When it comes to building a successful career in finance… knowledge alone isn’t enough. Employers today want professionals who can think critically, analyse data, manage risk & adapt to real-world situations. That’s why choosing the right banking and finance course can be a game-changer for your future.

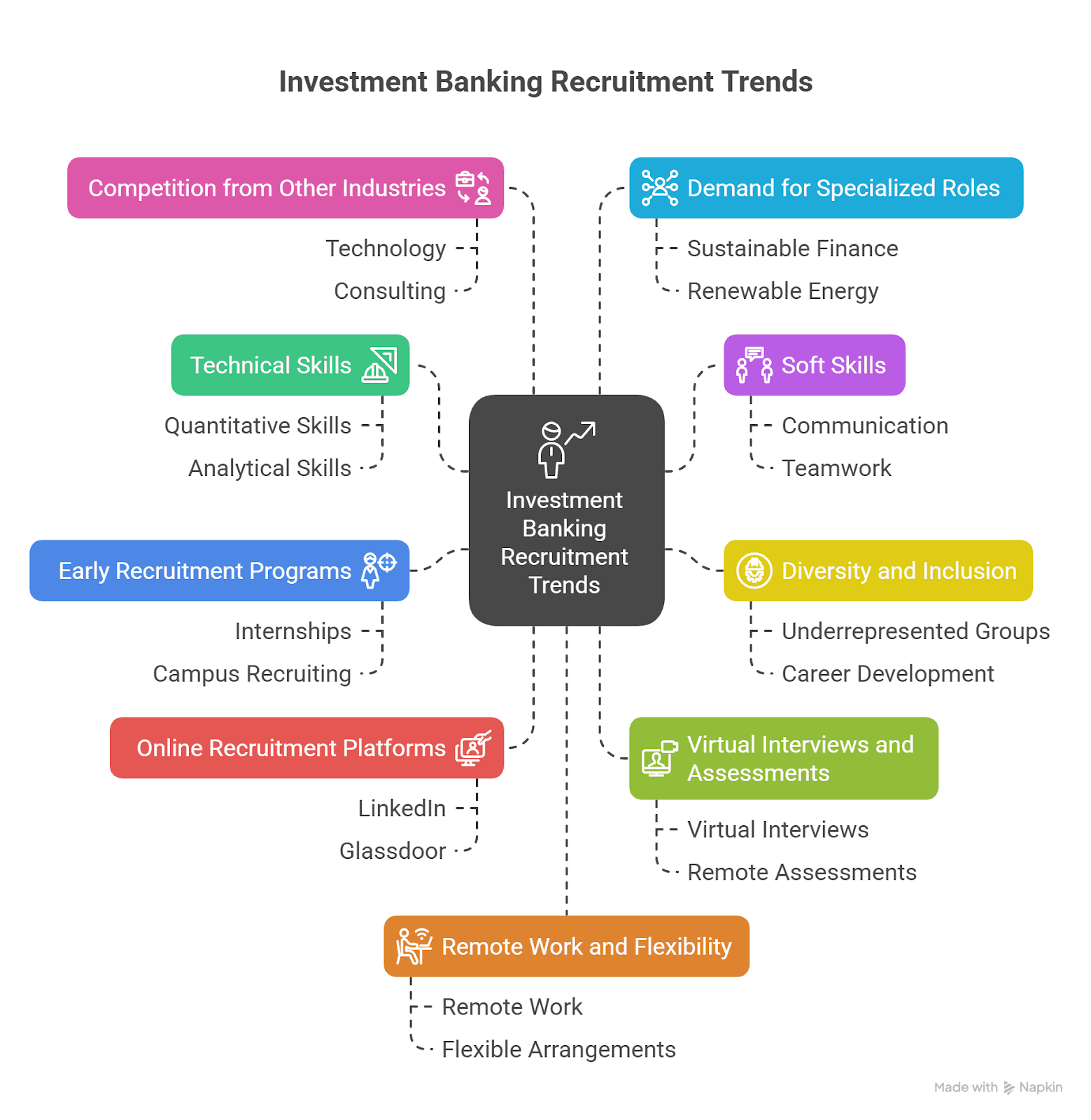

The finance industry is evolving fast… & roles in banking are more competitive than ever. If you’re looking to stand out in the world of banking jobs in India, what you need isn’t just a degree—but skills that match industry expectations.

