So here is the deal. You are in college or university, and you want to become a financial analyst? That’s great! Financial analysts work in all industries, including banking, real estate, insurance, retail, and more. The best way to get your foot in the door for this career is through an entry-level position as a junior or senior financial analyst.

If you’re already in another field and want a career change, a financial analyst is a great place to begin your new career!

KPMG ProDegree financial analyst course

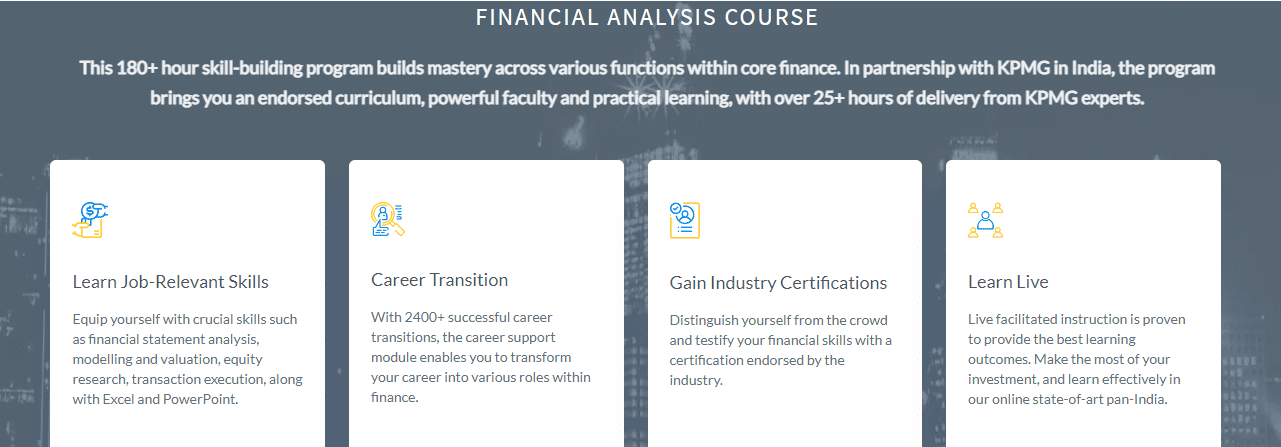

The KPMG ProDegree financial analyst course is an intense program covering all modules of economic analysis, financial modeling, management accounting, and management presentation skills needed to succeed in the industry. It is a fully online course that students can do at their own pace anytime, anywhere.

This program is for working professionals with strategic finance and analytical abilities to equip them for the next step in their careers. It offers a senior finance professional the ability to combine corporate strategy with finance, take a long-term view of strategy utilizing analytics, and analyze potential future outcomes for optimum decision making. It provides a solid foundation for all new-age financial technology.

Benefits of KPMG ProDegree financial analyst course:

- This highly interactive online program is designed to prepare you for your first role as an analyst and take you step-by-step through the skills and knowledge required to excel in a career as a financial analyst.

- The comprehensive curriculum includes an overview of Financial Analysis, Key Financial Ratios, Financial Modeling and KPI’s, Financial Reporting & Analysis.

- Students will work with a web-based program that provides all the foundational knowledge required as a financial analyst.

- This program is used by many of the world’s leading companies to train their employees, so it guarantees you’ll have access to top-quality resources.

- This program will teach students how to use Excel, PowerPoint, and Word to create financial models, spreadsheets, presentations, and memos tested for accuracy.

- Students will learn with a comprehensive curriculum covering calculations using ratios, operational efficiencies of firms, valuation methodologies for equity & debt securities, fund management, etc., by experienced professionals.

- Students will have access to a network of people with similar interests and responsibilities, data-driven learning content through the online program, knowledge checks, and assessments to make sure you understand the key concepts – all designed for their success!

Enroll in a KMPG Financial analyst course with Imarticus Learning today!

If students aim to become financial analysts, here’s their golden opportunity. Imarticus Learning is training professionals from all industries and backgrounds to take up this profession easily through our advanced financial modeling course.

We understand the importance of learning from experts in various industries for years and putting that into practice by having our faculty members have years of experience in the corporate world.

Some course USP:

- This financial analyst course for students is with placement assurance aid the students to learn job-relevant skills.

- Impress employers & showcase skills with the financial analyst certification endorsed by India’s most prestigious academic collaborations.

- World-Class Academic Professors to learn from through live online sessions and discussions.

A lot of institutions offer a solid

A lot of institutions offer a solid  Another important skill analysts should have is to be able to put the correct value to each aspect of a merger. They need to determine as precisely as possible the appropriate premiums needed for acquisition.

Another important skill analysts should have is to be able to put the correct value to each aspect of a merger. They need to determine as precisely as possible the appropriate premiums needed for acquisition.

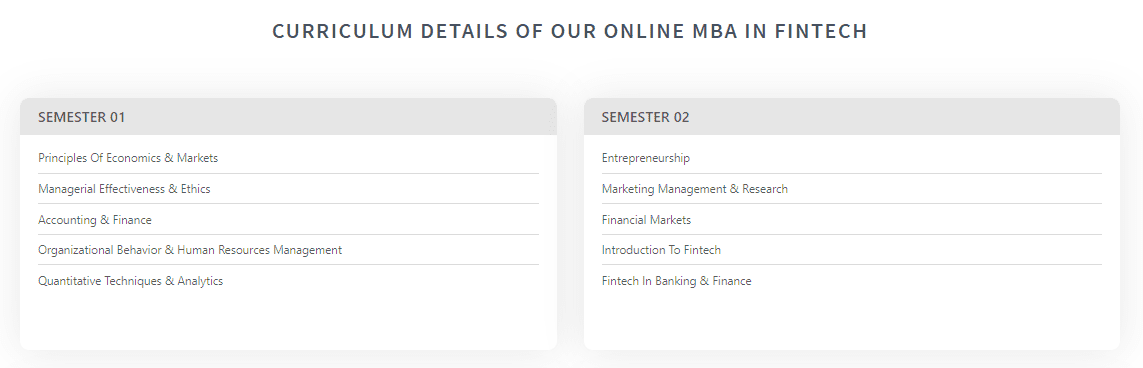

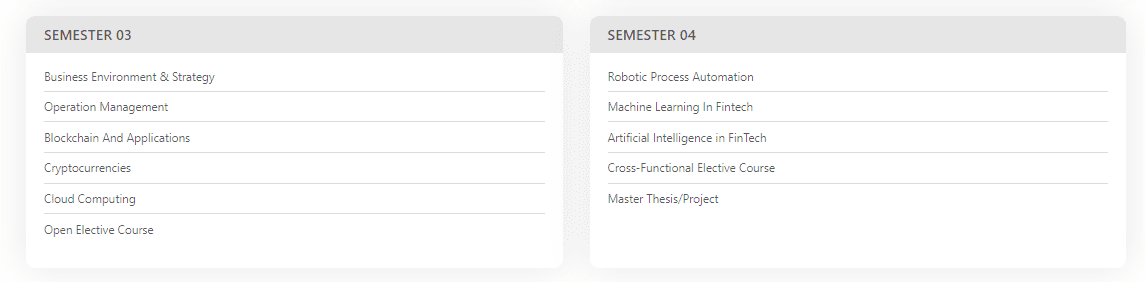

Credit risk management is a popular part of the banking sector today. You can undertake

Credit risk management is a popular part of the banking sector today. You can undertake

Here, we are going to talk about what

Here, we are going to talk about what