Starting an FRM certification gives you the technical skills and professional recognition you require to excel in today’s fast-paced financial environment.

Whether you must expand your analytical arsenal or gain senior positions in risk management, this certification can unlock international career doors and refine your competitive advantage.

What Is an FRM Course?

An FRM certification is a structured course of study that helps upgrade your understanding of market, credit, operational and liquidity risks.

It equips the candidates with the skills to write the challenging two-part FRM exam of the Global Association of Risk Professionals (GARP).

- Learning quantitative analysis in detail and the financial markets

- Simulation exercises and case studies using real-life examples

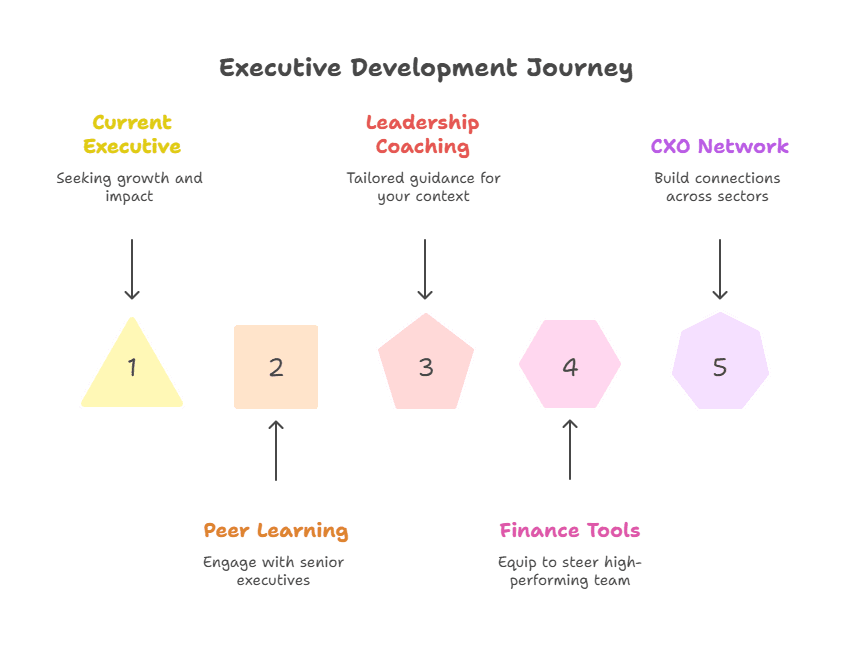

- Membership in an alumni network of risk professionals around the world

Why Get a Financial Risk Management Certification?

A Financial risk management qualification is universally accepted as proof of your expertise. You join an elite group-more than 90,000 professionals across more than 190 countries-with one qualification in common. International recognition means you are an even more desirable candidate for bank employers, asset managers, consultancies and regulators.

In addition, FRM certification indicates that you are committed to industry best practices, and this will get you stand out in a competitive career marketplace where employers go out of their way to seek excellent risk-management job prospects.

