Data Science is a lucrative career, intertwining analytics, technology, and innovative problem-solving to extract meaningful insights from massive databases. If you’re eager to learn about the eligibility for the Data Science Course and worry that a lack of technical expertise may hinder you, don’t worry.

Most non-technical professionals are now making a mark in data science, with areas of specialisation varying from data analysis to business decision-making. As the industry is growing, there must be an explanation of who can apply, what are the eligibility criteria for data science, and if non-coding data science jobs do exist or not.

In this step-by-step guide, we shall discuss Data Science Course Eligibility criteria, entry criteria for data science, and how non-technical students can pursue this career path.

We will also mention quality learning options, like Imarticus’ Postgraduate Programme in Data Science & Analytics, to guide you towards taking that initial step towards establishing a successful career.

Let’s explore how data science for beginners has become more accommodating than ever, and why companies are increasingly opening their doors to a diverse range of applicants.

What Are the Core Data Science Eligibility Criteria?

When it comes to data science, institutions often set certain foundational requirements. However, these vary significantly. Below are the most common data science eligibility criteria you’re likely to encounter:

Educational Qualifications

Most require a bachelor’s degree, but the subject matter can vary from economics to literature. STEM degrees are helpful, but they’re not often the only route to success.

Mathematical Aptitude

Basic statistics and probability knowledge is helpful. Not always required, but helpful to be acquainted with the application of the words mean, median, and standard deviation.

Programming Fundamentals

Certain courses want you to have prior coding experience, but others are for beginners. If you’re starting from scratch, search for courses that include beginner Python or R modules as part of the course.

English Proficiency

Since most of the course material and lectures are done in English, institutes typically want you to be English proficient. Some even require you to produce an English proficiency test if you’re an international student.

Willingness to Learn

Maybe the most undervalued necessity is a curious mind. Data science is tough but worth it. A can-do mentality is priceless, particularly for tech students who wish to bridge gaps.

Despite these requirements seeming daunting, do not eliminate data science for beginners from your list. Data science for beginners has never been so cool.

Many schools explicitly structure their coursework to accommodate beginners, providing assistance that develops strengths incrementally.