Let’s explore how a banking and finance course that blends theory with practice can help you gain a true edge in the job market.

Why You Need More Than a Degree in Today’s Banking World

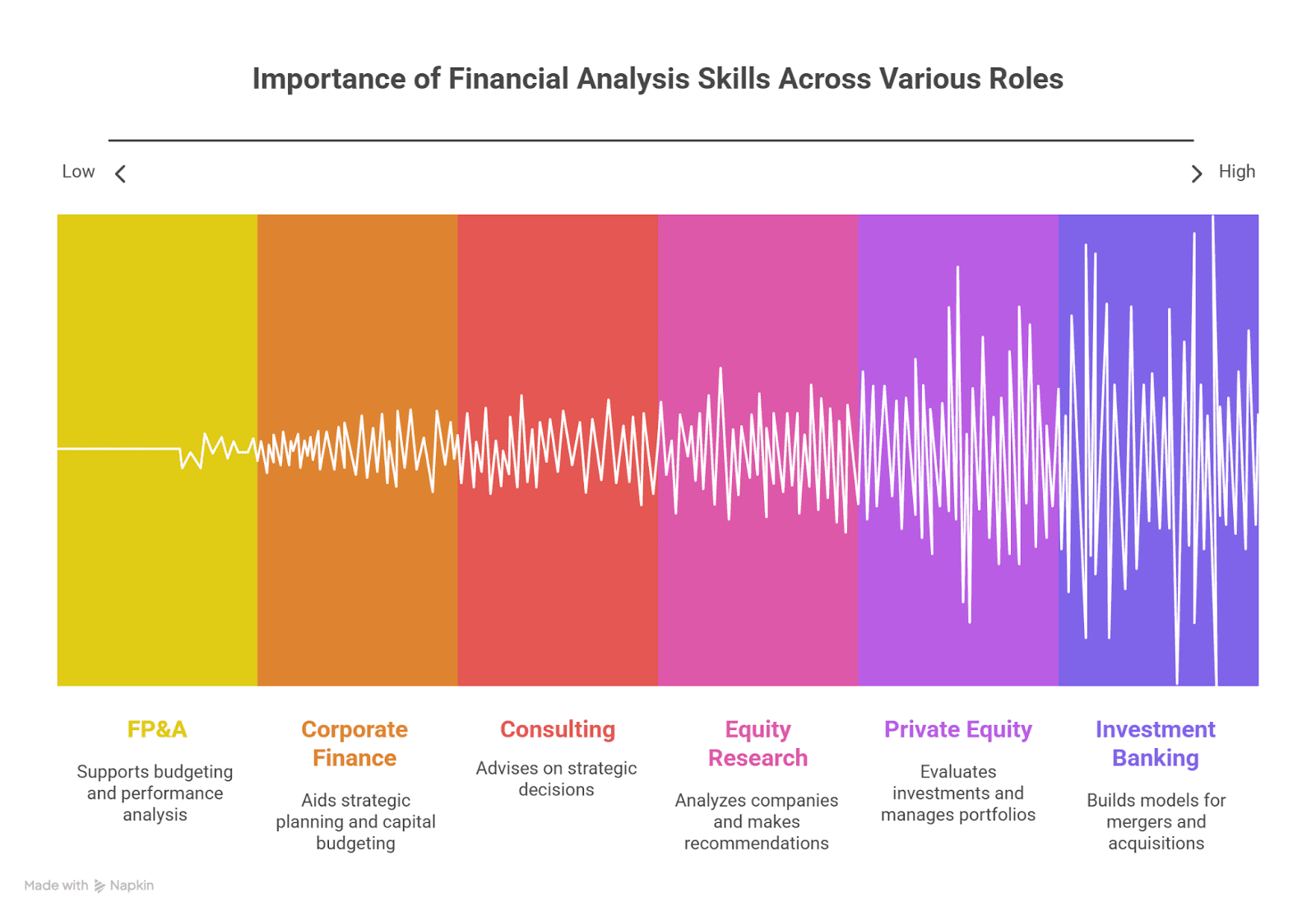

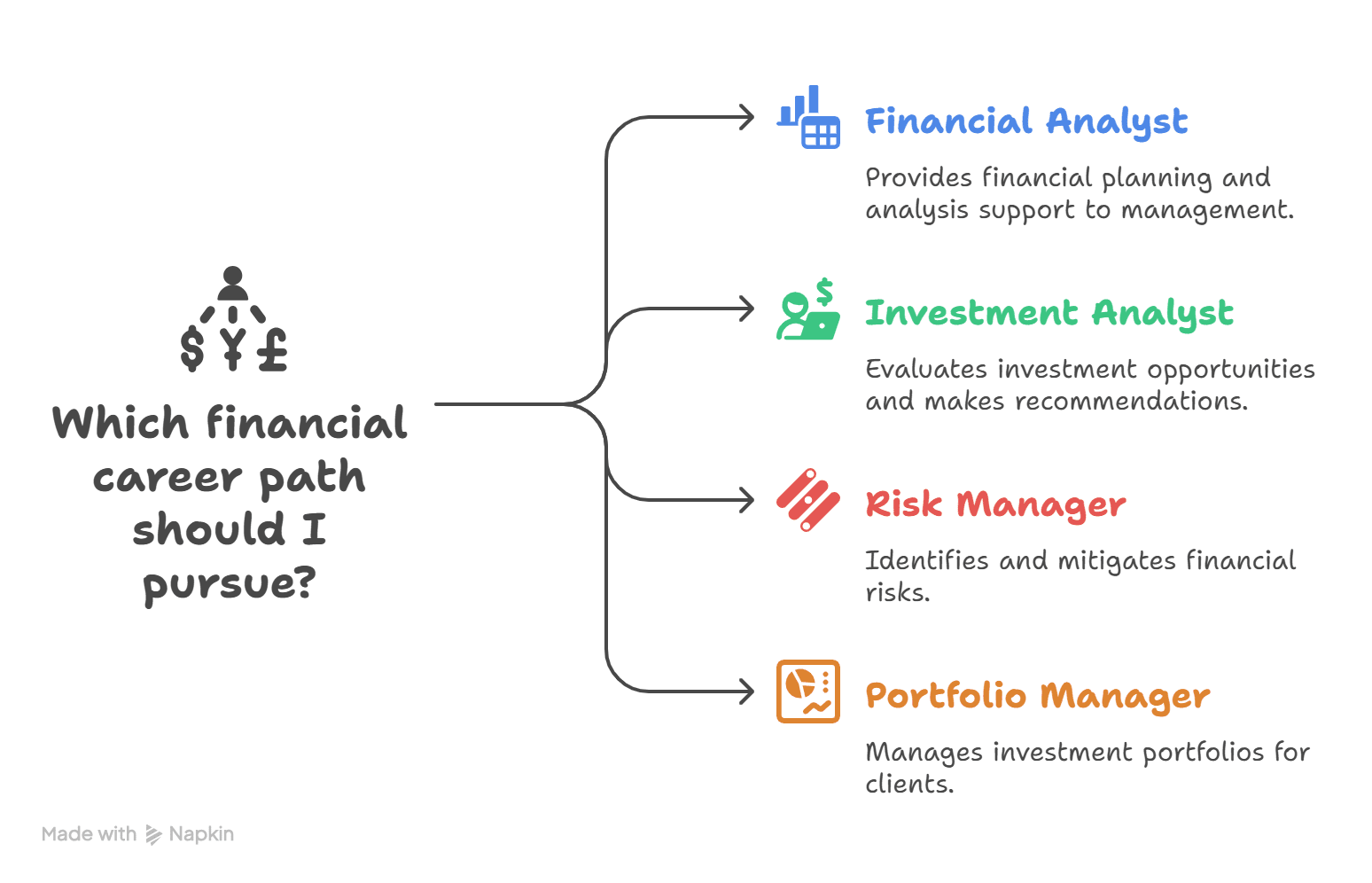

Banking roles are no longer just about handling ledgers or filling forms. Whether you’re aiming for retail banking, investment analysis, credit risk, or fintech roles, the demand is clear—practical banking skills are what hiring managers want.

