Most students finish class 12 with one clear instruction from everyone around them. Pick a degree and move ahead. Very few are told to think about the kind of financial decisions they might want to make ten years from now. That gap is exactly where a path like CFA after 12th becomes relevant.

The finance world is no longer limited to stock brokers shouting on trading floors. Today, it runs quietly through apps, dashboards, research reports, and investment strategies that shape how companies grow and how people build wealth. Choosing CFA after 12th is about stepping into that layer of thinking early. It is not just about adding a certification later. It is about training your mind to read financial signals, question assumptions, and understand how money actually moves in the economy.

A lot of students ask if it is too early to think about such a specialised path. The better question is whether it is useful to start building the right skills early. The CFA Certification goes deeper into how investments are evaluated, how risks are measured, and how portfolios are managed. When both run together during your college years, your learning becomes more focused and more relevant to the roles you may want later.

This guide is meant to give you that clarity before you take any step. It will walk you through what the CFA path looks like after school, how the timeline works with graduation, what skills you build, and where it can take you. By the end, you should be able to decide with confidence whether this is a direction that fits your long-term plans.

Did you know?

The CFA Program is offered in over 160 countries and is considered one of the top finance certifications in the world. (Source: CFA Institute).

What You Need to Know About CFA After 12th

The term CFA shows up often when students start looking at finance careers. It sounds formal, even distant at first. But the meaning becomes simple once you connect it to real work done in the finance world every day.

The Chartered Financial Analyst program is a professional qualification built around one core idea. Learn how money moves, how investments are evaluated, and how financial decisions are made with logic and discipline.

When I think about CFA after 12th, I see it as learning the language of money at a professional level. It is the difference between reading a news headline about a company and actually understanding what that company’s numbers are saying.

Students often search “what is CFA?” because they want clarity before committing to a long-term path. The program is not about memorising formulas alone. It trains you to read financial situations, measure risk, and make decisions that affect real investments.

The Purpose of the Program

At its core, the program prepares you for roles where financial judgment matters. It focuses on:

- Understanding how businesses earn and spend

- Analysing investments like stocks and bonds

- Studying economic trends and market cycles

- Building portfolios that grow wealth over time

- Following ethical standards in finance

This is why professionals in investment firms, banks, and asset management companies rely on this qualification.

How the CFA Charter Is Structured

The journey is divided into three CFA levels. Each level builds a new layer of understanding.

| Level | Focus | What You Learn |

| Level 1 | Concepts | Basics of finance and investment tools |

| Level 2 | Application | Valuing companies and assets |

| Level 3 | Strategy | Managing portfolios and wealth |

When someone plans CFA after 12th, they move through these levels during and after graduation in a structured way.

Where This Qualification Is Used

This qualification connects directly to roles where financial decisions are part of daily work. Industries that hire such professionals include:

- Investment banking

- Equity research firms

- Mutual fund companies

- Wealth management firms

- Corporate finance teams

These roles exist in India and across global financial centres, which is why many students consider CFA after 12th as a global career route.

Looking at how the program builds strong investment skills, global recognition, and access to high-growth finance roles can help you understand why it is often seen as a powerful long-term career move.

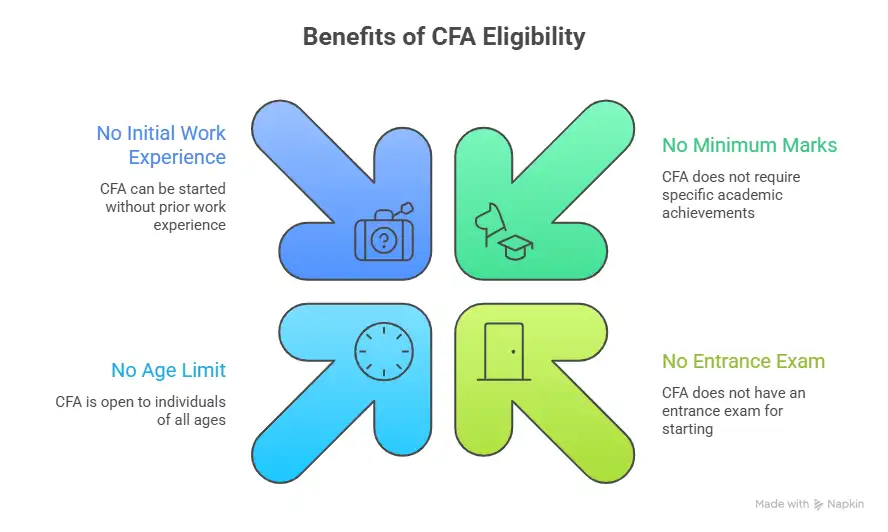

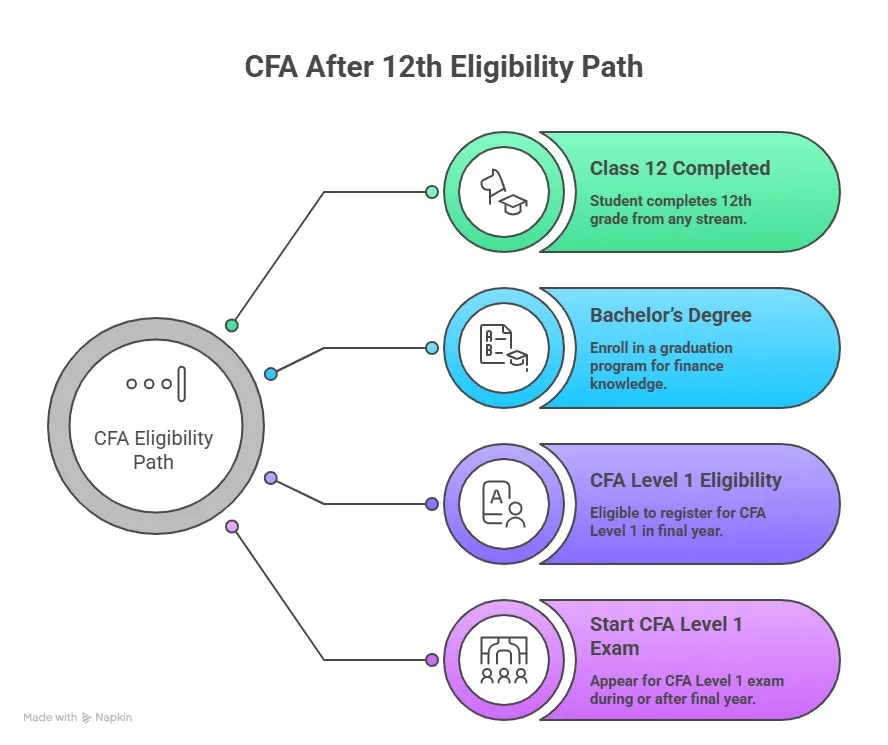

Can I Do CFA After 12th

This question shows up in almost every student discussion. The intent behind it is not just about eligibility. It is also about the right path. When someone asks can I do CFA after 12th, what they usually want is a roadmap. Here is how it works simply.

→ You complete class 12

→ You choose a graduation degree

→ You begin early preparation for CFA Level 1

→ You register in your final year or after graduation

So when students ask can we do CFA after 12th, the practical answer is yes in terms of preparation and planning. The CFA exam registration comes a bit later. Think of it like learning to drive. You can start learning theory before you get your license. The exam is the license. The preparation is the learning phase.

Also Read: Why CFA is the Gold Standard for Finance Professionals?