Data Science Non-Coding Jobs: Fact or Fiction

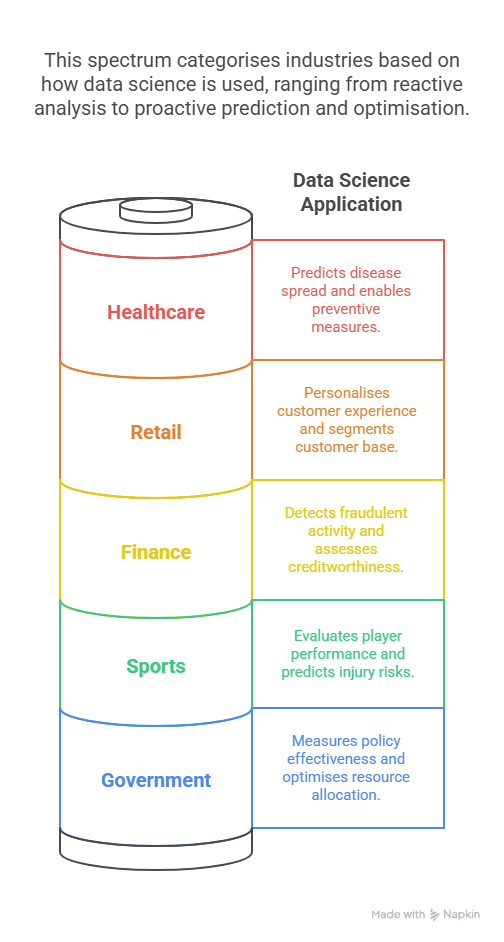

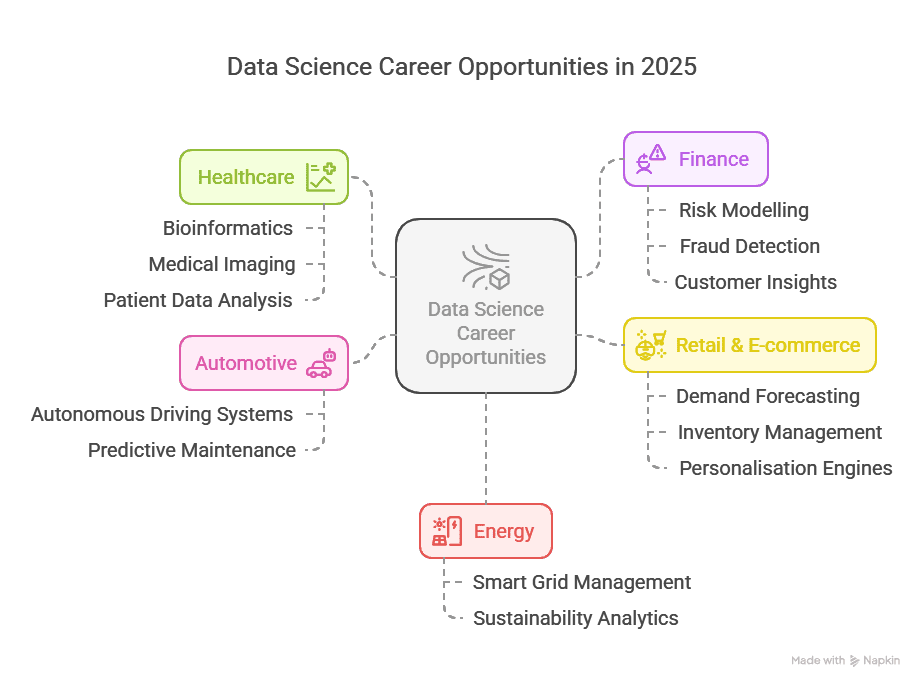

People tend to visualise someone deeply coding when they hear data science. But data science non-coding jobs are in abundance. Data science needs people to interpret the findings of the analysis and present them in an appropriate way to stakeholders.

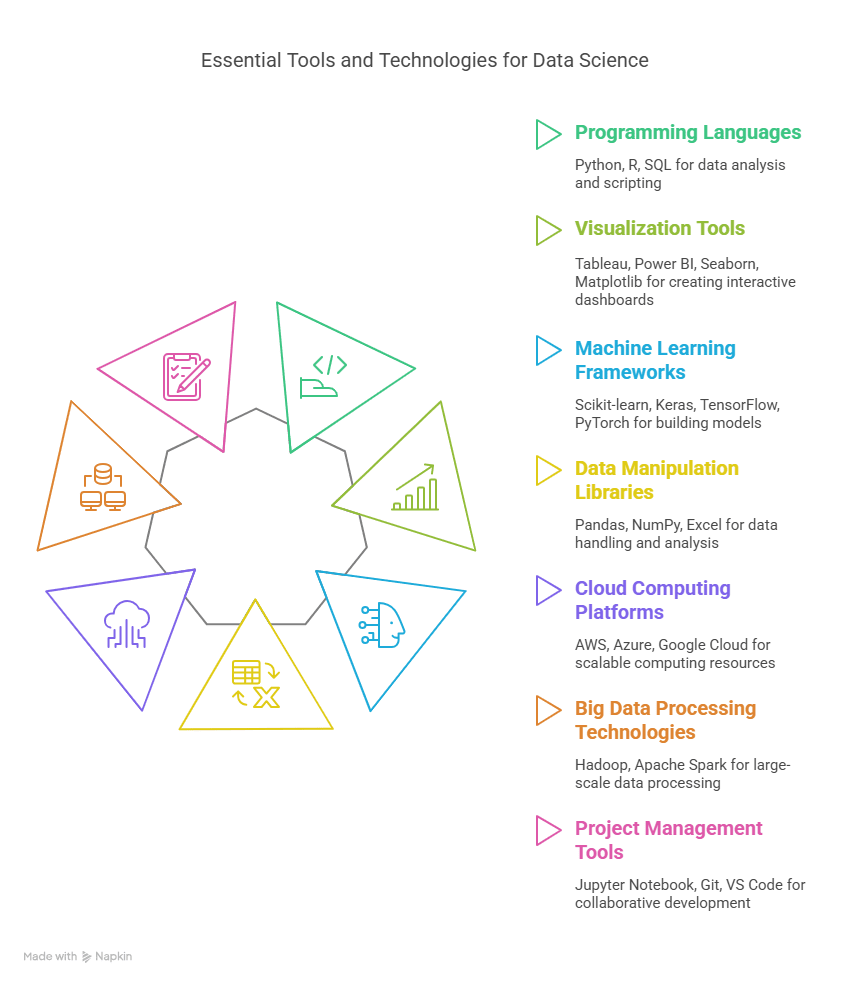

Data Visualisation Specialist: All about taking raw data and making it persuasive graphs and dashboards. Although little coding may be required, visualisation tools such as Tableau or Power BI are more important to learn.

