India is witnessing a data science revolution. This field is growing at an unprecedented pace.

Data science careers in India are booming. Opportunities are expanding across various sectors.

The digital transformation is a key driver. It fuels the demand for skilled data professionals.

Industries like IT, finance, and healthcare are leading the charge. They are actively seeking data experts.

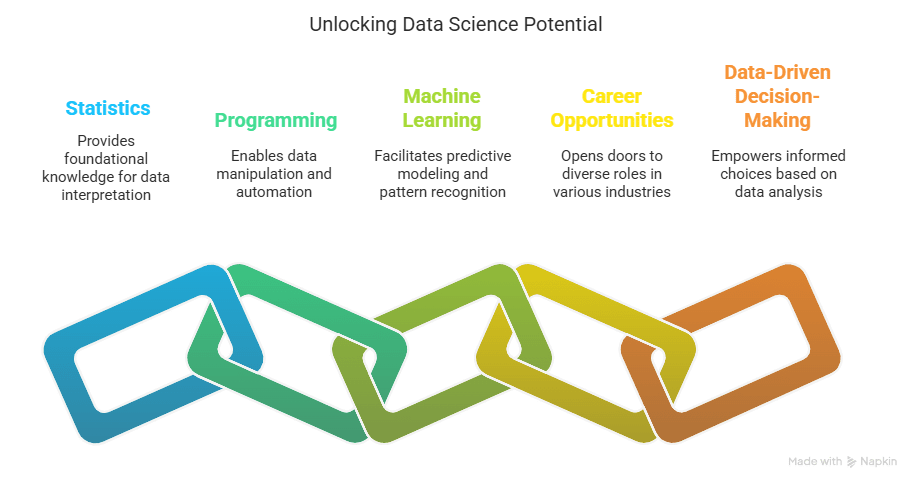

In-demand data science skills include machine learning and data visualisation. Programming languages like Python and R are essential.

The average salary for data scientists in India is competitive. It offers potential for rapid growth.

Entry-level positions are accessible to graduates. Relevant skills and training are crucial for success.

Advanced roles include data engineer and AI specialist. These positions offer exciting career paths.

Online courses and certifications are popular. They provide a gateway to acquiring data science skills.

The future of data science in India is promising. Investments in AI and big data are increasing.

Data science career opportunities are expanding beyond tech hubs. Smaller cities and towns are also seeing growth.

Networking and professional communities are vital. They play a crucial role in career advancement.

Data science is becoming integral to decision-making. It is transforming how organisations operate.

The Rise of Data Science in India: An Overview

The emergence of data science in India is reshaping the career landscape. It’s transforming industry operations through data-driven insights.

The journey began with the tech revolution. Now, the country sees a surge in data science roles. This trend continues to expand rapidly.

Digitalisation and automation have spurred demand. Data is central to strategic decision-making in business. Industries leverage this to stay competitive and innovative.

Several factors contribute to this rise. Key reasons include technological advancements, a growing digital ecosystem, and supportive government policies.

Key Contributors to the Rise:

- Technological advancements

- Expanding digital ecosystem

- Government policies

Organisations seek professionals skilled in analytics. They recognise data’s power in driving growth and efficiency. This creates unparalleled job opportunities.

Educational institutions are adapting too. They’re integrating data science into the curriculum. Students are gaining skills needed for these emerging roles.

Public and private partnerships are flourishing. They facilitate knowledge sharing and skill development. Collaboration is key to future success.

The rise extends beyond traditional sectors. New fields like IoT and blockchain are tapping into data science. This cross-industry appeal fuels broader participation.

India’s data science ecosystem is robust and inclusive. It supports diversity and innovation. This encourages the participation of diverse talent across regions.

Why Data Science Is Booming: Key Drivers in India

Data science is booming in India for multiple reasons. Key drivers propel its rapid rise. Understanding these factors reveals the field’s potential.

First, the digital transformation across industries creates vast data. Organisations seek to harness this data for insights. This need fuels the demand for skilled data professionals.

Second, technological advancements, particularly in AI and machine learning, boost data capabilities. Companies explore advanced analytics to gain a competitive edge. This fuels the demand for cutting-edge data skills.

