When you spend enough time around banks, fintechs, or trading floors, you realise something quickly. In finance, risk isn’t a footnote or an afterthought. It’s the main plot. For professionals, this is both a challenge and an opening.

If you can measure, explain, and act on risk, you’re not just another analyst; you’re the person boards and regulators want at the table. This is precisely where the FRM certification makes a difference.

It provides finance professionals with the knowledge, credibility, and confidence to move past implementation and toward leadership.

If you’ve ever wondered to yourself, What is FRM? What does an FRM do? Is FRM worth it in India? This guide lays out what FRM means today. The eligibility requirements, the testing format, the skills you’ll need, and the paths it can unlock in India and across the world. You’ll also see how FRM compares to other finance designations or credentials, what salary bands are realistic, and how to prepare for the exam without burning out.

Did you know over 90,000 FRMs work in more than 190 countries, with employers like JP Morgan, Deloitte, and BlackRock?

What is FRM Certification? Why Does It Matter?

The Financial Risk Manager (FRM) designation is a premier certification granted by the Global Association of Risk Professionals (GARP). It certifies your capability to identify, assess, and respond to risk in a complex financial environment.

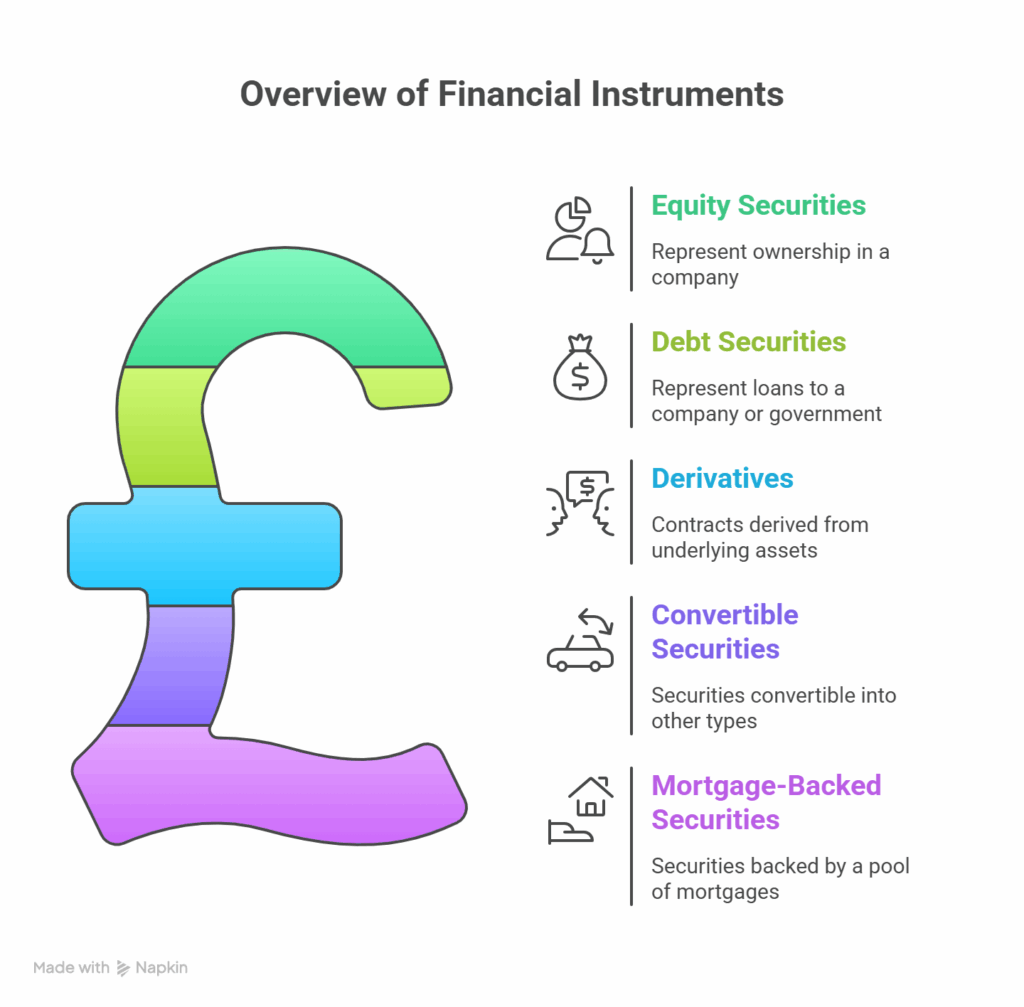

Unlike a number of other finance certifications, FRM focuses solely on risk across the full spectrum from market, credit, operational, to emerging areas such as climate and fintech risk. Today’s volatile business environment has made FRM-certified professionals indispensable.

“Modern finance is defined by new kinds of risks. FRM is the toolkit to deal with them.”

