Most finance careers look glamorous from the outside – big deals, global markets, impressive titles. But anyone who’s seriously explored this field knows that credibility matters just as much as ambition. And that’s exactly where the CFA comes in.

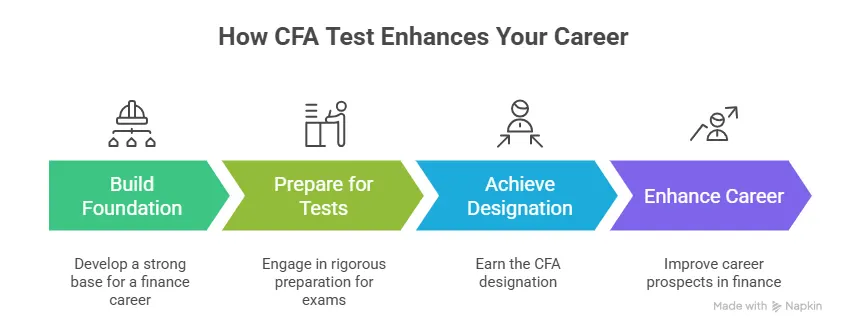

CFA tests are often seen as a defining milestone for anyone serious about building a long-term career in finance. If you’re aiming for roles in investment banking, asset management, equity research, or corporate finance, the CFA certification is one of those qualifications that instantly adds credibility to your profile.

It’s recognised across the world and valued by employers who want professionals with strong financial knowledge and real commitment to the field. For many students and young professionals, clearing the CFA exams feels like a turning point. It shows that you’re not just exploring finance – you’re ready to build a long-term career in it and put in the effort required to grow.

But before you jump in, it’s worth understanding what you’re signing up for. In this guide, I’ll walk you through everything you need to know about CFA tests in a clear, simple way. From understanding the exam structure and key dates to seeing sample questions and building an effective preparation plan, consider this your starting point to approaching the CFA with confidence.

Did you know?

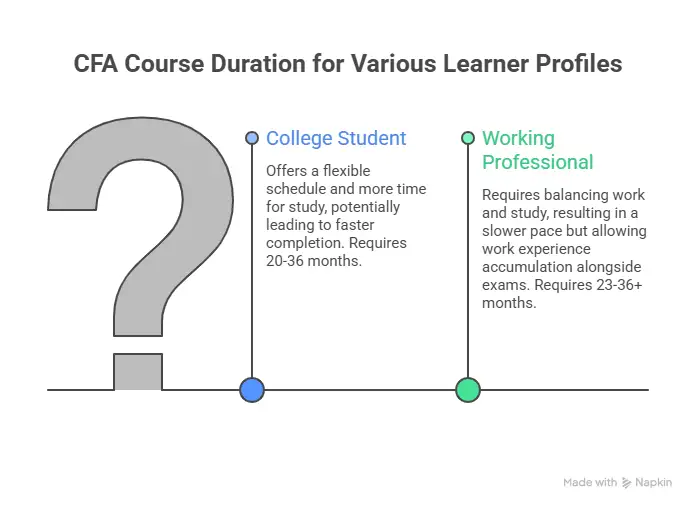

Many students start preparing for CFA during college or early in their careers so they can build strong fundamentals and stand out during placements or job applications.

What Are CFA Tests?

CFA tests are part of the Chartered Financial Analyst certification program conducted by the CFA Institute. If you’re wondering what is CFA, it is a globally recognised finance certification that focuses on building deep knowledge in investment management, financial analysis, portfolio management and ethical standards.

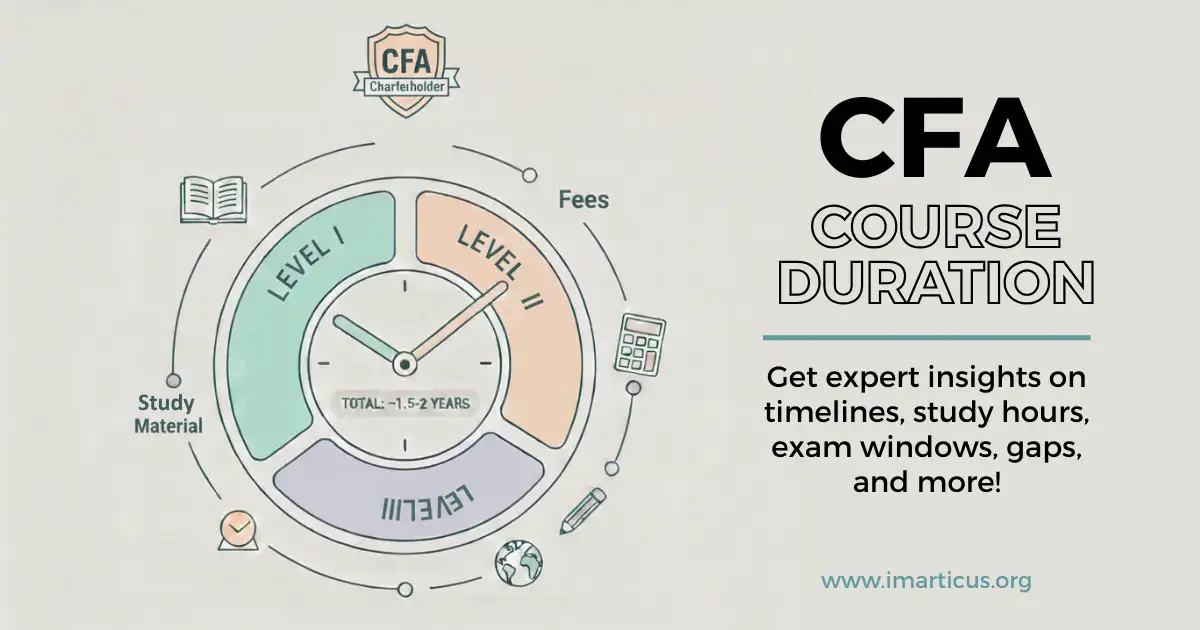

The CFA certification consists of three levels:

- CFA Level 1

- CFA Level 2

- CFA Level 3

Each level has its own CFA test exam that evaluates your understanding of finance concepts and your ability to apply them in real-world scenarios. These tests are not just academic exams. They’re designed to prepare you for real finance roles where analytical thinking, valuation skills and financial decision-making matter.

Clearing the CFA tests demonstrates:

- Strong financial knowledge

- Analytical ability

- Commitment to the finance profession

- Global career readiness

That’s why employers across investment banking, asset management and consulting value CFA-qualified candidates.

Why CFA Tests Matter for Finance Careers

If your goal is a career in finance, preparing for the CFA tests can open multiple doors. The CFA designation is globally recognised and often considered a gold standard in investment management and financial analysis.

Professionals who clear CFA tests often work in roles like:

- Investment banking

- Equity research

- Portfolio management

- Corporate finance

- Wealth management

- Risk management

Even for freshers, passing the CFA Level 1 exam significantly strengthens a finance resume. If you’re just starting your finance journey, understanding the CFA test exam structure early can help you plan better.