Furthermore, government initiatives support data-driven innovation. Policies promote tech adoption and investment. This environment fosters growth in data science roles.

Key Drivers of Growth:

- Digital transformation generates vast amounts of data

- Technological advancements in AI and machine learning

- Government initiatives supporting tech adoption

Industry leaders recognise data as a strategic asset. They invest heavily in analytics. This trend creates more data science career opportunities across sectors.

Moreover, the rise of e-commerce and fintech accelerates growth. These sectors rely on analytics for personalisation and customer insight. Their expansion necessitates more data science expertise.

The academic response is swift and targeted. Universities offer specialised courses. They align with industry requirements, preparing a new generation of data experts.

India’s workforce is adapting quickly. A culture of continuous learning and upskilling is vital. Professionals embrace certification programs to meet demand.

Top Industries Fueling Data Science Careers in India

Data science is now a crucial component across many industries in India. Key sectors are embracing analytics to transform their operations. Let’s explore which industries are leading the charge.

Firstly, the IT sector is at the forefront. It has been the largest employer of data science professionals. The IT industry’s appetite for analytics grows with technological advancements.

Finance also plays a pivotal role. Data science helps in fraud detection, risk management, and customer insights. Financial institutions increasingly rely on analytics for strategic decisions.

Healthcare is another vital industry. Data is used to enhance personalised medicine and diagnostics. Health organisations see significant value in data science applications.

E-commerce continues to surge. Online retailers leverage data for better inventory management. Data science helps in understanding customer behaviour and tailoring marketing strategies.

Telecommunications is also embracing analytics. Data helps improve customer service and optimise networks. This sector invests heavily in data-driven solutions.

Industries Leading Data Science Growth:

- Information Technology (IT)

- Finance

- Healthcare

- E-commerce

- Telecommunications

Emerging sectors like agriculture are not far behind. Smart agriculture uses data for crop analysis and resource optimisation. Such innovations create new analytics career paths.

The demand for data science in these industries opens vast opportunities. Professionals can explore roles that impact business outcomes. The need for analytics expertise continues to expand.

The integration of data science in these industries promises sustained growth. Companies across sectors recognise analytics as crucial to success. Careers in data science are not just rising but diversifying rapidly.

Most In-Demand Data Science Skills in India

Data science is a multi-faceted discipline requiring a unique skill set. Specific skills are in high demand across Indian industries. Let’s delve into the essential skills you need.

Machine learning tops the list. Professionals must understand algorithms and model-building. This skill is critical for predictive analytics and automation solutions.

Programming knowledge is crucial. Python is the go-to language for data scientists in India. R is another popular language, favoured for its statistical capabilities.

Statistical analysis is indispensable. Understanding data trends and patterns is vital. It’s the backbone of extracting meaningful insights.

Data visualisation helps communicate findings. Tools like Tableau and Power BI are favourites. These tools make complex data more accessible to decision-makers.

Big data technologies are increasingly relevant. Technologies like Hadoop and Spark are essential for large-scale data processing. Mastering them expands career options.

Key Programming Languages for Data Science:

Soft skills are gaining importance too. Problem-solving abilities and critical thinking are essential. These skills complement technical expertise and drive innovation.

Communication is key. Explaining technical data to non-experts is vital. Clear and effective communication elevates data’s impact on business decisions.

Domain knowledge enhances data science effectiveness. Understanding the industry you work in deepens insights. It’s beneficial to specialise in a specific sector.

Data Visualisation Tools in Demand:

- Tableau

- Power BI

- QlikView

Ethics and data privacy awareness are crucial. Handling data responsibly is non-negotiable. Professionals must adhere to best practices to protect sensitive information.

The demand for these skills will only grow. Data science’s role is expanding across sectors in India. Professionals equipped with the right skills will find numerous opportunities.

Continuous learning remains essential. Technologies evolve rapidly, requiring ongoing education. Keeping skills up-to-date ensures career progression and success.