FRM is recognised worldwide as the benchmark for risk expertise. At its core, the FRM is about proving you can think like a risk professional when the stakes are highest. In practice, being FRM-certified means you’re trained to see the unseen.

Think about when you carry an umbrella in the morning, even if the skies look clear, just in case it rains! You’re judging a small risk (rain) and preparing for it. FRMs do something similar, but at a much bigger scale. For example, while headlines track the stock falls, an FRM studies the chain reaction, from loan portfolios to cash flows, and the possibility of missed payments.

🔍 What FRMs Do Differently

Trace risk ripple effects beyond immediate headlines

⬇

Build and run stress tests that guide strategy.

⬇

Anticipate multi-sector impacts (e.g., oil price → loan defaults)

The certification arms you with the tools to make these calls. You learn to measure risks, design stress tests, and frame “what if” scenarios that test the resilience of portfolios and institutions. One of the daily tasks as a risk analyst involves stress-testing loan books, running models that ask, What happens if interest rates rise by 200 basis points overnight? The answers aren’t academic; they feed directly into boardroom decisions about capital buffers, hedging strategies, and client contracts.

What makes FRM matter today is the way risks themselves have evolved. It’s no longer just about market or credit losses; you’d need to evaluate exposures in areas like cybersecurity breaches, fintech disruptions, and even climate-related events. An FRM professional is expected to not only quantify these risks but also present them in a way that decision-makers can act upon quickly and confidently.

In my career, I’ve seen how organisations lean on FRM-certified professionals during turbulence. When a regulatory stress test flags potential vulnerabilities in the liquidity profile, an FRM’s analysis and recommendations directly shape the mitigation plans.

That’s why FRM has the reputation to its name: it signals that you can operate in this environment of constant uncertainty with clarity, discipline, and foresight. For a finance professional, it’s the step from being a participant in the system to being a guardian of its stability.

✨ In Simple Terms:

FRM = Ability to anticipate risks + skills to act decisively + credibility that leadership trusts.

What makes the FRM certification matter is its focus on preparing professionals for this constant cycle of risk identification and response. Beyond traditional market and credit risk, it brings attention to evolving areas such as climate-related financial exposure, fintech disruptions, and regulatory compliance pressures.

Learn more about how you can get an FRM Certification with this PDF from Imarticus Learning, an official GARP-approved FRM Exam Prep Provider.

FRM Eligibility in 2025: Who Can Take the Exam?

The FRM course is appealing to such a wide swath of candidates because it does not confine you to rigid eligibility requirements. An MBA generally requires work experience before choosing it, and the CFA expects finance candidates. The FRM is appropriate for everyone willing to pursue a career in risk management. Having said that, it is important for every candidate to know some practical considerations before registering.

Why This Matters

FRM’s eligibility framework makes it inclusive yet rigorous. You don’t need to prove you belong to finance before entering—but you’ll certainly be tested on whether you can keep up with its demands. For Indian candidates, this openness is particularly valuable: even engineering graduates, chartered accountants, or MBA students can pivot towards risk management by taking the exam.

Educational Requirements

There are no mandatory education profiles and qualifications to register for the FRM Part I exam. GARP does not require you to have a certain degree to register. You could be a student in undergrad, a recent graduate, or a working professional.

However, here’s the catch:

- Candidates who successfully hold a bachelor’s degree usually with a background in either finance, economics, mathematics, statistics, engineering, or business management.

- The exam is very quantitative. If your background has not given you a solid groundwork in mathematics, probability, or a little statistics, you will likely need to dedicate extra time to solidify your preparation.

So while GARP doesn’t mandate a degree, the implicit requirement is comfort with numbers, models, and analytical reasoning.

Work Experience Requirement

To earn the official FRM designation, passing the exams alone isn’t enough. You also need to demonstrate a minimum of two years of relevant work experience in risk, finance, trading, portfolio management, auditing, consulting, or analytics.

Key points about the work experience criteria:

- The experience can be completed before, during, or after you clear the exam.

- It doesn’t have to be in a traditional bank. Roles in fintech, insurance, credit rating, corporate finance, or regulatory organisations also count.

- Internships and part-time jobs typically do not qualify. GARP expects full-time, professional exposure.

What this means is you could sit for both Part I and Part II as a university student, but your “FRM Certified” badge will only be awarded once you complete the two-year work requirement and submit the verification.

Age and Location Flexibility

There is no age limit to take the FRM.

- Many candidates appear for the exam while still in their early twenties, but it’s not uncommon to see mid-career professionals—say, a 35-year-old credit analyst—taking it to pivot into senior risk management roles.

- Notably, the FRM is genuinely global. In 2024, exams were offered in 90+ exam centres globally — in India, in Mumbai, Delhi, Bengaluru, Hyderabad, and Chennai (which are all major cities in India), to name a few.

- In 2025, GARP continued this global reach, making it accessible, no matter where you may be located.

Registration & Enrollment Prerequisites

Before appearing, candidates must:

- Register with GARP (one-time enrollment fee of $400).

