If you talk to 10 ACCA learners today, each one will give you a different version of what the job market looks like. Some say it’s booming. Some say it’s competitive. Both are true depending on where you stand. ACCA Jobs follow a logic that becomes clearer only when you understand the skills employers prioritise, the cities that hire more aggressively, and the roles that actually accelerate your growth.

When students imagine the career landscape, the picture is often incomplete. They hear about global roles, Big Four opportunities, international mobility and high salaries. What they rarely hear is how these opportunities are structured, why employers choose ACCA qualified candidates and which roles are genuinely growing in India and abroad.

The current finance market is reshaping fast because companies expect professionals who can blend accounting clarity, reporting skills, analytics and digital fluency. This is exactly why ACCA Certification has become a strong hiring signal.

A recent India Talent Trends report highlighted that 43% of finance professionals believe AI and digital capabilities will redefine their career path in the next five years.

Source: ACCA Global Talent Trends 2025

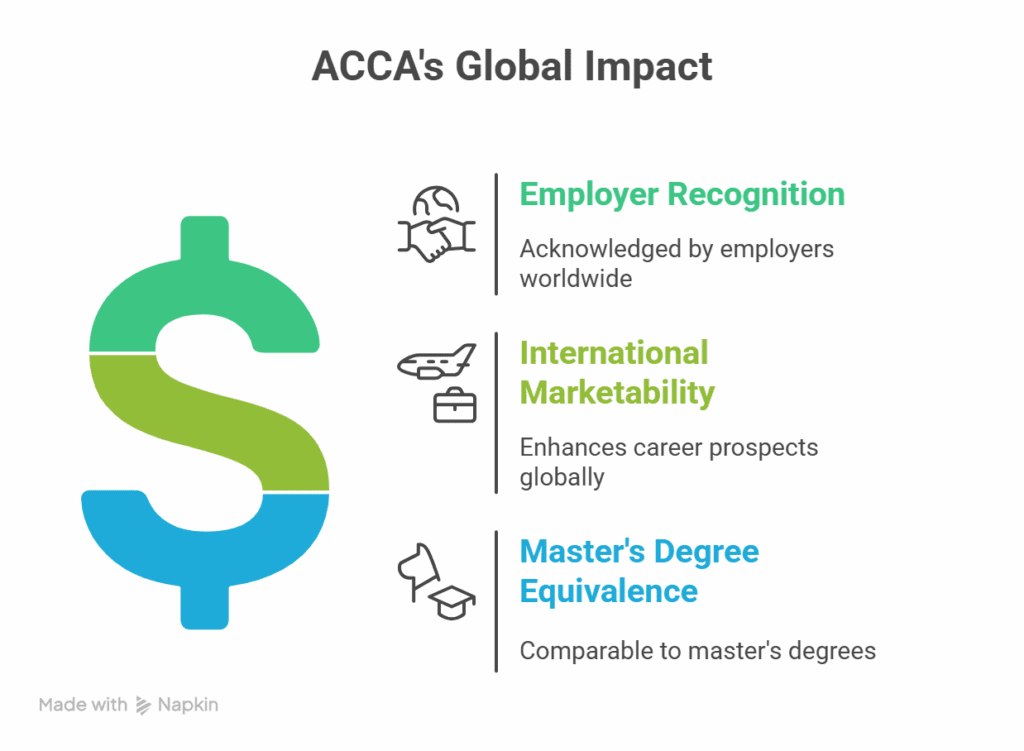

This shift shows why ACCA professionals are shortlisted, interviewed and eventually placed in competitive jobs. The qualification covers IFRS, audit, strategy and financial management, making it easier for employers to trust that an ACCA candidate can adapt to evolving finance expectations.

Why Companies Want ACCA Talent

Students often don’t understand the decision-making logic of recruiters. This part breaks down why the qualification aligns with hiring needs.

Recruiters repeatedly mention three needs:

- They need candidates who understand global financial reporting.

- They want future accountants who can collaborate with international counterparts.

- They prefer professionals who can pick up analytics tools without friction.

Inside this guide, you’ll find a clear breakdown of ACCA Jobs, the skills companies value, salary expectations and the smartest ways to position yourself.

