Fintech is everywhere in today’s world that aims at robust development from the way we make purchases to the way we borrow loans. Fintech is a short form of finance and technology clubbed together. Traditional financial services are given a chance by inducing technology into finance leveraging more scope for advanced financial services. Since consumers are adopting fintech at a faster pace, businesses or companies are investing more on fintech.

Nevertheless, fintech, as we observe, has reached the culmination like the other technologies such as blockchain, artificial intelligence, machine learning, virtual reality, and the cloud. Therefore, managing various financial aspects of a firm by outperforming the competition is possible only for a fintech professional who is well-versed in Fintech Courses.

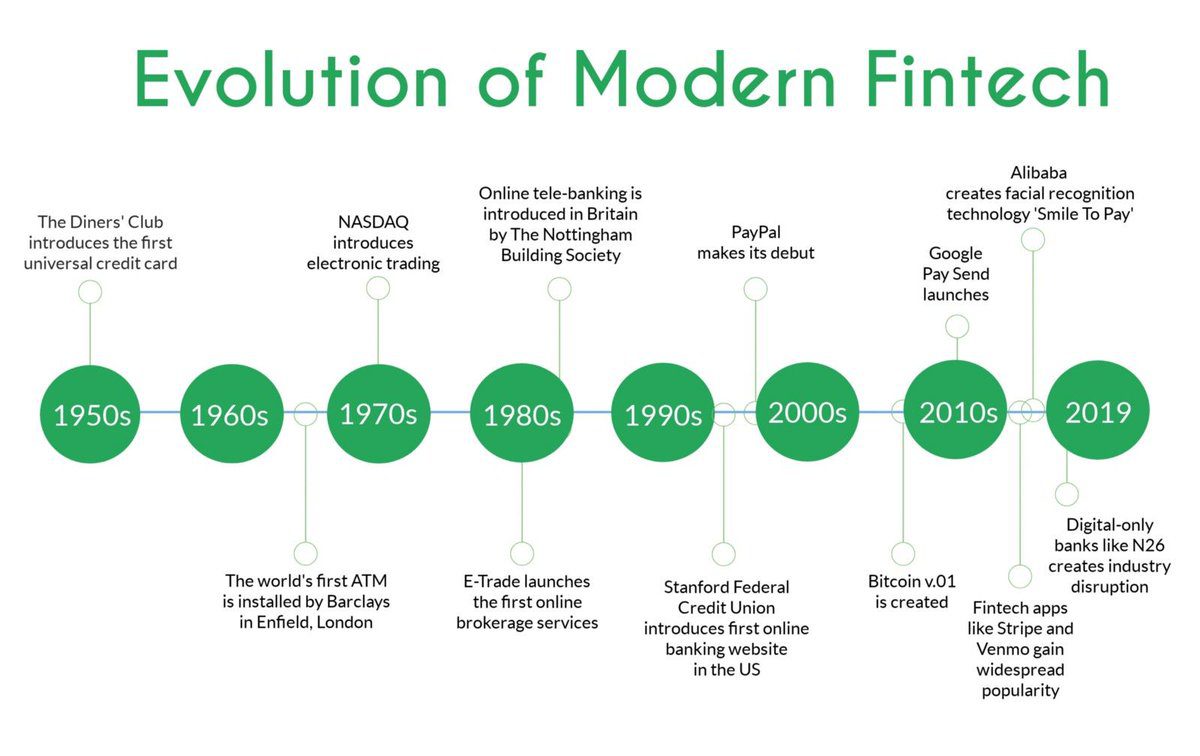

Have a look at some of the key developments in the miracle world of fintech where disruptive technology meets finance:

Investing in digital transformation

The experience of the customers with non-banking industries, retail and telecommunications have led to increased expectations from banks and credit unions. Access to the digital world has made the customers want for tech-savvy options in financial services. This strains the traditional working model of the financial institutions as more efforts need to be put in to cope with the competitive pressure. Hence, financial industries are investing a lump sum in digital transformation projects to satisfy the expectations of the consumers and to be on a digital upfront.

Application of Blockchain in fintech

Cryptocurrencies like Bitcoin and Ethereum took the world by storm which uses blockchain technology for peer-to-peer transactions and records it in a digital ledger thus eliminates the needs for prominent financial institutions. Blockchain is a transformative technology which poses huge potential grabbing the interest of the fintech industries. Recently, a successful pilot test for cross-border fund transfer from Thailand to Singapore was carried out using blockchain technology from the bank of Ayudhya to Standard Chartered Bank in Singapore. The use of blockchain by financial institutions will help its crowd of subsidiaries have efficient and flexible financial liquidity.

Inducing Artificial Intelligence in fintech

Artificial Intelligence (AI) can process the large sum of consumer data in seconds thereby, AI is leveraged more into the financial service industry more than using it as a cognitive for sales, marketing, wealth management, and investments. Artificial Intelligence is therefore used to work in close contact with many organizations to process and analyze its data using the latest algorithms and arrive at a promising solution for each customer. Its predictive analysis, automated chatbots and accurate decision making have advanced the position of AI from Machine Learning to robot-advisors.

Emerging Digital-only banks

The developments of fintech racing the market have posed a threat to the traditional banks with the dominance of digital-only banks. Thanks to the digital-savvy customers who were the ground reason behind the emergence of numerous digital products from these new players in town. Digital-only players focus on appealing to the masses with their innovative and efficient ideas. Thereby, pressurizing on the traditional banks to offer better and innovative digital solutions for its customers to protect themselves from these disrupters.

Design thinking

Fintech experts suggest that customer-first design should be the ideal key for the businesses who anticipate a positive outcome of UX vision. Clubbing their thoughts and creative engineering leads to an innovative mindset rather than just managing. The immersive UX vision which aims at satisfying the customer experience also benefits other aspects of technology like augmented reality(AR) and virtual reality(VR). A better consumer experience consolidating interactive and gamified experience is provided by using UX design for fintech.

Massive adoption of Cloud

Cloud adoption in fintech is set to be predominant as more and more cloud in the banking sector is evident. The adoption of cloud in banking is mainly due to its acceleration in time frame enabling increased innovation and responsiveness to the fast-paced changes in the financial service sector. However, the security or user data protection where the earlier barriers for large scale adoption of cloud platform which is not a concern with the present-day highly protective systems.

The merger of physical and digital

Generally, fintech reaches people with access to data more than the ones who do not have access to the internet. To remove such barriers effectively by consolidating physical and digital experience, especially in a country like ours where many people still do not have a reach to the internet, this development in fintech appeals to the masses. Like Canara banks digital banking branch which invariably allows its customers to walk into the branch and use its end-to-end digital experience seamlessly.

Conclusion

The revolutionary developments in fintech have changed the phase of financial services in a robust and efficient way. Thereby, creating more demand for fintech professionals for evolving businesses. Transforming your knowledge by getting insights into Fintech Courses will be an ideal option to flourish in this rapidly moving world of development.

For more details, you can contact us through the Live Chat Support system or can even visit one of our training centers based in – Mumbai, Thane, Pune, Chennai, Banglore, Hyderabad, Delhi, Gurgaon, and Ahmedabad.