- Pay the exam fee ($600–$1,000, depending on early vs late registration).

- Have a valid passport or government-issued ID (mandatory for exam day).

No recommendation letters, GMAT scores, or prior certifications are needed. The simplicity of enrollment is a big part of FRM’s appeal.

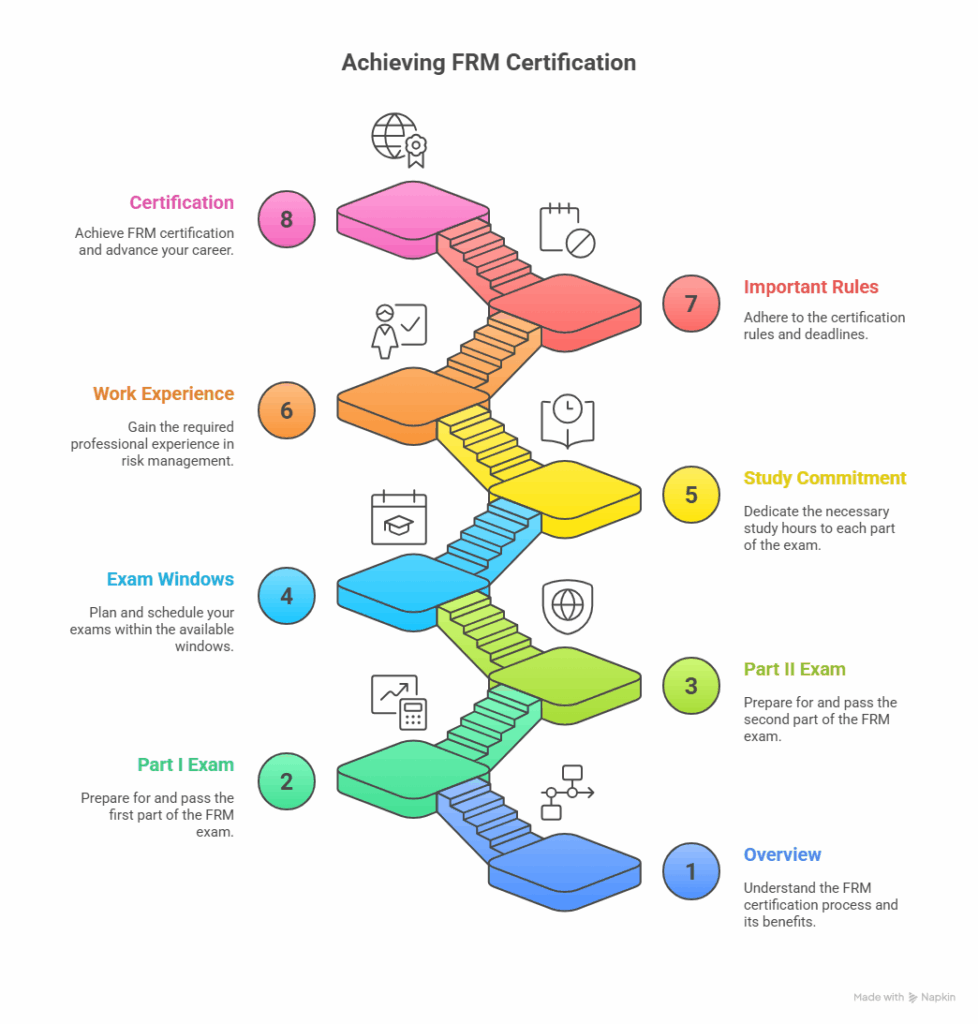

How Do You Get FRM Certification?

Becoming an FRM is a journey with defined checkpoints — enrolling with GARP, passing both exam parts, and proving two years of risk-related experience. Each step builds credibility and brings you closer to a globally recognised badge of expertise.

A simple step-by-step journey that shows you exactly how to go from registering for the exam to earning the FRM credential. Follow these milestones to stay on track and achieve your certification with confidence.