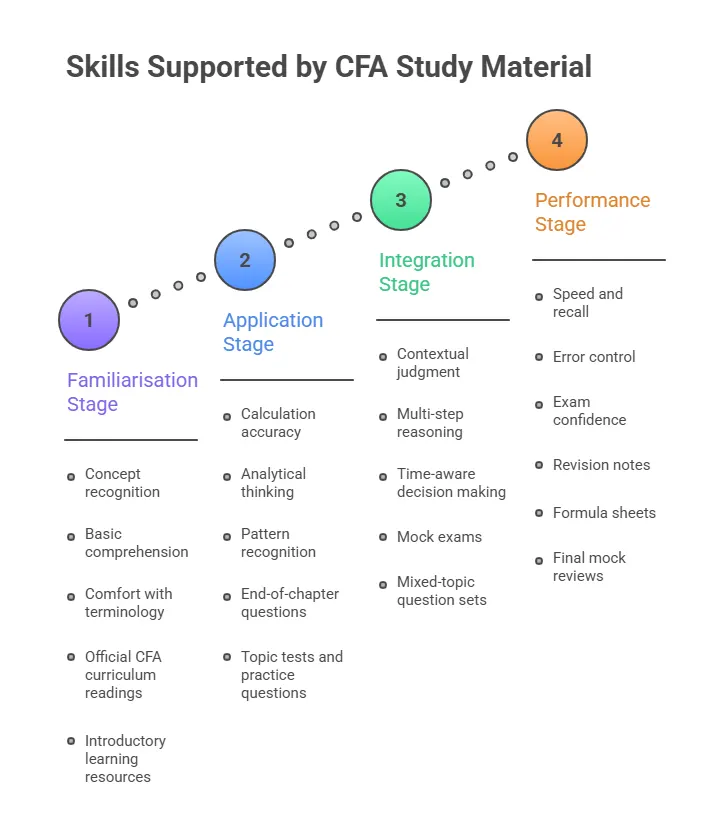

As candidates progress through each level, they gradually build the analytical and decision-making skills required in real finance roles.

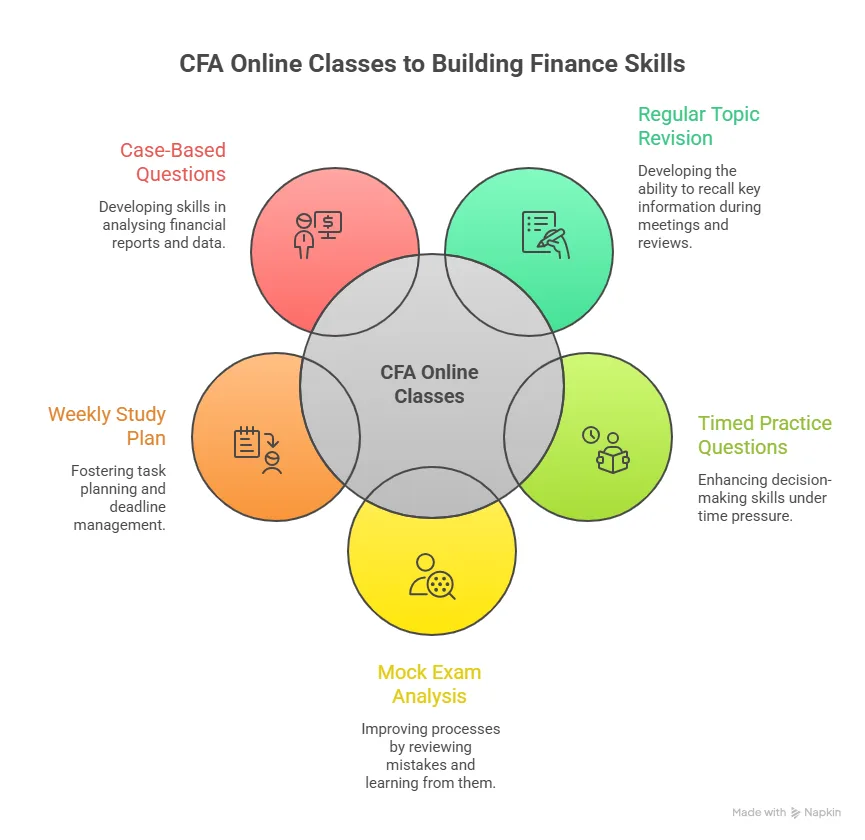

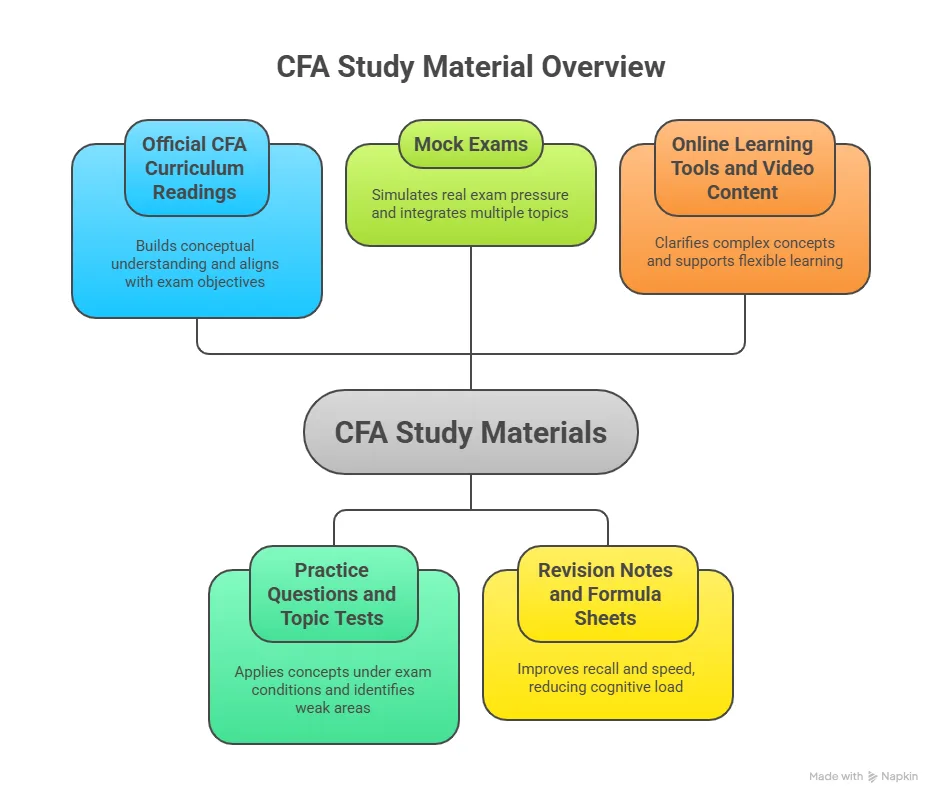

What Skills Do CFA Tests Evaluate?

CFA tests are designed to evaluate more than just theoretical knowledge. They assess whether you can apply financial concepts in practical situations.