Business Analyst: Spans technical teams and management. Examines data-driven insights for decision-making without necessarily drilling into code.

Project Manager: Oversees end-to-end data projects, ensures timely delivery, and coordinates with technical experts, data engineers, and clients.

If you’ve ever wondered, “Can non-technical students learn data science?” the existence of these roles should be a testament to the field’s flexibility.

Organisations increasingly recognise that data solutions must fit business objectives and user needs—skills that often come from those with non-traditional backgrounds.

Can Non-Technical Students Learn Data Science?

The quick answer is yes. For each highly technical job, there exists a corresponding one that works with other sets of skills. More to the point, a person who is a business or humanities individual can specialise in data interpretation, storytelling, or even leadership positions in analytics teams.

When you’re making the decision of whether data science is for you, ask yourself: Do you enjoy learning new technology? Do you like patterns and puzzle-solving? If you answered yes, you already possess a major piece of data science entry requirements—a true passion for getting meaning out of data.

Data Science for Beginners: Why the Sudden Rush?

Data science for beginners has been increasing to popularity for very good reasons:

- Data Explosion: Businesses generate and store more data than before.

- Accessible Tools Emergence: Cloud solutions and code-friendly libraries make it easier to manage data challenges.

- Competitive Advantage: Businesses look for professionals who have the ability to extract data to unearth secrets and spur creativity.

Based on IBM Analytics, the demand for data-savvy individuals is increasing. Institutions are thus eagerly recruiting students from various backgrounds to form groups that can handle multi-dimensional data issues.

Who Can Apply for Data Science Courses?

One of the questions that most prospective students want to know is, “Who can enroll in data science courses?” The general answer is that most applicants are welcome as long as they fulfill the minimum data science entry criteria. This may involve a bachelor’s degree, maths fundamentals, and a desire to learn core software packages.

Finance, healthcare, law, or even sociology professionals can draw on their domain expertise in data-driven fields. With specialized knowledge complemented by analytical techniques, you can be a valuable contributor to linking technical results to practical uses.

Brief Overview of Key Data Science Entry Requirements

| Requirement | Description | Importance |

| Formal Education | Bachelor’s degree or equivalent in any subject | High |

| Mathematics Competence | Conversant with basic stats and probability | Medium |

| Programming Skills | Useful but not necessary (most introductory-level courses) | Variable |

| English Competency | Comprehension of course material, lectures, and projects | Medium |

| Curiosity & Commitment | Ability to learn repeatedly and adjust | Very High |

These columns identify the overall picture. Naturally, each program could have its variations. But the overall trend remains the same: subject matter knowledge and a high enthusiasm to learn.

Best Data Science Courses for Non-Tech Students

So, which are the best data science courses for non-technical students? The trick is to find courses that cut and slice challenging topics:

Introductory Programming: Choose courses that instruct in Python, R, or even SQL from the ground up.

Applied Projects: Learning from actual datasets sets a firmer base.

Flexible Schedules: Most part-time or online courses are made for full-time employees.

Recommended options are Imarticus’ Postgraduate Programme in Data Science & Analytics. Further, sites like Coursera and edX acquaint you with concepts at the foundational level in a structured way. Alternatively, KDnuggets is ideal for guidance, breaking news, and forum discussions on the go.

Adding a Fresh Perspective – Industry Stats Beyond Tech

According to a recent survey, more than 45% of companies that are not technically inclined embarked on data-driven projects over the past five years. Education, sports, real estate, and media sectors invest in data analysts capable of interpreting relevant information for better decision-making. This makes it possible for people with non-tech backgrounds to excel by combining industry knowledge with analytical skills developed recently.