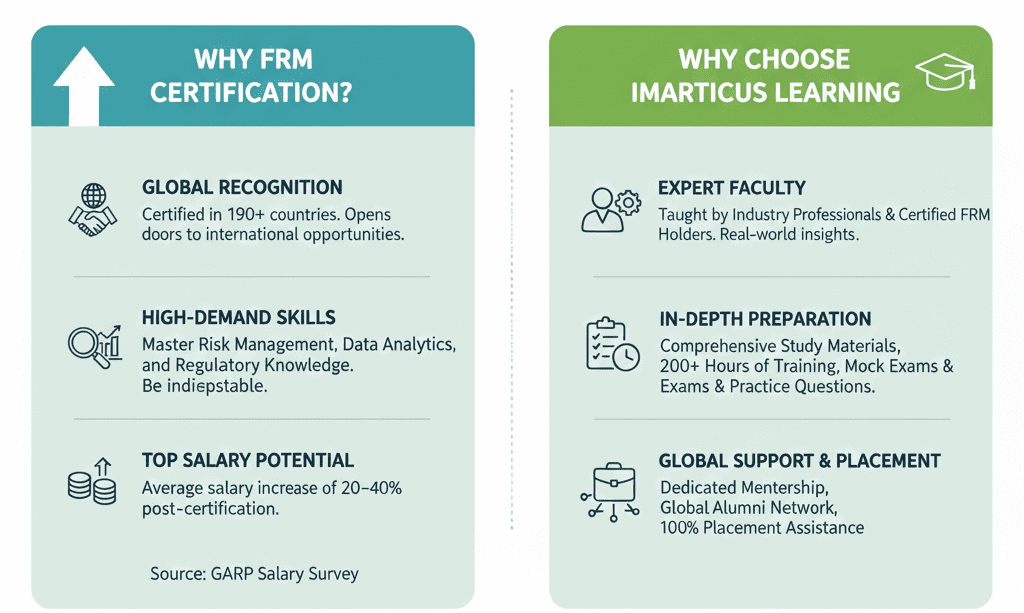

Why FRM Certification Accelerates Finance Career Growth

Unlike generic finance programs, FRM adds both depth and breadth to your professional profile. It brings:

- Credibility with Employers: Hiring managers instantly recognise FRM as proof of advanced risk skills.

- Versatility in Roles: You can work in banking, insurance, consulting, or even tech companies, managing risk.

- Future-Proofing: As regulations tighten, FRM-certified professionals will be in even higher demand.

- Global Reach: It’s recognised in every major financial hub—London, New York, Singapore, and Mumbai.

FRM Exam Structure

Before diving into the details, it’s important to understand how the FRM exam is organised. The structure sets the pace for your preparation and gives you a clear view of what lies ahead.

The Journey in Short

- Two computer-based exams (MCQ): Part I (100 questions), Part II (80 questions); 4 hours each.

- Windows now run in May, August, and November (good flexibility if work gets in the way).

- Average reported study time: ~240 hours per part (ranges widely by background).

FRM Topics and weightage (what you’re actually tested on)

| Domain | Part I | Part II |

| Foundations of Risk Management | 20% | – |

| Quantitative Analysis | 20% | – |

| Financial Markets & Products | 30% | – |

| Valuation & Risk Models | 30% | – |

| Market Risk Measurement & Management | – | 20% |

| Credit Risk Measurement & Management | – | 20% |

| Operational Risk & Resilience | – | 20% |

| Liquidity & Treasury Risk | – | 15% |

| Risk Management & Investment Management | – | 15% |

| Current Issues in Financial Markets | – | 10% |

See GARP’s 2025 Candidate Guide and Learning Objectives for the canonical list and readings.

A few things to keep in mind:

- Pass Part II within 4 years of passing Part I.

- Submit experience within 10 years of sitting Part II.

- Study materials: official 2025 books (Part I/II), Learning Objectives, practice exams via the GARP portal.

⏱️ Time cost: plan 200–300 hours per part, depending on your base. GARP’s survey median is near ~240 hours.

Who Should Pursue FRM?

FRM attracts a certain kind of professional: the ones who don’t shy away when models fail, markets shake, or regulators raise the bar. They want to learn the mechanics of risk and apply them where it matters.

Backgrounds for FRM that align well

- Engineering/Math/Statistics folks moving into quant risk, model validation, or analytics.

- Finance/Economics/Accounting grads aiming for credit, market, or treasury risk.

- Data/ML professionals in fintech/banks who need risk grounding for model risk governance.

You don’t need a finance degree; you do need comfort with numbers and the patience to read technical material. GARP doesn’t impose a degree prerequisite; your relevance is proven by passing the exams and your subsequent work. (GARP)

Who benefits the most

- FRM Course benefits people already in: credit underwriting, ALM/treasury, trading risk, stress testing, ERM, operational resilience, or model risk who want structure, credibility, and mobility.

- Consultants servicing banks/fintechs on Basel IV, IRRBB, climate, operational resilience, or capital planning.

Who may not need it

- If your ambition lies in equity research, investment banking deal teams, or corporate FP&A, the CFA or a focused MBA may serve you better.

- The FRM certification is the specialist route for those aiming to build careers in the risk backbone of financial institutions.

FRM Salary in India

The FRM Course equips you to master global finance challenges. FRM salary depends on city, employer type, and how quantitative the role is. Publicly shared data points (self-reported) give a sensible range, as follows.

How do FRM Salaries look globally

Global roles are accessible to FRMs as companies worldwide hire them to play pivotal roles in risk management across various domains.

- US Risk Analyst total pay is around $99K median (wide dispersion by bank and city).

Indicative total pay (India)

- Risk/Market Risk Analyst – India: median around ₹8–17 LPA, interquartile roughly ₹8.6L–₹18.9L, with 90th percentiles approaching ₹29L.