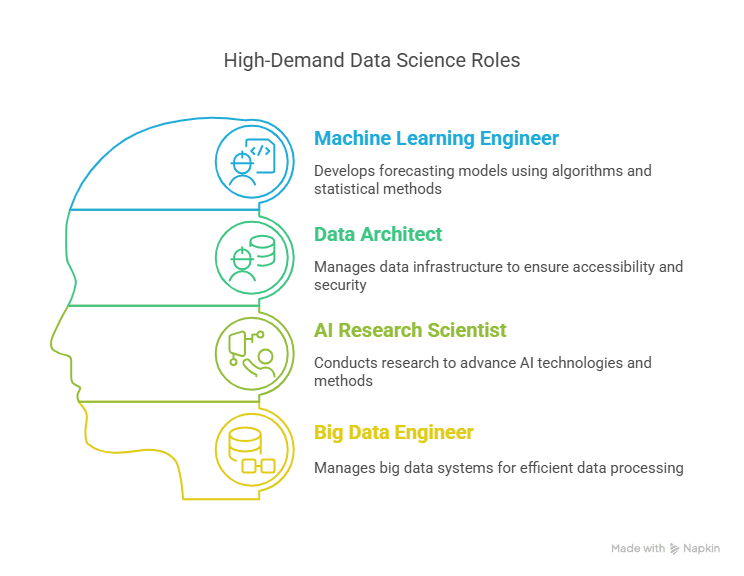

Fastest-Growing Data Science Job Roles

The field of data science is expansive, offering a variety of roles. Each role requires specific skills and expertise. Understanding these roles can guide career choices.

Many job roles are experiencing rapid growth. Companies seek varied specialists to handle different data aspects. Let’s explore the booming job titles in this sector.

Data Scientist

Data scientists are at the forefront of data-driven decision-making. They extract insights from data to guide business strategies. These professionals blend technical and analytical skills.

A data scientist’s role includes cleaning and analysing data. They utilise algorithms to build predictive models. Additionally, they must interpret complex data to provide actionable insights.

Core Responsibilities:

- Data collection and cleaning

- Statistical analysis

- Predictive modeling

Data scientists are expected to communicate findings clearly. Their insights help shape strategic business decisions. This role is often seen as the pinnacle of data science careers.

Data Analyst

Data analysts examine data to identify trends and patterns. They are integral to understanding historical data. Their work supports operational and strategic decisions.

Analysts often use visualisation tools to present data. They translate numbers into stories. This helps stakeholders understand data-driven conclusions.

Core Responsibilities:

- Data examination and interpretation

- Creating visual reports

- Supporting business initiatives

This role requires strong attention to detail. Problem-solving abilities are also crucial. Analysts often collaborate with other departments to optimise processes.

Machine Learning Engineer

Machine learning engineers design and implement intelligent systems. They focus on developing models that enable automation. Their work is foundational in creating AI-driven solutions.

These engineers translate data science prototypes into production-ready models. They require deep knowledge of algorithms. Coding skills, especially in Python, are essential.

Core Responsibilities:

- Model design and testing

- Deploying ML algorithms

- Collaborating with data scientists

The role blends software engineering with data science. It’s ideal for those who enjoy creating intelligent applications. Machine learning is vital in driving innovative technology.

Data Engineer

Data engineers manage and streamline data storage systems. They build frameworks for data generation and use. Their role ensures that data is accessible for analytical processes.

Engineers often work with big data technologies. They create systems that process large data sets efficiently. This ensures seamless data flow across the organisation.

Core Responsibilities:

- Building data pipelines

- Data storage solutions

- Streamlining data systems

This role is suited for tech-savvy professionals. Data engineers ensure that data systems are robust. Their work is crucial for any data-intensive project.

Business Intelligence Analyst

Business intelligence analysts focus on using data for business insights. They develop dashboards and reports. These tools assist in making informed business decisions.

Analysts integrate data from various sources. They leverage it to enhance business strategy and performance. Visualisation tools are frequently used in this role.

Core Responsibilities:

- Developing business reports

- Data integration and analysis

- Guiding business strategy

This role combines business acumen with technical skills. BI analysts help organisations gain a competitive edge. They ensure data-driven decision-making processes are in place.

Statistician

Statisticians use data to solve real-world problems. They apply mathematical theories to analyse and interpret data. Their expertise lies in data collection and statistical analysis.