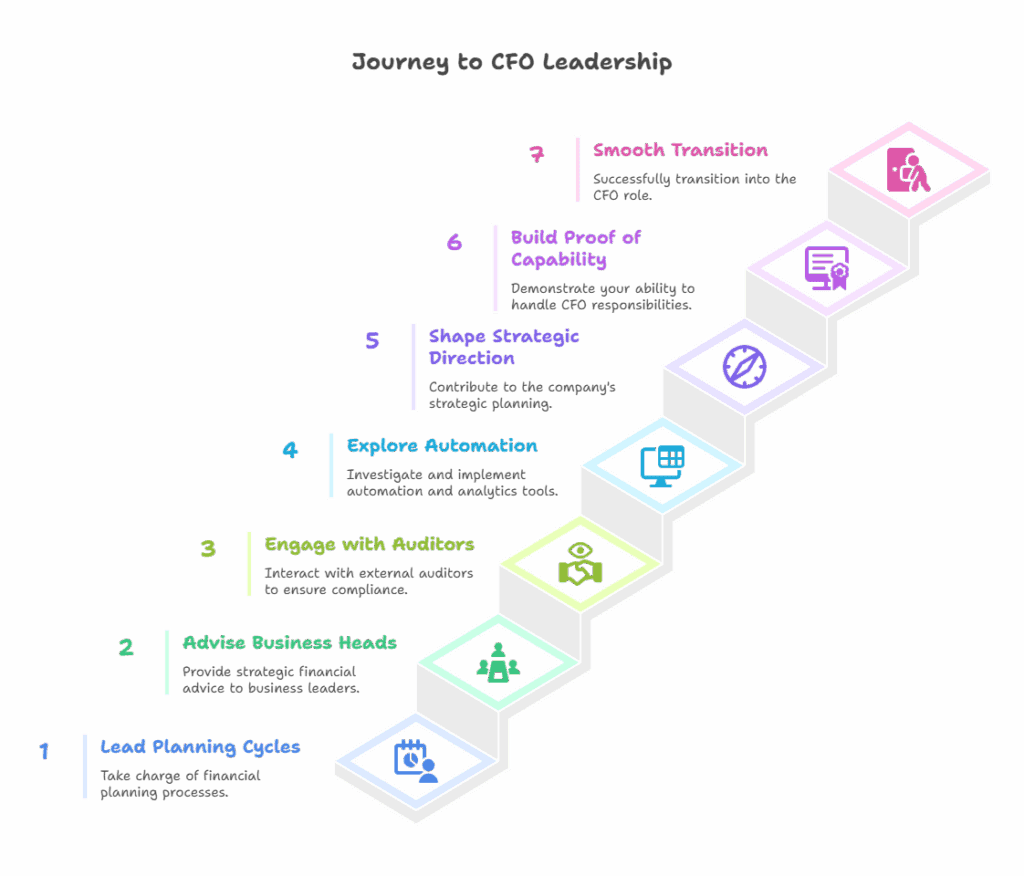

Access Global Risk Manager Skills

Through challenging coursework and exam preparation, you’ll gain global risk manager skills such as:

- Advanced quantitative analysis

- Valuation and risk modelling

- Integrated credit and market risk assessment

- Effective risk communication and governance

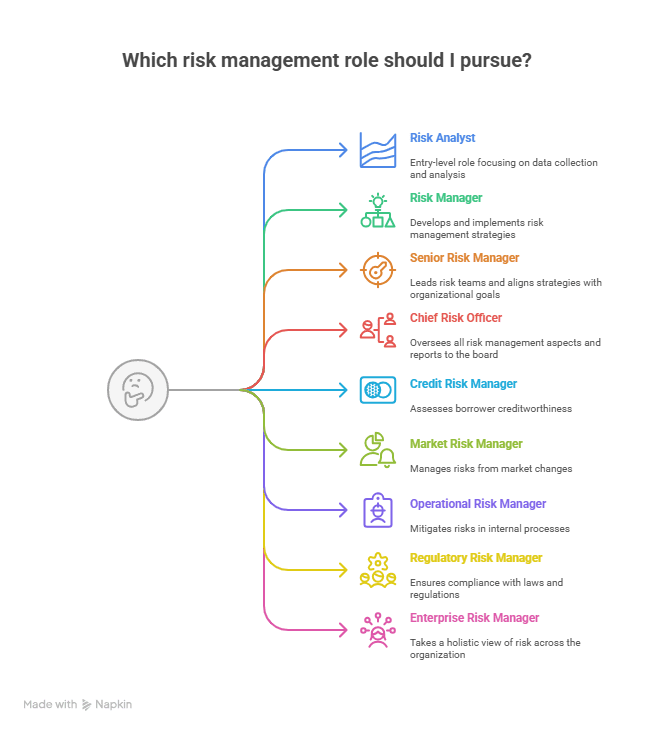

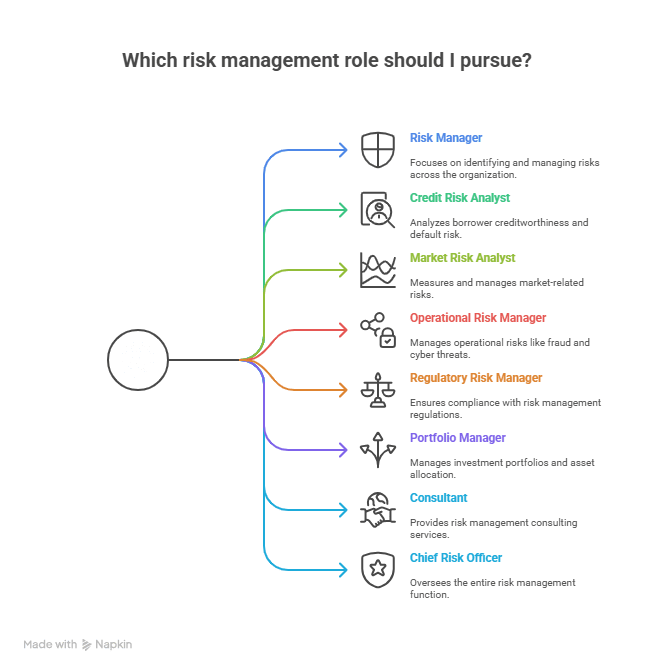

Discover FRM Career Opportunities

FRM certification presents diversified FRM career opportunities in the areas of:

- Credit risk analysis

- Market risk management

- Operational risk and compliance

- Portfolio management and advisory roles

Get Complete Risk Management Training

Your Risk management learning is not limited to books. Classes have live simulations, group projects and exposure to industry software, thus enabling you to implement theory on practical grounds in real scenarios.