- Market Risk Analyst – Mumbai: averages reported around ₹14.3 LPA, with a band near ₹10L–₹18L and higher outliers.

- Risk Analyst – Mumbai (for broader risk titles): median near ₹9 LPA, band ₹5.5L–₹17L.

- Risk Analyst – Bengaluru: several submissions cluster ₹8–20.5 LPA median.

Misconceptions About FRM

For all its credibility, the FRM certification is often surrounded by misconceptions that confuse professionals considering the path. Having mentored students for FRM, I’ve heard these myths repeated more times than I can count — in interviews, from colleagues, and even in online forums. Let’s clear them up.

FRM is only for quants.

It’s true that the exam leans heavily on quantitative concepts like value at risk, probability distributions, regression analysis, etc. But in practice, FRM roles are not about sitting in a corner building equations all day.

A risk manager has to bridge models with real-world decision-making. For instance, when a trading desk’s model flags a sudden liquidity squeeze, the FRM is the one who explains what that means for the bank’s funding costs and what the board should do about it.

FRM is Harder than CFA.

This one is a favourite debate on forums. The truth is, comparing FRM and CFA is like comparing an apple to an orange. CFA tests breadth across investments, portfolio management, and ethics.

FRM tests depth in risk. Candidates who enjoy applied problem-solving often find FRM more intuitive.

For example, a CFA question may ask you to value a bond. While an FRM question may push you to test what happens to that bond if rates jump 200 basis points overnight. The level of difficulty isn’t higher or lower; it’s targeted to a different skill set.

You Need Prior Banking Experience for FRM.

Another myth I hear often. Many successful FRM candidates come from consulting, IT, statistics, or even engineering backgrounds. In fact, the growing importance of fintech and data-driven risk functions has opened doors for professionals who never sat in a bank before. What matters is how you can apply the FRM toolkit.

I recall mentoring an engineer who had zero exposure to financial products. Within three years of earning FRM, he was leading a model risk validation team at a global bank because he could combine technical skills with risk frameworks.

FRM Guarantees a CRO Role.

The FRM is a passport, not a destination. It signals credibility, but climbing to the top to Chief Risk Officer, Partner, or equivalent, also requires leadership, governance, and business judgment.

Think of it this way: the FRM puts you in the room when critical conversations happen, but how far you go in that room depends on your ability to influence and lead. I’ve seen FRMs rise quickly when they paired the certification with real-world exposure.

👉 By separating fact from fiction, you start to see FRM for what it really is: a rigorous, respected certification that prepares you for a specialised role in finance — but one that still requires you to build complementary skills and experiences along the way.

An Overview of FRM, CFA, and PRM

If you see your career through a risk lens, the FRM makes sense in a way no other certification does.

While the CFA frames you as an investment strategist and the CPA as a numbers authority, the FRM defines you as the person who anticipates shocks, models uncertainty, and steadies the ship when markets wobble. That’s a different kind of credibility.

| Dimension | FRM | CFA | PRM |

| Name | Financial Risk Manager | Chartered Financial Analyst | Professional Risk Manager |

| Focus | Risk management (credit, market, liquidity, op-risk, resilience, AI/ESG risk under “current issues”) | Broad finance: equity, fixed income, corporate finance, portfolio mgmt. | Risk management, modular approach (credit, market, operational). |

| Admin Body | GARP (Global Association of Risk Professionals) | CFA Institute | PRMIA (Professional Risk Managers’ International Association) |

| Duration | 2 parts; many complete in 18–24 months | 3 levels; usually 2.5–4 years | 4 exams; modular, can be quicker |

| Exam Windows | May, Aug, Nov (CBT worldwide) | Feb, May, Aug, Nov (staggered by level) | Flexible scheduling |

| Work Experience Requirement | 2 years (risk-related) | 4 years (any investment/finance-related) | 2 years (risk/finance-related) |

| Cost (excluding materials) | $400 enrolment + $600–$1,000 per part | $940 enrolment + $1,250 per level (approx. total $3,000–4,000) | $400 enrolment + $1,500–2,000 total |

| Recognition | Strong in banks, consulting, regulators, fintechs (risk-centric roles) | Strongest overall brand in global finance | Recognised, but smaller footprint |

| Best Fit | Risk managers, quants, treasury/ALM, resilience experts | Portfolio managers, investment analysts, and corporate finance | Risk specialists are looking for an alternative pathway |

Numbers reflect GARP’s current fee schedule and structure; CFA/PRM details vary by window and provider.

Practical rule: If you want to be the person running risk (limits, stress, capital/liquidity, model governance), FRM fits. If you want to pick securities or work in client-facing investments, CFA fits. If you’re pure quant/dev, consider an FRM + targeted quant course stack.

Where Roles are Clustering

- Mumbai: market/treasury risk, liquidity, large-bank credit portfolios.