Statisticians model data to uncover patterns or trends. They work across industries like finance, healthcare, and government. Their analysis supports policy making and business planning.

Core Responsibilities:

- Data collection and analysis

- Applying statistical methods

- Reporting research findings

This role is highly valued for its mathematical rigour. Statisticians contribute to the foundation of data science. Their work ensures the accuracy and reliability of data-driven insights.

Data Science Career Pathways: From Entry-Level to Leadership

Embarking on a data science journey involves understanding various career paths. Each path offers unique opportunities and challenges. Entry-level roles often serve as stepping stones.

Beginner roles, like junior data analyst or BI intern, are ideal starting points. They provide exposure to basic tools and methodologies. These positions help build foundational skills.

Typical Entry-Level Roles:

- Junior Data Analyst

- BI Intern

- Data Assistant

As professionals gain experience, mid-level roles present themselves. Roles such as data scientist or machine learning engineer are common next steps. They offer more responsibilities and complex projects.

Mid-level professionals often tackle larger datasets. They also lead small teams or projects. This progression broadens their scope of influence within the organisation.

Common Mid-Level Roles:

- Data Scientist

- Machine Learning Engineer

- Data Engineer

In addition to technical skills, leadership roles require strategic insight. Senior positions, like data science manager, focus on project and team oversight. They need strong communication skills.

Leaders shape the department’s vision and strategic direction. They drive innovation while ensuring alignment with organisational goals. Leadership roles are pivotal in decision-making processes.

Progressing in a data science career often involves continuous learning. New technologies and trends emerge rapidly. Staying updated ensures career longevity and relevance.

Networking and community involvement are crucial, too. Sharing knowledge and experiences fosters growth. Attending seminars and conferences can open up new opportunities.

Aspiring leaders should also focus on developing soft skills. Skills like empathy and conflict resolution become essential. Such traits enhance team dynamics and project outcomes.

