Chief Marketing Officers (CMOs) have surpassed traditional marketing roles to become vital players in determining a company’s success in today’s dynamic corporate world.

CMOs are no longer mere brand custodians; they are orchestrators of profound strategies that include brand, product, and service management.

As globalisation remodels marketplaces and client expectations, CMOs must manage emerging roadblocks while fostering growth and preserving brand integrity.

CMOs create and convey brand identities, encourage product innovation, and improve consumer experiences. In the digital era, these tactics are the foundations of a successful, customer-centric organisation. It is now essential to use holistic courses for marketing professionals to upgrade your career.

Join us as we analyse the delicate art of being a CMO in today’s fast-paced, always-connected world, where products, services, and brands converge to create memorable customer experiences and drive company success. Keep reading to learn more.

Who is a CMO?

A CMO is more than a title; it represents a dynamic individual crucial in driving a company’s marketing efforts.

A CMO’s top priority is to protect a company’s brand. They are in charge of creating and upholding the brand’s identity, assuring that it connects with its desired demographic. This includes not just identifying the brand’s values but also ensuring that they are portrayed uniformly across all touchpoints.

A Chief Marketing Officer is also the principal creator of marketing initiatives. They are responsible for generating growth by finding market opportunities, analysing consumer patterns, and crafting innovative marketing strategies. They plan new products, price tactics, and marketing communications to pique the market’s interest and loyalty.

Finally, a CMO is an executive, collaborator, and visionary who traverses the challenges of modern marketing while pertaining them to broader corporate objectives. They are more than simply marketers; they are the engine that propels a business to thrive in an exigent and ever-changing environment.

Roles of CMOs in the Global Market

CMOs serve as vital leaders, planners, and evangelists of culture who help their organisations prosper in diversified and tricky global marketplaces. Their responsibilities include both planning and tactical execution, rendering them invaluable assets in the quest for global company success.

– Global Market Strategist

To navigate, contend, and prosper in foreign markets, CMOs must establish a comprehensive strategy. This entails conducting market analysis, identifying possibilities and obstacles, and developing market-specific strategies.

– Brand Custodian

CMOs are at the forefront of safeguarding and advocating the brand’s image internationally. This involves preserving brand consistency, cultural sensitivity, and brand reputation management.

– Cultural Ambassador

To ensure that marketing messages resonate effectively, CMOs must grasp the cultural minutiae of diverse markets. Linguistic problems, cultural allusions, and local customs are all part of this.

– Regulatory Compliance Navigator

Operating in overseas markets necessitates adherence to a variety of rules. CMOs ensure that marketing initiatives adhere to international guidelines and standards.

– Global Trend Tracker

CMOs keep attuned to global trends and market movements, ensuring that their organisations remain agile and adaptive in the face of evolving market conditions.

What is Brand, Product and Service Management?

The cornerstone upon which organisations grow is brand, product, and service management. They have a noticeable effect on how people view your company, interact with your products, and eventually become advocates or adversaries. Understanding and mastering these aspects promotes development, client retention, and sustainable growth, making them critical components of every business plan.

A brand is not merely a logo or a boisterous phrase; it is the essence of a business. Brand management includes developing and maintaining a brand’s identity, values, and perception. It all comes down to identifying what your company stands for and constantly delivering on that promise. Successful brand management creates consumer loyalty and distinguishes your company in a cluttered marketplace.

Products are tangible answers that meet the requirements and wants of customers. Identifying market opportunities, creating novel offers, and shepherding them through the product lifecycle are all part of effective product management. Pricing tactics, feature prioritisation, and product launch campaigns are all used to entice and keep consumers.

Service is an intangible component that improves the consumer experience. It includes everything from customer service to post-purchase interactions. Service management provides exemplary client experiences, responding quickly to grievances, and continually improving the service quality. Customers who receive exceptional service are more likely to become loyal supporters of the brand.