- Bengaluru: analytics/model risk for banks, global capability centres, payment/fintech risk.

- Gurgaon/Hyderabad/Pune: consulting delivery hubs, wholesale credit analytics, stress testing.

What Employers Now ask for (Beyond FRM)

- Ability to translate risk metrics into decisions (e.g., “what do we change Monday morning?”).

- Comfort with data tooling (SQL + Python/R) for validation and challenger models.

- Awareness of resilience regulation and third-party risk expectations.

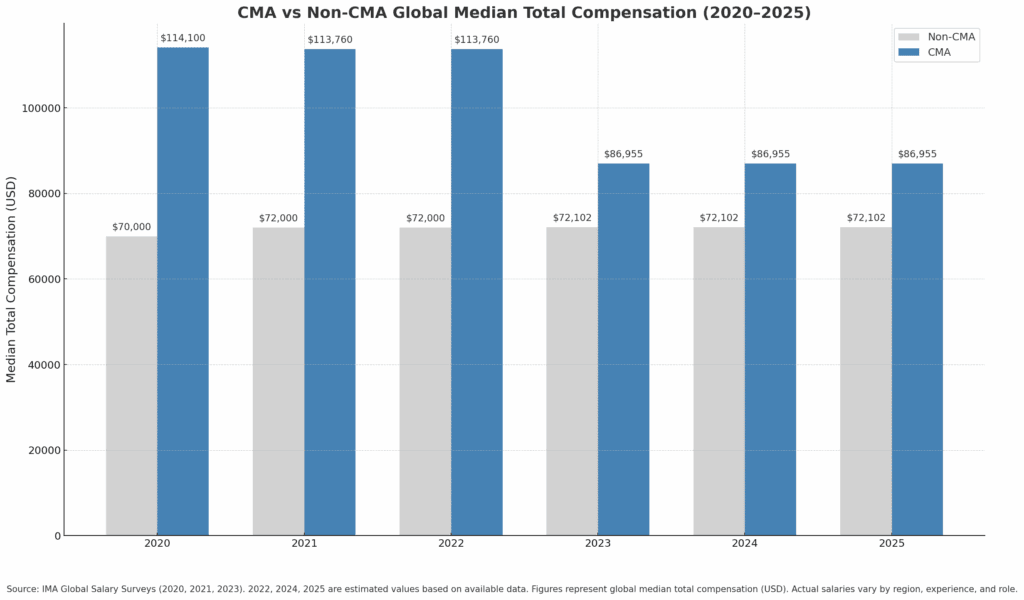

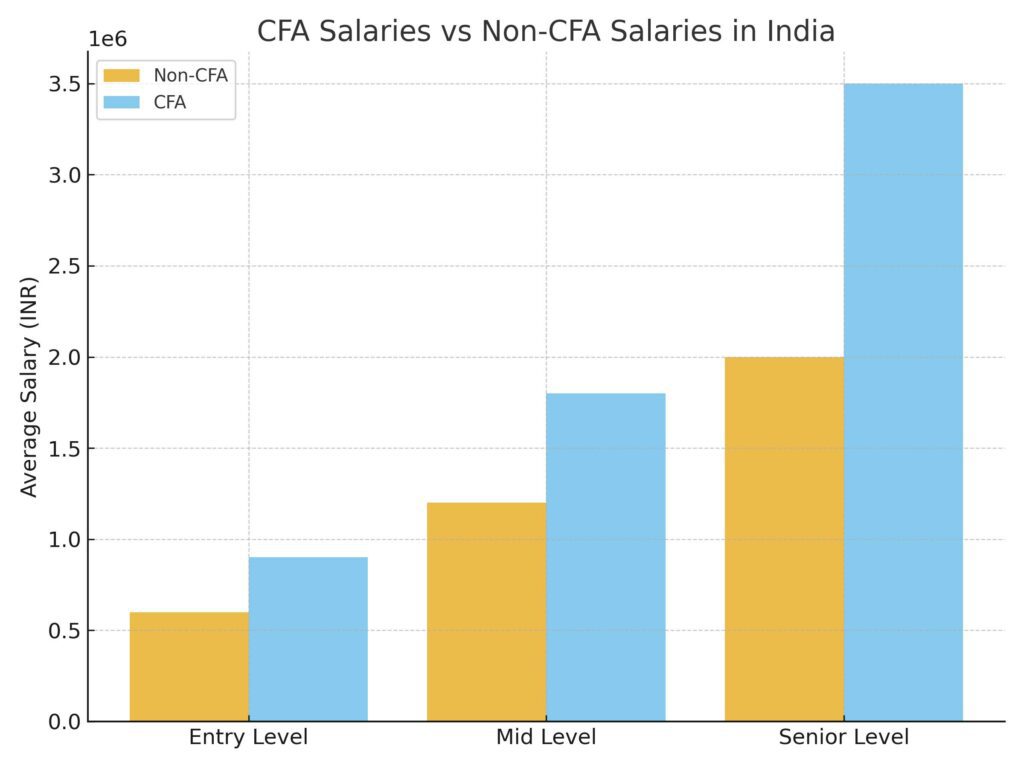

👉 Takeaway: While salaries vary by industry and geography, FRM-certified professionals consistently earn 30–40% higher packages compared to their non-certified peers.

