When you look at the CFA course in Bangalore, one thing becomes clear: this isn’t just India’s tech capital anymore – it’s evolving into a powerhouse for fintech, investment banking, asset management, and global finance roles that blend technology with finance.

Bangalore doesn’t limit CFA to classroom theory; it embraces it as a live credential. One that powers real decisions in Whitefield’s MNCs and Koramangala’s startups. This unique blend shapes how candidates prepare, where they study, and the seamless career leaps that follow each level.

That’s why pursuing CFA in Bangalore changes everything. Far from a two-year career break or pause for a full-time degree, CFA runs alongside your job, market shifts, and daily hustles. In Bangalore’s dynamic ecosystem, right from fintech valuations at Electronic City to portfolio strategies in Indiranagar.

In a city where careers move fast, and competition moves faster, choosing the right qualification isn’t optional anymore. It’s strategic. CFA fits in perfectly, offering credible growth without requiring you to quit your job.

It is like upgrading your phone while you’re still using it. You update it, and suddenly things feel faster, smoother, and more efficient. That’s exactly how CFA works in Bangalore. You don’t step out of your career to pursue CFA here. You grow inside it.

Many people chase the CFA course in Bangalore as a quick badge. In reality, it works like a compounding engine. Small, consistent gains first. Then momentum. Then mastery. You won’t become a chartered overnight – instead, the subtle wins will emerge. These shifts quietly open doors to fintech analyst roles, research roles, or advisory spots in Bangalore’s booming job market, where clear minds under pressure win big.

I’ll walk you through fees, classes, exam centres, job opportunities, and salaries so that you can step into the CFA course in Bangalore with clarity and confidence.

Did You Know?

Bangalore is one of the few Indian cities where CFA candidates get exposure to both traditional finance roles and fintech-driven finance at the same time. This combination makes your CFA learning far more practical and industry-relevant.

Why CFA Thrives in Bangalore

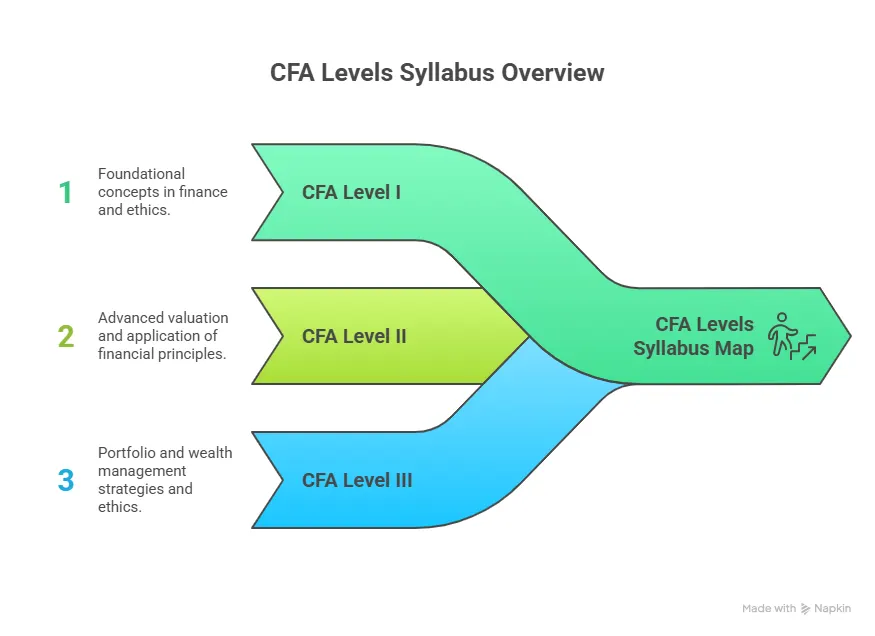

Before I dive into fees, classes, and everything else, I’ll quickly explain the most asked question: what is CFA? It is the global gold standard that equips you with investment analysis skills through its three progressive levels.

The CFA program is all about discipline, long-term thinking, and that global finance edge – honestly, Bangalore runs on the same philosophy. It’s not just code and startups here anymore; Bangalore offers:

- MNCs

- Fintech unicorns

- Global banks

- Investment firms in Whitefield, Koramangala, and Electronic City.

What you study in CFA doesn’t remain in textbooks – it jumps straight into real life. Suddenly, you’re spotting valuation models in fintech pitches, ethics dilemmas in boardroom chats, and portfolio strategies during morning standup calls. Reports start making sense faster. Team debates sharpen with data-backed reasoning. Guesswork fades into structured thinking.

That’s what makes CFA in Bangalore worth the hype for anyone serious about finance. Whether you’re a fresh graduate eyeing analyst roles or a working professional ready to level up, the city’s ecosystem turns theory into real-life use cases. No wonder “CFA Bangalore” is always searched – it’s where global credential meets local hustle, and your preparation feels alive from day one.

Now that we have covered the CFA course details, you can clearly see how this global qualification transforms into a powerful, practical advantage within Bangalore’s fast-moving and opportunity-rich finance ecosystem.

Lesser-Known Fact:

Many CFA candidates in Bangalore start applying concepts from Level 1 and Level 2 directly at work, even before clearing the exams. That early application is what gives Bangalore CFA aspirants a sharper edge in interviews.

What is the CFA Course in Bangalore?