Key skills tested include:

- Financial analysis

- Valuation

- Investment decision-making

- Risk assessment

- Portfolio management

Ethical judgement

These skills are directly relevant to real finance jobs, which is why CFA-certified professionals are highly valued.

This quick video breaks down some of the biggest myths around CFA tests and gives you a more realistic perspective on preparation, difficulty level and career scope.

Who Can Take CFA Tests?

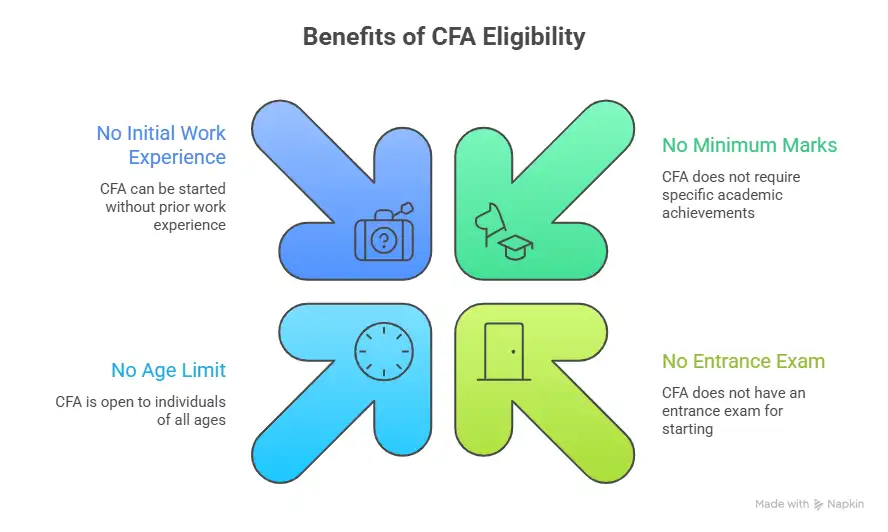

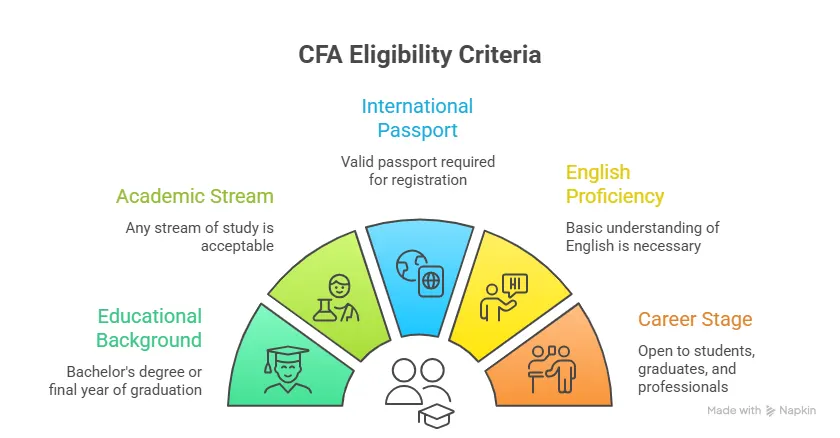

Before registering, it’s important to understand CFA eligibility requirements.

You can appear for CFA Level 1 if you:

- Are in the final year of your bachelor’s degree, or

- Have completed a bachelor’s degree, or

- Have relevant professional work experience.

To earn the full CFA charter, you also need around 4,000 hours of relevant work experience, Membership with the CFA Institute, and completion of all three levels.

The exams themselves are open globally, and many students begin CFA course preparation during college.

Why Practising CFA Test Questions Is Important

Many candidates focus only on reading theory from CFA books. That’s a mistake.

Regularly solving CFA test questions helps you:

- Understand exam pattern

- Improve speed

- Identify weak areas

- Build confidence

- Reduce exam anxiety

The more you practise, the more comfortable you become with the exam format.

Also Read: Smart tips to plan your CFA course fees wisely.

CFA Test Exam Structure Explained

Before you start your preparation, it’s important to understand the CFA test exam structure. Knowing what to expect makes the journey far more achievable.

Each level of the CFA tests focuses on different skill sets.

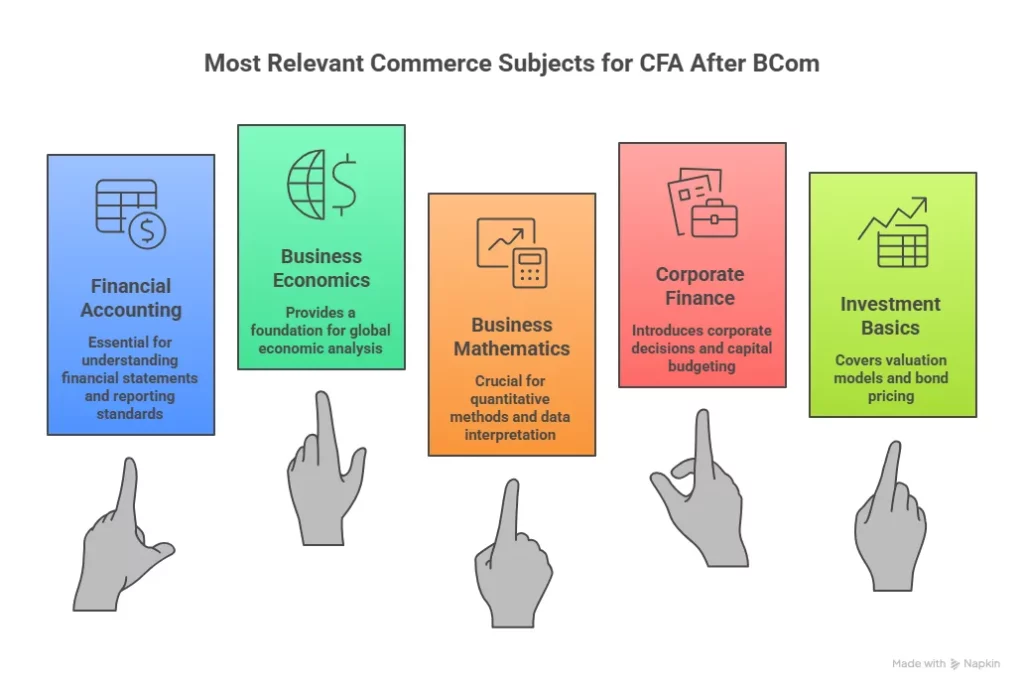

CFA Level 1 Exam

This is the entry-level exam that focuses on basic financial knowledge and concepts.

It covers:

- Financial reporting and analysis

- Quantitative methods

- Economics

- Corporate finance

- Equity investments

- Fixed income

- Ethics

The Level 1 CFA test exam is mostly based on multiple-choice questions and tests your conceptual clarity.

CFA Level 2 Exam

The CFA Level 2 goes deeper into valuation and analysis.

It focuses on:

- Asset valuation

- Financial modelling

- Equity and fixed income analysis

- Portfolio management concepts

Questions are more analytical and case-based compared to Level 1.