CFA Course After 12th Commerce

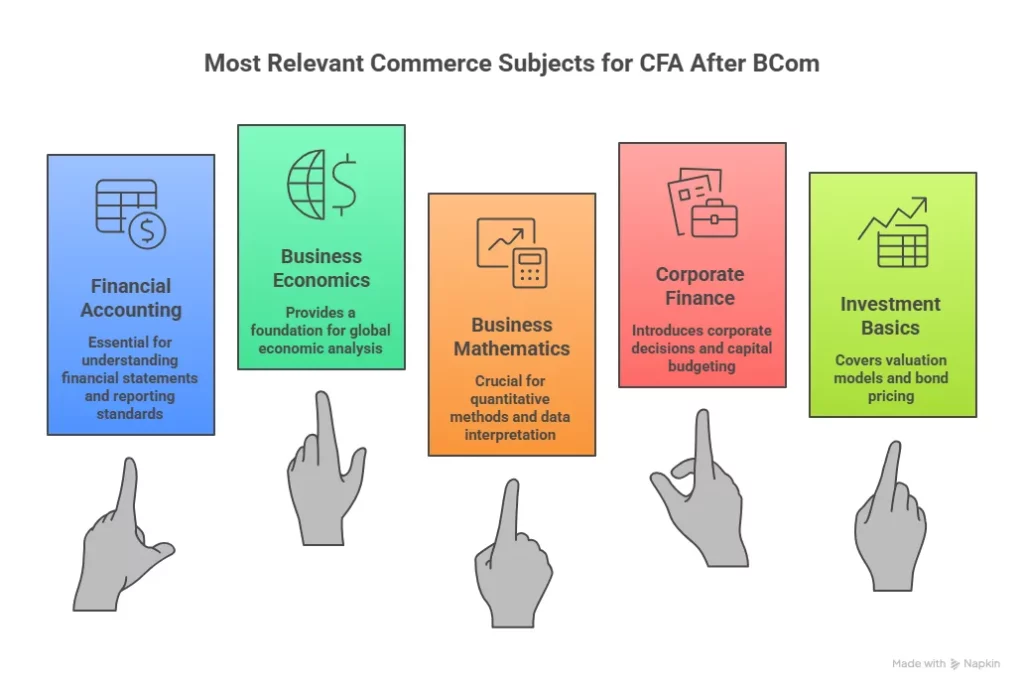

Students from a commerce background are naturally drawn to finance roles. That is why the CFA course after 12th commerce is a popular search.

Commerce students already study subjects like:

- Accountancy

- Economics

- Business Studies

These subjects create a strong base for CFA topics like financial reporting, corporate finance, and economics. But even students from science or the arts can pursue it. The CFA Program does not restrict streams. What matters is your comfort with numbers and finance concepts.

Many students also wonder, “Can I do CFA after 12th commerce without maths?” The answer is yes. Maths is helpful but not compulsory. The program focuses more on logic, data interpretation, and financial reasoning.

Also Read: What are the 5 Must-Know Things about CFA?

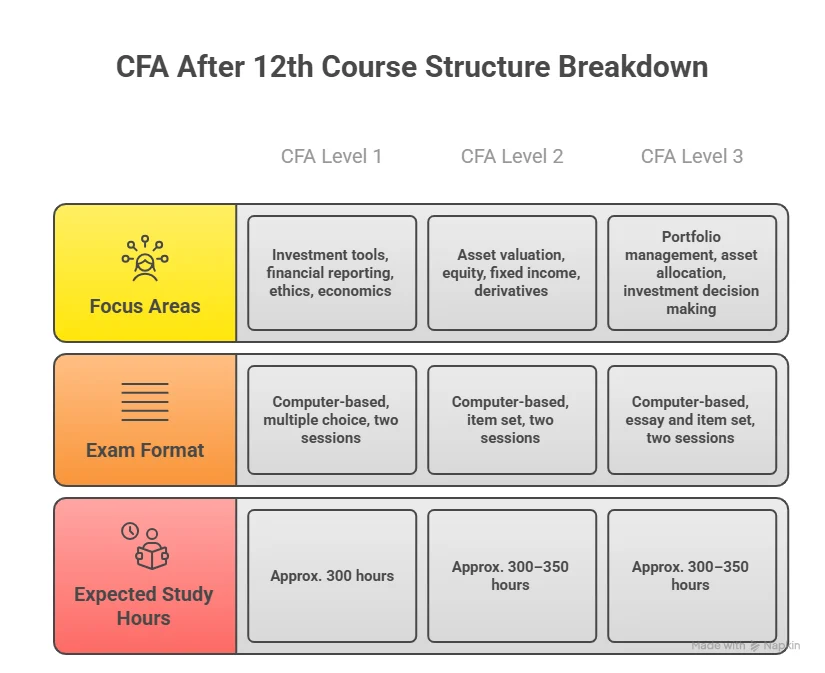

CFA Course Details After 12th

To understand the full journey, it helps to look at the CFA course details. The CFA Program has three levels.

CFA Levels Overview

| Level | Focus Area | Key Skills |

| Level 1 | Investment tools | Basic finance concepts |

| Level 2 | Asset valuation | Financial analysis |

| Level 3 | Portfolio management | Wealth planning |

Each level tests different skills. Level 1 builds knowledge. CFA Level 2 builds an application. And, CFA Level 3 builds decision-making.

Subjects Covered in CFA

The CFA subjects remain similar across levels, but the depth increases. Key subjects include:

- Ethics and Professional Standards

- Quantitative Methods

- Economics

- Financial Reporting

- Corporate Finance

- Equity Investments

- Fixed Income

- Derivatives

- Portfolio Management

These subjects make the CFA course after 12th one of the most detailed finance programs.

Exam Pattern

Each level is conducted in a computer-based format.

- Level 1 has multiple-choice questions

- Level 2 has item sets

- Level 3 includes case studies

Also Read: How to Become a CFA in India and Build a Global Finance Career?