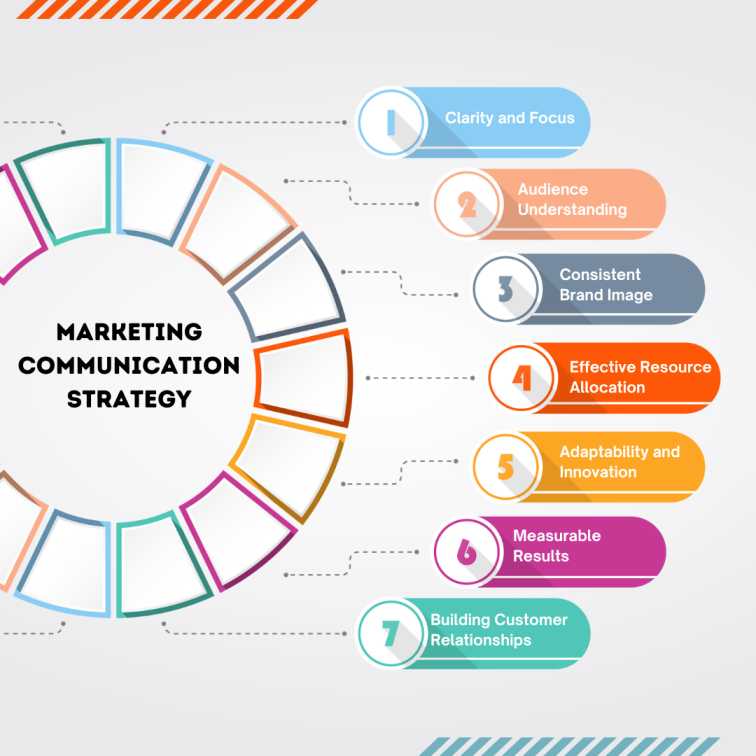

Strategies to Build a Compelling Brand Management Image

Building a potent brand image for your organisation might seem strenuous at first. Here are some strategies that will help you grow your brand.

1) Knowing the audience

Understanding your audience is vital for developing an engaging brand management strategy.

Start by performing extensive market research to determine their wants, preferences, and issues. Customise your messaging and branding to reflect their beliefs and objectives. Communication congruence across all touchpoints, from your website to social media, is paramount.

To establish trust, maintain openness, participate in honest storytelling, and aggressively seek and act on consumer feedback. Finally, a well-defined brand image that caters to the aspirations of your target audience will generate loyalty and development.

2) Deciding brand objectives

Developing brand objectives is essential for creating a compelling brand management image. These goals act as strategic pillars, leading the brand toward differentiation and resonance.

They include objectives like increasing brand awareness, fostering consumer loyalty, and guaranteeing consistent communication. By aligning tactics with these goals, a captivating brand image emerges, attracting and maintaining customers while leaving a long-lasting impression in the market.

3) Setting the brand apart from the competition

Employ distinctive brand management tactics to differentiate your brand from the competition. Make a point of emphasising different brand values, visuals, and messages.

Use innovative promotional activities, narratives, and visual elements. Customers will remember and approve of your brand if you are consistent and tangible.

4) Improving consistency

Increasing brand consistency requires creating and following a defined set of brand rules. This involves keeping consistent communication, graphic elements, and consumer interactions across all touchpoints.

Effective brand consistency builds trust, recognition, and an appealing corporate image that connects with your target audience, eventually creating long-term success.

5) Having an economic connection

Building a compelling brand management image requires establishing economic linkages through collaborative efforts, cost-effective production, and consumer value propositions.

Brands may transmit trustworthiness and create consumer loyalty by ensuring financial stability, sustainable growth, and affordability, reinforcing their favourable market reputation.

6) Being innovative and adaptive

Key brand management tactics include innovation and adaptation. Accept change, encourage creativity, and keep up with market trends.

Create an engaging image that speaks to your target audience, presenting your business as forward-thinking and attentive to their requirements.

Keep your brand up-to-date as it will thrive in a dynamic market. CMOs must ensure that they adapt to various popular digital marketing channels in this digital era.

7) Measuring and monitoring

By tracking performance, consumer input, and market changes, these methods ensure an engaging brand image.

In the modern marketplace, consistent evaluation and adaptation are critical to maintaining a strong and compelling brand presence.

8) Having a proper employee alignment

A great brand image is dependent on efficient employee alignment. Aligning employees with the brand’s values and endeavours enables unified communications and interaction for customers.

Employees and brand strategy working together foster loyalty and confidence, eventually forming an enticing management image that resonates with stakeholders as well as clients.

Brand Management Case Study

Nestlé’s revamp of the “Maggi” brand is one of the famous brand management success stories in India.

Maggi experienced a significant crisis in 2015 when the Food Safety and Standards Authority of India (FSSAI) banned it because of suspicions of high lead content. Nestlé reacted quickly by withdrawing all Maggi products from the market, completing thorough quality testing, and keeping an open dialogue with consumers. Nestlé reestablished trust and relaunched Maggi with its “Trust, Quality, and Nutrition” campaign, soon regaining its leading market position.

This case study highlights the significance of crisis management, transparency, and consumer-centric initiatives in brand management.