At its core, the CFA course in Bangalore is the same globally respected CFA program offered worldwide by the CFA Institute. It consists of three levels, with one goal: To shape you into a skilled investment professional with deep knowledge of finance, ethics, portfolio management, valuation, and risk.

But in Bangalore, it feels different. Here, the CFA certification is not just a qualification you study for. It becomes something you use while you’re studying.

You’re learning:

- Equity valuation while fintech companies pitch funding rounds.

- Risk management while global banks operate compliance teams.

- Portfolio strategies while asset managers rebalance funds.

- That’s what makes CFA in Bangalore powerful. You’re not waiting for the future to apply it. You’re already living it.

Why is the CFA Course in Bangalore Popular

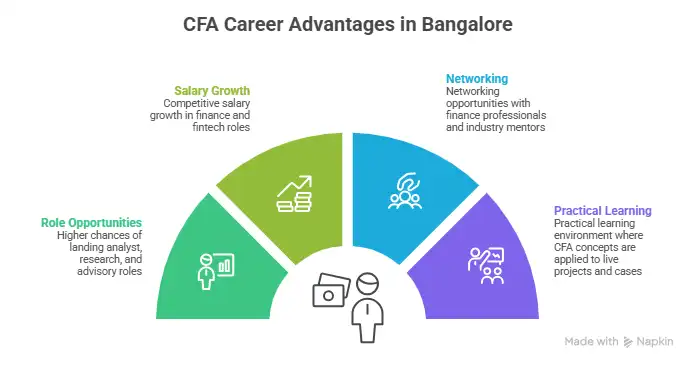

Bangalore offers three things that aspirants need to shine and excel in their CFA career:

| Key Advantage | What It Means for You |

| Industry Exposure | Hands-on relevance across fintech, investment banking, consulting, asset management, private equity, and venture capital roles |

| Flexible Learning | Multiple learning formats, including classroom, online, weekend batches, and hybrid models, to fit your schedule |

| Career Continuity | You don’t have to quit your job to pursue CFA. You grow within your career while preparing for the exam |

People don’t just search “CFA course in Bangalore” randomly. They search for it because they want real finance roles, global exposure, and career acceleration without pressing pause, and they clearly understand the long-term CFA benefits that come with building a globally respected finance credential.

Smart Insight:

CFA is not treated as a “future qualification.” It becomes a present skillset. You start thinking like an analyst long before you become one.

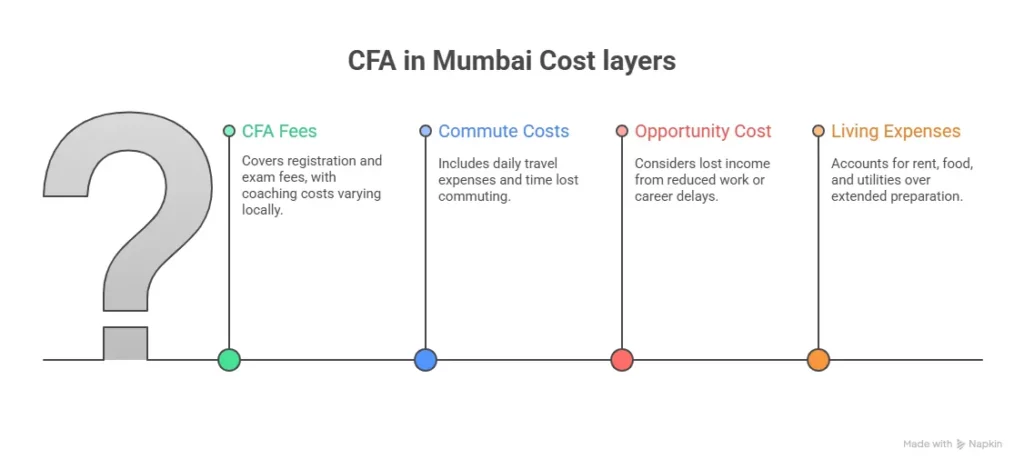

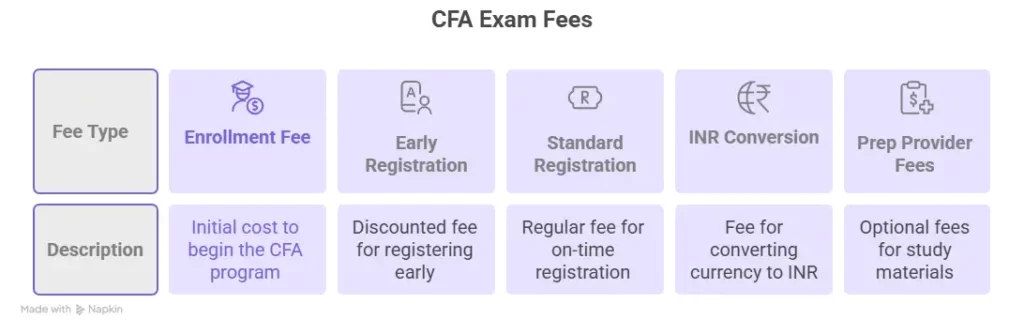

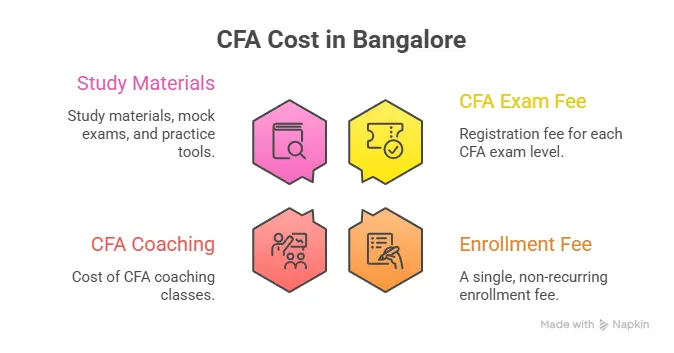

Understanding CFA Course Fees in Bangalore

Another practical reason why the CFA course in Bangalore is a smart move is financial clarity. The CFA course fees involve different costs: registration fees, exam fees, coaching fees, and study materials. The real advantage is transparency. The CFA training institute in Bangalore usually breaks everything down clearly.