Data Science Salaries in India: What to Expect

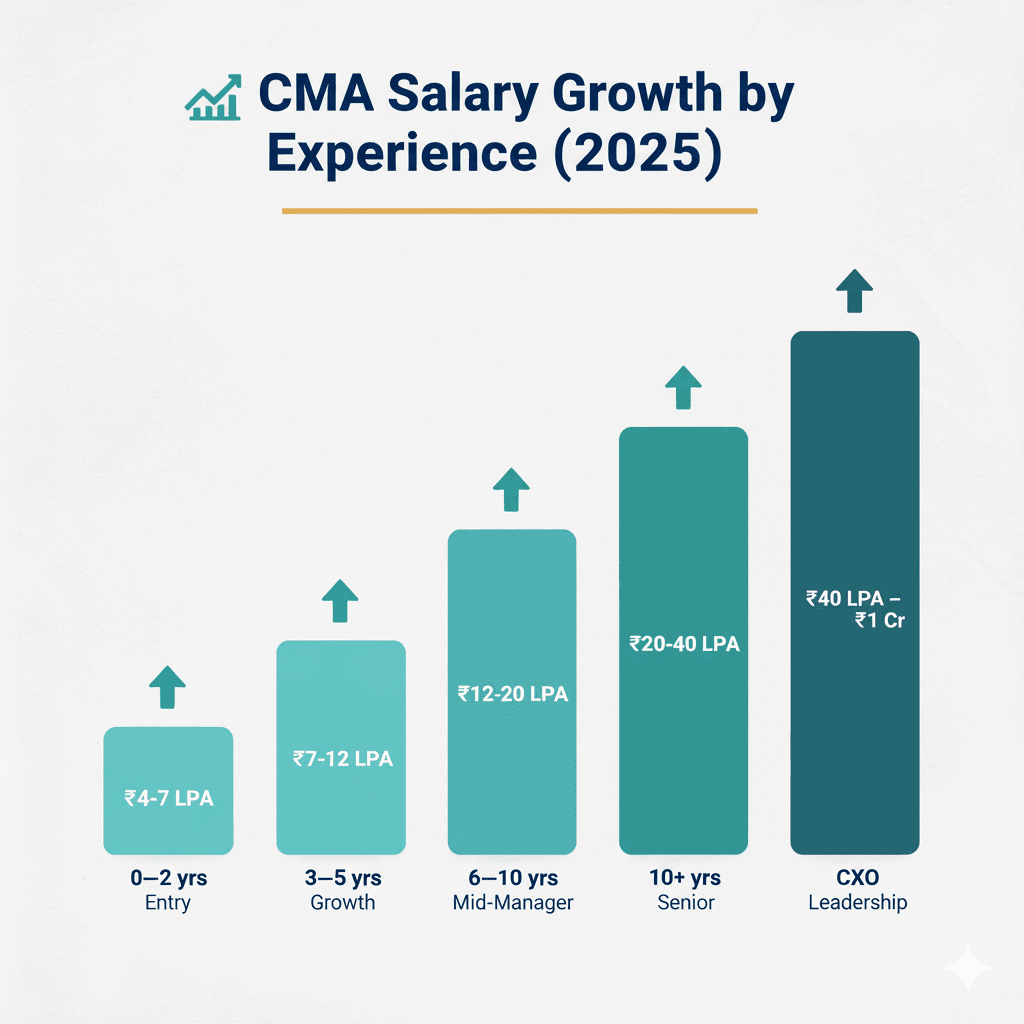

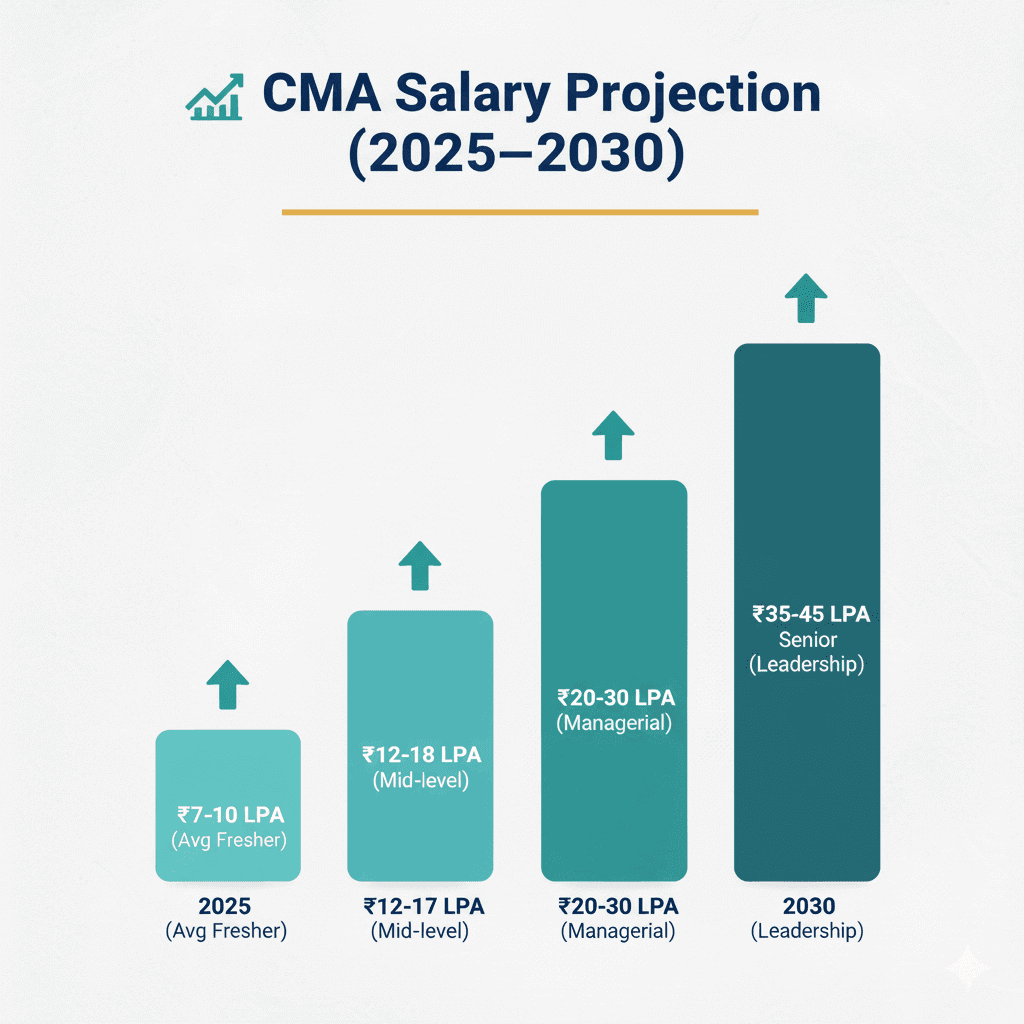

Data science offers lucrative salary packages. This is especially true in India, where demand continues to rise. Salaries vary widely based on several factors.