CFA Level 3 Exam

This is the final level and focuses heavily on portfolio management and wealth planning.

It tests:

- Portfolio strategy

- Risk management

- Wealth planning

- Application of concepts in real scenarios

CFA Level 3 tests include essay-type and case-based questions that evaluate decision-making ability.

How Difficult Are CFA Tests?

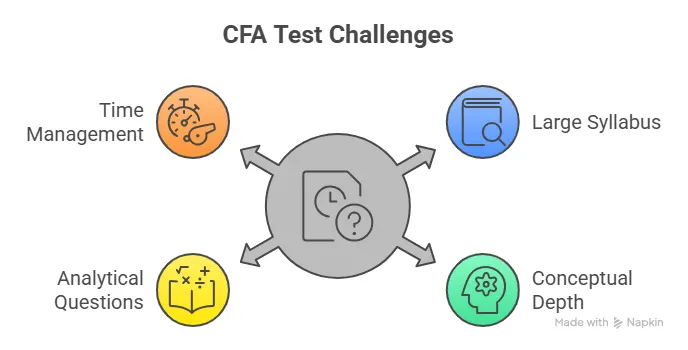

Let’s be honest – the CFA exam is quite challenging. The table below shows the difficulty level in detail:

| Aspect | Details |

| Overall Difficulty | CFA exams are challenging and require serious preparation. |

| Average Global Pass Rates | Level 1: ~35-40%Level 2: ~40-45%Level 3: ~45-50% |

| Study Time Required | Most candidates spend 300-400 hours preparing for each level. |

| Why CFA Tests Are Considered Tough | Vast syllabusConcept-heavy subjectsApplication-based questionsTime pressureHigh weightage for Ethics section. |

| Reality Check | CFA is difficult, not impossible. With structured preparation and consistency, thousands of candidates clear it every year. |

Also Read: Essential CFA Course Details Every Aspirant Should Know

How to Start Preparing for CFA Tests

If you’re considering registering with the CFA Institute, the best thing you can do is start early. Understanding the CFA test exam structure and syllabus gives you a clear direction.

Start with:

- Understanding exam format

- Reviewing syllabus

- Checking CFA test dates

- Creating a study plan

Why Understanding CFA Test Questions Matter

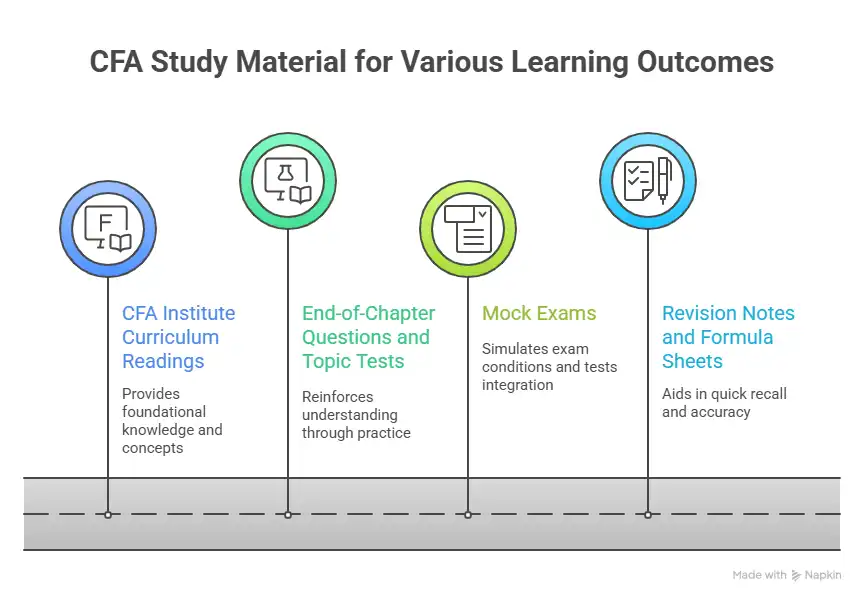

Once you understand the structure of CFA tests, the next step is getting familiar with the types of questions you’ll face. Many candidates underestimate this part, but practising CFA test sample questions is one of the most effective ways to prepare.

CFA exams are not just about memorising theory. They test your ability to apply concepts in practical finance scenarios. That’s why practising regularly from a CFA coaching institute with sample questions and mock tests becomes essential.

What Questions Can You Expect in the CFA Tests

The format of CFA test questions varies slightly across CFA levels, but the focus remains on concept clarity and application.

Level 1 CFA Test Questions

CFA Level 1 mostly includes multiple-choice questions.

These tests:

- Basic finance concepts

- Definitions and formulas

- Understanding of financial statements

- Ethics and professional standards

Questions are straightforward but require strong conceptual clarity and speed.

Level 2 CFA Test Questions

Level 2 introduces case-based questions.

You’ll see:

- Mini case studies

- Financial data interpretation

- Valuation scenarios

- Analytical problem-solving

This level tests how well you can apply concepts rather than just recall them.

Level 3 CFA Test Questions

Level 3 focuses on application and decision-making.

It includes:

- Essay-type questions

- Case-based portfolio scenarios

- Strategy and risk management questions

At this stage, the CFA test exam evaluates your ability to think like a finance professional.

Also Read: How to build a CFA career in Bangalore.