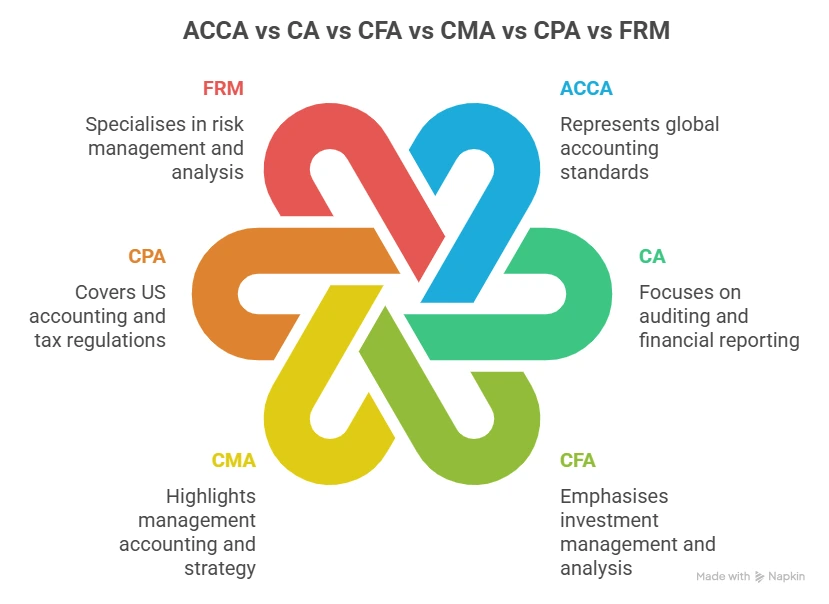

Understanding the ACCA Jobs Structure

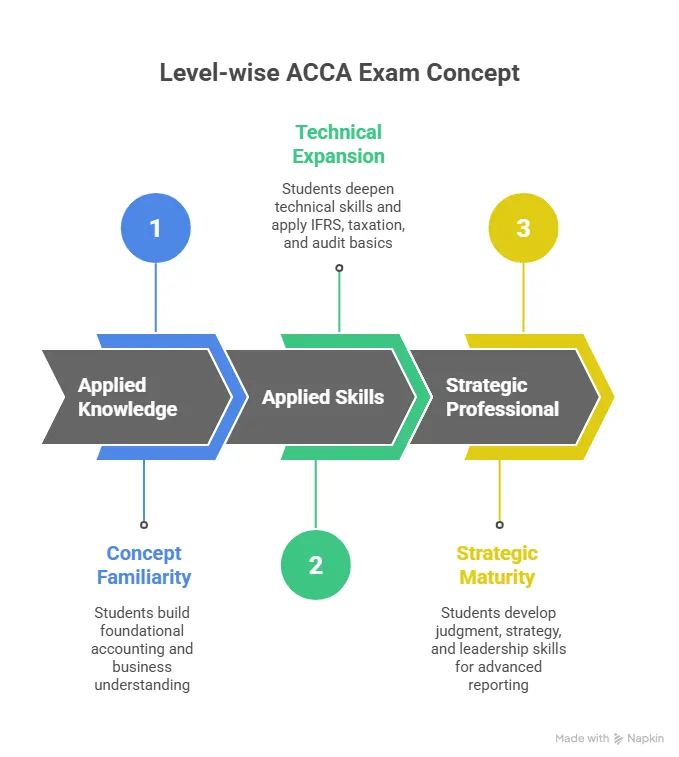

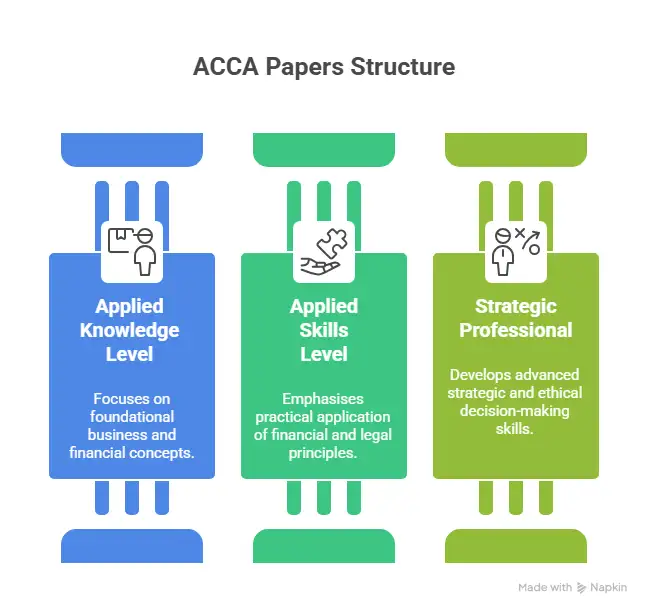

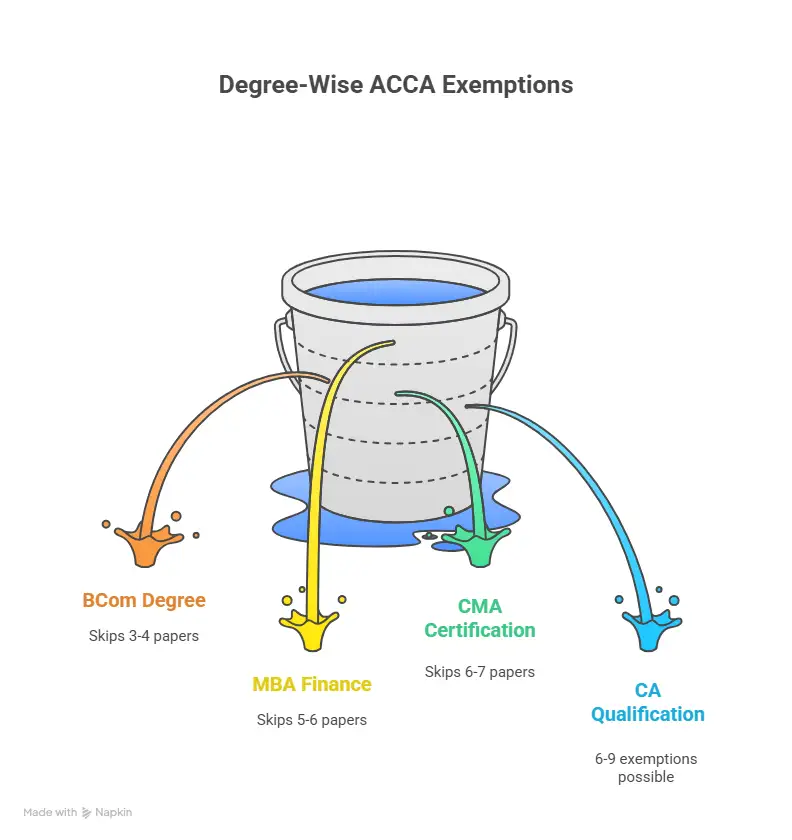

Before exploring the full landscape of ACCA Jobs, it helps to step back and understand exactly what the qualification prepares you for. If you’ve ever found yourself Googling what is ACCA, the simplest explanation is that ACCA is a globally recognised professional qualification in accounting, finance, audit, and business management. It trains you to think, analyse, report and solve problems at the level employers expect from world-class finance professionals.