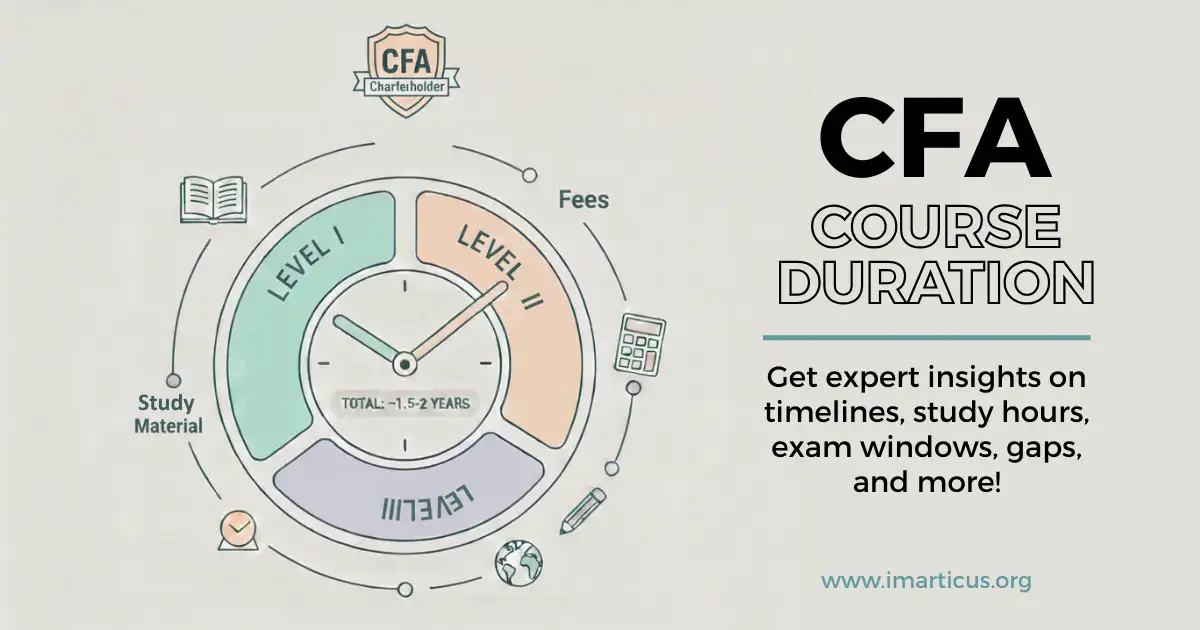

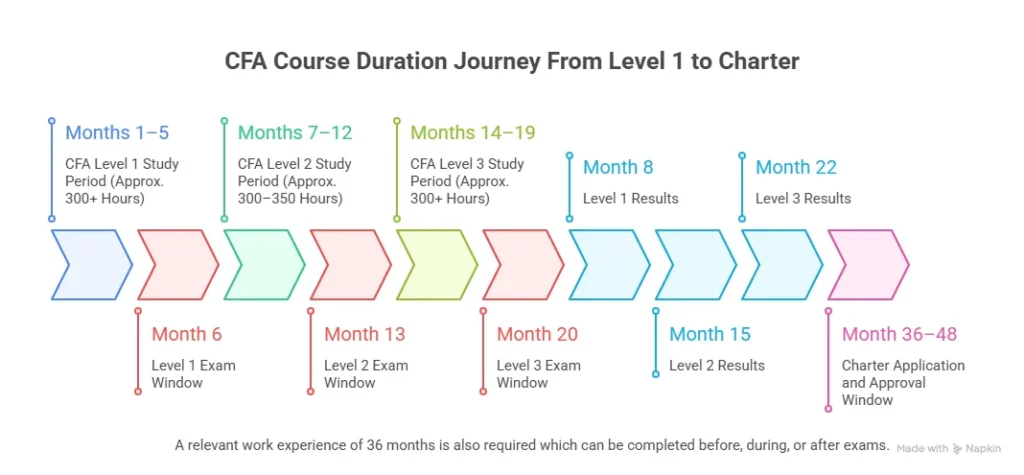

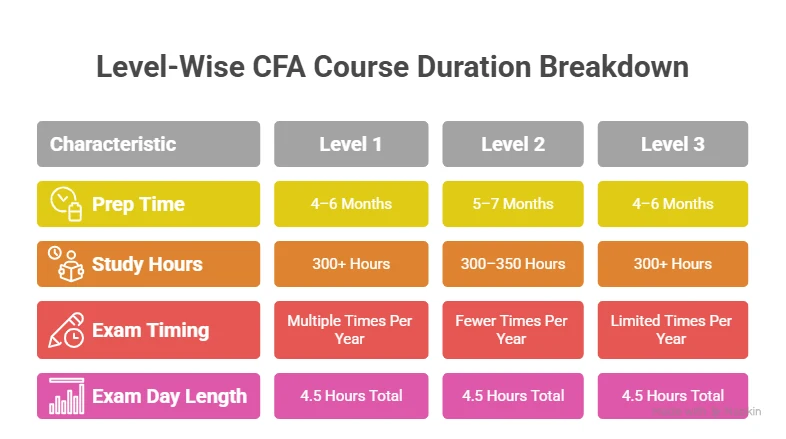

CFA Course Duration After 12th

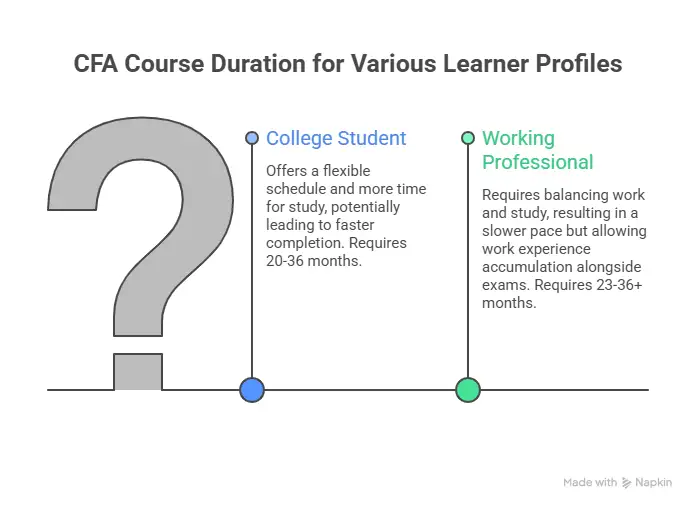

The total journey depends on how you plan your graduation and exam attempts. On average:

- Graduation takes 3 years

- CFA Levels take 2 to 3 years

So the total time for CFA after 12th is around 4 to 5 years. Here is a simple timeline view.

| Year | Activity |

| Year 1 | Graduation start + basic finance |

| Year 2 | Level 1 preparation |

| Year 3 | Level 1 exam attempt |

| Year 4 | Level 2 preparation |

| Year 5 | Level 3 completion |

Some students complete faster. Some take more time. It depends on your pace.

Also Read: How to Study for the CFA Level 1

CFA Course Fees in India

Before starting any program, cost matters. Students often search for full details about the CFA course after 12th, including fees. The CFA Program has three main costs:

- Registration Fee – This is a one-time enrollment fee that you pay when you first register for the CFA course.

- Exam Fee – The CFA exam fees are to be paid for each level when you take the exam.

- Study Material and Coaching – While this expense is optional, it’s quite useful for structured preparation. Here is a basic cost estimate of the CFA course fees.

| Expense | Approx Cost |

| Enrollment fee | ~₹31,000 to ₹36,000 |

| Exam fee per level | ~₹81,000 to ₹1,00,000 |

| Study material | ₹30,000 to ₹80,000 |

Did you know?

The average global pass rate for CFA Level 1 is around 37% according to CFA Institute results.