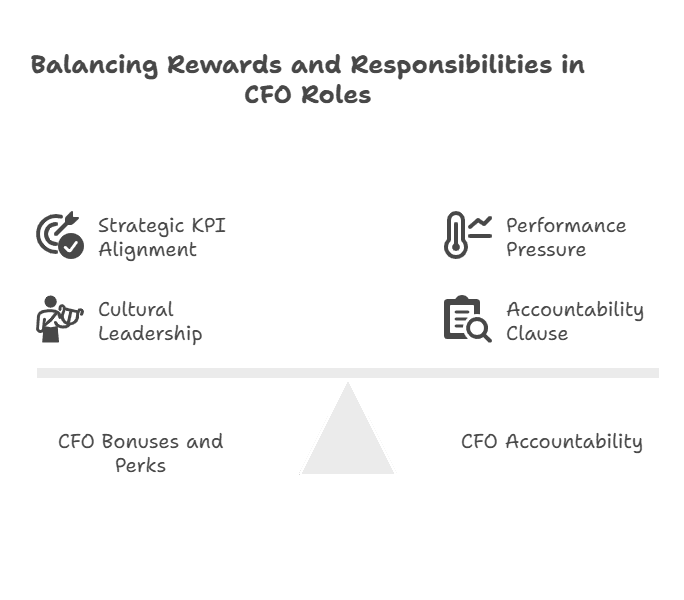

Realise the Advantages of FRM Certification

After taking the FRM course and achieving the certification, you:

- Enhance your employer attractiveness with hiring managers

- Potentially boost your salary by 20–30%

- Become a member of a network of seasoned practitioners

- Gain access to GARP-exclusive resources and events

- Distinct Perspective: Immersive Simulation and Networking

Unlike in most other courses, top FRM courses also have simulation labs in which you solve challenging risk problems. This practical training prepares you for being forced to make decisions under duress and building rapport with other students and mentors worldwide. FRM registrant levels grew at a compound annual rate of 29% over the past eight years, and this attests to industry demand for such practical training.

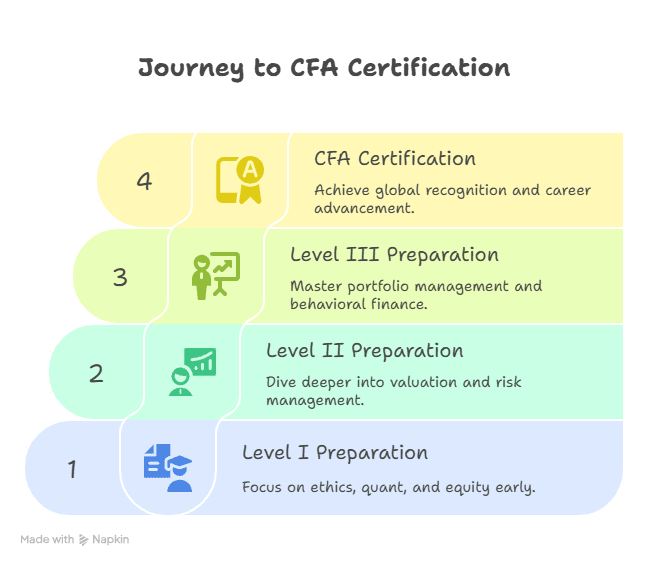

FRM Part I vs Part II: Brief Comparison

| Facet | FRM Part I | FRM Part II |

| Emphasis | Risk foundations and quantitative analysis | Application of risk management concepts |

| Questions | 100 multiple-choice | 80 multiple-choice |

| Time | 4 hours | 4 hours |

| Standard Fee | USD 800 | USD 800 |

| Enrollment Fee | One-time USD 400 (first-time candidates) | None if already paid at Part I |

| Approx. Pass Rate | 55–56% (latest cycles) | 51–53% (latest cycles) |

Who Provides the Best FRM Course?

An easy pick is Imarticus Learning’s FRM Certification Course. They combine experienced faculty, global case studies and flexible learning models to equip you for both exams and workplace challenges.

Frequently Asked Questions

What are the prerequisites?

A bachelor’s degree or relevant professional experience in finance, maths or economics.

How long will it take?

Most complete both parts within 1–2 years.

What is the enrollment fee?

One USD 400 payment and exam registration fees.

Do I have to study online?

Most offer live and self-study online modules.

How is the exam structured?

Two 4-hour exams, each consisting of multiple-choice questions.

Do I need work experience?

Yes, two years of relevant risk management experience before certification.

Which languages are supported?

English only for exams, though study materials are in a number of languages.

How often are exams administered?

May, August and November.

Are refresher courses offered?

Yes, continuing professional development is provided by GARP and third parties.

What is the global recognition?

Accepted in more than 190 countries, increasing your global mobility.

Conclusion

Taking an FRM course provides unmatched professional development and international recognition in the field of risk management in more than 190 countries.

Here are your three takeaways:

- Credibility: Be excellent with a GARP-approved credential.

- Skill Mastery: Enrol in master risk-management education and practical exposure.

- Career Advancement: Earn varied career prospects and robust global networks.

Ready to transform your career? Enrol now with Imarticus Learning’s FRM Certification Course and become a global risk-management leader.