FRM vs CFA vs PRM

When finance professionals look at advancing their careers, three credentials often dominate the conversation: FRM, CFA, and PRM. Each opens doors, but in very different directions. The real question is not deciding which is “better,” but what aligns with the role you see yourself in five years from now. Be it steering risk frameworks, managing investments, or specialising in niche risk domains.

| Differentiator | FRM | CFA | PRM |

| Primary Focus on Risk Management | ✅ | ❌ | ✅ |

| Global Recognition in Banking & Regulators | ✅ | ✅ | ✅ |

| Popularity in India & Asia | ✅ | ✅ | ❌ |

| Depth in Credit, Market & Operational Risk | ✅ | ❌ | ✅ |

| Coverage of Investment & Portfolio Management | ❌ | ✅ | ❌ |

| Quantitative & Statistical Emphasis | ✅ | ❌ | ✅ |

| Suitability for Risk Modelling & Analytics | ✅ | ❌ | ✅ |

| Exam Flexibility & Windows | ✅ | ❌ | ✅ |

| Average Completion Time (<2.5 Years) | ✅ | ❌ | ✅ |

| Work Experience Requirement (2–4 Years) | ✅ | ✅ | ✅ |

| Cost Effectiveness (Exam + Enrolment) | ✅ | ❌ | ✅ |

| Industry Acceptance Among Regulators (RBI, BIS, SEC) | ✅ | ✅ | ✅ |

| Wider Job Profiles (IB, Equity, Corporate Finance) | ❌ | ✅ | ❌ |

| CRO / Risk Head Career Path | ✅ | ❌ | ✅ |

| Global Exam Centres & Reach | ✅ | ✅ | ✅ |

| Breadth of Curriculum (Generalist vs Specialist) | ❌ | ✅ | ❌ |

| Strong Demand Post-2008 Crisis & Basel Norms | ✅ | ❌ | ✅ |

| Flexibility in Exam Attempts | ✅ | ❌ | ✅ |

| Recognition in FinTech & Climate Risk Roles | ✅ | ❌ | ❌ |

| Accessibility for Non-Finance Graduates | ✅ | ❌ | ✅ |

Still unsure which certification is best for you? Watch this video to solidify your decision!

Why FRM is the Smartest Career Move Today

The finance industry is amidst a shift. We still tend to think balance sheets are at the heart of it. But what really defines the strength of an institution, increasingly today, is how well it manages uncertainty.

The New Reality of Risk

Markets are more sensitive to global events, new technologies like AI carry risks that are tough to quantify, and regulators require a level of transparency that wasn’t asked for just a decade ago.

“In risk meetings today, the biggest question is not about the numbers. It’s about the unknowns those numbers may be hiding.”

Beyond Credit and Trading Limits

The conversations in risk teams today are very different from even five years ago. It’s no longer just about calculating credit exposures or setting trading limits.

Today, risk professionals need to ask:

- What happens if AI-generated trading strategies distort liquidity?

- How do we measure exposure to a supply chain shock caused by climate events?

- Will a fintech partnership introduce hidden operational risks?

These are questions no algorithm alone can answer; you need trained professionals who can step in, interpret signals, and guide action. An FRM makes you step up to all these as a sought-after professional in the business world.

What Companies Expect Now

I’ve heard more than enough stories from my mentees about how they need to brief leadership teams on how a sudden regulatory update would reshape the capital allocation in less than three months.

The ability to break down a dense, technical problem into a strategy the board could act on is something FRM prepared you for. And this is precisely the skill companies are paying a premium for right now.