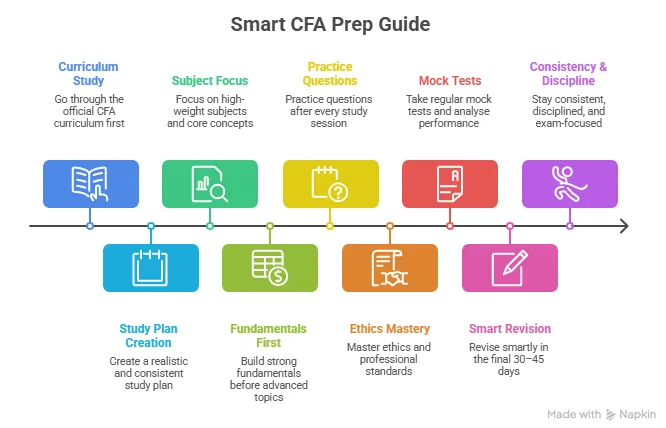

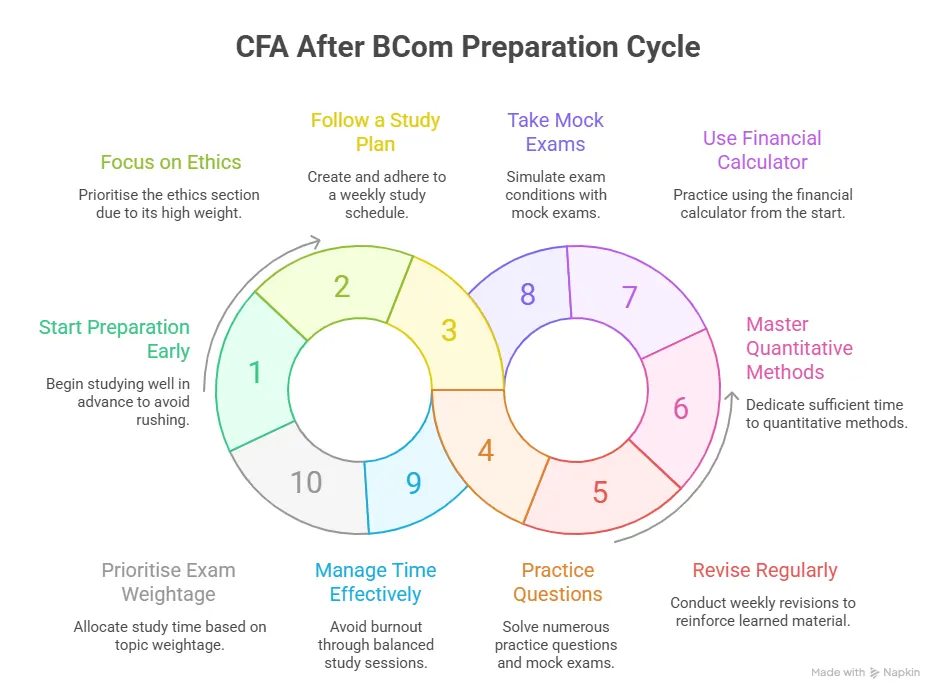

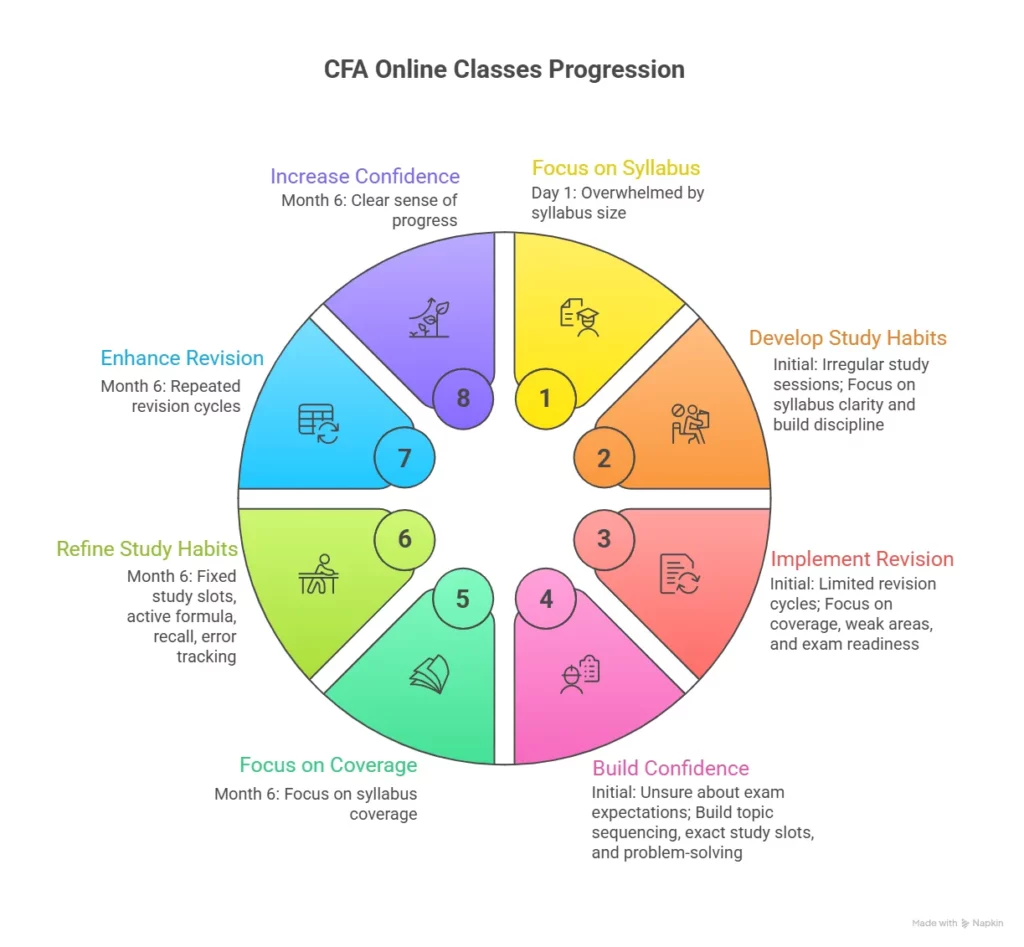

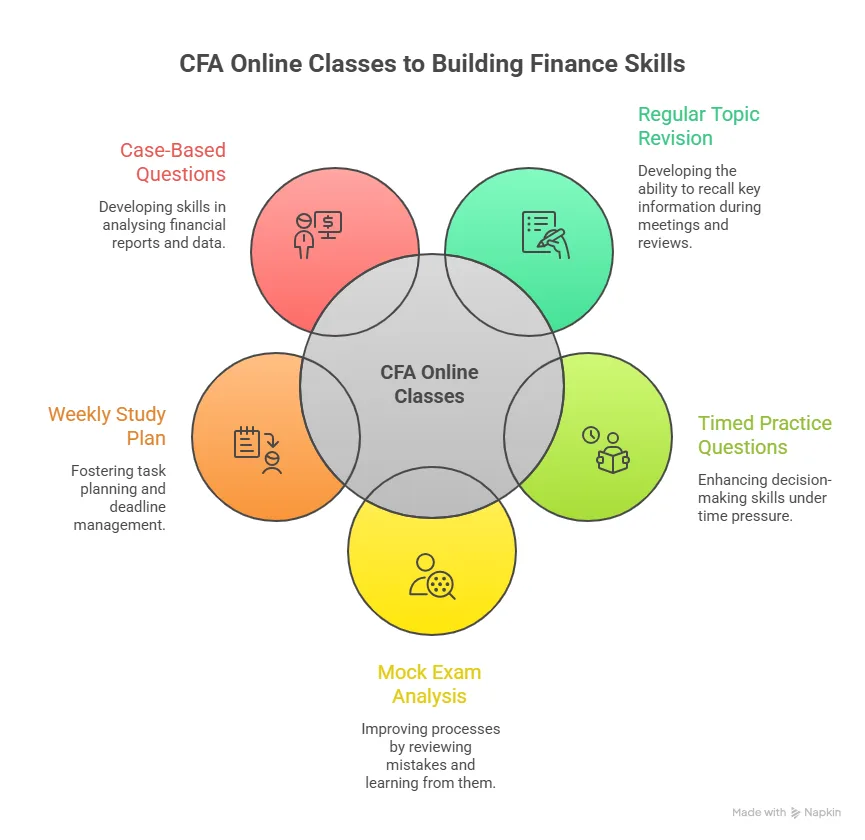

How to Do CFA After 12th Step by Step

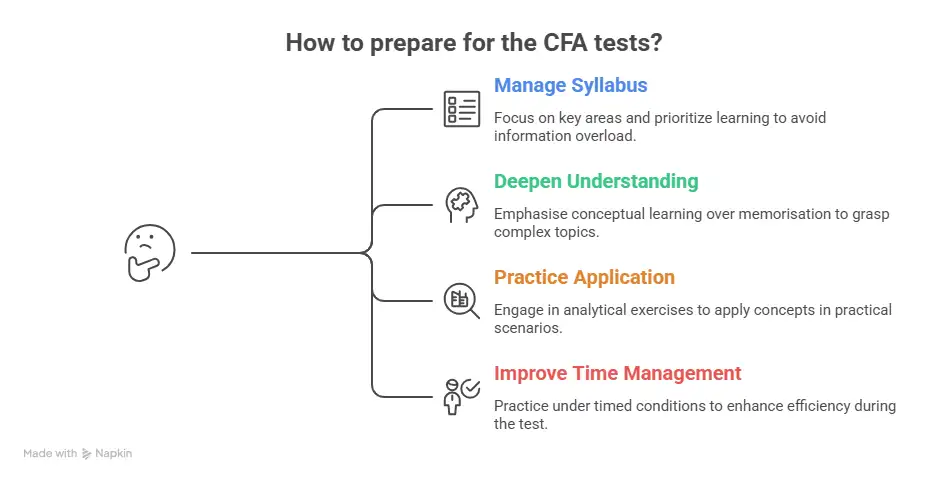

Once the direction is clear, the next step is preparation. Many students search for how to do CFA after 12th because they want a study plan that fits with college life. Preparation becomes easier when it is broken into small steps.