Location significantly influences earnings. Cities like Bangalore and Hyderabad offer competitive salaries. These regions host many tech hubs and startups.

Industry type also impacts salary levels. Data scientists in finance or IT often earn more. Emerging sectors are also promising in terms of pay.

Experience is a crucial determinant. Entry-level roles start with modest salaries. However, rapid growth is common as skills and experience increase.

Educational background plays a role, too. Graduates from top institutes often command higher salaries. Specialised certifications can also enhance earning potential.

Key Salary Influencers:

- Location

- Industry

- Experience

- Education

In addition to technical skills, soft skills can boost earnings. Effective communication and problem-solving can lead to managerial roles. Such positions usually come with salary increments.

The gender gap in salary is narrowing as well. More women are entering and excelling in data science. This is fostering a more inclusive and competitive environment.

For a holistic understanding, potential candidates are encouraged to research. Checking industry reports and salary surveys can provide insights. Staying informed helps in negotiating better compensation packages.

Overall, data science careers in India promise financial rewards. The field is burgeoning, with scope for personal and professional growth. With the right skills, salary expectations can align with career aspirations.

How to Start a Career in Data Science: Education, Courses, and Certifications

Launching a career in data science begins with a strong educational foundation. While many pursue degrees in computer science, statistics, or mathematics, focused industry-aligned programs like the Postgraduate Program in Data Science and Analytics by Imarticus Learning offer a more practical and direct path to employment.

You don’t need a conventional degree to succeed—what matters is acquiring the right skills. Imarticus’ program is designed to provide targeted, hands-on training across the whole data science lifecycle, from foundational tools like Python and SQL to advanced modules in AI, ML, and Deep Learning.

Imarticus makes high-quality data science education accessible through live online classes, expert faculty, and project-based learning. The program also offers unmatched career support, including 10 guaranteed interviews, resume workshops, and mock interviews—ensuring you’re job-ready from day one.

Why Choose Imarticus?

-

Learn from industry experts through live sessions

-

Work on 25+ real-world projects and case studies

-

Gain hands-on experience with 10+ industry-relevant tools

-

Get 100% Job Assurance with dedicated placement support

-

No coding background needed—perfect for freshers and career switchers

Certifications from Imarticus not only validate your skills but are highly recognised by top employers. Backed by industry leaders like IBM, our course enhances your profile and boosts your credibility in the job market.

By aligning learning with real business needs and offering expert mentorship and networking opportunities, Imarticus helps you build a strong foundation in data science and confidently step into a future-proof career.

Building a Competitive Edge: Internships, Projects, and Networking

Building a strong foundation in data science requires more than just theoretical knowledge. Internships are a great way to gain practical experience. They provide exposure to real-world data problems and industry practices.

Participating in live projects can significantly enhance your skills. Projects allow you to apply what you’ve learned in the classroom. They also give you a tangible body of work to showcase.

Networking is vital for career growth in data science. Connecting with professionals can open up new opportunities. It also helps in staying updated with industry trends and insights.

Engaging in professional communities can be highly beneficial. Data science meetups and conferences are excellent venues for networking. They offer a chance to meet like-minded individuals and experts.

Joining online forums can also expand your professional circle. Platforms such as LinkedIn and Kaggle host active data science communities. These platforms are valuable for learning and professional growth.

Key Strategies for Building a Competitive Edge:

- Secure internships for practical experience

- Engage in live data projects

- Network through meetups and online communities

Collaboration in data science circles can lead to exciting projects. Group engagements often result in innovative solutions. Collaboration also hones teamwork skills, which are vital in many data roles.