| Cost Component | What It Covers | Price Range |

| CFA Course Fees in Bangalore | Complete CFA program cost, including all three levels, CFA Institute registration, exams, coaching, and basic study support | ₹ 2.5 – 4 Lakhs |

| CFA Coaching Fees in Bangalore | Classroom or online training per level with faculty sessions, mock tests, and doubt-clearing | ₹ 70,000 – 1.2 Lakhs per level |

| CFA Books & Study Material in Bangalore | CFA curriculum, Kaplan/Schweser notes, question banks, and mock exams | ₹ 10,000 – 25,000 per level |

This transparency helps you plan better. You know what you are paying today and what you might need to budget for later. There are fewer surprises and more control.

You know:

- What’s exam-related

- What’s coaching-related

- What’s optional

- What’s mandatory

When you see your CFA course fees this way, it stops feeling like an expense and starts feeling like a structured investment. And when you know where your money is going, the investment feels meaningful. You’re not just paying fees. You’re building a long-term career foundation.

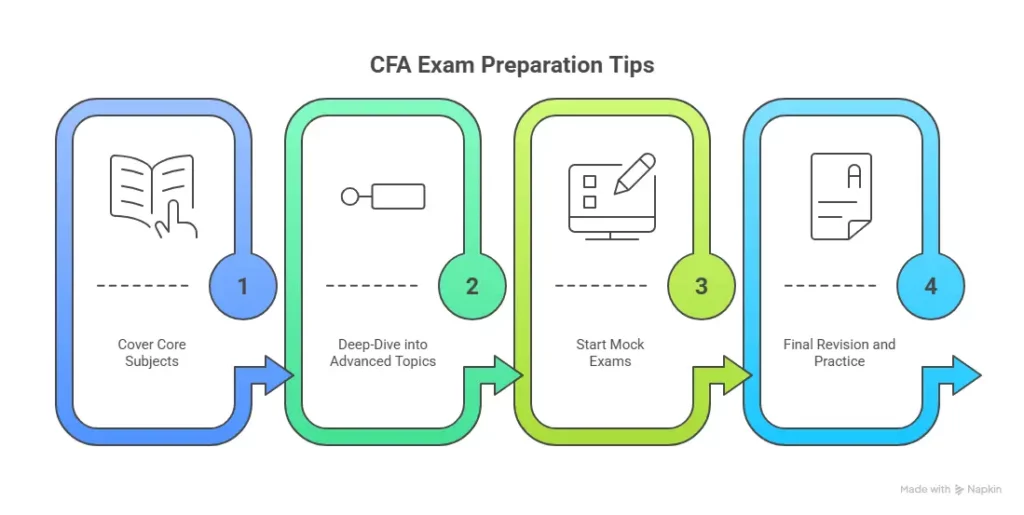

If you are wondering how to clear the CFA Level 1? Here’s a simple step-by-step guide that shows you exactly how to prepare the right way:

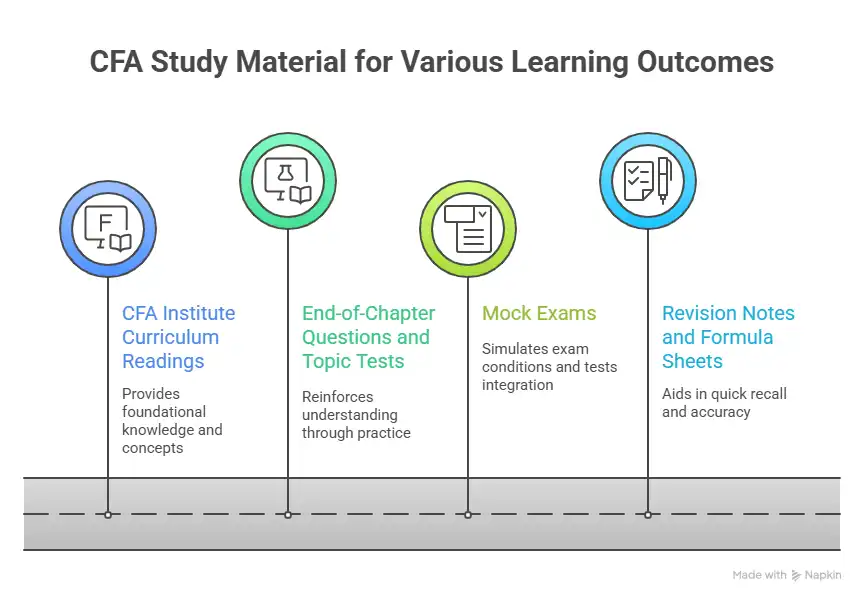

Strong Ecosystem of CFA Coaching in Bangalore

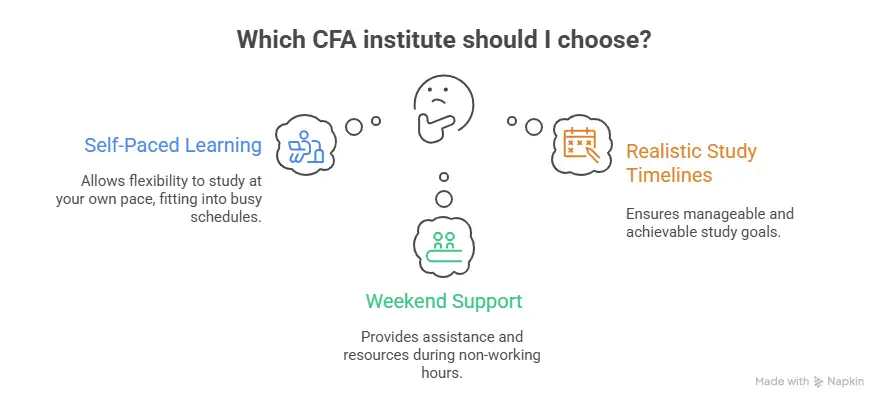

The city isn’t short on options, but what makes it special is the quality and seriousness of its CFA ecosystem. You’ll find some of the most structured and outcome-driven CFA coaching centres in Bangalore, backed by experienced faculty and industry-aligned teaching. From reputed CFA training institutes in Bangalore to flexible CFA coaching classes in Bangalore, the focus goes beyond just completing the CFA course syllabus. It’s about preparing you for real-world finance roles.

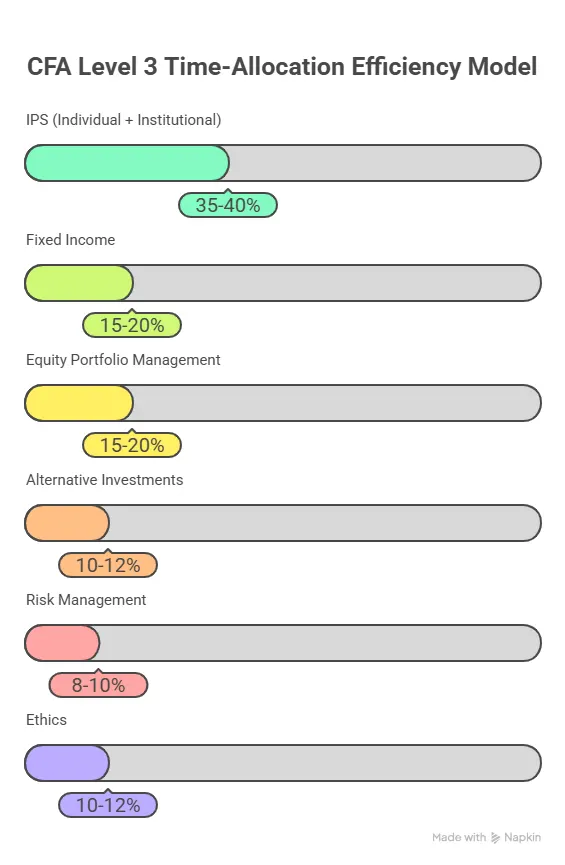

What makes learning here practical is the flexibility and support built around your routine. There are weekend batches for working professionals, dedicated CFA Level 1 coaching in Bangalore for beginners who need a strong foundation, and focused mentorship for CFA Level 2 and CFA Level 3 candidates who are already thinking like professionals. Add to that mock exams that mirror real testing pressure, and your preparation feels close to the actual CFA experience.

One of the biggest advantages is the availability of quality CFA coaching in Bangalore. You will find:

- Classroom and online formats.

- Weekday and weekend batches.

- Dedicated CFA Level 1 classes in Bangalore.

- Advanced mentoring for higher levels.

- Mock exams and doubt-solving sessions.

Coaching in Bangalore is not just about teaching. It is about building a complete CFA ecosystem around you. From beginners to working professionals, there is something for everyone. This makes CFA training in Bangalore sustainable. You don’t burn out. You build consistency.

Flexible Learning Through CFA Classes in Bangalore

Whether you’re a full-time student or a working professional looking for the best CFA coaching in Bangalore. Your routine and learning preference differ based on your current CFA levels, where some manage college, some try to figure out time after demanding workdays, and many are finding their rhythm while balancing both.

That’s where CFA classes in Bangalore stand out. You can choose:

- Offline classroom learning

- Live online classes

- Hybrid models

- Recorded sessions for revision

This flexibility makes CFA training in Bangalore practical and sustainable.