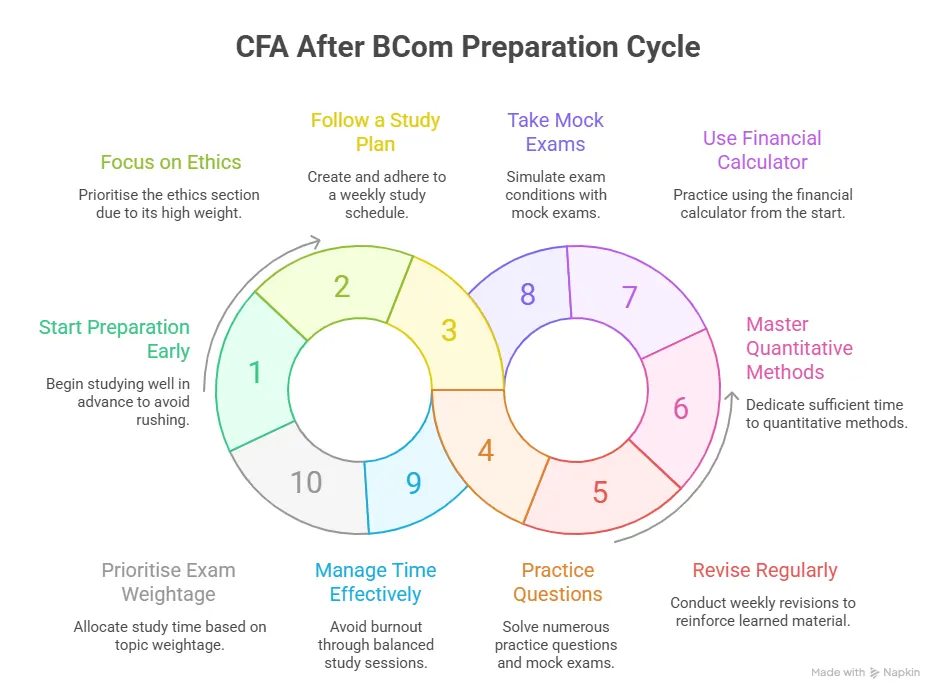

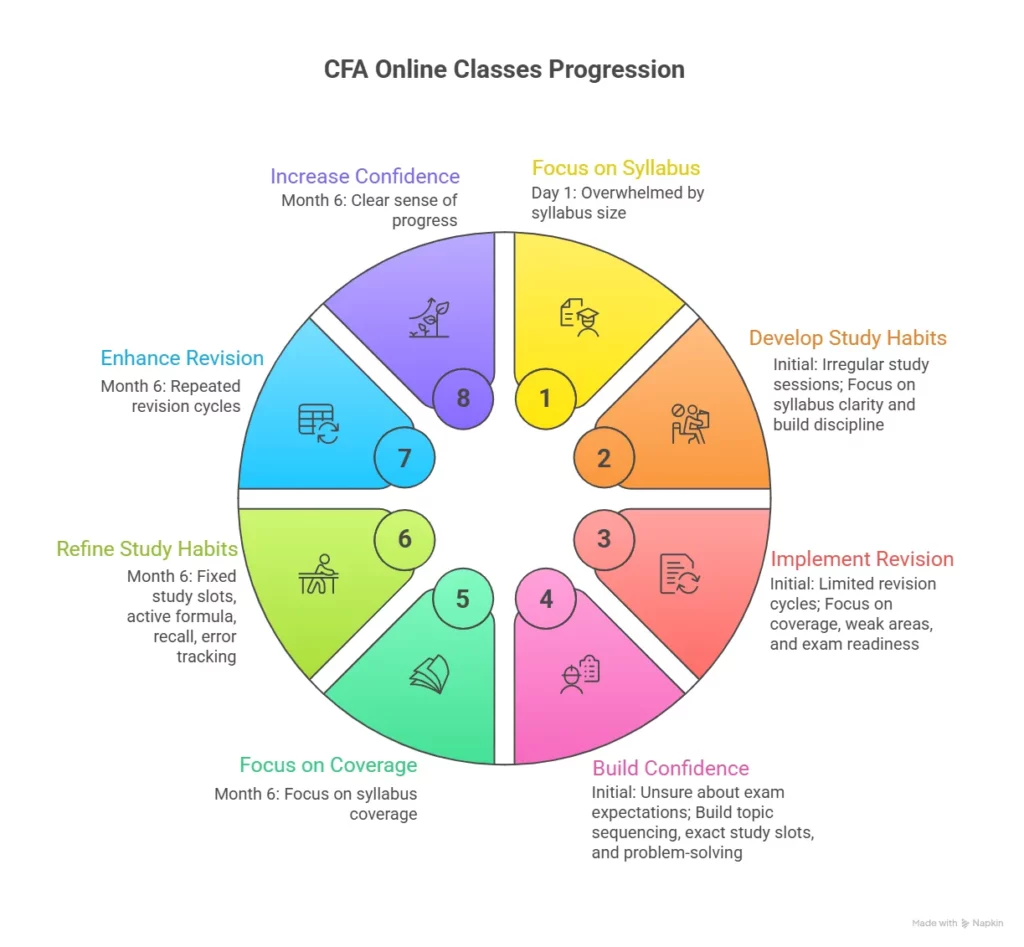

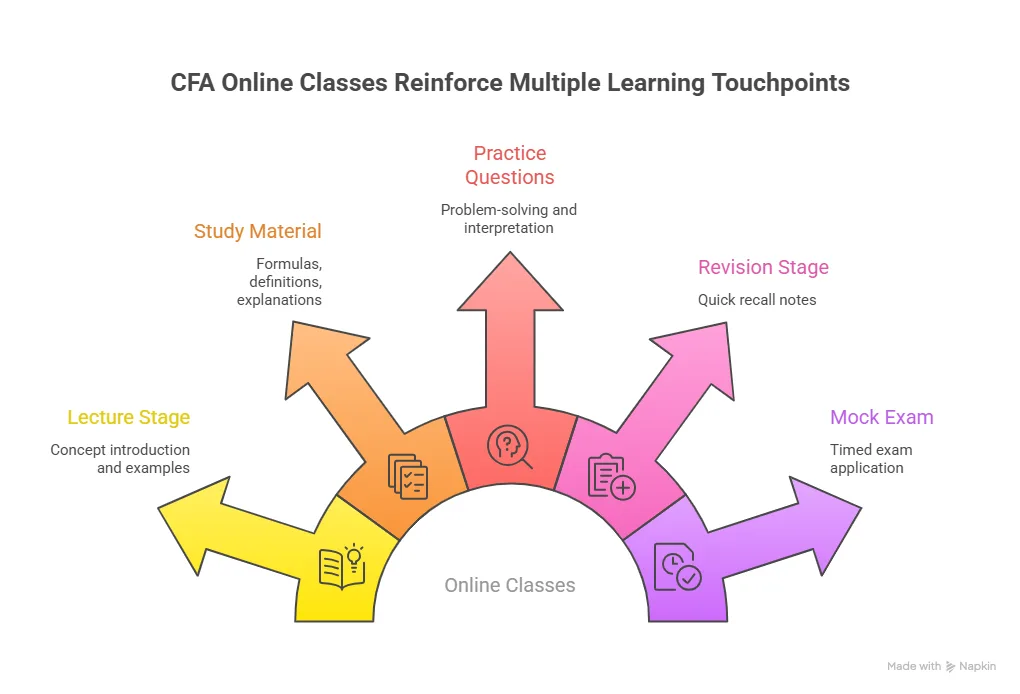

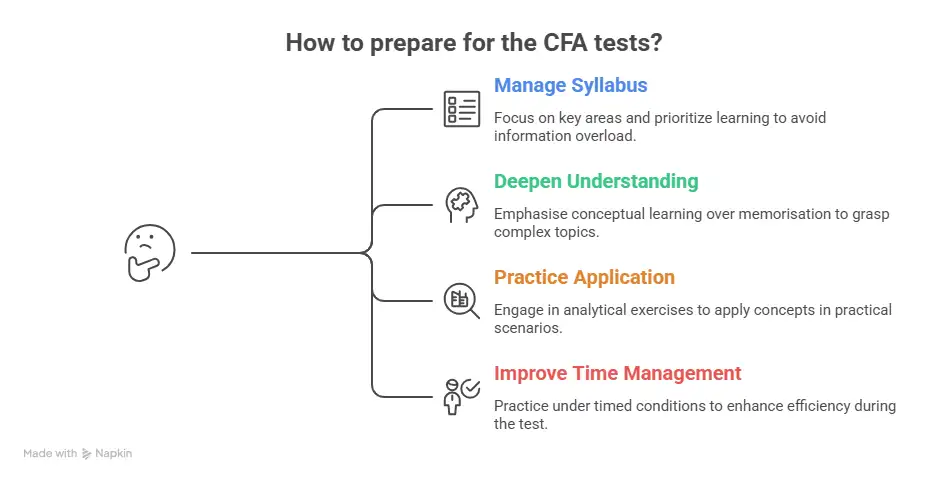

How to Prepare Effectively for CFA Test

Since the CFA course syllabus is vast, random studying rarely works and preparing for the CFA tests requires a structured approach. A clear CFA test prep strategy helps you stay consistent and avoid last-minute stress. Here’s a practical approach.