Step-by-Step Preparation Strategy

- Start with the basics in your first year of graduation.

- Build concepts slowly before moving to advanced topics.

- Follow a fixed study schedule every week.

- Use practice questions regularly.

- Revise often instead of studying new topics every day.

This method helps in building a strong base for the CFA course after 12th. When students search, “How to do CFA after 12th?”, they want steps they can follow. Here is a simple plan.

Step 1: Choose the Right Graduation

Pick a degree that supports your financial goal. Good options include:

- BCom

- BBA Finance

- BA Economics

- BSc Finance

This helps you align your college subjects with CFA topics.

Step 2: Build Basics in Year 1

Start with simple concepts:

- Time value of money

- Basic accounting

- Market structures

You can use free resources and beginner courses.

Step 3: Start Level 1 Preparation in Year 2

Level 1 focuses on concepts. This is the best time to start a structured study.

Step 4: Register for the Final Year

You can register for CFA Level 1 in your final year of graduation. This is when you become eligible.

Step 5: Complete All 3 Levels

After Level 1, you move to Level 2 and Level 3. Each level goes deeper into finance and investment analysis.

Why Students Choose CFA After 12th

Students who plan the CFA course after 12th are usually interested in roles like:

- Investment banking

- Equity research

- Portfolio management

- Financial consulting

These roles are linked to capital markets and global finance. The program is also respected by employers worldwide. That is why many students explore how to do the CFA course after completing 12th as early as possible.

Getting a strong start with Level 1 can shape the entire journey, especially when you understand the exam format, study approach, and how to manage time effectively alongside college or work commitments.