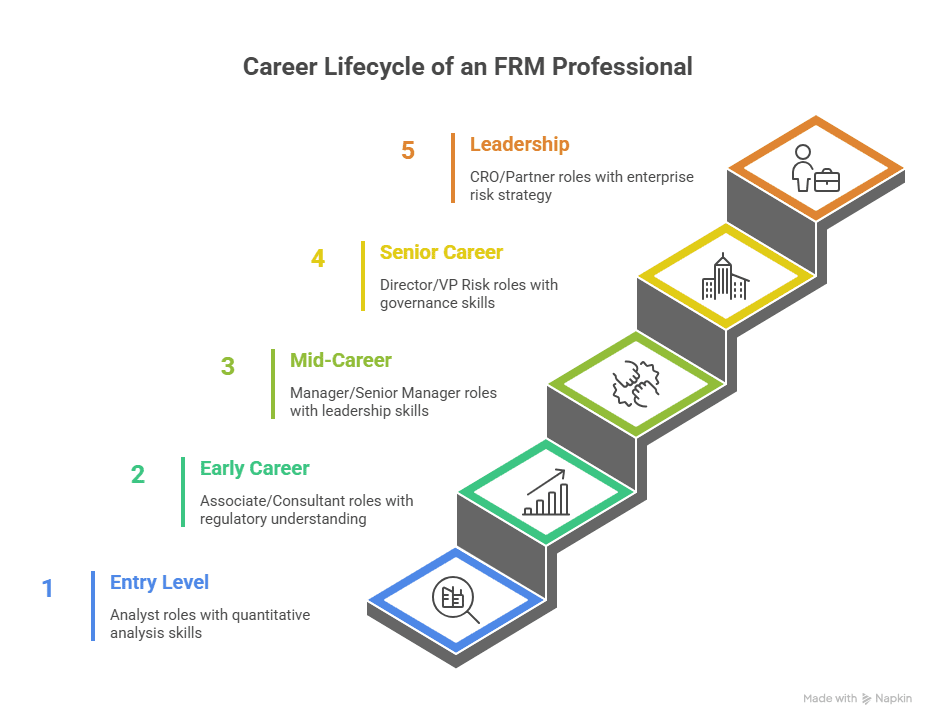

The Leadership Trajectory

For professionals eyeing leadership roles, the trajectory is clear: risk managers today are future CROs.

Boards are realising that planning for risk is a strategy. If you can show that you understand the risks shaping tomorrow’s business environment, you position yourself not just as a risk specialist but as someone who belongs in the decision-making circle.

And that’s the payoff of FRM: it’s a way of signalling that you’re prepared for the realities of modern finance, where risk defines both challenges and opportunities.

Behind every successful FRM professional is structured learning. Imarticus Learning’s FRM Certification course helps professionals make that connection.

FAQs About FRM

The right career move often comes down to the right answers. These FAQs address the doubts candidates ask most often.

What is FRM certification, and why is it important?

FRM is an internationally acknowledged certification that confirms your skills in risk management, provided by GARP. An individual earns the FRM certification as a way to demonstrate that they can handle market, credit, or operational risk in practice. For those who frequently inquire about what the FRM course is, it’s a certification that forms the basis on which you can launch your global career in risk.

Can FRM help in becoming a CRO?

Yes, an FRM can play a key role in establishing you in top-management or C-suite roles like a CRO. The vast majority of CROs and senior risk leaders throughout the world have an FRM designation. The program not only builds in terms of technical depth, but it also builds leadership credibility, and therefore provides a powerful pathway into a risk career. For those who are comparing what the difference is between CFA and FRM, FRM is specifically designed for risk leadership roles.

What is the FRM salary in India?

An entry-level analyst might expect starting salaries in the range of ₹6-9 LPA, while CROs are earning ₹35 LPA or beyond. FRMs get pay increases at a higher rate when compared to their peers or counterparts in the industry, as risk professionals typically make more than 30-40% on pay packages. If you are wondering what is FRM course in India is worth, the pay-off is leveraged due to the demand for the individual.

What does an FRM do?

FRMs assess, produce, and reduce financial risks through banking, insurance, consulting, and fintech sectors. They deal with models, stress tests, compliance, and governance to keep organisations secure. Anyone wondering what FRM is, it’s about protecting financial stability.

Is FRM better than CFA for risk management roles?

FRM is very specific about risk, while CFA is much broader in terms of investment and portfolio management. If you’re approaching the exam with a focus on trading desks, capital markets, or portfolio roles, then CFA is sufficient. However, if you’re trying to differentiate what CFA FRM is, the point is that FRM is the safer bet for risk-related roles.

What is the FRM exam structure like?

The FRM exam has two parts (part 1 has 100 questions) and part 2 has 80 4-hour exams. This exam is offered three times a year globally, including in India. If you are looking at what an FRM exam format looks like, anticipate quantitative, analytical, and scenario assessment.

How much does it cost to take an FRM course?

You can expect FRM course fees to include a one-time enrollment fee of $400 and exam fees ranging from $600–$1,000, depending on registration (early vs late).

What I’d Tell A Serious FRM Candidate

If you enjoy connecting the maths to the mess or numbers to narratives, FRM is a good investment. The certification alone won’t hand you a front-row seat; pairing it with applied project work (credit/market dashboards, liquidity stress playbooks, model reviews) is what unlocks opportunities and pay growth.

The path I generally recommend for most candidates in India:

- Do your Part I

- Take a risk internship/rotation or analytics role

- Do Part II within a year

- Ship a tangible project (e.g., ECL model review, liquidity stress automation, op-risk scenario pack)

- Interview with evidence, not adjectives.

If you want structure for your prep, explore FRM preparation with Imarticus Learning that will keep you honest on timelines, mock cadence, and feedback loops—and make sure they orient around the official GARP materials rather than replacing them.