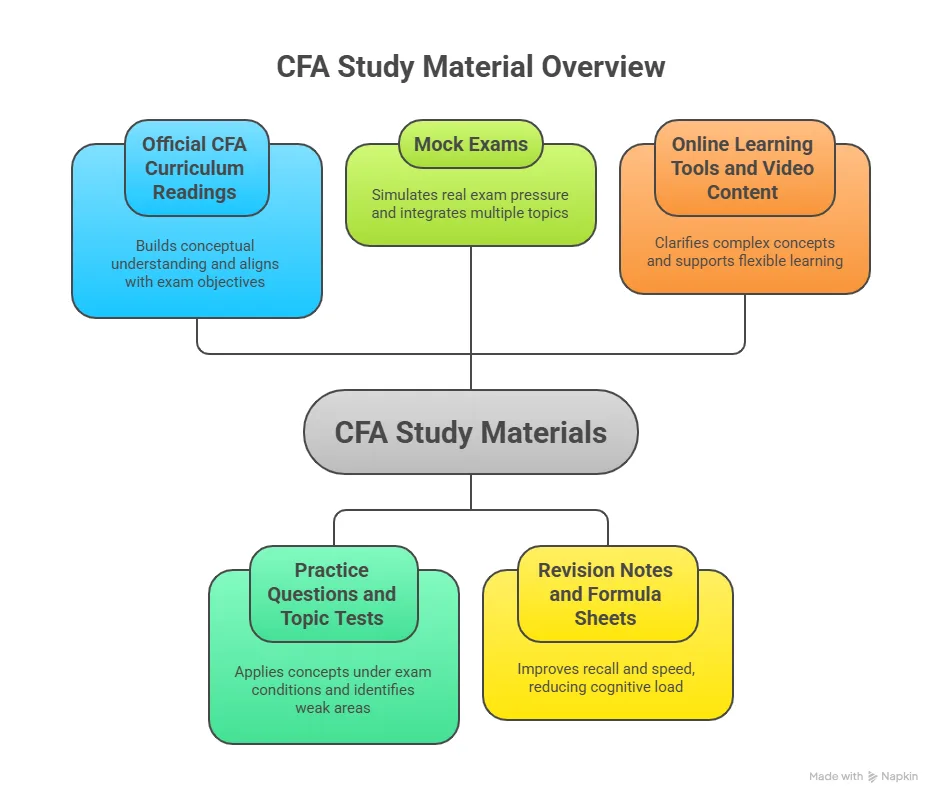

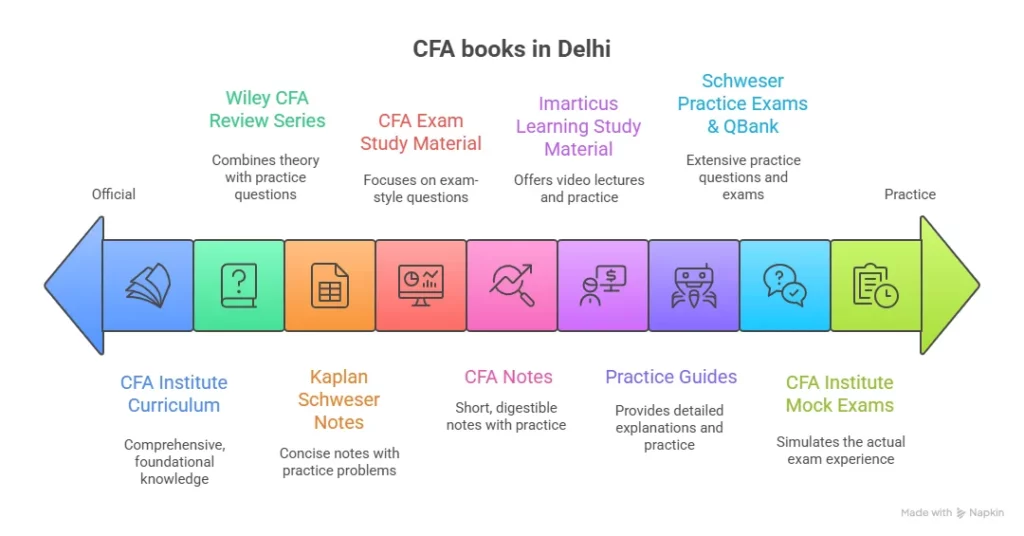

CFA Books and Study Materials in Bangalore

Good preparation starts with good resources. Bangalore gives you easy access to:

- CFA Institute curriculum

- Kaplan / Schweser notes

- Mock exam platforms

- Practice question banks

That’s why students often search for CFA books Bangalore. Everything you need is available without hassle, both online and offline.

Balancing CFA with a full-time job can feel tough, but it’s completely doable with the right routine. This video shows how just 2 focused hours a day can keep you on track without burnout.

CFA Exam Centres in Bangalore

Bangalore also has official CFA exam centres, which takes a huge amount of pressure off your shoulders. When your exam city and your preparation city are the same, planning becomes simpler, and your mindset stays calmer.

That’s why students often search for things like CFA Bangalore test center address. They’re not just looking for a location on Google Maps. They’re looking for certainty. They want to know where they’ll write their exam so they can plan travel, timing, and revision days without last-minute stress.

Writing your CFA exam in the same city where you study makes a real difference. There’s no unfamiliar travel, no hotel bookings, no worrying about traffic patterns in a new place. You already know the routes, the neighbourhoods, and how to reach on time. That familiarity keeps your mind focused on the exam, not on logistics.

CFA exam centre in Bangalore saves you from spending energy managing travel chaos, you spend it on revision, confidence, and clarity. And when you’re walking into one of the most important exams of your career, that calm control matters more than you realise.

Also Read: CPA vs CFA – which is better for your finance career?