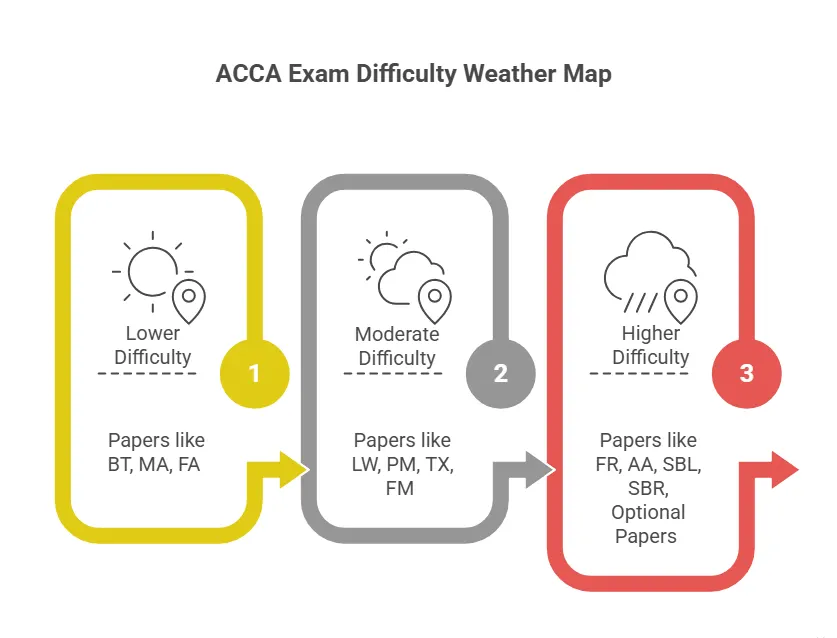

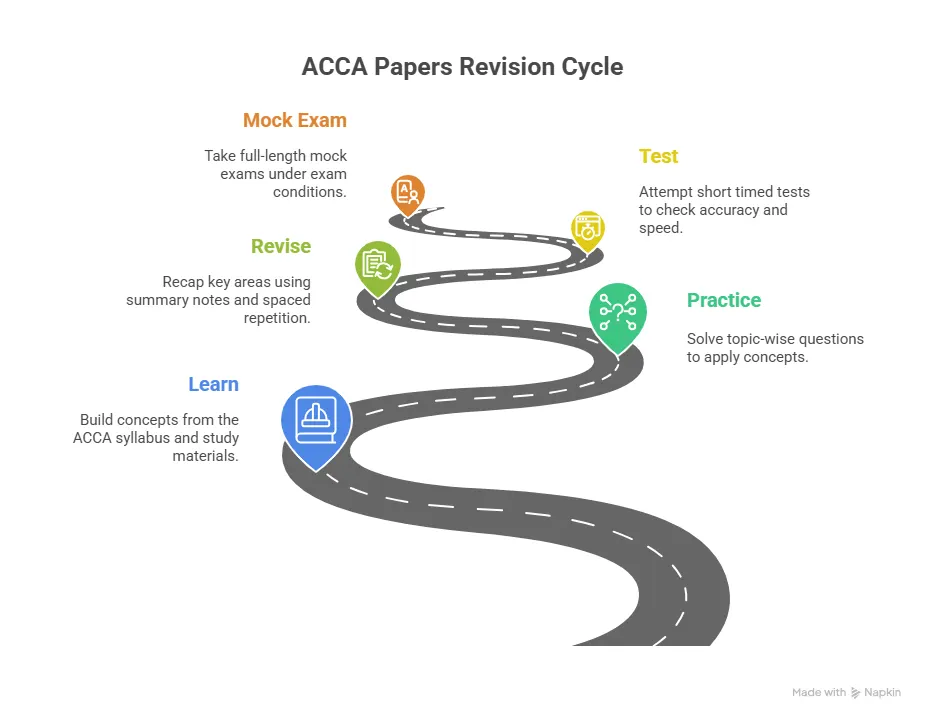

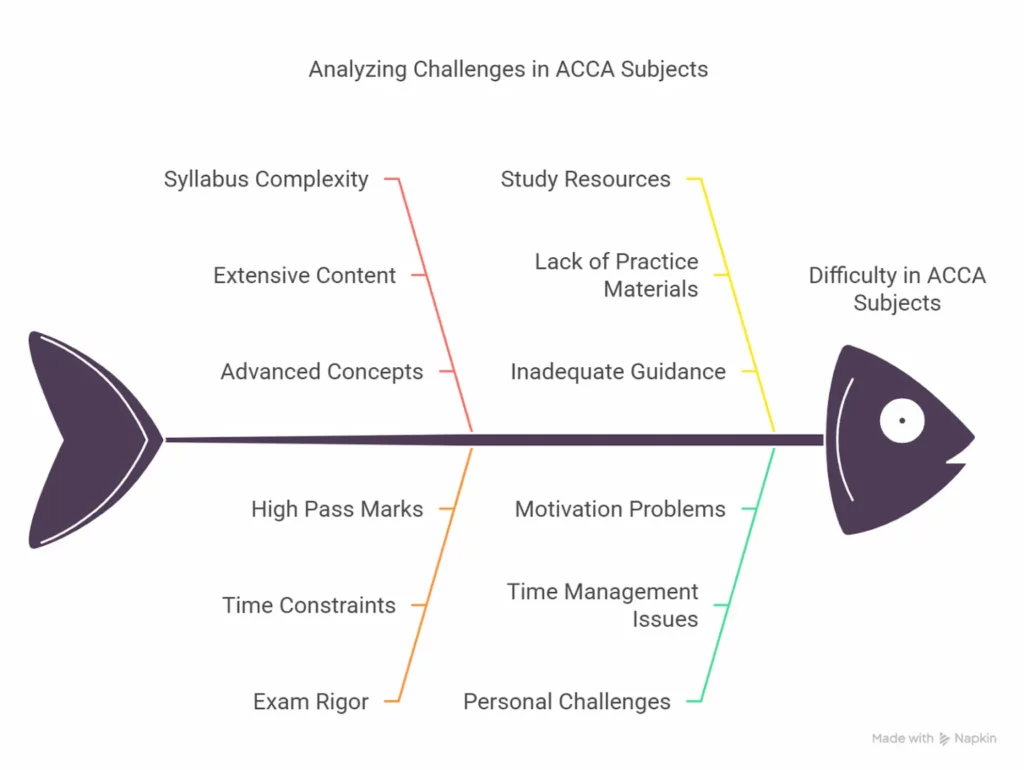

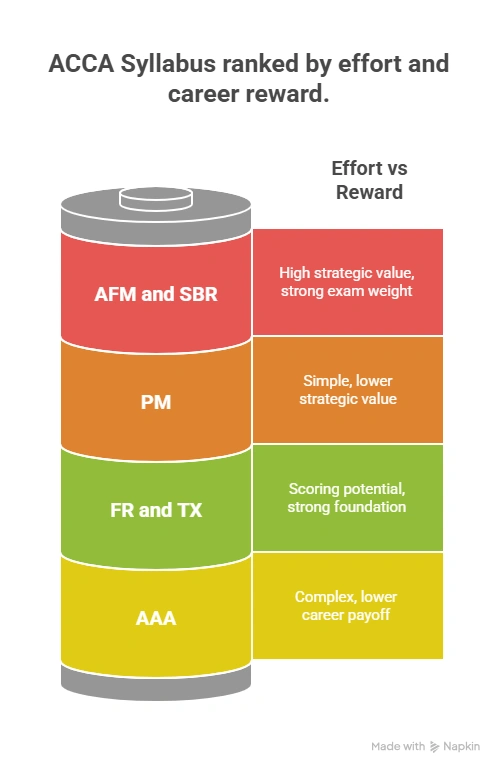

The ACCA course covers everything from financial reporting and audit to performance management, taxation, strategy and analytics. These are not just exam subjects; they are the core building blocks of the roles you eventually step into. This is why the jobs in ACCA naturally align with the skills you develop throughout the qualification.

As you progress through the papers, the competencies you build map directly to job functions:

- Your financial reporting and IFRS knowledge prepare you for roles in corporate accounting, reporting and global finance teams.

- Your audit and assurance training creates a strong foundation for audit associates and internal audit roles.