Sources: LinkedIn , 365 Data Science

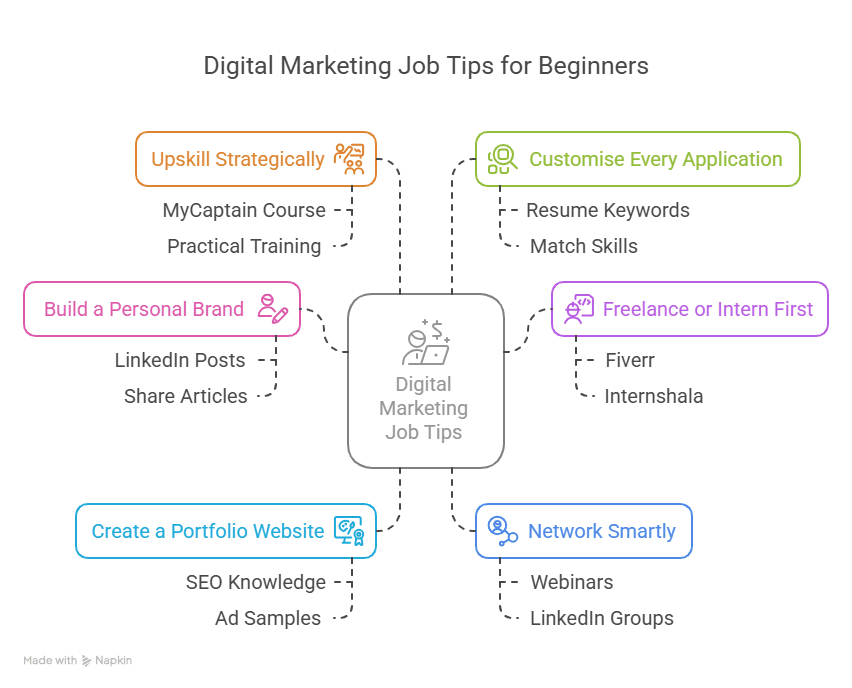

Path of Non Technical Person Towards Data Analytics Industry-Data Analyst And Data Scientist

FAQs: Frequently Asked Questions Before You Get Started

- Do I have to code a lot for data science?

Not really. Most jobs need data visualisation, domain knowledge, or project management.

- Is higher-level maths a hard requirement?

Basic algebra and statistics are normally enough to begin with. Some programs learn associated math concepts during the process.

- Can students without technical backgrounds master data science in a short time?

Yes, if they work hard on the foundation courses and hands-on exercises. The learning curve is different for different individuals, but yes, it is possible with sustained effort.

- Are there any entry requirements for data science in terms of previous work experience?

Most programs do not expect prior experience. Passion, fundamental knowledge, and hard work are valued more.

- Which one should I learn first: Python or R?

Python is more common. But R is still used in academia and statistics. Either is fine for a beginner.

- Who can enroll in data science courses if they are not from a STEM field?

Anyone who has a bachelor’s degree and is interested in learning may typically apply. Business and humanities majors typically prove to be good methods.

- Is course accommodation an option?

Yes. Practically all institutions offer online, part-time, and full-time availability that suits different timetables.

- What if I only want to specialise in data visualisation?

This is more than fine. Software tools like Tableau, Power BI, and particular data visualisation streams are available on the majority of courses.

- Do best data science courses for non-tech students exist that include only applied learning?

There are certain courses that have more project-based emphasis than theory, ideal for students who learn well through practice.

- Is beginner data science career placement guidance included?

There are certain institutes that have job placement facilities or career counseling available, especially hot programs that would like to possess a high rate of success.

Conclusion

Data science isn’t merely for programming hobbyists. The profession is expansive, dynamic, and more open than ever before to candidates without technical backgrounds.

If you have subject-matter expertise that you wish to use in conjunction with data-driven insights, or simply have a sense of enjoying pattern detection, then your non-technical background might prove beneficial.

More than ever before, today’s courses are designed to open doors to novices, progressively developing the technical and analytical proficiency required.

Key Takeaways

- Inclusivity: Eligibility to a Data Science Course is generally kept open for diverse professional and academic backgrounds.

- Multiple Pathways: There are plenty of data science non-coding jobs available—emphasise your ability, be it data storytelling, consulting, or visualisation.

- Continuous Evolution: Space for innovative ideas exists within the industry. Continuous learning goes with the package of a successful data science career.

Remember, however, that the question of “Who can apply for data science courses?” has a straightforward answer: almost anyone who is willing to put in time and effort to learn. The future holds endless possibilities, and your background may just be the secret ingredient to be the standout in data science.

Chart Your Data Journey

If you are willing to go deeper, look at the Postgraduate Programme in Data Science & Analytics by Imarticus Learning.

It offers both foundational and advanced modules, so it is a strong contender for future students of any kind. Don’t let your non-technical background hold you back to discover the power of analytics and insights.