One of the best features that have made blockchain so easily adaptable is the verification feature of transactions that are immutable, secure, permanently recorded, maintained as a public ledger and has no third-party interference.

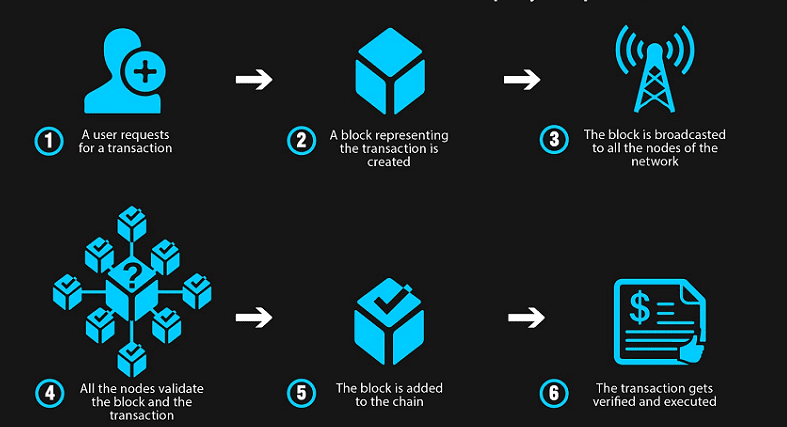

How verification is achieved:

Blockchains are made of blocks of code joined together and is essentially a process based on consensus between transacting parties. The blockchain network has many nodes of such continuous blockchains. It functions as a ledger which is decentralized. Whenever a new block is introduced, the transaction gets a digital signature fingerprint which cannot be altered and consists of hashtag functions of the previous block with an output that is unique. If the output is changed and not verified the transaction becomes invalid and unverified. This means that all network nodes should receive the exact same output on executing the hash. If the change is acceptable by this test, the transaction is verified.

Blockchains provide security, immutable records, and verification as the prime features. The different blocks are held together by connecting hashtags, and each and every block holds the hash code of the preceding block got from the values generated when the new block is introduced.

Every initialized transaction has the connecting nodes verify the following

- Transaction history is immaterial, and the balance of the wallet address of the sender is checked.

- Receiver address is also verified.

The request is approved if these conditions are met perfectly. A Digital authentication signature is formed by the request and unique private keys required for the transaction. This is then sent and verified across all nodes of the network for matching the key and signature by means of an output complex hashing algorithm generated with the request by a nonce. Nodes compete with each other to solve the hash thereby doubly ensuring the verification process.

Remember that the nodes are interconnected and are small configurations that are high-end and can solve the above code for the right output. They also broadcast the result to other transacting miner nodes in the network to ensure the solution is right. This ensures that all nodes are constantly watching the transactions and that the transaction is public verified.

It is important to note that a block can contain very many transactions. Only the transacting nodes that verify the transaction first is the rewarded miner thereby setting up a fool-proof verification system with healthy mining completion. Any miscalculation will result in invalidating the transaction broadcast across all connected nodes. Mining rewards are generally in the form of BTC or Ethereum on the Bitcoin blockchain network. A transaction is verified, validated and completed only when all nodes mine the information and receive their reward.

To learn all about this feature do a fintech course like the one at Imarticus which necessarily focuses on a global curriculum, hands-on practical blockchain training, and project work and which helps you build your industry and vertical relevant portfolio, learn at your convenience and get set to be career-ready as a blockchain developer.