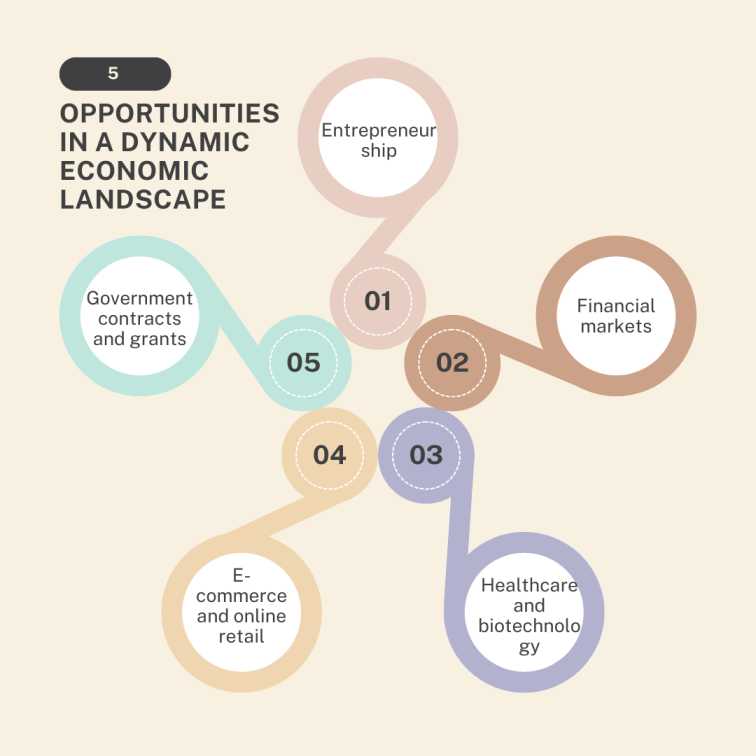

Product Management Strategies

Product management strategies are critical for designing, releasing, and managing goods successfully in a competitive market. Product managers can use the following essential strategies:

1) Product development and life cycle management

Product development and life cycle management are essential product management techniques. Product managers supervise a product’s development and oversee its complete life cycle, from concept to market.

This comprises brainstorming, designing, developing, launching, growing, and eventually retiring. Effective management ensures that the product remains competitive, matches consumer demands, and maximises profitability throughout its life cycle, ensuring its market relevance and value.

2) Pricing strategies

Pricing techniques in product management are critical in determining a product’s success. Pricing strategies such as value-driven pricing, price penetration, and flexible pricing can all have an impact on market positioning and profitability.

Product managers can optimise revenue, sustain growth, and improve the total product lifecycle by integrating pricing with customer value and competitive landscapes, assuring an innovative and viable approach to product management.

3) Promotion portfolio optimisation

In product management, promotion portfolio optimisation is allocating resources strategically to multiple advertising and promotional channels depending on performance and ROI.

Companies can maximise their marketing efficacy, reach target audiences seamlessly, and obtain higher returns on advertising expenses by analysing data and directing investments on important channels.

This approach guarantees that promotional activities are in compliance with overall organisational goals and have the greatest possible impact for the budgeted amount.

4) Omni channel marketing

A powerful product management method, omni-channel marketing effortlessly connects numerous channels—online, offline, and mobile—to create a single and consistent consumer experience.

This strategy improves consumer engagement, builds brand loyalty, and increases sales prospects. Businesses can reach their intended demographic proactively, react to changing buyer patterns, and optimise their entire product management strategy for long-term success by integrating marketing activities across different touchpoints.

5) Competitive analysis

Competitive analysis is an essential product management strategy. Product managers acquire insights on differentiating and strengthening their offers by attentively examining rivals’ goods, tactics, and market positioning.

This method aids in the identification of opportunities, the prediction of market trends, and the refinement of product features, pricing, and marketing. Ultimately, competition research drives data-driven decisions, allowing goods to remain competitive, pertinent, and customer-focused in a volatile market setting.

Product Management Case Study

The success of “Ola,” a ride-sharing platform, is a remarkable case study in product management in India. Ola transformed the traditional taxi business by providing a straightforward mobile application that allowed consumers to easily book trips.

Their product strategy stressed price, usability, and convenience. Ola collected customer feedback and reaffirmed its app features over time, introducing choices such as multiple car kinds, in-app payments, and safety measures.

Ola quickly gained popularity by customising its products to the Indian market’s distinct demands and constraints, including varied payment methods and traffic circumstances.

Service Management Strategies

Service management methods are vital for service organisations as they assist in optimising performance, improving consumer satisfaction, and boosting overall productivity. Here are some of the most important service management strategies:

– Understanding the service landscape

A thorough understanding of the service landscape is essential for developing efficient service management strategies. This includes configuring the service ecosystem, identifying pain points, and understanding consumer relationships.

Service managers may design plans to improve service quality, streamline procedures, and optimise consumer experiences by analysing these data, eventually increasing business profitability and client satisfaction.