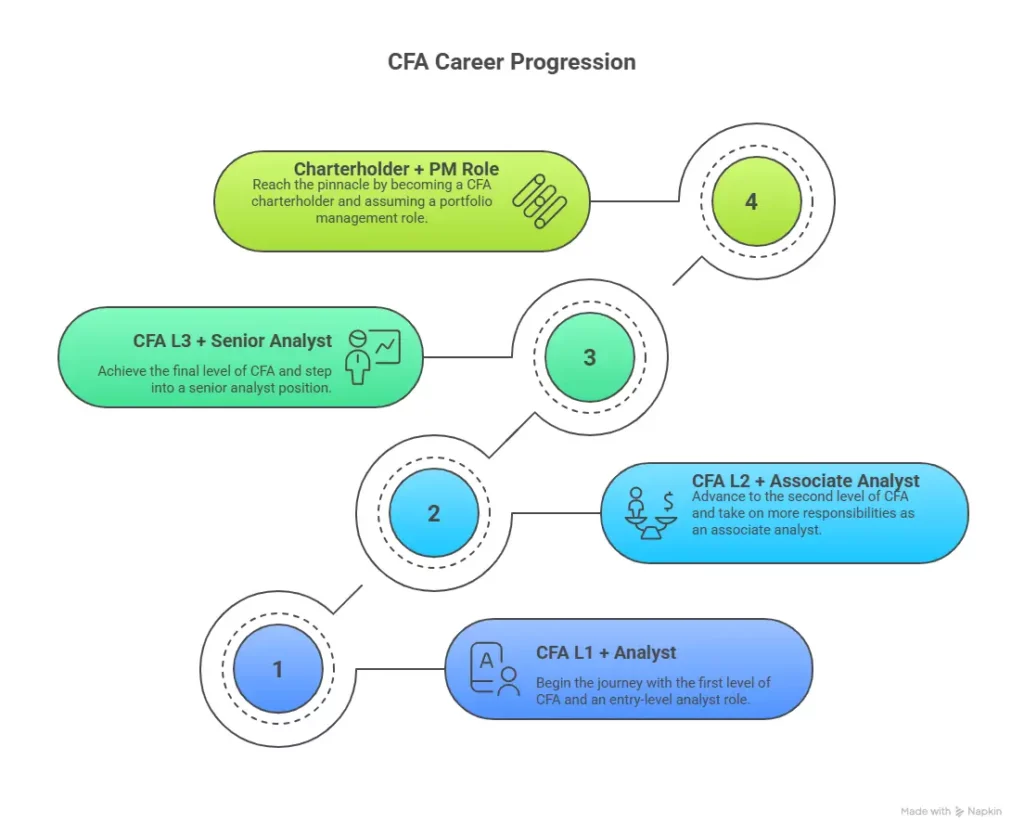

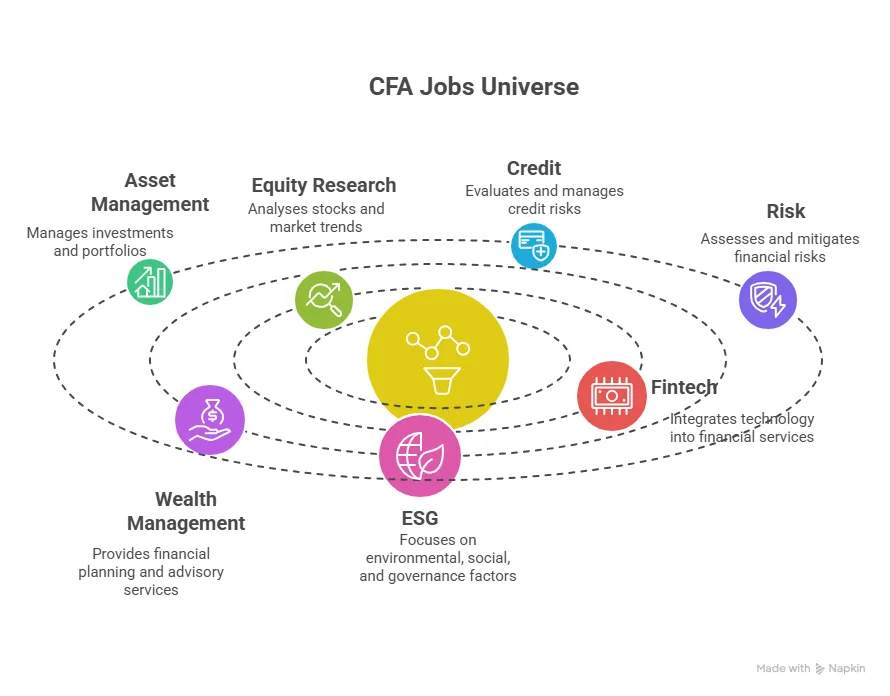

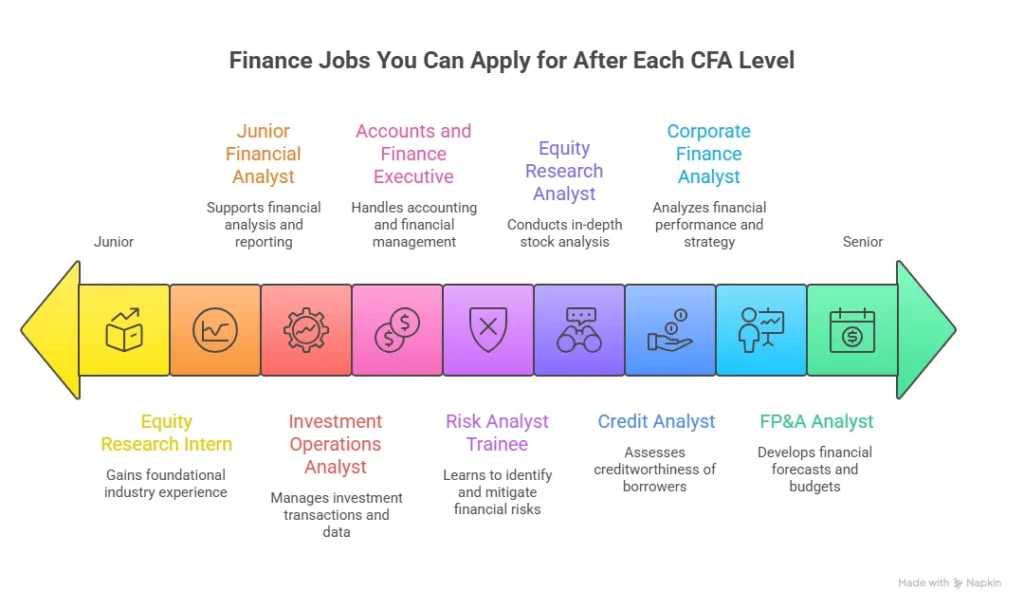

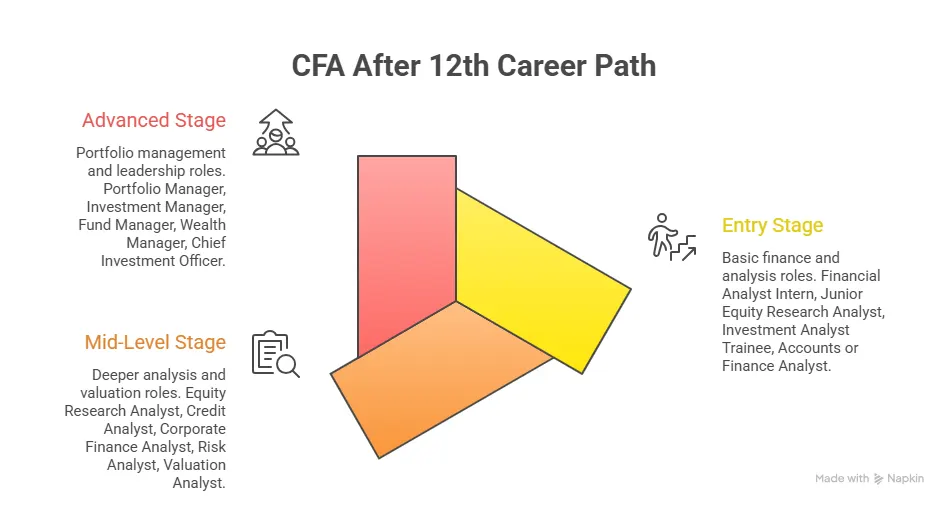

Career Scope After CFA

Once I understood the structure of the program, the next big question was about career direction. When someone plans CFA after 12th, they are usually thinking about real job roles in finance.

The CFA Program is designed for careers in investment management and financial analysis. It connects directly with industries that deal with money, markets, and decision-making. Here are the main career paths that open up after completing CFA.

Top Career Roles

- Equity Research Analyst

- Investment Banker

- Portfolio Manager

- Risk Analyst

- Financial Consultant

- Asset Manager

- Wealth Manager

Each role focuses on analysing investments and managing funds.

Industries That Hire CFA Professionals

The demand for CFA charterholders comes from multiple sectors.

Key Hiring Industries

- Investment banks

- Asset management firms

- Mutual fund companies

- Hedge funds

- Consulting firms

- Corporate finance teams

According to the CFA Institute career guide, many charterholders work in portfolio management and research roles.

Also Read: What are the Top Roles You Can Land with a CFA Certification?

Salary After CFA in India

Salary is one of the most searched topics when students explore the CFA course after 12th. The pay depends on your level, skills, and experience. Here is a general range based on market trends from Glassdoor India.

Salary Range by Role

| Role | Average Salary Range |

| Equity Analyst | ₹6 to 12 LPA |

| Investment Banking Analyst | ₹10 to 25 LPA |

| Portfolio Manager | ₹12 to 30 LPA |

| Risk Analyst | ₹8 to 18 LPA |

| Wealth Manager | ₹7 to 20 LPA |

These numbers grow as you gain experience.

Understanding how earnings grow across different stages of the program helps in setting realistic expectations and planning your career path in finance. It gives a clearer picture of how roles and salary levels typically progress as you move from Level 1 to Level 3.

Who Should Choose CFA After 12th

Not every student will enjoy the CFA journey. It suits certain interests and skills. You may find CFA a good fit if you enjoy:

- Analysing numbers

- Following market news

- Understanding business performance

- Thinking long-term about money

It may feel difficult if you do not enjoy finance concepts or if you prefer creative fields.

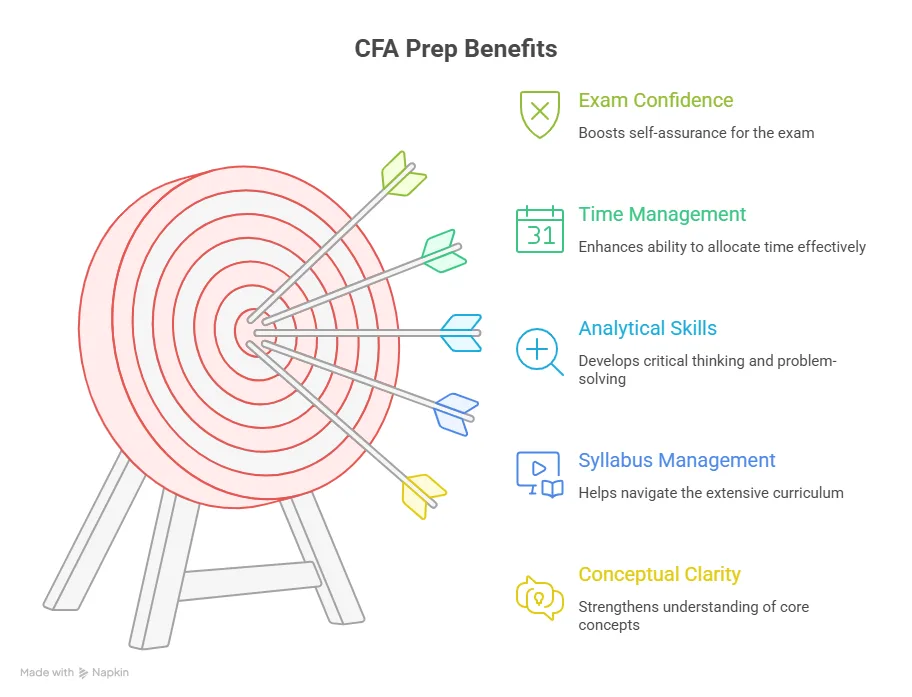

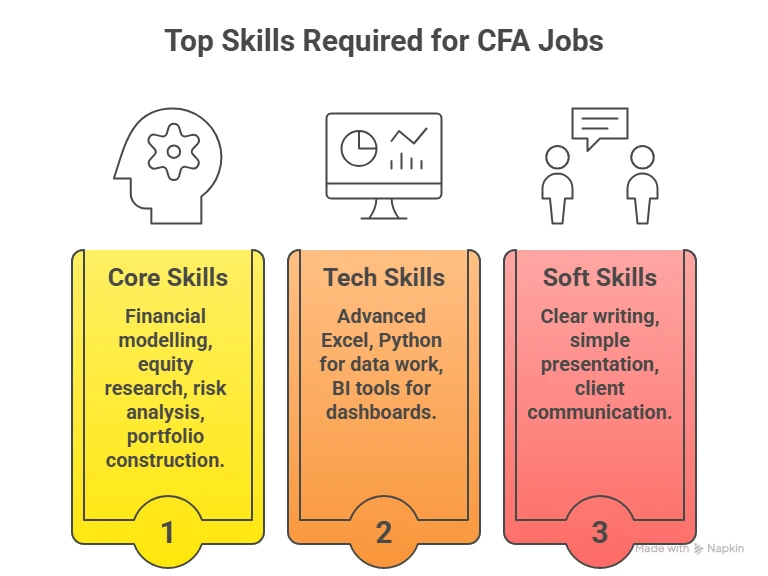

Skills You Build Through CFA

The program focuses on real-world skills that are useful in finance jobs.