By focusing on internships, projects, and networking, aspiring data scientists can significantly boost their career prospects. These elements help build a robust professional profile, making candidates more attractive to potential employers in India’s competitive data science job market.

The Role of Soft Skills and Business Acumen in Data Science

Technical prowess is crucial in data science, but it’s not the only factor. Soft skills like communication play a pivotal role. Effective data communication can translate complex findings into actionable insights.

Critical thinking and problem-solving abilities also shine. These skills help data scientists tackle unexpected challenges. They enable professionals to devise innovative solutions swiftly.

Understanding business acumen is equally essential. Data scientists often work to align their analyses with business goals. This requires knowing not just the data, but how to apply it to real-world scenarios.

Business acumen encompasses market awareness and strategic thinking. Data scientists use these skills to predict industry trends. They provide forecasts that guide company decisions.

Collaboration is a key attribute in team settings. Working with diverse teams requires interpersonal skills. This fosters a productive and inclusive work environment.

Essential Soft Skills for Data Scientists:

- Communication and storytelling

- Critical thinking and problem-solving

- Collaborative teamwork

Strong soft skills complement technical expertise. They enable data scientists to contribute effectively to an organisation’s strategic objectives. This holistic approach is vital for success in data science roles.

To conclude, while technical skills are foundational, the integration of soft skills and business understanding elevates a data scientist’s impact. These competencies ensure that data insights align with and drive business success.

Data Science in India’s Startup and Tech Ecosystem

India’s startup scene is a vibrant landscape, teeming with innovation. Data science plays a central role in this environment, driving many startups towards success. These companies leverage data to refine their products and services.

Startups in sectors like fintech, e-commerce, and healthcare are leading the charge. Data science helps them analyse consumer trends and make data-driven decisions. This analysis is critical for staying competitive and appealing to investors.

The tech ecosystem in India is supportive of data science growth. It provides a fertile ground for data-driven startups. Incubators and accelerators often focus on these companies, offering resources and mentorship.

Moreover, tech giants and unicorns in India frequently invest in data science. These investments drive advancements and create job opportunities. Consequently, data science has become essential in the tech ecosystem.

Key Factors Fueling Data Science in Startups:

- Access to vast amounts of data

- Innovation-driven industry culture

- Supportive government and institutional policies

Data science also fosters scalability in startups. Predictive analytics, for example, allows for better resource allocation. This results in efficient scaling without unnecessary overheads.

Overall, data science is not just a tool but a catalyst. It transforms how startups operate, contributing significantly to India’s tech ecosystem. As more startups embrace this trend, the ecosystem continues to thrive and evolve.

The Future of Data Science in India: Trends and Opportunities

The future of data science in India holds immense promise. As technology advances, so do the avenues for data science careers. Many industries are beginning to harness their potential, resulting in a growing demand for skilled professionals.

Emerging technologies like artificial intelligence (AI) and machine learning are at the forefront. They are revolutionising traditional practices and opening new possibilities. These advancements make data science an integral part of modern solutions.

Upcoming Trends in Data Science:

- Integration of AI with data analytics

- Surge in autonomous systems and IoT (Internet of Things)

- Rise in demand for real-time data processing

Opportunities in data science are expanding beyond tech hubs. Smaller cities are seeing increased investments, widening the scope for career growth. This decentralisation allows more professionals to contribute regardless of their location.

The education sector is adapting too. More universities now offer specialised data science programs. Online platforms are also providing flexible learning opportunities. This accessibility enhances the skill set of professionals.

Opportunities in Data Science to Explore:

- Personalised education and training programs

- Startup innovations in digital health and smart city projects

- Development of data-driven public policy solutions

Collaboration between government bodies and tech firms is also strengthening. Initiatives are being launched to encourage research and innovation. These efforts are paving the way for a robust data science ecosystem.

Overall, data science is set to drive India’s technological growth. The opportunities are vast and varied, with trends indicating sustained growth. This makes it an exciting time to be part of India’s data science journey.

Challenges and Solutions: Navigating a Data Science Career in India

Embarking on a data science career in India comes with its own set of challenges. Identifying and overcoming these can lead to a successful and fulfilling career.