– Identifying the procedures of service dependencies

Identifying notable service dependencies is an aspect of service management strategies. This involves diagramming the linkages and interactions between different services in a system.

Understanding these dependencies allows organisations to properly prioritise and manage services, assuring uninterrupted operations and rapid problem response, and ultimately improving service quality and reliability.

– Looking after content marketing strategies

Content marketing management correlates to service management. It necessitates a systematic approach to content development, creation, and distribution that is aligned with consumer demands and corporate objectives.

Effective content strategies involve establishing objectives, tracking performance, and responding to changing market circumstances. Content marketing methods, like service management, strive to provide value and create long-term client connections.

– Incorporating KPIs

It is critical to use Key Performance Indicators (KPIs) in service oversight methods. KPIs provide measurable criteria for evaluating service quality, efficacy, and client retention.

Organisations continuously evaluate, analyse, and optimise their service delivery by aligning KPIs with strategic goals, resulting in improved performance, cost-efficiency, and the capacity to satisfy and surpass customer expectations.

– Using data analytics for marketing insights

Implementing data analytics to garner marketing insights is an effective service management method. It allows companies to examine client behaviour, preferences, and market trends.

These insights drive customised marketing efforts, personalised services, and other initiatives that improve customer happiness and drive corporate development while optimising resource allocation and efficiency.

Service Management Case Study

The revamping of the Indian Railways is a significant case study in service leadership in India. The government began a major makeover in response to various difficulties such as ageing infrastructure, ineffective operations, and consumer unhappiness.

The installation of computerised ticketing systems, increased passenger facilities, and rigorous timeliness standards improved the customer experience dramatically. In addition, the use of information analytics and IoT technology enabled predictive maintenance, which reduced service disruptions.

Indian Railways diversified its services to increase income by establishing luxury trains such as the “Palace on Wheels” and “Maharajas’ Express,” which appeal to high-end travellers. This diversity drew foreign visitors and contributed to the economic prosperity of the places they passed through.

The Indian Railways transformed a decrepit infrastructure into a symbol of excellence, creativity, and customer service via strategic service management, establishing a wonderful example for service sectors across the country.

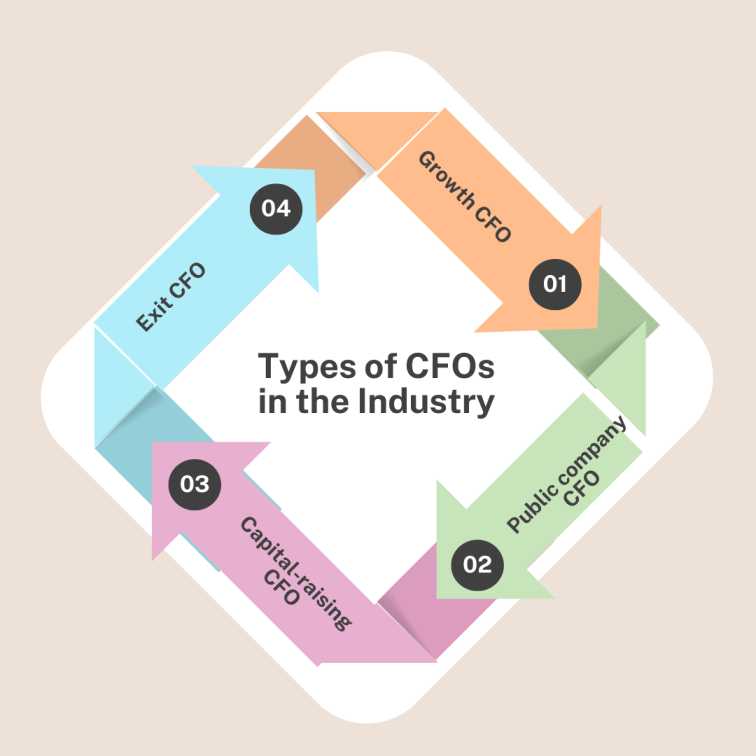

Conclusion

Effective brand, product, and service management tactics must be tackled for CMOs to effectively traverse today’s changing marketplace. CMOs can generate strong brand equity, encourage consumer loyalty, and promote long-term viability by emphasising brand authenticity, creative product development, and great customer service.

The goal is to remain malleable, leverage data-driven insights, and react to changing customer preferences. CMOs that adopt these methods will, ultimately, not just thrive but flourish in a perpetually shifting business environment, positioning their organisations for future prosperity and relevance.

Wondering which courses for marketing professionals would help you become a successful CMO? Check out Imarticus Learning’s Post Graduate Certificate Programme for Emerging Chief Marketing Officers with IIM Indore.

This course would help you decode your way to becoming a new-age CFO.

If you want to know more about their digital marketing course and study digital marketing, check out the website right away.