And not just technical knowledge… but also soft skills like communication, attention to detail & the ability to use digital tools.

Here’s how a modern banking and finance course compares to traditional classroom learning:

| Traditional Learning | Industry-Focused Course |

| Theoretical knowledge only | Blends theory with hands-on training |

| Limited job readiness | Prepares you with interview & job support |

| No exposure to banking tools | Offers training in real-time banking simulations |

| Generic syllabus | Updated modules based on current industry needs |

One such practical program is the Post Graduate Program in Banking and Finance by Imarticus… designed for those who want job-ready skills & placement assurance.

Top Employers Are Looking for These Practical Banking Skills

The truth is… banks & financial institutions are not just looking for top scores—they’re looking for professionals who can add value from Day 1.

These are some of the practical banking skills you must develop:

| Skill | Why It Matters |

| Risk assessment & credit analysis | Crucial for loan officers & credit teams |

| Financial statement analysis | Needed in almost every finance role |

| Regulatory compliance knowledge | Mandatory across banking sectors |

| MS Excel & financial modelling | In-demand in investment & commercial banking roles |

| Client relationship management | Key for front-office & branch roles |

A placement-focused approach is essential—which is why a placement-focused finance course ensures you learn not just what to do… but how to do it in real-world situations.

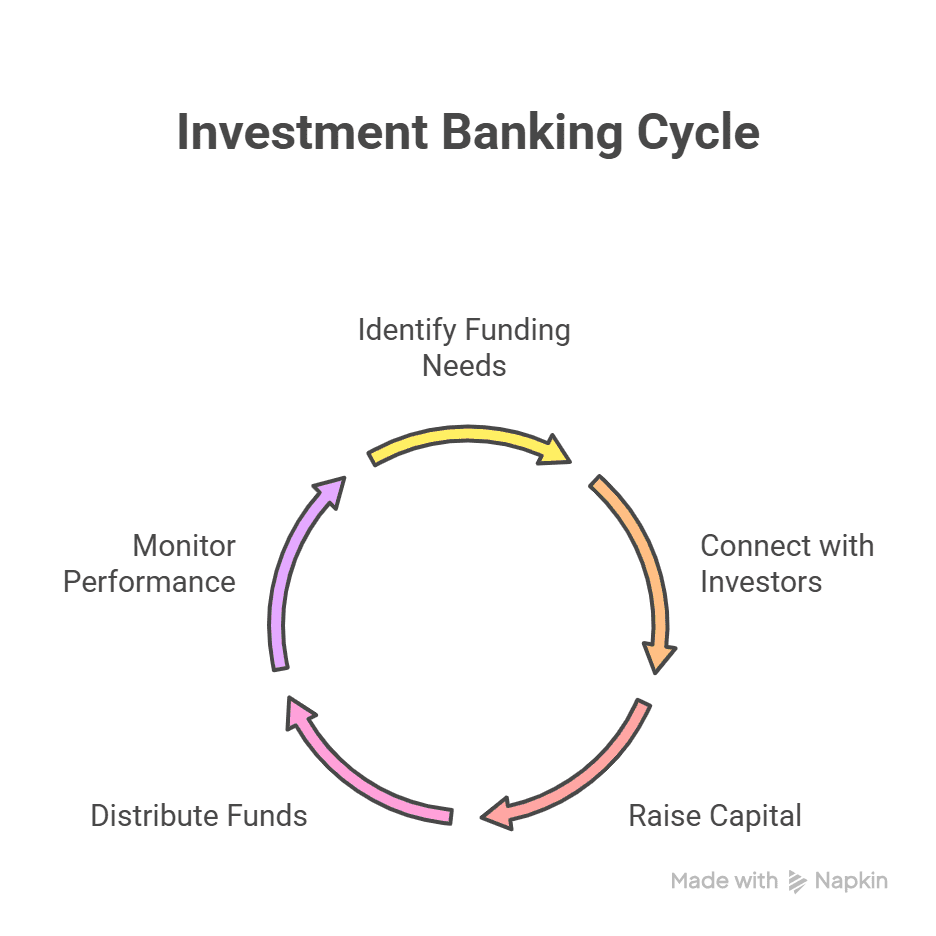

Rising Demand for Banking Jobs in India

Whether it’s public sector banks, private banks, NBFCs or fintech firms… the need for trained professionals is growing.

Let’s look at what the banking jobs in India market currently looks like:

| Banking Role | Average Salary (INR) | Key Skills Required |

| Relationship Manager | ₹3.5 – ₹6 LPA | Sales, CRM, financial products knowledge |

| Credit Analyst | ₹5 – ₹9 LPA | Risk analysis, report writing, Excel |

| Investment Banking Associate | ₹10 – ₹16 LPA | Financial modelling, client handling |

| Wealth Manager | ₹6 – ₹12 LPA | Investment products, market awareness |

| Compliance Officer | ₹4 – ₹7 LPA | Legal & regulatory framework understanding |

With the right banking and finance course, you can confidently apply for these roles… knowing you’re trained in the exact skills employers need.

For a deeper dive into career paths, check out our curated list of Useful Blogs for Learning About Banking and Finance.

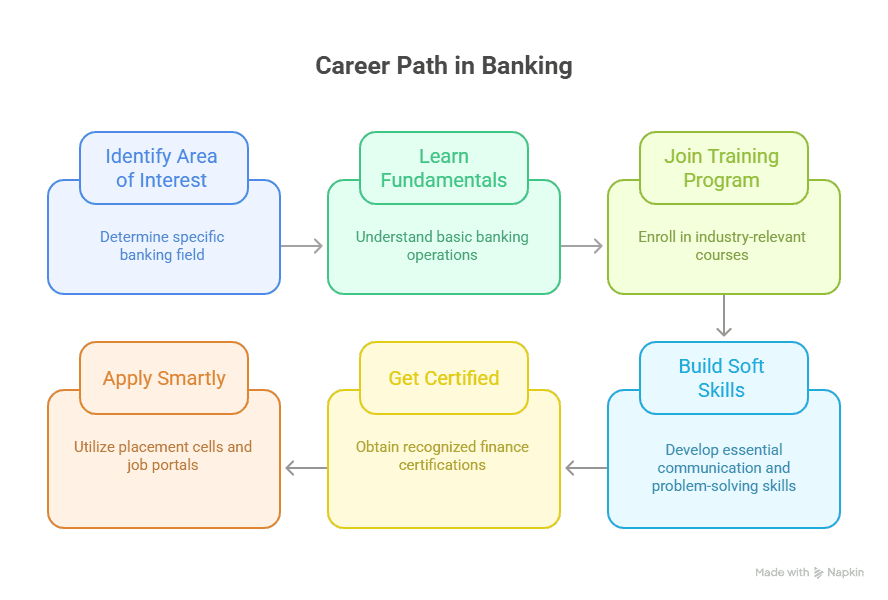

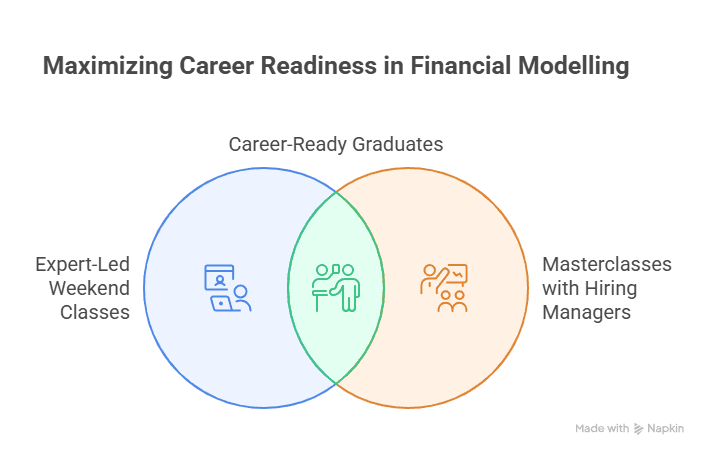

What Makes a Banking and Finance Course Truly Job-Oriented?