Key Skills Developed

- Financial analysis

- Investment decision making

- Risk assessment

- Data interpretation

- Ethical judgment

These skills are used in daily work by finance professionals.

Also Read: What Course Should You Pursue Apart From A CFA To Make A Career In Wealth Management?

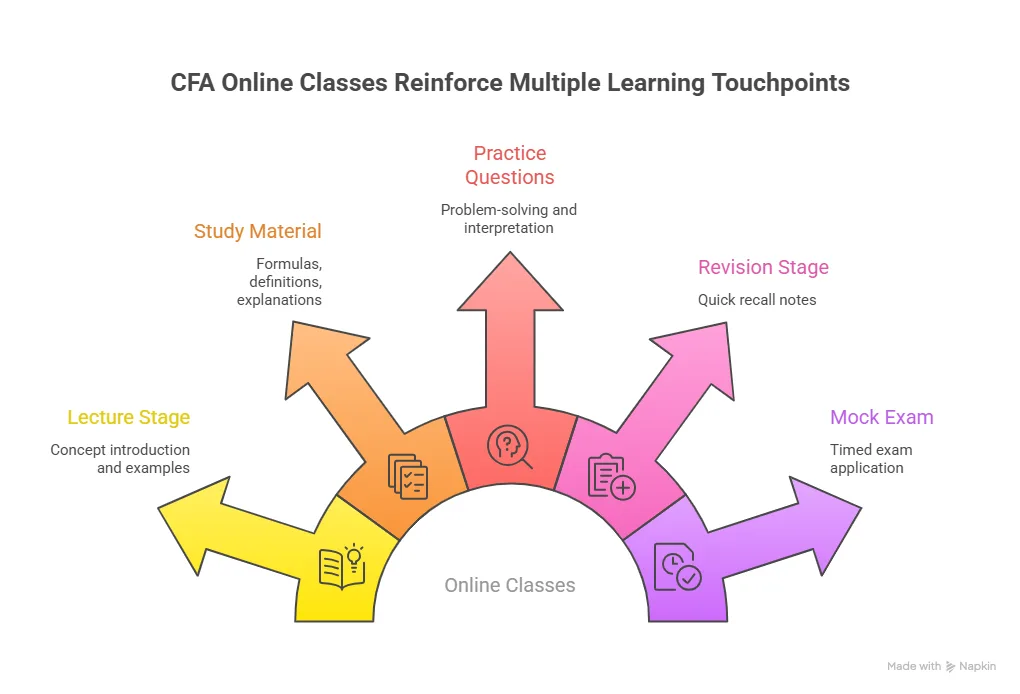

Study Resources for CFA

The CFA Program provides official curriculum books. These are detailed and cover all topics. Along with official material, students also use:

- Practice question banks

- Mock exams

- Video lectures

- Revision notes

These resources help in better understanding.

Books and Learning Tools

Students often ask for the best CFA books. Popular options include:

- CFA Institute curriculum books

- Kaplan Schweser notes

- Wiley CFA guides

These books simplify concepts and provide practice questions.

Importance of Mock Tests

Mock tests help you understand your exam readiness. Benefits of mock tests include:

- Time management practice

- Understanding exam pattern

- Identifying weak areas

- Improving speed and accuracy

Regular testing improves performance in the CFA course after 12th.