- Performance management and financial management papers align with FP&A, budgeting, forecasting and business partnering roles.

- Taxation papers help you take up tax trainee or compliance roles.

- Strategic-level papers build the mindset needed for managerial, analytical and leadership paths later in your career.

In other words, the ACCA Qualification isn’t separate from the job market – it is designed to flow into it. Each paper strengthens the competencies that employers evaluate when hiring for ACCA. As soon as you acquire practical exposure alongside your studies, your classroom learning converts into workplace value, making the transition smoother and the opportunities clearer.

This video dives into the details of the ACCA course and explains in-depth how this qualification prepares you for future-ready global finance jobs:

How ACCA Jobs Levels Progress as Your Skills Grow

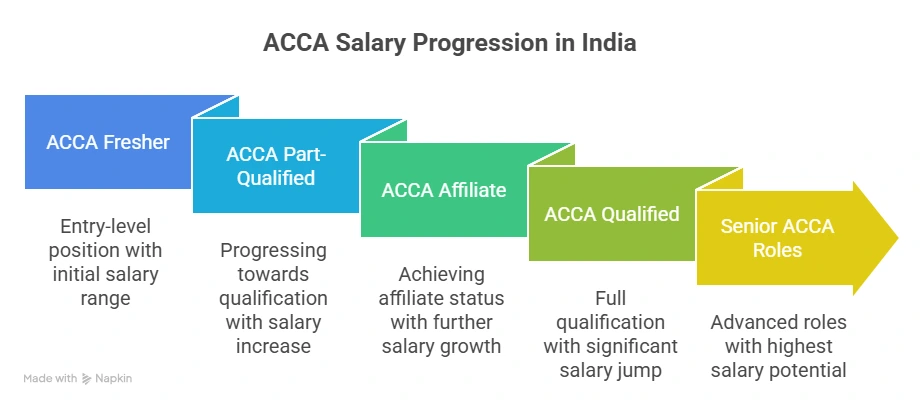

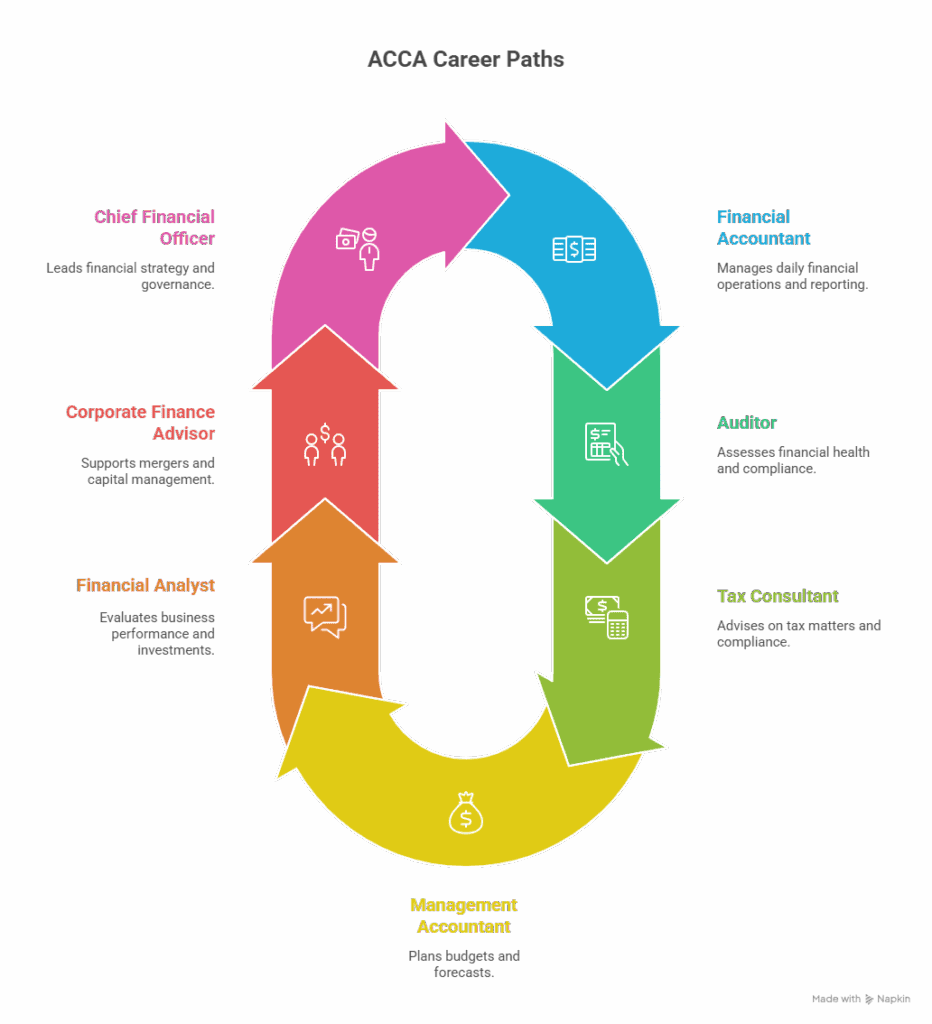

The ACCA certification matches the job market hierarchy neatly. You begin with ACCA Entry Level Jobs, transition into mid-level analytical roles, and eventually step into leadership or niche domains.

This section introduces you to the structural “levels” for jobs in ACCA so you can visualise the growth trajectory.

| Role Type | Experience Range | Salary Range (India) | Key Highlights |

| Entry Level Jobs | 0 to 2 years | ₹3 to 6 LPA | Ideal for affiliates and newly qualified candidates |

| Analyst, Audit Associate, Tax Associate | 1 to 3 years | ₹5 to 10 LPA | Exposure to MIS, audit documentation, and reconciliations |

| Senior Analyst or Assistant Manager | 2 to 5 years | ₹8 to 15 LPA | IFRS roles, planning, forecasting, business partnering |

| Finance Manager and Risk Lead | 4 to 7 years | ₹12 to 20 LPA | Team management and stakeholder collaboration |

| Director, Controller or CFO Track | 8 plus years | ₹20 to 50+ LPA | Global oversight roles and governance |

(Source: AmbitionBox, Glassdoor, 6figr.com)

Why ACCA Entry Level Jobs Matter More Than Students Think

A lot of students underestimate the importance of ACCA Entry Level Jobs. They assume these roles are temporary stepping stones. What they do not realise is that entry-level exposure influences how fast they move up. This section resolves a common misunderstanding among students about starting salaries and the value of early experience.

Employers observe two things closely.

- How quickly you learn.

- How consistently you deliver accuracy.