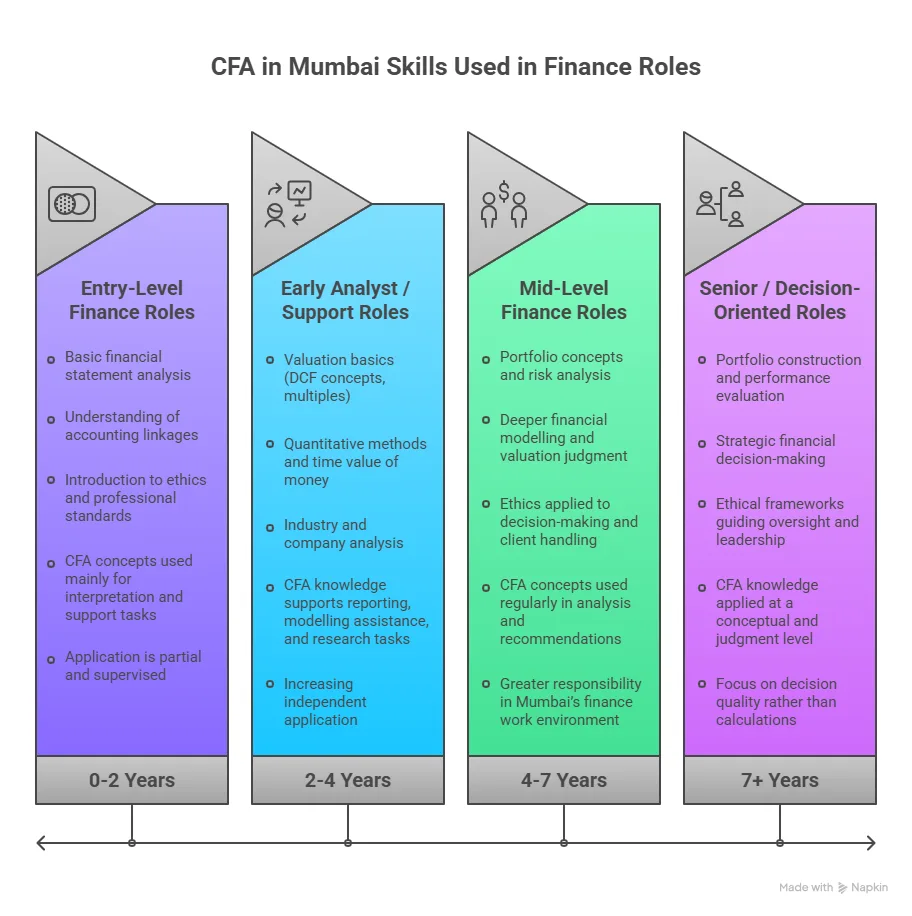

CFA Jobs in Bangalore: Progression by Level

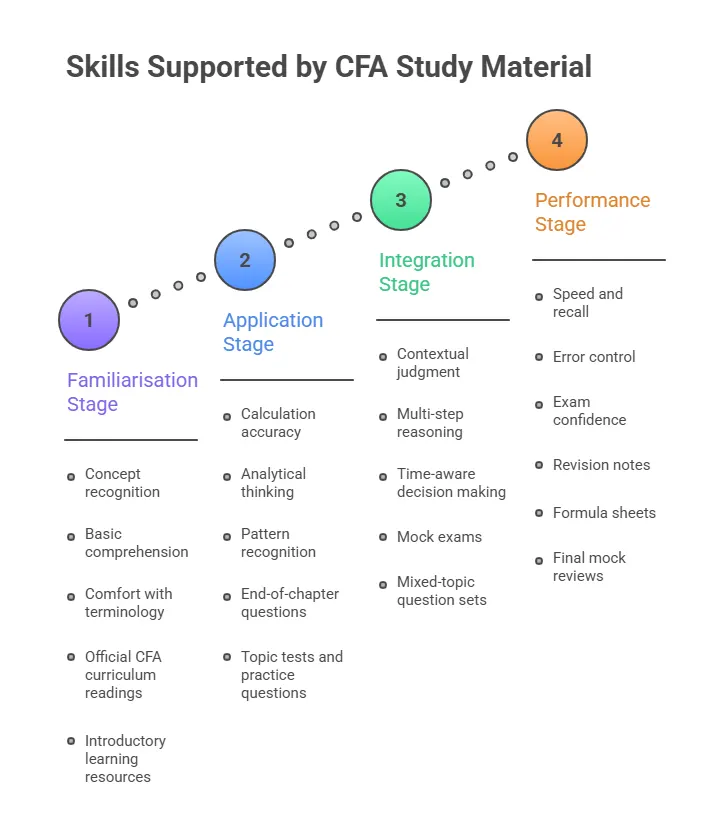

One of the best parts about pursuing the CFA course in Bangalore is that jobs open up even before you become a charterholder. Opportunities start opening up as you move through each level. Your learning immediately begins to translate into employable skills.

After CFA Level 1 Exam, you become comfortable with financial statements, basic valuation, and market concepts. This is where entry doors open. Many candidates start with:

- Junior analyst roles

- Research assistant positions

- Finance and operations roles in banks, fintech companies, and investment firms

These roles help you understand how finance actually works on the ground. You move from theory to application, which builds confidence fast.

After CFA Level 2, things get more specialised. Your analytical depth increases, and companies begin trusting you with higher responsibility:

- Equity research analyst roles

- Valuation and financial modelling positions

- Portfolio and investment support roles

This is the level where CFA starts carrying real weight on your resume. Recruiters know you can handle complexity.