| CFA Test Prep Step | What You Should Do | Why It Matters for CFA Tests |

| Understand the syllabus | Start by reviewing the CFA curriculum for your level in detail. Go through each subject and topic before beginning preparation. | Knowing the full syllabus helps you avoid confusion later and ensures you don’t miss important topics during CFA test prep. |

| Create a realistic study plan. | Break the syllabus into weekly or monthly targets. Most candidates prepare consistently for 4-6 months before the exam. | A structured plan keeps your CFA test preparation organised and prevents last-minute pressure or rushed revision. |

| Focus on concepts first. | Take time to understand financial concepts clearly instead of memorising formulas immediately. Build strong fundamentals. | Strong conceptual clarity makes solving CFA test questions much easier and improves long-term retention. |

| Practise regularly | After completing each topic, solve CFA test sample questions and practice problems. Make this a weekly habit. | Regular practice helps reinforce learning, improve accuracy, and build confidence for actual CFA tests. |

| Take mock tests seriously | Attempt full-length mock exams under timed conditions at regular intervals. Analyse your performance after each test. | Mock tests improve time management, build exam stamina, and help identify weak areas before the real CFA test. |

| Revise consistently | Keep dedicated time for revision every week and especially in the final month before the exam. | Regular revision strengthens retention, sharpens concepts, and ensures you walk into the CFA tests with confidence. |

Interesting Insight:

The CFA program is widely regarded as the “gold standard” in investment management education, with average pass rates around 40-50% across levels because of its strong focus on analytical skills, ethics and real-world financial decision-making.(Source: CFA Institute)

Common Mistakes CFA Aspirants Should Avoid

Many candidates fail not due to lack of intelligence but poor strategy. Here are a few common mistakes students make and smart ways to avoid them:

| Common Mistake | Why It Hurts Your Preparation | Smart Tip to Avoid It |

| Starting preparation too late | Leads to rushed learning and poor concept clarity before exams. | Start at least 5–6 months early and follow a structured weekly study plan. |

| Ignoring the ethics section | Ethics has high weightage and can impact overall results significantly. | Revise ethics regularly and practice scenario-based questions. |

| Only reading theory without practice | CFA exams are application-based, not just theoretical. | Solve practice questions after every topic and focus on concept application. |

| Skipping mock tests | Without mocks, time management and exam readiness remain weak. | Attempt multiple full-length mock tests under timed conditions. |

| Unrealistic study schedules | Over-ambitious plans lead to inconsistency and burnout. | Create a practical daily study routine you can sustain long-term. |

| Underestimating Level 2 difficulty | Level 2 is concept-heavy and more analytical than Level 1. | Allocate extra revision time and focus on question-solving for Level 2 topics. |

Also Read: Everything you should know about CFA salary in India.

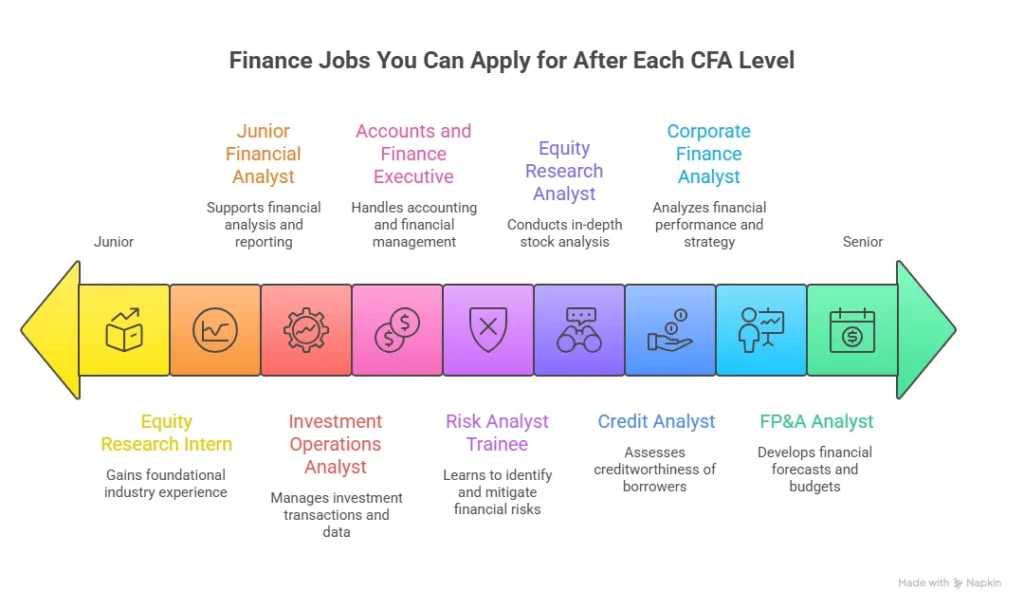

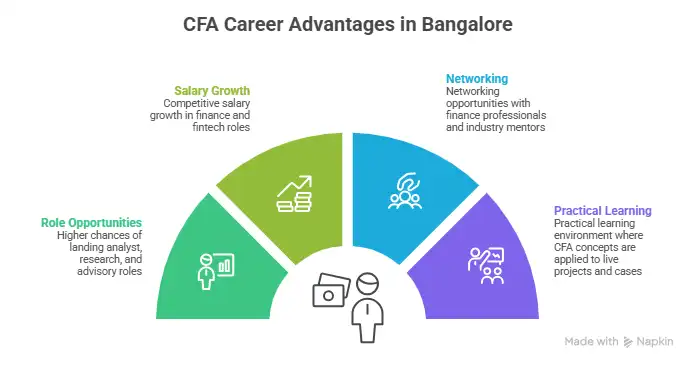

Career Opportunities After Clearing the CFA Tests

Once you progress through the CFA tests, multiple career paths open up. The certification is useful across various finance domains.

| Career Path | How CFA Knowledge Helps |

| Investment Banking | CFA knowledge helps in valuation, financial modelling, and deal analysis. |

| Equity Research | You learn how to analyse companies, industries, and markets. |

| Portfolio Management | CFA tests focus heavily on portfolio strategy and wealth management. |

| Corporate Finance | Understanding financial statements and capital budgeting helps in corporate roles. |

| Wealth Management | CFA charterholders often work with high-net-worth clients and investment portfolios. |

The flexibility of the CFA program makes it valuable across industries.

Why Employers Value Candidates Who Clear CFA Tests

Finance roles today require more than basic academic knowledge. Companies look for candidates who understand financial markets, valuation and investment decision-making in depth.