The moment you enter the finance workflow, your learning accelerates because you encounter variance analysis, internal audit samples, working papers, MIS cycles, closing processes and compliance checkpoints. These are the skills that form the backbone of senior finance roles. Without this early exposure, your growth slows later.

So, your early ACCA Job is not merely an entry. It is the foundation of your career potential that is accelerated over the long term.

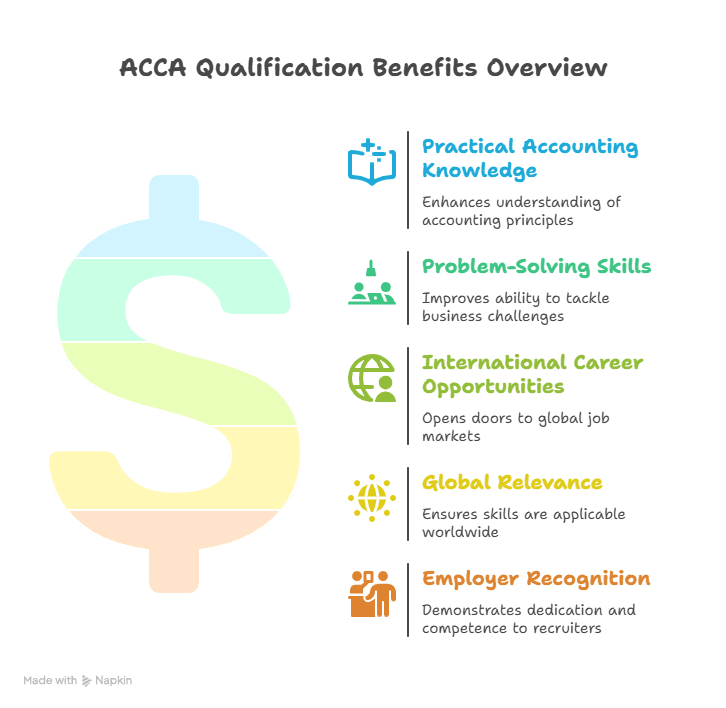

Critical Skills That Strengthen Your ACCA Job Profile

ACCA professionals stand out here because the ACCA qualification trains students across IFRS, performance management, audit and financial control.

For example, companies with cross-country consolidation requirements often shortlist ACCA candidates first because IFRS training saves onboarding time.

Another point employers highlight is readiness. When a candidate already understands variance analysis, audit sampling, impairment rules, discounting logic and forecasting, the training investment reduces drastically. This is why ACCA Jobs appear on both global and local job boards so consistently. It opens doors to high-paying global finance jobs.

Employers rarely pick candidates based purely on exams cleared. They observe four major skill blocks. This section explains what skills matter most for securing high-paying jobs and thriving in them.

- Conceptual Finance Skills

Your ACCA Qualification builds this foundation through IFRS, audit, costing, finance management and performance analysis. - Analytical and Technical Skills

A finance professional today must know Excel deeply and be aware of dashboards, forecasting models and basic automation. Tools such as Power BI or Tableau make an ACCA CV far more competitive. - Risk, Governance and Control Mindset

This is a big reason ACCA Certification is valued. Companies strongly prefer candidates trained in internal controls, assurance and reporting integrity. - Communication and Business Partnering

Almost all jobs require stakeholder clarity. You must learn how to explain numbers without jargon and convert analysis into recommendations.

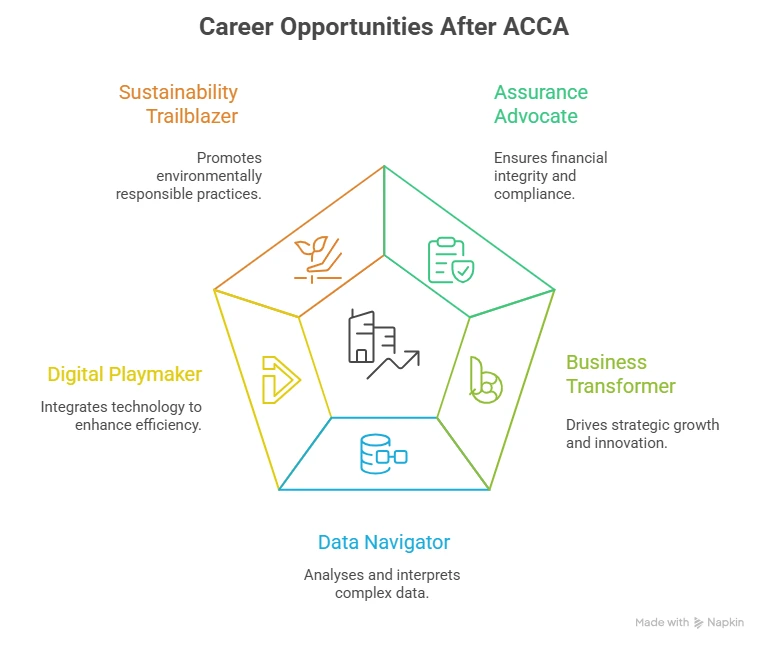

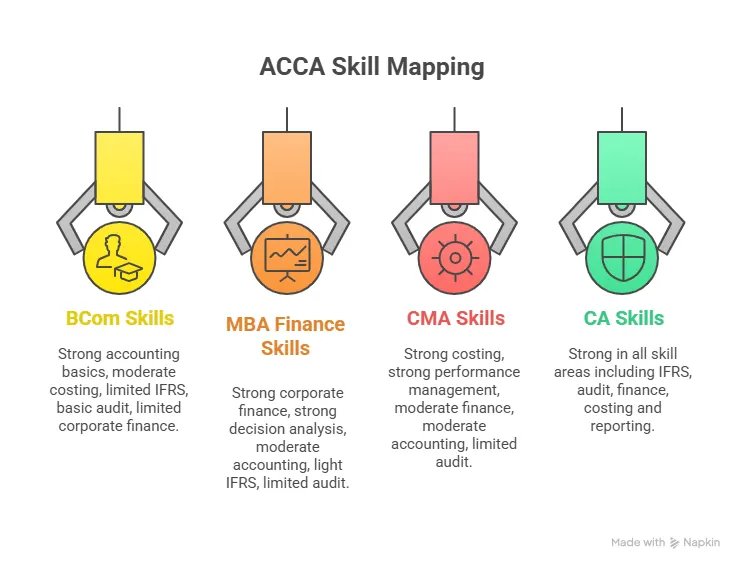

This visual shows an overview of various skills-to-job aspects for getting better chances to approach ACCA Jobs in the market today:

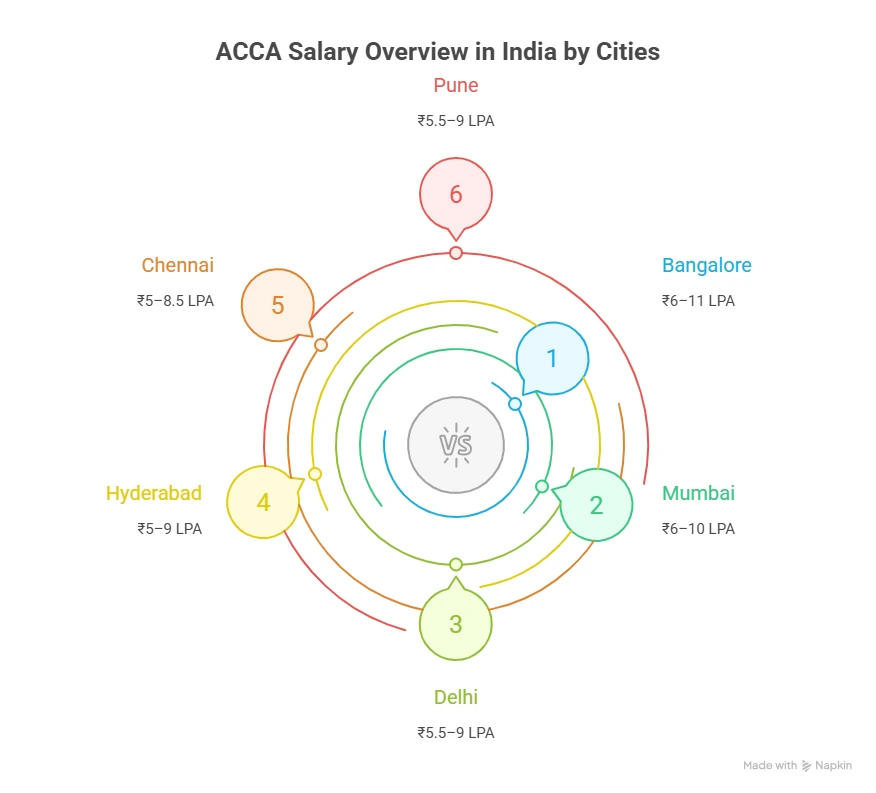

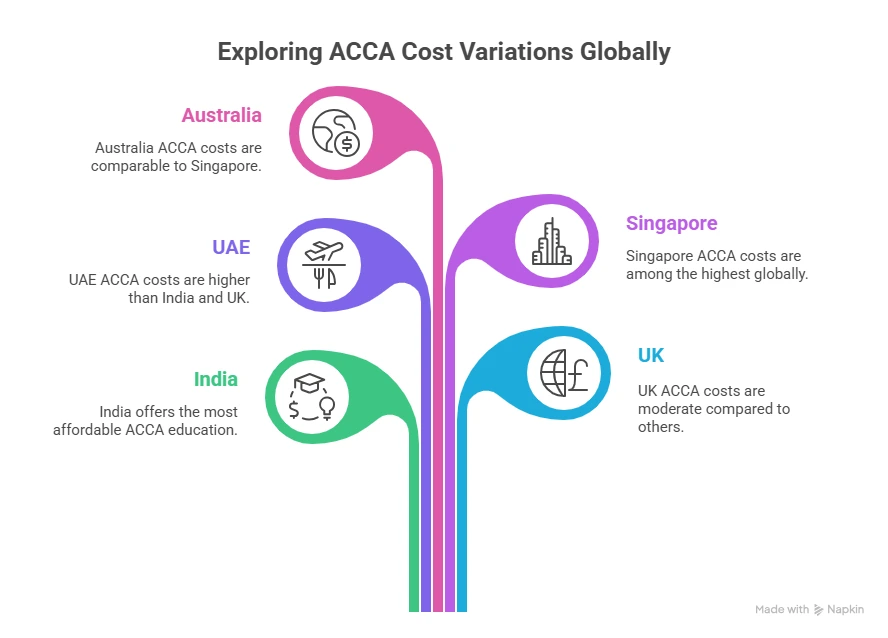

How Geography Influences ACCA Jobs

Every major finance hub hosts companies that rely on ACCA-qualified professionals. India’s economy has a large banking, IT, shared services and consulting ecosystem. Because of this, cities like Mumbai, Bengaluru, Pune, Hyderabad and Gurgaon generate large volumes of jobs for ACCA qualified professionals. Each region has its own hiring pattern.

India also has a rapidly growing GCC (Global Capability Centre) market. These centres are used by multinational firms to run global finance operations. ACCA candidates often fit these roles well.

This section helps students understand why location affects opportunity volume, salaries and role diversity. A major part of ranking for ACCA Jobs is addressing user intent around “where can I work with ACCA”.

- India: Largest Market For ACCA Jobs

India has become a mature market for ACCA career opportunities. Companies such as Deloitte, EY, KPMG, PwC, Accenture, WNS, Infosys, BDO, Grant Thornton and ITC have shown consistent hiring interest in ACCA Job profiles. With metro cities offering higher salaries, students often migrate to these hubs.

According to data published by 6figr, salary insights of certain ACCA profiles in Mumbai report average salaries around ₹24.8 lakhs. (Source)

This level of compensation does not reflect the average entry-level package, but it reinforces long-term earning potential.

- ACCA Jobs in the USA: A Growing Interest Area

Many students search for ACCA Jobs in the USA because the American market offers high compensation. While the USA does prioritise CPA for certain accounting roles, several opportunities still exist for global finance professionals, especially in finance operations, analytics, consolidations and risk management teams. ACCA candidates working in India-based GCCs often support US teams directly, which builds eligibility for global mobility.

Students should approach the USA market with a strategy. Three paths work well.

- Position yourself for India-based roles that handle US reporting.

- Apply for remote positions with global companies.

- Pursue niche analytical roles such as FP&A, data-backed reporting and risk review.

These roles typically value global credentials, including the ACCA Qualification and ACCA Certification.

- Remote and Global ACCA Jobs: The New Normal

Remote finance functions have expanded rapidly. Companies realise that accounting and analytical tasks can be handled from anywhere if the candidate demonstrates clarity, reliability and strong communication. ACCA professionals already work with international clients during their coursework and training, which makes them suitable for remote execution.

For remote jobs, companies focus on:

- Ability to manage deadlines independently

- Confidence in IFRS and global reporting

- Familiarity with shared drives, cloud-based workflow tools

- Clear communication skills

- Willingness to adapt to time-zone shifts

Remote global roles are especially promising for Indian ACCA candidates because the compensation often exceeds domestic salaries.

