The world is changing faster than ever before, and nowhere is that more evident than in the world of technology. This blog post will discuss how the current chip shortage affects distributed cloud computing. We will also explore the powers of distributed cloud computing and how they can benefit your business. Stay tuned for more information!

Cloud computing helps businesses worldwide cut costs, increase productivity, and innovate faster than ever by using remote servers hosted in third-party data centers instead of investing in and managing their infrastructure.

An overview of distributed cloud computing

Distributed cloud computing is a distributed system that shares resources between multiple computers to provide high availability and performance. In addition, it can allow for better collaboration among employees working remotely or in different locations by allowing them instant access to each other’s files and information.

Distributed cloud computing is a form of data center technology that allows for sharing resources between multiple computers to provide high availability and performance. It can also allow better collaboration among employees working remotely or in different locations. By allowing instant access to each other’s files and information, distributed cloud computing can help promote teamwork and productivity.

What are the benefits of using distributed cloud computing?

There are many benefits of using distributed cloud computing, including:

- Increased Availability: With distributed cloud computing, the system will still function as expected if one server goes down. It is because the resources get distributed among multiple servers.

- Increased Performance: Distributed cloud computing can improve performance by allowing users to access data from different geographic locations.

- Reduced Costs: By sharing resources between multiple computers, businesses can save money on their data center costs.

- Flexibility: Distributed cloud computing allows businesses to scale their systems up or down as needed, which helps them save money on energy costs.

How does the chip shortage affect distributed cloud computing?

The current chip shortage is affecting distributed cloud computing in a few ways:

- It is causing delays for companies trying to build new data centers because they cannot get the chips needed to complete their projects.

- It makes existing servers more expensive due to higher demand from businesses looking to buy them before prices go up further. It makes distributed cloud computing less attractive than traditional hosting solutions like Amazon AWS or Microsoft Azure that offer unlimited capacity.

- The chip shortage is causing some businesses to consider moving their operations back in-house, negating any benefits of distributed cloud computing.

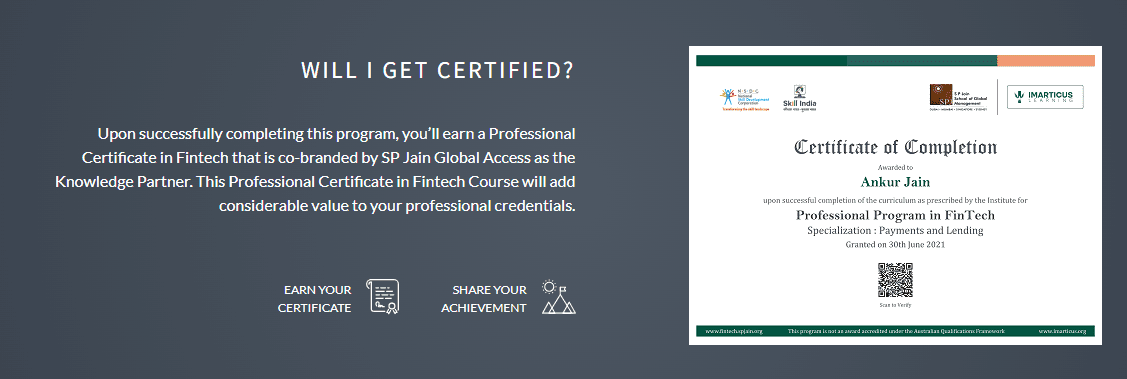

Discover FinTech Courses Online with Imarticus Learning

FinTech Courses online provide a one-of-a-kind learning experience for students seeking to excel in this competitive business. Learners will have all the tools they need with practical application skills and real-world experience before these possibilities fly off the shelf!

Course Benefits For Learners:

- These financial technology courses will educate students on applying machine learning algorithms and blockchain technology, preparing them to lead this fascinating business.

- Fintech has a promising future, and students may stay up to date on the newest advances by attending networking events, job boards, or webinars.

- Students will also get access to some fantastic tools that will assist them in finding a great new job following graduation!

Contact us through our chat support system, or visit one of our training sites in Mumbai, Thane, Pune, Chennai, Bengaluru, Delhi, and Gurgaon.