMG in India.

- Course content powered by Kaplan – an ACCA Gold Approved Learning Partner.

This combination of international curriculum and domestic career support ensures you emerge with both technical skills and practical employability, making your ACCA Career not just globally relevant but commercially effective.

FAQs About the ACCA Career

Over the years, I’ve noticed that students and professionals tend to have the same doubts while exploring ACCA as a career option. You will find that the following frequently asked questions about the ACCA career will assist you in making a clearer and confident decision.

What are the job roles after pursuing ACCA?

With ACCA, you can work in roles such as Financial Analyst, Internal Auditor, Tax Consultant, Business Controller, Risk & Compliance Manager, Finance Manager, and roles in corporate finance, consulting, MNCs, startups, and public sector organisations.

Is ACCA a good career option?

Yes, ACCA is considered a strong career option because it offers global recognition, flexible career paths, and opportunities across industries like finance, consulting, technology, and multinational corporations.

Will ACCA be replaced by AI?

It’s understandable to worry if your role might disappear to automation, but the good news is: an ACCA qualification is much less likely to be made redundant by AI. While routine tasks such as data entry or basic reporting may well be automated, ACCA professionals focus on strategy, decision-making, risk management, ethical judgement and business leadership – areas where human insight and professional ethics still matter a lot. Think of AI as a tool that will help you be more efficient, not replace you.

Is ACCA a stressful job?

Like many roles in finance and business, an ACCA career can come with its share of pressure – especially during audit seasons, financial closures, tight deadlines or strategic reviews. However, stress levels don’t only depend on the qualification – they heavily depend on your company culture, the role you choose, how you manage your workload, and your ability to build good systems. With the right employer, good time management, and self-care, many ACCA professionals manage a great career without burning out.

Which field is best after ACCA?

There isn’t one best field after ACCA – and that’s actually a strength of the qualification. You could lean into Corporate Finance, Financial Planning & Analysis (FP&A), Internal Audit, Risk & Compliance, Consulting, Fintech, ESG & Sustainability – whatever matches your strengths and passion.

Is a job guaranteed after ACCA?

Technically, no qualification can guarantee a job. However, with ACCA, you significantly increase your employability. However, if you enrol with Imarticus Learning, you get an added advantage of a 100% placement or internship guarantee upon completing the first two levels of ACCA.

But even with that, your personal effort, networking, experience, and how you present your skills will make a huge difference in landing the right role.

Should You Choose an ACCA Career?

If you’re someone who wants flexibility, global exposure, strong pay growth, and modern finance roles, then an ACCA Career makes complete sense. ACCA prepares you not only for technical accounting roles, but also for leadership, strategy, consulting, and international finance opportunities.

What starts as an ACCA course gradually evolves into a powerful professional identity. Your career after ACCA can lead you into multinational companies, fast-growing startups, board-level roles, or even your own consulting practice over time.

The ACCA course doesn’t just give you a qualification, it gives you a globally respected, future-ready career path with multiple opportunities to grow, evolve, and succeed. If you’re serious about building a global finance career, now is the time to take the first step.