One major challenge is the rapid evolution of technology. Keeping up with new tools and methods can be overwhelming. Regular learning and staying updated are a must.

Competitions are increasing as more professionals enter the field. This surge requires individuals to continuously hone their skills and stand out. Building a unique portfolio helps demonstrate expertise and creativity.

Common Challenges in Data Science Careers:

- Keeping pace with technological advancements

- High competition in job markets

- Bridging the gap between theoretical knowledge and practical application

Practical experience is often a barrier for newcomers. Gaining hands-on experience through internships and projects bridges this gap. It improves understanding and adds value to resumes.

Networking is crucial for career advancement. Engaging with professional groups and attending industry events can open doors. These connections often lead to job opportunities and mentorship.

Lastly, finding a balance between technical skills and business insights is key. Companies seek individuals who can translate data into actionable strategies. Developing this combination will enhance job prospects and career growth.

Women in Data Science: Bridging the Gender Gap

Women are increasingly making their mark in data science in India. This shift is crucial for fostering diversity and innovation.

Historically, the tech industry has been male-dominated. This trend is changing as more women pursue careers in data science. Initiatives and programs aim to support and mentor women in this field.

Organisations are recognising the value of diverse teams. They are actively hiring and promoting female data scientists. Encouraging women in the workplace enhances creativity and problem-solving.

Ways to Support Women in Data Science:

- Mentorship programs for women professionals

- Networking groups and forums for sharing experiences

- Scholarships and grants for women in data science education

Many companies now offer scholarships and training specifically for women. These opportunities encourage female participation and growth. They also help break down barriers to entry.

Efforts to bridge the gender gap are gaining momentum. As more women succeed in data science, they pave the way for future generations. This progress is vital for creating a balanced and inclusive industry.

Data Science for Social Impact: Healthcare, Environment, and Beyond

Data science is transforming how we address social issues. Its applications are vast, spanning healthcare, the environment, and more.

In healthcare, data science aids in diagnosis and treatment. Personalised medicine and efficient health management rely on analytics. Data-driven insights improve patient outcomes and resource use.

Environmental challenges also benefit from data science. It helps monitor climate change and optimise resource use. Efficient data analysis supports conservation efforts and environmental policy-making.

Key Areas of Social Impact:

- Enhancing healthcare and patient care

- Addressing environmental concerns and sustainability

- Advancing education and personalised learning

Beyond healthcare and the environment, data science influences education. Customised learning experiences and improved educational outcomes can be achieved. Data science makes education more adaptive and personalised.

In summary, data science is a powerful tool for social change. Tackling issues in healthcare, the environment, and education enhances quality of life. Its role in these areas will continue to grow and evolve.

Frequently Asked Questions About Data Science Careers in India

Many aspiring data scientists have questions. We address some of the most common queries below.

What qualifications do I need?

A strong foundation in mathematics and computer science is essential. Many start with a degree in these fields.

How important are technical skills?

Technical skills, like programming in Python or R, are crucial. They form the backbone of data science work.

What about soft skills?

Soft skills, such as communication and teamwork, are vital. They complement technical skills and enhance effectiveness.

Is there a demand for data scientists in India?

Yes, the demand is significant. Industries across India are increasingly investing in data-driven decision-making.

Commonly Asked Questions:

- What educational background is preferred?

- Are online courses beneficial?

- How do I gain practical experience?

- What industries are hiring data scientists?

- How can I advance in this field?

Understanding these questions can shape career pathways. They provide clarity and direction for those entering this field.

Conclusion: Your Roadmap to a Successful Data Science Career in India

Embarking on a data science career in India offers exciting prospects. With the right skills and strategic planning, the opportunities are vast. This journey requires dedication, continuous learning, and adaptability to ever-evolving technologies.

Building a robust foundation in both technical and soft skills is essential. Start by mastering In-Demand Data science skills, including machine learning and data visualisation. Combine this with practical experience gained through internships and projects.

Networking with industry professionals can open new doors. Join professional communities and attend seminars to stay updated and connected. These connections can provide valuable insights and potentially lead to career opportunities.

In conclusion, a future in data science in India is bright. By equipping yourself with the necessary skills and knowledge, you can navigate this field successfully and contribute significantly to various industries.