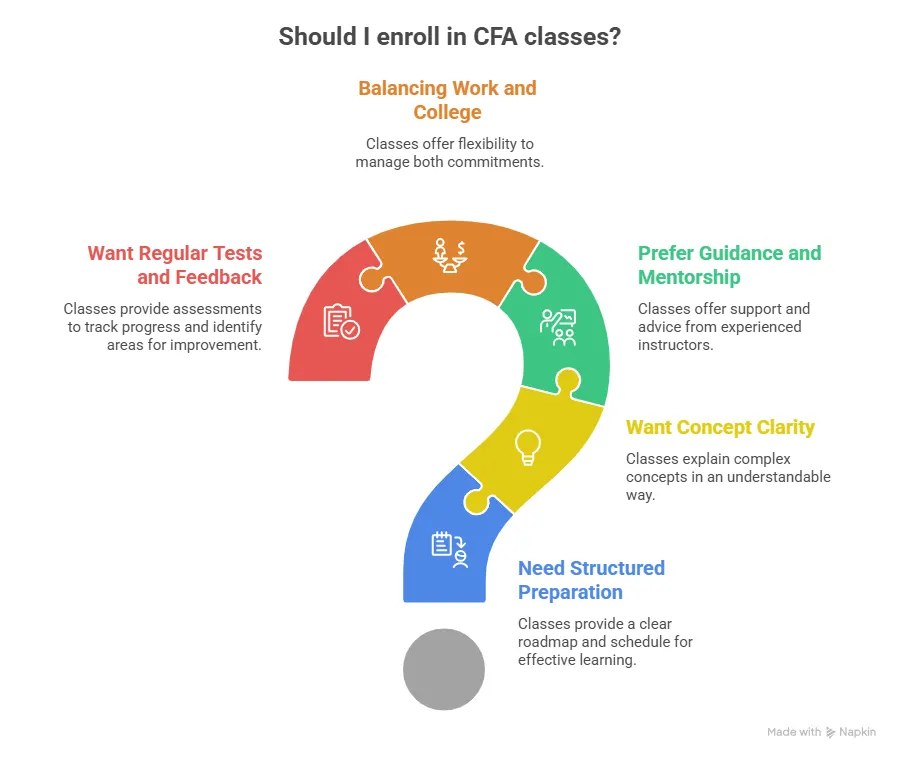

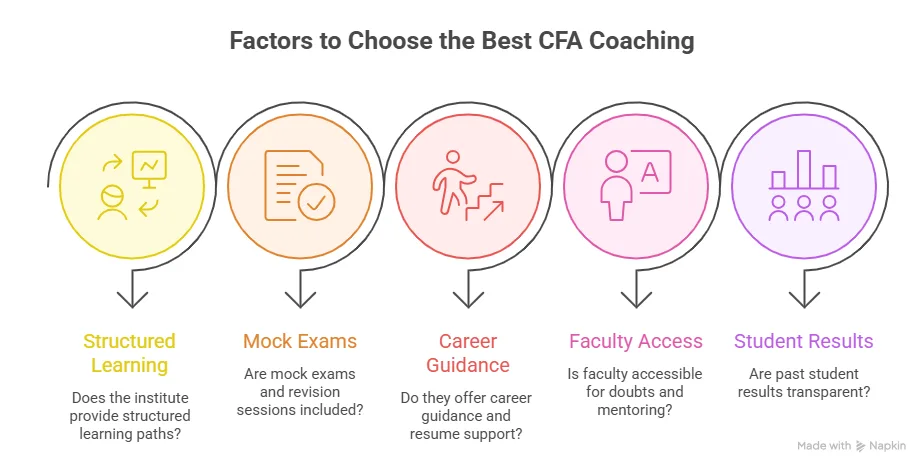

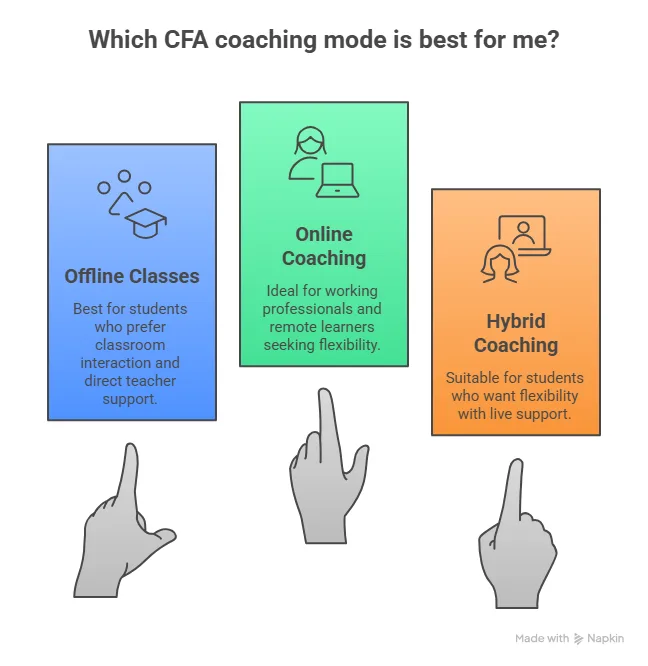

Self-Study vs Coaching

Many students preparing for CFA after 12th wonder if coaching is required. Both options work. It depends on your learning style.

Self Study Works Well If

- You can study regularly without reminders

- You are comfortable learning from books

- You can solve doubts using online forums

Coaching Helps If

- You prefer structured classes

- You want guidance for difficult topics

- You need regular tests and feedback

Institutes such as Imarticus Learning provide structured training programs that align with the CFA curriculum and help students stay consistent.

Also Read: The Growth of CFA Courses and 2020-2027’s Outlook

Why Many Students Choose Imarticus Learning for CFA Preparation

Preparing for CFA after 12th requires more than just books and notes. It needs structure, guidance, and a system that helps you stay consistent across months of preparation. This is where a training partner plays an important role. The CFA Program preparation by Imarticus Learning is designed to align closely with the actual CFA curriculum while also helping students build practical finance skills that are used in real roles.

Below are some of the key features that make Imarticus Learning a preferred choice for many students planning their CFA journey.

- CFA Institute Prep Provider with curriculum alignment: Imarticus Learning is a recognised CFA Institute Prep Provider, which means the program is structured around the official CFA curriculum and updated learning outcomes every year.

- Industry collaboration with KPMG in India: The program is delivered in collaboration with KPMG, giving learners exposure to industry practices and practical finance applications beyond theory.

- Kaplan Schweser study material integration: Students get access to Kaplan Schweser content along with Imarticus modules, combining global learning resources with structured local support.

- Expert-led training with real-world application focus: The program uses industry-led instruction with practical case-based learning so students can apply concepts in real financial situations.

- Comprehensive support system with revision tools and mock tests: The preparation includes structured mock exams, revision kits, and curated study material to improve exam readiness.

For a student planning CFA after 12th, these elements make the preparation journey more structured and manageable. With the right mix of curriculum alignment, practical learning, and career support, it becomes easier to stay focused and build confidence at every level of the program.

FAQs on CFA After 12th

Students often have a mix of practical and career-related doubts when they explore CFA after 12th, from eligibility and preparation timelines to job scope and salary expectations. The answers below bring clarity to the most frequently asked questions so that you can move ahead with a clear and confident plan.

Can I opt for the CFA course after the completion of 12th class?

Yes, you can plan for CFA after 12th, but you cannot directly register for the exam immediately after school. The registration becomes valid once you are in the final year of your graduation or after completing your degree. During graduation, you can begin your preparation early so that you are ready for Level 1 when you become eligible. Many students take guidance from institutes such as Imarticus Learning to align their college studies with CFA preparation.

How do I start my preparation for CFA after 12th?

The right way to begin CFA after 12th is by choosing a graduation course that supports finance learning and then starting with basic concepts such as accounting and economics in the first year. From the second year, you can begin structured Level 1 preparation using the official curriculum and practice questions. Coaching support from Imarticus Learning can help in creating a consistent study routine and covering difficult topics in a clear way.

Do people get jobs after clearing CFA Level 1?

After completing Level 1 in the CFA, many students secure entry-level roles such as research analyst or finance intern. These roles help in building industry experience while you continue with Level 2 and Level 3. Institutes like Imarticus Learning also support students with placement assistance and interview preparation for such entry-level finance roles.

Is CFA in India good for a career?

Yes, CFA after 12th is considered a strong career option in India because the financial markets are growing and there is a rising demand for skilled investment professionals. The program builds knowledge in portfolio management, equity research, and financial analysis, which are valuable in investment firms, banks and consulting companies. Many training providers, including Imarticus Learning, offer design programs that connect the CFA curriculum with real-world finance careers.

What makes the CFA course tough to clear?

The CFA after 12th path is challenging because it requires consistent study discipline and a strong understanding of finance concepts. The syllabus is detailed, and the exams test both theory and application. Students who follow a structured plan, practice regularly and revise concepts find it easier to manage the difficulty level and clear each stage.

What is a CFA salary?

The salary potential after CFA after 12th depends on your role, experience and skills. Entry-level roles may start around 6 to 10 lakh per year and can increase significantly as you gain experience and complete all levels. Senior roles such as portfolio manager or investment banker can offer much higher salary ranges depending on the organisation and responsibilities.

Is 67% enough to pass CFA?

The CFA after the 12th exam does not have a fixed passing percentage. The passing score changes every year based on exam difficulty and the performance of candidates. Many students aim to score above 70% in practice tests to stay on the safe side and improve their chances of clearing the exam.

Is CFA in demand?

Yes, CFA after 12th leads to a career path that is in demand due to the growth of the investment markets, financial planning services and asset management industry. Companies need professionals who can analyse investments and manage funds responsibly. This demand is expected to grow further as more people participate in financial markets.

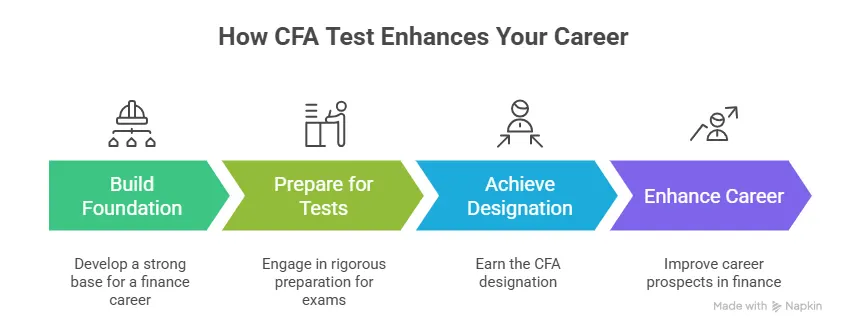

Start Your CFA After 12th Journey With a Clear Plan

Choosing a path like CFA after 12th is a long-term decision. It shapes your skills, your career direction, and the kind of work you will enjoy every day. When you break it down into simple steps, the journey becomes easier to follow. You start with graduation. You build your basics. You prepare steadily for CFA Level 1. Then you move forward level by level.

What matters most is clarity and consistency. A clear plan keeps you focused. A steady study routine helps you stay on track even when college work gets busy. The effort you put in now builds a strong base for finance roles in the future.

Many students who explore how to do CFA after 12th feel unsure at the start. That feeling is normal. It becomes easier when you have the right structure, the right resources, and the right support system. That is why many learners prefer organised preparation support with the CFA Program prep offered by Imarticus Learning to stay disciplined and exam-ready.

If finance, investments, and markets interest you, then this path can open doors to strong global careers. The sooner you plan your next steps, the more confident your journey becomes.