A great program does more than teach theory. It prepares you for interviews, builds confidence & gets you job-ready through real experiences.

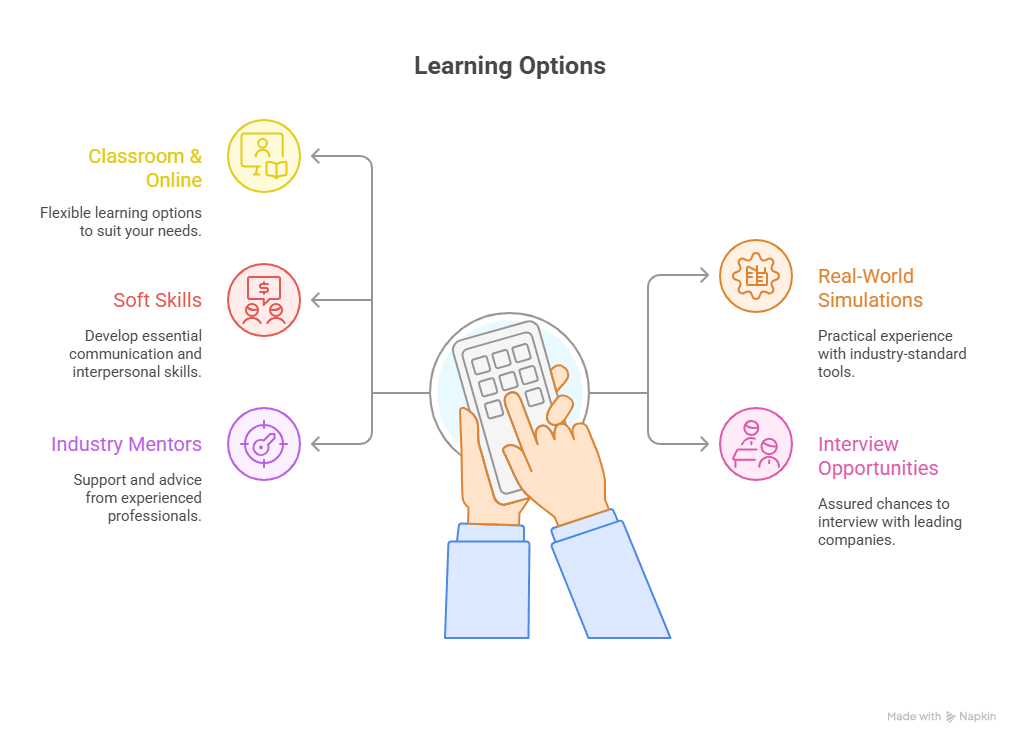

The Post Graduate Program in Banking and Finance includes:

- Classroom & online learning options

- Real-world simulations & tools

- Soft skill & interview preparation

- Guaranteed interview opportunities

- Guidance from industry mentors

Such a placement-focused finance course puts you on the fast track to career growth in finance… with the right support at every step.

Who Should Take Up a Banking and Finance Course?

This course is ideal for:

- Commerce graduates who want specialised skills

- Freshers aiming for banking jobs in India

- Working professionals looking for a career switch

- Anyone interested in career growth in finance

Also, if you’re considering adding credibility to your resume, don’t miss our blog on Banking and Finance Courses That Will Matter in 2023.