Choosing The Right Location For Your ACCA Career

Choosing your work location is a strategic decision and is also a key factor for the best ACCA career options. For example:

- If you want strong audit exposure, metros with Big Four presence are ideal.

- If you want to transition into FP&A or analytics, cities with large tech companies or GCCs offer better roles.

- If your long-term goal is to shift into ACCA Jobs in the USA or Europe, work in organisations with global consolidation responsibilities.

A balanced table below helps visualise location-specific opportunities. This section helps students decide which city or country best suits their ambitions.

| Region | Type of ACCA Jobs | Salary Pattern | Best Career Strategy |

| Mumbai | Audit, FP&A, corporate finance | Moderate to high | Best for long-term growth and global role exposure |

| Bengaluru | Analytics, finance transformation | High | Ideal for tech-driven finance roles |

| Pune | GCC, shared services | Medium | Good for structured career progression |

| Hyderabad | Risk, audit, reporting | Medium to high | Strong for compliance-related roles |

| USA | Finance ops, FP&A, risk | Very high | Requires a strong global experience base first |

| Remote | Reporting, MIS, analytics | Varies | Best for candidates with communication strength |

Mastering Applications on the ACCA Job Portals

Students often browse portals randomly without a strategy. To succeed and increase your chances of ACCA employability, you need structured portal habits for ACCA Jobs. Rather than checking job boards casually, treat this like a weekly plan.

This section gives actionable instructions on how to use job portals correctly because most competitor blogs barely scratch the surface.

Building Your ACCA Job Portal List

Create a dedicated tracker with the following portals:

- Indeed

- Naukri

- ACCA’s Career Portal

- eFinancialCareers

- IIMJobs and Hirist

- Glassdoor

- Global consulting firm career pages

- Fintech career pages

Mentor Insights → Set weekly application targets. Students who apply consistently for 12 consecutive weeks have significantly higher callback rates, especially when applying to ACCA Job Portal listings that specifically request ACCA Certification.

Optimising Your Applications For ACCA Jobs

Recruiters often filter profiles using keywords. This section helps students understand what to update in their profiles so their applications rise in recruiter searches. Add these to your profile headline or skills section:

- ACCA Qualification

- ACCA affiliate or ACCA member

- IFRS knowledge

- Variance analysis

- Month-end close

- MIS reporting

- Financial modelling

- Consolidations

Updating your profile regularly boosts visibility. Job portals show fresh updates to recruiters first.

Watch this video to find out more about high-paying jobs after BCom with global certifications like ACCA:

How To Present Yourself To Secure Competitive ACCA Jobs

Your personal brand is the first impression you leave on employers. Your resume, LinkedIn, portfolio and communication combine to build a perception of reliability and expertise. A strong brand does not require decades of experience. It requires clarity in storytelling. This section teaches the candidate how to build a strong professional brand, which is essential for standing out in the competitive job landscape.

Creating A Resume That Reflects The ACCA Qualification

Students often struggle to highlight their ACCA Certification correctly. This section solves that.

Every resume applying for ACCA Jobs should have four visible elements:

- Your ACCA Qualification status

- Technical exposure

- Relevant achievements

- Sector preferences

→ A clean resume headline could be:

“ACCA Affiliate with IFRS, Audit and Analytics Skills Seeking Global Finance Roles”

→ A summary paragraph example:

“I am an ACCA affiliate with experience in MIS reporting, reconciliations, and variance analysis. I have contributed to forecasting models and worked with cross-functional teams. I am open to India-based and international roles, including jobs in the USA.”

Building Interview Confidence For ACCA Jobs

Candidates often know the answers but struggle to communicate them smoothly. This section gives structure.

Interviewers primarily test clarity, logic and composure. Apart from technical questions like impairment rules or sampling techniques, they will ask situational questions. Prepare 3 stories that show:

- A challenge you solved

- A time you collaborated well

- A situation where you improved an existing process

Mentor Insight → Prepare 10 technical topics from your ACCA Qualification subjects because these frequently appear in interviews. The stronger your command of IFRS and financial concepts, the easier it is to stand out.

To help you picture the rhythm of ACCA Jobs more clearly, this infographic shows how weekly tasks play out across roles like audit, FP&A, reporting and tax.

Why Choose Imarticus Learning for Your ACCA Journey

If you’re serious about securing meaningful jobs in ACCA, choosing the right training partner can make a real difference. At Imarticus Learning, every element of the ACCA course prep has been built with career-readiness in mind, not just exam passing.

Here are the distinctive advantages you’ll get:

- Industry-led programme in collaboration with KPMG in India: Your ACCA preparation is tied directly to real-world practices, case studies and frameworks used by a Big 4 firm.

- Joint certification and gold status recognition: Upon successful completion, you earn a joint certificate alongside your ACCA papers, and Imarticus is an ACCA Gold Status Learning Partner, a strong signal to recruiters that you’ve prepared with quality.

- Robust, exam-aligned content powered by Kaplan Publishing: The study materials, books, live classes, question banks, and video lectures are all endorsed and aligned with ACCA standards.

- Guaranteed internship or placement support: After the first two ACCA levels, Imarticus provides a pathway to internships, offering you early exposure to real ACCA Job environments.

- Live sessions and webinars led by industry practitioners: With monthly live sessions conducted by KPMG professionals, you keep pace with the evolving skills and expectations that recruiters look for in ACCA Jobs.

FAQs About ACCA Jobs

This section answers the most frequently asked questions students have about ACCA Jobs, from salaries and hiring cities to global opportunities and long-term career paths. It gives you clear, practical guidance to help you plan your ACCA journey with confidence.

What kind of jobs can I get with ACCA?

ACCA Jobs span a broad spectrum, including audit, tax, financial analysis, management accounting, internal control, risk management and finance transformation. Early on, most candidates find roles such as Accounts Executive, Junior Analyst, Tax Associate or Audit Trainee. With experience, you progress into positions like Financial Analyst, FP&A Specialist, Internal Auditor, Compliance Officer and eventually Finance Manager or Controller.