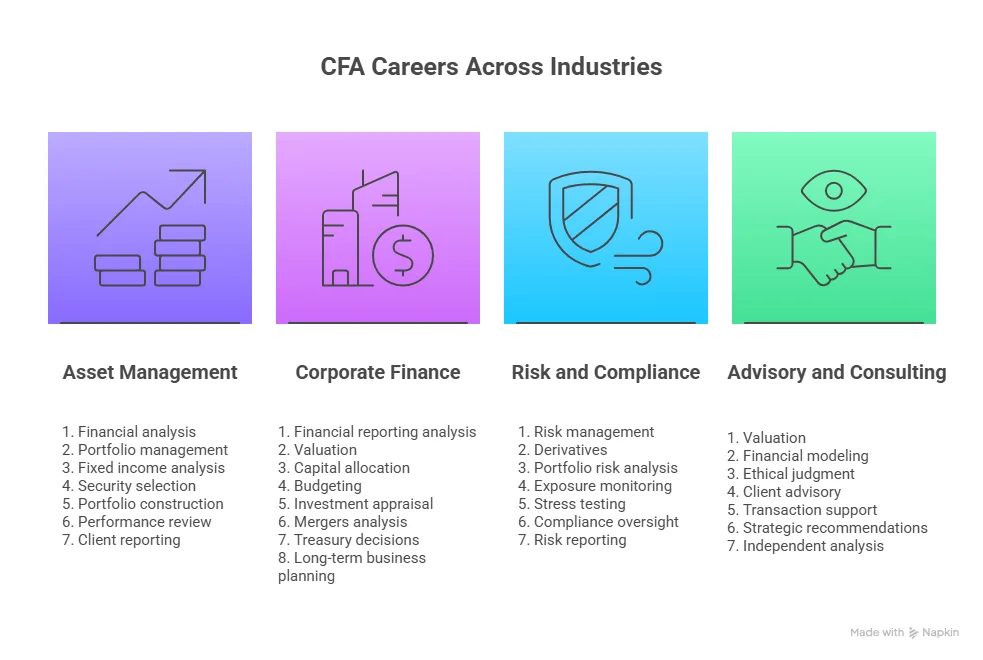

After completing CFA, your profile shifts from learner to expert. You become eligible for:

- Portfolio management tracks

- Investment banking roles

- Asset management positions

- Risk management and strategic finance leadership

That’s why CFA jobs in Bangalore are always in demand. The city continuously needs professionals who can think globally and execute locally.

Did You Know?

Most working professionals in Bangalore pursue CFA specifically because it lets them upgrade their careers without quitting their jobs or taking a career break.

CFA Salary Expectations in Bangalore

Let’s be honest, salary matters. And CFA has a strong reputation for long-term earning power. That’s why I always calculate ROI by looking straight at the earning potential it unlocks for you.

In Bangalore, compensation grows with:

- Your CFA level

- Your years of experience

- Your chosen finance domain

CFA Level 1 candidates usually start in entry-level analyst roles. CFA Level 2 candidates see a noticeable jump. Charterholders enter a different league altogether.

| CFA Level / Profile | Typical Roles | Experience Range | Average Salary Range |

| CFA Level 1 Candidate | Junior Analyst, Research Assistant, Finance Executive | 0 – 2 years | ₹4 – 7 LPA |

| CFA Level 2 Candidate | Equity Research Analyst, Valuation Analyst, Investment Analyst | 2 – 4 years | ₹7 – 12 LPA |

| CFA Charterholder | Portfolio Manager, Senior Analyst, Investment Banker, Risk Manager | 4 – 8+ years | ₹12 – 25 LPA+ |

| Senior CFA Professionals | Fund Manager, Head of Research, Strategy Lead | 8+ years | ₹25 – 50 LPA+ |

CFA brings career stability, credibility, and steady financial growth. It works like a long-term investment that compounds with time. This long-term potential is also reflected in the CFA salary in India, where professionals with higher levels and experience consistently command stronger compensation across finance roles.

Did you know?

When broken down yearly, CFA often costs less than many full-time MBA programs but delivers stronger specialisation in finance roles.

Why Choose Imarticus Learning for the CFA Course in Bangalore?

CFA in Bangalore is not about memorising formulas. It’s about becoming job-ready. This is where Imarticus Learning stands apart.

Imarticus focuses on turning students into finance professionals, not just exam qualifiers. What makes it different:

- Faculty with real industry experience – You learn from people who have worked in banks, consulting firms, and financial institutions. That makes every concept practical.

- Designed for working professionals – Classes fit into real-life schedules. You don’t have to choose between your job and your CFA preparation.

- Mock tests that feel like real exams – You train under pressure, so the real exam feels manageable.

- Resume and interview preparation – Because passing exams is not enough. You need to present yourself well in the job market.

- Career guidance beyond one level – Most institutes stop after Level 1. Imarticus supports your entire CFA journey.

It bridges the gap between CFA theory and actual finance roles. That’s why many students consider it among the best CFA coaching in Bangalore.

FAQs About the CFA Course in Bangalore

By now, you should have a clearer idea of what pursuing the CFA course in Bangalore looks like. Through these frequently asked questions, I’ll clear those last doubts, so you can take your next step with complete confidence.