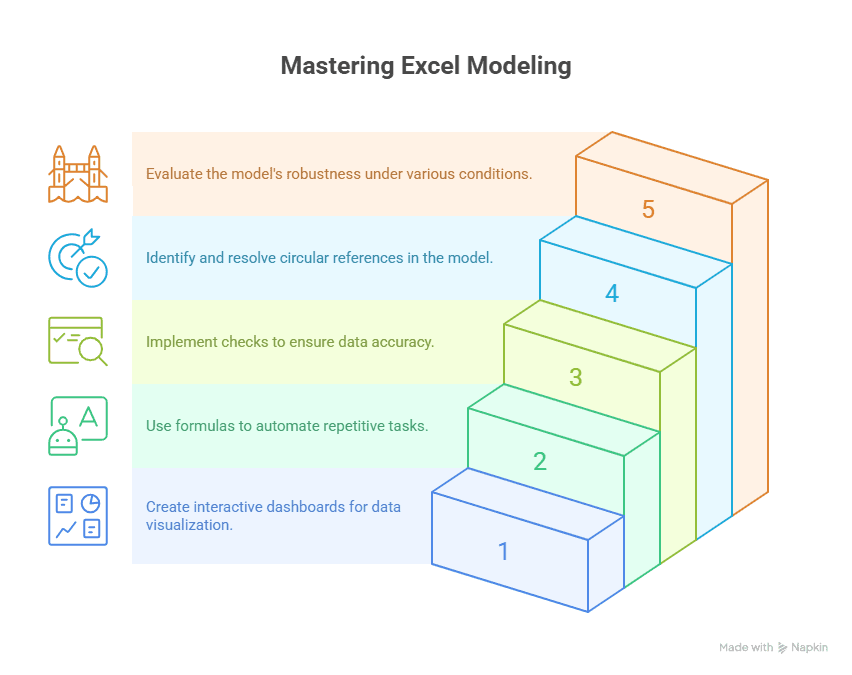

What You Should Expect to Learn in a Good Program

Here’s what a top-tier banking and finance course curriculum usually includes:

| Module | Skills You Gain |

| Financial Systems & Markets | Market awareness & industry context |

| Credit & Risk Management | Risk profiling, credit scoring |

| Banking Operations | Customer service, KYC/AML practices |

| Regulatory Compliance & Ethics | Legal framework understanding |

| Advanced Excel & Financial Modelling | Practical banking tools mastery |

This balance of technical & soft skills is key for career growth in finance… especially if you’re aiming for leadership roles later.

Add-On Certifications to Boost Your Career

Apart from full-fledged programs, many professionals also pursue finance certifications for graduates like:

- NISM Modules – for investment & securities knowledge

- Certified Credit Analyst – for lending roles

- Financial Planning Certification – for advisory careers

These add depth to your resume… & when combined with a banking and finance course, help create a well-rounded profile.

FAQs

1. What is the benefit of a banking and finance course?

It builds real-world knowledge… boosts placement chances & skills employers want.

2. Do banking jobs in India require certifications?

Yes… most roles prefer a certified profile & strong practical banking skills.

3. Is a placement-focused finance course better than a regular degree?

Definitely… it prepares you for interviews, tools & real job roles.

4. What are must-have practical banking skills today?

Risk analysis… Excel modelling & compliance knowledge top the list.

5. Are there finance certifications for graduates that boost careers?

Yes… NISM, credit analysis & wealth management certifications help a lot.

6. How competitive are banking jobs in India today?

Very… so digital skills, domain knowledge & certifications are key.

7. Can I switch careers with a banking and finance course?

Yes… it’s ideal for freshers & professionals seeking career growth in finance.

8. How long does it take to see career growth in finance?

With the right training… most learners see progress within 6–12 months.

Final Thoughts: Build the Skills That Truly Matter

In today’s competitive job landscape… only those who are prepared with hands-on expertise, clarity in fundamentals & exposure to modern tools will truly succeed.

The right banking and finance course gives you just that—a powerful mix of technical know-how, soft skills & industry readiness.

Whether you’re looking for banking jobs in India, aiming to develop practical banking skills, or seeking career growth in finance—it all begins with choosing a placement-focused finance course that delivers on its promises.

So, don’t wait for job opportunities to find you… prepare yourself with the skills employers are actively looking for. Start your journey today with the Post Graduate Program in Banking and Finance from Imarticus Learning.