Clearing the CFA tests demonstrates:

- Strong analytical ability

- Commitment to the finance profession

- Global standard knowledge

- Understanding of financial markets

- Ethical decision-making skills

This is why CFA charterholders are often preferred for roles in investment management and financial analysis. Even during interviews, candidates preparing for CFA tests often stand out because they already understand core finance concepts.

If you’re exploring how CFA tests connect directly to real career outcomes, this video gives a clear and realistic picture of what you can expect in terms of salary, job roles and growth in India. It explains how CFA professionals are valued across finance roles and what opportunities could look like by 2026.

How CFA Tests Improve Your Earning Potential

One of the biggest motivations for many candidates is salary growth. While salaries vary by role and location, professionals who clear CFA tests often see strong career progression.

Some CFA benefits include:

- Higher earning potential

- Better job opportunities

- Faster career growth

- Global job mobility

- Strong professional credibility

Many finance professionals pursue the CFA tests specifically to move into higher-paying roles in investment management and corporate finance.

CFA Tests and Salary Impact

While CFA alone doesn’t guarantee a high salary, it significantly improves career prospects.

| Level | India: Salary & Career Impact | Global: Salary & Career Impact |

| CFA Level 1 | Improves chances of getting quality entry-level roles in finance, such as analyst, operations, and research support. | Helps secure entry-level roles in investment firms, banks, and financial services with global recognition. |

| CFA Level 2 | Opens opportunities for core roles in equity research, financial analysis, valuation, and corporate finance. | Considered a strong qualification for research, valuation, and investment analysis roles across global markets. |

| CFA Charterholder | High career growth in asset management, investment banking, portfolio management, and wealth management. | Among the most respected finance credentials with strong demand in the US, UK, Middle East, and Asia. |

| Overall Career Impact | Enhances long-term salary growth, credibility, and promotion opportunities in finance careers. | Offers global mobility, strong earning potential, and long-term career credibility in the finance industry. |

The real value lies in long-term career growth and credibility.

If you’re exploring career options after clearing the CFA tests, it helps to understand what roles are actually available in the industry. This quick video walks through the top CFA job opportunities in India and what each role typically involves.

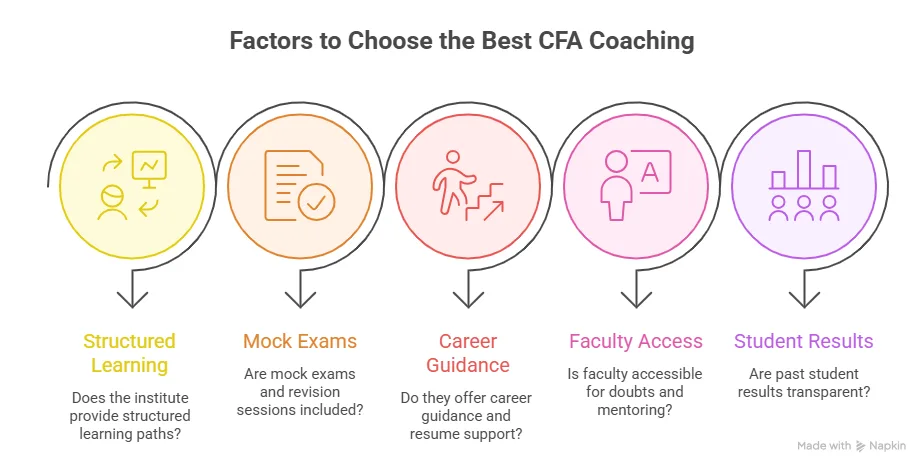

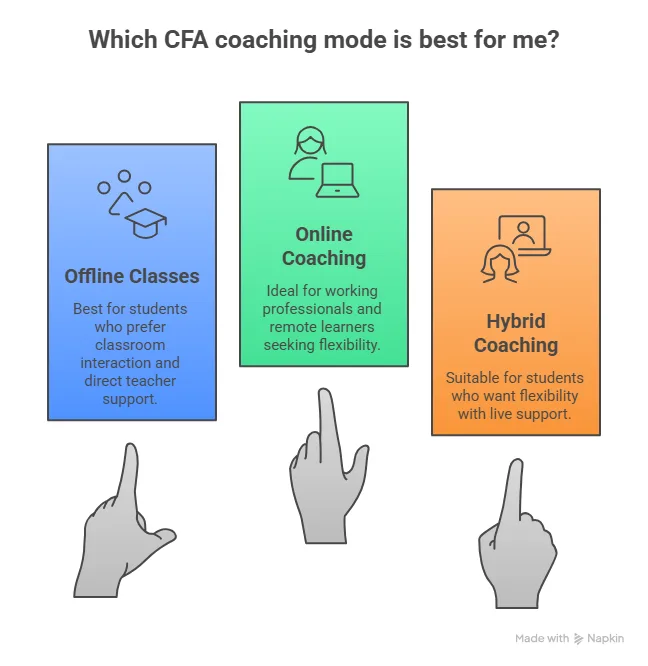

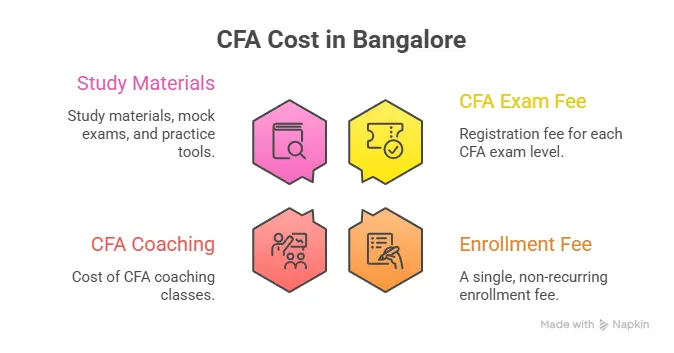

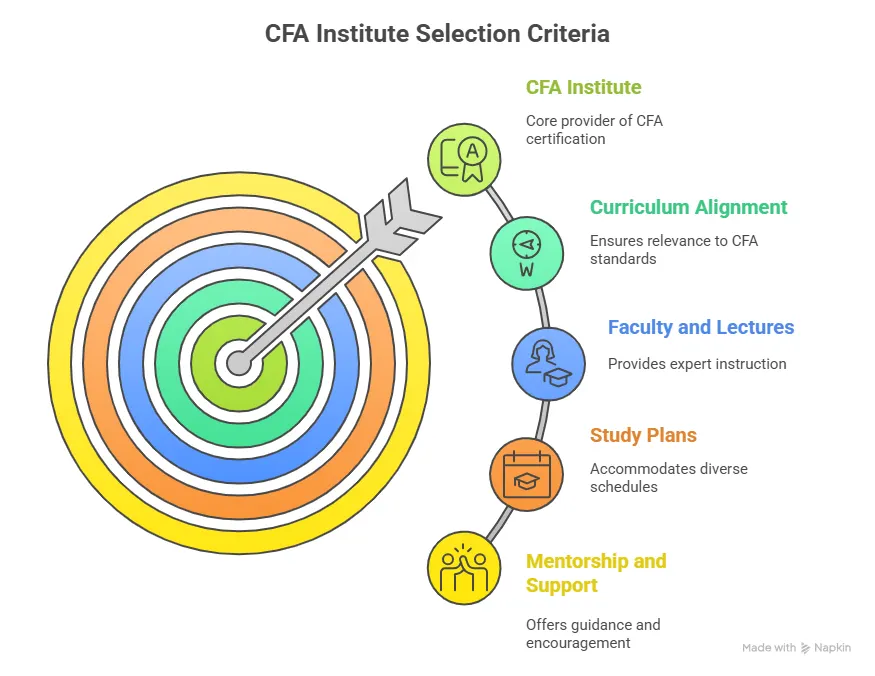

Why Imarticus Learning is the Right Support for CFA Test Preparation

Preparing for CFA tests on your own is possible, but many students benefit from structured guidance and mentorship. A well-designed CFA program can help you stay consistent, understand complex topics faster and prepare with confidence.