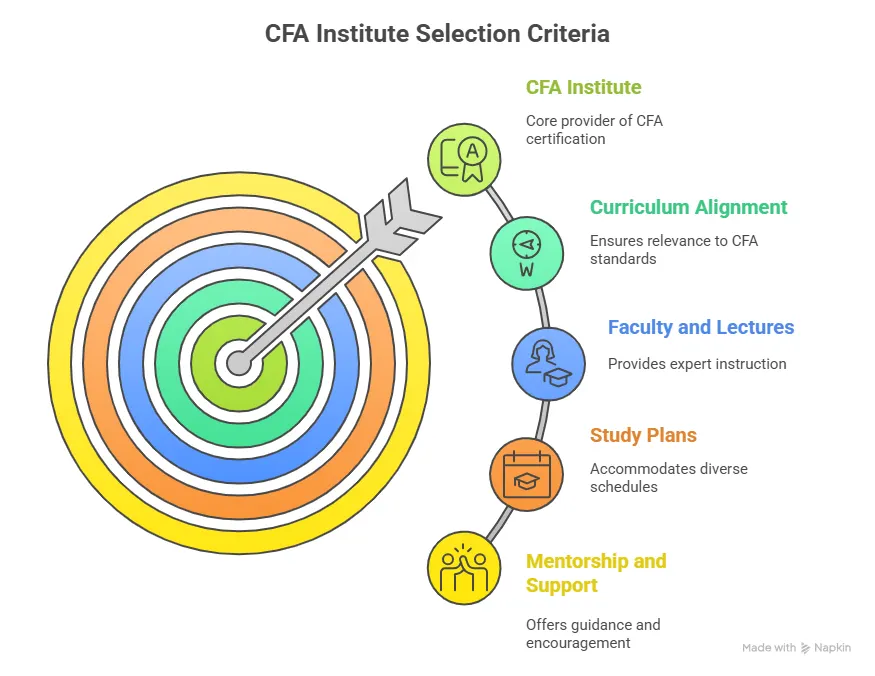

Which is the best CFA institute in Bangalore?

There is no single best institute, but the one that matches your schedule, learning style, and career goals is the ideal choice you can make for effective preparation. Many students prefer Imarticus Learning because it offers industry-driven teaching, flexible batches, strong mock tests, and career support beyond just exam preparation.

What should I look for in a CFA institute in Bangalore?

You should look for experienced faculty, flexible class timings, regular mock exams, doubt-clearing sessions, support with resumes and interviews, and institutes that provide internship and placement opportunities.

Are there CFA colleges in Bangalore?

CFA is a professional certification offered by the CFA Institute and not a college degree. However, many colleges in Bangalore integrate CFA preparation with their commerce, finance, or management programs. This allows students to start preparing for CFA while completing their graduation, saving time and building strong finance skills early in their careers.

What are the typical CFA course fees in Bangalore?

The cost of pursuing the CFA in Bangalore includes more than just the exam itself – you’ll pay for registration, exam fees, coaching fees, and study materials. While the CFA Institute exam fees are standard worldwide, coaching or training fees in Bangalore can vary depending on the institute, batch format, and level. The full CFA journey fees can range between ₹2.5 lakh to ₹4 lakh, which is reasonable when compared to the value it brings in career growth and opportunity.

What kind of roles are available for CFA Level 1 jobs in Bangalore?

After clearing CFA Level 1, you are eligible for entry-level finance roles like Junior Analyst, Research Assistant, Finance Executive, Investment Operations Analyst, and Business Analyst roles. These jobs help you build practical exposure while you continue preparing for higher CFA levels, especially in banks, fintech firms, and investment companies in Bangalore.

What kind of roles are available for CFA Level 2 jobs in Bangalore?

After clearing CFA Level 2, you become suitable for more core finance and analytical roles such as Equity Research Analyst, Valuation Analyst, Investment Analyst, Portfolio Support roles, Risk Analyst, and Credit Analyst. In Bangalore, these opportunities are common across investment firms, asset management companies, consulting firms, banks, and fintech startups, where deeper financial analysis skills are highly valued.

What kind of roles are available for CFA Level 3 jobs in Bangalore?

After clearing CFA Level 3, you become eligible for senior and decision-oriented roles such as Portfolio Manager, Investment Manager, Senior Research Analyst, Wealth Manager, Risk and Strategy Lead, and Fund Management roles. In Bangalore, these positions are common in asset management companies, investment banks, wealth management firms, and global financial institutions where strong portfolio and investment decision skills are highly valued.

What is the typical range for a CFA salary in Bangalore?

CFA salaries in Bangalore grow as you grow. At CFA Level 1, you usually start with entry-level analyst or finance roles. After CFA Level 2, you move into stronger research and valuation positions with better pay. Once you become a CFA charterholder, you step into senior roles like portfolio management, investment analysis, or strategy, where compensation increases significantly. It’s not about instant jumps, but steady and solid career growth over time.

Building Your Career with the CFA Course in Bangalore

Choosing the CFA course in Bangalore is not just about enrolling in another professional program. It is about placing yourself in an environment where finance is active, competitive, and constantly evolving. Bangalore gives your CFA journey context. What you learn in class connects directly to what you see in offices, startups, boardrooms, and financial discussions every day.

Here, CFA doesn’t feel like a distant goal. You start noticing finance everywhere – in startup funding news, in market discussions at work, in the way companies make decisions. Slowly, your thinking changes. You become more structured, more confident, and more sure of your direction.

With strong CFA coaching in Bangalore, flexible CFA classes in Bangalore, reputed CFA institutes in Bangalore, and a job market that genuinely values the CFA credential, the city gives you a rare combination of learning and opportunity. You get the space to grow without stepping away from your career. You don’t pause your progress, you accelerate it.

If you are serious about finance and want a qualification that grows with you, adapts to your career, and compounds over time, CFA in Bangalore is a smart, strategic, and future-ready choice.