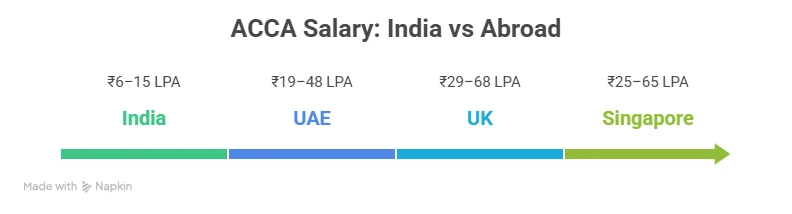

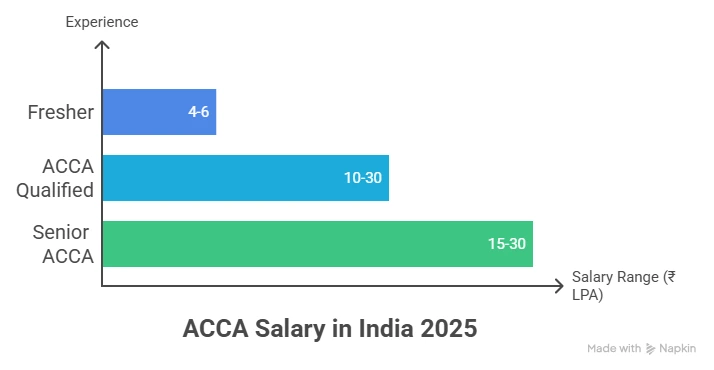

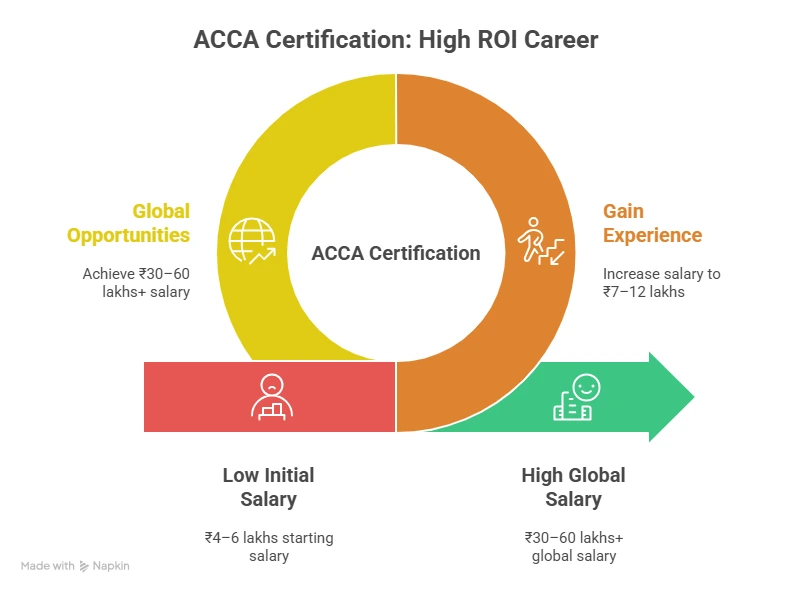

What is the ACCA job salary?

The salary for ACCA Jobs differs based on city, experience and industry. Freshers generally start at ₹4 to ₹6 lakhs per annum in major Indian metros. With 3 to 5 years of experience, compensation often reaches ₹10 to ₹20 lakhs annually as professionals move into mid-level roles involving analytics, month-end close and performance reporting. Senior positions or international roles can exceed ₹20 lakhs and, in certain GCC or multinational setups, reach significantly higher.

Where can I work with ACCA?

You can work in a wide range of organisations with an ACCA certification. These include multinational corporations, Big Four firms, global capability centres, fintech start-ups, banks, consulting firms and outsourcing service companies. Cities such as Mumbai, Bengaluru, Pune, Hyderabad and Gurgaon are major hiring hubs. Those targeting ACCA Jobs in the USA often begin by working in India-based teams that support US reporting cycles. Remote roles have also expanded widely, allowing ACCA candidates to work with international teams from India itself.

Is the ACCA salary more than the CA?

Compensation for ACCA Jobs and CA roles varies based on firm size, industry and job location. Many companies offer similar packages for both qualifications. However, ACCA professionals working in global finance teams, multinational reporting, FP&A, consulting or finance transformation often earn higher salaries because these functions value international exposure. Long-term earning potential depends on performance, upskilling and global exposure more than the qualification alone.

What is the 7-year rule in ACCA?

The 7-year rule relates to completing the Strategic Professional level of the ACCA Qualification within seven years of clearing your first exam at that level. Completing practical experience requirements also matters because full membership strengthens your credibility. Students should plan their exam roadmap, internships and full-time roles so the 7-year timeline does not pose hurdles later. If you feel you need structured guidance to map out your exam plan effectively, the mentorship and training support at Imarticus Learning helps you stay organised and on track throughout your ACCA journey.

Who hires ACCA in India?

A wide range of companies hire for ACCA Jobs in India. These include Big Four firms, multinational corporations, banking institutions, consulting firms, GCCs, fintech organisations and shared services companies. Firms such as Deloitte, EY, KPMG, PwC, Accenture, WNS, Infosys and Grant Thornton regularly recruit ACCA candidates. As the economy grows, more mid-sized companies have also started hiring ACCA talent for roles in reporting, tax, audit and analysis. Imarticus Learning guides students toward these opportunities with training and placement support.

Will ACCA be replaced by AI?

AI is transforming finance, but ACCA will remain relevant. Automation handles repetitive tasks, but ACCA professionals are trained in judgement-based areas such as risk assessment, interpretation of financial statements, compliance and advisory decision-making. The ACCA Qualification also encourages digital readiness, making candidates better equipped to work with AI tools. Embracing AI improves employability rather than reducing it.

Which city is best for ACCA in India?

The best cities for ACCA Jobs in India are Mumbai, Bengaluru, Hyderabad, Pune and Gurgaon because these locations host multinational corporations (MNCs), Big Four offices, GCC hubs and fast-growing fintech companies. Mumbai offers exceptional exposure to corporate finance and audit. Bengaluru is a hub for analytics-focused ACCA roles. Hyderabad and Pune have strong shared services ecosystems. Candidates should choose a city based on long-term role preferences, growth opportunities and industry clusters.

Bringing It All Together

ACCA opens doors to a wide spectrum of roles across audit, reporting, FP&A, analytics, tax and global finance operations. The path becomes clearer once you understand how skills, geography, job portals and real-world experience shape your opportunities. If you build the right mix of technical clarity and practical exposure, you don’t just qualify for ACCA Jobs, you become genuinely employable in a market that values capability over titles.

And if you need structured guidance, industry-ready training or mentorship while preparing for the ACCA Course, Imarticus Learning offers a solid stepping stone for strengthening your fundamentals and job readiness. Their programs are designed with real workplace expectations in mind, which means you learn the concepts the way employers expect you to use them. Through practical examples, case-driven sessions, guided practice and doubt-solving support.