What makes Imarticus Learning the right choice:

- Structured study plans aligned with the CFA curriculum.

- Experienced faculty and mentorship

- Regular mock tests and performance tracking

- Doubt-solving and revision support

- Career guidance and placement assistance

Learning with the right support system not only makes CFA preparation more manageable but also helps you stay motivated throughout the journey. With consistent effort and the right guidance, clearing the CFA tests becomes a realistic and achievable goal.

FAQs About CFA Tests

If you’re planning to appear for CFA tests, here are answers to some of the most frequently asked questions to help you prepare with confidence and move forward with a clear understanding.

What are CFA tests?

CFA tests are the exams conducted by the CFA Institute as part of the Chartered Financial Analyst certification program. They assess knowledge of investment management, financial analysis and portfolio management. There are three levels of CFA. Each level has its own CFA test exam focusing on different finance skills.

When are CFA test dates announced?

CFA test dates are announced annually by the CFA Institute. Exams are conducted in multiple windows throughout the year, depending on the level.

How hard is the CFA test?

CFA tests are challenging, but they’re far from impossible. The difficulty mainly comes from the size of the syllabus, the emphasis on application-based questions and the discipline needed to study consistently over several months. Unlike many exams that rely on rote learning, CFA tests reward genuine understanding and logical thinking.

How long should I prepare for the CFA tests?

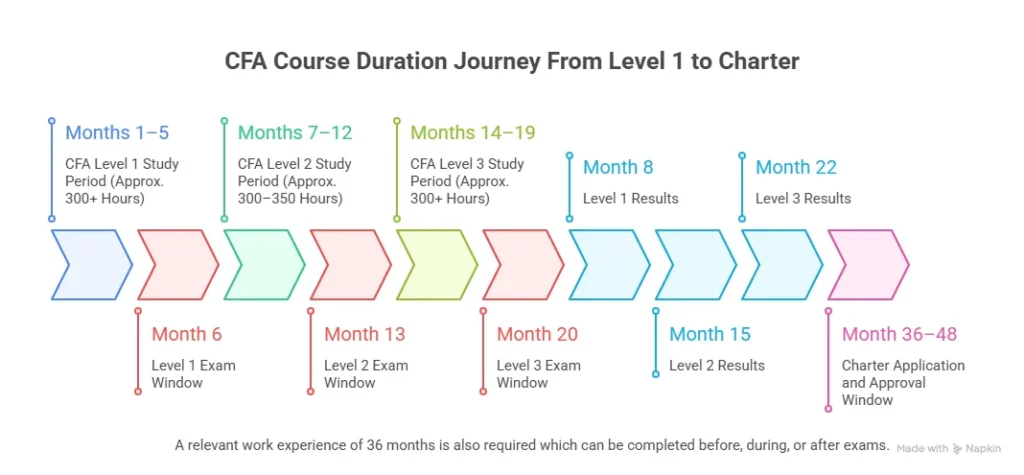

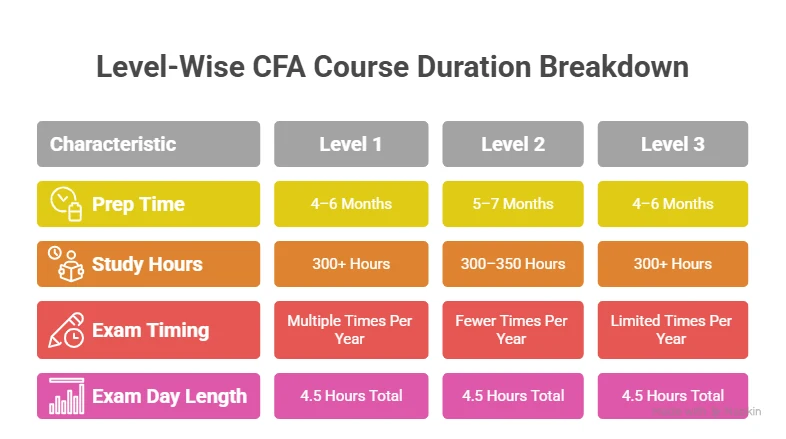

With consistent preparation and practice, CFA tests are manageable. Most candidates prepare for 4 to 6 months per level, dedicating approximately 300-400 hours of study.

How many attempts are allowed for CFA tests?

There’s no strict cap on how many times you can attempt CFA tests. If you don’t clear a level on your first try, you’re allowed to reattempt it. That said, every attempt comes with a fresh registration and exam fee, which is why most candidates aim to clear each level in one go.

What is the best way to start CFA test prep?

Start by understanding the syllabus, creating a study plan and practising CFA test sample questions regularly. Joining reputed training institutes like Imarticus Learning, where you get structured coaching, can help many students stay consistent and understand complex topics better.

Are mock tests important for CFA preparation?

Yes, mock tests play a huge role in preparing for CFA tests. Mock exams help you practise under timed conditions, improve your speed and identify weak areas early. They also train you to manage exam pressure. The CFA exam is not just about knowing concepts – it’s about applying them quickly and accurately. When you take regular mock tests, you start understanding question patterns, time allocation and how to avoid common mistakes.

Are CFA tests useful for investment banking careers?

Yes. CFA knowledge in valuation, financial analysis and markets is highly useful for investment banking roles. While no certification guarantees a job, clearing CFA tests significantly improves career opportunities in finance. Doing CFA from top institutes like Imarticus Learning can help you get internship and placement opportunities.

Boost Your Career with the CFA Tests

CFA tests require time commitment, discipline and consistent effort. Beyond the exams themselves, the CFA journey builds analytical thinking, financial expertise and a deeper understanding of global markets.

The CFA course offers long-term professional value that few finance certifications can match.

For anyone who wants to move into core finance roles, starting your CFA preparation with a clear plan can make the process far more manageable. Focus on building strong concepts, practice regularly and stay consistent with your preparation.

With the right approach, preparation and guidance, clearing the CFA tests becomes more than just an academic milestone – it becomes a powerful step toward building a credible, high-growth career in the global finance industry.